Small-Scale LNG Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Small-Scale LNG Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Small-Scale LNG Market Size accounted for USD 38.3 Billion in 2022 and is estimated to achieve a market size of USD 119.2 Billion by 2032 growing at a CAGR of 12.3% from 2023 to 2032.

Small-Scale LNG Market Highlights

- Global small-scale LNG market revenue is poised to garner USD 119.2 billion by 2032 with a CAGR of 12.3% from 2023 to 2032

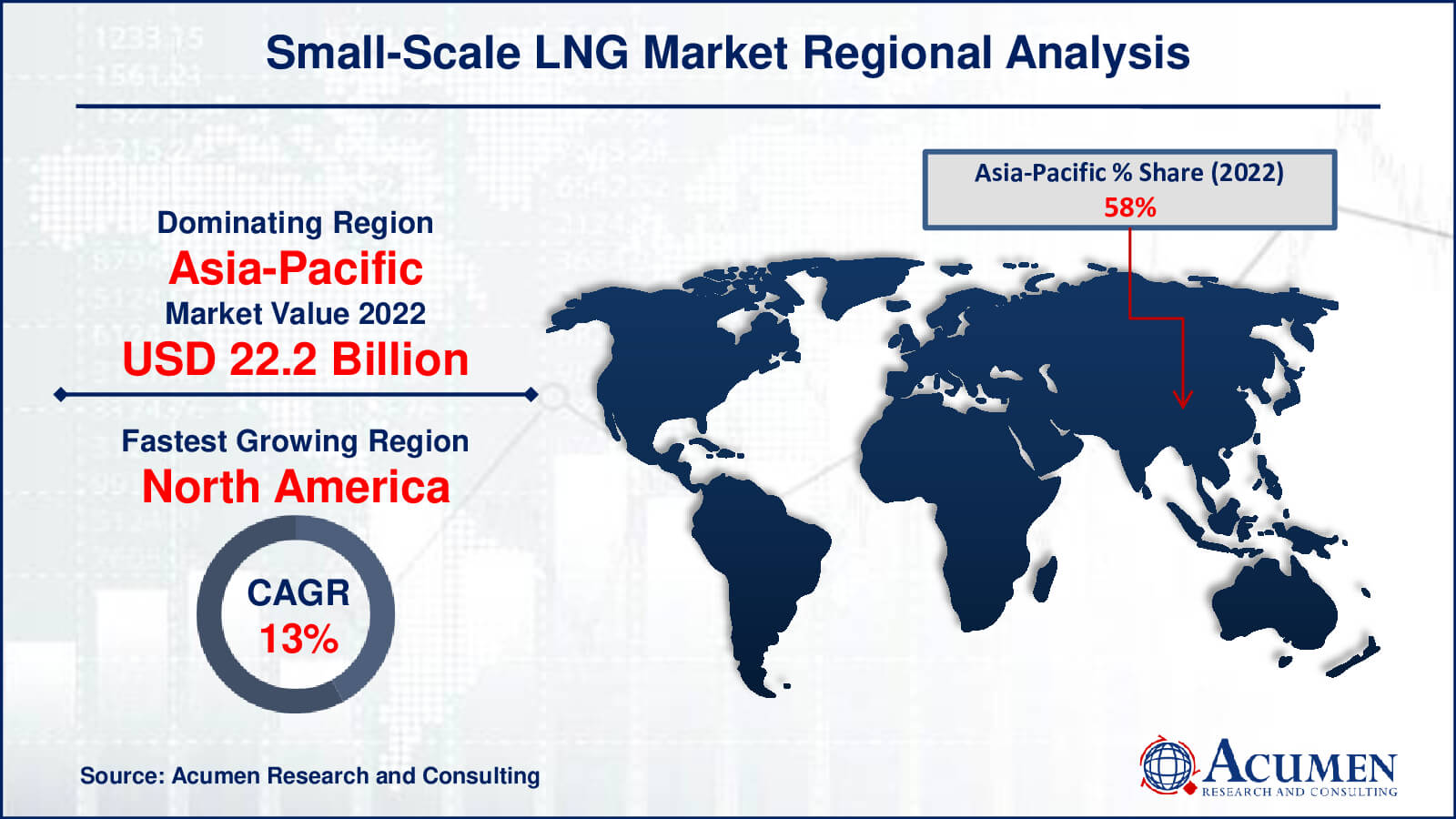

- Asia Pacific small-scale LNG market value occupied around USD 22.2 billion in 2022

- North America small-scale LNG market growth will record a CAGR of more than 13% from 2023 to 2032

- Among types, liquefaction terminal sub-segment generated USD 20.7 billion revenue in 2022

- Based on application, heavy duty vehicles sub-segment generated around 63% market share in 2022

- Growing adoption of LNG as a cleaner and more cost-effective fuel is a popular small-scale LNG market trend

Small-scale liquefied natural gas (LNG) involves the conversion of natural gas into a colorless and odorless liquid within compact industrial facilities. These units have limited capacity but play a crucial role as the liquefied gas can be reconverted into its gaseous form for various applications after undergoing extreme cooling. Small-scale LNG presents a more environmentally friendly alternative compared to oil and diesel. It is commonly utilized to fulfill power generation needs in isolated industrial and residential complexes without access to traditional grids. Moreover, it finds widespread use in transportation, industrial processes, commercial enterprises, and residential heating.

Global Small-Scale LNG Market Dynamics

Market Drivers

- Rising consumption of LNG as fuel in ships and carriers

- Growing trend of developing trains powered by LNG

- Ongoing process of rapid industrialization in many regions

- Emerging as a primary fuel option for various modes of transportation, including trucks, buses, and even trains

Market Restraints

- Escape or release of methane gas

- Environmental damage

- Health issues related to fracking techniques

Market Opportunities

- Growing multinational companies

- Rising international businesses

- Growing need for natural gas

Small-Scale LNG Market Report Coverage

| Market | Small-Scale LNG Market |

| Small-Scale LNG Market Size 2022 | USD 38.3 Billion |

| Small-Scale LNG Market Forecast 2032 |

USD 119.2 Billion |

| Small-Scale LNG Market CAGR During 2023 - 2032 | 12.3% |

| Small-Scale LNG Market Analysis Period | 2020 - 2032 |

| Small-Scale LNG Market Base Year |

2022 |

| Small-Scale LNG Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By Mode Of Supply, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Gazprom, Engie, Honeywell International Inc., Wärtsilä, Linde plc, Gasum Ltd., IHI Corporation, Excelerate Energy, Prometheus Fuels, Cryostar, General Electric, and Shell Plc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Small-Scale LNG Market Insights

LNG is a great alternative for diesel in trucks and ships, supporting environmental sustainability by significantly reducing CO2 emissions and fuel costs. It appears to be a more viable alternative to traditional fuels in the transportation industry, allowing businesses to reduce their environmental effect and operating costs. This makes LNG a popular choice for a variety of end-user industries. Furthermore, growing industrialization and increased demand for natural gas as a transportation fuel will propel the small-scale liquefied natural gas (LNG) market forward. Furthermore, the market value will be boosted by reduced natural gas prices and volatility in crude oil prices owing to surplus supply. Furthermore, LNG serves as the principal fuel for transportation. For example, in November 2020, FGEN LNG, a subsidiary of First Gen Corporation, was considering the building of a liquefied natural gas (LNG) project in The First Philippine Industrial Park (FPIP). The inquiry focused on FGEN LNG's proposed temporary offshore LNG plant. This port was capable of supplying LNG to FPIP via specialized trucks fitted with concentrated shielded compartments.

Natural gas is widely available and readily transported over the world. However, methane, a strong greenhouse gas, is released at every stage of the supply chain. Methane's global warming potential is 28 to 34 times that of carbon dioxide, restricting market expansion. Furthermore, fracking, a popular method of collecting natural gas, involves pumping water into an underground gas reserve to bring it closer to the surface. Unfortunately, this practice has been linked to health risks, environmental damage, and an increase in methane emissions. These difficulties are projected to impede the small-scale liquefied natural gas (LNG) market's growth in the future.

The increasing demand for natural gas is driven by its availability as a natural resource. For example, the International Energy Agency (IEA) predicts that recoverable natural gas reserves are sufficient for around 230 years. As a result, the increased demand for natural gas presented an opportunity throughout the anticipated period. Furthermore, growing multinational corporations and foreign firms will present opportunities for the small-scale liquefied natural gas market in the forecasted year. For example, in August 2020, Uniper Global Commodities SE and its subsidiary Liqvis GmbH made substantial progress in improving the trading and fulfillment of small-scale liquefied natural gas (ssLNG) by introducing a blockchain-based platform. This move highlighted their commitment to using new solutions to improve the speed and security of ssLNG transactions.

Small-Scale LNG Market Segmentation

The worldwide market for small-scale LNG is segmented into type, application, and geography.

Small-Scale Liquefied Natural Gas (LNG) Market By Type

- Liquefaction Terminal

- Regasification Terminal

According to the small-scale liquefied natural gas market analysis, liquefaction terminal dominates the type segment. The expansion of this sector is connected to the increased export of LNG, which requires liquefaction before being transported between ports. The increased use of LNG as a fuel for heavy-duty vehicles, particularly in China and European countries, is cited as the primary cause of this occurrence. LNG emerges as the most viable option for long-haul vehicles. The density of LNG within heavy-duty trucks can vary greatly throughout the world because to differences in saturation pressures and ambient temperatures. The LNG car fuel system increases fuel density in vehicle tanks and filling stations, ensuring that natural gas is supplied to the engine at the appropriate pressure.

Small-Scale Liquefied Natural Gas (LNG) Market By Application

- Heavy Duty Vehicles

- Industrial and power

- Marine transport

- Other

According to the small-scale liquefied natural gas industry research, heavy-duty vehicles will dominate the application category in 2022. For example, China and European countries are leading the way in the usage of LNG as a fuel for heavy-duty vehicles. Heavy-duty trucks use LNG to reduce carbon dioxide emissions, nitrogen oxide emissions, and particle matter, all of which are sources of air pollution. Furthermore, using LNG gas for heavy-duty materials increases driving range, and improves fuel efficiency, and overall performance. Overall, these advantages increase the demand for LNG as a fuel for heavy-duty materials.

Small-Scale Liquefied Natural Gas (LNG) Market By Mode of Supply

- Truck

- Transshipment and Bunkering

- Pipeline and Rail

According to the small-scale liquefied natural gas (LNG) market forecast, the truck segment is expected to dominate mode of supply segment in the coming years. Trucks provide several advantages over transshipment, bunkering, rail, and other forms of LNG transit and distribution. These advantages include shorter refueling times, better scheduling efficiency, and fewer downtimes. In places without access to trains, pipelines, or ports for transshipment and bunkering, transporting LNG by truck is the most practical and effective alternative. This approach is suitable to large and diverse terrains. In January 2021, Shell Energy added a truck loading unit to its LNG terminal in Hazira, India, as part of its small-scale LNG supply infrastructure. The primary purpose of this effort was to improve consumer access to greener energy by increasing the availability of LNG transportation throughout India.

Small-Scale LNG Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Small-Scale LNG Market Regional Analysis

According to the small-scale liquefied natural gas market analysis, based on the regional analysis market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East and Africa. Asia-Pacific dominated the worldwide Small-Scale LNG Market and is likely to be the fastest-growing subsegment in the future years. Countries such as China, India, Singapore, Japan, and others have a significant need for small-scale liquefied natural gas (LNG). China was a key driver of the worldwide rise in demand for liquefied natural gas (LNG) in 2021, with import volume expected to reach 64.4 million tons by 2022. As a result, China has emerged as one of the world's largest importers of liquefied natural gas. Singapore is also a major actor in global marine shipping on an international scale. For example, in May 2021, FueLNG, in partnership with the Maritime and Port Authority of Singapore (MPA), successfully completed the first bunkering of an oil tanker, the Pacific Emerald, utilizing liquefied natural gas (LNG) as fuel in Singapore. Furthermore, India plans to establish small-scale liquefied natural gas (LNG) plants to supply natural gas to remote locations without pipeline infrastructure. For example, in June 2022, GAIL Limited, a state-owned corporation specialized in natural gas exploration and production, announced its plans to build compact liquefaction plants. These facilities are aimed in places that lack access to liquefied natural gas (LNG) pipelines. Overall, because of these factors, Asia Pacific dominates the Small-Scale LNG Market.

Small-Scale LNG Market Players

Some of the top small-scale liquefied natural gas (LNG) companies offered in our report are Gazprom, Engie, Honeywell International Inc., Wärtsilä, Linde plc, Gasum Ltd., IHI Corporation, Excelerate Energy, Prometheus Fuels, Cryostar, General Electric, Shell Plc.

Frequently Asked Questions

How big is the small-scale LNG market?

The small-scale LNG market size was valued at USD 38.3 billion in 2022.

What is the CAGR of the global small-scale LNG market from 2023 to 2032?

The CAGR of small-scale LNG Market is 12.3% during the analysis period of 2023 to 2032.

Which are the key players in the small-scale LNG market?

The key players operating in the global market are including Gazprom, Engie, Honeywell International Inc., W�rtsil�, Linde plc, Gasum Ltd., IHI Corporation, Excelerate Energy, Prometheus Fuels, Cryostar, General Electric and Shell plc.

Which region dominated the global small-scale LNG market share?

Asia Pacific held the dominating position in the small-scale LNG Market analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of small-scale Liquefied Natural Gas (LNG) during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global small-scale liquefied natural gas (LNG) industry?

The current trends and dynamics in the small-scale LNG market include rising consumption of LNG as fuel in ships and carriers, growing trend of developing trains powered by LNG, and ongoing process of rapid industrialization in many regions.

Which segment dominates the market By Type?

Liquefaction terminal segment dominate the small-scale LNG market.