Sleep Tech Devices Market | Acumen Research and Consulting

Sleep Tech Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

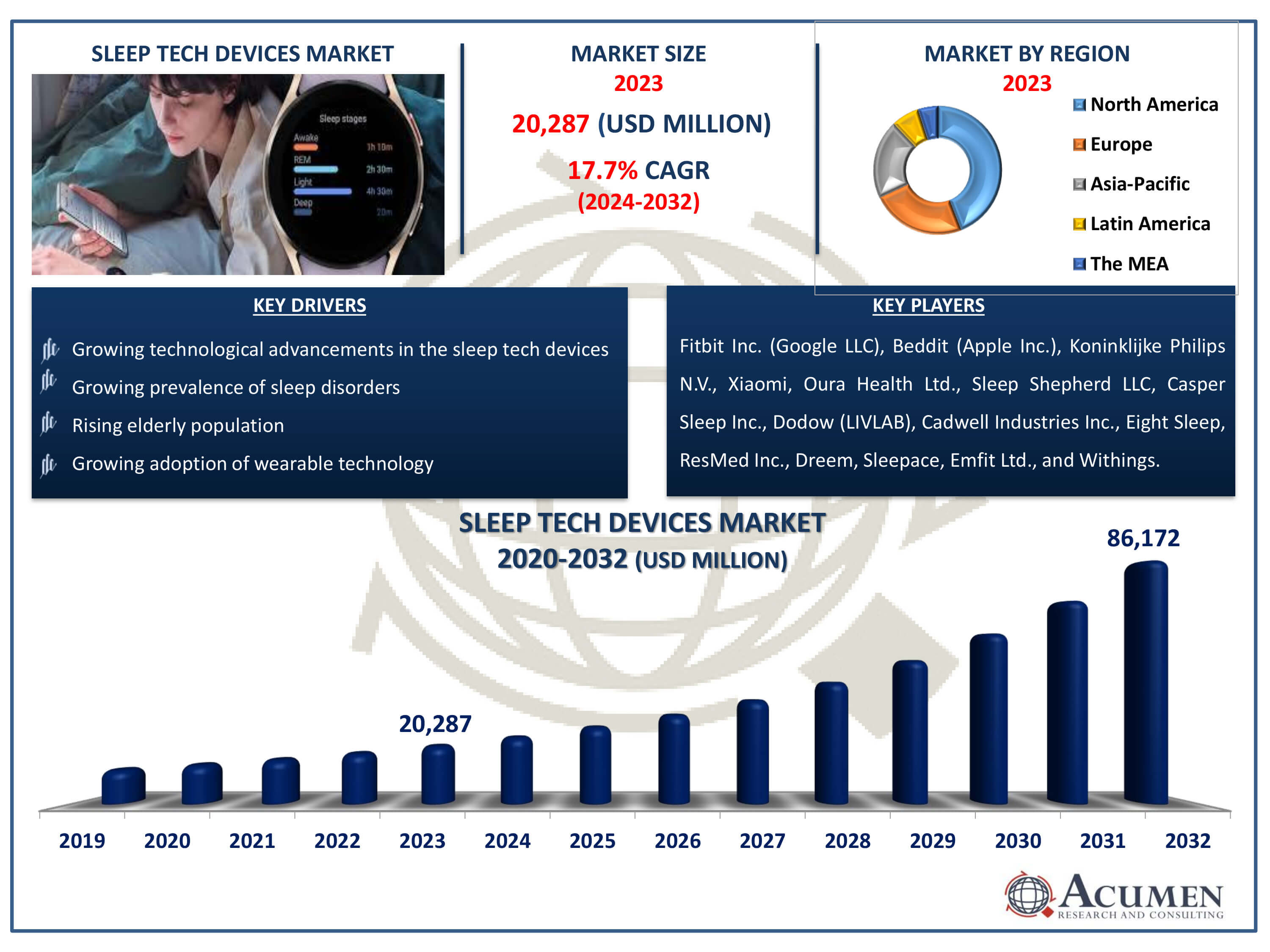

The Sleep Tech Devices Market Size accounted for USD 20,287 Million in 2023 and is estimated to achieve a market size of USD 86,172 Million by 2032 growing at a CAGR of 17.7% from 2024 to 2032.

Sleep Tech Devices Market Highlights

- Global sleep tech devices market revenue is poised to garner USD 86,172 million by 2032 with a CAGR of 17.7% from 2024 to 2032

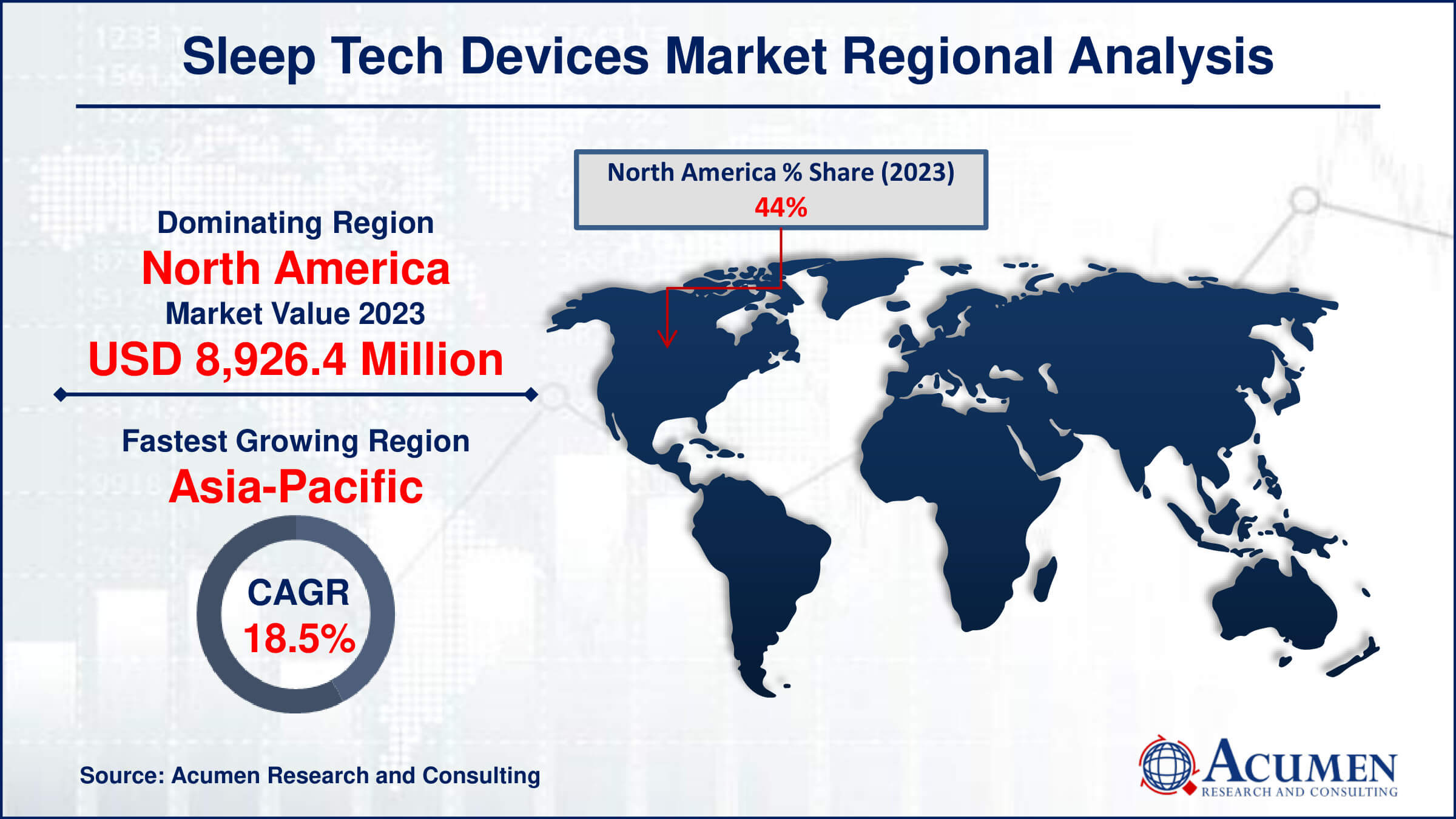

- North America sleep tech devices market value occupied around USD 8,926.4 million in 2023

- Asia-Pacific sleep tech devices market growth will record a CAGR of more than 18.5% from 2024 to 2032

- Among gender, the male sub-segment generated more than USD 12,375.2 million revenue in 2023

- Based on application, the insomnia sub-segment generated around 47% market share in 2023

- Integration with other health monitoring systems is a popular sleep tech devices market trend that fuels the industry demand

The sleep tech devices market is booming due to the increasing prevalence of sleep disorders worldwide. Additionally, the growing popularity of wearable devices is driving demand for sleep tech. Sleep devices help users understand their sleep patterns to improve sleep quality, optimize daytime performance, or treat sleep problems. Many of these devices are worn during sleep, using sensors to gather and summarize data about the sleeper. Unlike lab-based sleep tests that directly record brain activity, these gadgets monitor physical signs such as heart rate and body movement. Wearable devices collect data throughout the night, while other trackers can be placed under or on the mattress, or next to the bed, to gather information discreetly. This data is then sent to a device for analysis and display, offering insights into sleep patterns and helping users achieve better rest.

Global Sleep Tech Devices Market Dynamics

Market Drivers

- Growing prevalence of sleep disorders

- Rising elderly population

- Growing technological advancements in the sleep tech devices

- Growing adoption of wearable technology

Market Restraints

- Strict regulatory framework

- High cost of sleep tech devices

- Data privacy and security concerns

Market Opportunities

- Increasing awareness regarding sleep tech devices in emerging countries

- Miniaturization of newly developed devices

- Expansion into untapped markets

Sleep Tech Devices Market Report Coverage

| Market | Sleep Tech Devices Market |

| Sleep Tech Devices Market Size 2022 | USD 20,287 Million |

| Sleep Tech Devices Market Forecast 2032 | USD 86,172 Million |

| Sleep Tech Devices Market CAGR During 2023 - 2032 | 17.7% |

| Sleep Tech Devices Market Analysis Period | 2020 - 2032 |

| Sleep Tech Devices Market Base Year |

2022 |

| Sleep Tech Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Gender, By Application, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Fitbit Inc. (Google LLC), Beddit (Apple Inc.), Koninklijke Philips N.V., Xiaomi, Oura Health Ltd., Sleep Shepherd LLC, Casper Sleep Inc., Dodow (LIVLAB), Cadwell Industries Inc., Eight Sleep, ResMed Inc., Dreem, Sleepace, Emfit Ltd., and Withings. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Sleep Tech Devices Market Insights

The sleep tech devices market is rapidly growing, driven primarily by the increasing number of sleep disorders worldwide. Inadequate sleep is a widespread issue across all age groups and is recognized as a public health epidemic. It's often overlooked and under-reported, leading to significant economic costs. Poor sleep can cause various health issues, such as cardiovascular disease, diabetes, obesity, cognitive problems, and an increased risk of accidents both on the road and at work. It also negatively affects academic and job performance. In fact, sleep deprivation is linked to seven of the top fifteen causes of death in the United States, including heart disease, diabetes, cancer, accidents, stroke, high blood pressure, and septicemia.

Technological advancements in sleep tracking are also boosting the market. Companies are focusing on creating innovative sleep technologies to help people sleep better and manage sleep disorders more effectively. Many new sleep tech products are being launched, offering solutions to a range of sleep-related issues, often caused by our tech-heavy lifestyles. According to industry analysis, the growing number of elderly people, who are particularly affected by sleep disorders, is further driving demand for these devices. In June 2023, Noise, a prominent smartwatch brand, unveiled its latest innovation: the Colorfit Pulse Buzz smartwatch. This cutting-edge device is equipped with advanced features including heart rate monitoring, SpO2 tracking for blood oxygen levels, comprehensive sleep monitoring, and cycle tracking capabilities.

However, the market faces challenges. Strict regulatory requirements and the high cost of sleep tech devices are significant barriers. On the upside, the trend towards miniaturization of devices is gaining momentum. Smaller, more advanced gadgets make it easier for users to wear them and track their sleep and movements. These devices often use motion sensors, microphones, and cameras, and some even use temperature and light sensors. Newer wearables might include electrodes and other body sensors to monitor sleep more accurately. This ongoing innovation is making sleep tech devices more accessible and effective, paving the way for future growth in the market.

Sleep Tech Devices Market Segmentation

The worldwide market for sleep tech devices is split based on product, gender, application, distribution channel, and geography.

Sleep Tech Devices Products

- Wearables

- Smart Watches and Bands

- Others

- Non-Wearables

- Beds

- Sleep Monitors

- Others

The wearables segment held a significant share of the market in 2023 and is expected to maintain this trend over the sleep tech devices industry forecast period from 2024 to 2032. The rise of wearable technology is a key part of the digital health revolution, offering a range of innovative, advanced, and affordable devices that use multiple sensors to gather data on user behaviors, including sleep. These wearables do more than just track activity they can also monitor bio-signals like heart rate, heart rate variability, skin conductance, and temperature. They operate continuously, creating massive datasets, or "Big Data," which can offer deep insights into users health. For example in July 2023, Boult Audio made a significant entry into the wearable market with the launch of the Boult Drift and Boult Cosmic Smartwatches in India. These sleek gadgets not only mark Boult's debut in wearables but also come equipped with advanced sleep trackers, allowing users to delve into detailed sleep monitoring and analysis. Given their capabilities, wearables are set to drive demand in the sleep tech market in the coming years, as they provide valuable information that can help users understand and improve their sleep patterns.

Sleep Tech Devices Genders

- Male

- Female

According to the sleep tech devices industry analysis, the male category has captured a significant share of the market. This is largely due to the high levels of stress and busy work or travel schedules that often lead to sleep disorders among men. Additionally, sleep apnea is more common in middle-aged men than in women, which further drives demand for sleep tech devices in this group. However, the market for women is also expected to grow significantly in the coming years. This growth is due to the major hormonal changes women experience throughout their lives, such as pregnancy, menstruation, and menopause, which can affect sleep patterns and increase the need for sleep monitoring and improvement devices.

Sleep Tech Devices Applications

- Insomnia

- Obstructive Sleep Apnea (OSA)

- Narcolepsy

- Others

Among the various applications of sleep tech devices, insomnia stands out as the largest segment. Insomnia, characterized by difficulty falling asleep or staying asleep, affects a significant portion of the population worldwide. Sleep tech devices designed to address insomnia offer a range of solutions, including sleep tracking, relaxation techniques, and personalized sleep recommendations. According to National Council of Aging, Inc., about 30% of adults have symptoms of insomnia, with 10% having insomnia that impacts their daily activities. These devices empower users to understand their sleep patterns, identify potential triggers for insomnia, and adopt strategies to improve sleep quality. With the rising prevalence of insomnia and the growing demand for effective sleep solutions, the insomnia segment continues to drive innovation and growth in the sleep tech devices market.

Obstructive sleep apnea (OSA) held the notable share of the sleep tech devices market. This is due to the increasing number of sleep apnea cases worldwide. OSA is a sleep disorder where a person's breathing repeatedly stops during sleep because the throat muscles relax too much. These pauses in breathing happen multiple times during the night, leading to disrupted and poor-quality sleep. Age is a significant factor in the prevalence of OSA, with people aged 18 to 60 being more at risk. According to the American Academy of Sleep Medicine (AASM), the chances of developing OSA increase with age. For women, the risk goes from 2% at age 30 to 28% at age 60. For men, the risk rises from 4% at age 30 to 67% at age 60.

Sleep Tech Devices Distribution Channels

- Direct-to-Consumer

- Hospital

- Specialty Clinics

- Others

Specialty clinics and hospitals dominated the sleep tech devices market. This is because these devices are typically prescribed by healthcare professionals, who are mostly associated with hospitals and specialized clinics. However, there's a noticeable surge in the direct-to-consumer segment. This growth is mainly attributed to the rising trend of online shopping. Many consumers prefer the convenience of purchasing wearable sleep tech devices like smartwatches and bands directly from e-commerce platforms. As a result, the direct-to-consumer market is experiencing significant expansion.

Sleep Tech Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Sleep Tech Devices Market Regional Analysis

In terms of sleep tech devices market analysis, North America emerged as the powerhouse in the sleep tech devices market, boasting the largest revenue share. This dominance is fueled by a perfect storm of factors, a surge in chronic sleep disorders, a significant proportion of the population grappling with obesity, the relentless pace of modern life, and a burgeoning aging population. Let's zoom in on some staggering statistics: according to the Sleep Foundation, a staggering 35% of American adults, 25% of young children, and a whopping 72% of high school students are grappling with insufficient sleep. These numbers underscore the pressing need for innovative solutions to address sleep-related issues in the region.

The Asia-Pacific region is fastest growing throughout the sleep tech devices market forecast period; it's poised to become a major player in the global sleep tech landscape. A trifecta of factors a rising tide of chronic health conditions, a growing awareness of sleep disorders, and a sharp uptick in cases of obstructive sleep apnea. As the world awakens to the importance of a good night's sleep, both North America and the Asia-Pacific region are at the forefront of pioneering solutions that promise to revolutionize how we rest and recharge. From cutting-edge wearables to innovative sleep clinics, the race is on to ensure that everyone, regardless of geography, can enjoy the benefits of a truly restful slumber.

Sleep Tech Devices Market Players

Some of the top sleep tech devices companies offered in our report includes Fitbit Inc. (Google LLC), Beddit (Apple Inc.), Koninklijke Philips N.V., Xiaomi, Oura Health Ltd., Sleep Shepherd LLC, Casper Sleep Inc., Dodow (LIVLAB), Cadwell Industries Inc., Eight Sleep, ResMed Inc., Dreem, Sleepace, Emfit Ltd., and Withings.

Frequently Asked Questions

How big is the sleep tech devices market?

The sleep tech devices market size was valued at USD 20,287 million in 2023.

What is the CAGR of the global sleep tech devices market from 2024 to 2032?

The CAGR of sleep tech devices is 17.7% during the analysis period of 2024 to 2032.

Which are the key players in the sleep tech devices market?

The key players operating in the global market are including Fitbit Inc. (Google LLC), Beddit (Apple Inc.), Koninklijke Philips N.V., Xiaomi, Oura Health Ltd., Sleep Shepherd LLC, Casper Sleep Inc., Dodow (LIVLAB), Cadwell Industries Inc., Eight Sleep, ResMed Inc., Dreem, Sleepace, Emfit Ltd., and Withings.

Which region dominated the global sleep tech devices market share?

North America held the dominating position in sleep tech devices industry during the analysis period of 2024 to 2032.

Asia-Pacific region exhibited fastest growing CAGR for market of sleep tech devices during the analysis period of 2024 to 2032.

Asia-Pacific region exhibited fastest growing CAGR for market of sleep tech devices during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global sleep tech devices industry?

The current trends and dynamics in the sleep tech devices industry include growing prevalence of sleep disorders, rising elderly population, growing technological advancements in the sleep tech devices, and growing adoption of wearable technology.

Which gender held the maximum share in 2023?

The male gender held the maximum share of the sleep tech devices industry.