Sodium Hypochlorite Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Sodium Hypochlorite Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

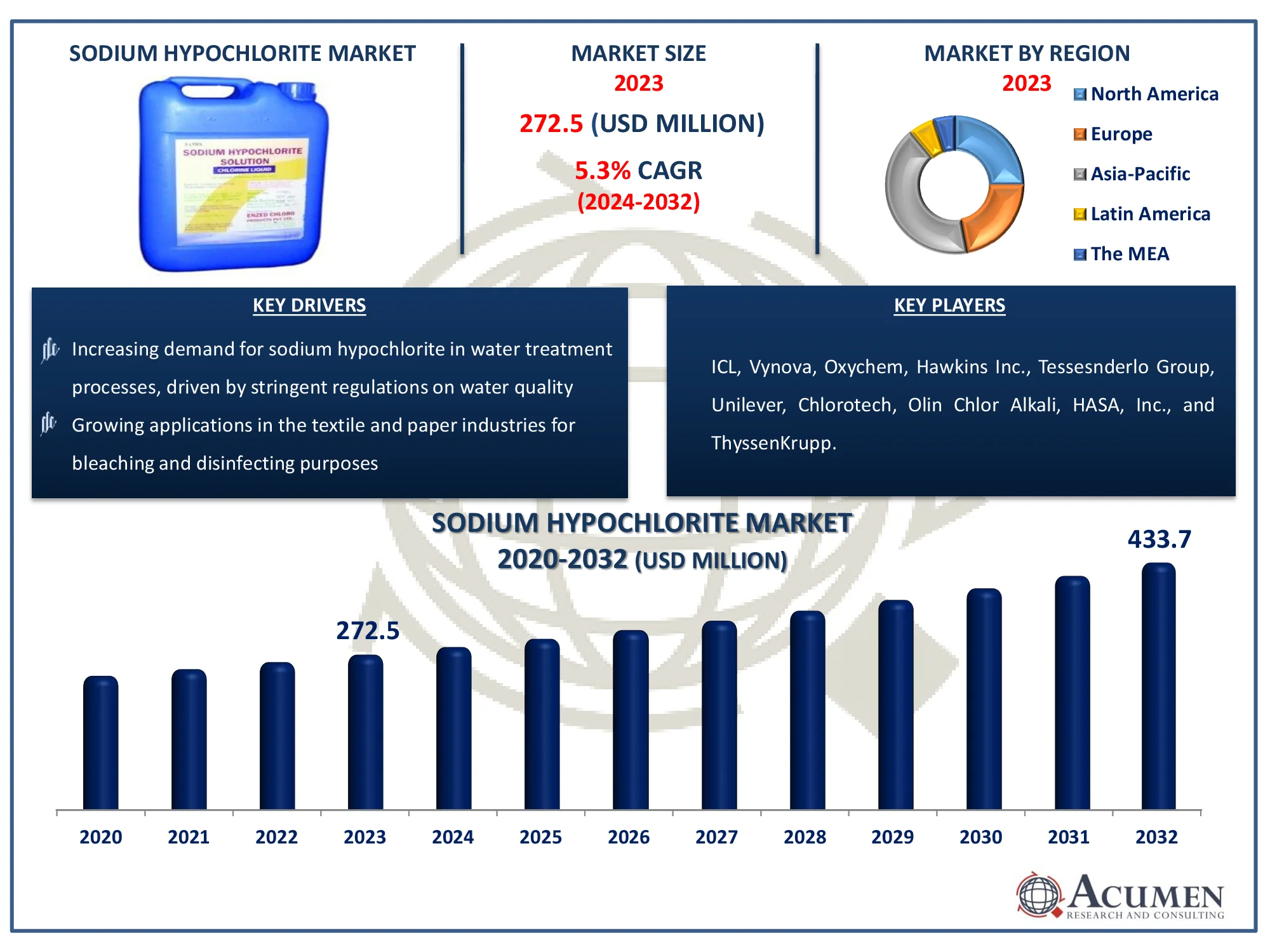

The Global Sodium Hypochlorite Market Size accounted for USD 272.5 Million in 2023 and is estimated to achieve a market size of USD 433.7 Million by 2032 growing at a CAGR of 5.3% from 2024 to 2032.

Sodium Hypochlorite Market Highlights

- Global sodium hypochlorite market revenue is poised to garner USD 433.7 million by 2032 with a CAGR of 5.3% from 2024 to 2032

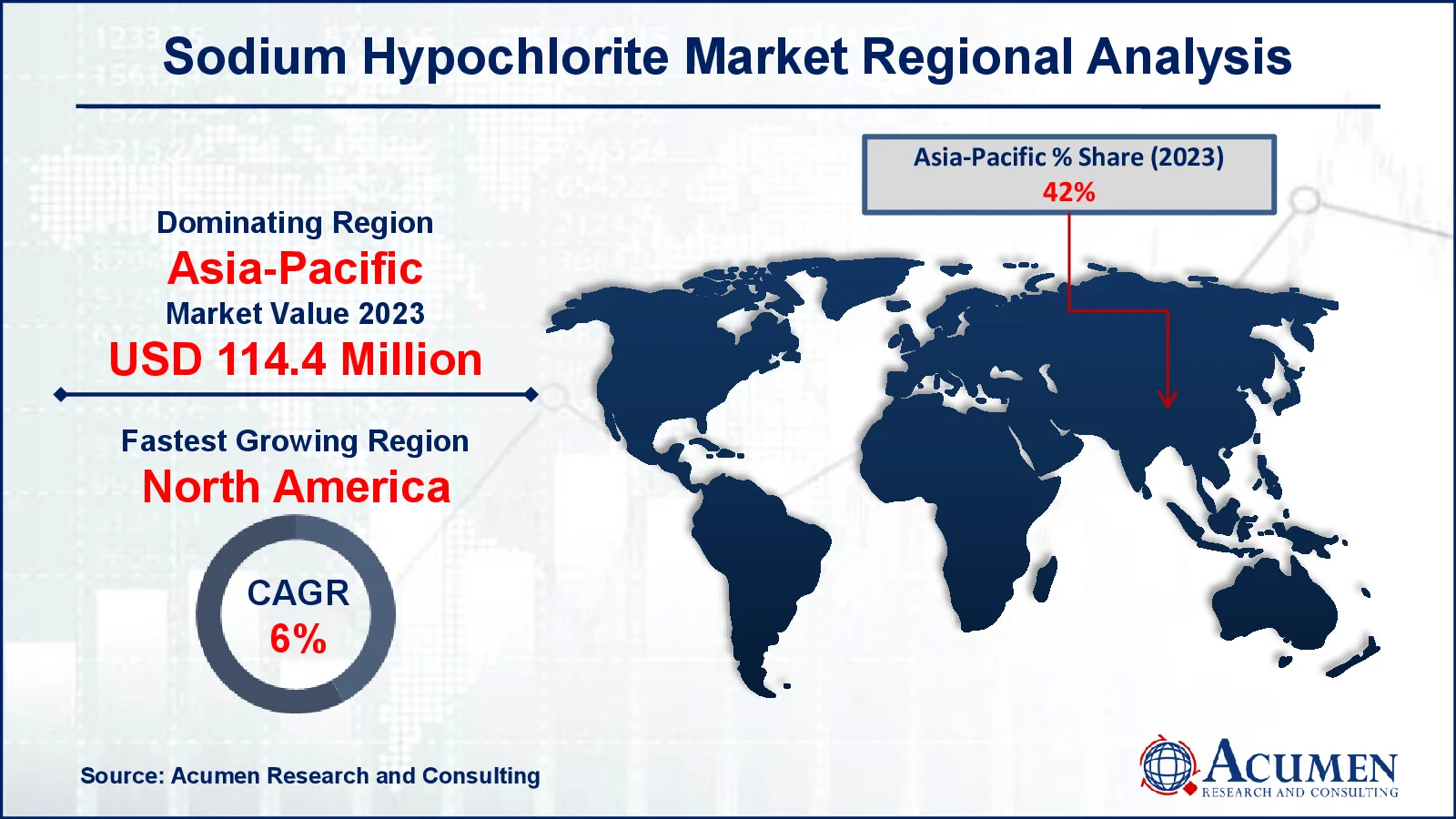

- Asia-Pacific sodium hypochlorite market value occupied around USD 114.4 million in 2023

- North America sodium hypochlorite market growth will record a CAGR of more than 6% from 2024 to 2032

- Among application, the disinfection sub-segment generated noteworthy revenue in 2023

- Based on end-use, the water treatment sub-segment generated 51% sodium hypochlorite market share in 2023

- The expanding industrial sector, particularly in textile and paper production is a popular sodium hypochlorite market trend that fuels the industry demand

Sodium hypochlorite is commonly used as bleach, antimicrobial agent or disinfectant. Sodium hypochlorite solution can be made from reacting sodium hydroxide solution with chlorine. It is a pale greenish-yellow in color in liquid form. It is also commonly known as household chemical which is widely used as disinfectant. The compound is easily decomposes when put in liquid form, by liberating fumes of chlorine. Hence, it is mainly used as a bleaching agent and disinfectant.

Global Sodium Hypochlorite Market Dynamics

Market Drivers

- Growing applications in the textile and paper industries for bleaching and disinfecting purposes

- Increasing demand for sodium hypochlorite in water treatment processes, driven by stringent regulations on water quality

- Rising awareness of hygiene and sanitation, particularly in the healthcare and food sectors, fueling sodium hypochlorite usage

Market Restraints

- Health hazards associated with sodium hypochlorite, including potential respiratory issues and skin irritations, limiting its usage

- Availability of alternative disinfectants and bleaching agents that may offer safer and more effective solutions

- Fluctuating raw material prices impacting production costs and market stability

Market Opportunities

- Expanding applications in the agriculture sector for crop protection and disease management present new growth avenues

- Advancements in production technologies that enhance efficiency and reduce environmental impact offer competitive advantages

- Increasing investments in wastewater treatment facilities globally create significant demand for sodium hypochlorite as a disinfectant

Sodium Hypochlorite Market Report Coverage

| Market | Sodium Hypochlorite Market |

| Sodium Hypochlorite Market Size 2022 |

USD 272.5 Million |

| Sodium Hypochlorite Market Forecast 2032 | USD 433.7 Million |

| Sodium Hypochlorite Market CAGR During 2023 - 2032 | 5.3% |

| Sodium Hypochlorite Market Analysis Period | 2020 - 2032 |

| Sodium Hypochlorite Market Base Year |

2022 |

| Sodium Hypochlorite Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ICL, Vynova, Oxychem, Hawkins Inc., Tessesnderlo Group, Unilever, Chlorotech, Olin Chlor Alkali, HASA, Inc., and ThyssenKrupp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Sodium Hypochlorite Market Insights

Sodium hypochlorite traditionally is a household chemical which is used as a disinfectant or a bleaching agent across the world. It is commonly known as the liquid bleach. The major application of sodium hypochlorite is - it acts as a bleaching agent in various ranges of industries such as, Water Treatment, paper and pulp, and detergents. During the COVID-19 pandemic, sanitizer is the most sold product due to awareness of personal hygiene.

Currently, there is high demand from healthcare industries as the sodium hypochlorite is utilized as a disinfectant or sanitizer. It is the key ingredient for the products like sanitizer or cleaning products which disinfects the surface. Due to the property to act as a disinfectant, it is in high demand from some other end use industries which manufactures sanitizers, hand wash, and other cleaning products. This is the major reason to drive the sodium hypochlorite market in this pandemic.

Sodium hypochlorite is also used in agriculture, food, waste disposal industries, and others. Mainly sodium hypochlorite is used for water treatment in water treatment plant for disinfection of water. For water treatment the concentration of sodium hypochlorite is high, because higher the concentration fastest will be the process. Sodium hypochlorite is usually used as a biocide in applications of the industries to control the bacteria and slime formation in water systems in paper and pulp mills, power plants, etc. It is also used for treating cyanide waste water, such as, silver cyanide plating solutions and electroplating wastes. Owing to the properties of sodium hypochlorite, there is high demand of it from the end use industries.

The availability of cheap substitutes such as, lithium hypochlorite, calcium hypochlorite, and citric acid can hamper the growth of the sodium hypochlorite market. Another major factor to hamper the growth of the market is, adverse side effects such as, gas poisoning, and lungs can get damaged by the fumes of sodium hypochlorite. If the sodium hypochlorite started decomposing it emits the chlorine fumes which are harmful to the human body, it can affect the front line workers in the manufacturing units.

Sodium Hypochlorite Market Segmentation

The worldwide market for sodium hypochlorite is split based on application, end-use, and geography.

Sodium Hypochlorite Market By Application

- Disinfection

- Bleaching

- Oxidizing

- Odor removal

- Others

According to sodium hypochlorite industry analysis, by application segment, disinfection application dominated the market in 2023. This due to the high demand of sodium hypochlorite for the production of household cleaning products, for cleaning of swimming pools, and waste water treatment. Sodium hypochlorite is used in production of chemicals which are used in waste water treatment for decades across the world. Increasing number of manufacturing facilities and rising industrialization worldwide, due to this the discharge of industrial waste water in the water bodies is at its peak. Because of this reason it is projected that there will be high demand of sodium hypochlorite in waste water treatment in the future.

Sodium Hypochlorite Market By End-Use

- Water Treatment

- Textile

- Household

- Chemical

- Agriculture

- Others

The water treatment industry is expected to hold the largest share in the sodium hypochlorite market forecast period. This domination arises from the expanding global demand for safe drinking water and efficient wastewater treatment systems. Sodium hypochlorite is well-known for its potent disinfection properties, making it an essential element for water treatment operations in municipal and industrial contexts.. With growing worries about waterborne diseases and the necessity for strict sanitation measures, municipalities and water treatment facilities are increasingly using sodium hypochlorite to maintain drinking water's microbiological safety.

Furthermore, regulatory bodies are enforcing strict water quality standards, which is increasing the use of sodium hypochlorite in water purification. Water treatment is likely to be the most important end-use segment for sodium hypochlorite in the near future due to its versatility in eliminating bacteria, viruses, and algae, as well as its low cost when compared to other disinfectants.

Sodium Hypochlorite Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Sodium Hypochlorite Market Regional Analysis

Asia-Pacific region dominated the market share over 42% of the revenue in 2023. This is due to rapid increase in urbanization and changing lifestyle in this region. High demand for treated water, rising requirements for sanitizers and personal hygiene products across the countries from this region such as, China, India, Thailand, Indonesia, and others. Moreover, the countries such as, India, Japan, South Korea, Thailand, and others are becoming major hubs for textile industries rapidly due to the cheap and skilled labor, lands at low price, and ease of regulations, because of these reasons there is high demand of sodium hypochlorite as a bleaching agent.

In contrast, North America is the fastest-growing region in the sodium hypochlorite market. This expansion can be attributed to increased awareness of cleanliness, particularly in light of recent health problems. The rising use of sodium hypochlorite for a variety of applications, including water treatment and disinfection products, is driving sodium hypochlorite market growth in the area. Furthermore, governmental backing and technological advancements in industrial applications are likely to boost demand, establishing North America as a major player in the global sodium hypochlorite market.

Sodium Hypochlorite Market Players

Some of the top sodium hypochlorite companies offered in our report include ICL, Vynova, Oxychem, Hawkins Inc., Tessesnderlo Group, Unilever, Chlorotech, Olin Chlor Alkali, HASA, Inc., and ThyssenKrupp.

Frequently Asked Questions

How big is the sodium hypochlorite market?

The sodium hypochlorite market size was valued at USD 272.5 million in 2023.

What is the CAGR of the global sodium hypochlorite market from 2024 to 2032?

The CAGR of sodium hypochlorite is 5.3% during the analysis period of 2024 to 2032.

Which are the key players in the sodium hypochlorite market?

The key players operating in the global market are including ICL, Vynova, Oxychem, Hawkins Inc., Tessesnderlo Group, Unilever, Chlorotech, Olin Chlor Alkali, HASA, Inc., and ThyssenKrupp.

Which region dominated the global sodium hypochlorite market share?

Asia-Pacific held the dominating position in sodium hypochlorite industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of sodium hypochlorite during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global sodium hypochlorite industry?

The current trends and dynamics in the sodium hypochlorite industry include increasing demand for sodium hypochlorite in water treatment processes, driven by stringent regulations on water quality, growing applications in the textile and paper industries for bleaching and disinfecting purposes., and rising awareness of hygiene and sanitation, particularly in the healthcare and food sectors, fueling sodium hypochlorite usage.

Which end-use held the maximum share in 2023?

The water treatment end-use held the maximum share of the sodium hypochlorite industry.