Smart Sensor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Smart Sensor Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

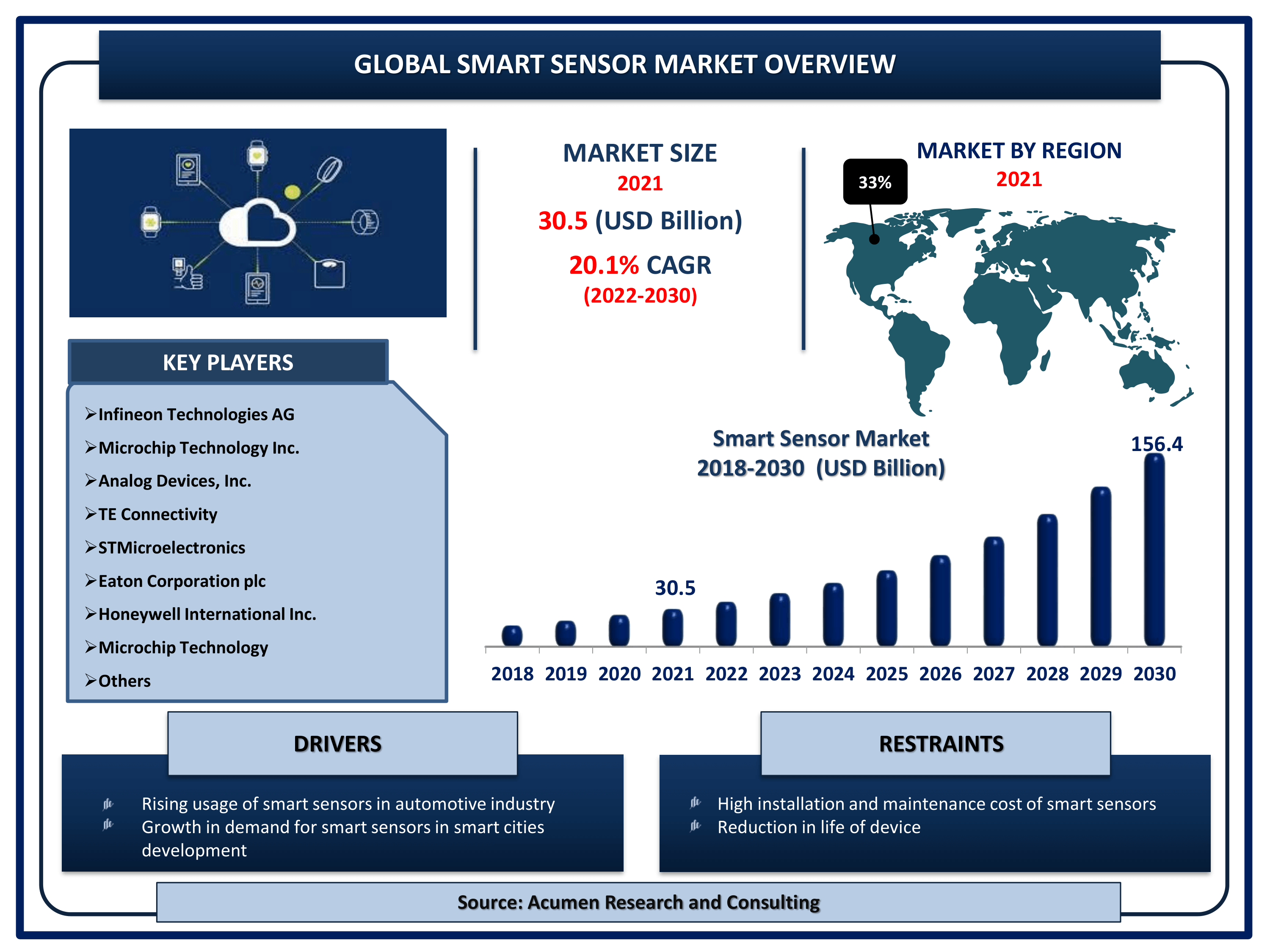

The Global Smart Sensor Market Size accounted for USD 30.5 Billion in 2021 and is projected to achieve a market size of USD 156.4 Billion by 2030 rising at a CAGR of 20.1% from 2022 to 2030. According to The Apache ADC Foundation, a smart sensor is a service (run by a built-in DAG) that significantly reduces Airflow infrastructure costs by combining multiple instances of small, lightweight Sensors into a single process. The main idea of the smart sensor service is to improve the efficiency of these long-running tasks by using centralized processes to execute those tasks in batches, rather than using one process for each task.

Smart Sensor Market Report Statistics

- Global smart sensor market revenue is estimated to reach USD 156.4 Billion by 2030 with a CAGR of 20.1% from 2022 to 2030 smart sensor

- North America smart sensor market share accounted for over 33% shares in 2021

- According to the our analysis, there were around 10 billion active IoT devices in the world in 2021

- Asia-Pacific smart sensor market growth will register fastest CAGR from 2022 to 2030

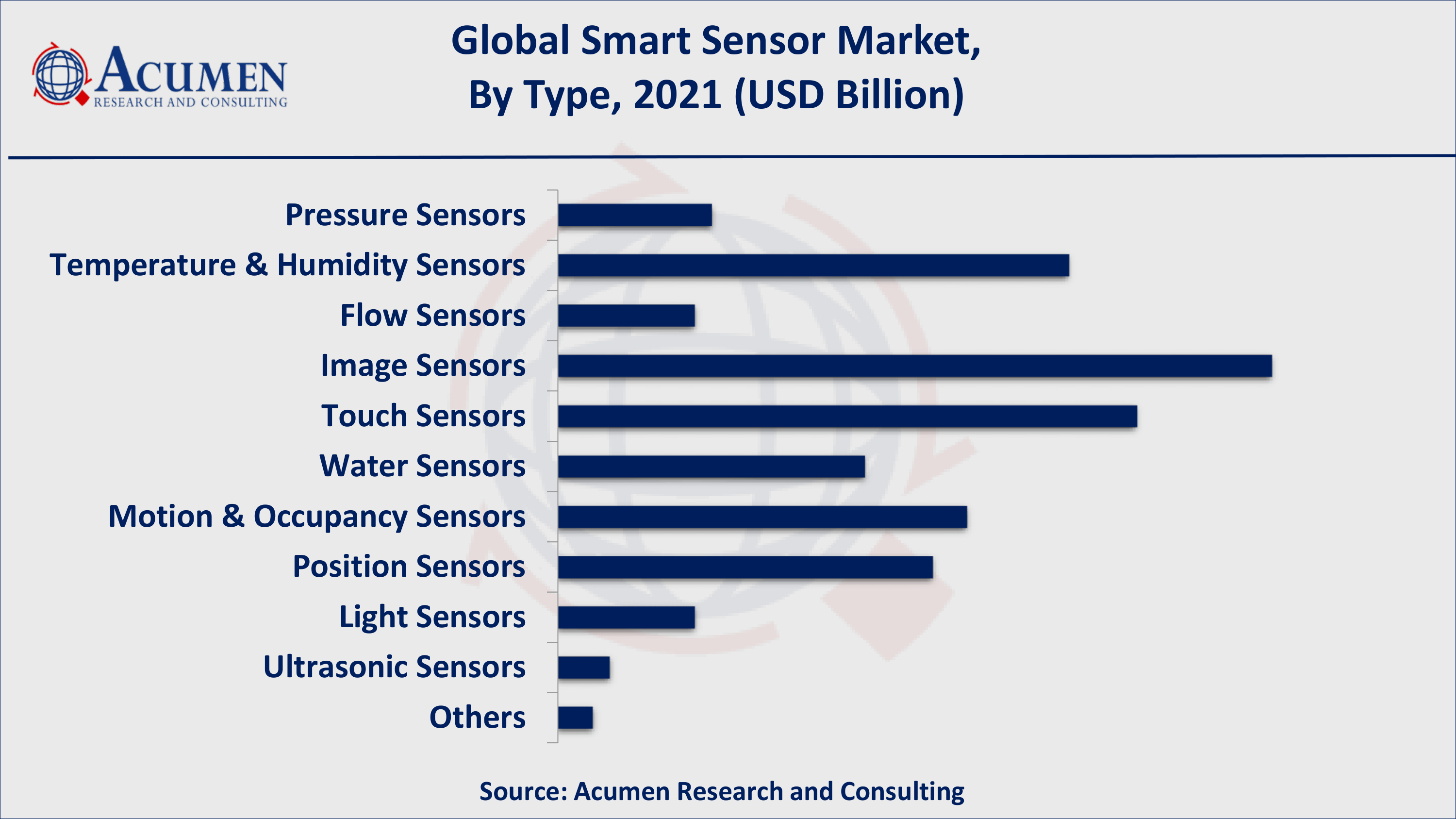

- Based on type, image sensor gathered over 20% of the overall market share in 2021

- Increasing demand for smart sensors in IoT-based devices will fuel the global smart sensor market value

- Growing miniaturization of sensors in wearables is a popular smart sensor market trend that is fueling the industry demand

COVID-19 has positive impact on smart sensors market

As energy costs continue to rise and environmental concerns persist around the world, there is increasing pressure for increased adoption of energy-saving and cost-effective solutions, particularly in smart buildings and cities. Technology will play a critical role in ensuring the safe return of businesses to their offices, particularly as lockdown restrictions ease. Automation of shared touch points such as door handles, elevators, and sanitary systems is a simple way to limit cross-contamination in shared office space. According to the ADJACENT DIGITAL POLITICS LTD report, technology can also be used to monitor hand soap and sanitizer bottle fill levels, monitor and alarm the mandatory two-meter distance between people using infrared beams, and analyze movement around the office and density in recreational areas using thermal imaging camera systems. Specialized equipment is also being used to take temperature readings of employees and visitors in order to detect high temperatures, which is a key indicator of COVID-19 positivity. Room sensors could be installed in offices to measure humidity and temperature levels and send alerts when the optimal conditions for virus multiplication are met, allowing for preventative measures to be taken.

Global Smart Sensor Market Dynamics

Market Drivers

- Increasing demand for consumer electronics and IoT-based devices

- Rising usage of smart sensors in automotive industry

- Growth in demand for smart sensors in smart cities development

- Rise in use of wireless technology

Market Restraints

- High installation and maintenance cost of smart sensors

- Reduction in life of device caused by smart sensors

Market Opportunities

- Government support to promote green building construction

- Surging adoption of wearables and increasing application in biomedical sector

Smart Sensor Market Report Coverage

| Market | Smart Sensor Market |

| Smart Sensor Market Size 2021 | USD 30.5 Billion |

| Smart Sensor Market Forecast 2030 | USD 156.4 Billion |

| Smart Sensor Market CAGR During 2022 - 2030 | 20.1% |

| Smart Sensor Market Analysis Period | 2018 - 2030 |

| Smart Sensor Market Base Year | 2021 |

| Smart Sensor Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Component, By Technology, By Industry, By Connectivity, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Infineon Technologies AG, Microchip Technology Inc., Analog Devices, Inc., TE Connectivity, STMicroelectronics, Eaton Corporation plc, Honeywell International Inc., Microchip Technology, NXP Semiconductors, Robert Bosch GmbH, and Siemens AG among others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Market Dynamics

Smart sensors mean energy savings; R&D has 100% gains in the global market

According to the ACEEE report, smart sensors installed in buildings save energy by automating controls and optimizing systems. This can result in energy savings of 5-15% when smart sensors are installed. Furthermore, smart sensors installed in buildings by incorporating such integrated systems can account for 30-50% of savings in buildings that would otherwise be inefficient. The purchase price, energy savings, and payback time of smart technologies vary depending on the type of technology. BAS installation, for example, is more cost effective when installed in larger buildings. Thus, the wireless capability of smart controls and smart sensors makes them a user-friendly retrofit choice for installation.

Additionally, The DOE Pacific Northwest National Laboratory (PNNL) in 2017 considered a broader set of smart energy efficiency measures, finding that integrating smart sensors and controls throughout the commercial building stock has the potential to save as much as 29% of building energy consumption through high-performance sequencing of operations, optimizing settings based on occupancy patterns, and detecting and diagnosing inadequate equipment operation and installation problems.

Big calls for “smart sensors” in development of smart cities majorly drive the growth of global market

Smart cities are proving to be an excellent model for researching the suitability of sensor-based monitoring instruments. According to a report published by downtoearth.org, smart cities - much-needed platforms for on-field use and evaluation of sensor-based technology - are projects launched in 2015 by the Union Ministry of Housing and Urban Affairs (MoHUA) under the Smart Cities Mission (SCM). Smart sensors improve traffic flow, transportation efficiency, and solid waste collection routes; mobile applications allow citizens to report problems in real time and interact directly with city Microcontroller. Low-cost mobile messaging, telemedicine, and video-consultations improve health outcomes and lower healthcare costs, while self-driving cars and car-sharing platforms relieve pressure on land use according to the statistics released by the OECD 2019. Furthermore, it can have a significant impact on the local job market; for example, new ways of delivering public Microcontroller may provide opportunities for start-ups, Biomedical & Healthcare, and consultancies related to digital innovation, as well as attract skilled workers.

Smart Sensor Market Segmentation

The worldwide smart sensor market is split based on type, component, technology, industry, connectivity, and geography.

According to our smart sensor market forecast, temperature and humidity sensors are expected to grow significantly in the coming years. Temperature sensors that are smart are widely used in measurement control systems and instrumentation. Temperature sensors provide an interpretable temperature reading in a digital format that can be used in a variety of applications including healthcare, automotive, and building automation. Such factors contribute to the expansion of the global intelligent sensors market.

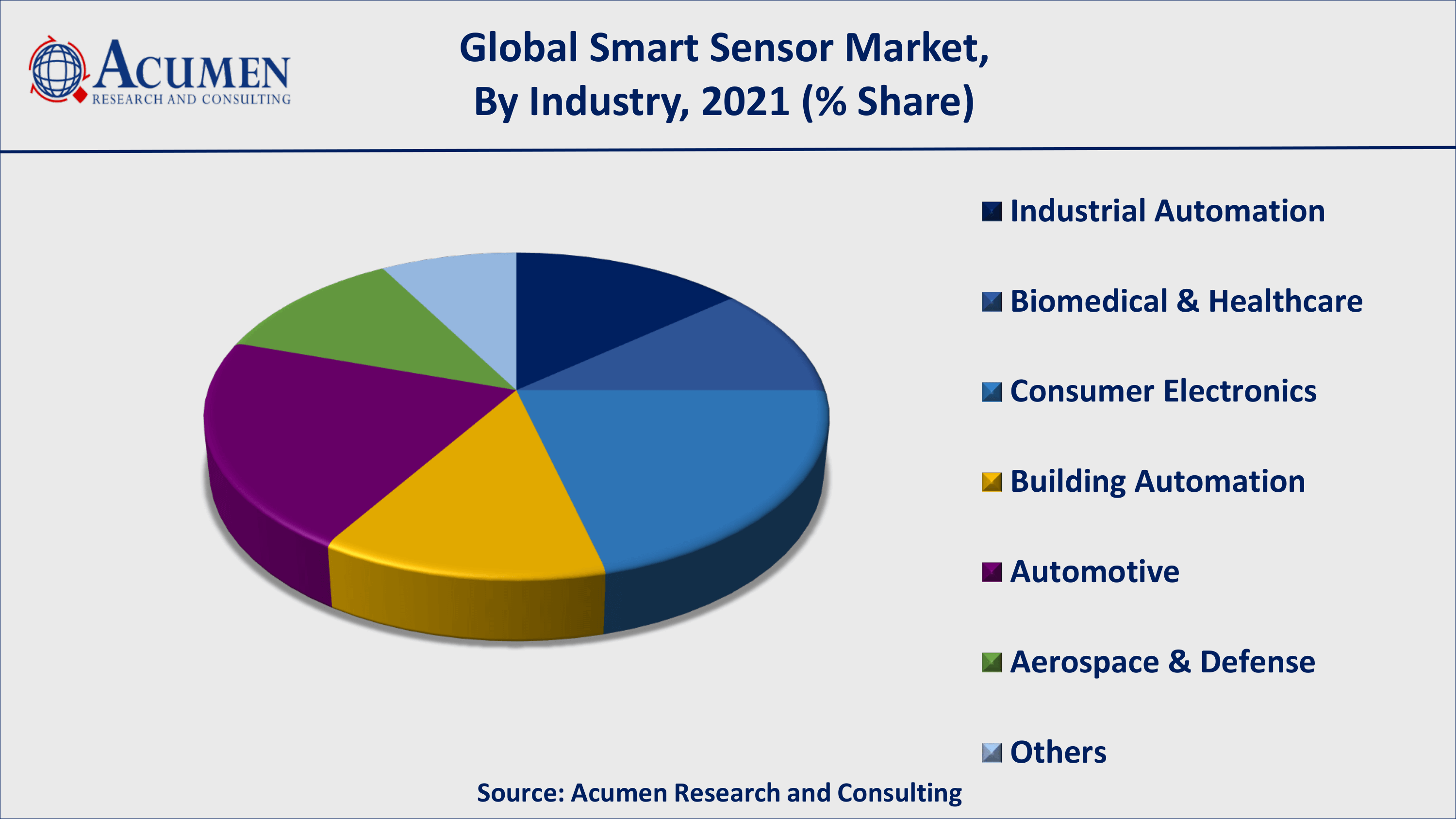

According to the smart sensor industry analysis, consumer electronics is growing at an exponential rate and will continue to do so throughout the forecast period. As consumers become more technologically savvy, the adoption of advanced technology is increasing at a rapid pace. As a result, many smart cities have taken the first step toward installing smart sensors in buildings. With the advancement of technology, it now provides tangible benefits to an ever-increasing consumer base. The installation of such smart sensors is cost-effective, simple to deploy, and requires less maintenance. This outcome will result in significant benefits, including improvements to energy use, hyper-efficiency, and automated operational purposes, resulting in both energy and cost savings.

Smart Sensor Market By Type

- Pressure Sensors

- Temperature & Humidity Sensors

- Flow Sensors

- Image Sensors

- Touch Sensors

- Water Sensors

- Motion & Occupancy Sensors

- Position Sensors Light Sensors

- Ultrasonic Sensors

- Others

Smart Sensor Market By Component

- ADC

- Microcontroller

- Transceivers

- Amplifier

- DAC

- Others

Smart Sensor Market By Technology

- CMOS

- MEMS

- Others

Smart Sensor Market By Industry

- Industrial Automation

- Biomedical & Healthcare

- Consumer Electronics

- Building Automation

- Automotive

- Aerospace & Defense

- Others

Smart Sensor Market By Connectivity

- Wired

- Wireless

Smart Sensor Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Smart Sensor Market Regional Analysis

Asia-Pacific Region to Grow At a Highest CAGR for the Smart Sensor Market

Asia-Pacific is expected to have the fastest growing CAGR and to maintain its dominance throughout the forecast period. Rising technological adoptions, combined with the government's increased emphasis on infrastructure development, will drive demand for smart sensors in this region even higher. India is expected to be the fastest growing market for smart and intelligent sensors in APAC during the forecast period. India is one of the world's fastest developing countries, with the government heavily investing in advanced technologies and smarter infrastructure. With such rapid advancements, sensors in the country are finding widespread use in smart phones, automobiles, and healthcare, among other areas.

Smart Sensor Market Players

The prominent players of the global smart sensor market involve Infineon Technologies AG, Microchip Technology Inc., Analog Devices, Inc., TE Connectivity, STMicroelectronics, Eaton Corporation plc, Honeywell International Inc., Microchip Technology, NXP Semiconductors, Robert Bosch GmbH, and Siemens AG among others.

Frequently Asked Questions

What is the size of global smart sensor market in 2021?

The market size of smart sensor market in 2021 was accounted to be USD 30.5 Billion.

What is the CAGR of global smart sensor market during forecast period of 2022 to 2030?

The projected CAGR of smart sensor market during the analysis period of 2022 to 2030 is 20.1%.

Which are the key players operating in the market?

The prominent players of the global smart sensor market are Infineon Technologies AG, Microchip Technology Inc., Analog Devices, Inc., TE Connectivity, STMicroelectronics, Eaton Corporation plc, Honeywell International Inc., Microchip Technology, NXP Semiconductors, Robert Bosch GmbH, and Siemens AG among others.

Which region held the dominating position in the global smart sensor market?

North America held the dominating smart sensor during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for smart sensor during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global smart sensor market?

Increasing demand for consumer electronics and IoT-based devices, rising usage of smart sensors in automotive industry, and growth in demand for smart sensors in smart cities development drives the growth of global smart sensor market.

Which type held the maximum share in 2021?

Based on type, image sensors segment is expected to hold the maximum share smart sensor market.