Steel Casting Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Steel Casting Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

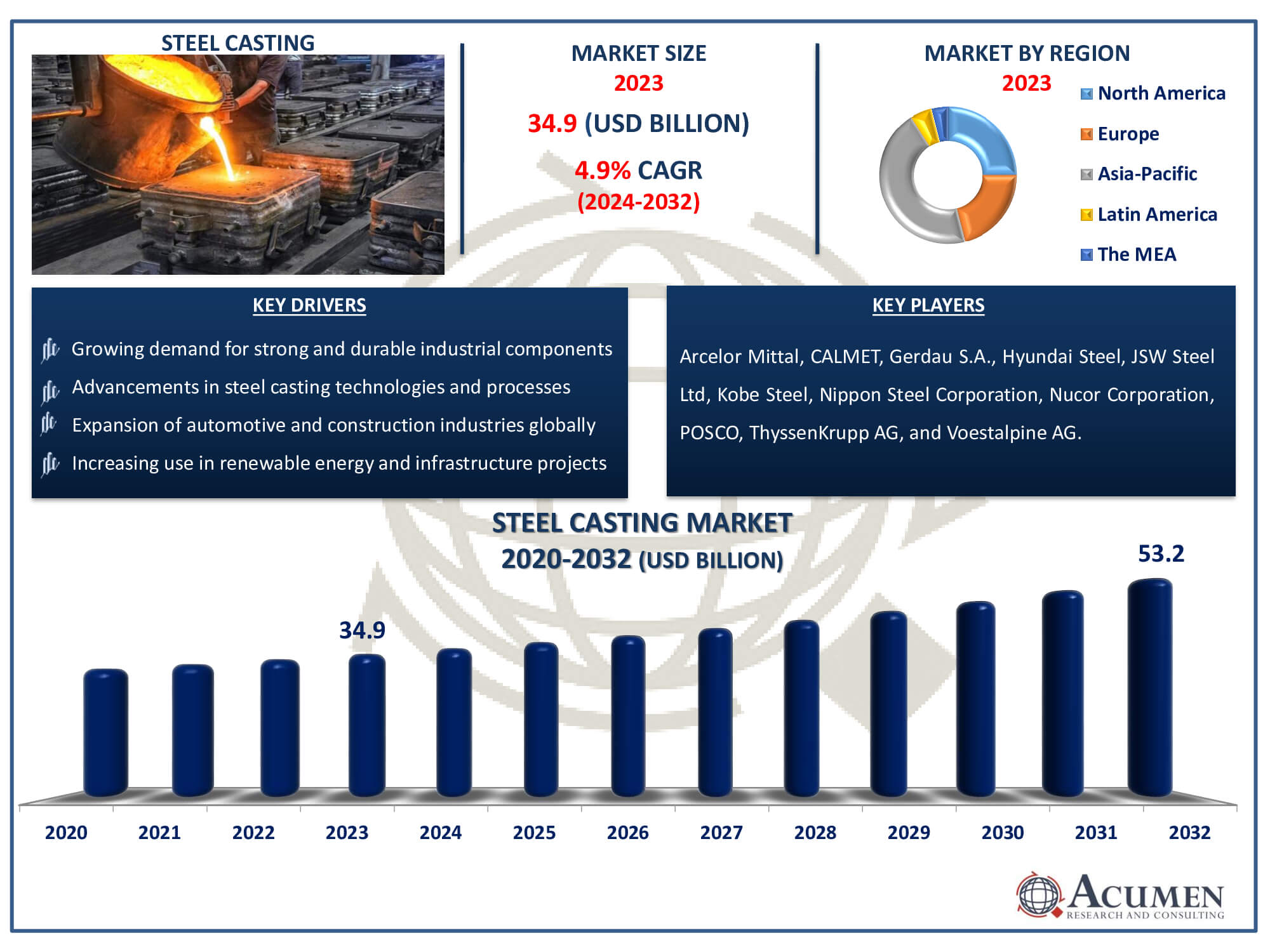

The Steel Casting Market Size accounted for USD 34.9 Billion in 2023 and is estimated to achieve a market size of USD 53.2 Billion by 2032 growing at a CAGR of 4.9% from 2024 to 2032.

Steel Casting Market Highlights

- The global steel casting market is projected to reach USD 53.2 billion by 2032, growing at a CAGR of 4.9% from 2024 to 2032

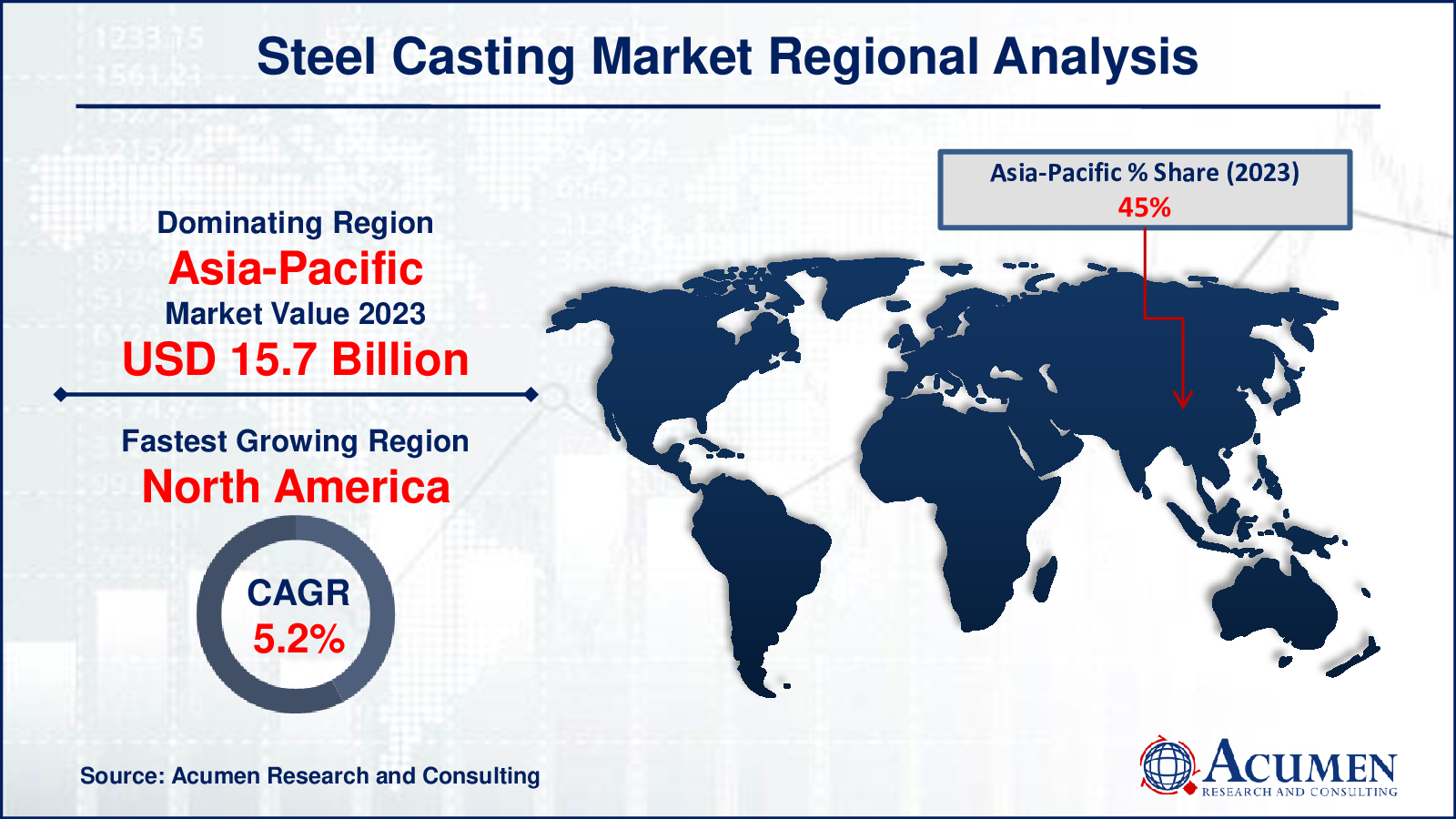

- The Asia-Pacific steel casting market was valued at USD 15.7 billion in 2023

- North America steel casting market is expected to grow at a CAGR of 5.2% from 2024 to 2032

- Based on product type, the stainless steel casting occupied significant revenue in 2023

- The sand casting application held utmost share in the steel casting market in 2023

- Increasing adoption of advanced simulation and modeling techniques to optimize casting processes is a key trend in the steel casting market, boosting industry growth

Steel casting is the technique of producing metal components by pouring molten steel into a mold cavity, which hardens into the appropriate shape when cooled. It is a versatile manufacturing technology commonly employed in industries that require strong, long-lasting, and intricately formed metal parts. The process begins with the creation of a mold, commonly out of sand or clay, into which molten steel is poured under regulated conditions. Once the steel has solidified, the mold is removed, revealing a finished casting that can range in size from small components to big, sophisticated elements utilized in heavy machinery, car engines, Oil & Gas equipment, and other applications.

Steel casting has various advantages, including the ability to make products with great dimensional accuracy, an outstanding surface polish, and sophisticated geometries that would be difficult or expensive to achieve using other manufacturing techniques. It enables the fabrication of components with excellent strength, wear resistance, and heat resistance, making it ideal for applications requiring dependability and performance under difficult conditions. Steel castings play an important role in a variety of industrial sectors, including infrastructure development, transportation, energy production, and many other crucial applications.

Global Steel Casting Market Dynamics

Market Drivers

- Growing demand for strong and durable industrial components

- Advancements in steel casting technologies and processes

- Expansion of automotive and construction industries globally

- Increasing use in renewable energy and infrastructure projects

Market Restraints

- High initial setup costs for foundries and equipment

- Environmental concerns and stringent regulations on emissions

- Competition from alternative materials like aluminum and composites

Market Opportunities

- Adoption of automation and digitalization in casting processes

- Expansion into emerging markets with infrastructure development

- Rising demand for specialized and custom-designed steel components

Steel Casting Market Report Coverage

| Market | Steel Casting Market |

| Steel Casting Market Size 2022 | USD 34.9 Billion |

| Steel Casting Market Forecast 2032 | USD 53.2 Billion |

| Steel Casting Market CAGR During 2023 - 2032 | 4.9% |

| Steel Casting Market Analysis Period | 2020 - 2032 |

| Steel Casting Market Base Year |

2022 |

| Steel Casting Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Process, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arcelor Mittal, CALMET, Gerdau S.A., Hyundai Steel, JSW Steel Ltd, Kobe Steel, Nippon Steel Corporation, Nucor Corporation, POSCO, ThyssenKrupp AG, and Voestalpine AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Steel Casting Market Insights

The strong demand in numerous industry sectors, such as automotive, construction, aerospace, and energy, is a major driver. Steel castings are preferred for their strength, durability, and capacity to survive severe environments, making them ideal for important components such as engine blocks, gears, and structural sections in infrastructure projects. Furthermore, improvements in steel casting technologies, including as computer simulations and 3D mold printing, improve manufacturing efficiency and precision, driving market growth.

However, the business is constrained by high initial investment costs for establishing foundries and procuring specialized equipment. Environmental rules also present obstacles, particularly in terms of emissions and waste management related to steel casting processes. Furthermore, competition from alternative materials such as aluminum and composite materials, which provide advantages in weight reduction and particular applications, limits steel casting's growth potential in certain markets.

Despite these limitations, there are various opportunities in the steel casting sector. The use of automation and digitalization in casting operations increases productivity while decreasing production costs. Expansion into emerging markets, along with increased infrastructural development, creates new opportunities for growth. Furthermore, the increasing demand for specialized and custom-designed steel components in industries such as renewable energy and industrial machinery creates chances for innovation and market expansion. Overall, while facing hurdles, the steel casting industry continues to flourish with technological breakthroughs and expanding application areas around the world.

Steel Casting Market Segmentation

The worldwide market for steel casting is split based on product type, process, application, and geography.

Steel Casting Market By Product Type

- Carbon Steel Casting

- Alloy Steel Casting

- Stainless Steel Casting

According to the steel casting industry analysis, stainless steel casting has dominated the market due to its adaptable features and wide range of applications in many industries. Stainless steel has exceptional corrosion resistance, strength, and durability, making it perfect for use in harsh situations such as maritime, chemical processing, and food manufacturing. It is widely utilized in the production of components that require hygiene, reliability, and lifespan, such as valves, pumps, medical devices, and architectural fittings. The increased emphasis on quality and performance in industrial applications further boosts the demand for stainless steel casting, confirming its position as a major product category in the global steel casting market.

Steel Casting Market By Process

- Sand Casting

- Investment Casting

- Die Casting

- Others

Sand casting has historically dominated the steel casting business due to its versatility, cost-effectiveness, and capacity to produce massive and complicated components. This method entails making a mold from compacted sand around a pattern of the desired object and then pouring molten steel into the mold cavity. Sand casting is popular because to its ability to handle diverse steel grades, rapid production rates, and adaptability to different sizes and shapes. It remains popular in industries such as automotive, aerospace, and heavy machinery that demand large-scale manufacturing of complicated components like as engine blocks, gears, and turbine blades, demonstrating its supremacy in the steel casting market.

Steel Casting Market By Application

- Automotive

- Aerospace & Defense

- Construction

- Industrial Machinery

- Power Generation

- Oil & Gas

- Others

As per the steel casting market forecast, the automotive sector has considerably dominated the industry due to the widespread usage of steel components in engine parts, transmission systems, and chassis components. Steel castings are preferred for their strength, durability, and cost-effectiveness, as they meet high performance standards in car manufacture. Additionally, the aerospace and defense industries make significant contributions to the market by using steel castings for important applications such as aircraft engine components, landing gear, and structural parts. The oil and gas industry follows closely, using steel castings in valves, pumps, and drilling equipment, emphasizing their relevance in difficult settings that require tough and reliable materials for operating efficiency and safety.

Steel Casting Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Steel Casting Market Regional Analysis

Asia-Pacific dominates the worldwide steel casting market, owing to widespread industrialization, rapid infrastructural development, and the region's position as a manufacturing hub. China, India, and Japan are the world's largest automotive producers, with high demand for steel castings in engine components, chassis parts, and structural elements. The increase in construction activity, driven by urbanization and industrial expansion, raises the demand for steel castings in infrastructure projects. Furthermore, Asia-Pacific benefits from increased investments in areas like as aerospace, defense, and power generation, which contribute to its dominating position in the worldwide steel casting market.

The steel casting market is expanding rapidly in Europe and North America, owing to technical improvements, high quality standards, and dynamic industrial sectors. In Europe, countries such as Germany, France, and Italy are at the forefront of automotive and aerospace industry, where steel castings play an important part in making components for engines, transmissions, and structural applications. The region's emphasis on sustainability and rigorous environmental restrictions encourages the use of modern steel casting technology.

In North America, notably the United States and Canada, market growth is being driven by a strong automotive industry, as well as investments in infrastructure and defense. Steel castings are essential in the construction of heavy machinery, oil and gas equipment, and power generation components. The region's emphasis on innovation and quality control assures excellent manufacturing standards, which fuels demand for steel castings in a variety of applications. Both Europe and North America continue to innovate in steel casting methods and materials, establishing themselves as significant players in the global steel casting market's growth and development.

Steel Casting Market Players

Some of the top steel casting companies offered in our report includes Arcelor Mittal, CALMET, Gerdau S.A., Hyundai Steel, JSW Steel Ltd, Kobe Steel, Nippon Steel Corporation, Nucor Corporation, POSCO, ThyssenKrupp AG, and Voestalpine AG.

Frequently Asked Questions

How big is the steel casting market?

The steel casting market size was valued at USD 34.9 billion in 2023.

What is the CAGR of the global steel casting market from 2024 to 2032?

The CAGR of steel casting industry is 4.9% during the analysis period of 2024 to 2032.

Which are the key players in the Steel Casting market?

The key players operating in the global market are including Arcelor Mittal, CALMET, Gerdau S.A., Hyundai Steel, JSW Steel Ltd, Kobe Steel, Nippon Steel Corporation, Nucor Corporation, POSCO, ThyssenKrupp AG, and Voestalpine AG.

Which region dominated the global steel casting market share?

Asia-Pacific held the dominating position in steel casting industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of steel casting during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global steel casting industry?

The current trends and dynamics in the steel casting market include growing demand for strong and durable industrial components, advancements in steel casting technologies and processes, and expansion of automotive and construction industries globally.

Which type held the maximum share in 2023?

The stainless steel casting held the maximum share of the steel casting industry.