Silicon Fertilizer Market | Acumen Research and Consulting

Silicon Fertilizer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

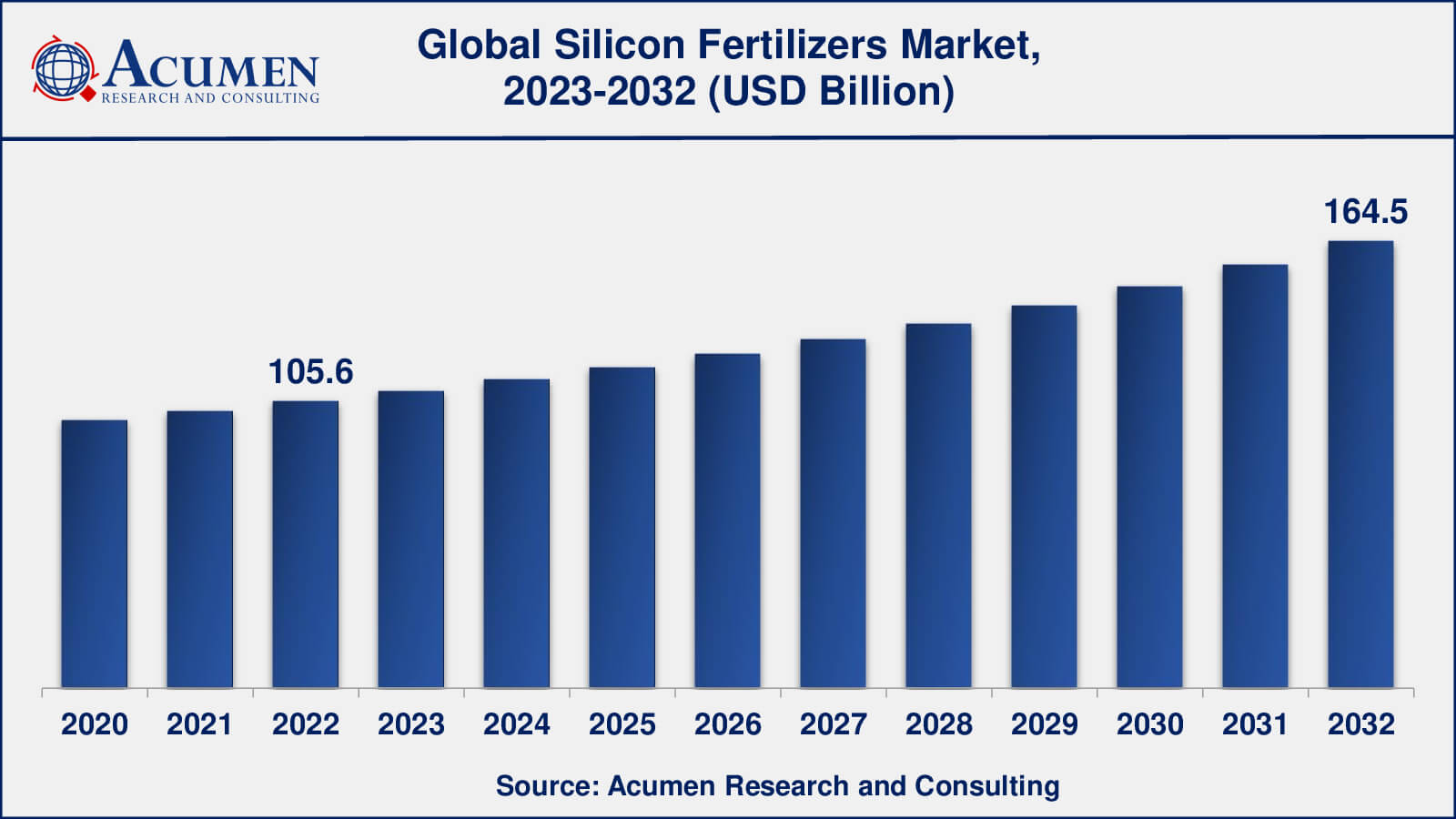

The Global Silicon Fertilizer Market Size accounted for USD 105.6 Billion in 2022 and is estimated to achieve a market size of USD 164.5 Billion by 2032 growing at a CAGR of 4.6% from 2023 to 2032.

Silicon Fertilizer Market Highlights

- Global silicon fertilizer market revenue is poised to garner USD 164.5 billion by 2032 with a CAGR of 4.6% from 2023 to 2032

- Asia-Pacific silicon fertilizer market value occupied almost USD 40 billion in 2022

- Asia-Pacific silicon fertilizer market growth will record a CAGR of over 5% from 2023 to 2032

- Among form, the liquid sub-segment generated over US$ 14.4 billion revenue in 2022

- Based sales channel, the OEM sub-segment generated around 65% share in 2022

- Increasing investment in R&D is a popular silicon fertilizer market trend that fuels the industry demand

Silicon is a chemical component symbolically known as Si. Silicon exists in soil and glass and is the best semiconductor material in electronic mechanisms. In its purest form, silicon is a metal-like constituent with an appearance and weight fairly reminiscent of aluminum. In its actual state, silicon appears inevitable with other elements in the form of composites. It is plentiful in the crust of the earth. The major applications of silicon include motor squares, dynamos, machine instruments, and others. Silicon is the base material for PC chips and microelectronics.

Global Silicon Fertilizer Market Dynamics

Market Drivers

- Increasing demand for higher crop yields

- Rising demand for organic food

- Growing need to reduce the use of chemical fertilizers

- Surging research and development activities

Market Restraints

- High cost

- Limited awareness

- Inconsistent results

Market Opportunities

- Increasing demand for bio-stimulants

- Emergence of new application methods

- Adoption in developing countries

Silicon Fertilizer Market Report Coverage

| Market | Silicon Fertilizer Market |

| Silicon Fertilizer Market Size 2022 | USD 105.6 Million |

| Silicon Fertilizer Market Forecast 2032 | USD 164.5 Million |

| Silicon Fertilizer Market CAGR During 2023 - 2032 | 4.6% |

| Silicon Fertilizer Market Analysis Period | 2020 - 2032 |

| Silicon Fertilizer Market Base Year | 2022 |

| Silicon Fertilizer Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Form, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Denka Co. Ltd., Goodearth Resources Sdn Bhd, Plant Tuff Inc., Fertipower Norway, Agripower, Fuji Silysia Chem, Fubang Fertilizer, MaxSil, Ignimbrite, Yara International ASA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Silicon Fertilizer Market Insights

Since silicon fertilizers exist in the earth's covering, plants can gather them in expansive fixations, such as macronutrients. In spite of plenteous advantages in agriculture, silicon is usually not considered a fundamental plant component. Naturally, silicon occurs as oxides (silica) and silicates and is utilized as fertilizer owing to its property of nourishing crops and being resistant to several plant diseases. However, due to a lack of awareness, silicon fertilizers are not yet extensively used in agriculture and are considered modern agricultural technology, and are currently likely to restrict market growth. Silicon showcases great outcomes in the development of plant roots, thus allowing better root resistance and rapid growth in drought conditions. With the adoption of modern farming mechanisms, the demand for silicon fertilizers is expected to grow considerably.

Silicon Fertilizer Market, By Segmentation

The worldwide market for silicon fertilizer is split based on type, form, application, and geography.

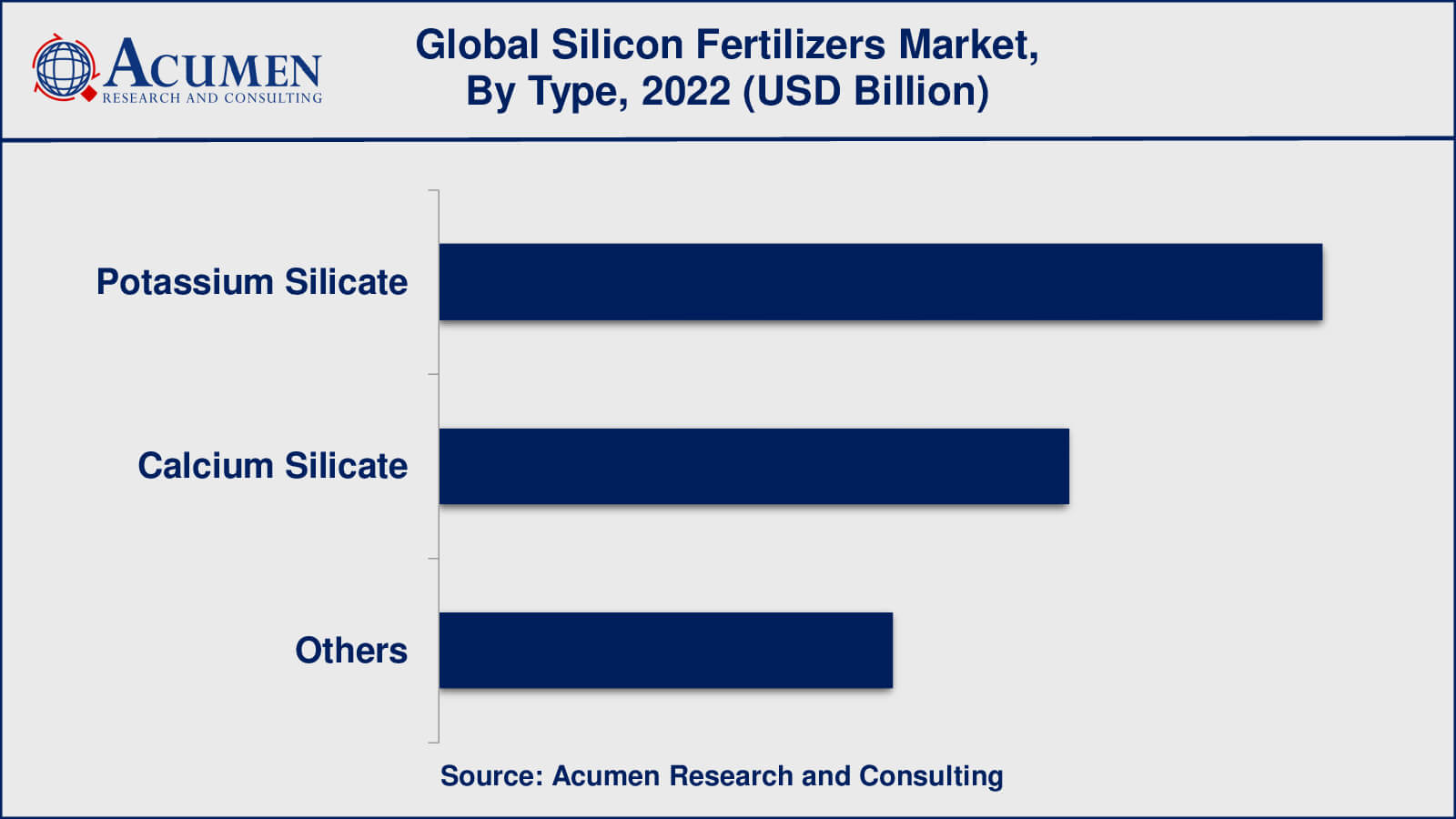

Silicon Fertilizers Market, By Type

- Potassium Silicate

- Calcium Silicate

- Others

As per the silicon fertilizer industry analysis, potassium silicate dominated the silicon fertilizer market in terms of type. Potassium silicate is a commonly used form of silicon fertilizer due to its high solubility, which makes it simpler for plants to absorb. Moreover, it offers plants with both potassium and silicon, which are necessary elements for plant growth and development. Calcium silicate is also a significant type of silicon fertilizer, but its use is relatively speaking less than potassium silicate because of its lower solubility and slower release rate. Other types of silicon fertilizers, such as sodium silicate and magnesium silicate, have also been created, but their market share is comparatively small in comparison to potassium silicate and calcium silicate.

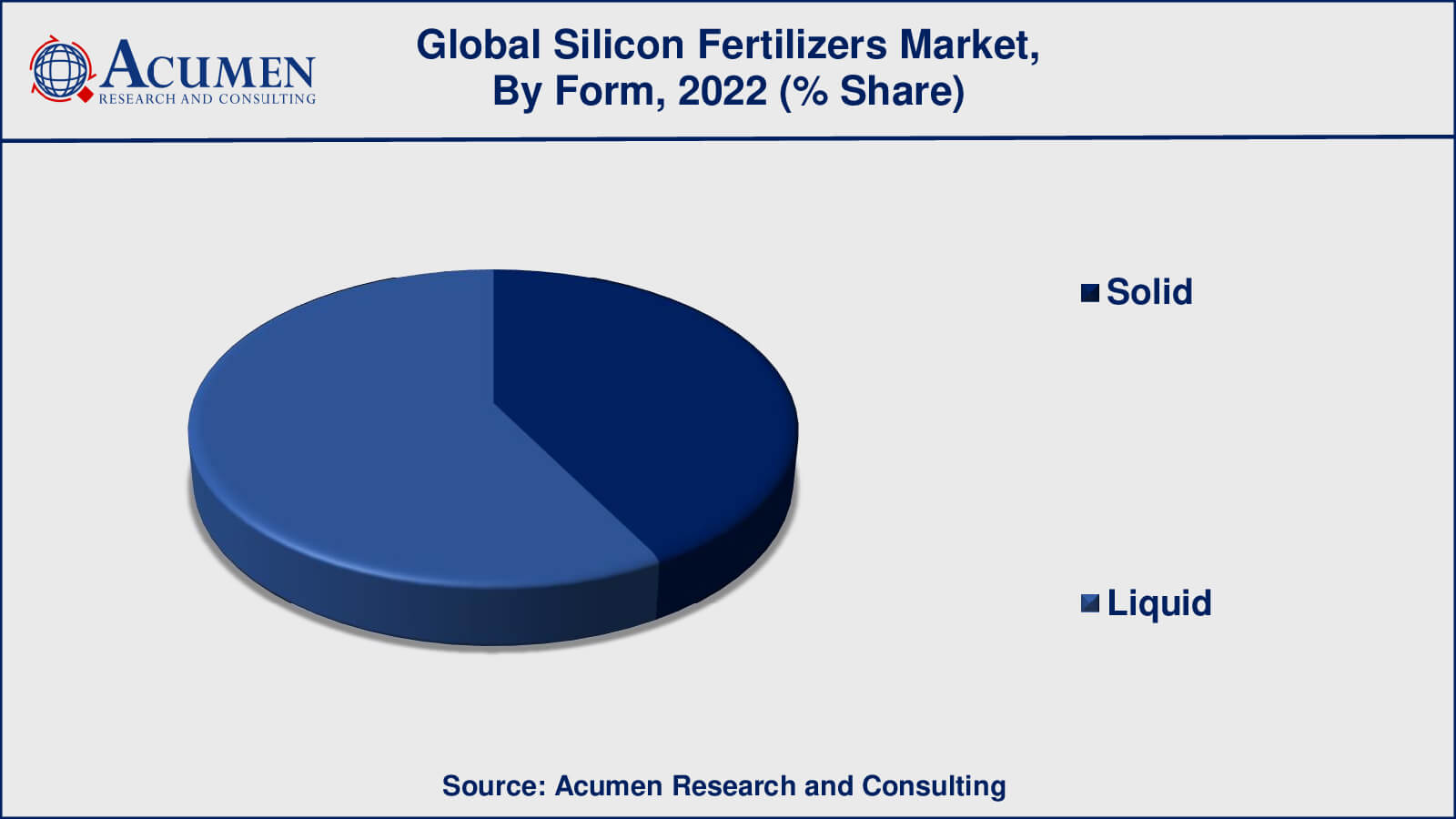

Silicon Fertilizers Market, By Form

- Solid

- Liquid

The liquid form of silicon fertilizer dominated the industry in terms of market share. The liquid form of silicon fertilizer is preferred by many farmers as it is easier to apply and provides a more uniform distribution of the fertilizer across the field. Furthermore, because liquid silicon fertilizers can be easily mixed with other liquid fertilizers or pesticides, they are a more convenient option for farmers. Solid silicon fertilizers, on the other hand, have a slower release rate and require more effort to apply evenly across the field, making them less popular among farmers. However, the use of solid silicon fertilizers is growing, particularly in areas where water scarcity is a concern, because solid fertilizers can be more water efficient.

Silicon Fertilizers Market, By Application

- Hydroponics

- Horticultural Crops

- Field Crops

- Others

According to the silcion fertilizer market forecast, the horticultural crops sub-segment is expected to dominate the industry. Fruits, vegetables, and ornamental plants all require a high level of nutrients, including silicon, to grow and develop properly. As a result, silicon fertilizers are commonly used in crop production to improve crop quality, yield, and overall health. Field crops, such as cereals, grains, and oilseeds, are also big users of silicon fertilizers because it helps them withstand abiotic stresses like drought, salinity, and heavy metal toxicity. Silicon fertilizers have also become more popular in hydroponic systems in recent years, as they can improve nutrient uptake and plant growth in soilless culture systems. Turf and ornamental plants, greenhouse crops, and silage production are some of the other uses for silicon fertilizers.

Silicon Fertilizers Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Silicon Fertilizer Market Regional Analysis

Asia-Pacific is considered the largest region in the global silicon fertilizer market, accounting for a significant market share. This is due to the region's large agricultural sector, growing population, and increasing food demand, which has resulted in a greater demand for effective fertilizers to improve crop yields. Additionally, countries such as China and India are major producers and consumers of silicon fertilizers, driving market growth in the region.

The North American market for silicon fertilizers is expected to grow due to the increasing demand for organic food and sustainable agriculture. The US and Canada are the major markets in the region, and the adoption of silicon fertilizers is expected to increase as farmers become more aware of their benefits.

The European market for silicon fertilizers is expected to grow due to the increasing demand for bio-stimulants and sustainable agriculture practices. The region is also experiencing a shift towards organic farming, which is expected to drive the adoption of silicon fertilizers.

Silicon Fertilizer Market Players

Some of the top silicon fertilizer companies offered in the professional report include BASF SE, Denka Co. Ltd., Goodearth Resources Sdn Bhd, Plant Tuff Inc., Fertipower Norway, Agripower, Fuji Silysia Chem, Fubang Fertilizer, MaxSil, Ignimbrite, Yara International ASA.

Frequently Asked Questions

What was the market size of the global silicon fertilizer in 2022?

The market size of silicon fertilizer was USD 105.6 billion in 2022.

What is the CAGR of the global silicon fertilizer market from 2023 to 2032?

The CAGR of silicon fertilizer is 4.6% during the analysis period of 2023 to 2032.

Which are the key players in the silicon fertilizer market?

The key players operating in the global silicon fertilizer market are including BASF SE, Denka Co. Ltd., Goodearth Resources Sdn Bhd, Plant Tuff Inc., Fertipower Norway, Agripower, Fuji Silysia Chem, Fubang Fertilizer, MaxSil, Ignimbrite, Yara International ASA.

Which region dominated the global silicon fertilizer market share?

Asia-Pacific held the dominating position in silicon fertilizer industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of silicon fertilizer during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global silicon fertilizer industry?

The current trends and dynamics in the silicon fertilizer industry include increasing demand for higher crop yields, rising demand for organic food, and growing need to reduce the use of chemical fertilizers.

Which type held the maximum share in 2022?

The potassium silicate type held the maximum share of the silicon fertilizer industry.