Single Use Bioprocessing Market | Acumen Research and Consulting

Single-Use Bioprocessing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

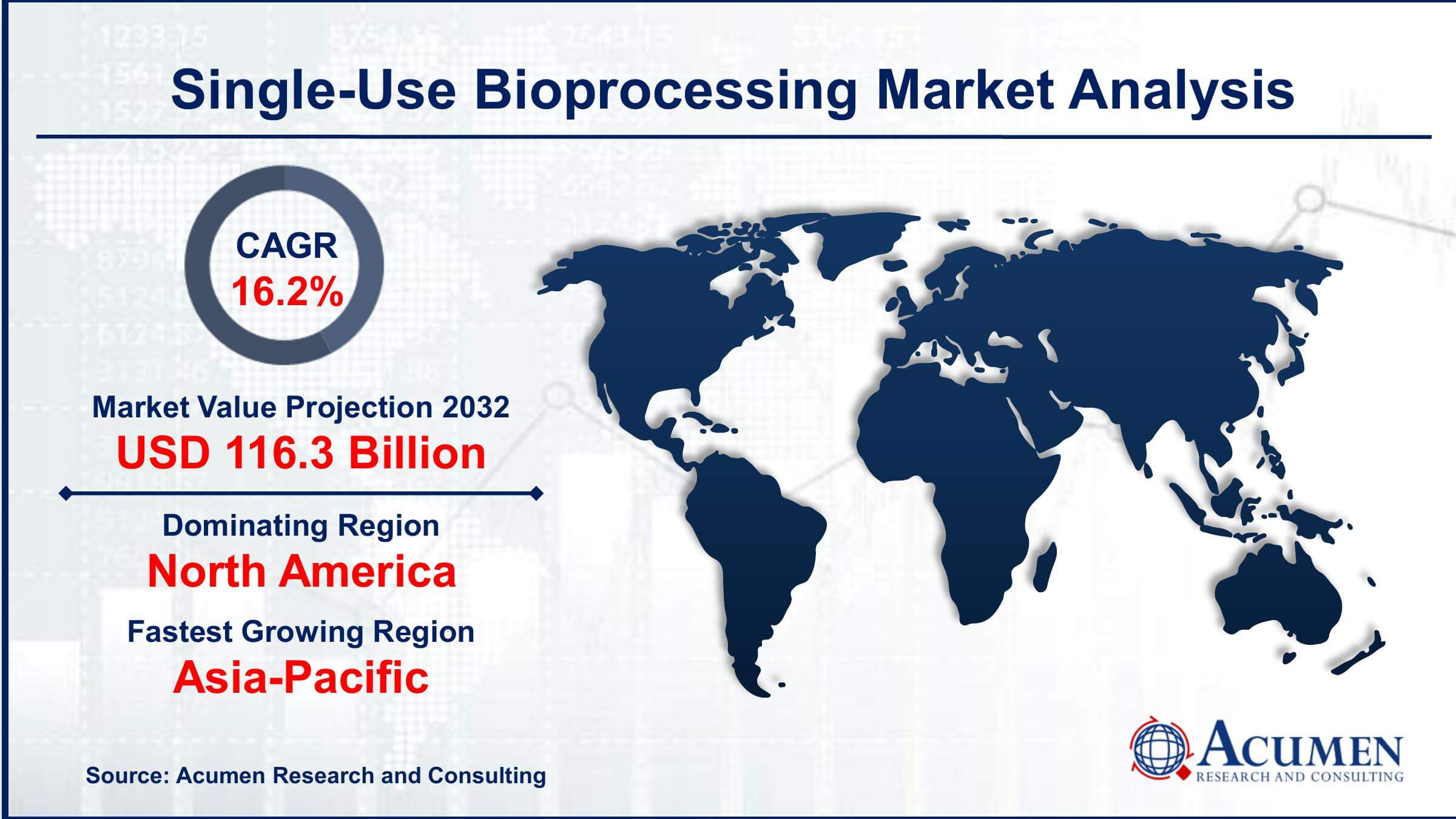

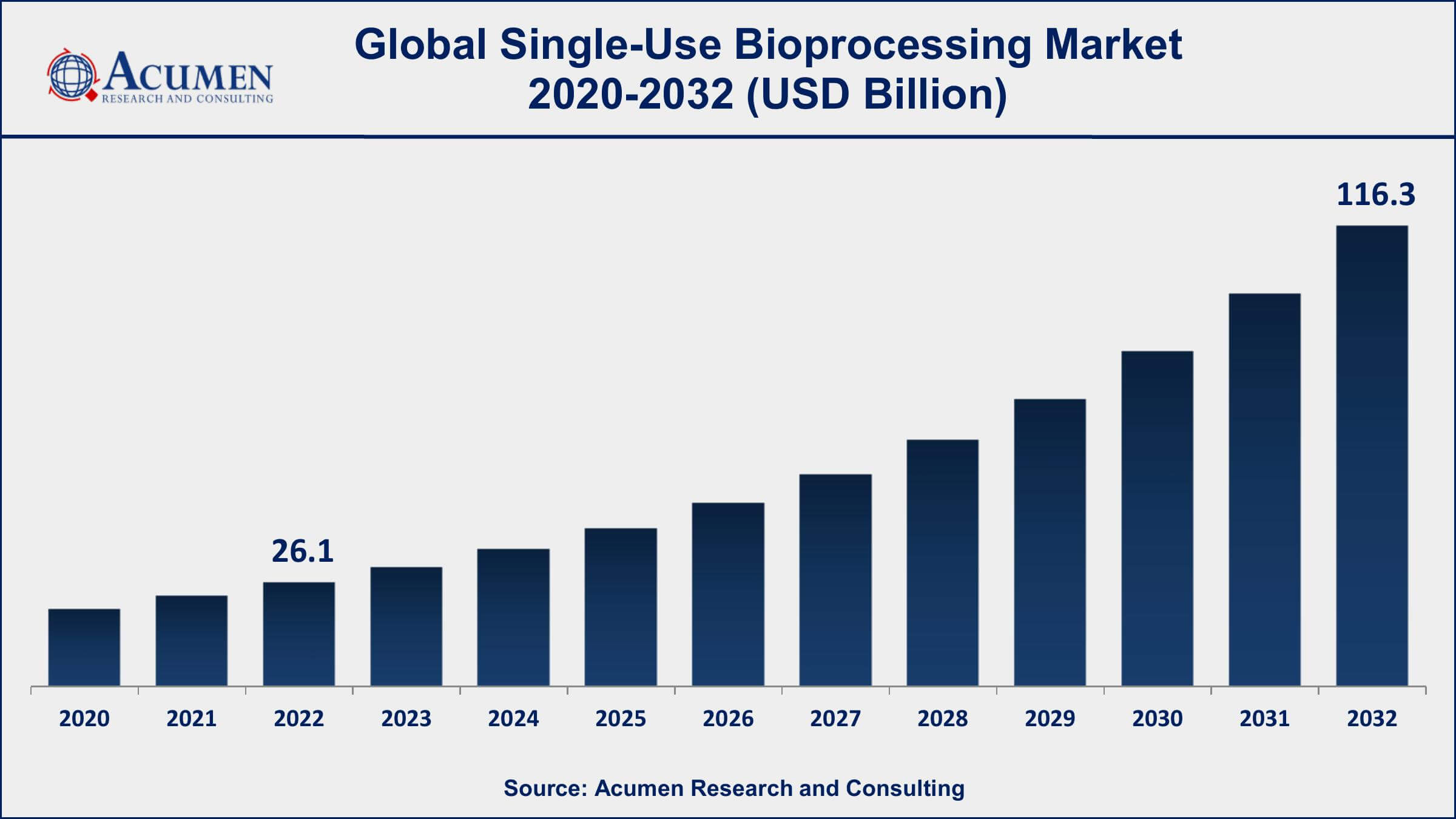

The Global Single-Use Bioprocessing Market Size accounted for USD 26.1 Billion in 2022 and is projected to achieve a market size of USD 116.3 Billion by 2032 growing at a CAGR of 16.2% from 2023 to 2032.

Single-Use Bioprocessing Market Highlights

- Global Single-Use Bioprocessing Market revenue is expected to increase by USD 116.3 Billion by 2032, with a 16.2% CAGR from 2023 to 2032

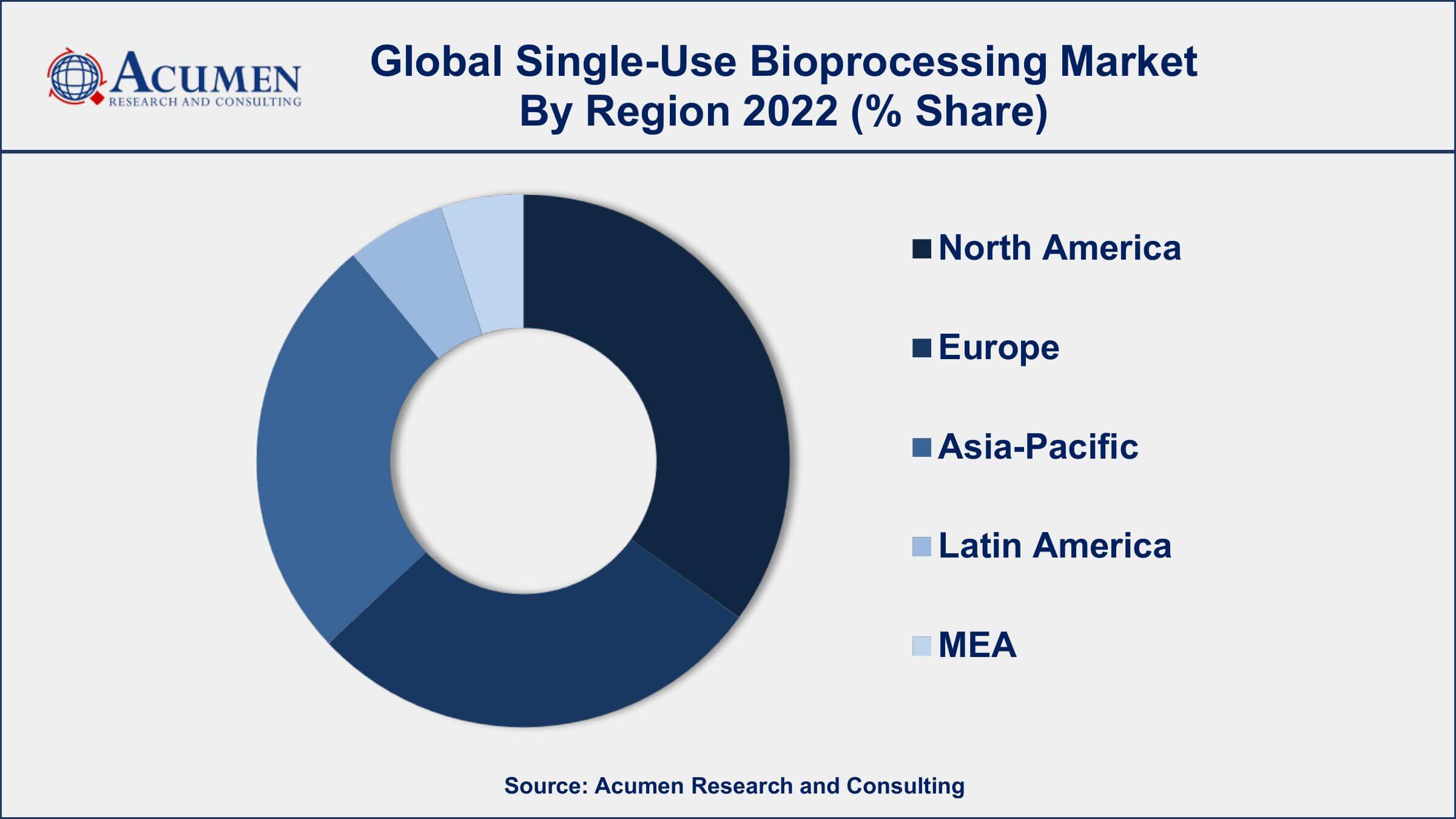

- North America region led with more than 34% of Single-Use Bioprocessing Market share in 2022

- Asia-Pacific Single-Use Bioprocessing Market growth will record a CAGR of around 17.1% from 2023 to 2032

- According to the research study, single-use bioprocessing plants have a 35% better CO2 balance than conventional stainless-steel reactors, widely adopted by manufacturers

- By product, the media bags and containers segment has recorded more than 44% of the revenue share in 2022

- Increasing demand for biopharmaceuticals and personalized medicine, drives the Single-Use Bioprocessing Market value

Single-use bioprocessing refers to a set of technologies and equipment used in the manufacturing of biopharmaceuticals and other biologics, where disposable, single-use components are utilized instead of traditional stainless-steel equipment. These single-use systems include bioreactors, mixers, filters, tubing, and other disposable components that come pre-sterilized and are used only once during the production process. Single-use bioprocessing offers several advantages, such as reducing the risk of cross-contamination, minimizing cleaning and validation efforts, and enabling greater flexibility and speed in manufacturing, thereby resulting in cost-effectiveness and increased productivity.

Over the past decade, the single-use bioprocessing market has experienced significant growth. This growth can be attributed to various factors, including the rising demand for biopharmaceuticals, the need for faster and more flexible manufacturing processes, and the increasing adoption of single-use technologies by biopharmaceutical manufacturers. Additionally, the advantages of single-use systems, such as reducing the risk of product contamination and easing regulatory compliance, have further contributed to their widespread adoption.

Global Single-Use Bioprocessing Market Trends

Market Drivers

- Increasing demand for biopharmaceuticals and personalized medicine

- Cost-effectiveness and reduced risk of cross-contamination

- Growing adoption of single-use technologies by biopharmaceutical manufacturers

- Advancements in single-use technology, including improved materials and automation

Market Restraints

- Concerns about plastic waste and environmental impact

- Limited scalability for large-scale production

Market Opportunities

- Adoption in personalized medicine and gene therapies

- Expansion of contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) specializing in single-use bioprocessing

Single-Use Bioprocessing Market Report Coverage

| Market | Single-Use Bioprocessing Market |

| Single-Use Bioprocessing Market Size 2022 | USD 26.1 Billion |

| Single-Use Bioprocessing Market Forecast 2032 | USD 116.3 Billion |

| Single-Use Bioprocessing Market CAGR During 2023 - 2032 | 16.2% |

| Single-Use Bioprocessing Market Analysis Period | 2020 - 2032 |

| Single-Use Bioprocessing Market Base Year | 2022 |

| Single-Use Bioprocessing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Workflow, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Danaher Corporation, Sartorius AG, Merck KGaA (MilliporeSigma), Eppendorf AG, Repligen Corporation, 3M Company, Entegris, Inc., Saint-Gobain Performance Plastics, Parker Hannifin Corporation, Avantor, Inc., and Meissner Filtration Products, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Single-Use Bioprocessing Market Dynamics

Single-use bioprocessing is a modern approach to biopharmaceutical manufacturing that involves the use of disposable, single-use components instead of traditional stainless-steel equipment. These single-use systems include bioreactors, mixers, filters, tubing, and other disposable components that are pre-sterilized and used only once during the production process. Single-use bioprocessing offers several advantages, such as reducing the risk of cross-contamination, minimizing cleaning and validation efforts, and enabling greater flexibility and speed in manufacturing. This approach has gained significant popularity in the biopharmaceutical industry due to its cost-effectiveness, ease of implementation, and ability to streamline manufacturing processes.

The applications of single-use bioprocessing are diverse and encompass various stages of biopharmaceutical production. Single-use systems are extensively used in upstream processes, including cell culture and fermentation. Bioreactors equipped with single-use bags facilitate the growth of cells and microorganisms for the production of proteins, antibodies, vaccines, and other biologics. In downstream processes, single-use systems are employed in filtration, chromatography, and purification steps to isolate and concentrate the desired biopharmaceutical products.

The single-use bioprocessing market had been experiencing significant growth and was projected to continue expanding in the coming years. The increasing demand for biopharmaceuticals, driven by the rising prevalence of chronic diseases and the growing aging population, has been a major driver of this market's growth. Biopharmaceuticals, including monoclonal antibodies, vaccines, and cell therapies, require efficient and reliable manufacturing processes, and single-use bioprocessing has emerged as a preferred solution for many manufacturers. The adoption of single-use bioprocessing offers several advantages, including reduced risk of cross-contamination, faster setup times, and enhanced flexibility in manufacturing operations.

Single-Use Bioprocessing Market Segmentation

The global Single-Use Bioprocessing Market segmentation is based on product, workflow, application, end user, and geography.

Single-Use Bioprocessing Market By Product

- Filtration Assemblies

- Media Bags & Containers

- Disposable Mixers

- Disposable Bioreactors

- Others

According to the single-use bioprocessing industry analysis, the media bags & containers segment accounted for the largest market share in 2022. Media bags and containers play a crucial role in biopharmaceutical manufacturing as they are used for storage, mixing, and transport of cell culture media and other process fluids. The increasing adoption of single-use technologies in bioprocessing has driven the demand for media bags and containers due to their advantages in terms of flexibility, reduced risk of contamination, and ease of use. One of the key factors contributing to the growth of this segment is the expanding biopharmaceutical industry. With a growing pipeline of biologics, vaccines, and cell therapies, the demand for media bags and containers has surged.

Single-Use Bioprocessing Market By Workflow

- Upstream

- Downstream

- Fermentation

In terms of workflows, the upstream segment is expected to witness significant growth in the coming years. The upstream bioprocessing stage involves cell culture, media preparation, and bioreactor operations, which are crucial steps in the production of biopharmaceuticals and other biologics. The adoption of single-use technologies in the upstream process has gained momentum due to the numerous advantages it offers, including reduced risk of contamination, faster turnaround times, and increased flexibility in manufacturing operations. One of the key drivers of the upstream segment's growth is the rising demand for biopharmaceuticals globally.

Single-Use Bioprocessing Market By Application

- Filtration

- Cell Culture

- Purification

- Others

According to the single-use bioprocessing market forecast, the filtration segment is expected to witness significant growth in the coming years. Filtration is a critical step in bioprocessing, involved in the removal of impurities, particles, and microorganisms from process fluids such as cell culture media, buffers, and final biopharmaceutical products. The adoption of single-use filtration technologies has gained significant traction in the biopharmaceutical industry due to their advantages, including reduced risk of cross-contamination, faster setup times, and ease of use. One of the key factors driving the growth of the filtration segment is the increasing demand for biopharmaceuticals and the subsequent need for reliable and efficient filtration processes. As the biopharmaceutical pipeline continues to expand with the development of new therapies, there is a growing requirement for high-quality filtration solutions to ensure the safety and efficacy of the final products.

Single-Use Bioprocessing Market By End User

- Clinical & Academic Research Institutes

- Biopharmaceutical Manufacturers

- Others

Based on the end user, the biopharmaceutical manufacturers segment is expected to continue its growth trajectory in the coming years. Biopharmaceutical manufacturers are increasingly adopting single-use technologies for their production processes due to the numerous advantages offered by these systems. The shift towards single-use bioprocessing has been driven by factors such as increased cost-effectiveness, reduced risk of cross-contamination, enhanced flexibility, and faster turnaround times. One of the key drivers for the growth of this segment is the rising demand for biopharmaceutical products globally. With the prevalence of chronic diseases on the rise and an aging population, there is a growing need for innovative and targeted therapies.

Single-Use Bioprocessing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Single-Use Bioprocessing Market Regional Analysis

Geographically, North America is dominating the single-use bioprocessing market in 2022. The region's dominance can be attributed to its strong presence of established biopharmaceutical companies, a well-developed healthcare infrastructure, and a favorable regulatory environment. North America is home to numerous biopharmaceutical manufacturers that are at the forefront of research and development in the biotechnology and pharmaceutical industries. These companies have been early adopters of single-use bioprocessing technologies, recognizing the benefits of increased flexibility, reduced contamination risks, and quicker turnaround times. Additionally, North America has a robust network of contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) that specialize in biopharmaceutical production. Many of these CMOs and CDMOs have invested in state-of-the-art single-use bioprocessing facilities, providing services to biopharmaceutical companies both within the region and globally. This has further driven the adoption of single-use technologies in the region.

Single-Use Bioprocessing Market Player

Some of the top single-use bioprocessing market companies offered in the professional report include Thermo Fisher Scientific, Danaher Corporation, Sartorius AG, Merck KGaA (MilliporeSigma), Eppendorf AG, Repligen Corporation, 3M Company, Entegris, Inc., Saint-Gobain Performance Plastics, Parker Hannifin Corporation, Avantor, Inc., and Meissner Filtration Products, Inc.

Frequently Asked Questions

What was the market size of the global single-use bioprocessing in 2022?

The market size of single-use bioprocessing was USD 26.1 Billion in 2022.

What is the CAGR of the global single-use bioprocessing market from 2023 to 2032?

The CAGR of single-use bioprocessing is 16.2% during the analysis period of 2023 to 2032.

Which are the key players in the single-use bioprocessing market?

The key players operating in the global market are including Thermo Fisher Scientific, Danaher Corporation, Sartorius AG, Merck KGaA (MilliporeSigma), Eppendorf AG, Repligen Corporation, 3M Company, Entegris, Inc., Saint-Gobain Performance Plastics, Parker Hannifin Corporation, Avantor, Inc., and Meissner Filtration Products, Inc.

Which region dominated the global single-use bioprocessing market share?

North America held the dominating position in single-use bioprocessing industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of single-use bioprocessing during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global single-use bioprocessing industry?

The current trends and dynamics in the single-use bioprocessing industry include increasing demand for biopharmaceuticals and personalized medicine, cost-effectiveness and reduced risk of cross-contamination, and growing adoption of single-use technologies by biopharmaceutical manufacturers.

Which workflow held the maximum share in 2022?

The upstream workflow held the maximum share of the single-use bioprocessing industry.