Skin Antiseptic Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Skin Antiseptic Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

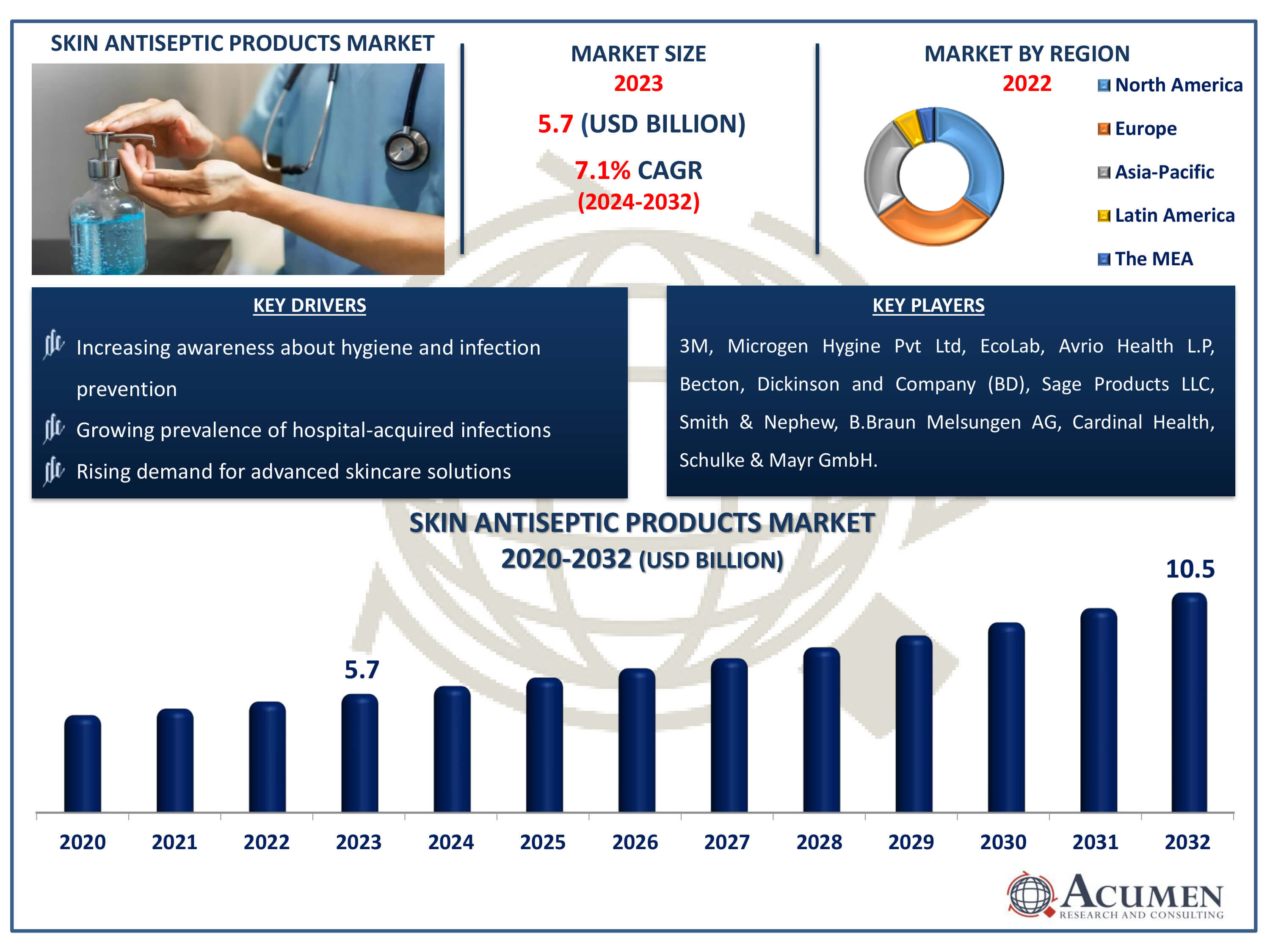

The Skin Antiseptic Products Market Size accounted for USD 5.7 Billion in 2023 and is estimated to achieve a market size of USD 10.5 Billion by 2032 growing at a CAGR of 7.1% from 2024 to 2032.

Skin Antiseptic Products Market Highlights

- Global skin antiseptic products market revenue is poised to garner USD 10.5 billion by 2032 with a CAGR of 7.1% from 2024 to 2032

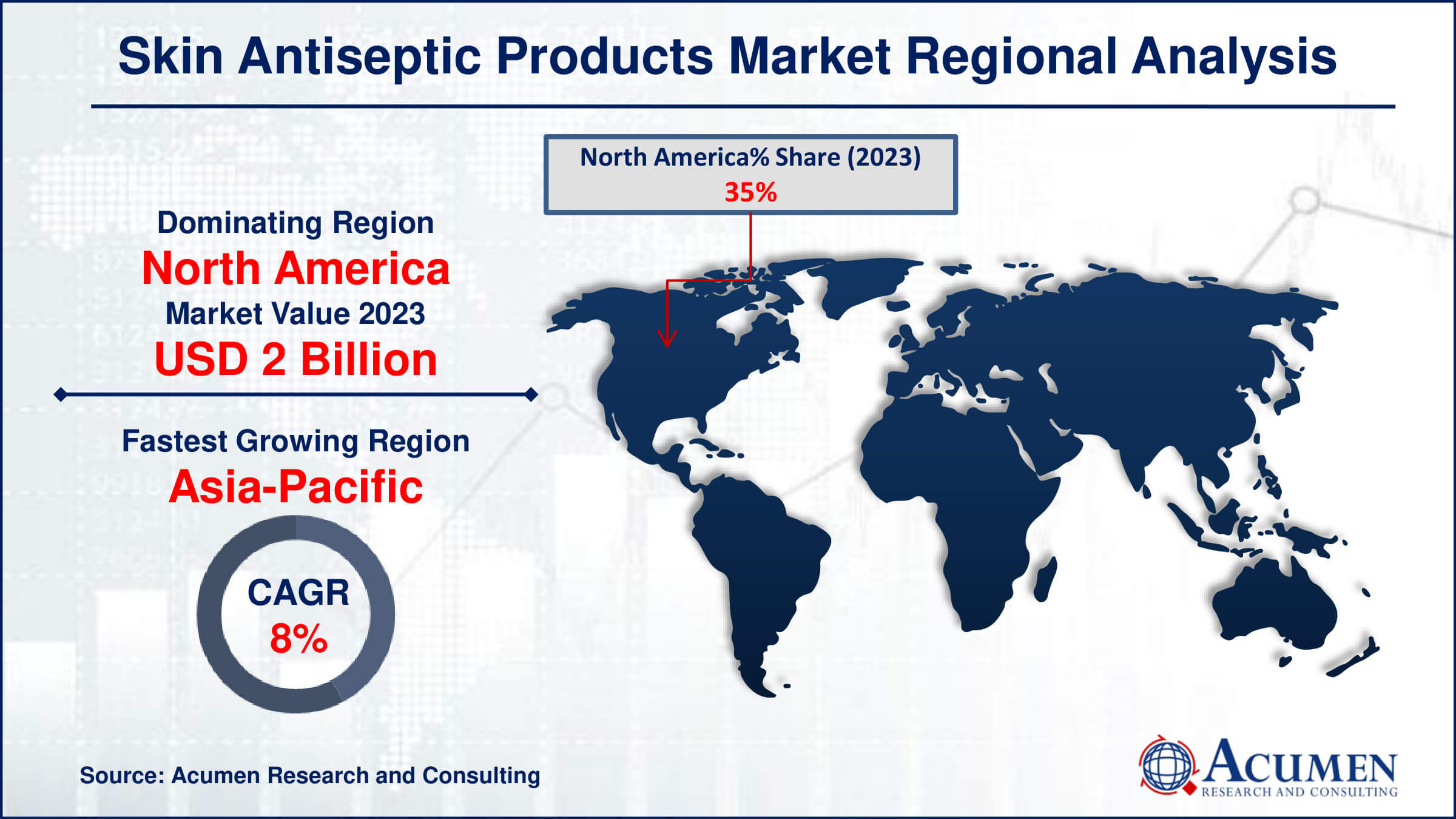

- North America skin antiseptic products market value occupied around USD 2 billion in 2023

- Asia Pacific skin antiseptic products market growth will record a CAGR of more than 8% from 2024 to 2032

- Among type, the solutions sub-segment generated significant market share in 2023

- Based on formulation, the alcohol sub-segment generated notable market share in 2023

- Increasing demand for natural and organic ingredients driven by consumer preference for eco-friendly and chemical-free solutions is the skin antiseptic products market trend that fuels the industry demand

Skin antiseptic products are solutions or formulations designed to disinfect and cleanse the skin, reducing the risk of infection before medical procedures or surgeries. These products typically contain antimicrobial agents like chlorhexidine gluconate or iodine-based compounds. Their applications span various medical settings, including hospitals, clinics, and ambulatory surgical centers, where they are used to prepare patients skin prior to injections, surgeries, or other invasive procedures. Additionally, skin antiseptic products find utility in home healthcare settings, aiding in wound care and infection prevention. With increasing awareness about hygiene and infection control, the demand for these products is rising, driving growth in the skin antiseptic products market globally. Factors such as the prevalence of hospital-acquired infections and the growing emphasis on patient safety further contribute to the market's expansion.

Global Skin Antiseptic Products Market Dynamics

Market Drivers

- Increasing awareness about hygiene and infection prevention

- Growing prevalence of hospital-acquired infections

- Rising demand for advanced skincare solutions

Market Restraints

- Stringent regulatory requirements for product approval

- High competition among existing market players

- Concerns regarding skin irritation and allergies

Market Opportunities

- Expansion into emerging markets with unmet healthcare needs

- Development of innovative formulations for sensitive skin

- Integration of technology for improved efficacy and user experience

Skin Antiseptic Products Market Report Coverage

| Market | Skin Antiseptic Products Market |

| Skin Antiseptic Products Market Size 2022 | USD 5.7 Billion |

| Skin Antiseptic Products Market Forecast 2032 | USD 10.5 Billion |

| Skin Antiseptic Products Market CAGR During 2023 - 2032 | 7.1% |

| Skin Antiseptic Products Market Analysis Period | 2020 - 2032 |

| Skin Antiseptic Products Market Base Year |

2022 |

| Skin Antiseptic Products Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Formulation, By Application, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M, Microgen Hygine Pvt Ltd, EcoLab, Avrio Health L.P, Becton, Dickinson and Company (BD), Sage Products LLC, Smith & Nephew, B.Braun Melsungen AG, Cardinal Health, and Schulke & Mayr GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Skin Antiseptic Products Market Insights

The growing emphasis on hygiene and infection prevention has drives the demand for skin antiseptic products, propelling the market forward. With a heightened awareness of the importance of cleanliness in healthcare settings, consumers and healthcare professionals alike are increasingly turning to these products for protection against pathogens due to rising cases of hwalth-associated infection. For instance, according to the Centers for Disease Control and Prevention (CDC), at least 1 in 25 hospital patients experience a healthcare-associated infection. This trend is particularly evident in hospitals, clinics, and other medical facilities where maintaining sterile environments is critical. Skin antiseptics offer a convenient and effective means of reducing the risk of infections, driving their adoption across various industries. Moreover, manufacturers are also concentrating on infection control by their developments. For instance, in September 2022, Schülke Group, a prominent global provider of infection prevention and hygiene solutions in healthcare, revealed its acquisition of Vesismin Health, a Spanish company headquartered in Barcelona, specializing in hospital infection control. As a result, the skin antiseptic products market is experiencing steady growth, driven by the critical need for robust infection control measures.

Skin antiseptic products face challenges in market growth due to concerns about skin irritation and allergies among consumers. The fear of adverse reactions discourages potential users from adopting these products, limiting market expansion. Manufacturers are compelled to address these concerns through innovation, such as developing hypoallergenic formulations and conducting extensive safety testing. Effective communication of product safety and benefits is crucial to alleviate consumer apprehensions and promote adoption. Despite these challenges, continued research and development efforts aim to create safer and more tolerable antiseptic solutions to overcome market barriers.

The increasing demand for skin antiseptic products has prompted a shift towards the development of innovative formulations tailored for sensitive skin. This emerging trend presents a significant opportunity within the market, as consumers seek effective solutions for their skincare needs. Formulations designed for sensitive skin offer a compelling value proposition, addressing concerns such as irritation and allergic reactions commonly associated with traditional antiseptic products. Manufacturers are capitalizing on this opportunity by investing in research and development to create specialized formulations. For instance, in January 2022, PDI revealed a strategic collaboration with the Association for Professionals, aiming to enhance the science and implementation of infection prevention and control within healthcare facilities. As a result, the market for skin antiseptic products is poised for growth, driven by the increasing emphasis on innovative solutions for sensitive skin.

Skin Antiseptic Products Market Segmentation

The worldwide market for skin antiseptic products is split based on type, formulation, application, end-use industry, and geography.

Skin Antiseptic Product Types

- Swab Sticks

- Solutions

- Wipes

According to the skin antiseptic products industry analysis, solutions-type products are dominates in the skin antiseptic market due to their multifaceted approach to hygiene and health. These formulations typically offer a comprehensive solution, combining germ-killing agents with moisturizing and soothing ingredients. Their versatility appeals to a wide range of users, from healthcare professionals to everyday consumers concerned with cleanliness. With an emphasis on efficacy and convenience, these products are reshaping the industry landscape, driving growth and setting new standards for skin antiseptics. As consumer awareness of health and hygiene continues to rise, solutions-type products are poised to maintain their stronghold in the market.

Skin Antiseptic Product Formulations

- Iodine

- Chlorhexidine

- Octenidine

- Alcohols

- Others

Alcohol formulations showcasing significant market share in 2023 due to their unparalleled efficacy in killing a broad spectrum of microbes, including bacteria and viruses. For instance, in January 2022, ESTA Technology introduced ULTRABloom foam hand sanitizer, which is alcohol-free and protects against bacteria, yeast, viruses, fungi, and mould. Their rapid action and ability to evaporate quickly make them ideal for use in healthcare settings, where immediate disinfection is crucial. Moreover, alcohol-based antiseptics are generally well-tolerated by the skin and cause minimal irritation, making them suitable for frequent use. Their versatility extends beyond healthcare to various other industries, including cosmetics and personal care. Overall, their effectiveness, speed, and compatibility have solidified alcohol-based formulations as the dominant segment of skin antiseptic products worldwide.

Skin Antiseptic Product Applications

- Injections

- Surgeries

According to the skin antiseptic products industry forecast, the injections segment dominates skin antiseptic products industry due to its crucial role in medical procedures. Healthcare settings rely heavily on injections for various treatments and vaccinations, necessitating stringent hygiene protocols. Skin antiseptics play a pivotal role in minimizing the risk of infection at injection sites, thus ensuring patient safety. Moreover, with the increasing emphasis on infection control and prevention in healthcare facilities, the demand for effective antiseptic products for injections remains consistently high. As a result, manufacturers prioritize research and development in this segment to offer advanced formulations.

Skin Antiseptic Product End-Uses

- Hospitals

- Outpatient Facilities

- Home Care

- Research & Manufacturing

According to the skin antiseptic products industry analysis, hospitals as end users dominates in market due to their stringent hygiene protocols and high patient volume. Hospitals rely on skin antiseptics to prevent infections during surgeries, procedures, and patient care, driving substantial demand for these products. The rigorous standards set by healthcare regulatory bodies further emphasize the importance of effective skin antiseptics in hospitals. Additionally, the prevalence of healthcare-associated infections underscores the critical role these products play in maintaining patient safety and reducing the risk of complications. Consequently, manufacturers often modify their products to meet the specific needs and preferences of hospital settings, further solidifying the segment's dominance in the market.

Skin Antiseptic Products Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Skin Antiseptic Products Market Regional Analysis

For several reasons, the North America region dominates the skin antiseptic products market due to the growing number of surgeries being performed is a key driver in boosting market expansion. Preparing the skin before surgery is crucial, and as a result, there is anticipated growth in the demand for skin antiseptic products. Additionally, the rising prevalence of infectious diseases among the population in the United States is another significant factor contributing to market growth. Moreover, there has been an observed increase in the adoption of branded skin antiseptic products within healthcare facilities in the U.S., which is expected to further propel market growth in the forecast year. Moreover, presence of robust key players further contributes to region’s dominance, For instance, in July 2020, BD (Becton, Dickinson and Company), a prominent global medical technology firm, unveiled the introduction of BD PurPrep, a patient preoperative skin preparation featuring a sterile solution. It stands as the premier and sole fully sterile povidone-iodine plus isopropyl alcohol single-use antiseptic skin preparation accessible in the United States.

Asia Pacific is fastest growing region in skin antiseptic products market. The surge in government and private sector investments in healthcare is driving this expansion. This favorable landscape is anticipated to attract numerous international and local companies to venture into the regional market, thereby fueling their growth. China currently holds dominance in the Asia Pacific skin antiseptic products market, while India's market is projected to experience substantial growth at a significant compound annual growth rate (CAGR) throughout the forecast period.

Skin Antiseptic Products Market Players

Some of the top skin antiseptic products companies offered in our report include 3M, Microgen Hygine Pvt Ltd, EcoLab, Avrio Health L.P, Becton, Dickinson and Company (BD), Sage Products LLC, Smith & Nephew, B.Braun Melsungen AG, Cardinal Health, Schulke & Mayr GmbH.

Frequently Asked Questions

How big is the skin antiseptic products market?

The skin antiseptic products market size was valued at USD 5.7 billion in 2023.

What is the CAGR of the global skin antiseptic products market from 2024 to 2032?

The CAGR of skin antiseptic products is 7.1% during the analysis period of 2024 to 2032.

Which are the key players in the skin antiseptic products market?

The key players operating in the global market are including 3M, Microgen Hygine Pvt Ltd, EcoLab, Avrio Health L.P, Becton, Dickinson and Company (BD), Sage Products LLC, Smith & Nephew, B.Braun Melsungen AG, Cardinal Health, Schulke & Mayr GmbH.

Which region dominated the global skin antiseptic products market share?

North America held the dominating position in skin antiseptic products industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia Pacific region exhibited fastest growing CAGR for market of skin antiseptic products during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global skin antiseptic products industry?

The current trends and dynamics in the skin antiseptic products industry include increasing awareness about hygiene and infection prevention, growing prevalence of hospital-acquired infections, and rising demand for advanced skincare solutions.

Which type held the maximum share in 2023?

The solutions type held the maximum share of the skin antiseptic products industry.