Smart/Switchable Glass Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Smart/Switchable Glass Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

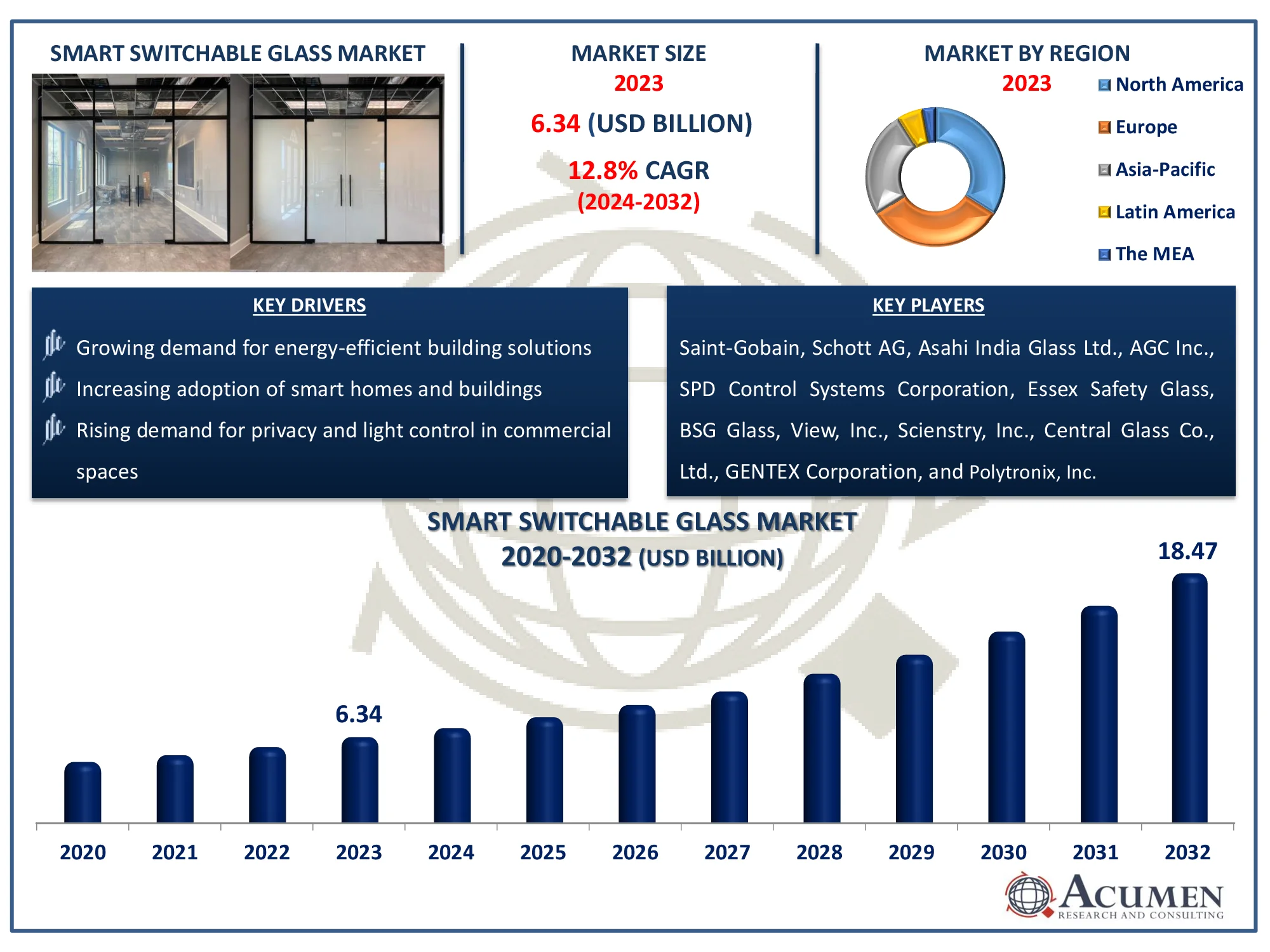

The Global Smart/Switchable Glass Market Size accounted for USD 6.34 Billion in 2023 and is estimated to achieve a market size of USD 18.47 Billion by 2032 growing at a CAGR of 12.8% from 2024 to 2032.

Smart/Switchable Glass Market Highlights

- The global smart/switchable glass market is projected to reach USD 18.47 billion by 2032, with a CAGR of 12.8% from 2024 to 2032

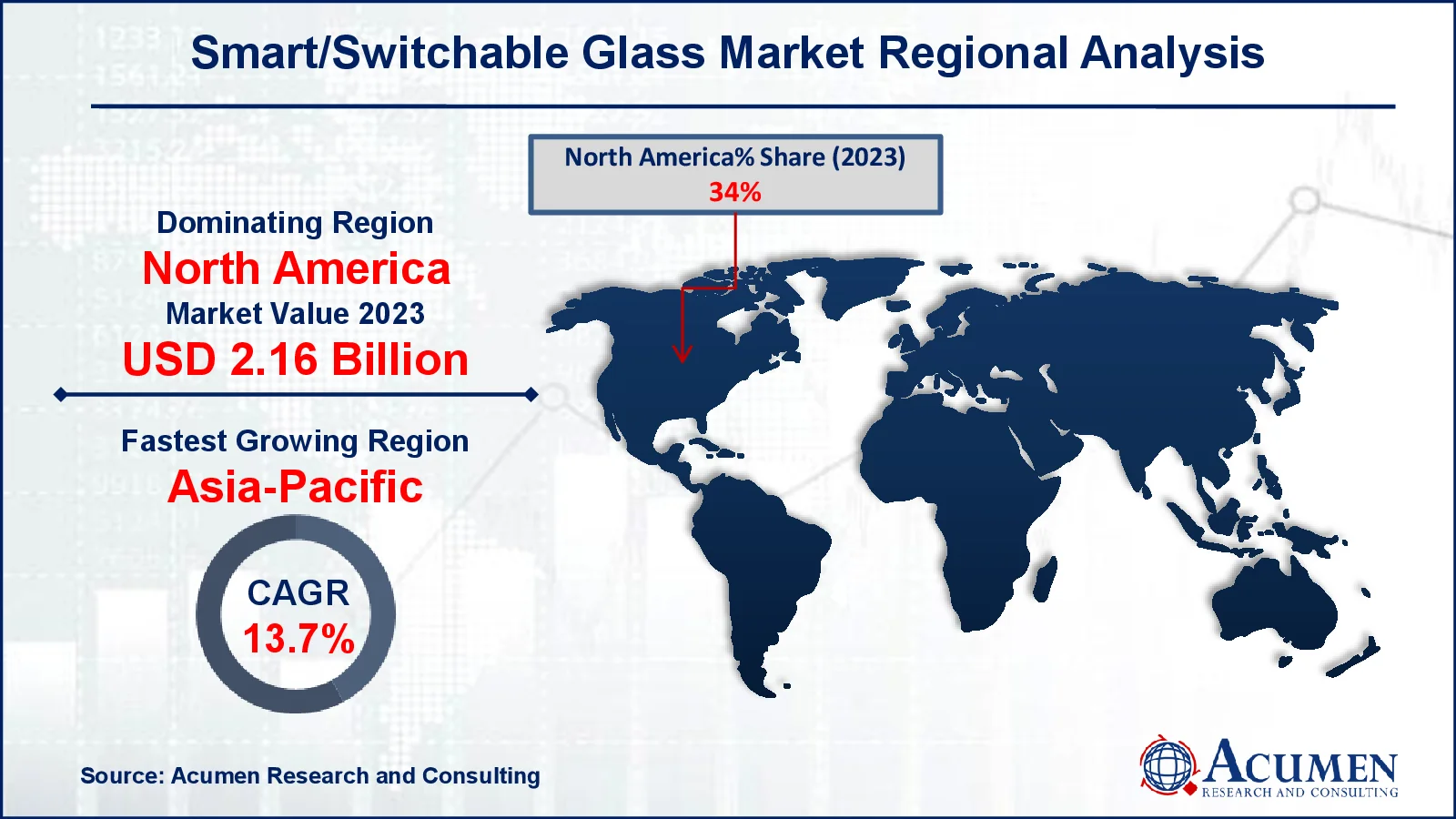

- In 2023, the North American smart/switchable glass market held a value of approximately USD 2.16 billion

- The Asia-Pacific region is expected to grow at a CAGR of over 13.7% from 2024 to 2032

- The electrochromic (EC) glass technology accounted for 62% of the market share in 2023

- The automotive & transportation application captured 48% of the market share in 2023

- Advancements in electrochromic and thermochromic technologies for dynamic tinting is the smart/switchable glass market trend that fuels the industry demand

Smart or switchable glass, also known as intelligent glass, privacy glass, light control glass (LCG), electric glass, or dynamic glass, is produced by laminating smart or switchable film. This type of glass offers weather-friendly building exteriors and regulates the flow of visible light, ultraviolet (UV) radiation, and infrared (IR) energy. It is commonly used in office partitions, hotel guest rooms, hospitals, automotive applications, as well as windows and skylights in both residential and commercial buildings. Furthermore, the increasing construction activities worldwide are a key factor driving the growth of the smart glass market during the forecast period.

Global Smart/Switchable Glass Market Dynamics

Market Drivers

- Growing demand for energy-efficient building solutions

- Increasing adoption of smart homes and buildings

- Rising demand for privacy and light control in commercial spaces

Market Restraints

- High initial cost of smart glass installations

- Limited awareness in emerging markets

- Technical limitations in large-scale applications

Market Opportunities

- Technological advancements in switchable glass materials

- Expanding applications in the automotive industry

- Rising demand for sustainable and eco-friendly building materials

Smart/Switchable Glass Market Report Coverage

|

Market |

Smart/Switchable Glass Market |

|

Smart/Switchable Glass Market Size 2023 |

USD 6.34 Billion |

|

Smart/Switchable Glass Market Forecast 2032 |

USD 18.47 Billion |

|

Smart/Switchable Glass Market CAGR During 2024 - 2032 |

12.8% |

|

Smart/Switchable Glass Market Analysis Period |

2020 - 2032 |

|

Smart/Switchable Glass Market Base Year |

2023 |

|

Smart/Switchable Glass Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Control Mode, By Technology, By End-User Industry, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Saint-Gobain, Schott AG, Asahi India Glass Ltd., AGC Inc., SPD Control Systems Corporation, Essex Safety Glass, Polytronix, Inc., BSG Glass, View, Inc., Scienstry, Inc., Central Glass Co., Ltd., and GENTEX Corporation. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Smart/Switchable Glass Market Insights

The rapidly expanding automotive industry is a key factor driving the growth of the smart glass market. For instance, in 2022, the United States saw 11.5 million new light vehicle sales. As the world's second-largest market for vehicle sales and production, the U.S. plays a significant role in the global automotive industry. According to Autos Drive America, international automakers produced 4.9 million vehicles in the U.S. in 2023. Furthermore, foreign direct investment in the U.S. automotive sector amounted to $195.6 billion in 2023. The sale of both light and heavy vehicles has increased in recent years, with premium automotive brands like Mercedes-Benz and BMW focusing on incorporating modern concepts into their vehicles to create a unique selling proposition (USP).

Additionally, as consumer investment potential has risen over the last decade, there has been a growing demand for luxury features in vehicles, and collaborations between key market players boosting the need for smart glass market. For instance, in August 2023, Gauzy Ltd. teamed up with Kolbe, a leading manufacturer of premium windows and doors, to introduce a comprehensive switchable privacy glass solution for the residential market. This solution allows homeowners to seamlessly blend personalized living spaces with advanced integrated technology. It features Premium Polymer Dispersed Liquid Crystal (PDLC) films laminated between two glass panes, offering an innovative and flexible privacy solution for residential use. These growing features in vehicles boost demand of smart/switchable glass market.

The growing popularity of vehicles with sunroofs and panoramic windows, driven by an increase in global tourism, further supports the rising demand for smart glass market. For instance, in May 2023, Gabriel India signed a contract with Inalfa Roof Systems to manufacture sunroofs for SUVs and sedans. The company announced plans to invest USD 20.72 million in establishing a greenfield facility in Chennai, Tamil Nadu. Set to begin operations in the first quarter of 2024, the facility will have an initial production capacity of 200,000 sunroofs per year. As a result, the demand for switchable glass in automotive applications is expected to propel the smart glass market's growth during the forecast period.

Smart/Switchable Glass Market Segmentation

Smart/Switchable Glass Market Segmentation

The worldwide market for switchable glass is split based on control mode, technology, end-user industry, and geography.

Smart Switchable Glass Market By Control Mode

- Remote

- Switches

- Rheostats

- Others

According to the smart switchable glass industry analysis, the remote control mode growing rapidly due to its convenience and ability to integrate with smart building systems and automotive applications. It allows users to adjust the glass’s opacity from a distance, offering enhanced control and flexibility. The increasing popularity of smart homes and connected devices also contributes to its growth, as consumers seek more seamless and automated solutions. The switches and rheostats segments also hold significant smart glass market share, providing simple and cost-effective control solutions.

Smart Switchable Glass Market By Technology

- Suspended Particle Devices (SPD) Glass

- Polymer Dispersed Liquid Crystal (PDLC) Glass

- Electrochromic (EC) Glass

- Thermochromic

- Photochromic

- Others

The electrochromic (EC) glass segment is expected to experience the highest compound annual growth rate (CAGR) in the smart/switchable glass market due to its growing adoption in applications such as energy-efficient buildings and automotive industries. EC glass provides energy savings by adjusting its opacity in response to voltage, reducing the need for artificial lighting and heating. Additionally, the increasing demand for eco-friendly and sustainable building materials further boosts its market growth. Innovations in EC glass technology and its integration into various consumer products are driving the segment's expansion.

Smart Switchable Glass Market By End-User Industry

- Architecture & Construction

- Automotive & Transportation

- Aerospace& Defense

- Electronics

- Others

According to the smart/switchable glass market forecast, in 2023, the automotive and transportation segment led market and is expected to maintain its dominance throughout the forecast period, driven by increasing consumer spending power and improved living standards in emerging regions, particularly in North America and Europe. Additionally, the widespread use of smart/switchable glass in automotive applications, such as window visors and windshields, is further fueling smart glass market growth in this segment.

Smart/Switchable Glass Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Smart/Switchable Glass Market Regional Analysis

Smart/Switchable Glass Market Regional Analysis

For several reasons, North America is expected to hold the largest market share and continue its growth throughout the forecast period, in smart glass market driven by rising per capita income and the strong presence of market players in the region. For instance, in October 2023, Guardian Industries Holdings, LLC launched SunGuard SNX 70+, a triple silver-coated glass that offers a visible light transmission of 68% and a solar heat gain coefficient of 0.28 when applied to Guardian UltraClear low-iron glass. Designed to provide a consistent neutral reflected color, this glass maintains its aesthetic appeal when viewed both directly and from an angle. Additionally, increased consumer spending power and improving living standards are further fueling the growth of the smart glass market. The adoption of electric vehicles and technological advancements in the region are expected to boost demand for industry in the automotive sector. Moreover, the growing use of smart glass in the aerospace industry, solar power generation, and government initiatives promoting electric vehicles have contributed to increased demand in for smart/switchable glass market in North America.

Asia-Pacific is projected to witness the highest CAGR in smart glass market, driven by rapid economic growth in countries such as China, Japan, and India. The region's expanding solar energy infrastructure, along with growth in construction, housing, transportation, and electronics, is also contributing to the rising demand for smart glass market. For instance, as per Invest India, in the fiscal year 2024-25, the government has increased its capital expenditure by 11.1%, reaching $133 billion, which represents 3.4% of the GDP. These investments are expected to drive growth in the construction sector, facilitating the development of modern infrastructure across the country. Additionally, government initiatives such as the Pradhan Mantri Awas Yojana-Urban (PMAY-U) have made significant strides, with 1.18 crore houses sanctioned, 86.6 lakh completed, and 1.15 crore currently under construction as of September 10, 2024.

Smart/Switchable Glass Market Players

Some of the top switchable glass companies offered in our report include Saint-Gobain, Schott AG, Asahi India Glass Ltd., AGC Inc., SPD Control Systems Corporation, Essex Safety Glass, Polytronix, Inc., BSG Glass, View, Inc., Scienstry, Inc., Central Glass Co., Ltd., and GENTEX Corporation.

Frequently Asked Questions

How big is the smart/switchable glass market?

The smart/switchable glass market size was valued at USD 6.34 billion in 2023.

What is the CAGR of the global smart/switchable glass market from 2024 to 2032?

The CAGR of switchable glass is 12.8% during the analysis period of 2024 to 2032.

Which are the key players in the smart/switchable glass market?

The key players operating in the global market are including Saint-Gobain, Schott AG, Asahi India Glass Ltd., AGC Inc., SPD Control Systems Corporation, Essex Safety Glass, Polytronix, Inc., BSG Glass, View, Inc., Scienstry, Inc., Central Glass Co., Ltd., GENTEX Corporation.

Which region dominated the global smart/switchable glass market share?

North America held the dominating position in smart switchable glass industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of switchable glass during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global smart switchable glass industry?

The current trends and dynamics in the smart switchable glass industry include growing demand for energy-efficient building solutions, increasing adoption of smart homes and buildings, and rising demand for privacy and light control in commercial spaces.

Which technology held the maximum share in 2023?

The suspended particle devices (SPD) technology glass mode held the maximum share of the smart switchable glass industry.