Silver Wound Dressing Market | Acumen Research and Consulting

Silver Wound Dressing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

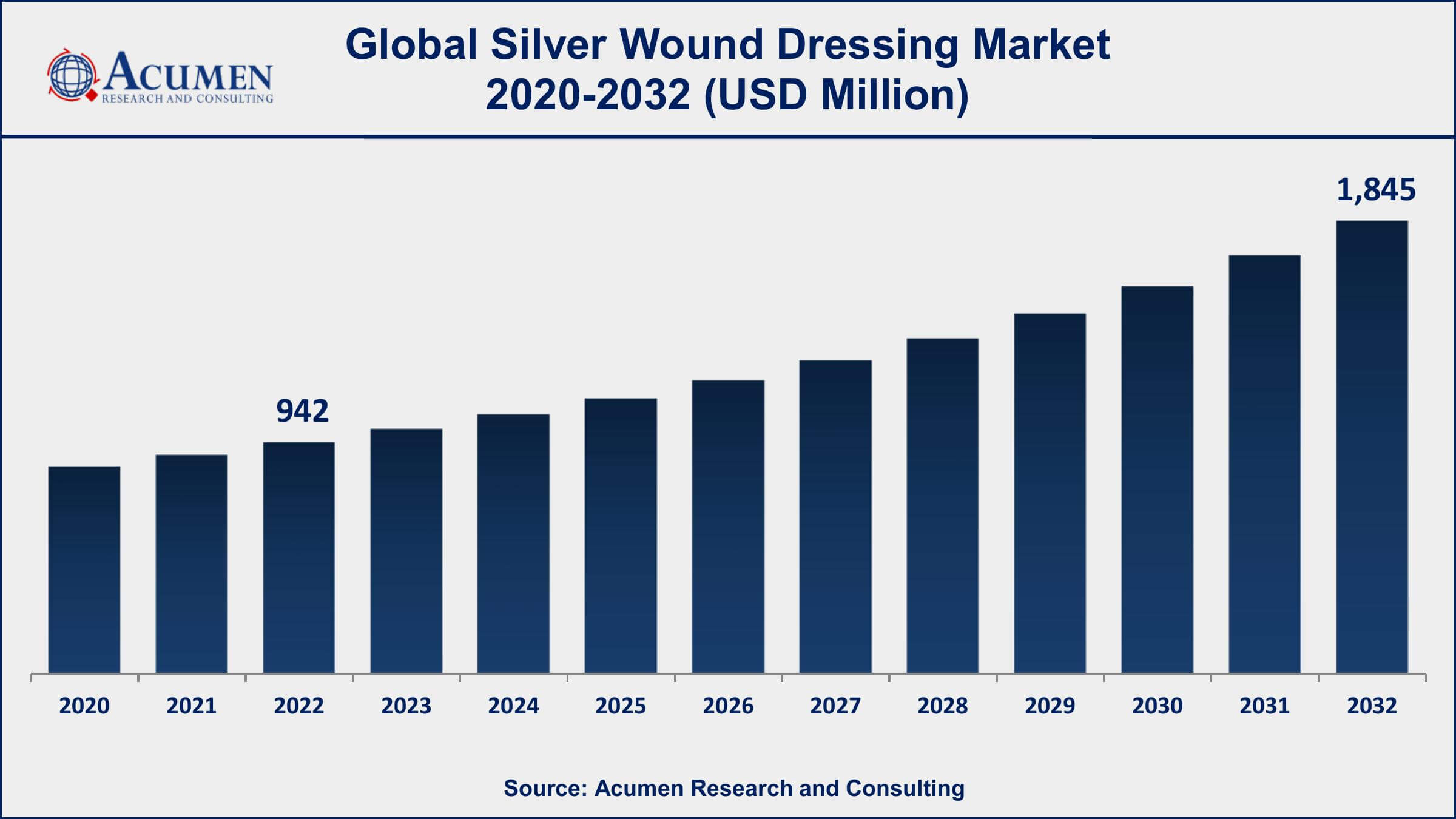

The Global Silver Wound Dressing Market Size accounted for USD 942 Million in 2022 and is projected to achieve a market size of USD 1,845 Million by 2032 growing at a CAGR of 6.4% from 2023 to 2032.

Silver Wound Dressing Market Key Highlights

- Global silver wound dressing market revenue is expected to increase by USD 1,845 Million by 2032, with a 6.4% CAGR from 2023 to 2032

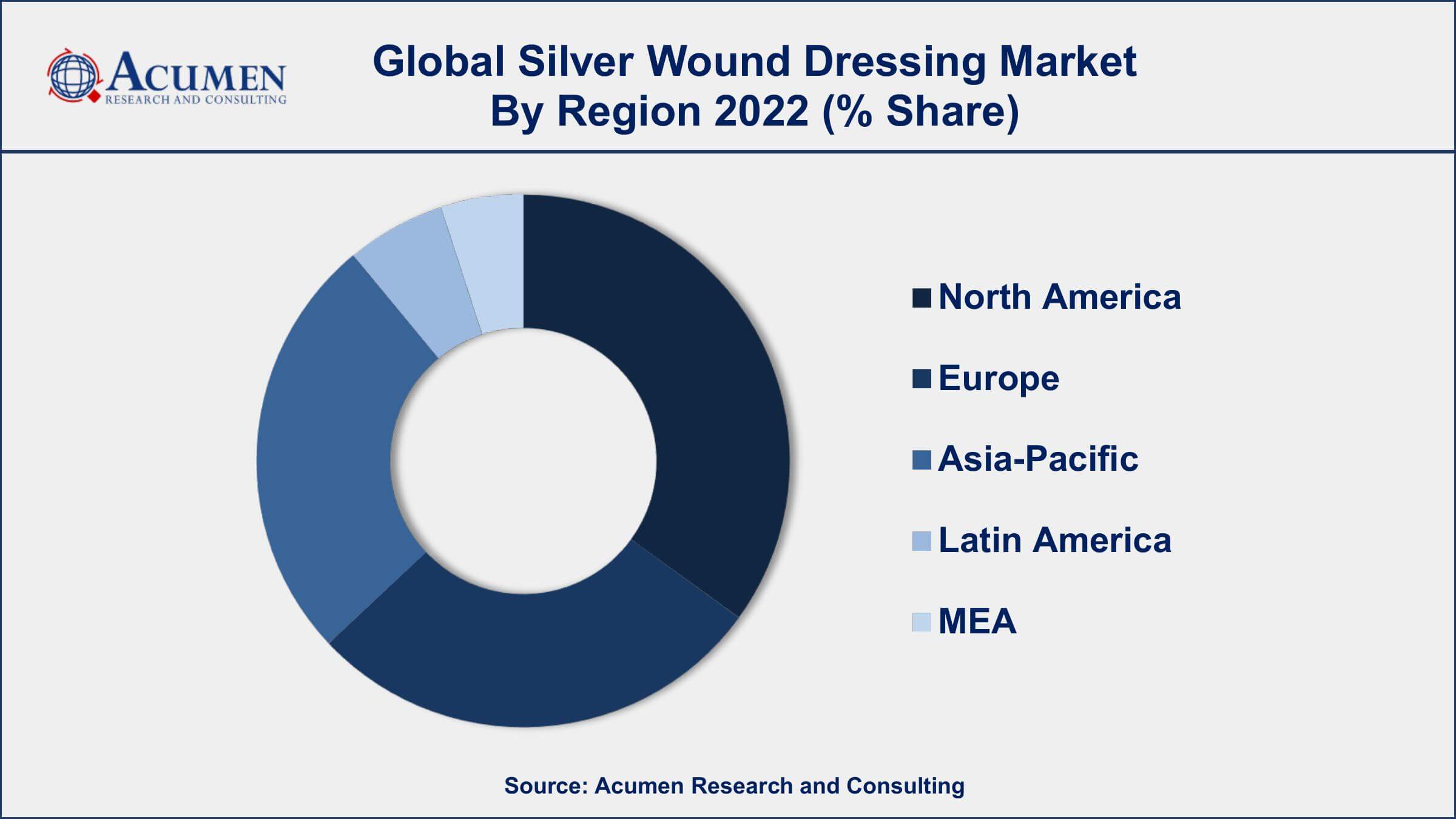

- North America region led with more than 42% of silver wound dressing market share in 2022

- Asia-Pacific silver wound dressing market growth will record a CAGR of over 7% from 2023 to 2032

- According to one study, approximately 180,000 people die each year as a result of burns worldwide, with over 486,000 individuals hospitalized in the United States alone.

- Research published in the Journal of Wound Care found that silver wound dressings reduced the incidence of wound infection by up to 38%.

- Silver wound dressings are extensively used in the treatment of burns, diabetic ulcers, and surgical wounds.

- Increasing prevalence of chronic wounds and diabetes-related ulcers, drives the silver wound dressing market value

Silver wound dressings are a type of wound care product that contains silver, a natural antimicrobial agent that can help to prevent infection and promote healing in wounds. These dressings may be made from a variety of materials, including foam, hydrocolloid, and alginate, and can be used to treat a wide range of wounds, including burns, ulcers, and surgical wounds.

In recent years, the market for silver wound dressings has experienced significant growth, driven in part by an increase in the number of people with chronic wounds and an aging population. The growth of the silver wound dressing market can also be attributed to the increasing demand for advanced wound care products that are effective, safe, and easy to use. Silver wound dressings offer several advantages over traditional wound care products, including the ability to reduce the risk of infection, promote faster healing, and reduce the need for frequent dressing changes. As a result, they have become an important tool in the management of chronic wounds and are increasingly being used in hospitals, clinics, and home care settings around the world.

Global Silver Wound Dressing Market Trends

Market Drivers

- Increasing prevalence of chronic wounds and diabetes-related ulcers

- Growing geriatric population

- Advancements in wound care technology

- Rise in healthcare expenditure

- Increasing awareness about wound care management

Market Restraints

- High cost of silver wound dressings

- Availability of alternative wound care products

Market Opportunities

- Rising demand for antimicrobial wound dressings

- Growing adoption of silver wound dressings in home care settings

Silver Wound Dressing Market Report Coverage

| Market | Silver Wound Dressing Market |

| Silver Wound Dressing Market Size 2022 | USD 942 Million |

| Silver Wound Dressing Market Forecast 2032 | USD 1,845 Million |

| Silver Wound Dressing Market CAGR During 2023 - 2032 | 6.4% |

| Silver Wound Dressing Market Analysis Period | 2020 - 2032 |

| Silver Wound Dressing Market Base Year | 2022 |

| Silver Wound Dressing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Wound Type, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Smith & Nephew plc, 3M Company, Molnlycke Health Care AB, Coloplast A/S, ConvaTec Group plc, Mölnlycke Health Care AB, Medline Industries, Inc., B. Braun Melsungen AG, Acelity L.P. Inc., PAUL HARTMANN AG, Hollister Incorporated, and DermaRite Industries, LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Silver wound dressings are potent anti-microbial and are widely used to assist in the management of wounds that are associated with the risk of infection. Silver wound dressings have a variety of clinical uses owing to the technological innovations and differences in the nature of silver content involved. Using silver in wound dressings offers anti-microbial activity and includes antibiotic-resistant bacteria. Silver wound dressings are easier to apply, need less frequent dressing changes, provide sustained availability of required silver, and provide the additional advantage of excessive exudates, facilitation of autolytic debridement along with maintenance of moist wound environment. Generally, silver wound dressings are used in the treatment of chronic and acute wound infections. Silver wound dressings are available in the market in different variants including films, pads, and bandages along with combined wound dressings such as calcium alginate for efficient moister retention and wound healing properties. Silver wound dressings have the capability of faster wound healing and efficient health recovery and thus are majorly used and preferred by healthcare practitioners and patients, globally. The active agent in the silver wound dressings is silver ions which are effective in killing microbes by blocking the respiratory enzyme system and remaining non-toxic to human tissues. Silver wound dressings find major applications in the treatment of chronic injuries and burns. Silver in silver wound dressings differs from antibiotics since it has many sites of antimicrobial action on target cells and thus reduces the risk of bacterial resistance. Hence, antiseptics control the bioburden in wounds and also limit exposure to antibiotics, thus reducing the risk of further antibiotic resistance.

Currently, the use of silver wound dressings is prominent in inpatient and outpatient healthcare applications since they are widely used in the treatment of burns and chronic wounds. Moreover, increasing occurrences of sports injuries coupled with rising investments in medical expenditures incurred by governments of various economies are some other key factors fuelling the overall growth of the global silver wound dressing market value. Also, the increasing susceptibility of the aging population towards foot ulcers, diabetic ulcers, and lesions is another key aspect fuelling the growth of the overall market. Furthermore, growing health awareness, increasing disposable incomes in developing economies such as China, India, Indonesia, Argentina, etc. coupled with growth in the geriatric population along with evolution in technological advancements are some major factors anticipated to drive the global silver wound dressings market over the forecast period. However, the increasing uses of technologically advanced tissue-engineered wound management dressings as well as lack of efficacy, research, and safety concerns related to silver wound dressings coupled with high cost in development are some major elements hampering the growth of the global silver wound dressing industry.

Silver Wound Dressing Market Segmentation

The global silver wound dressing market segmentation is based on product type, wound type, end-user, and geography.

Silver Wound Dressing Market By Product Type

- Silver Alginate Dressings

- Silver Foam Dressings

- Silver Hydrocolloid Dressings

- Silver Nitrate Dressings

- Silver Plated Dressings

- Others

According to the silver wound dressing industry analysis, the silver hydrocolloid dressings segment accounted for the largest market share in 2022. Silver hydrocolloid dressings are a type of silver wound dressing that is made of a hydrocolloid material infused with silver ions. They are designed to provide a moist wound environment while also offering antimicrobial properties to help prevent infections. The silver hydrocolloid dressings segment is expected to experience significant growth in the silver wound dressing market. One of the key drivers of this growth is the increasing demand for advanced wound care products that offer effective and safe wound healing. Silver hydrocolloid dressings are becoming increasingly popular due to their ability to provide a moist wound-healing environment while also offering antimicrobial properties that can help prevent infections.

Silver Wound Dressing Market By Wound Type

- Chronic wounds

- Acute wounds

- Surgical wounds

- Burn wounds

- Others

In terms of wound types, the chronic wounds segment is expected to witness significant growth in the coming years. Chronic wounds are wounds that have not healed in a timely manner, often lasting for several weeks or months. These wounds can be caused by a variety of factors, including diabetes, poor circulation, and pressure ulcers. The increasing prevalence of chronic wounds is one of the key factors driving growth in the silver wound dressing market. The aging population, along with the growing incidence of obesity and diabetes, is contributing to a rise in chronic wound cases. This has created a need for advanced wound care products, such as silver wound dressings, that can help to promote healing and prevent infections.

Silver Wound Dressing Market By End-user

- Hospitals

- Clinics

- Homecare settings

- Ambulatory surgical centers

- Others

According to the silver wound dressing market forecast, the homecare settings segment is expected to witness significant growth in the coming years. Home care settings refer to the care provided to patients in their own homes by healthcare professionals or family members. There is a growing trend towards home care settings, as more patients prefer to receive care in the comfort of their own homes. This has created a need for advanced wound care products that can be easily used in a home care setting. Silver wound dressings are particularly well-suited to home care settings because they are easy to use and offer effective wound healing. They do not require frequent dressing changes, which can be inconvenient for patients and caregivers, and they can be applied quickly and easily.

Silver Wound Dressing Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Silver Wound Dressing Market Regional Analysis

North America dominates the silver wound dressing market for several reasons. One of the key factors contributing to this dominance is the high prevalence of chronic wounds in the region. According to the CDC, over 6 million people in the US suffer from chronic wounds, including diabetic ulcers, pressure ulcers, and venous leg ulcers. This has created a significant demand for advanced wound care products, such as silver wound dressings that can help to promote healing and prevent infections. Another factor contributing to North America's dominance in the silver wound dressing market is the presence of well-established healthcare infrastructure and reimbursement policies. The region has a highly developed healthcare system, with advanced hospitals and medical centers equipped with the latest technologies and wound care products. Additionally, many insurance providers in the region cover the cost of silver wound dressings, making them more accessible to patients in need.

Silver Wound Dressing Market Player

Some of the top silver wound dressing market companies offered in the professional report includes Smith & Nephew plc, 3M Company, Molnlycke Health Care AB, Coloplast A/S, ConvaTec Group plc, Mölnlycke Health Care AB, Medline Industries, Inc., B. Braun Melsungen AG, Acelity L.P. Inc., PAUL HARTMANN AG, Hollister Incorporated, and DermaRite Industries, LLC.

Frequently Asked Questions

What was the market size of the global silver wound dressing in 2022?

The market size of silver wound dressing was USD 942 Million in 2022.

What is the CAGR of the global silver wound dressing market from 2023 to 2032?

The CAGR of silver wound dressing is 6.4% during the analysis period of 2023 to 2032.

Which are the key players in the silver wound dressing market?

The key players operating in the global market are including Smith & Nephew plc, 3M Company, Molnlycke Health Care AB, Coloplast A/S, ConvaTec Group plc, Mölnlycke Health Care AB, Medline Industries, Inc., B. Braun Melsungen AG, Acelity L.P. Inc., PAUL HARTMANN AG, Hollister Incorporated, and DermaRite Industries, LLC.

Which region dominated the global silver wound dressing market share?

North America held the dominating position in silver wound dressing industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of silver wound dressing during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global silver wound dressing industry?

The current trends and dynamics in the silver wound dressing industry include increasing prevalence of chronic wounds and diabetes-related ulcers, and rising demand for antimicrobial wound dressings.

Which type held the maximum share in 2022?

The burn wounds type held the maximum share of the silver wound dressing industry.