Soil Moisture Sensor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Soil Moisture Sensor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

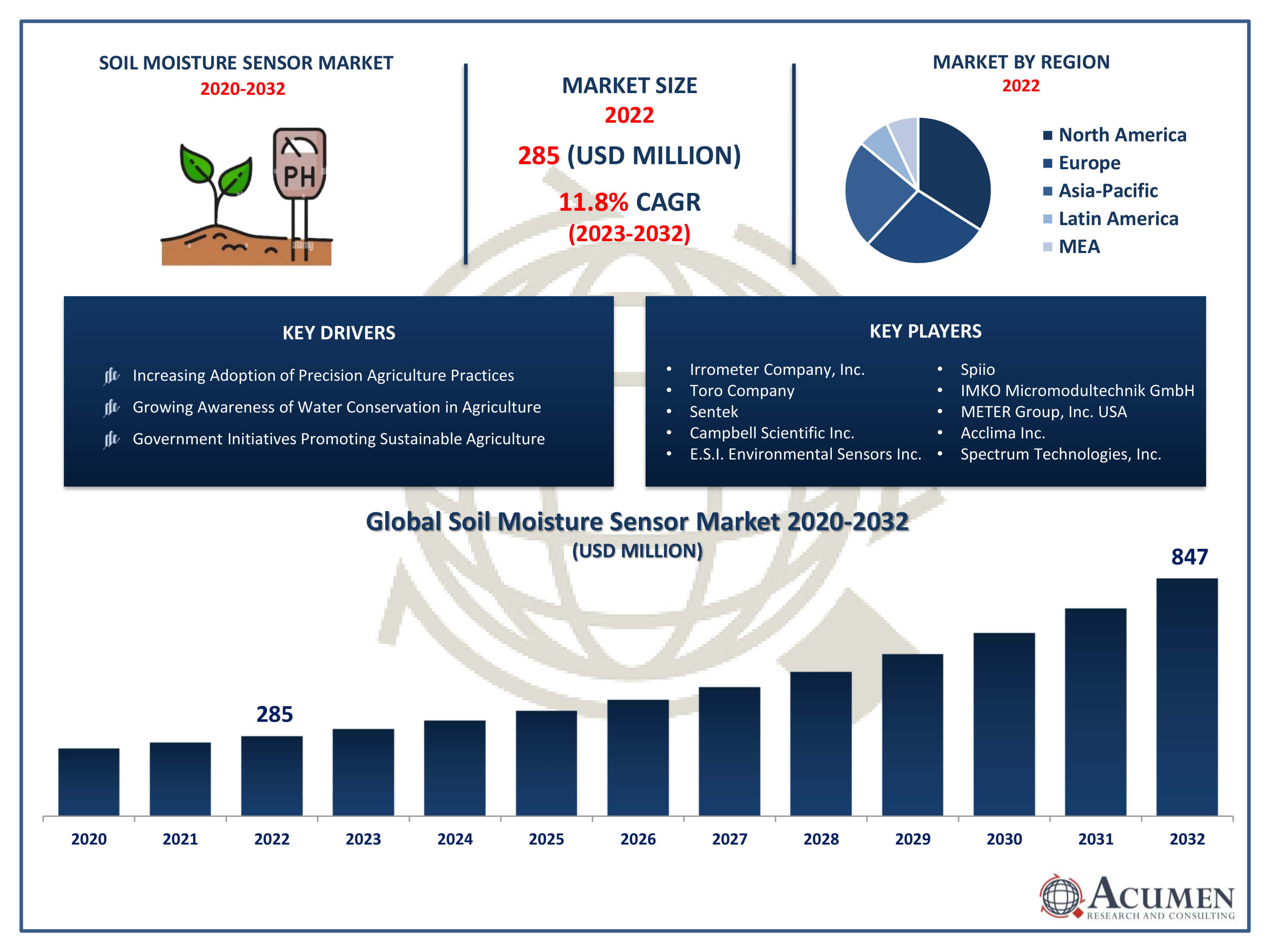

The Soil Moisture Sensor Market Size accounted for USD 285 Million in 2022 and is projected to achieve a market size of USD 847 Million by 2032 growing at a CAGR of 11.8% from 2023 to 2032.

Soil Moisture Sensor Market Highlights

- Global soil moisture sensor market revenue is expected to increase by USD 847 million by 2032, with a 11.8% CAGR from 2023 to 2032

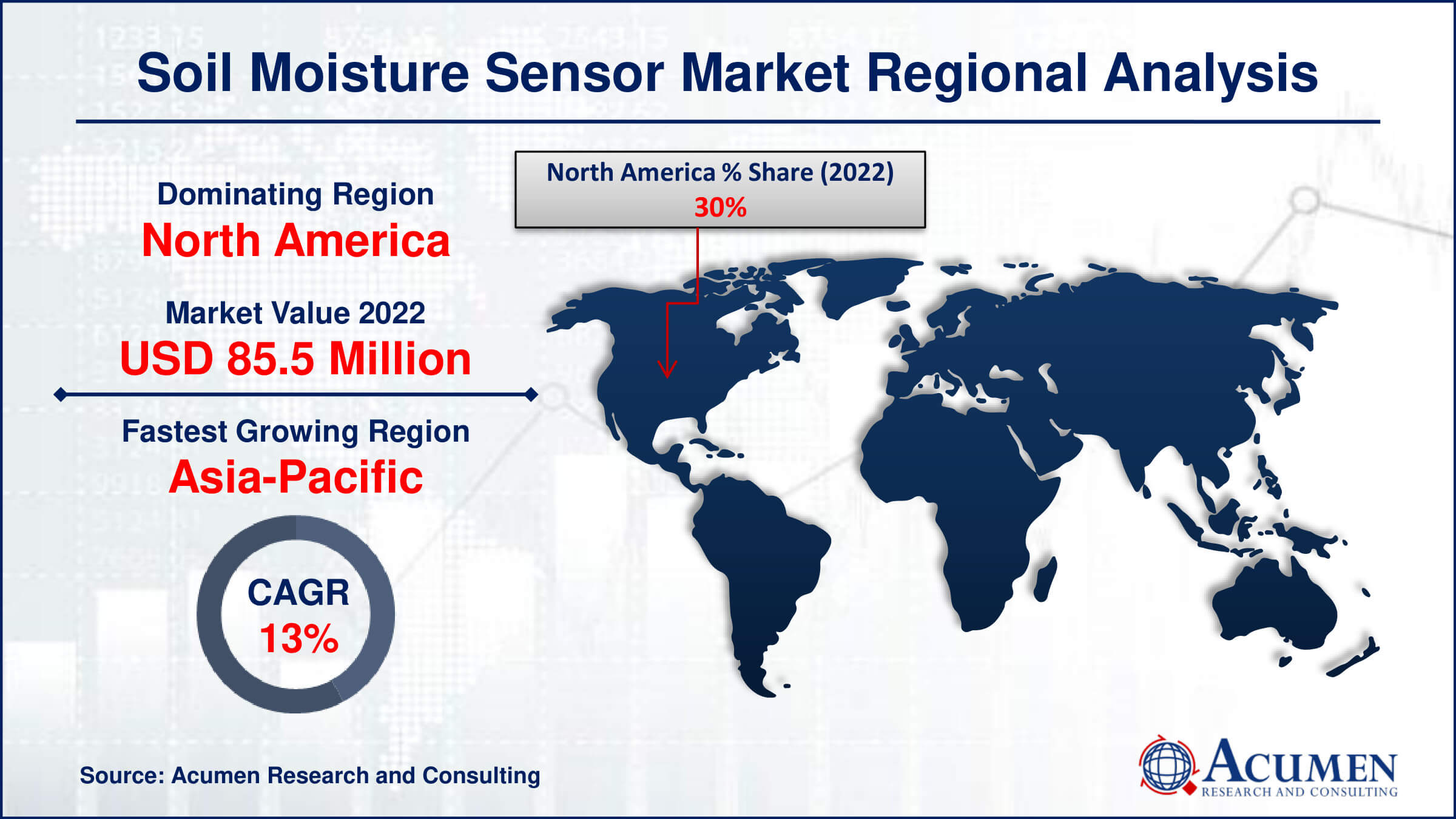

- North America region led with more than 30% of soil moisture sensor market share in 2022

- Asia-Pacific soil moisture sensor market growth will record a CAGR of more than 13.1% from 2023 to 2032

- By sensor, the tensiometers segment captured more than 36% of revenue share in 2022.

- By application, the agriculture segment has held the largest market share of 60% in 2022

- Increasing adoption of precision agriculture practices, drives the soil moisture sensor market value

A soil moisture sensor is a device designed to measure the water content in the soil. It plays a crucial role in precision agriculture by helping farmers optimize irrigation practices through real-time data on soil moisture levels. These sensors typically work by measuring the dielectric constant of the soil, which changes with variations in moisture content. The information obtained from soil moisture sensors allows farmers to make informed decisions about when and how much to irrigate, leading to improved water efficiency, reduced water usage, and increased crop yields.

A soil moisture sensor is a device designed to measure the water content in the soil. It plays a crucial role in precision agriculture by helping farmers optimize irrigation practices through real-time data on soil moisture levels. These sensors typically work by measuring the dielectric constant of the soil, which changes with variations in moisture content. The information obtained from soil moisture sensors allows farmers to make informed decisions about when and how much to irrigate, leading to improved water efficiency, reduced water usage, and increased crop yields.

The market for soil moisture sensors has experienced significant growth in recent years, driven by the increasing adoption of precision harvesting practices and the need for sustainable water management. For instance, the Chinese government intends to implement a stringent water resource management (SWRM) system to address the escalating water scarcity exacerbated by economic expansion and population growth. As awareness of the importance of efficient water use in agriculture continues to rise, farmers and agricultural professionals are seeking advanced technologies like soil moisture sensors to enhance their decision-making processes.

Market growth is also fueled by technological advancements in sensor design and wireless communication, making it easier for farmers to integrate these devices into their farming operations. For example, Monnit launched the ALTA soil moisture sensor in March 2021. Additionally, government initiatives promoting water conservation and sustainable agriculture practices further contribute to the expanding market for soil moisture sensors

Global Soil Moisture Sensor Market Trends

Market Drivers

- Increasing adoption of precision agriculture practices

- Growing awareness of water conservation in agriculture

- Technological advancements in sensor design and wireless communication

- Government initiatives promoting sustainable agriculture

- Rising demand for improved crop yields

Market Restraints

- High initial costs and installation expenses

- Limited awareness and education among farmers

Market Opportunities

- Increasing focus on smart agriculture and IoT in agriculture

- Integration with precision farming platforms for comprehensive solutions

Soil Moisture Sensor Market Report Coverage

| Market | Soil Moisture Sensor Market |

| Soil Moisture Sensor Market Size 2022 | USD 285 Million |

| Soil Moisture Sensor Market Forecast 2032 | USD 847 Million |

| Soil Moisture Sensor Market CAGR During 2023 - 2032 | 11.8% |

| Soil Moisture Sensor Market Analysis Period | 2020 - 2032 |

| Soil Moisture Sensor Market Base Year |

2022 |

| Soil Moisture Sensor Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Sensor, By Connectivity, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Irrometer Company, Inc., Toro Company, Sentek, Campbell Scientific Inc., E.S.I. Environmental Sensors Inc., Spiio, IMKO Micromodultechnik GmbH, METER Group, Inc. USA, Acclima Inc., and Spectrum Technologies, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Soil moisture sensors typically utilize various technologies, such as capacitance or impedance measurements, to assess the water content in the soil. By inserting the sensor probes into the ground, farmers can obtain real-time information about the moisture levels at different soil depths, enabling them to make informed decisions regarding irrigation timing and quantity.

The applications of soil moisture sensors are diverse and play a crucial role in modern agriculture. One primary application is precision irrigation, where the sensors assist farmers in optimizing water usage by delivering accurate, site-specific information about soil moisture conditions. This targeted approach not only conserves water resources but also enhances crop yield and quality. Additionally, soil moisture sensors find applications in environmental monitoring, helping researchers and land managers access and manage water resources, prevent soil erosion, and mitigate the impact of drought conditions.

The growing global awareness of water conservation in agriculture and the adoption of precision farming techniques have significantly driven the soil moisture sensor market. For instance, according to a 2023 report by the U.S. Department of Agriculture (USDA), 27 percent of farms and ranches in the United States employed precision agriculture techniques for crop and livestock management. Farmers and agricultural enterprises increasingly recognize the value of these sensors in optimizing irrigation, reducing water wastage, and improving crop yields.

Technological advancements and innovations in sensor design, including the integration of wireless communication and data analytics, have also contributed to market expansion. For example, in April 2022, Sensoterra introduced a new generation of Single Depth sensors featuring a redesigned antenna. This latest sensor significantly enhances LoRaWAN signal strength by a factor of 2 to 4, while also offering improved durability and increased accuracy.

Government initiatives promoting sustainable agricultural practices and water resource management have further propelled market growth. As precision agriculture continues to gain traction worldwide, the demand for soil moisture sensors is expected to rise, driven by the need for efficient water use and optimized farming operations.

Soil Moisture Sensor Market Segmentation

The global Soil Moisture Sensor Market segmentation is based on sensor, connectivity, application, and geography.

Soil Moisture Sensor Market By Sensor

- Capacitance

- Gypsum Blocks

- Probes

- Granular Matrix Sensors

- Time Domain Transmissometry (TDT) Sensors

- Tensiometers

According to the soil moisture sensor industry analysis, the tensiometers segment accounted for the largest market share in 2022. Tensiometers are devices that assess the soil's ability to retain water by measuring the tension or suction required to extract water from the soil. This segment's growth can be attributed to the increased recognition of the importance of precise soil moisture management in agriculture, especially in regions facing water scarcity or where irrigation resources need to be optimized. Tensiometers have been favored for their accuracy in measuring soil moisture potential, providing valuable insights into the soil's water-holding capacity. The growth of the tensiometers segment is also influenced by ongoing advancements in sensor technology, making these devices more user-friendly, durable, and capable of transmitting real-time data for efficient decision-making.

Soil Moisture Sensor Market By Connectivity

- Wireless

- Wired

In terms of connectivity, the wireless segment is expected to witness significant growth in the coming years. Wireless soil moisture sensors offer advantages such as remote data collection, ease of installation, and reduced maintenance compared to traditional wired systems. These devices utilize wireless communication technologies such as Bluetooth, Wi-Fi, or cellular networks to transmit soil moisture data to centralized platforms, allowing farmers to monitor and manage soil conditions conveniently.

Wireless soil moisture sensors enable farmers to receive timely information about soil moisture levels, helping them make informed decisions on irrigation scheduling and resource allocation. Furthermore, advancements by key players further boost the segment's dominance in the market. For instance, in March 2021, Monnit Corporation introduced the ALTA soil moisture sensor, a wireless device that offers smartphone connectivity. This sensor measures water tension through a hydrophilic fabric-enveloped matrix material. As a result, the wireless segment is expected to boost its growth in the forecast year.

Soil Moisture Sensor Market By Application

- Agriculture

- Residential

- Construction and Mining

- Sports

- Research Studies

- Forestry

- Weather Forecasting

- Landscaping and Ground Care

According to the soil moisture sensor market forecast, the agriculture segment is expected to witness significant growth in the coming years. Soil moisture sensors play a pivotal role in precision agriculture, a trend that has gained momentum globally. Farmers are increasingly recognizing the importance of optimizing water usage for irrigation, as it directly impacts crop yield and resource efficiency. The agriculture segment's growth is driven by the need for accurate and real-time data on soil moisture levels to make informed decisions about irrigation schedules, ensuring that crops receive the right amount of water at the right time. Governments and agricultural organizations are also promoting the use of soil moisture sensors as part of sustainable farming practices. These sensors contribute to resource conservation by preventing over-irrigation, minimizing water wastage, and improving overall water use efficiency in agriculture.

Soil Moisture Sensor Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Soil Moisture Sensor Market Regional Analysis

North America has been a dominating region in the soil moisture sensor market due to several key factors. The region's leadership can be attributed to the widespread adoption of advanced agricultural technologies, a high level of awareness regarding water conservation, and the presence of a well-established farming industry. For instance, farm sector debt is projected to rise by 5.2 percent, amounting to an increase of $27.0 billion, reaching a total of $547.6 billion in 2024. Farmers in North America, particularly in the United States and Canada, have been early adopters of precision agriculture practices, recognizing the benefits of optimizing irrigation through the use of soil moisture sensors. This proactive approach to technology adoption has driven the demand for these sensors, fostering market growth.

Moreover, the availability of government initiatives and subsidies promoting sustainable farming practices and water conservation has further incentivized farmers in North America to invest in precision irrigation technologies, including soil moisture sensors. The region's strong focus on research and development contributes to market growth. For instance, in January 2023, CropX Technologies acquired Tule Technologies, a U.S.-based company. This acquisition provides CropX with new data capture technologies, enhancing their AI predictions and expanding their market presence in California. As a result, the presence of key market players and innovative agricultural technology startups has contributed to the continuous evolution and improvement of soil moisture sensing technologies.

Asia-Pacific is the fastest-growing region in the soil moisture sensor market due to increasing agricultural activities and the adoption of advanced farming techniques to enhance crop yield. Governments in countries like China and India are investing heavily in smart agriculture technologies to ensure food security and efficient water management. Rapid urbanization and industrialization are also driving the need for sustainable water usage practices. For instance, in September 2023, Chinese President Xi Jinping emphasized the crucial importance of high-quality development in promoting new-type industrialization. Additionally, the region's vulnerability to climate change impacts, such as irregular rainfall patterns, is propelling the demand for precise irrigation solutions. As a result, there is a significant boost in the market for soil moisture sensors.

Soil Moisture Sensor Market Player

Some of the top soil moisture sensor market companies offered in the professional report include Irrometer Company, Inc., Toro Company, Sentek, Campbell Scientific Inc., E.S.I. Environmental Sensors Inc., Spiio, IMKO Micromodultechnik GmbH, METER Group, Inc. USA, Acclima Inc., and Spectrum Technologies, Inc.

Frequently Asked Questions

How big is the soil moisture sensor market?

The soil moisture sensor market size was USD 285 Million in 2022.

What is the CAGR of the global soil moisture sensor market from 2023 to 2032?

The CAGR of soil moisture sensor is 11.8% during the analysis period of 2023 to 2032.

Which are the key players in the soil moisture sensor market?

The key players operating in the global market are including Irrometer Company, Inc., Toro Company, Sentek, Campbell Scientific Inc., E.S.I. Environmental Sensors Inc., Spiio, IMKO Micromodultechnik GmbH, METER Group, Inc. USA, Acclima Inc., and Spectrum Technologies, Inc.

Which region dominated the global soil moisture sensor market share?

North America held the dominating position in soil moisture sensor industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of soil moisture sensor during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global soil moisture sensor industry?

The current trends and dynamics in the soil moisture sensor industry include increasing adoption of precision agriculture practices, growing awareness of water conservation in agriculture, and technological advancements in sensor design and wireless communication.

Which connectivity held the maximum share in 2022?

The wired connectivity held the maximum share of the soil moisture sensor industry.