Soap Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Soap Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Soap Market Size accounted for USD 38.4 Billion in 2022 and is projected to achieve a market size of USD 66.5 Billion by 2032 growing at a CAGR of 5.7% from 2023 to 2032.

Soap Market Key Highlights

- Global soap market revenue is expected to increase by USD 66.5 Billion by 2032, with a 5.7% CAGR from 2023 to 2032

- North America region led with more than 34% of soap market share in 2022

- The CDC reports that handwashing with soap can reduce the risk of respiratory infections by 16-21%

- Liquid soap is the most popular form of soap, accounting for over 50% of the market share

- Online channel is the fastest-growing segment of the market, with a CAGR of 6.2% from 2023 to 2032

- Growing demand for personalized medicine and targeted therapies, drives the soap market value

Soap is a common personal hygiene product that is used to clean and disinfect the body. It is made by combining fats or oils with an alkali, such as lye, and then mixing in various fragrances, colors, and other ingredients to create different scents and textures. Soaps can come in many different forms, including bar soap, liquid soap, and body wash.

In recent years, the soap market has experienced significant growth, driven by increasing consumer awareness of the importance of hygiene and health. The COVID-19 pandemic has also contributed to this growth, as people have become more vigilant about cleanliness and hand-washing. This growth can be attributed to factors such as rising disposable incomes, urbanization, and increasing demand for organic and natural products. In addition, there has been a shift towards more sustainable and eco-friendly soap products, with consumers seeking out brands that use natural and environmentally-friendly ingredients and packaging. This trend is expected to continue, with many soap manufacturers investing in research and development to create new, innovative products that meet these changing consumer preferences.

Global Soap Market Trends

Market Drivers

- Increasing consumer awareness of hygiene and health

- Growing demand for organic and natural products

- Rising popularity of liquid soaps and body washes

- Increasing demand for specialty soaps such as anti-aging, anti-acne, and moisturizing soaps

Market Restraints

- Fluctuating prices of raw materials

- Competition from alternative hygiene products such as hand sanitizers and wet wipes

Market Opportunities

- Development of innovative products such as natural and eco-friendly soaps

- Increasing demand for customized and personalized soap products

Soap Market Report Coverage

| Market | Soap Market |

| Soap Market Size 2022 | USD 38.4 Billion |

| Soap Market Forecast 2032 | USD 66.5 Billion |

| Soap Market CAGR During 2023 - 2032 | 5.7% |

| Soap Market Analysis Period | 2020 - 2032 |

| Soap Market Base Year | 2022 |

| Soap Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Composition, By Form, By Application, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Unilever, Procter & Gamble, Colgate-Palmolive, Johnson & Johnson, Reckitt Benckiser Group, Kao Corporation, Beiersdorf AG, Henkel AG & Co. KGaA, L'Oréal SA, The Clorox Company, Godrej Consumer Products Limited, and Kimberly-Clark Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Soap is a cleaning agent that is used to remove dirt, oil, and other impurities from the skin and other surfaces. Soap is made by combining fats or oils with an alkali, such as sodium hydroxide, to create a chemical reaction called saponification. Soap is used by every individual for personal care, dishwashing, or clothes as specific soaps are available for specific purposes. Soaps are evolving and innovating every time with increasing desires and customer requirements including different fragrances, cost margin, organic products, and others.

Soap is an essential product in every household as it is used for a variety of applications including personal care, dishwashing, laundering, and others. Different varieties of soaps are used for different applications as the chemical composition differs based on the end use of the consumer. However, the soap industry undergoes a dynamic environment as the market vendors have to make continual changes in the production cycle depending on the changing preferences of consumers. Such fluctuation in preference poses a challenge for manufacturers to accomplish the market demand and create pressure on manufacturers. Although end-user-specified soaps especially for infants and men are boosting the market growth. Awareness about personal hygiene and rising living standards has also given wide scope to the market to expand massively.

Soap Market Segmentation

The global soap market segmentation is based on product type, composition, form, application, distribution channel, and geography.

Soap Market By Product Type

- Bath and Body Soap

- Kitchen Soap

- Laundry Soap

According to the soap industry analysis, the bath and body soap segment held the largest market share in 2022. This segment includes bar soaps, liquid soaps, and body washes that are specifically designed for use on the body. The bath and body soap segment has experienced steady growth in recent years, driven by factors such as increasing consumer awareness of hygiene and health, rising disposable incomes, and growing demand for natural and organic products. Additionally, the demand for natural and organic bath and body soaps is also expected to increase, as consumers become more aware of the potentially harmful effects of synthetic chemicals in personal care products.

Soap Market By Composition

- Organic

- Conventional

In terms of composition, the organic soap segment is a rapidly growing part of the overall soap market, as consumers increasingly seek out natural and environmentally-friendly personal care products. Organic soap is made using natural ingredients and avoids the use of synthetic chemicals and artificial fragrances, making it a popular choice among consumers who are looking for safer and healthier options for their skin. The growth of the organic soap segment can be attributed to several factors, including increasing consumer awareness of the potentially harmful effects of synthetic chemicals in personal care products, rising demand for natural and sustainable products, and growing popularity of eco-friendly lifestyles. In addition, the increasing availability of organic soap products through e-commerce platforms and specialty stores is also driving the growth of this segment.

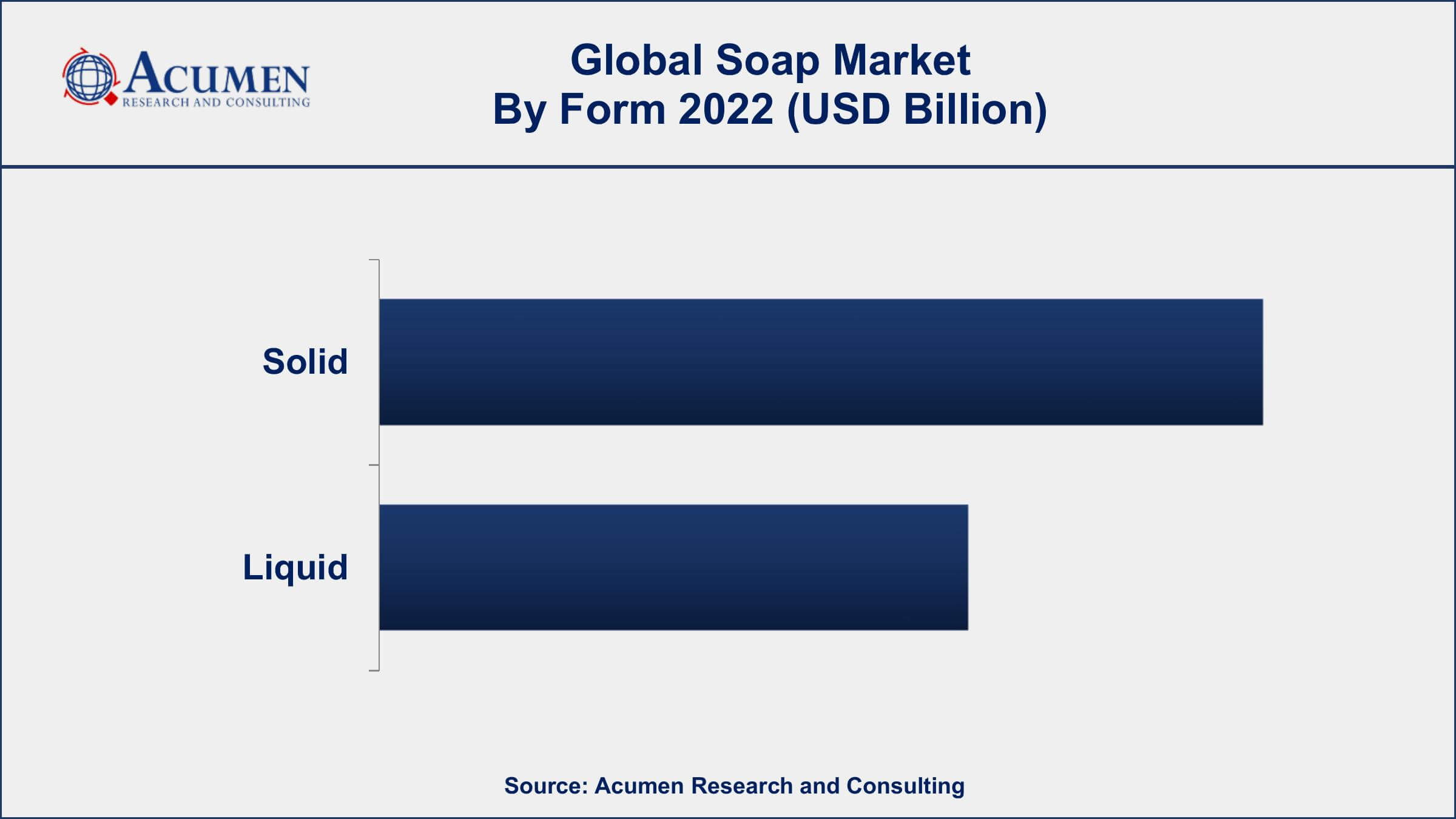

Soap Market By Form

- Solid

- Liquid

According to the soap market forecast, the liquid segment is expected to witness significant growth in the coming years. This growth is driven by factors such as increasing consumer demand for convenience and hygiene, growing awareness of health and wellness, and the development of new and innovative product formulations. Moreover, manufacturers are investing in research and development to create new and innovative liquid soap products to meet the evolving needs and preferences of consumers. For instance, there has been an increasing trend towards natural and eco-friendly liquid soap products, as consumers become more aware of the potentially harmful effects of synthetic chemicals and artificial fragrances in personal care products.

Soap Market By Application

- Household

- Commercial

Based on the application, the household segment is expected to witness significant growth in the coming years. This segment includes dishwashing soaps, laundry soaps, and all-purpose cleaning soaps, among others. The growth of the household soap segment can be attributed to several factors, including the increasing demand for convenience and effectiveness in household cleaning products, the development of new and innovative product formulations, and the growing popularity of natural and eco-friendly cleaning products. In addition, the increasing availability of household soap products through e-commerce platforms and specialty stores is also driving the growth of this segment.

Soap Market By Distribution Channel

- Supermarket/Hypermarket

- Pharmacies

- Online Channel

- Others

In terms of distribution channels, the online channel segment has been experiencing significant growth in recent years. This growth is driven by factors such as increasing internet penetration, rising smartphone usage, and the convenience and ease of online shopping. The online channel includes e-commerce platforms, specialty online retailers, and company websites. Moreover, the COVID-19 pandemic has accelerated the growth of the online channel segment, as consumers turned to online shopping to avoid crowded stores and minimize the risk of exposure to the virus. The pandemic also led to increasing demand for hygiene products such as soap, further boosting the online soap market growth.

Soap Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Soap Market Regional Analysis

North America is dominating the soap market due to several factors, including the high level of hygiene awareness among consumers, the presence of several large soap manufacturers, and the increasing popularity of natural and organic soap products. The United States is the largest market in North America, accounting for a significant share of the global soap market. The high level of hygiene awareness among consumers in North America has led to a growing demand for soap products, as consumers seek to maintain cleanliness and hygiene in their daily lives. In addition, several large soap manufacturers such as Procter & Gamble, Colgate-Palmolive, and Unilever are based in North America, which has contributed to the dominance of the regional market. Moreover, the increasing popularity of natural and organic soap products has also contributed to the North America market growth.

Soap Market Player

Some of the top soap market companies offered in the professional report include Unilever, Procter & Gamble, Colgate-Palmolive, Johnson & Johnson, Reckitt Benckiser Group, Kao Corporation, Beiersdorf AG, Henkel AG & Co. KGaA, L'Oréal SA, The Clorox Company, Godrej Consumer Products Limited, and Kimberly-Clark Corporation.

Frequently Asked Questions

What was the market size of the global soap in 2022?

The market size of soap was USD 38.4 Billion in 2022.

What is the CAGR of the global soap market from 2023 to 2032?

The CAGR of soap is 5.7% during the analysis period of 2023 to 2032.

Which are the key players in the soap market?

The key players operating in the global market are including Unilever, Procter & Gamble, Colgate-Palmolive, Johnson & Johnson, Reckitt Benckiser Group, Kao Corporation, Beiersdorf AG, Henkel AG & Co. KGaA, L'Or�al SA, The Clorox Company, Godrej Consumer Products Limited, and Kimberly-Clark Corporation.

Which region dominated the global soap market share?

North America held the dominating position in soap industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of soap during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global soap industry?

The current trends and dynamics in the soap industry include increasing consumer awareness of hygiene and health, and growing demand for organic and natural products.

Which product type held the maximum share in 2022?

The bath and body soap type held the maximum share of the soap industry.