Specialty Enzymes Market | Acumen Research and Consulting

Specialty Enzymes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

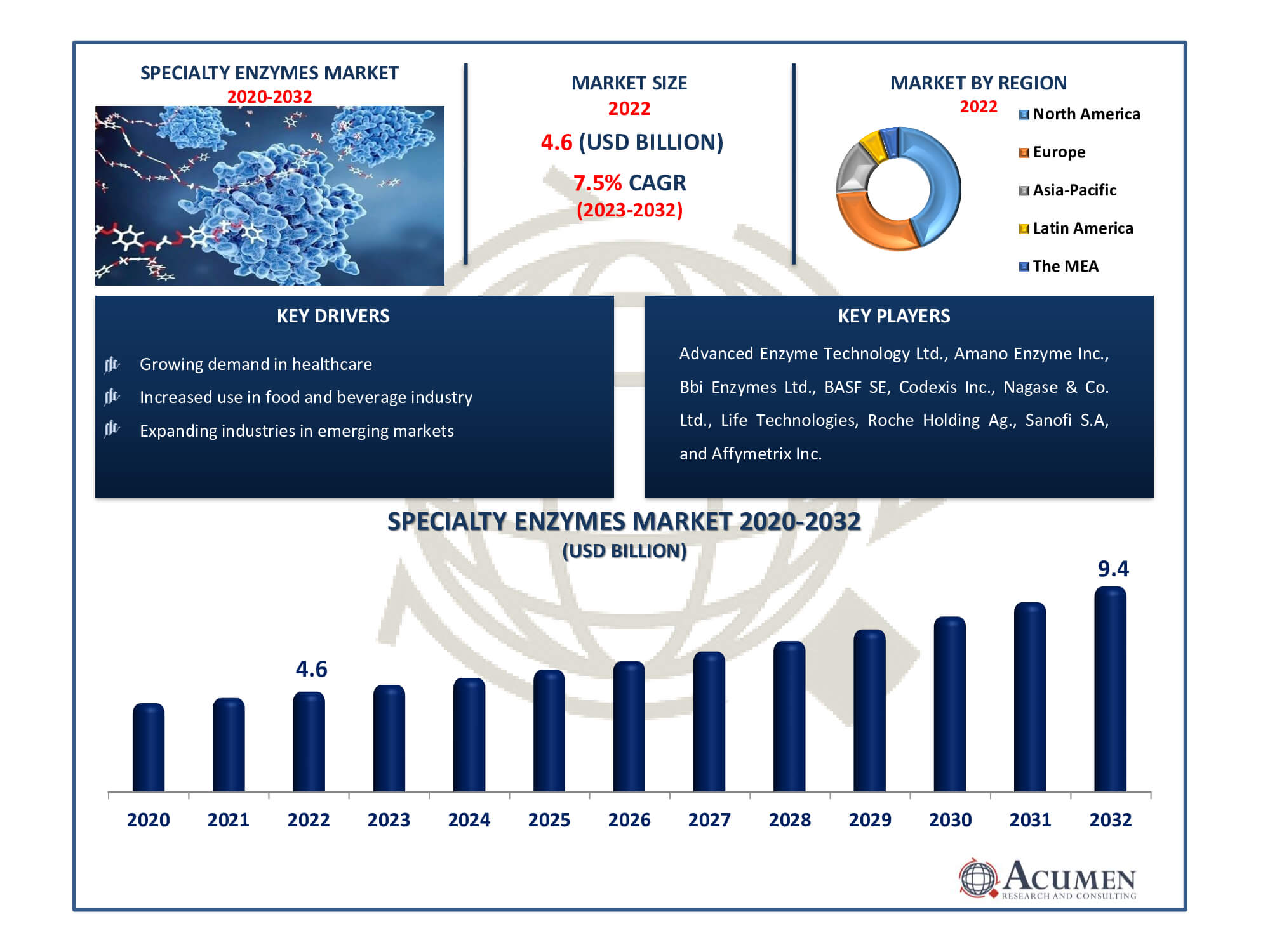

The Specialty Enzymes Market Size accounted for USD 4.6 Billion in 2022 and is estimated to achieve a market size of USD 9.4 Billion by 2032 growing at a CAGR of 7.5% from 2023 to 2032.

Specialty Enzymes Market Highlights

- Global specialty enzymes market revenue is poised to garner USD 9.4 billion by 2032 with a CAGR of 7.5% from 2023 to 2032

- North America specialty enzymes market value occupied around USD 2 billion in 2022

- Asia-Pacific specialty enzymes market growth will record a CAGR of more than 8% from 2023 to 2032

- Among source, the microorganisms sub-segment generated over US$ 3.4 billion revenue in 2022

- Based on application, the pharmaceutical sub-segment generated around 40% share in 2022

- Enzymes used to develop more efficient waste treatment processes is a popular specialty enzymes market trend that fuels the industry demand

Specialty enzymes are proteins that are created by living organisms and act as catalysts to accelerate chemical reactions. They operate at fast speeds under mild circumstances such as specified temperatures and pH levels, making them indispensable in a variety of industries. These enzymes are used in a variety of industries, including healthcare, food processing, manufacturing, and research. The Specialty Enzymes Market expands to satisfy increased demand as technology progresses. These enzymes improve efficiency and sustainability, fostering innovation and growth in a variety of industries. The expansion of the market not only creates additional opportunities, but it also contributes to advancements that help industry and the environment. This ever-changing market is at the cutting edge of scientific and industrial advancement.

Global Specialty Enzymes Market Dynamics

Market Drivers

- Growing demand in healthcare

- Increased use in food and beverage industry

- Demand for specialty enzymes in detergents

- Expanding industries in emerging markets

Market Restraints

- Enzyme production and purification can be expensive

- Stringent regulations on enzyme use in certain applications

- Competition from chemical alternatives

- Complex manufacturing

Market Opportunities

- Developing tailor-made enzymes for specific applications

- Ongoing research can uncover novel enzyme applications

- Collaborating with industries and research institutions

Specialty Enzymes Market Report Coverage

| Market | Specialty Enzymes Market |

| Specialty Enzymes Market Size 2022 | USD 4.6 Billion |

| Specialty Enzymes Market Forecast 2032 | USD 9.4 Billion |

| Specialty Enzymes Market CAGR During 2023 - 2032 | 7.5% |

| Specialty Enzymes Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Advanced Enzyme Technology Ltd., Amano Enzyme Inc., Bbi Enzymes Ltd., BASF SE, Codexis Inc., Nagase & Co. Ltd., Life Technologies, Roche Holding Ag., Sanofi S.A, and Affymetrix Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Specialty Enzymes Market Insights

The increasing demand for non-harmful biological catalysts in pharmaceuticals and diagnostics primarily drives the market value. Advanced tools for optimizing pharmaceutical production and increased investments in research and development activities for new digestive aids support market growth. The rising prevalence of chronic digestive disorders and growing acquisitions among players further boost the specialty enzymes market. Moreover, the alternatives to chemical catalysts and the development of enzymes with a long shelf life are projected to create potential opportunities over the forecast period.

On the other hand, the substantial costs involved in maintaining specialty enzyme products and rising safety concerns due to the increased risk of enzyme contamination are likely to hinder growth during the forecast timeframe. The high cost of generating and using these enzymes is one limitation in the specialty enzymes market. The development, purification, and maintenance of customized enzymes can be time-consuming and costly, making these items highly pricey. This cost may be prohibitive for some users and industries.

On the positive side, the increasing popularity of specialty enzymes stems from their numerous advantages. These systems can effectively track assets and individuals while recording crucial data. Moreover, their ability to operate continuously without interruptions further enhances their appeal. The realization of these benefits is expected to create multiple opportunities in the specialty enzymes market in the coming years.

Specialty Enzymes Market Segmentation

The worldwide market for specialty enzymes is split based on type, source, application, and geography.

Specialty Enzymes Type

- Carbohydrases

- Amylases

- Cellulases

- Other Carbohydrases

- Proteases

- Lipases

- Polymerases & Nucleases

- Other Enzymes

As per our specialty enzymes market analysis, carbohydrases are the largest and most important section in the industry. Carbohydrases are enzymes that break down carbohydrates into simpler sugars, which have numerous applications in industries such as food, medicines, and biofuels. Because of their versatility and widespread application, they are the market leader. Proteases is expected to the second-largest segment. Proteases are enzymes that help break down proteins into peptides and amino acids. They are used in industries such as detergents, medicines, and food. Because of their importance in protein degradation, they account for the second-largest section of the speciality enzymes market.

Specialty Enzymes Source

- Microorganisms

- Plants

- Animals

According to the specialty enzymes industry analysis, microorganisms is the largest segment in 2022. Microorganisms are the primary source for generating customised enzymes due to their efficiency, scalability, and variety in enzyme manufacture. Microbial enzymes have several applications in a variety of industries, including food, pharmaceuticals, and biofuels, which contributes to their market domination. Plants is the significantly held second largest share of the market. Plant-derived enzymes, while necessary, are less widespread in commercial applications than microbial enzymes. However, their importance in a variety of industries, particularly the food and beverage industry, places them as the second-largest source of speciality enzymes.

Specialty Enzymes Application

- Pharmaceutical

- Research & Biotechnology

- Diagnostics

- Biocatalyst

Based on application, the pharmaceutical segment has registered a major share in the specialty enzymes market and the segment is also projected to maintain its dominance over the forecast period from 2023 to 2032. The wide range of applications and benefits of specialty enzymes in the pharmaceutical sector is particularly accelerating the market value. These are used in drug manufacturing, disease diagnostics, or in therapies for cancer, cardiovascular diseases, lysosomal storage disorders, and pain management among others.

Specialty Enzymes Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Specialty Enzymes Market Regional Analysis

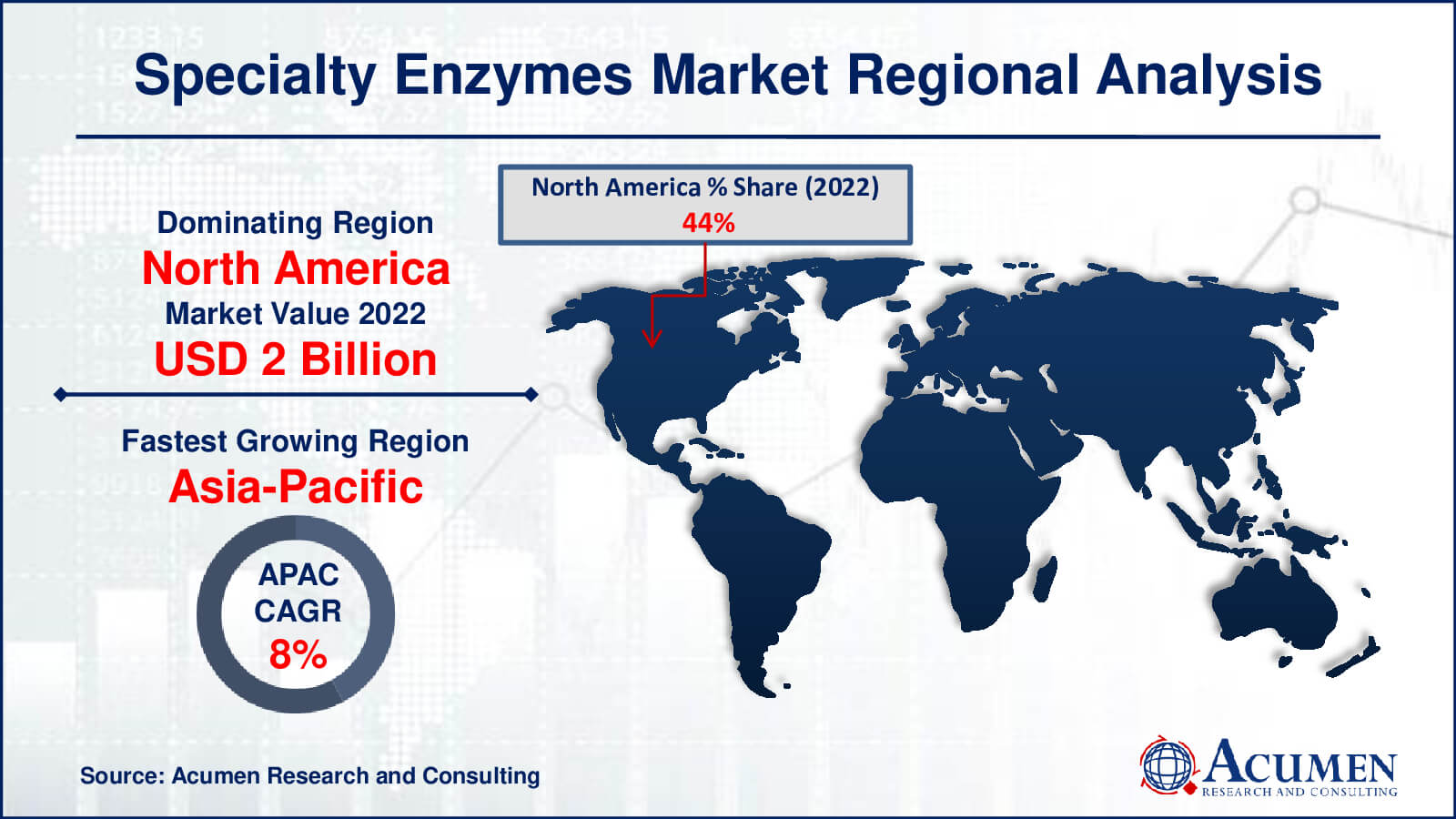

In 2022, North America dominated the specialty enzymes market, and it's expected to maintain this leadership during the forecast period. This is due to the well-established healthcare infrastructure and easy access to advanced solutions, which are driving market growth. Technological advancements and the availability of enzymes for a wide range of applications are also significant contributors to the regional market.

The United States, in particular, held the largest market share in terms of value. In contrast, the Asia Pacific region is poised to experience the fastest growth from 2023 to 2032. The rapid economic growth and increasing awareness of a healthy lifestyle are fueling market expansion in this region.

Growing healthcare infrastructure and the acceptance of specialty enzymes in numerous applications, particularly in the pharmaceutical and biotechnology industries, have contributed to Asia Pacific's emergence as a prominent participant in the specialty enzymes market. Furthermore, rising healthcare expenditures and increased R&D efforts are adding to the region's market expansion. Furthermore, the presence of a huge population base, particularly in countries such as India and China, is a significant driver of increased demand for specialty enzymes.

Overall, according to the specialty enzyme market forecast, Asia Pacific region has a high potential, thanks to a large consumer base and favorable economic conditions that are propelling its rapid rise.

Specialty Enzymes Market Players

Some of the top specialty enzymes companies offered in our report includes Advanced Enzyme Technology Ltd., Amano Enzyme Inc., Bbi Enzymes Ltd., BASF SE, Codexis Inc., Nagase & Co. Ltd., Life Technologies, Roche Holding Ag., Sanofi S.A, and Affymetrix Inc.

Frequently Asked Questions

How big is the specialty enzymes market?

The specialty enzymes market was USD 4.6 billion in 2022.

What is the CAGR of the global specialty enzymes market from 2023 to 2032?

The CAGR of specialty enzymes is 7.5% during the analysis period of 2023 to 2032.

Which are the key players in the specialty enzymes market?

The key players operating in the global market are including Advanced Enzyme Technology Ltd., Amano Enzyme Inc., Bbi Enzymes Ltd., BASF SE, Codexis Inc., Nagase & Co. Ltd., Life Technologies, Roche Holding Ag., Sanofi S.A, and Affymetrix Inc.

Which region dominated the global specialty enzymes market share?

North America held the dominating position in specialty enzymes industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of specialty enzymes during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global specialty enzymes industry?

The current trends and dynamics in the specialty enzymes industry include growing demand in healthcare, increased use in food and beverage industry, demand for specialty enzymes in detergents, and expanding industries in emerging markets.

Which type held the maximum share in 2022?

The carbohydrases held the maximum share of the specialty enzymes industry.