Spray Drying Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Spray Drying Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

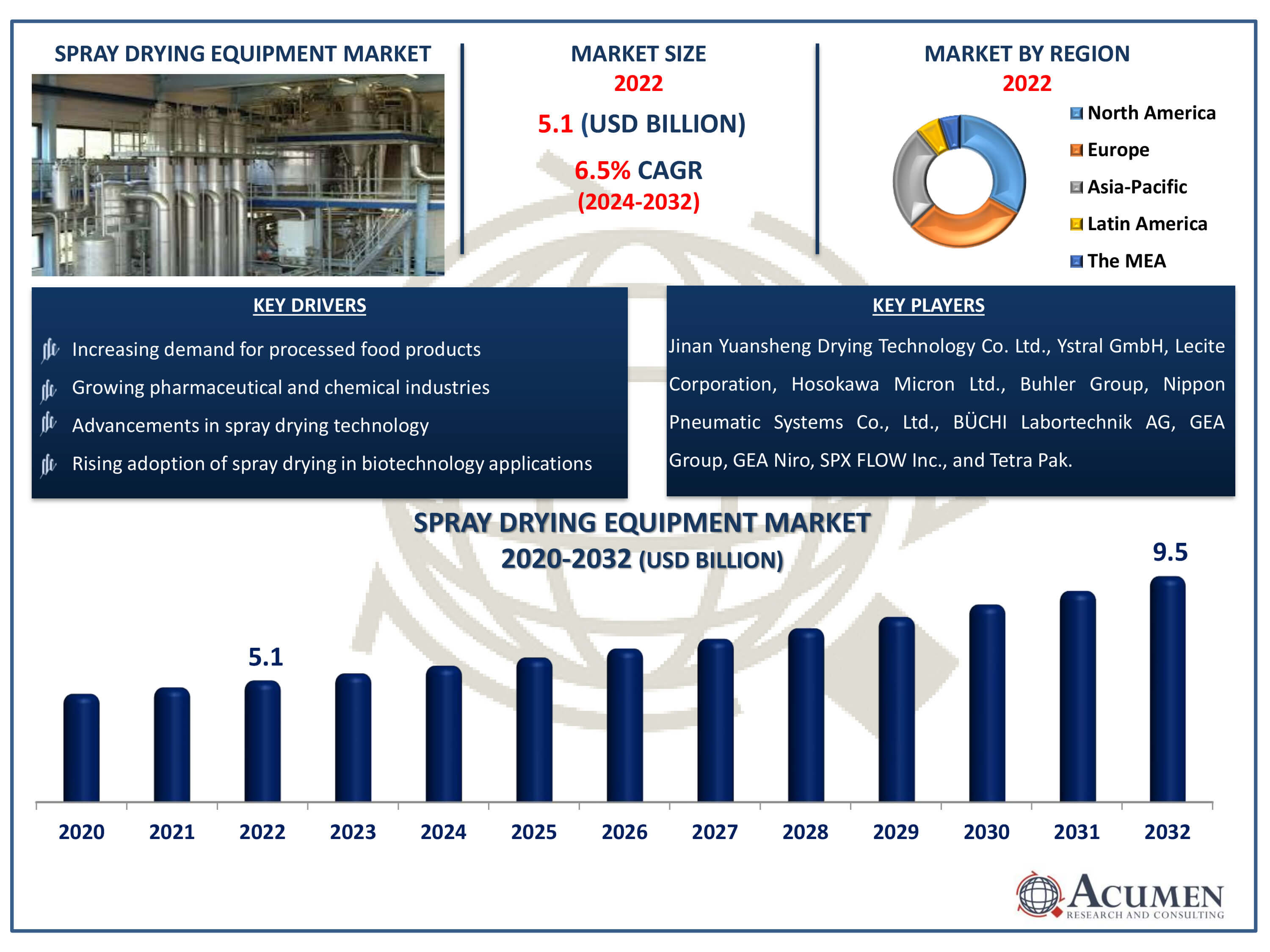

The Spray Drying Equipment Market Size accounted for USD 5.1 Billion in 2022 and is estimated to achieve a market size of USD 9.5 Billion by 2032 growing at a CAGR of 6.5% from 2024 to 2032.

Spray Drying Equipment Market Highlights

- Global spray drying equipment market revenue is poised to garner USD 9.5 billion by 2032 with a CAGR of 6.5% from 2024 to 2032

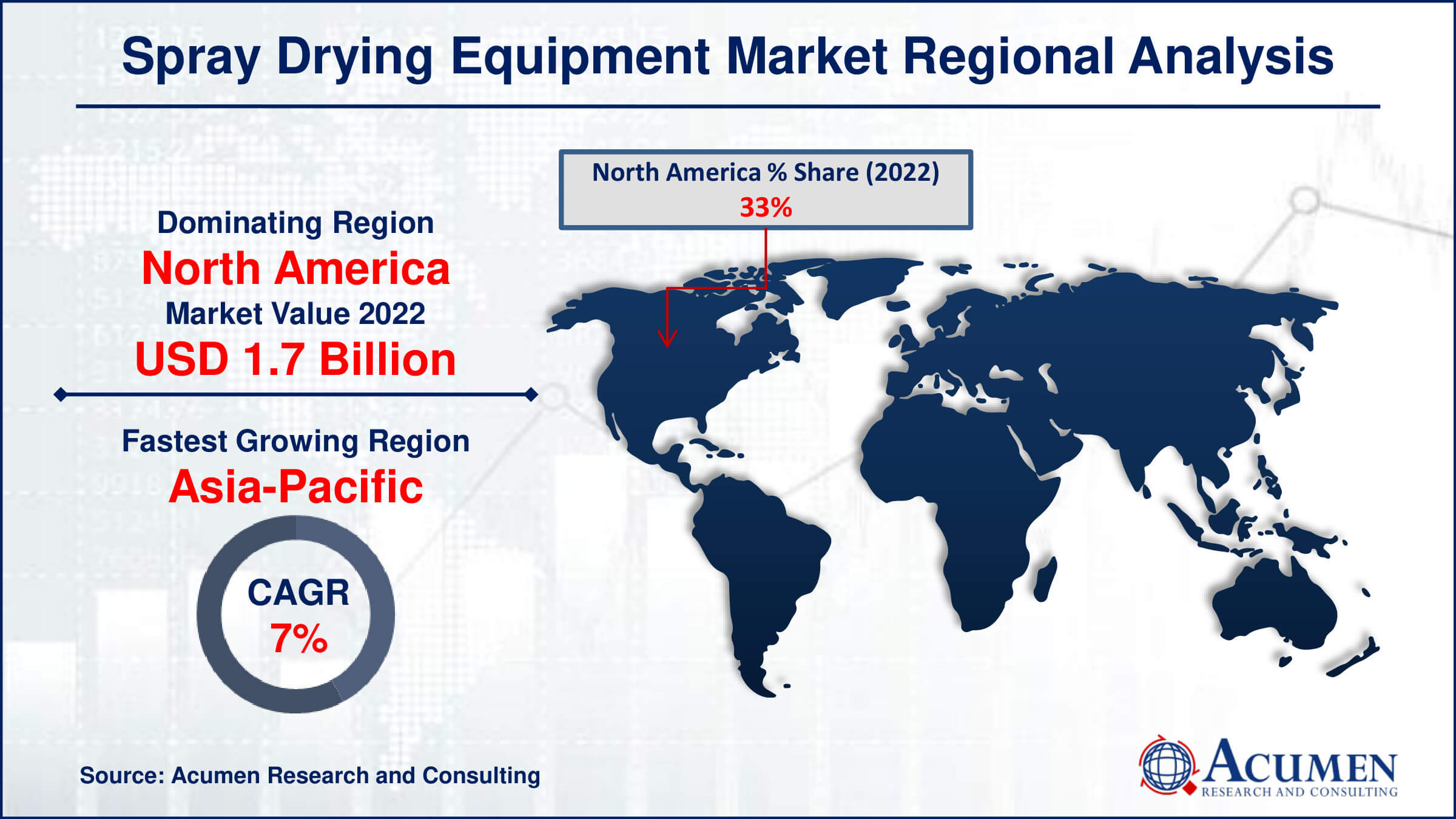

- North America spray drying equipment market value occupied around USD 1.7 billion in 2022

- Asia-Pacific spray drying equipment market growth will record a CAGR of more than 7% from 2024 to 2032

- Among product, the nozzle atomizer sub-segment generated USD 2.1 billion revenue in 2022

- Based on flow, the co-current sub-segment generated around 54% spray drying equipment market share in 2022

- Within stage segment, the two-stage sub-segment generated more than USD 2.2 billion revenue in 2022

- The open cycle segment generated around 66% spray drying equipment market share in 2022

- On the basis of application segment, the food & dairy sub-segment generated USD 2 billion revenue in 2022

- Emerging markets in Asia-Pacific and Latin America presenting untapped opportunities is a popular spray drying equipment market trend that fuels the industry demand

In spray drying facilities, moisture is effectively removed from things using a basic process. This process begins by dispersing liquid or slurry into small droplets, which are subsequently exposed to a stream of heated gas. The heat rapidly evaporates moisture from the droplets, leaving behind granular product particles. Spray dryers are often designed as vertical columns, with slurry supplied at the top and heated gases moving from bottom to top. This counter-current flow promotes maximum contact between droplets and gas, resulting in complete drying. Spray drying is frequently employed in sectors such as food processing and pharmaceuticals because it is excellent at creating dry, granular materials.

Global Spray Drying Equipment Market Dynamics

Market Drivers

- Increasing demand for processed food products

- Growing pharmaceutical and chemical industries

- Advancements in spray drying technology

- Rising adoption of spray drying in biotechnology applications

Market Restraints

- High initial investment costs

- Energy-intensive nature of spray drying processes

- Stringent regulations regarding food and pharmaceutical product safety

Market Opportunities

- Expansion of spray drying applications in the nutraceutical industry

- Growing demand for instant powdered products

- Rising focus on sustainable and energy-efficient spray drying solutions

Spray Drying Equipment Market Report Coverage

| Market | Spray Drying Equipment Market |

| Spray Drying Equipment Market Size 2022 | USD 5.1 Billion |

| Spray Drying Equipment Market Forecast 2032 |

USD 9.5 Billion |

| Spray Drying Equipment Market CAGR During 2024 - 2032 | 6.5% |

| Spray Drying Equipment Market Analysis Period | 2020 - 2032 |

| Spray Drying Equipment Market Base Year |

2022 |

| Spray Drying Equipment Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product, By Stage, By Flow, By Cycle, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Jinan Yuansheng Drying Technology Co. Ltd., Ystral GmbH, Lecite Corporation, Hosokawa Micron Ltd., Buhler Group, Nippon Pneumatic Systems Co., Ltd., BÜCHI Labortechnik AG, GEA Group, GEA Niro, SPX FLOW Inc., and Tetra Pak. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Spray Drying Equipment Market Insights

Spray drying, a key process in many chemical industries, is well-known for its superior thermal drying characteristics. Its adaptability extends across several sectors, most notably the food and pharmaceutical industries, where it has numerous and diverse uses. The chemical processing industry is expected to increase significantly, driven by rising demand for resins and a variety of polymers. This development trajectory is fueled by the increasing popularity of ready-to-eat goods, as well as improvements in spray-drying technologies targeted at improving product longevity. Despite its numerous benefits, obstacles like as high thermal energy consumption and operational expenses may limit market growth. However, growing economies in Asia-Pacific provide potential development possibilities, thanks to factors such as rising disposable incomes and shifting consumer tastes.

Spray drying is essential for dehydration and moisture removal, successfully reducing microbiological contamination and increasing product shelf life. Spray drying machinery includes air dryers, atomizers, heaters, dispersers, chambers, pumping systems, exhaust air cleaners, and process control systems. Notable is the widespread use of spray drying technology in the manufacturing of powdered milk, medicines, and heat-sensitive items such as milk powder, egg powder, and coffee powder. This method produces tiny, granular particles that are required for a variety of applications in the food sector, such as flavourings, bread items, and pharmaceutical formulation. Spray drying usage is expected to grow even further as industry seek efficient and cost-effective solutions for product drying and formulation. Continuous breakthroughs in spray-drying technologies, along with a constant quest of innovation, will propel the evolution of this vital process across varied industrial landscapes, assuring its long-term relevance and indispensability in current production procedures.

Spray Drying Equipment Market Segmentation

The worldwide market for spray drying equipment is split based on product, stage, flow, cycle, applications, and geography.

Spray Drying Equipment Products

- Fluidized

- Nozzle Atomizer

- Rotary Atomizer

- Centrifugal

Within the spray drying equipment market, the nozzle atomizer segment is the biggest, owing to its extensive use and adaptability in a variety of industrial applications. Nozzle atomizers are preferred for their capacity to produce tiny droplets, which facilitates effective drying operations in a variety of materials and industries. Their exact control over droplet size and distribution makes them ideal for applications that need uniform drying and consistent product quality. Plus, nozzle atomizers allow for easy adjustment of spray settings to fit varying feedstock qualities and output needs. Food processing, pharmaceuticals, and chemicals are among the industries that widely use nozzle atomizers to obtain optimal drying results, contributing to the segment's dominance in the spray drying equipment market. This segment's appeal is bolstered by its dependability, ease of maintenance, and compatibility with a wide range of drying conditions, making it a top choice for industrial drying operations globally.

Spray Drying Equipment Stages

- Multi-Stage

- Two-Stage

- Single-Stage

According to spray drying equipment industry analysis, the two-stage sector has emerged as the industry leader, with the biggest market share and the potential to sustain its position. Its sustained supremacy is due to its cost-effectiveness and adaptability, which make it ideal for a wide range of industrial applications. On the other side, the multistage product sector is expected to have the greatest compound annual growth rate (CAGR) throughout the spray drying equipment industry forecast period. This development trajectory is fueled by its distinct characteristics, which include the capacity to efficiently regulate pressure drops and produce dust-free agglomerated products with excellent dispersibility. Such characteristics distinguish the multistage product sector as a top alternative for companies looking for sophisticated and efficient spray drying solutions to fulfil their changing requirements.

Spray Drying Equipment Flows

- Counter-Current

- Co-Current

- Mixed Flow

The co-current flow segment is the largest in the spray drying equipment market due to its efficiency and adaptability in a wide range of industrial applications. Co-current flow, also known as concurrent flow, is the movement of drying air and feedstock in the drying chamber at the same time. This arrangement allows for quick moisture evaporation from the material as it travels through the chamber, resulting in faster drying periods and higher energy efficiency. In addition, co-current flow provides for exact control of product features and moisture content, making it ideal for applications that need constant product quality and uniform drying. Co-Current flow spray dryers are widely used in industries such as food processing, pharmaceuticals, and chemicals to efficiently dry a broad range of materials, contributing to the segment's dominance in the spray drying equipment market. Its popularity is bolstered by its flexibility to various production scales and compatibility with varied feedstock compositions, making it the favored choice for industrial drying operations worldwide.

Spray Drying Equipment Cycles

- Closed

- Open

The open cycle category leads the spray drying equipment market due to its extensive usage across various industries and versatility of application. Open cycle spray dryers use ambient air to dry, making them appropriate for a broad variety of applications and production scales. These dryers are used for many industrial operations because to their capacity to handle heat-resistant materials, availability in a variety of diameters and capacities, and low energy consumption. Furthermore, open cycle spray dryers are extremely effective in drying a wide variety of commodities, including food goods, chemicals, and pharmaceuticals, which contributes to their market dominance. Their versatility, cost-effectiveness, and convenience of use make them vital assets in industrial drying processes, resulting in their dominance in the spray drying equipment industry.

Spray Drying Equipment Applications

- Pharmaceuticals & Nutraceuticals

- Food & Dairy

- Chemical

- Others

The food & dairy sector dominates the spray drying equipment market due to its widespread use in the food and dairy industries for a variety of applications. Spray drying equipment is essential for the manufacturing of powdered food and dairy products such as milk powder, powdered eggs, and powdered coffee, among others. These powdered goods have various advantages, including increased shelf life, simplicity of storage, and efficient transportation. Furthermore, spray drying preserves nutritional value and flavour in food and dairy products, making them very appealing to customers. The growing global demand for processed and convenience food items supports the expansion of the Food & Dairy segment in the spray drying equipment market, ensuring its dominance in the industry.

Spray Drying Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Spray Drying Equipment Market Regional Analysis

North America has emerged as the frontrunner in regional revenue within the global market for spray dryer devices. Meanwhile, the Asia-Pacific region is poised to dominate throughout the spray drying equipment market forecast period. This dominance is attributed to the region's stable GDP and the prospective growth of the functional food and beverages (F&B) domain, coupled with the expanding pharmaceutical sector, which is driving consumer health consciousness. Within North America, the United States and Canada lead the international market for spray drying facilities, fueled by high demand for milk alternatives and various powdered milk products. Notably, the significant US market for food products and additives necessitates the reliability of spray drying equipment while preserving product characteristics. The Asia-Pacific region is experiencing rapid growth, driven by changing food preferences and increasing disposable income levels. Positive governmental regulations encouraging international investments in food and dairy production facilities further bolster the market outlook in the region.

Spray Drying Equipment Market Players

Some of the top spray drying equipment companies offered in our report includes Jinan Yuansheng Drying Technology Co. Ltd., Ystral GmbH, Lecite Corporation, Hosokawa Micron Ltd., Buhler Group, Nippon Pneumatic Systems Co., Ltd., BÜCHI Labortechnik AG, GEA Group, GEA Niro, SPX FLOW Inc., and Tetra Pak.

Frequently Asked Questions

How big is the spray drying equipment market?

The spray drying equipment market size was USD 5.1 billion in 2022.

What is the CAGR of the global spray drying equipment market from 2024 to 2032?

The CAGR of spray drying equipment is 6.5% during the analysis period of 2024 to 2032.

Which are the key players in the spray drying equipment market?

The key players operating in the global market are including Jinan Yuansheng Drying Technology Co. Ltd., Ystral GmbH, Lecite Corporation, Hosokawa Micron Ltd., Buhler Group, Nippon Pneumatic Systems Co., Ltd., B�CHI Labortechnik AG, GEA Group, GEA Niro, SPX FLOW Inc., and Tetra Pak.

Which region dominated the global spray drying equipment market share?

North America held the dominating position in spray drying equipment industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of spray drying equipment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global spray drying equipment industry?

The current trends and dynamics in the spray drying equipment industry include increasing demand for processed food products, growing pharmaceutical and chemical industries, advancements in spray drying technology, and rising adoption of spray drying in biotechnology applications.

Which product held the maximum share in 2022?

The nozzle atomizer product held the maximum share of the spray drying equipment industry.