Sorbitol Market Analysis - Global Industry Size, Share, Trends and Forecast 2021 - 2028

Published :

Report ID:

Pages :

Format :

Sorbitol Market Analysis - Global Industry Size, Share, Trends and Forecast 2021 - 2028

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

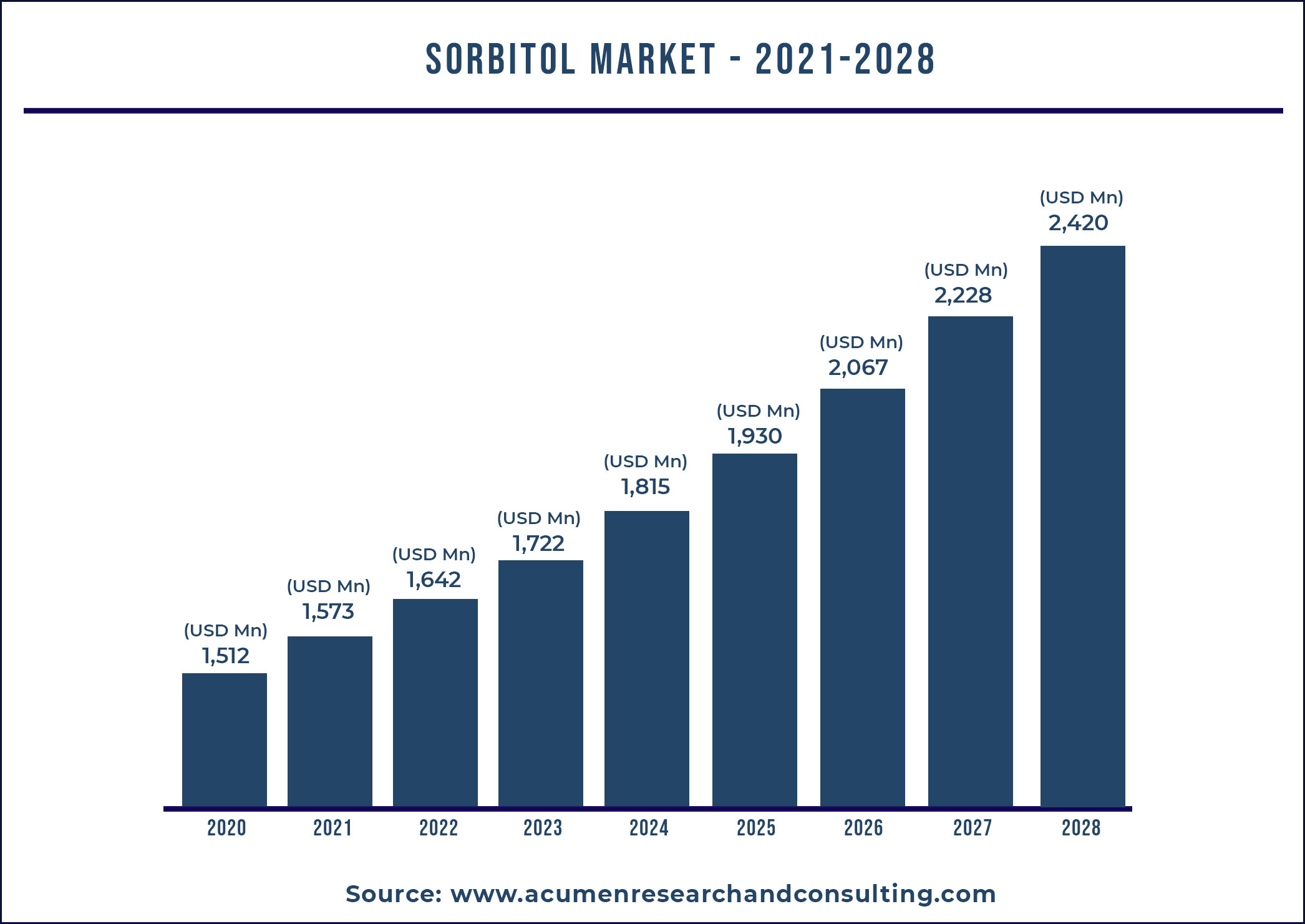

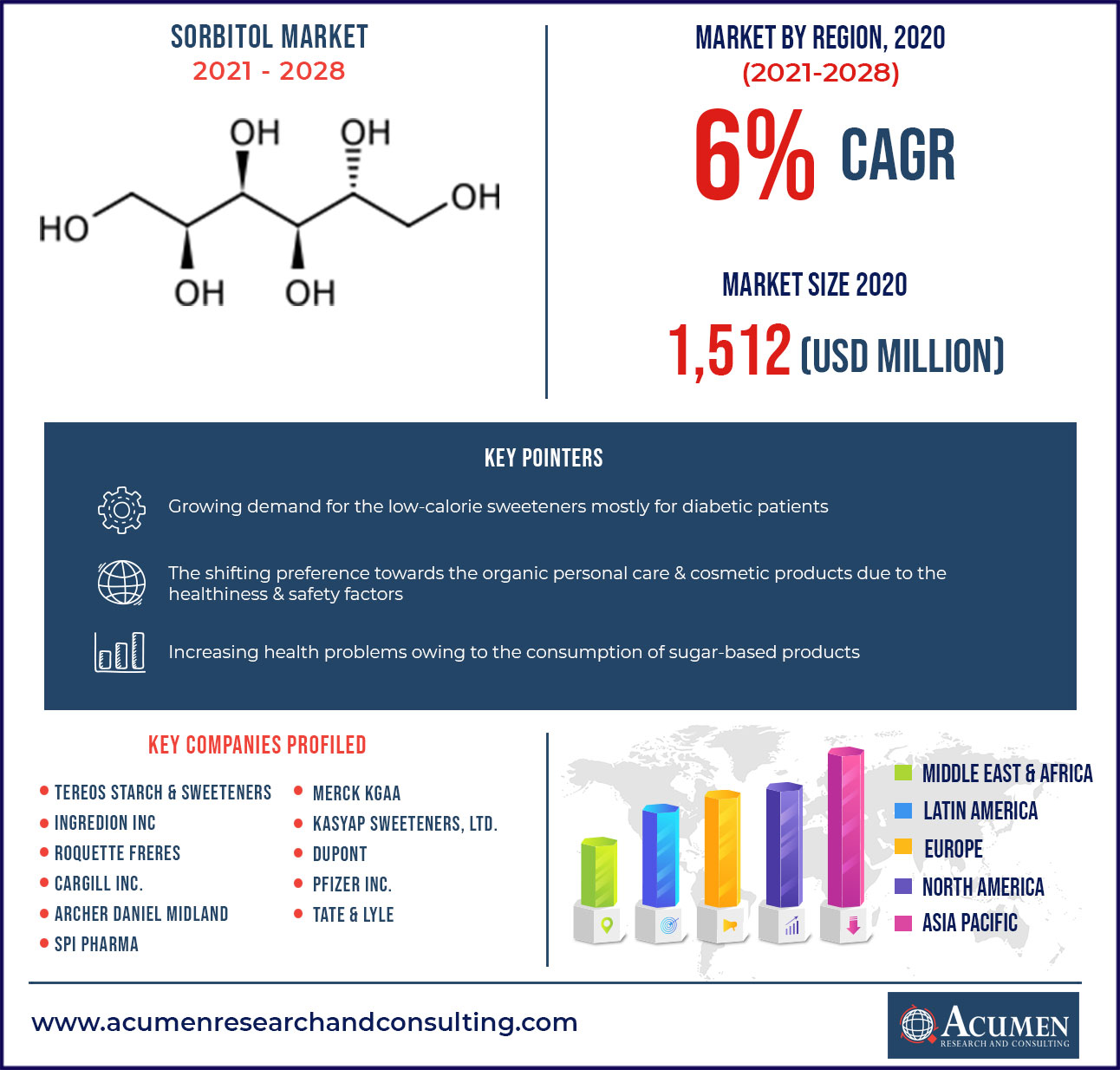

The Global Sorbitol Market size was valued at USD 1,512 Million in 2020 and projected to reach the market size of USD 2,420 Million in 2028, growing at a CAGR of 6% throughout the forecast period of 2021 to 2028.

Sorbitol is primarily consequent from corn, seaweed, fruits, and berries. It is the type of sugar or sweetener alcohol extorted from the corn syrup and also from fruits and berries such as pear, prunes, apples, and others. It is made through the catalytic hydrogenation of sucrose. In addition, it is a sugar substitute for low-calorie sweeteners, which is used in many foodstuffs like ice cream, candy, gum, baked goods, toothpaste, cosmetics, personal care, pharmaceuticals, and others.Sorbitol is evident to growdue to the launch of low-sugar foods by manufacturers in the food and beverage industry. Moreover, increasing adaptation of the diabetic and dietetic food and beverages, growing products demand like as a substitution for the sugar in consumer food products is anticipated to drive demand for the product over the forecast period.

Sorbitol Market Dynamics

- Drivers

- Growing demand for the low-calorie substitute sweeteners mostly for diabetic patients

- The shifting preference towards the organic personal care & cosmetic products due to the health& safety factors

- Increasing health problems owing to the consumption of sugar-based products

- Restraints

- Obedience to international quality standards, price competition, and serious consequences of the losing a single large indenture have a high level of negative impact on the sorbitol producing players

- Opportunities

- Variations in the cost and supply of sugar is createslucrative opportunities for sorbitol

- Increasing demand from the food & beverage (F & B) industry in emerging markets

Sorbitol Market Report Coverage:

| Market | Sorbitol Market |

| Market Size 2020 | US$ 1,512 Mn |

| Market Forecast 2028 | US$ 2,420 Mn |

| CAGR | 6% During 2021 - 2028 |

| Analysis Period | 2017 - 2028 |

| Base Year | 2020 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Type, By End-Use, By End-User By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Tereos Starch & Sweeteners, Ingredion Inc, Roquette Freres, Cargill Inc., Archer Daniel Midland, SPI Pharma, Merck KGaA, Kasyap Sweeteners, Ltd., DuPont, Pfizer Inc., Tate & Lyle and among others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Increasing consumer preference towards low-calorie food

One of the primary factors driving the growth of the sorbitol market is the increasing consumer preference toward low-calorie food. Growing sedentary lifestyle in the developed countries have resulted in surging health problems such as diabetes and obesity. Hence, to overcome such situation many people have opted for low-calorie foods and sugar substitute in their day-to-day diet instead of traditional high calorie sugar products. Sugar-alcohols such as sorbitol are as sweet as sugar but the lower in calories and also do not have negative effects of traditional sugar such as raising blood sugar level or tooth decay among other. It also has certain digestive benefits due to its hyperosmotic nature which help in better bowel movement and keeping the gut healthy.These are the factors are propelling the growth of the sorbitol market across the globe throughout the forthcoming years.

Increasing use of sorbitol in chocolates and confectionary productsdriving the sorbitol market growth

Sorbitol usage in food and beverages is increasing more than ever lately. Baked food products, confectioneries, and chocolates are some of the prominent products where sorbitol is frequently used as texturizer due to its non-carcinogenic, humectants and moisture-stabilizer properties. The global consumption of chocolate confectioneries was growing at a CAGR of 2% during the period from 2013 to 2018, while it grew at a rate of more than 7.8% in China, India and Asia Pacific as a whole during the same period. Moreover, baked food products grew at a CAGR or 4.6% globally during 2013 to 2018. Apart from confectionery and baked products, sorbitol is also used as an alternate feedstock for the production of propylene glycol. Propylene glycol is a synthetic food additive which has extensive application in food & feed, cosmetics, functional fluids, polymers among others. Hence, range of industrial applications of sorbitol will further drive the market during the forecast period.

Sorbitol Market Segmentation

Market by Type

- Liquid/Syrup Sorbitol

- Crystal/Powder Sorbitol

Liquid/Syrup sorbitol held dominatingmarket share as it is able to bind water molecules and stabilize the mass in numerous cosmetics, personal care products, foods and beverages.

Market by End-Use

- Cosmetics & Personal Care

- Food & Beverage

- Pharmaceuticals

- Chemicals

Based on the end-use, the pharmaceuticals segment is leading the market share and is expected to expand during the forecast period, due to growing demand for sorbitol in this segment is used in the manufacturing of ascorbic acid for vitamin C tablets.

Sorbitol Market Regional Overview

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Asia-Pacific region is expected to dominate the sorbitol paints market throughout the forecasted years

Among all the regions, Asia Pacific led the market and accounted for more than 55.0% share of the global revenue in 2020 owing to rising health-conscious consumers, increase in the numerous emerging consumer markets growing at a high speed is fuelling the market for sorbitol in the region. In addition, the changing lifestyles of public and urbanization in emerging countries have propelled the popularity of product by the end-users. Moreover, sorbitol is widely being used for non-food applications in the Asia Pacific, for instance, Japan has been the main importer of the product for the oral care industry.

The growing penetration of the sorbitol in the European region is due to the well-established food and beverages industry that keeps constantly developing and adapting for the latest ingredients. This region is not only one of the substantial markets for food and beverages, but also the most organized market. Furthermore, the market in Europe is projected to expand the growth opportunities of the product as a substitute for sugar in sugar-based foods and beverages and meat products as sorbitol is used to avoid the burning of meat.

Sorbitol Market Players

The prominent players of the sorbitol market includesTereos Starch & Sweeteners, Ingredion Inc, Roquette Freres, Cargill Inc., Archer Daniel Midland, SPI Pharma, Merck KGaA, Kasyap Sweeteners, Ltd., DuPont, Pfizer Inc., Tate & Lyle and among others.

Frequently Asked Questions

How much was the market size of global Sorbitol Market in 2020?

The market size value of global Sorbitol Market in 2020 was accounted to be USD 1,512 Million

What will be the projected CAGR for global Sorbitol Market during forecast period of 2021 to 2028?

The projected CAGR of Sorbitol Market during the analysis period of 2021 to 2028 is 6%

Which are the prominent competitors operating in the market?

The prominent players of the anti-corrosion paints market includesTereos Starch & Sweeteners, Ingredion Inc, Roquette Freres, Cargill Inc., Archer Daniel Midland, SPI Pharma, Merck KGaA, Kasyap Sweeteners, Ltd., DuPont, Pfizer Inc., Tate & Lyle and among others.

Which region held the dominating position in the global SorbitolMarket?

Asia-Pacific held the dominating share for Sorbitolduring the analysis period of 2021 to 2028

Which region exhibited the fastest growing CAGR for the forecast period of 2021 to 2028?

Europe region exhibited fastest growing CAGR for Sorbitolduring the analysis period of 2021 to 2028

What are the current trends and dynamics in the Sorbitol?

Growing demand for the low-calorie sweeteners,the shifting preference towards the organic personal care & cosmetic products, increasing health problems owing to the consumption of sugar-based products are driving the sorbitol market growth.

By segment Application, which sub-segment held the maximum share?

Based on type, liquid/Syrup sorbitol segment held the maximum share for Sorbitol Market in 2020