Soldering Flux Paste Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Soldering Flux Paste Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

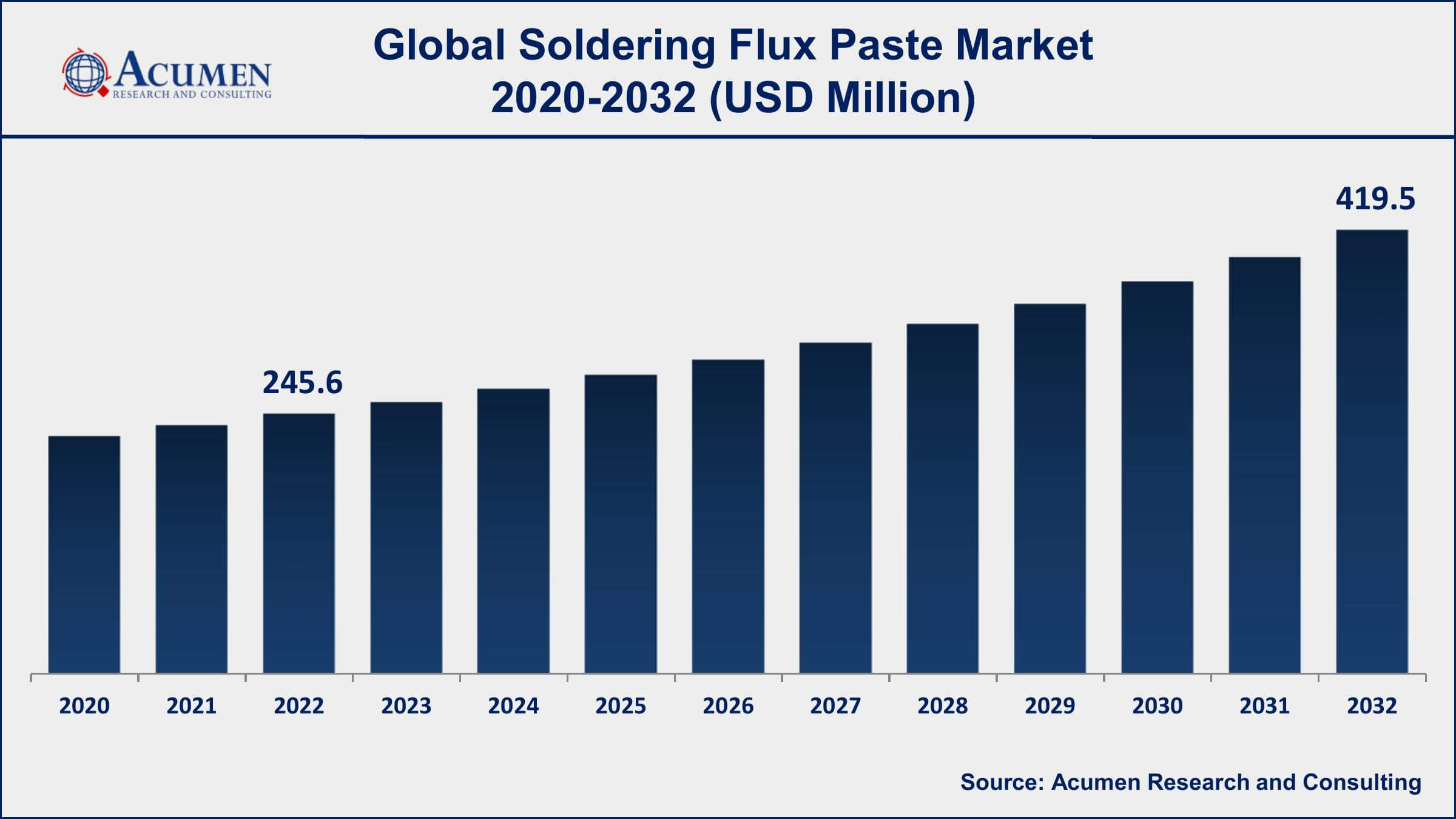

The Global Soldering Flux Paste Market Size accounted for USD 245.6 Million in 2022 and is projected to achieve a market size of USD 419.5 Million by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

Soldering Flux Paste Market Key Highlights

- Global soldering flux paste market revenue is expected to increase by USD 419.5 Million by 2032, with a 5.6% CAGR from 2023 to 2032

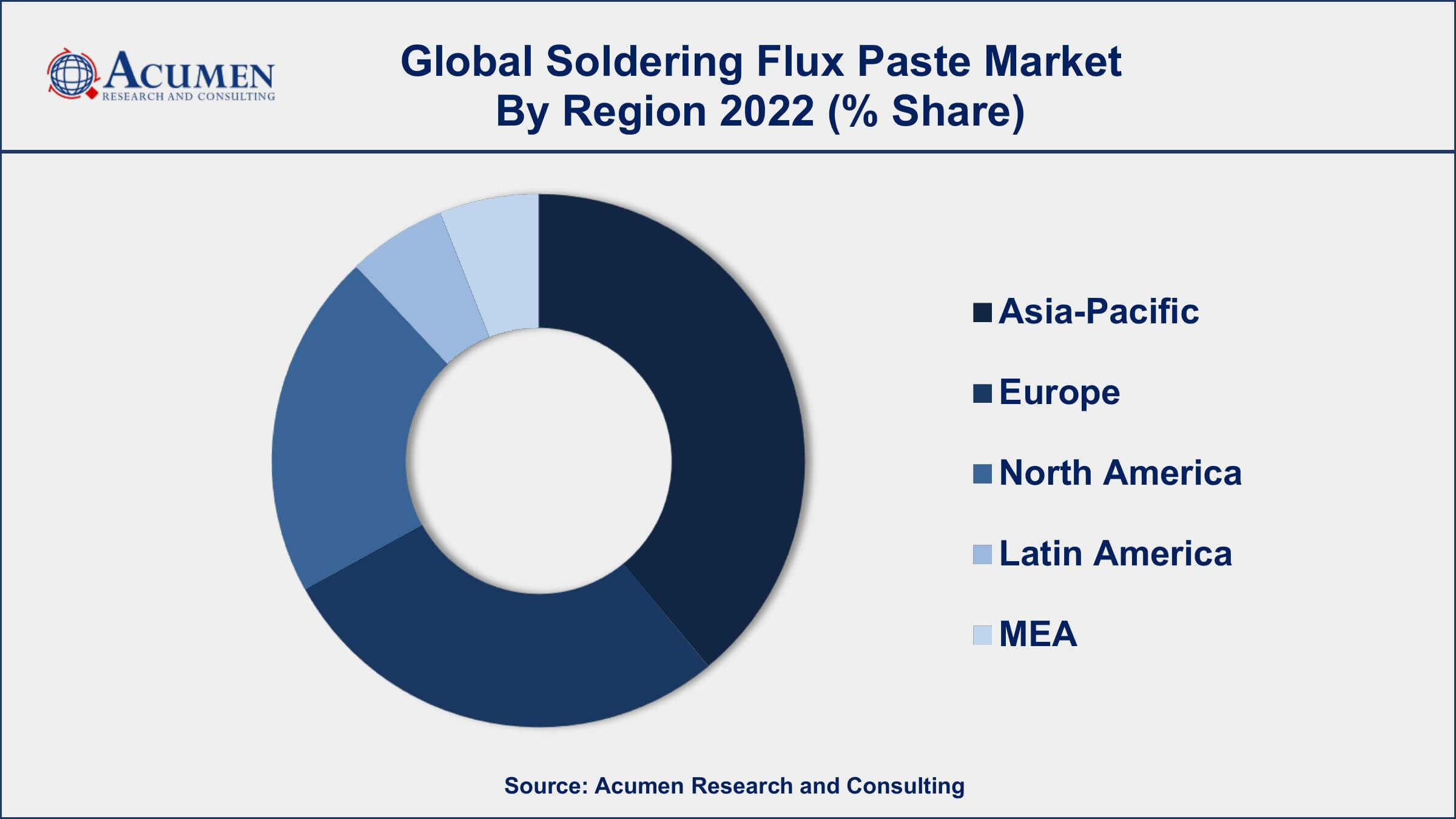

- Asia-Pacific region led with more than 46% of soldering flux paste market share in 2022

- North America soldering flux paste market growth will record a CAGR of over 6% from 2023 to 2032

- Rosin-based flux segment is the most widely used soldering flux paste, accounting for over 58% of the global market share

- Based on the end-use industry, the electronics and semiconductor sub-segment generated around 46% share in 2022

- Increasing adoption of automated soldering processes in manufacturing, drives the soldering flux paste market value

Soldering flux paste is a material used in soldering to facilitate the flow of solder and improve its adhesion to the surfaces being joined. It is typically composed of a mixture of rosin, a solvent, and an activator. The rosin acts as a flux, which removes oxides from the surface of the metals being joined and helps the solder bond more effectively. The solvent thins the rosin, making it easier to apply, while the activator enhances the fluxing action and promotes the formation of a strong solder joint.

The market for soldering flux paste has been growing steadily in recent years, driven by a range of factors. One key driver has been the growing demand for electronics products, which has led to an increase in the use of soldering flux paste in the manufacture of electronic components. In addition, the increasing use of renewable energy sources such as solar panels has also driven demand for soldering flux paste, as these technologies require large amounts of soldering to join the various components together. Other factors driving market growth include the increasing popularity of DIY electronics projects and the rising use of lead-free solders, which require the use of specialized flux pastes.

Global Soldering Flux Paste Market Trends

Market Drivers

- Growing demand for electronics products

- Increasing use of renewable energy sources such as solar panels

- Rising popularity of DIY electronics projects

- Increasing use of lead-free solders

- Advancements in soldering technology

Market Restraints

- Availability of alternative soldering technologies

- Volatility in raw material prices

Market Opportunities

- Growing popularity of flux pastes that are free from harmful chemicals

- Increasing adoption of automated soldering processes in manufacturing

- Rising demand for miniaturized electronic components

Soldering Flux Paste Market Report Coverage

| Market | Soldering Flux Paste Market |

| Soldering Flux Paste Market Size 2022 | USD 245.6 Million |

| Soldering Flux Paste Market Forecast 2032 | USD 419.5 Million |

| Soldering Flux Paste Market CAGR During 2023 - 2032 | 5.6% |

| Soldering Flux Paste Market Analysis Period | 2020 - 2032 |

| Soldering Flux Paste Market Base Year | 2022 |

| Soldering Flux Paste Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Kester, Alpha Assembly Solutions, MG Chemicals, AIM Solder, Indium Corporation, Nihon Superior Co. Ltd., LA-CO Industries, Inc., RMA Electronics, Inc., Petroferm Inc., Qualitek International, Inc., FCT Assembly, Inc., and PanaVise Products, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A solder paste is a powder metal solder suspended in a thick medium – flux that acts as a temporary adhesive. Soldering flux pastes are made of rosin, organic materials, resins, and various levels of solid residues. The market for soldering flux paste has witnessed significant growth due to rising demand from various applications such as SMT assembly, semiconductor packaging, and industrial soldering. The major factors driving the growth of the market include an increase in demand for solder flux paste-based products that provide surface protection from the re-oxidation of products across end-use industries.

The growing demand for solder paste that provides efficient soldering results with broad process windows and post-process residues that are cleanable in saponified water has led to the growth of the soldering flux paste market globally. Increased use of soldering flux paste in the electronics & semiconductor sector is expected to change the dynamics of the market in near future. However, growing opportunities across the Asia-Pacific market; as well as the growing semiconductor and printed circuit board industry are major opportunity areas for the market players. The major challenges faced by the market include limited availability of clean assembly and inert flow environment for no-clean flux, risk of exposure of the soldered particles, and transportation process complexity of solder paste.

Soldering Flux Paste Market Segmentation

The global soldering flux paste market segmentation is based on type, end-use industry, and geography.

Soldering Flux Paste Market By Type

- Rosin Based Paste

- Water Soluble Paste

- No-Clean Flux

In terms of types, the rosin-based paste segment has seen significant growth in the soldering flux market in recent years. Rosin-based fluxes are widely used in soldering applications due to their excellent ability to remove oxides and other contaminants from metal surfaces. They also offer good thermal stability and are relatively inexpensive compared to other flux types, making them a popular choice for many soldering applications. The growth of the rosin-based paste segment can be attributed to various factors. Firstly, the rising demand for electronics products has led to the increased use of rosin-based fluxes in the manufacturing of electronic components such as circuit boards, microprocessors, and other electronic devices. In addition, the increasing adoption of lead-free solders, which require more aggressive fluxes, has further fueled the growth of the rosin-based paste segment. Moreover, the growing trend towards eco-friendly and sustainable products has also led to an increase in demand for rosin-based fluxes.

Soldering Flux Paste Market By End-Use Industry

- Electronics & Semiconductor

- Automotive

- Industrial

- Others

According to the soldering flux paste market forecast, the electronics & semiconductor segment is expected to witness significant growth in the coming years. The increasing demand for electronics products and the growing semiconductor industry has led to a surge in the use of soldering flux paste in the manufacturing of various electronic components. The use of soldering flux paste is essential in the production of circuit boards, microprocessors, and other electronic devices. Moreover, the increasing trend towards the miniaturization of electronic components has led to the use of lead-free solders, which require specialized flux pastes. This has further boosted the demand for soldering flux paste in the electronics and semiconductor segment. Additionally, the growing adoption of renewable energy sources such as solar panels has also contributed to the growth of this segment, as soldering flux paste is required to join various components together in the production of solar panels.

Soldering Flux Paste Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Soldering Flux Paste Market Regional Analysis

Asia-Pacific dominates the soldering flux paste market, accounting for a significant share of the global market. The region is home to some of the world's largest electronics manufacturing countries, including China, Japan, South Korea, and Taiwan. The growing demand for electronics products in these countries has led to an increase in the use of soldering flux paste in the manufacturing of various electronic components. Moreover, the rise of the semiconductor industry in the region has also contributed to the regional market growth. In addition, Asia-Pacific is witnessing rapid industrialization and urbanization, which has led to the growth of various end-use industries such as automotive, construction, and consumer goods. These industries also require soldering flux paste for various applications, further boosting the demand for the product. Furthermore, the low labor costs in the region have led to the establishment of many manufacturing plants, making Asia-Pacific a hub for soldering flux paste production.

Soldering Flux Paste Market Player

Some of the top soldering flux paste market companies offered in the professional report include Kester, Alpha Assembly Solutions, MG Chemicals, AIM Solder, Indium Corporation, Nihon Superior Co. Ltd., LA-CO Industries, Inc., RMA Electronics, Inc., Petroferm Inc., Qualitek International, Inc., FCT Assembly, Inc., and PanaVise Products, Inc.

Frequently Asked Questions

What was the market size of the global soldering flux paste in 2022?

The market size of soldering flux paste was USD 245.6 Million in 2022.

What is the CAGR of the global soldering flux paste market from 2023 to 2032?

The CAGR of soldering flux paste is 5.6% during the analysis period of 2023 to 2032.

Which are the key players in the soldering flux paste market?

The key players operating in the global market are including Kester, Alpha Assembly Solutions, MG Chemicals, AIM Solder, Indium Corporation, Nihon Superior Co. Ltd., LA-CO Industries, Inc., RMA Electronics, Inc., Petroferm Inc., Qualitek International, Inc., FCT Assembly, Inc., and PanaVise Products, Inc.

Which region dominated the global soldering flux paste market share?

Asia-Pacific held the dominating position in soldering flux paste industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of soldering flux paste during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global soldering flux paste industry?

The current trends and dynamics in the soldering flux paste industry include growing demand for electronics products, increasing use of renewable energy sources such as solar panels, rising popularity of DIY electronics projects, and increasing use of lead-free solders.

Which type held the maximum share in 2022?

The rosin based paste type held the maximum share of the soldering flux paste industry.