STD Testing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

STD Testing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

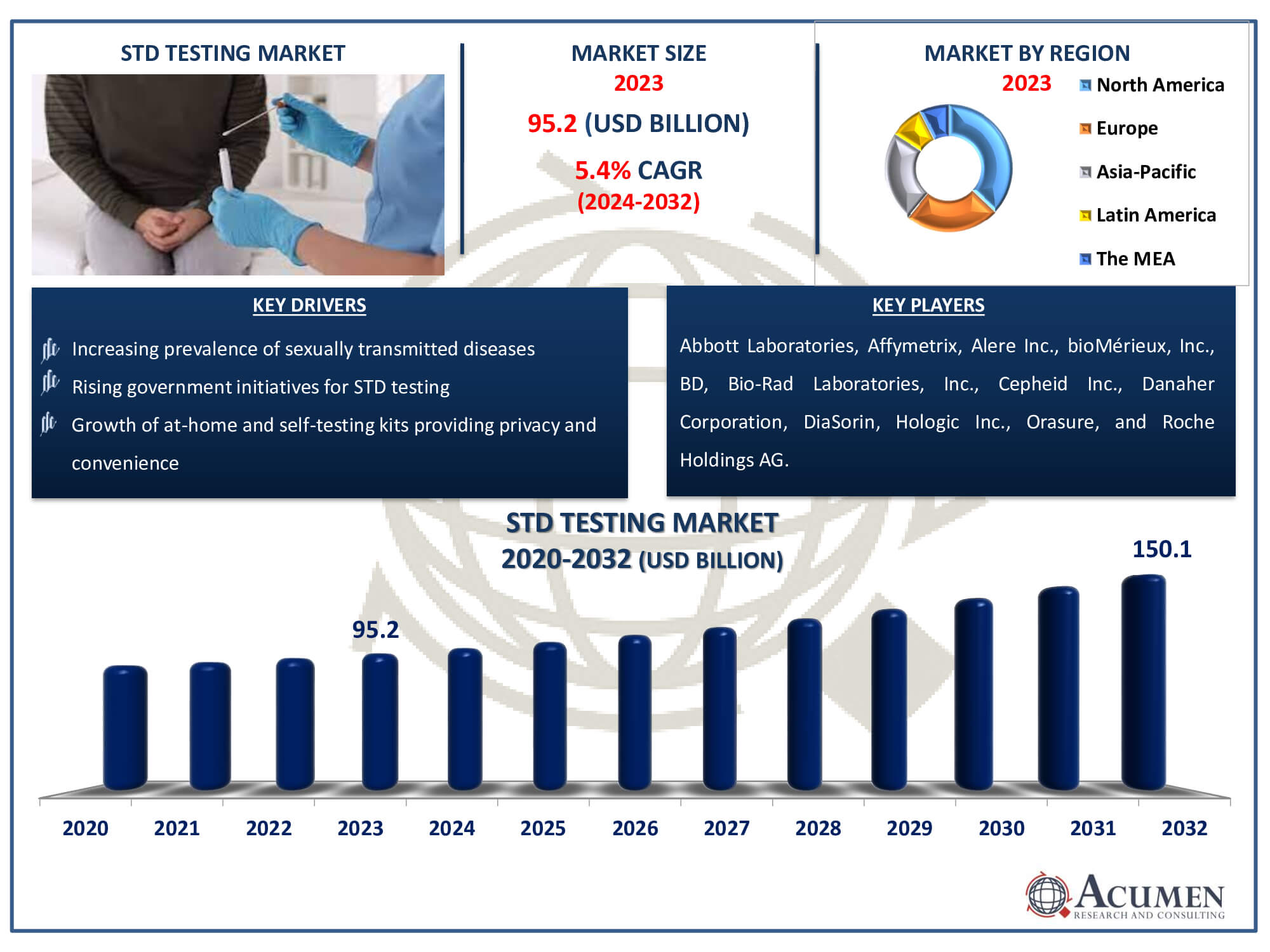

The STD Testing Market Size accounted for USD 95.2 Billion in 2023 and is estimated to achieve a market size of USD 150.1 Billion by 2032 growing at a CAGR of 5.4% from 2024 to 2032.

STD Testing Market Highlights

- Global STD testing market revenue is poised to garner USD 150.1 billion by 2032 with a CAGR of 5.4% from 2024 to 2032

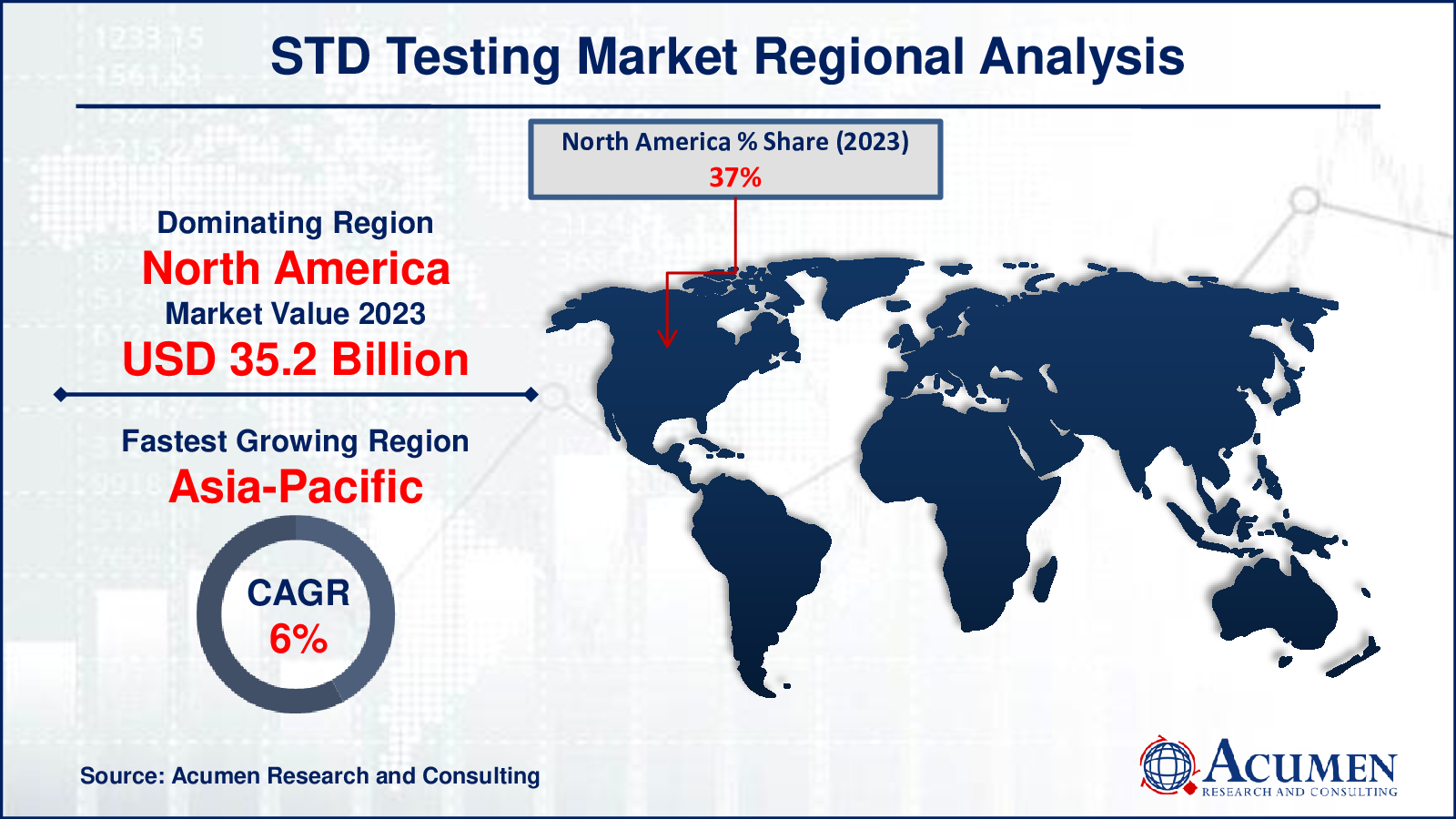

- North America STD testing market value occupied around USD 35.2 billion in 2023

- Asia-Pacific STD testing market growth will record a CAGR of more than 6% from 2024 to 2032

- Among disease type, the chlamydia sub-segment gathered notable market share in 2023

- According to the World Health Organization (WHO), the most common curable sexually transmitted infections (STIs) are trichomonas, chlamydia, gonorrhea, and syphilis

- Based on device type, the laboratory testing sub-segment occupied around 70% market share in 2023

- Increased adoption of at-home testing is a popular STD testing market trend that fuels the industry demand

The widespread prevalence of sexually transmitted diseases (STDs) is a major driver of the booming STD testing market. According to the World Health Organization, over 1 million sexually transmitted infections are contracted every day across the globe. WHO data further highlights the staggering annual numbers: Trichomoniasis leads with 156 million new cases, followed by Chlamydia at 127 million, Gonorrhea at 87 million, and Syphilis at 6.3 million. These alarming statistics underscore the critical need for effective STD testing, fueling the industry's substantial growth worldwide

Sexually transmitted diseases (STDs) are infections that are passed from one person to another through sexual contact. STDs are frequently transmitted through oral, vaginal, or anal sex, claims Medline Plus. But studies have also revealed that STDs can spread via other types of intimate physical contact, like skin-to-skin contact. Sexually transmitted diseases also commonly known as sexually transmitted infections (STIs) can be caused by viruses, bacteria, and parasites. Women are more susceptible to STDs, particularly during pregnancy.

Global STD Testing Market Dynamics

Market Drivers

- Increasing prevalence of sexually transmitted diseases

- Increased awareness and education about sexual health and the importance of regular testing

- Rising government initiatives for STD testing

- Technological advancements in diagnostic methods enhancing accuracy and convenience

Market Restraints

- Social stigma and embarrassment associated with STD testing

- Limited access to healthcare facilities in rural and underserved areas

- High costs of advanced diagnostic tests and lack of insurance coverage

Market Opportunities

- Increasing national screening programs around the world

- Growth of at-home and self-testing kits providing privacy and convenience

- Expansion of telemedicine and digital health platforms for remote consultation and testing

- Development of more affordable and accessible testing solutions for emerging markets

STD Testing Market Report Coverage

| Market | STD Testing Market |

| STD Testing Market Size 2022 | USD 95.2 Billion |

| STD Testing Market Forecast 2032 | USD 150.1 Billion |

| STD Testing Market CAGR During 2023 - 2032 | 5.4% |

| STD Testing Market Analysis Period | 2020 - 2032 |

| STD Testing Market Base Year |

2022 |

| STD Testing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Disease Type, By Product Type, By Location of Testing, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Laboratories, Affymetrix, Alere Inc., bioMérieux, Inc., Becton Dickinson and Company, Bio-Rad Laboratories, Inc., Cepheid Inc., Danaher Corporation, DiaSorin, Hologic Inc., Orasure, and Roche Holdings AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

STD Testing Market Insights

The growing prevalence of STDs around the world is the primary driver of the sexually transmitted disease testing market growth. According to the World Health Organization, over 374 million new infections are acquired annually, with Chlamydia, syphilis, gonorrhea, and trichomoniasis being the most common. It is also estimated that 500 million people between the ages of 15 and 49 are infected with the herpes simplex virus (HSV) in their genital area. As a result, the value of the STD testing market is multiplying as the number of patients increases globally.

Another factor driving the STD testing market is increased patient awareness and favorable government support for testing. Adolescents and young adults between the ages of 15 and 24 are more vulnerable to STIs than older adults. According to the World Health Organization, 20% of HIV/AIDS patients are in their twenties, and one out of every twenty adolescents contracts an STI each year. Youths are more likely than adults to engage in unprotected sex, have multiple sexual partners, and engage in transgenerational and transactional sex. The Centers for Disease Control and Prevention (CDC) recommends that sexually active people get tested for STDs. Furthermore, all adolescents and adults aged 13 to 64 should be tested for HIV at least once. Every year, all sexually active women under the age of 25 should be tested for gonorrhea and chlamydia. Additionally, all pregnant women should be tested for HIV, syphilis, and hepatitis B and C.

However, the social stigma associated with these tests prevents the market from expanding. According to the WHO, barriers to greater and more effective use of these treatments include a lack of public awareness, a lack of training among health workers, and a long-standing, widespread stigma surrounding STIs. Furthermore, a large proportion of sexually infected people live in remote areas where rapid testing is not feasible, resulting in a lack of testing, which also inhibits market growth.

Additionally, rising government initiatives in various countries are expected to generate a plethora of growth opportunities for the market in the coming years. The National AIDS Control Programme (NACP) IV, initiated by the National AIDS Control Organization (NACO), is an HIV/AIDS prevention and control programme in India. The NACP IV programme aimed to provide universal and standardized high-quality STI/RTI services in all healthcare settings. Furthermore, NACO offers free standardized STI/RTI services to the public. As a result, favorable government initiatives are assisting the STD testing market to grow positively, particularly in India, Indonesia, Thailand, and African countries, among others.

STD Testing Market Segmentation

The worldwide market for STD testing is split based on disease type, product type, location of testing, and geography.

STD Testing Market By Disease Type

- Chlamydia

- Gonorrhea

- Herpes Simplex Virus

- Syphilis

- Human Papillomavirus (HPV)

- Genital Herpes (HSV I & HSV II)

- HIV/AIDS

- Trichomoniasis

- Other Diseases

According to the STD Testing industry analysis, chlamydia STD testing generated the maximum significant share in 2023 and is expected to continue its trend during the forecast timeframe from 2024 to 2032. Chlamydia (Chlamydia trachomatis) is the most common sexually transmitted infection in the world and its high prevalence, coupled with widespread screening programs, contributes significantly to its dominance in the STD testing market. In 2019, the CDC received reports of 1,808,703 cases of Chlamydia trachomatis infection, making it the most common reportable condition in the United States. Adolescents and young adults have the highest rates of reported chlamydia. In 2019, nearly two-thirds (61%) of all reported chlamydia cases were in people aged 15 to 24.

STD Testing Market By Product Type

- Instruments/Analyzers

- Laboratory devices

- Thermal cyclers – PC

- Lateral Flow Readers

- Flow Cytometers

- Absorbance Microplate Reader

- Differential Light Scattering Machines

- Other Laboratory Devices

- Point of care devices

- Phone chips (Microfludics + ICT)

- Portable/Bench Top/Rapid Diagnostic Kits

- Laboratory devices

- Consumables

- Reagents

- Kits

- Test Strips

- Others

According to the STD testing market analysis, the consumables sector dominated the STD testing market by product type, accounting for the majority of the market. Consumables, such as reagents, kits, and other test materials, are widely utilized in STD testing methods, making them an important market component. Subcategories of consumables include reagents, kits, test strips, and specimen collection equipment. These supplies are used in a variety of STD tests, including HIV, chlamydia, gonorrhea, and syphilis. Their high demand and use in STD testing techniques help to maintain their market dominance.

STD Testing Market By Location of Testing

- Laboratory Testing

- Point of Care (POC) Testing

As per the STD testing market forecast, the laboratory testing segment is predicted to lead the market in terms of testing location. This sort of testing involves the examination of biological materials in a laboratory setting, which is normally carried out by qualified medical professionals and necessitates specialized equipment and knowledge. Laboratory testing is often thought to be more accurate than point of care (POC) testing due to the use of specialist equipment and skilled medical experts.

Laboratory testing can also perform a variety of assays, such as PCR and ELISA, which are not available in point-of-care settings. Furthermore, laboratories are manned by highly qualified medical specialists capable of performing complex tests and interpreting the results. These specialists can also provide assistance and support to patients who are suffering STD-related symptoms or concerns.

STD Testing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

STD Testing Market Regional Analysis

North America is well-positioned to preserve its worldwide market leadership, due a number of crucial factors. First is the growing number of STI’s in US. According to the Center for Diesease Control (CDC), more than 2.5 million cases of syphilis, gonorrhea, and chlamydia were reported in the United States in 2022. One key advantage is the availability of technologically innovative products in the region. These revolutionary products are at the forefront of medical breakthroughs, offering more precise and effective testing methods for sexually transmitted illnesses. Additionally, the region benefits from a strong regulatory environment, as evidenced by the FDA's clearance of STD testing devices. This clearance ensures that the gadgets meet strict safety and efficacy standards, which boosts customer confidence and encourages wider use.

Insurance coverage policies in North America also play an important role in sustaining the STD testing industry. These insurance frequently cover the expenses of STD testing, making it more affordable to a larger part of the population. This accessibility is critical for encouraging early detection and treatment, ultimately improving public health outcomes. Furthermore, the emergence of novel point-of-care (POC) testing concepts is changing the face of STD testing in North America. POC testing enables for rapid, on-site diagnosis, which can be very useful in clinical settings, distant places, or circumstances requiring immediate results. These novel approaches improve the convenience and speed of STD testing, making it easier for people to get tested and obtain results quickly.

The Asia-Pacific region is expected to account for a sizable portion of the STD testing market between 2024 and 2032. This increase is mostly due to the rising number of STD cases in growing nations such as China, India, Indonesia, and the Philippines.

According to recent estimates from China's Administration for Disease Control and Prevention, 62,167 people were infected with HIV, 464,435 with syphilis, and 105,160 with gonorrhea in 2020. Similarly, the Indian Journal of Clinical and Experimental Dermatology (IJCED) reports that sexually transmitted infections (STDs) affect around 30 million people in India each year, or about 5-6% of the sexually active adult population.

Several other reasons are driving the STD testing market in Asia-Pacific. Increasing awareness through educational programs helps to educate the public on the necessity of STD testing and prevention. There is also an increasing awareness among the youth population about sexual health. Furthermore, government activities to promote STD testing are critical in driving market growth.

STD Testing Market Players

Some of the top STD testing companies offered in our report includes Abbott Laboratories, Affymetrix, Alere Inc., bioMérieux, Inc., Becton Dickinson and Company, Bio-Rad Laboratories, Inc., Cepheid Inc., Danaher Corporation, DiaSorin, Hologic Inc., Orasure, and Roche Holdings AG.

Frequently Asked Questions

How big is the STD testing market?

The STD testing market size was valued at USD 95.2 billion in 2023.

What is the CAGR of the global STD testing market from 2024 to 2032?

The CAGR of STD Testing industry is 5.4% during the analysis period of 2024 to 2032.

Which are the key players in the STD testing market?

The key players operating in the global market are including Abbott Laboratories, Affymetrix, Alere Inc., bioM�rieux, Inc., Becton Dickinson and Company, Bio-Rad Laboratories, Inc., Cepheid Inc., Danaher Corporation, DiaSorin, Hologic Inc., Orasure, and Roche Holdings AG.

Which region dominated the global STD testing market share?

North America held the dominating position in STD testing industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of STD testing during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global STD testing industry?

The current trends and dynamics in the STD testing industries include increasing prevalence of sexually transmitted diseases, increased awareness and education about sexual health and the importance of regular testing, and rising government initiatives for STD testing.

Which disease type held the maximum share in 2023?

The chlamydia disease type held the maximum share of the STD testing industry.