Sterilization Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Sterilization Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

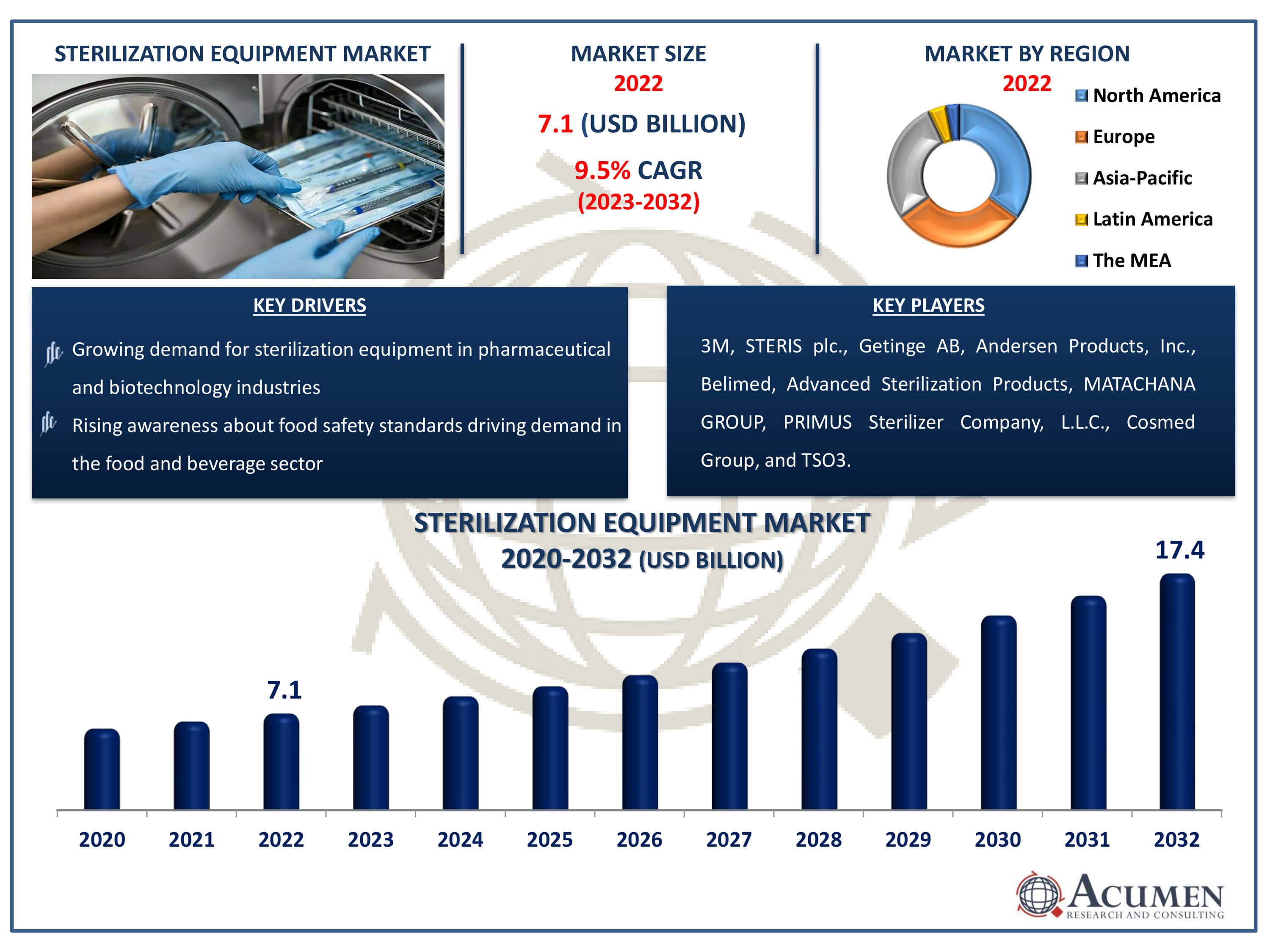

The Sterilization Equipment Market Size accounted for USD 7.1 Billion in 2022 and is estimated to achieve a market size of USD 17.4 Billion by 2032 growing at a CAGR of 9.5% from 2023 to 2032.

Sterilization Equipment Market Highlights

- Global sterilization equipment market revenue is poised to garner USD 17.4 billion by 2032 with a CAGR of 9.5% from 2023 to 2032

- North America sterilization equipment market value occupied around USD 2.5 billion in 2022

- Asia-Pacific sterilization equipment market growth will record a CAGR of more than 11% from 2023 to 2032

- Among product, the low-temperature sterilizers sub-segment generated USD 2.3 billion revenue in 2022

- Based on end-use, the hospitals & clinics sub-segment generated around 30% market share in 2022

- Increasing applications of sterilization equipment in research laboratories and academic institutions is a popular sterilization equipment market trend that fuels the industry demand

Sterilization is the process of eliminating biological agents, including transmissible species like spores, fungus, eukaryotic cells, fluids, and bacteria. It is an important surgical operation that guarantees the sterility and effectiveness of the equipment. The use of non-sterilized commodities can cause a variety of health problems, including public health concerns and possibly deadly illnesses, emphasizing the necessity of disease preventive strategies. Furthermore, sterilization equipment is essential in hospital settings, where cleanliness and infection prevention are critical. Ensuring that adequate sterilization practices are followed is critical for protecting patient health and preserving medical procedures.

Global Sterilization Equipment Market Dynamics

Market Drivers

- Increasing focus on infection control in healthcare settings

- Growing demand for sterilization equipment in pharmaceutical and biotechnology industries

- Rising awareness about food safety standards driving demand in the food and beverage sector

- Technological advancements leading to the development of more efficient sterilization methods

Market Restraints

- High initial investment costs associated with sterilization equipment

- Stringent regulatory requirements impacting market entry barriers

- Challenges related to disposal of sterilization by-products and environmental concerns

Market Opportunities

- Expansion of healthcare infrastructure in emerging markets

- Adoption of sterilization technologies in developing countries

- Growing demand for single-use sterilization products

Sterilization Equipment Market Report Coverage

| Market | Sterilization Equipment Market |

| Sterilization Equipment Market Size 2022 | USD 7.1 Billion |

| Sterilization Equipment Market Forecast 2032 | USD 17.4 Billion |

| Sterilization Equipment Market CAGR During 2023 - 2032 | 9.5% |

| Sterilization Equipment Market Analysis Period | 2020 - 2032 |

| Sterilization Equipment Market Base Year |

2022 |

| Sterilization Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M, STERIS plc., Getinge AB, Andersen Products, Inc., Belimed, Advanced Sterilization Products, MATACHANA GROUP, PRIMUS Sterilizer Company, L.L.C., Cosmed Group, and TSO3. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Sterilization Equipment Market Insights

The primary driver behind the growth of the global sterilization equipment market is the increasing geriatric population and rising consumer awareness regarding infections and diseases. Other contributing factors include heightened spending on healthcare infrastructure and government initiatives focusing on public health through the implementation of stringent regulations in various countries. However, the high prices of sterilization equipment pose a challenge in more developed economies, hindering the growth of the sterilization equipment industry. Sterilization technology is not limited to medical applications but also plays a crucial role in the food and beverage market. This thriving sector is expected to generate significant revenue opportunities in the sterilization equipment market forecast period, particularly with the widespread use of cleaning and disinfecting containers and packaging. Market players in the sterilization equipment industry rely on designing equipment with comprehensive disinfection capabilities for a wide range of instruments. Nevertheless, the combination of high costs and strict regulatory environments in emerging economies may impede market growth during the sterilization equipment industry forecast period.

Significant prospects are presented by the sterilization equipment market, driven by growing usage across many sectors and evolving technological improvements. Firstly, there is a big potential due to the growing need for sterilization equipment in healthcare institutions. The necessity for strict sterilization procedures and increased worries about hospital-acquired illnesses have led to an increase in the need for sophisticated sterilization equipment. This includes not just conventional medical settings but also newly developing domains including ambulatory surgery centers, outpatient centers, and dentistry clinics. Furthermore, the broader application of sterilization equipment outside of the healthcare sector in sectors like biotechnology, food and beverage, and pharmaceuticals offers still another encouraging opportunity for market expansion. Sterilization technologies are being used more often in various industries as a means of upholding regulatory requirements, maintaining hygiene standards, and ensuring product safety and quality assurance. Sterilization equipment, for example, addresses customer concerns about food safety in the food business by ensuring the preservation of perishable commodities, extending shelf life, and eliminating infections. Similar to this, sterilization equipment is essential to the biotechnology and pharmaceutical industries for maintaining product integrity and avoiding contamination during the manufacturing process. Sterilization equipment's market reach is increased by this diversity of uses, which creates room for growth and innovation.

Sterilization Equipment Market Segmentation

Sterilization Equipment Market Segmentation

The worldwide market for sterilization equipment is split based on product, end-use, and geography.

Sterilization Equipment Products

- Heat Sterilizers

- Depyrogenation Oven

- Steam Autoclaves Pre-Clinical Services

- Low-Temperature Sterilizers

- Ethylene Oxide Sterilizers

- Hydrogen Peroxide Sterilizers

- Others

- Sterile Membrane Filters

- Radiation Sterilization Devices

- Electron Beams

- Gamma Rays

- Others

- Consumables & Accessories

According to sterilization equipment industry analysis, the low-temperature sterilizers category in the market has the most share for a number of reasons. Heat-sensitive materials including plastics, electronics, and medical equipment with fragile components can be sterilised at lower temperatures with these sterilisers, which use techniques like hydrogen peroxide gas plasma, ethylene oxide gas, and peracetic acid. The segment's prominence is partly attributed to its adaptability in sterilising a broad range of materials. Technological developments have also improved the safety and effectiveness of low-temperature sterilisation techniques, leading to a rise in their use across a number of sectors, including biotechnology, pharmaceuticals, and healthcare. Low-temperature sterilisers continue to be in high demand due to strict sterilisation standards rules and the necessity for dependable sterilisation solutions in healthcare facilities; this has solidified their position as the market leader for sterilisation equipment.

Sterilization Equipment End-Uses

- Hospitals & Clinics

- Biotech and Pharmaceutical Companies

- Medical Device Companies

- Food & Beverage Industry

- Others

The market for sterilisation equipment is dominated by the hospitals & clinics sector for a number of important reasons. First of all, as vital healthcare facilities, hospitals and clinics prioritise patient care and safety, which calls for strict sterilisation procedures. The need for dependable sterilisation equipment to stop infections and guarantee patient safety is growing as medical procedures become more complicated. The increasing occurrence of healthcare-associated infections (HAIs) and the requirement to comply with regulatory guidelines propel the use of sophisticated sterilisation technology in medical facilities. Moreover, the need for sterilisation equipment in these environments is fueled by the global growth of healthcare infrastructure, especially in emerging nations. Hospitals and clinics are an important market for sterilisation equipment makers because they require a wide range of medical tools, devices, and equipment to be sterilised. This solidifies the segment's position as the largest end-user in the sterilisation equipment market.

Sterilization Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Sterilization Equipment Market Regional Analysis

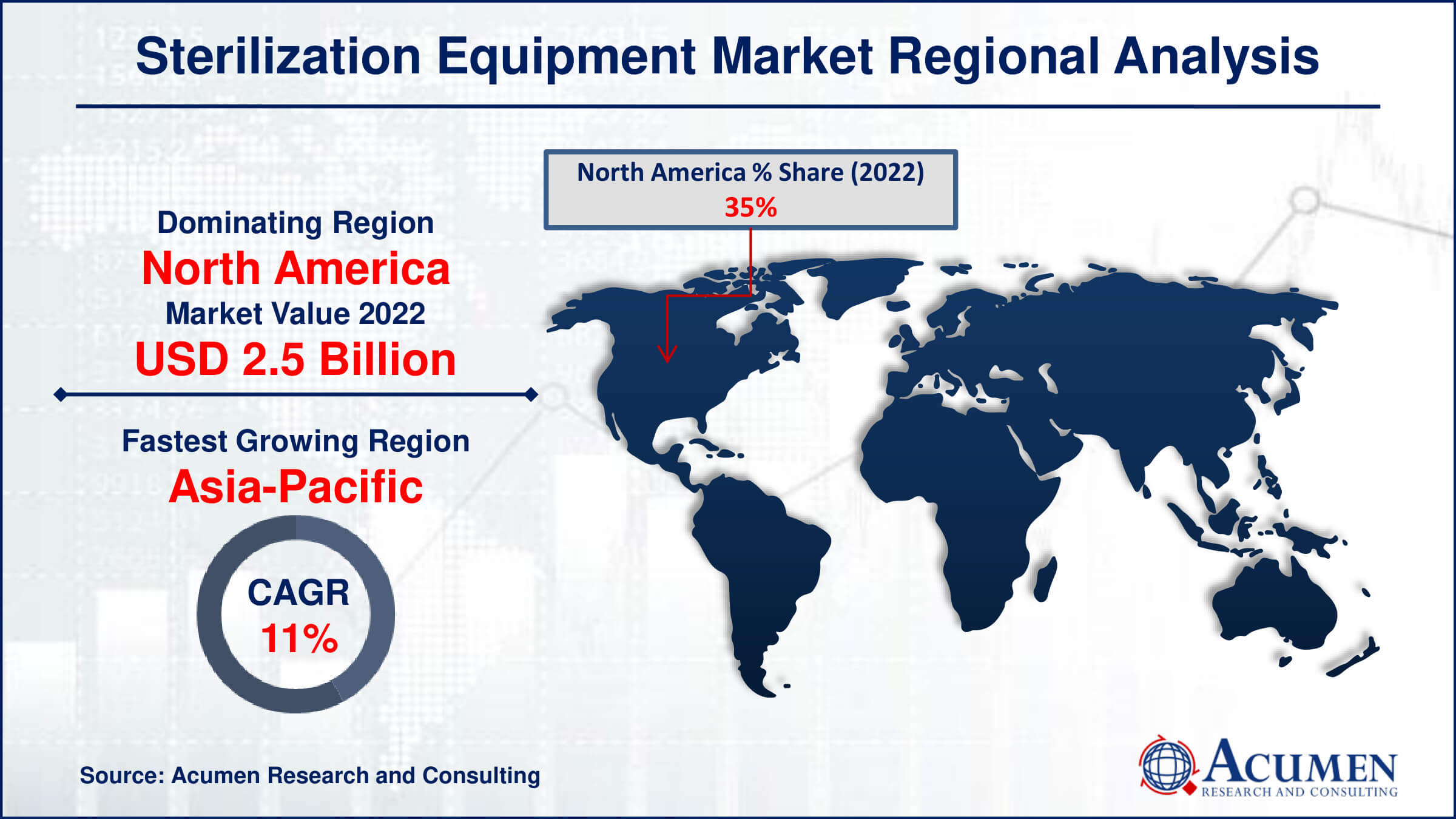

In terms of sterilization equipment market analysis, in 2022, North America, followed closely by Europe, held the highest market share in the globally. This trend was primarily driven by several factors, including the increasing number of clinics and hospitals, a growing population, and government initiatives aimed at enhancing healthcare services across North America. These factors collectively fueled the development and expansion of the sterilization equipment market in the region.

Looking ahead, the Asia-Pacific region is poised for the fastest growth in the sterilization equipment market over the projected period. This anticipated growth can be attributed to the region's large and burgeoning population, coupled with a higher incidence of hospital-acquired diseases in healthcare facilities and operating centers. Furthermore, the Asia-Pacific sterilization equipment market is bolstered by the burgeoning number of pharmaceutical companies and the potential expansion of the food and beverage industry, both of which prioritize the sterilization of products to ensure safety and quality standards.

Sterilization Equipment Market Players

Some of the top sterilization equipment companies offered in our report includes 3M, STERIS plc., Getinge AB, Andersen Products, Inc., Belimed, Advanced Sterilization Products, MATACHANA GROUP, PRIMUS Sterilizer Company, L.L.C., Cosmed Group, and TSO3.

Frequently Asked Questions

How big is the sterilization equipment market?

The sterilization equipment market size was valued at USD 7.1 billion in 2022.

What is the CAGR of the global sterilization equipment market from 2023 to 2032?

The CAGR of sterilization equipment is 9.5% during the analysis period of 2023 to 2032.

Which are the key players in the sterilization equipment market?

The key players operating in the global market are including 3M, STERIS plc., Getinge AB, Andersen Products, Inc., Belimed, Advanced Sterilization Products, MATACHANA GROUP, PRIMUS Sterilizer Company, L.L.C., Cosmed Group, and TSO3

Which region dominated the global sterilization equipment market share?

North America held the dominating position in sterilization equipment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of sterilization equipment during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global sterilization equipment industry?

The current trends and dynamics in the sterilization equipment industry including increasing focus on infection control in healthcare settings, growing demand for sterilization equipment in pharmaceutical and biotechnology industries, rising awareness about food safety standards driving demand in the food and beverage sector, and technological advancements leading to the development of more efficient sterilization methods.

Which end-use held the maximum share in 2022?

The hospitals & clinics held the maximum share of the sterilization equipment industry.