Stethoscope Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Stethoscope Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

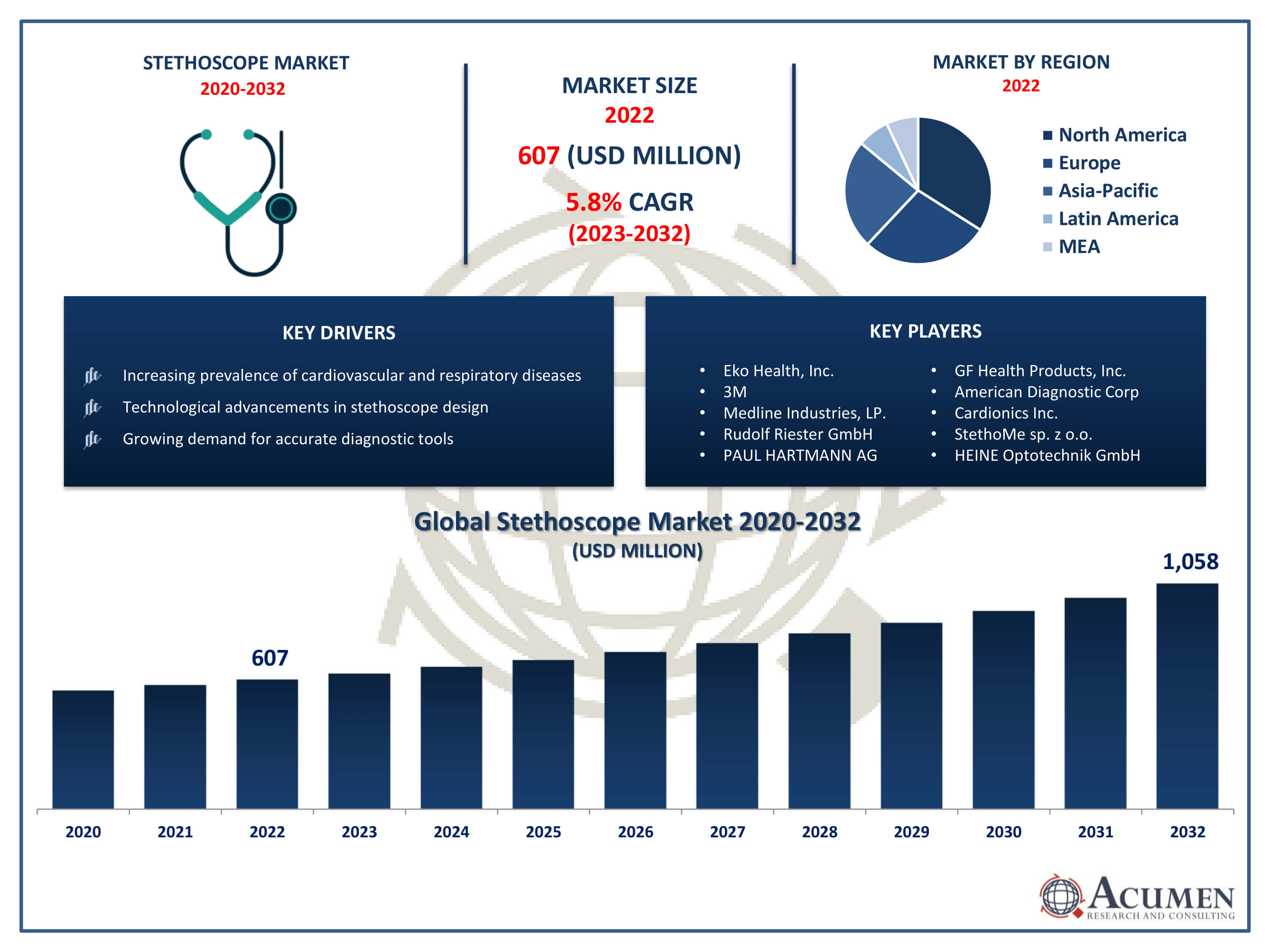

Request Sample Report

The Stethoscope Market Size accounted for USD 607 Million in 2022 and is projected to achieve a market size of USD 1,058 Million by 2032 growing at a CAGR of 5.8% from 2023 to 2032.

Stethoscope Market Highlights

- Global stethoscope market revenue is expected to increase by USD 1,058 million by 2032, with a 5.8% CAGR from 2023 to 2032

- Global electronic stethoscope market revenue is anticipated to achieve USD 197 million by 2032 growing at 6.8% CAGR from 2023 to 2032

- Global smart stethoscope market size will attain almost USD 100 million by 2032 rising at a CAGR of around 7% between 2023 to 2032

- North America region led with more than 33% of stethoscope market share in 2022

- Asia-Pacific stethoscope market growth will record a CAGR of more than 6.6% from 2023 to 2032

- By technology type, the traditional acoustic stethoscope segment captured more than 74% of revenue share in 2022.

- By end-use, the hospitals segment is projected to expand at the fastest CAGR over the projected period

- Increasing prevalence of cardiovascular and respiratory diseases, drives the stethoscope market value

A stethoscope is a medical device used by healthcare professionals to listen to internal sounds of the body, primarily the heart and lungs. It consists of a chest piece, typically made of metal or plastic, connected to flexible tubing and earpieces. The chest piece has a diaphragm and a bell, which can be placed on the patient's skin to amplify and transmit sound waves to the earpieces. Stethoscopes are essential tools for doctors, nurses, and other medical professionals for diagnosing various medical conditions such as heart murmurs, lung infections, and abnormal breath sounds.

The market for stethoscopes has seen steady growth over the years, driven by factors such as the increasing prevalence of cardiovascular and respiratory diseases, technological advancements in stethoscope design, and the growing demand for accurate diagnostic tools. According to the World Health Report, over 620 million individuals are currently living with cardiovascular disease (CVD). In 2021 alone, approximately 20.5 million individuals lost their lives due to CVD, accounting for nearly one-third of all global deaths. With the rise in healthcare expenditure globally and the expansion of healthcare infrastructure in developing countries, the demand for stethoscopes is expected to continue growing. Additionally, the introduction of electronic stethoscope, which amplifies and filters sounds for better clarity, has further fueled market growth by providing healthcare professionals with advanced diagnostic capabilities.

Global Stethoscope Market Trends

Market Drivers

- Increasing prevalence of cardiovascular and respiratory diseases

- Technological advancements in stethoscope design

- Growing demand for accurate diagnostic tools

- Expansion of healthcare infrastructure in developing countries

- Adoption of telemedicine and remote patient monitoring solutions

Market Restraints

- Competition from alternative diagnostic technologies

- High cost associated with advanced stethoscope models

Market Opportunities

- Development of innovative stethoscope designs with digital capabilities

- Integration of stethoscopes with telemedicine platforms

Stethoscope Market Report Coverage

| Market | Stethoscope Market |

| Stethoscope Market Size 2022 | USD 607 Million |

| Stethoscope Market Forecast 2032 |

USD 1,058 Million |

| Stethoscope Market CAGR During 2023 - 2032 | 5.8% |

| Stethoscope Market Analysis Period | 2020 - 2032 |

| Stethoscope Market Base Year |

2022 |

| Stethoscope Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology Type, By Sales Channel, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Eko Health, Inc., 3M, Medline Industries, LP., Rudolf Riester GmbH (Halma plc), Welch Allyn (Hill-Rom Holdings, Inc.), PAUL HARTMANN AG, GF Health Products, Inc., American Diagnostic Corporation, Cardionics Inc., StethoMe sp. z o.o., and HEINE Optotechnik GmbH & Co. KG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A stethoscope is a fundamental medical device used by healthcare professionals to listen to internal body sounds, primarily those of the heart and lungs. Consisting of a chest piece, tubing, and earpieces, stethoscopes work by transmitting sound waves from the patient's body to the ears of the examiner. The chest piece typically has a diaphragm and a bell, each serving different functions in amplifying specific sounds. When placed on the patient's skin, the stethoscope allows healthcare providers to hear heartbeats, lung sounds, and other internal bodily noises. Stethoscopes come in various types, including acoustic and electronic models, with differences in functionality and features to cater to different clinical needs. The applications of stethoscopes in healthcare are vast and critical across medical specialties. In cardiology, stethoscopes help detect heart murmurs, abnormal heart rhythms, and other signs of heart disease. Stethoscopes are indispensable instruments in pulmonology, facilitating the accurate diagnosis of respiratory conditions like pneumonia, bronchitis, and asthma. Healthcare professionals rely on them to detect distinctive sounds such as wheezing, crackles, and diminished breath sounds, crucial indicators for identifying these ailments early on. According to WHO statistics, pneumonia alone accounted for 14% of deaths among children under 5 years old, claiming 740,180 lives in 2019. Additionally, chronic obstructive pulmonary disease (COPD) emerged as the third leading cause of global mortality, resulting in 3.23 million deaths the same year. As of March 2023, NCBI data revealed that over 300 million people worldwide suffer from asthma, with an additional 100 million at risk. In essence, stethoscopes are essential tools for healthcare professionals, allowing them to quickly diagnose respiratory conditions and initiate timely and effective treatments.

The stethoscope market has experienced notable growth in recent years, driven by several factors. One significant contributor to this growth is the increasing prevalence of cardiovascular and respiratory diseases worldwide. In 2019, chronic respiratory diseases (CRDs) were the third leading cause of death worldwide, accounting for 4 million deaths and affecting 454.6 million people. That same year, there were 488.9 million new cases of lower respiratory infections (LRIs), representing a 23.9% decrease from 1990. Furthermore, chronic obstructive pulmonary disease (COPD) was a major health concern, accounting for 3.23 million deaths, making it the third leading cause of death.

With a rise in conditions such as hypertension, heart disease, and respiratory infections, there's a heightened demand for diagnostic tools like stethoscopes that aid in early detection and monitoring of these ailments. Additionally, technological advancements in stethoscope design have propelled market expansion. Manufacturers have introduced innovative features such as Bluetooth connectivity, noise cancellation, and digital recording capabilities, enhancing diagnostic accuracy and convenience for healthcare professionals. For example, the newly launched 3M Littmann CORE Digital Stethoscope is packed with cutting-edge features, including active noise cancellation, multiple listening modes, visualization and AI analysis, and an impressive 40x amplification, among many others. These advancements have not only improved the performance of stethoscopes but also opened up new opportunities in the market. Moreover, the expansion of healthcare infrastructure, particularly in developing countries, has further fueled the growth of the stethoscope market.

Stethoscope Market Segmentation

The global stethoscope market segmentation is based on technology type, sales channel, end-use, and geography.

Stethoscope Market By Technology Type

- Electronic/ Digital

- Traditional Acoustic Stethoscope

- Smart Stethoscope

According to the stethoscope industry analysis, the traditional acoustic stethoscope segment accounted for 74% market share in 2022. One key factor contributing to tradtitional stehoscope market growth is the enduring reliability and familiarity of acoustic stethoscopes among healthcare professionals. Many practitioners prefer the simplicity and tactile feedback provided by traditional stethoscopes, especially in primary care settings where quick and accurate assessments are essential. This preference for acoustic stethoscopes has sustained demand within the market segment, particularly among physicians, nurses, and medical students. Furthermore, the affordability of acoustic stethoscopes compared to their electronic counterparts has made them accessible to a broader range of healthcare providers, particularly in resource-constrained settings. While electronic stethoscopes offer advanced features, such as digital amplification and noise filtering, acoustic stethoscopes remain a cost-effective option for healthcare facilities with budget constraints.

Stethoscope Market By Sales Channel

- Distributors

- Direct Purchase

- E-commerce

In terms of sales channels, the distributors segment is expected to witness significant growth in the coming years. Over recent years, this segment has experienced notable growth driven by several factors. One significant factor is the expansion of healthcare infrastructure globally, which has led to an increase in the number of healthcare facilities and providers requiring stethoscopes. As healthcare services become more accessible, the demand for medical devices, including stethoscopes, has surged, creating opportunities for distributors to meet this growing demand. Moreover, the rising adoption of online platforms and e-commerce channels for the purchase of medical supplies has further fueled the growth of the distributors segment. Distributors are leveraging digital platforms to reach a wider customer base, including healthcare professionals, hospitals, clinics, and individual consumers.

Stethoscope Market By End-use

- Home Healthcare

- Clinics

- Hospitals

- Nurse Practitioners

- Veterinary

- EMT/ First Responders

According to the stethoscope market forecast, the hospital segment is expected to witness significant growth in the coming years. As hospitals strive to enhance patient care and diagnostic accuracy, there is a continuous demand for high-quality stethoscopes. These devices are indispensable tools for healthcare professionals in hospitals, aiding in the assessment of cardiac and respiratory conditions, among others. With the increasing prevalence of cardiovascular and respiratory diseases globally, hospitals are investing in advanced stethoscopes equipped with features such as amplified sound transmission and noise reduction capabilities to improve diagnostic precision. Furthermore, the modernization of healthcare infrastructure in hospitals worldwide has contributed to the growth of the stethoscope industry. As hospitals upgrade their medical equipment and adopt digital health technologies, there is a growing need for stethoscopes that integrate seamlessly with electronic health records (EHR) systems and telemedicine platforms.

Stethoscope Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

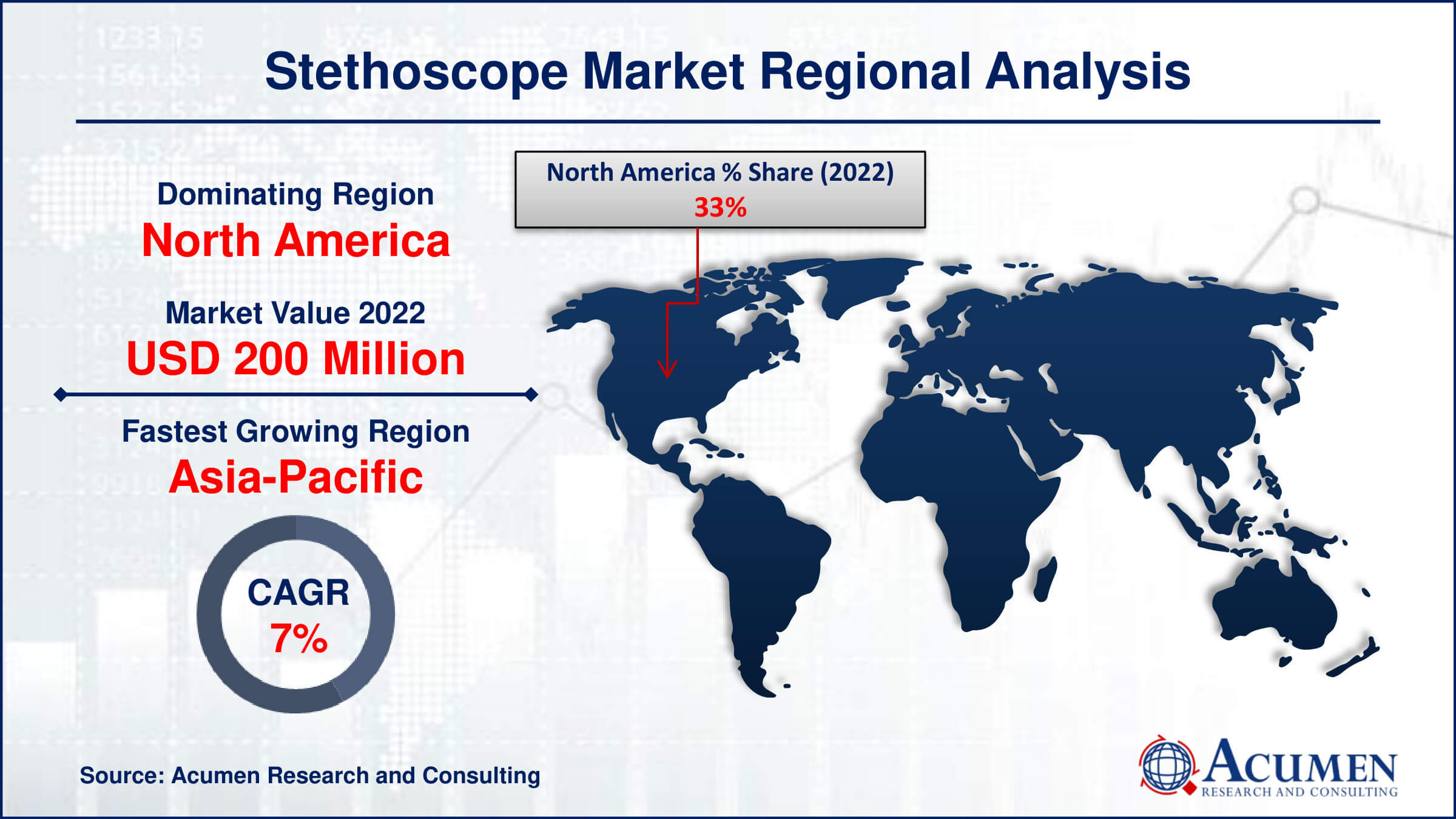

Stethoscope Market Regional Analysis

North America stands out as a dominating region in the stethoscope market due to several key factors. One significant factor is the region's advanced healthcare infrastructure and high adoption rate of innovative medical technologies. With well-established healthcare systems and a strong focus on patient care, healthcare providers in North America demand cutting-edge diagnostic tools, including stethoscopes. This demand drives manufacturers to introduce technologically advanced stethoscope models with features such as digital amplification, Bluetooth connectivity, and telemedicine integration, catering to the preferences of healthcare professionals in the region. For instance, in July 2023, Astellas Pharma Inc. and Eko Health Inc. announced a License & Supply Agreement for the global distribution and licensing of Eko’s latest digital stethoscope, the CORE 500, along with a custom suite of Eko’s AI-powered software for detecting cardiovascular diseases. Moreover, North America is home to a large number of prominent medical device manufacturers and distributors, further contributing to its dominance in the stethoscope market. Companies based in the region benefit from access to advanced research and development facilities, enabling them to innovate and launch new stethoscope products ahead of competitors. Additionally, the presence of a robust distribution network ensures widespread availability of stethoscopes across various healthcare facilities, including hospitals, clinics, and ambulatory care centers. This extensive distribution network, coupled with efficient supply chain management practices, strengthens North America's position as a leading market for stethoscopes.

Stethoscope Market Player

Some of the top stethoscope market companies offered in the professional report include Eko Health, Inc., 3M, Medline Industries, LP., Rudolf Riester GmbH (Halma plc), Welch Allyn (Hill-Rom Holdings, Inc.), PAUL HARTMANN AG, GF Health Products, Inc., American Diagnostic Corporation, Cardionics Inc., StethoMe sp. z o.o., and HEINE Optotechnik GmbH & Co. KG.

Frequently Asked Questions

How big is the stethoscope market?

The stethoscope market size was USD 607 Million in 2022.

What is the CAGR of the global stethoscope market from 2023 to 2032?

The CAGR of stethoscope is 5.8% during the analysis period of 2023 to 2032.

Which are the key players in the stethoscope market?

The key players operating in the global market are including Eko Health, Inc., 3M, Medline Industries, LP., Rudolf Riester GmbH (Halma plc), Welch Allyn (Hill-Rom Holdings, Inc.), PAUL HARTMANN AG, GF Health Products, Inc., American Diagnostic Corporation, Cardionics Inc., StethoMe sp. z o.o., and HEINE Optotechnik GmbH & Co. KG.

Which region dominated the global stethoscope market share?

North America held the dominating position in stethoscope industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of stethoscope during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global stethoscope industry?

The current trends and dynamics in the stethoscope industry include increasing prevalence of cardiovascular and respiratory diseases, technological advancements in stethoscope design, and growing demand for accurate diagnostic tools.

Which sales channel held the maximum share in 2022?

The distributors sales channel held the maximum share of the stethoscope industry.