Sports Medicine Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Sports Medicine Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

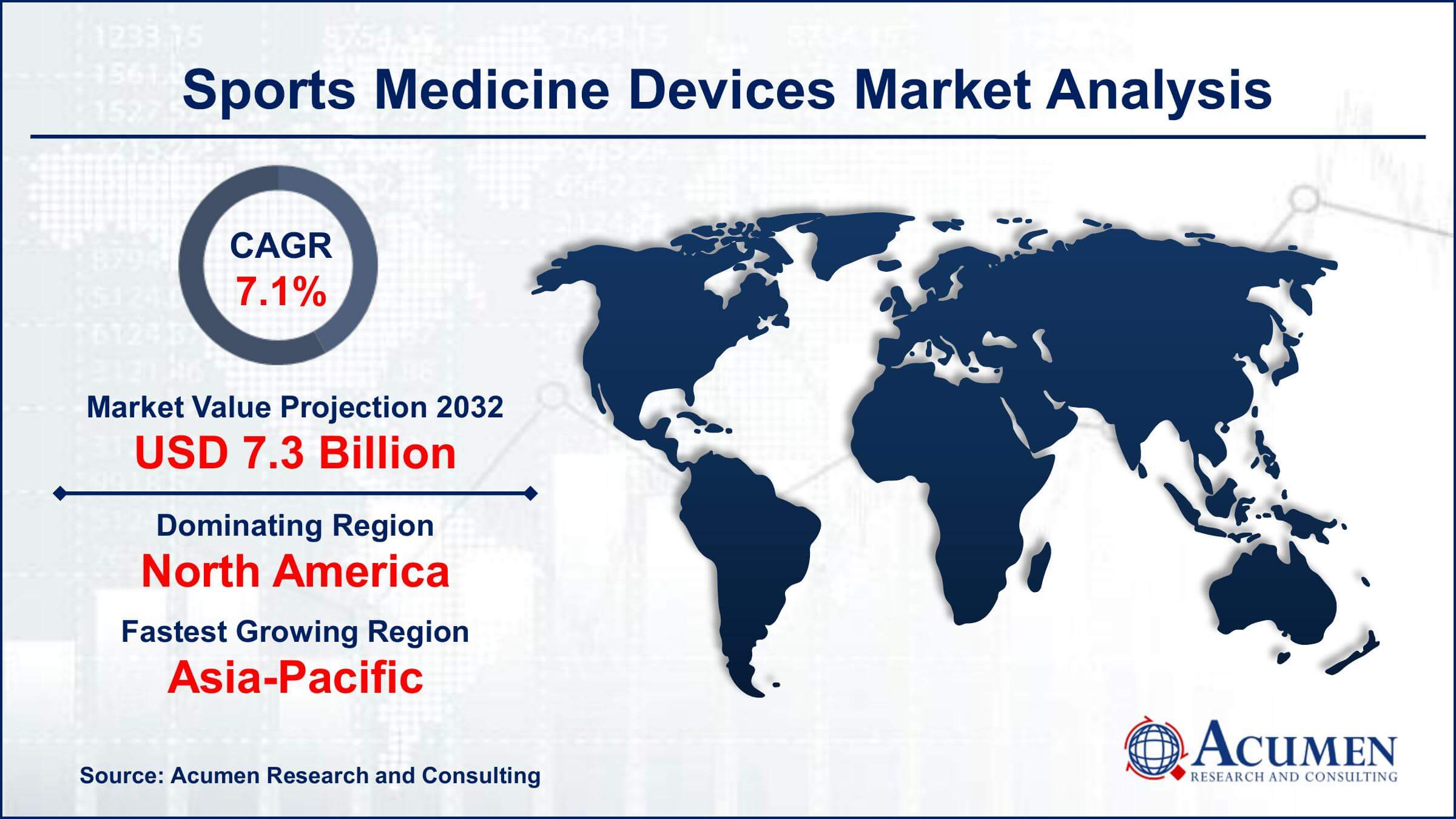

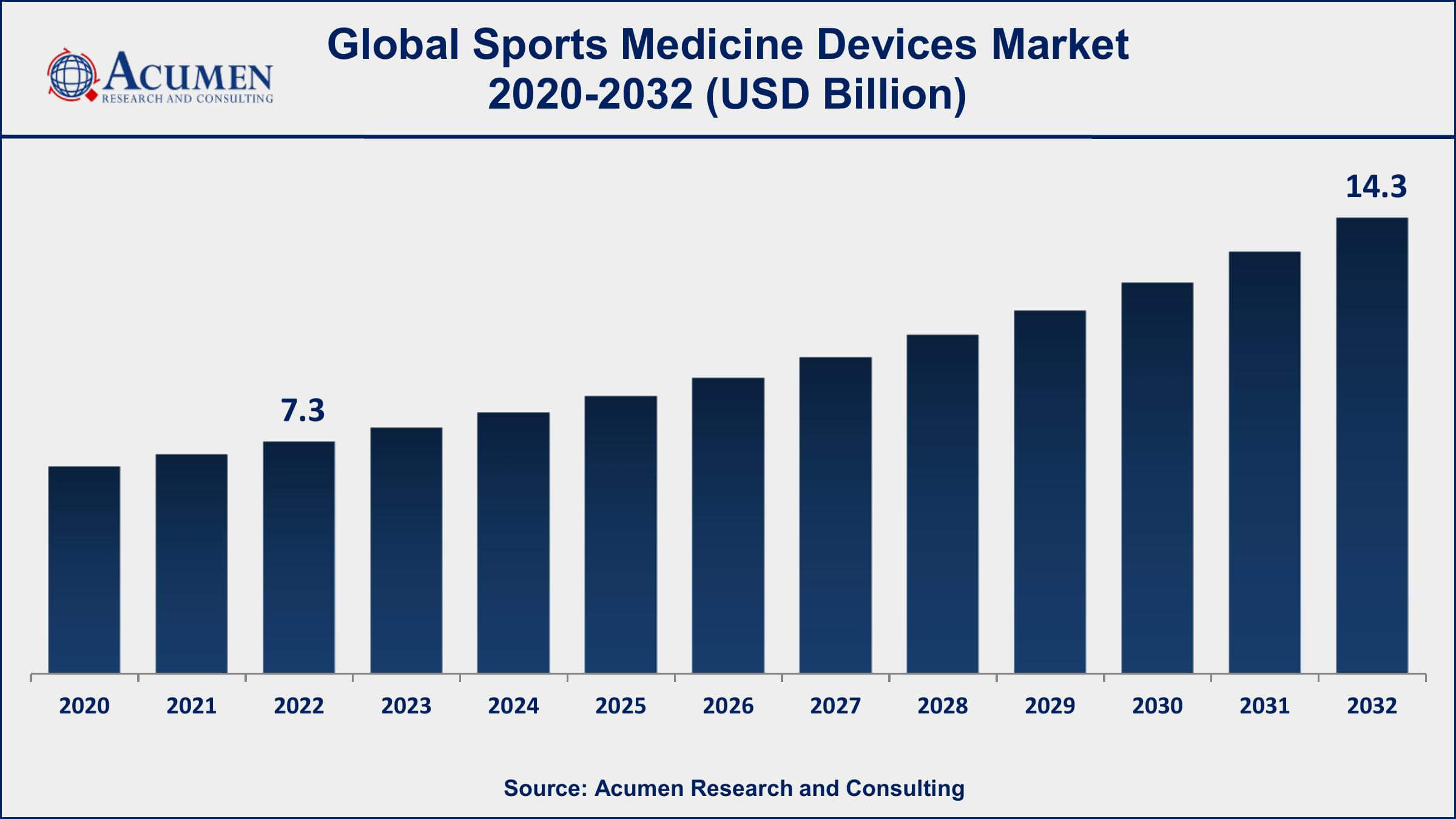

Request Sample Report

The Global Sports Medicine Devices Market Size accounted for USD 7.3 Billion in 2022 and is projected to achieve a market size of USD 14.3 Billion by 2032 growing at a CAGR of 7.1% from 2023 to 2032.

Sports Medicine Devices Market Highlights

- Global Sports Medicine Devices Market revenue is expected to increase by USD 14.3 Billion by 2032, with a 7.1% CAGR from 2023 to 2032

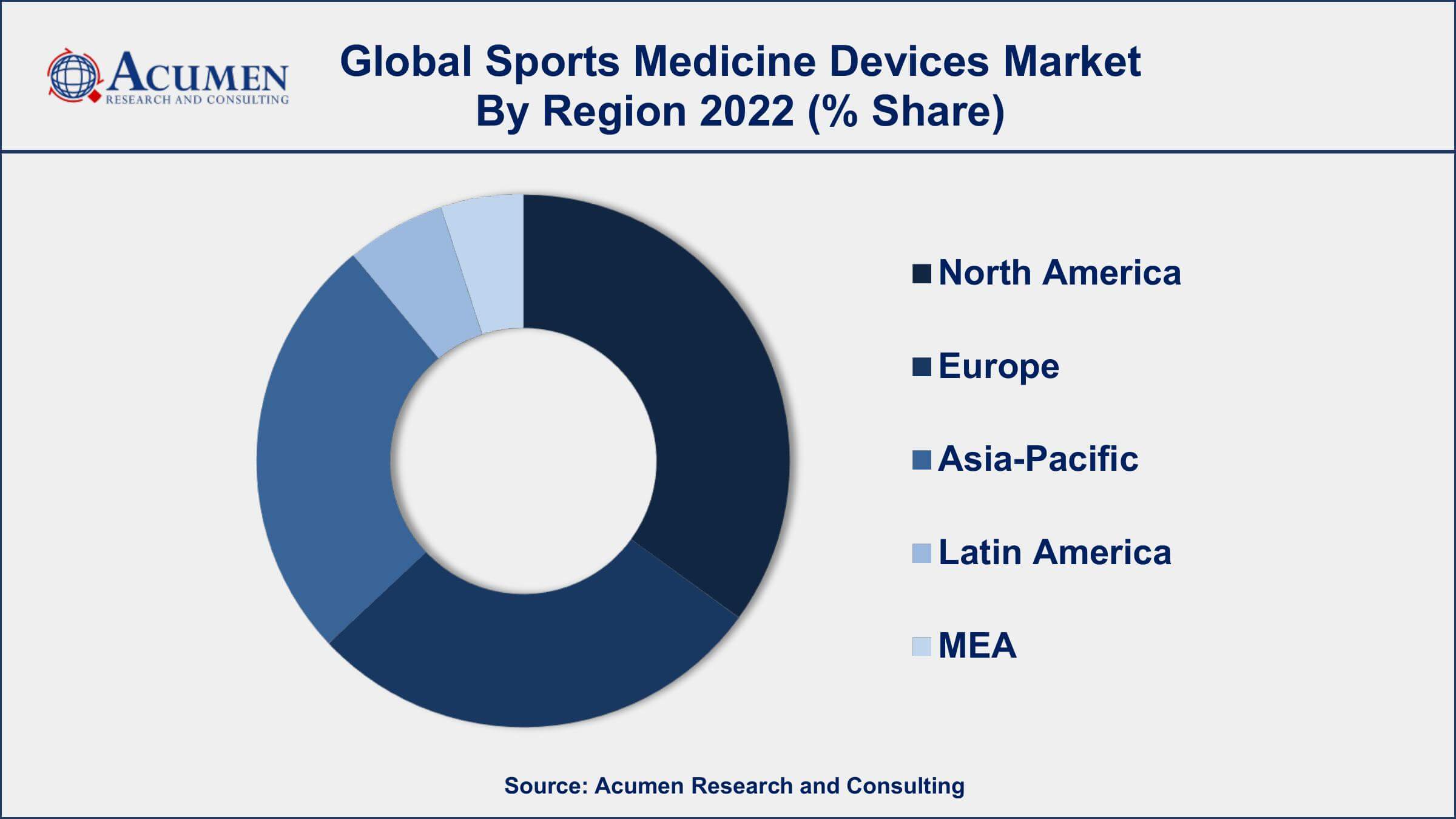

- North America region led with more than 39% of Sports Medicine Devices Market share in 2022

- Asia-Pacific sports medicine devices market growth will record a CAGR of more than 8% from 2023 to 2032

- By product, the body reconstruction and repair segment has accounted more than 38% of the revenue share in 2022

- By application, the knee injury segment is predicted to grow at the fastest CAGR of 7.8% between 2023 and 2032

- Increasing prevalence of sports-related injuries, drives the Sports Medicine Devices Market value

Sports medicine devices refer to a wide range of medical equipment and products used in the prevention, treatment, and rehabilitation of sports-related injuries. These devices are designed to provide support, enhance performance, and aid in the recovery process for athletes and individuals engaged in physical activities. They include orthopedic braces, support systems, surgical instruments, monitoring devices, and other specialized equipment tailored for sports medicine applications.

The market for sports medicine devices has been witnessing significant growth in recent years. The increasing prevalence of sports-related injuries, coupled with the growing awareness of the importance of prompt and effective treatment, has fueled the demand for these devices. Additionally, the rising participation in sports and recreational activities, along with the growing number of professional athletes, has created a robust market for sports medicine devices. Technological advancements have also played a crucial role in the market growth. Innovations such as minimally invasive surgical techniques, advanced imaging modalities, and the development of smart devices and wearables have revolutionized sports medicine. These technologies enable accurate diagnosis, personalized treatment plans, and real-time monitoring of athletes' health and performance, thereby driving the adoption of sports medicine devices. Furthermore, the increasing investments in research and development activities by key market players and the healthcare industry as a whole have propelled the market growth.

Global Sports Medicine Devices Market Trends

Market Drivers

- Increasing prevalence of sports-related injuries

- Growing awareness of the importance of prompt and effective treatment

- Rising participation in sports and recreational activities

- Growing number of professional athletes

Market Restraints

- High cost associated with sports medicine devices

- Limited reimbursement policies for sports medicine treatments

Market Opportunities

- Growing demand for non-invasive treatment options

- Integration of artificial intelligence and machine learning in sports medicine devices

Sports Medicine Devices Market Report Coverage

| Market | Sports Medicine Devices Market |

| Sports Medicine Devices Market Size 2022 | USD 7.3 Billion |

| Sports Medicine Devices Market Forecast 2032 | USD 14.3 Billion |

| Sports Medicine Devices Market CAGR During 2023 - 2032 | 7.1% |

| Sports Medicine Devices Market Analysis Period | 2020 - 2032 |

| Sports Medicine Devices Market Base Year | 2022 |

| Sports Medicine Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arthrex, Inc., Johnson & Johnson (DePuy Synthes), Medtronic plc (Medtronic SofamorDanek), Smith & Nephew plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., Breg, Inc., Mueller Sports Medicine, Inc., Össur hf., DJO Global, Inc., Cramer Products, Inc., and Conmed Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Sports medicine devices are specialized medical equipment and products used in the field of sports medicine to prevent, diagnose, treat, and rehabilitate sports-related injuries. These devices are designed to support and enhance the performance of athletes, as well as aid in their recovery process. They encompass a wide range of products, including orthopedic braces, joint supports, compression garments, surgical instruments, monitoring devices, and rehabilitation equipment.

The applications of sports medicine devices are diverse and cater to various aspects of sports medicine. One key application is injury prevention, where devices such as braces and supports are used to provide stability, protect vulnerable joints, and minimize the risk of injuries during sports activities. These devices can help athletes maintain proper form, improve biomechanics, and reduce the impact on their bodies. Sports medicine devices also play a crucial role in the diagnosis and treatment of sports-related injuries.

The sports medicine devices market has been experiencing steady growth in recent years and is expected to continue its upward trajectory. Factors such as the increasing incidence of sports-related injuries, growing awareness about the importance of sports medicine, and technological advancements in the field are driving the market growth. The rising participation in sports and recreational activities, as well as the growing number of professional athletes, further contribute to the market expansion. Moreover, the market is witnessing significant opportunities for growth. The increasing focus on preventive healthcare and the demand for non-invasive treatment options create avenues for the adoption of sports medicine devices. Additionally, the integration of artificial intelligence and machine learning in these devices, along with the development of customized and patient-specific solutions, presents promising prospects for market growth.

Sports Medicine Devices Market Segmentation

The global Sports Medicine Devices Market segmentation is based on product, application, and geography.

Sports Medicine Devices Market By Product

- Orthopedic Devices

- Arthroscopy Devices

- Artificial Joint Implants

- Fracture Repair Devices

- Prosthesis

- Body Support and Recovery

- Thermal Therapy

- Compression Devices

- Support Devices and Braces

- Body Reconstruction and Repair

- Surgical Equipment

- Bone/Cartilage Repair and Reconstruction

- Body Monitoring and Evaluation

- Musculoskeletal

- Respiratory

- Cardiac

- Hemodynamic

- Other

- Accessories

In terms of products, the body reconstruction and repair segment has seen significant growth in the recent years. This segment primarily focuses on devices and technologies used for the surgical reconstruction and repair of musculoskeletal injuries and conditions related to sports activities. The increasing prevalence of sports-related injuries, along with the growing demand for advanced treatment options, has propelled the growth of this segment. Technological advancements have played a vital role in driving the growth of the body reconstruction and repair segment. Innovations in minimally invasive surgical techniques, such as arthroscopy, have revolutionized the field by offering less invasive procedures, faster recovery times, and improved patient outcomes. Additionally, the development of biocompatible implants and tissue engineering technologies has enhanced the options available for reconstructive procedures, allowing for better restoration of damaged tissues and joints. Moreover, the expanding applications of body reconstruction and repair devices beyond professional athletes to the general population have contributed to the segment's growth.

Sports Medicine Devices Market By Application

- Knee Injury

- Ankle-foot Injury

- Shoulder Injury

- Back-spine Injury

- Hip-groin Injury

- Hand-wrist Injury

- Arm-elbow Injury

According to the sports medicine devices market forecast, the knee injury segment is expected to witness significant growth in the coming years. Knee injuries, such as ligament tears, meniscus tears, and patellar dislocations, are prevalent in sports activities and require specialized devices for diagnosis, treatment, and rehabilitation. The increasing incidence of knee injuries, both among athletes and the general population, has been a key driver for the growth of this segment. Advancements in sports medicine devices specific to knee injuries have significantly contributed to the segment's growth. Innovative technologies and devices, such as arthroscopic instruments, knee braces, orthopedic implants, and rehabilitation equipment, have improved the treatment options available for knee injuries. Minimally invasive surgical techniques, such as arthroscopy, have become the preferred approach for knee injury repair, leading to faster recovery times and better patient outcomes. Additionally, the growing emphasis on sports and fitness activities, coupled with the rise in sports participation among individuals of all ages, has fueled the demand for knee injury devices.

Sports Medicine Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Sports Medicine Devices Market Regional Analysis

North America dominates the sports medicine devices market for several reasons, making it the leading region in terms of market share and revenue. One key factor is the high prevalence of sports-related injuries in North America. The region has a significant sports culture, with a large number of individuals participating in various sports and physical activities. This leads to a higher incidence of sports injuries, creating a substantial demand for sports medicine devices. Another reason for North America's dominance is its well-established healthcare infrastructure and advanced medical technology. The region boasts advanced hospitals, specialized sports medicine clinics, and research institutions dedicated to sports medicine. This enables quick and efficient adoption of innovative sports medicine devices and technologies. Additionally, North America has a strong network of healthcare professionals, including orthopedic surgeons, sports medicine physicians, and physical therapists, who are highly skilled in diagnosing and treating sports injuries.

Sports Medicine Devices Market Player

Some of the top sports medicine devices market companies offered in the professional report include Arthrex, Inc., Johnson & Johnson (DePuy Synthes), Medtronic plc (Medtronic SofamorDanek), Smith & Nephew plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., Breg, Inc., Mueller Sports Medicine, Inc., Össur hf., DJO Global, Inc., Cramer Products, Inc., and Conmed Corporation.

Frequently Asked Questions

What was the market size of the global sports medicine devices in 2022?

The market size of sports medicine devices was USD 7.3 Billion in 2022.

What is the CAGR of the global sports medicine devices market from 2023 to 2032?

The CAGR of sports medicine devices is 7.1% during the analysis period of 2023 to 2032.

Which are the key players in the Sports Medicine Devices Market?

The key players operating in the global market are including Arthrex, Inc., Johnson & Johnson (DePuy Synthes), Medtronic plc (Medtronic SofamorDanek), Smith & Nephew plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., Breg, Inc., Mueller Sports Medicine, Inc., �ssur hf., DJO Global, Inc., Cramer Products, Inc., and Conmed Corporation.

Which region dominated the global sports medicine devices market share?

North America held the dominating position in sports medicine devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of sports medicine devices during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global sports medicine devices industry?

The current trends and dynamics in the sports medicine devices market growth include increasing prevalence of sports-related injuries, growing awareness of the importance of prompt and effective treatment, and rising participation in sports and recreational activities.

Which product held the maximum share in 2022?

The body reconstruction and repair product held the maximum share of the sports medicine devices industry.