Smart Pills Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Smart Pills Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

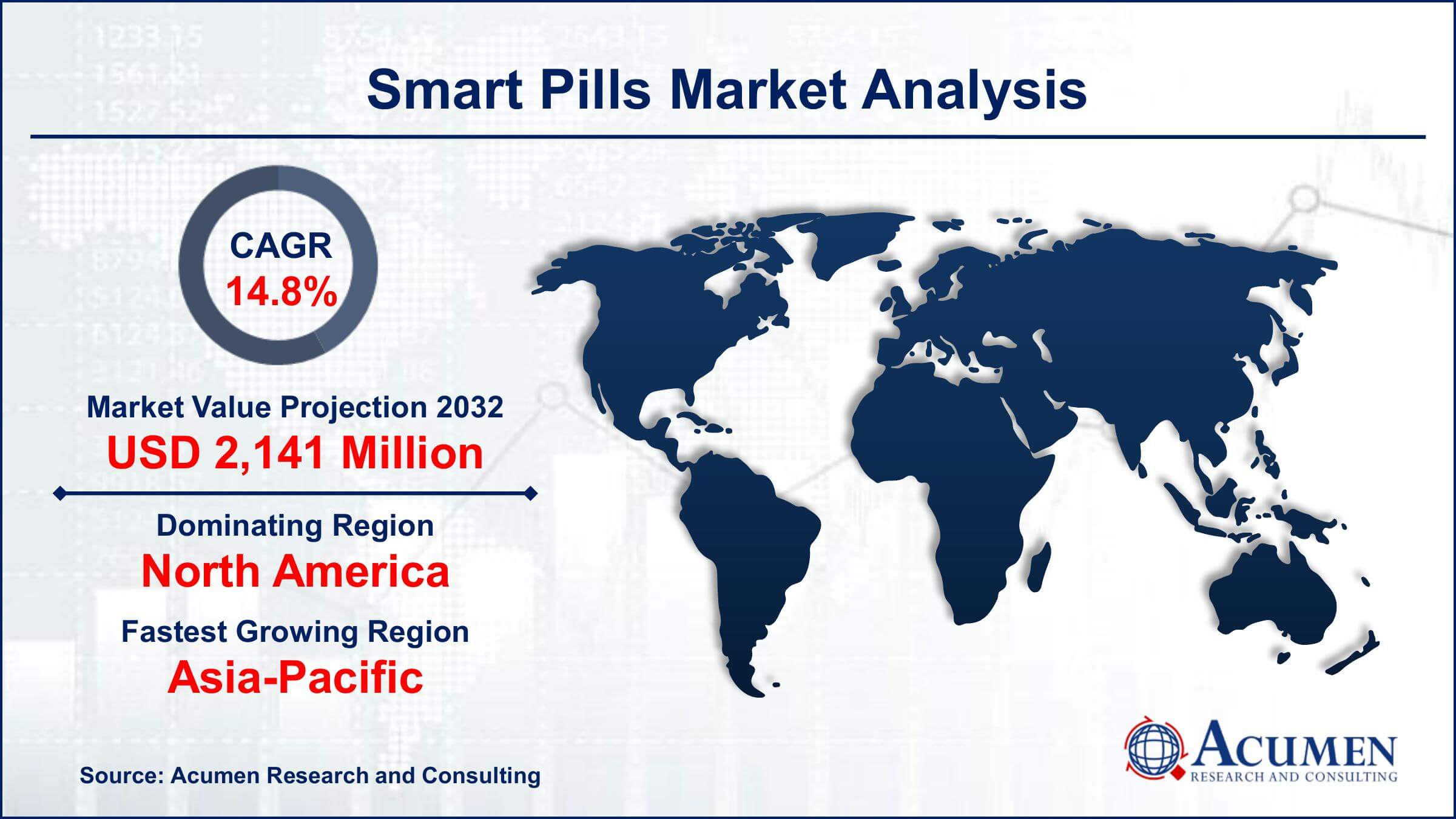

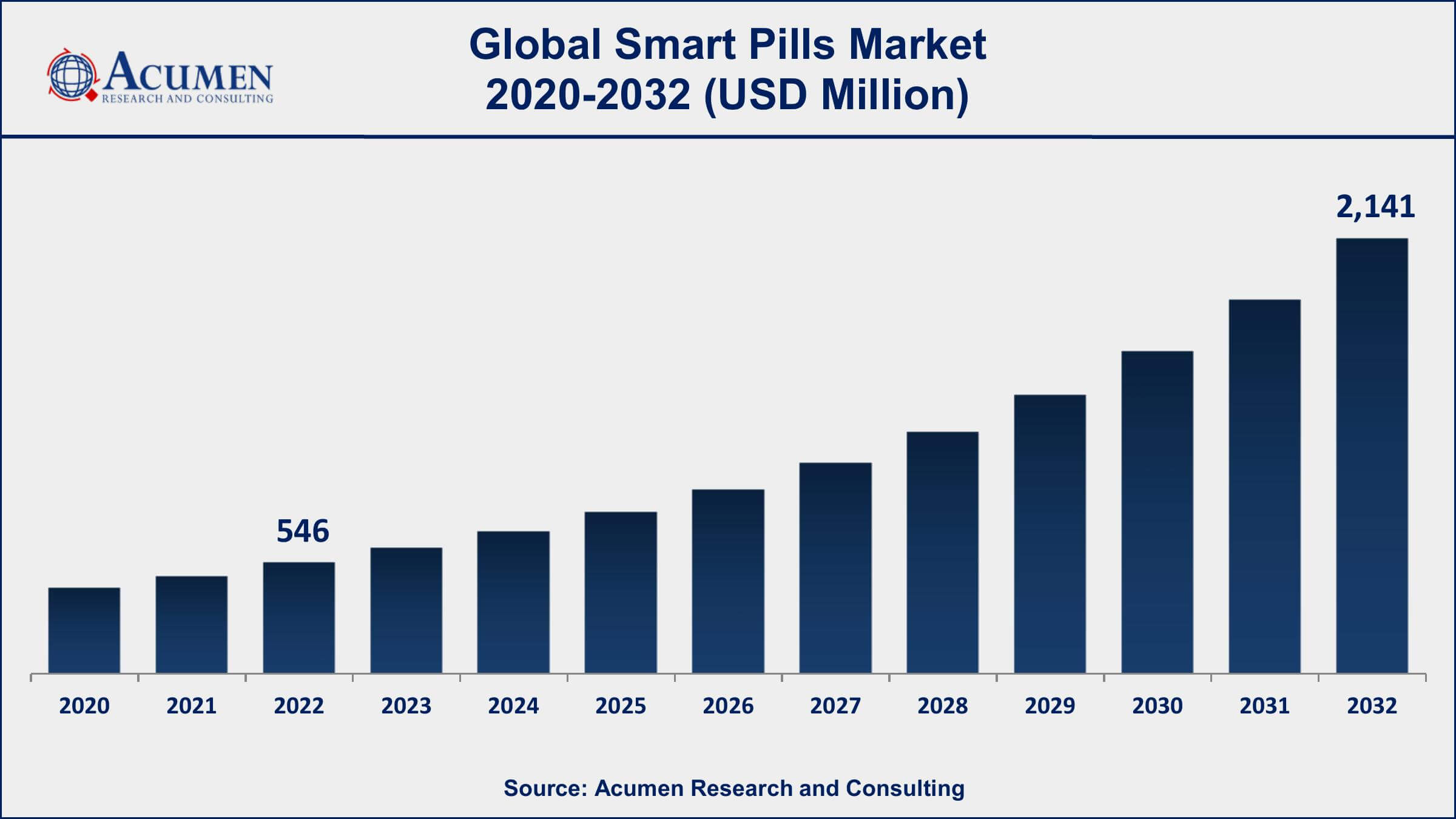

The Global Smart Pills Market Size accounted for USD 546 Million in 2022 and is projected to achieve a market size of USD 2,141 Million by 2032 growing at a CAGR of 14.8% from 2023 to 2032.

Smart Pills Market Key Highlights

- Global smart pills market revenue is expected to increase by USD 2,141 Million by 2032, with a 14.8% CAGR from 2023 to 2032

- North America region led with more than 44% of smart pills market share in 2022

- According to the survey, more than 70% of healthcare professionals stated they planned to prescribe smart pills to their patients in the coming years

- According to a study published in the journal Frontiers in Psychology, 15-20% of university students report using smart pills to improve academic performance

- Asia-Pacific smart pills industry growth will record a CAGR of around 15% from 2023 to 2032

- Increasing geriatric population and demand for remote patient monitoring, drives the smart pills market value

Smart pills, also known as digital pills or ingestible sensors, are medications that are embedded with sensors or other electronic components to monitor a patient's medication adherence, vital signs, and other health metrics. These sensors transmit data to a device, such as a smartphone, that allows healthcare providers to track patient progress in real-time. Smart pills are becoming increasingly popular for patients who have difficulty adhering to medication regimens or who require constant monitoring for chronic conditions.

The global smart pills market has been growing rapidly in recent years due to advancements in technology and the increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular diseases. The growing adoption of smart pills by healthcare providers to improve patient outcomes, along with the increasing demand for non-invasive diagnostic tools, is expected to drive the smart pills market growth in the coming years.

Global Smart Pills Market Trends

Market Drivers

- Rising prevalence of chronic diseases and increasing demand for non-invasive diagnostic techniques

- Advancements in smart pill technology and IoT

- Increasing geriatric population and demand for remote patient monitoring

- Growing awareness and adoption of wearable devices

Market Restraints

- High cost of smart pills and related devices

- Lack of reimbursement policies for smart pill technology

Market Opportunities

- Growing demand for personalized medicine and targeted drug delivery

- Use of smart pills in the sports industry for monitoring athlete performance and health

Smart Pills Market Report Coverage

| Market | Smart Pills Market |

| Smart Pills Market Size 2022 | USD 546 Million |

| Smart Pills Market Forecast 2032 | USD 2,141 Million |

| Smart Pills Market CAGR During 2023 - 2032 | 14.8% |

| Smart Pills Market Analysis Period | 2020 - 2032 |

| Smart Pills Market Base Year | 2022 |

| Smart Pills Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application Area, By Disease Indication, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Proteus Digital Health, Inc., Medtronic plc, Capsule Technologies, Inc., Philips Healthcare, Proteus Biomedical, Given Imaging Ltd., IntroMedic Co., Ltd., Olympus Corporation, Bio-Images Research Limited, Medisafe Inc., VitalConnect, Inc., and HQ Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Smart pills are the medical devices that are increasingly used in invasive surgeries and have effectively reduced the gap between healthcare and technology. These pills contain drugs and an ingestible sensor which in contact with stomach fluid detects the type of pill taken by the body. For instance, recently FDA approved the use of a smart pill named “Abilify MyCite” in the United States. This pill is developed by Proteus Digital Health in collaboration with Otsuka Pharmaceutical Co., Ltd. It transfers the information to a smart phone which is paired with an app. This data is further accessed by the doctor via a web portal, thus helping in monitoring the condition of the patient.

The central point driving the smart pills market is the positive repayment situation over the globe, the quiet inclination for insignificantly obtrusive strategies, and rising instances of colon tumors. In addition, benefits offered by smart pills innovation, for example, expanded modernity in endoscopy systems, controlled medication conveyance, and remote patient checking are bringing about the expanding appropriation of keen pills innovation. In any case, the mechanical ineptitude of endoscopes, high expense, and fear among patients of swallowing a microchip are a few limitations of this technology.

Smart Pills Market Segmentation

The global smart pills market segmentation is based on application area, disease indication, and geography.

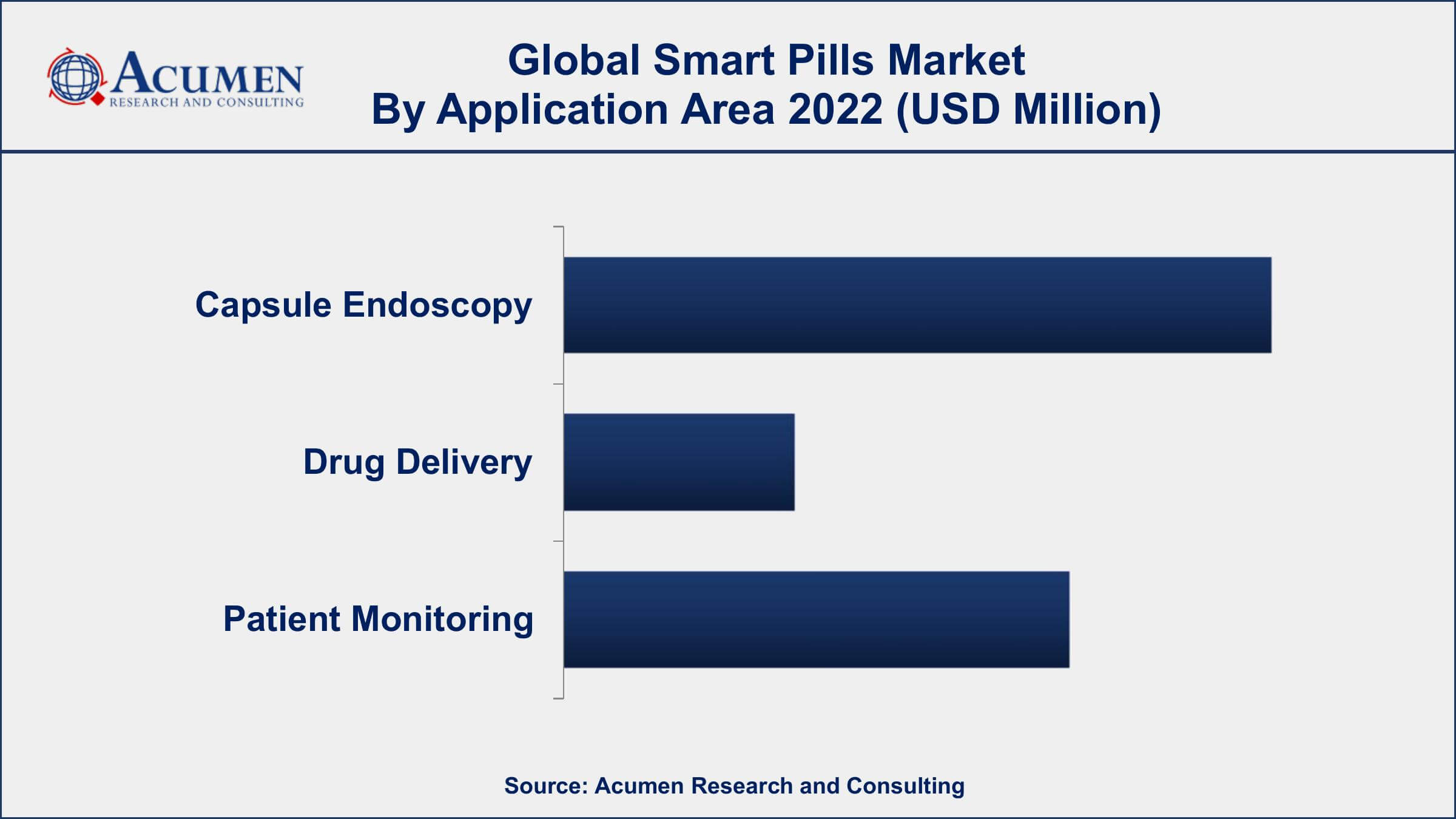

Smart Pills Market By Application Area

- Capsule Endoscopy

- Colon Capsule Endoscopy

- Small Bowel Video Capsule Endoscopy

- Drug Delivery

- Patient Monitoring

In terms of application areas, the capsule endoscopy segment has seen significant growth in recent years. Capsule endoscopy involves the use of a small, pill-shaped camera that is swallowed by the patient, which then takes pictures of the digestive tract as it moves through the body. The images are transmitted to a device worn by the patient and can be reviewed by a healthcare professional to identify any abnormalities or issues in the digestive system. The growth is being driven by factors such as the increasing prevalence of gastrointestinal diseases, the rising geriatric population, and advancements in endoscopic technologies. Additionally, capsule endoscopy is a non-invasive alternative to traditional endoscopy procedures, which is also driving its adoption. The growing demand for remote patient monitoring is also expected to drive the adoption of smart pills for capsule endoscopy procedures.

Smart Pills Market By Disease Indication

- Occult GI Bleeding

- Small Bowel Tumors

- Crohn's Disease

- Celiac Disease

- Neurological Disorders

- Inherited Polyposis Syndromes

- Others

According to the smart pills market forecast, the small bowel tumors segment is expected to witness significant growth in the coming years. Small bowel tumors are relatively rare and difficult to detect, but capsule endoscopy has emerged as an effective diagnostic tool for their detection. Capsule endoscopy can provide high-quality images of the small intestine, which can help healthcare professionals identify any abnormalities or tumors in the area. The growth is being driven by factors such as the increasing prevalence of small bowel tumors, rising demand for non-invasive diagnostic techniques, and advancements in imaging technologies. The smart pills industry is also expected to contribute to the growth of the small bowel tumors segment, as smart pills can provide additional data and insights beyond what is captured by traditional capsule endoscopy procedures. For example, smart pills can track medication adherence and vital signs, which can help healthcare professionals monitor and manage patients with small bowel tumors more effectively.

Smart Pills Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

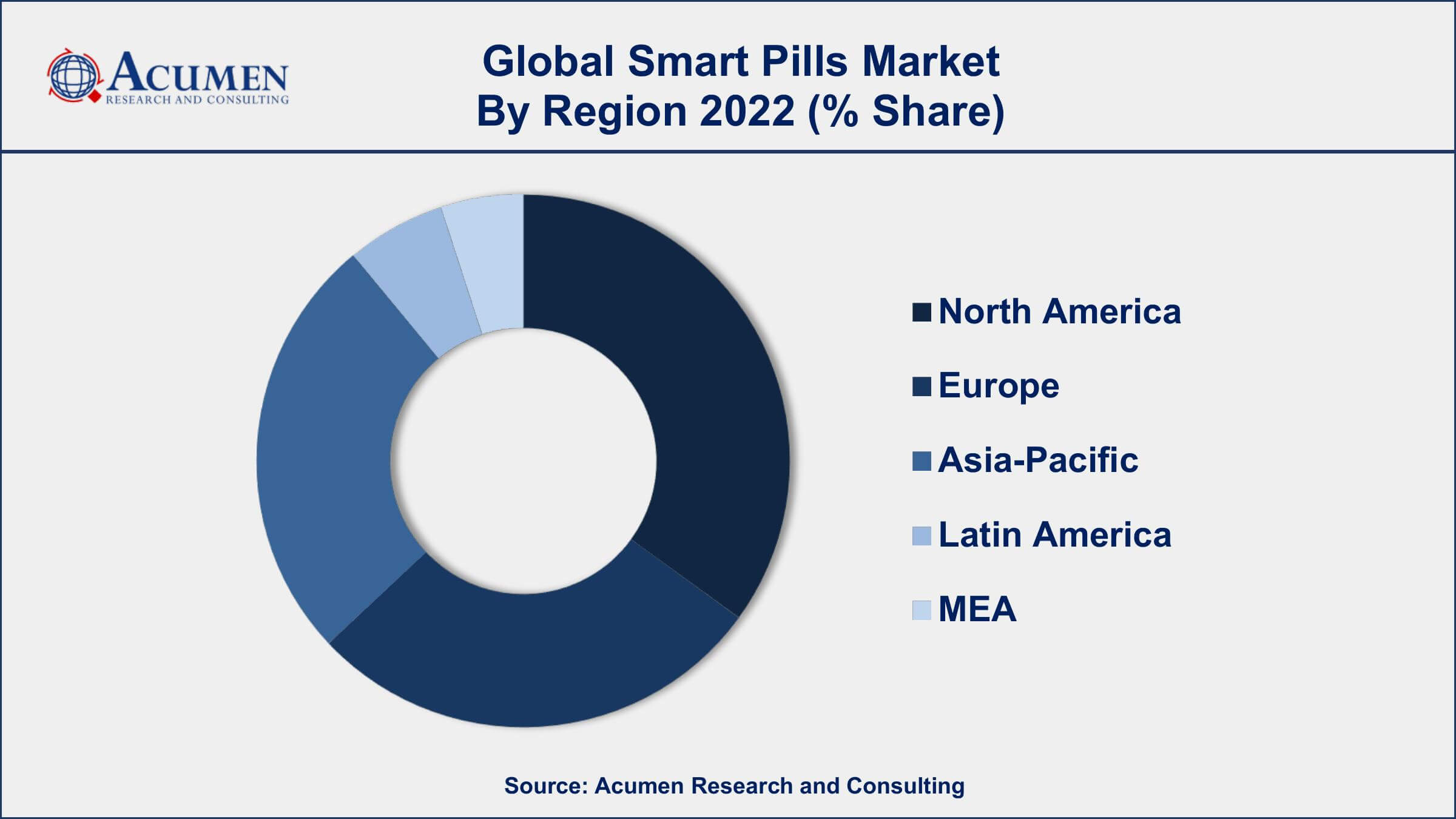

Smart Pills Market Regional Analysis

North America dominates the smart pills market due to several factors. One of the main drivers of the market in North America is the region's advanced healthcare infrastructure and high adoption rate of digital health technologies. The United States, in particular, has a well-established healthcare system and is home to many of the world's leading pharmaceutical and biotechnology companies, which has fueled the innovation and development of smart pills in the region. In addition, there is a growing demand for non-invasive diagnostic tools in North America, which has contributed to the increasing adoption of smart pills in the region. Another factor driving the North America market growth is the increasing prevalence of chronic diseases, such as diabetes, obesity, and gastrointestinal disorders. Smart pills offer a promising solution for the management of these conditions, as they allow for continuous monitoring and tracking of patients' vital signs and medication adherence. Furthermore, the region's aging population is also driving demand for remote patient monitoring solutions, which is another area where smart pills can provide significant benefits.

Smart Pills Market Player

Some of the top smart pills market companies offered in the professional report include Proteus Digital Health, Inc., Medtronic plc, Capsule Technologies, Inc., Philips Healthcare, Proteus Biomedical, Given Imaging Ltd., IntroMedic Co., Ltd., Olympus Corporation, Bio-Images Research Limited, Medisafe Inc., VitalConnect, Inc., and HQ Inc.

Frequently Asked Questions

What was the market size of the global smart pills in 2022?

The market size of smart pills was USD 546 Million in 2022.

What is the CAGR of the global smart pills market from 2023 to 2032?

The CAGR of smart pills is 14.8% during the analysis period of 2023 to 2032.

Which are the key players in the smart pills market?

The key players operating in the global market are including Proteus Digital Health, Inc., Medtronic plc, Capsule Technologies, Inc., Philips Healthcare, Proteus Biomedical, Given Imaging Ltd., IntroMedic Co., Ltd., Olympus Corporation, Bio-Images Research Limited, Medisafe Inc., VitalConnect, Inc., and HQ Inc.

Which region dominated the global smart pills market share?

North America held the dominating position in smart pills industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of smart pills during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global smart pills industry?

The current trends and dynamics in the smart pills industry include rising prevalence of chronic diseases and increasing demand for non-invasive diagnostic techniques, and advancements in smart pill technology and IoT.

Which application area held the maximum share in 2022?

The capsule endoscopy application area held the maximum share of the smart pills industry.