Specialty Fuel Additives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Specialty Fuel Additives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

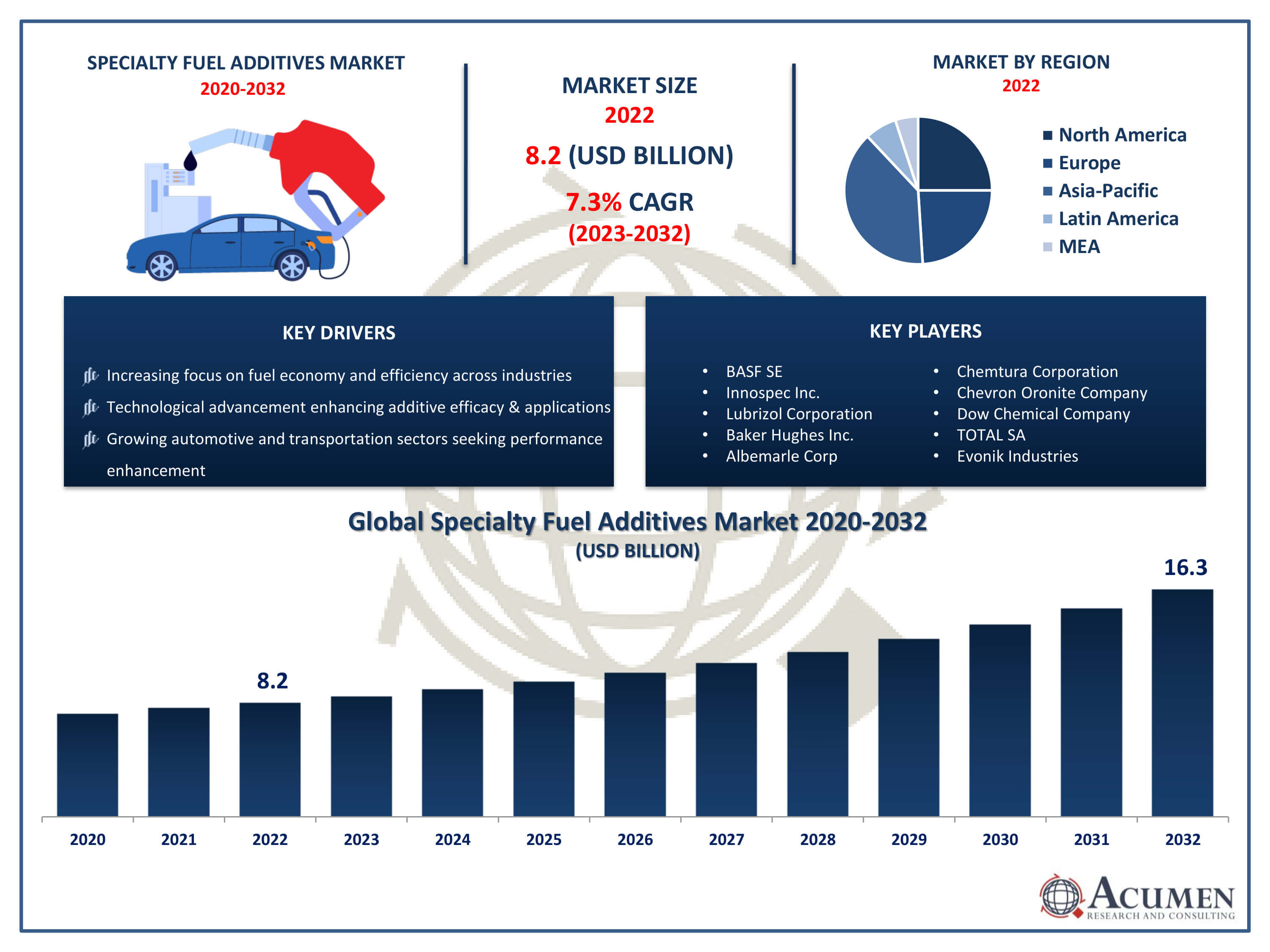

The Specialty Fuel Additives Market Size accounted for USD 8.2 Billion in 2022 and is projected to achieve a market size of USD 16.3 Billion by 2032 growing at a CAGR of 7.3% from 2023 to 2032.

Specialty Fuel Additives Market Highlights

- Global specialty fuel additives market revenue is expected to increase by USD 16.3 Billion by 2032, with a 7.3% CAGR from 2023 to 2032

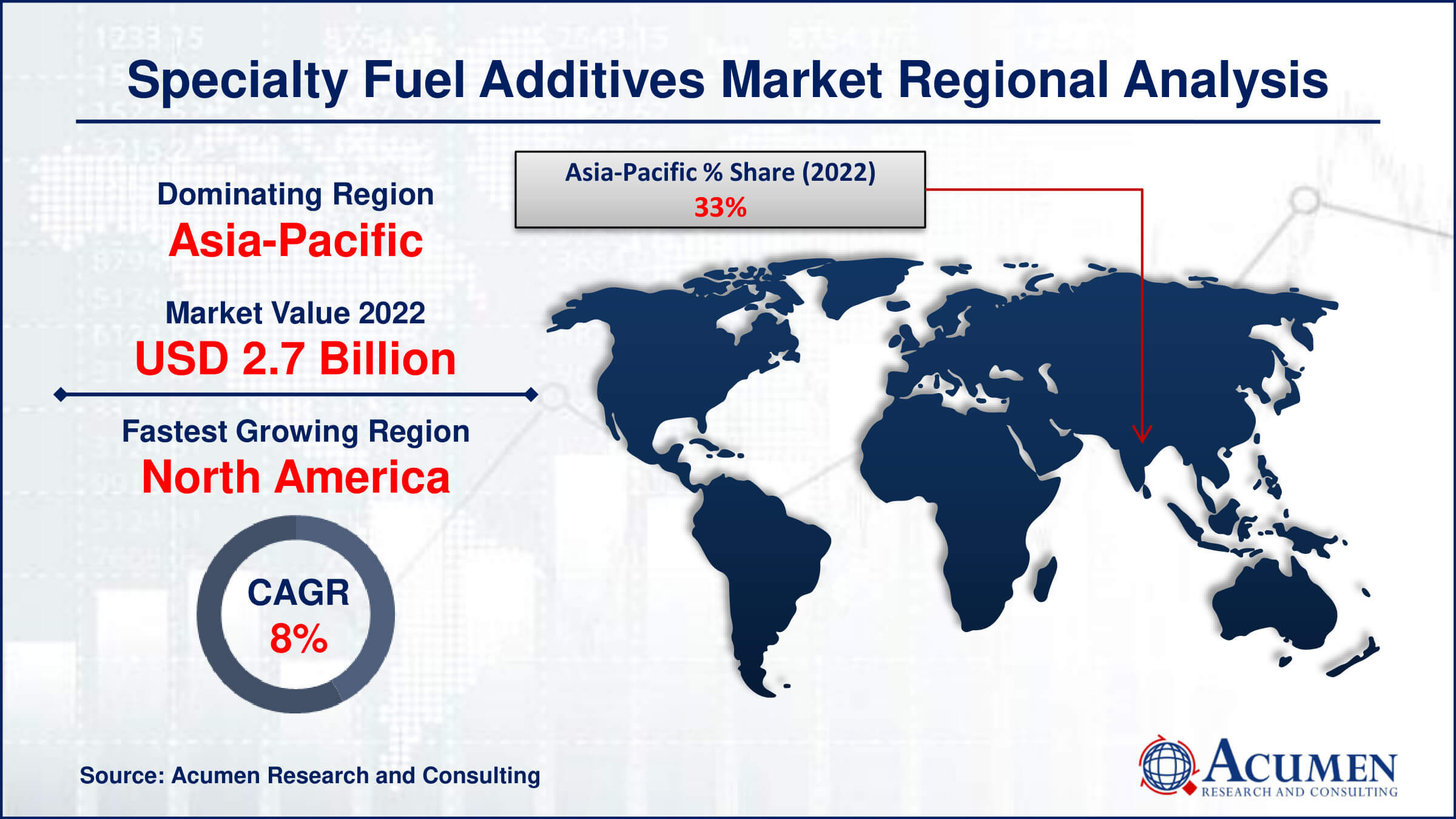

- Asia-Pacific region led with more than 33% of specialty fuel additives market share in 2022

- North America specialty fuel additives market growth will record a CAGR of more than 8.1% from 2023 to 2032

- By product, the deposit control additivesare the largest segment of the market, accounting for over 35% of the global market share

- By application, the diesel additives are one of the largest and fastest-growing segments of the specialty fuel additivesindustry

- Increasing focus on fuel economy and sustainability in automotive and transportation sectors, drives the specialty fuel additives market value

Specialty fuel additives are chemical compounds designed to enhance the performance and efficiency of fuels used in various applications, including automotive, aerospace, marine, and industrial sectors. These additives are formulated to address specific challenges such as improving combustion efficiency, reducing emissions, preventing engine deposits, and enhancing lubrication. They can be added to gasoline, diesel, jet fuel, and other types of fuels to optimize their properties and meet the stringent requirements of modern engines and environmental regulations.

The market for specialty fuel additives has experienced steady growth in recent years due to several factors. Increasing environmental concerns and stringent emission regulations have compelled fuel manufacturers and end-users to adopt cleaner-burning fuels with lower emissions. Additionally, the demand for more efficient and reliable engines has driven the need for advanced fuel additives that can enhance engine performance and durability while minimizing maintenance costs. Moreover, technological advancements in additive chemistry and manufacturing processes have enabled the development of innovative solutions that offer superior performance and compatibility with modern engine designs. With the ongoing evolution of automotive and transportation technologies, the specialty fuel additives market is poised for further expansion.

Global Specialty Fuel Additives Market Trends

Market Drivers

- Stringent environmental regulations driving demand for cleaner fuel formulations

- Increasing focus on fuel economy and sustainability in automotive and transportation sectors

- Technological advancements enhancing efficacy and expanding applications of specialty fuel additives

- Growing demand for improved engine performance and equipment lifespan

- Rising awareness and adoption of additive solutions to address emerging challenges in the fuel industry

Market Restraints

- Fluctuating crude oil prices affecting investment in fuel additive research and development

- Concerns regarding the long-term sustainability and environmental impact of certain additive formulations

Market Opportunities

- Expansion into emerging markets with growing industrial and automotive sectors

- Development of bio-based and sustainable fuel additives to meet evolving regulatory standards

Specialty Fuel Additives Market Report Coverage

| Market | Specialty Fuel Additives Market |

| Specialty Fuel Additives Market Size 2022 | USD 8.2 Billion |

| Specialty Fuel Additives Market Forecast 2032 |

USD 16.3 Billion |

| Specialty Fuel Additives Market CAGR During 2023 - 2032 | 7.3% |

| Specialty Fuel Additives Market Analysis Period | 2020 - 2032 |

| Specialty Fuel Additives Market Base Year |

2022 |

| Specialty Fuel Additives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Innospec Inc., Infineum International Limited, Baker Hughes Inc., Albemarle Corp, Chemtura Corporation, Chevron Oronite Company, Dow Chemical Company, TOTAL SA, Evonik Industries, Lubrizol Corporation, and Clariant Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Specialty fuel additives are advanced chemical formulations designed to improve the performance, efficiency, and environmental impact of various types of fuels. These additives are carefully engineered to address specific challenges associated with fuel usage, such as reducing emissions, enhancing combustion efficiency, preventing engine deposits, and improving fuel stability. They are typically blended into gasoline, diesel, jet fuel, and other petroleum-based fuels to optimize their properties and meet the requirements of different industries and applications. The applications of specialty fuel additives span across multiple sectors, including automotive, aerospace, marine, industrial, and power generation. In the automotive industry, these additives are commonly used to enhance engine performance, improve fuel economy, and reduce emissions. They help maintain fuel system cleanliness, prevent fuel injector clogging, and protect engine components from corrosion and wear. In the aviation sector, specialty fuel additives are critical for ensuring the safety and efficiency of aircraft operations.

The specialty fuel additives market has been experiencing robust growth globally, driven by several key factors. With increasing concerns about environmental pollution and stringent regulations aimed at reducing emissions, there's a growing demand for cleaner and more efficient fuel solutions. Specialty fuel additives play a crucial role in meeting these requirements by enhancing combustion efficiency, reducing harmful emissions, and improving fuel economy. This heightened focus on environmental sustainability has led to significant investments in research and development, driving innovation in additive formulations and expanding the market's growth opportunities. Moreover, the automotive and transportation sectors, which are major consumers of specialty fuel additives, are witnessing rapid expansion, particularly in emerging economies. As consumer preferences shift towards more fuel-efficient vehicles and industries seek to optimize their operations, the demand for high-performance fuel additives is expected to surge.

Specialty Fuel Additives Market Segmentation

The global specialty fuel additives market segmentation is based on product, application, and geography.

Specialty Fuel Additives Market By Product

- Fuel Antioxidants

- Petroleum Dyes & Markers

- Octane Enhancers

- Lubricity Improvers

- Corrosion Inhibitors

- Deposit Control Additives

- Cold Flow Improvers

- Cetane Number Improvers

- Fuel System Icing Inhibitors

- Metal Deactivators

- Others

In terms of products, the deposit control additives segment accounted for the largest market share in 2022. Deposit control additives are crucial components in fuel formulations as they prevent the accumulation of deposits in engines and fuel systems, ensuring optimal performance and longevity. With the rising demand for cleaner and more efficient fuel solutions, deposit control additives play a vital role in addressing issues such as fuel system fouling, injector clogging, and combustion chamber deposits, which can lead to reduced engine efficiency and increased emissions. One of the primary drivers of growth in the deposit control additives segment is the increasing adoption of advanced engine technologies, such as direct fuel injection and turbocharging, which are more susceptible to deposit formation. As automakers strive to meet stringent emissions regulations and improve fuel economy, the demand for deposit control additives that can effectively mitigate deposit-related issues is on the rise. Moreover, the expanding automotive market in emerging economies, coupled with the growing awareness among consumers about the importance of engine cleanliness and performance, is further fueling the demand for deposit control additives.

Specialty Fuel Additives Market By Application

- Gasoline/Petrol Additives

- Diesel Additives

- Aviation Turbine Fuel Additives

- Others

According to the specialty fuel additives market forecast, the diesel additives segment is expected to witness significant growth in the coming years. Diesel additives are specifically formulated to enhance the performance and efficiency of diesel fuel, addressing challenges such as improving combustion, reducing emissions, and preventing engine wear and corrosion. With the widespread use of diesel fuel in various applications including transportation, industrial machinery, and power generation, the demand for diesel fuel additives has been steadily increasing. One of the primary drivers of growth in the diesel additives segment is the stringent emissions regulations imposed by governments worldwide. These regulations mandate the reduction of harmful emissions such as nitrogen oxides (NOx) and particulate matter (PM) from diesel engines. Diesel additives play a crucial role in achieving compliance with these regulations by improving combustion efficiency and reducing the formation of harmful pollutants. Additionally, the growing demand for fuel efficiency and the need to prolong engine lifespan further boost the adoption of diesel additives, as they can enhance fuel economy and protect engine components from wear and corrosion.

Specialty Fuel Additives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Specialty Fuel Additives Market Regional Analysis

The Asia-Pacific region stands out as a rapidly growing region in the specialty fuel additives market, fueled by several key factors. One of the primary drivers of growth is the region's burgeoning automotive industry, which is witnessing robust expansion due to rising disposable incomes, urbanization, and increasing mobility needs. As countries in the Asia-Pacific region undergo rapid industrialization and urban development, the demand for specialty fuel additives, particularly those aimed at improving fuel efficiency and reducing emissions, is on the rise to meet stringent environmental regulations and address concerns about air quality. Moreover, the Asia-Pacific region is experiencing significant infrastructure development, including investments in transportation networks, energy infrastructure, and industrial facilities. This infrastructure development necessitates reliable and efficient fuel solutions, driving the demand for specialty fuel additives to optimize engine performance, enhance equipment reliability, and prolong operational lifespan. Additionally, the region's growing focus on sustainability and energy efficiency further propels the adoption of specialty fuel additives, as industries seek innovative solutions to reduce their environmental footprint and comply with evolving regulatory standards.

Specialty Fuel Additives Market Player

Some of the top specialty fuel additives market companies offered in the professional report include BASF SE, Innospec Inc., Infineum International Limited, Baker Hughes Inc., Albemarle Corp, Chemtura Corporation, Chevron Oronite Company, Dow Chemical Company, TOTAL SA, Evonik Industries, Lubrizol Corporation, and Clariant Corporation.

Frequently Asked Questions

How big is the specialty fuel additives market?

The specialty fuel additives market size was USD 8.2 Billion in 2022.

What is the CAGR of the global specialty fuel additives market from 2023 to 2032?

The CAGR of specialty fuel additives is 7.3% during the analysis period of 2023 to 2032.

Which are the key players in the specialty fuel additives market?

The key players operating in the global market are including BASF SE, Innospec Inc., Infineum International Limited, Baker Hughes Inc., Albemarle Corp, Chemtura Corporation, Chevron Oronite Company, Dow Chemical Company, TOTAL SA, Evonik Industries, Lubrizol Corporation, and Clariant Corporation.

Which region dominated the global specialty fuel additives market share?

Asia-Pacific held the dominating position in specialty fuel additives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of specialty fuel additives during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global specialty fuel additives industry?

The current trends and dynamics in the Specialty Fuel Additives Market growth include stringent environmental regulations driving demand for cleaner fuel formulations, and increasing focus on fuel economy and sustainability in automotive and transportation sectors.

Which product held the maximum share in 2022?

The deposit control additives product held the maximum share of the specialty fuel additives industry.