Shrimp Feed Market | Acumen Research and Consulting

Shrimp Feed Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

The Shrimp Feed Market Size accounted for USD 4.4 Billion in 2022 and is estimated to achieve a market size of USD 7.4 Billion by 2032 growing at a CAGR of 5.4% from 2023 to 2032.

Shrimp Feed Market Highlights

- Global shrimp feed market revenue is poised to garner USD 7.4 billion by 2032 with a CAGR of 5.4% from 2023 to 2032

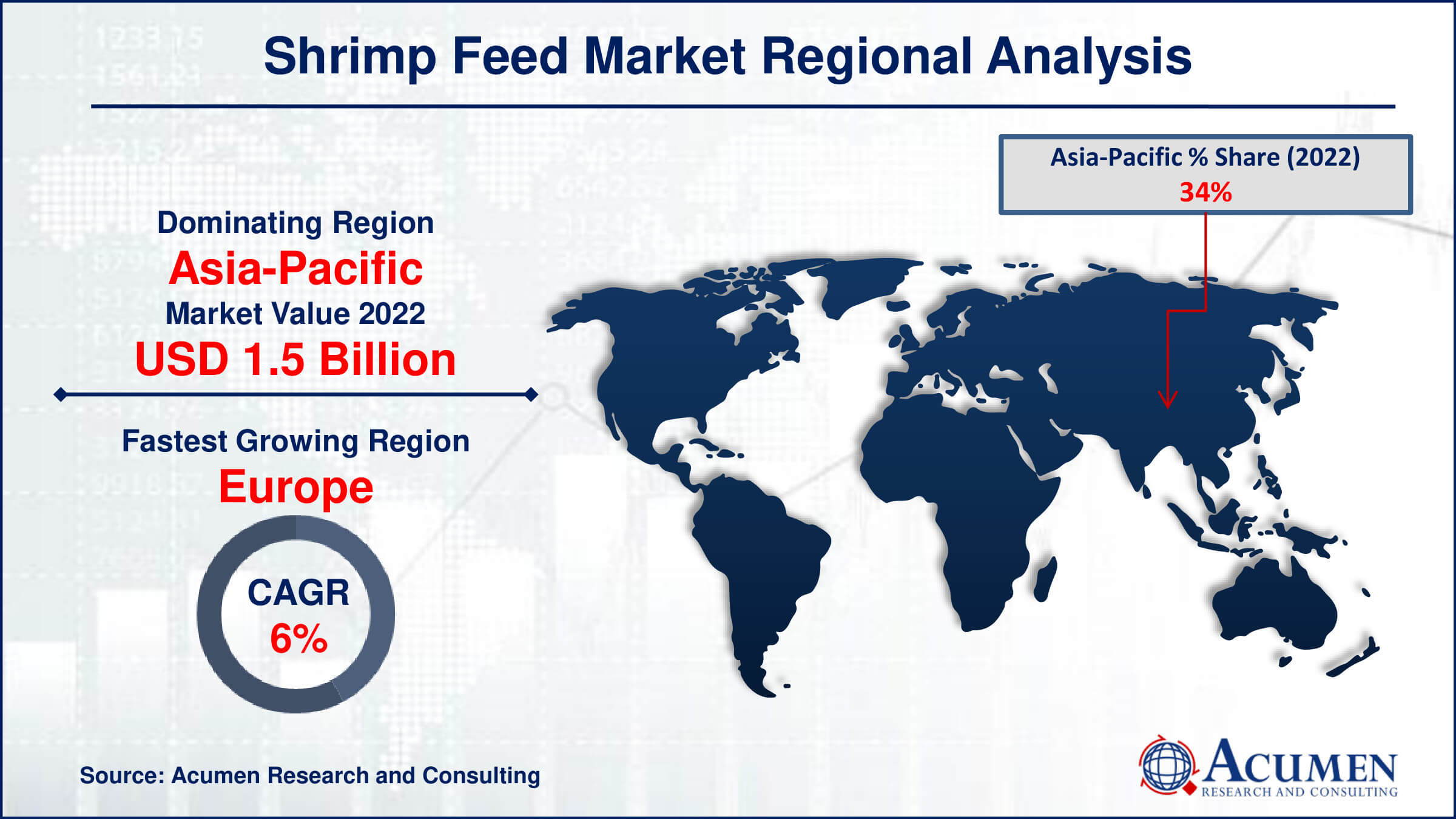

- Asia Pacific shrimp feed market value occupied around 34% market share in 2022

- Europe shrimp feed market growth will record a CAGR of more than 6% from 2023 to 2032

- Among type, grower feed sub-segment generated 44% market share in 2022

- Based on ingredients, the fish meal based feed sub-segment generating 38%market share in 2022

- Development of sustainable and eco friendly feed options is becoming a popular shrimp feed market trend

Shrimp feed is a specialized type of animal feed formulated to meet the nutritional requirements of shrimp in aquaculture systems. It typically consists of a balanced mixture of proteins, carbohydrates, lipids, vitamins, and minerals modified to the specific needs of shrimp species at different growth stages. Shrimp feed is essential for promoting healthy growth, maximizing feed conversion efficiency, and ensuring optimal production in shrimp farming operations. It is typically provided in pellet or granule form and can be customized based on factors such as shrimp species, size, and environmental conditions. Proper application of shrimp feed involves regular feeding schedules, monitoring of feed consumption, and adjusting feeding rates based on shrimp growth and water quality parameters to achieve optimal results in terms of growth, health, and overall productivity of the shrimp farming operation.

Global Shrimp Feed Market Dynamics

Market Drivers

- Rising demand for shrimp products

- Technological advancements in feed formulations

- Intensive shrimp farming practices

Market Restraints

- Fluctuations in cost of raw materials

- Disease occurrence in shrimp farms

Market Opportunities

- Expansion of aquaculture industries

- Rising seafood consumption

Shrimp Feed Market Report Coverage

| Market | Shrimp Feed Market |

| Shrimp Feed Market Size 2022 | USD 4.4 Billion |

| Shrimp Feed Market Forecast 2032 |

USD 7.4 Billion |

| Shrimp Feed Market CAGR During 2024 - 2032 | 4.2% |

| Shrimp Feed Market Analysis Period | 2020 - 2032 |

| Shrimp Feed Market Base Year |

2022 |

| Shrimp Feed Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Ingredient, By Additive, By Shrimp Specie, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cargill Incorporated, Guangdong Yuehai Feeds Group Co., Ltd., Charoen Pokphand Group Company, Ltd., Nutreco N.V., BioMar Group A/S, Nutreco N.V., BioMar Group A/S, BernAqua., Avanti, and CP Aquaculture. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Shrimp Feed Market Insights

The rising demand for shrimp products drives the growth of shrimp feed market. This growth can be attributed to several factors including rising consumer preference for shrimp-based dishes, especially in emerging economies, as well as the expanding aquaculture industry. Shrimp farmers are increasingly recognizing the importance of high-quality feed to ensure optimal growth rates, disease resistance, and overall health of their shrimp stocks. For instance, Avansya, the collaboration between Cargill and DSM-Firmenich, declared that the EverSweet stevia sweetener has garnered favorable safety assessments from both the European Food Safety Authority (EFSA) and the UK Food Standards Agency (FSA) on 24 January 2024. This advancement moves the innovative sweetener nearer to becoming commercially accessible in the European Union and the UK. Consequently, there has been a surge in the development and adoption of specialized shrimp feed formulations that are modified to meet the nutritional requirements of different shrimp species at various growth stages. Additionally, technological advancements in feed manufacturing processes and intensive shrimp farming practices further driving market expansion.

Additionally, fluctuations in the cost of raw materials significantly hinder the growth of the shrimp feed market. Shrimp feed production heavily depend on ingredients such as fishmeal, soybean meal, and wheat, all of which are susceptible to price volatility driven by factors like weather conditions, global demand, and geopolitical tensions. These fluctuations directly impact production costs, decrease profit margins for feed manufacturers and potentially leading to increased prices for consumers. Moreover, disease occurrence in shrimp farms further make a barrier in the shrimp feed market.

Additionally, the expansion of the aquaculture industry presents a significant opportunity for the shrimp feed market. With the growing demand for seafood and decreasing wild fish stocks, aquaculture has become a key solution to meet global protein needs. Shrimp farming, in particular, has seen remarkable growth due to its high demand and profitability. For instance, on November 9, 2023, Trouw Nutrition, a key division of Nutreco specializing in functional and nutritional solutions for sustainable livestock farming, achieved a significant milestone in its mission to support farmers in operating more efficiently and sustainably, thereby promoting advancements in sustainable dairy farming practices. To sustain this growth, the aquaculture sector requires high-quality, nutritious feeds modified specifically for shrimp. This demand has spurred innovation in the shrimp feed market, with companies developing specialized formulations to optimize shrimp growth, health, and product quality. As a result, seafood consumption is also became an opportunity for the shrimp feed market in the coming years.

Shrimp Feed Market Segmentation

The worldwide market for shrimp feed is split based on type, ingredient, additive, and geography.

Shrimp Feed based on Type

- Starter Feeds

- Grower Feeds

- Finisher Feeds

According to shrimp feed industry analysis, grower feeds dominates the market in 2022. They represent an intermediate phase and maintain the nutritional requirements necessary for rapid growth. Starter feeds are the fastest-growing type in the shrimp feed market, owing to their crucial role in the early stages of shrimp growth. These feeds are specifically formulated to meet the nutritional requirements of young shrimp, promoting healthy development and rapid growth. With a balanced blend of proteins, fats, vitamins, and minerals, starter feeds enhance the overall productivity of shrimp farms. Their popularity stems from their effectiveness in boosting shrimp growth rates and improving disease resistance, making them a preferred choice among shrimp farmers worldwide. Due to these factors, starter feeds are solidifying their dominance in the market.

Shrimp Feed based on Ingredients

- Fish Meal-Based Feeds

- Soybean Meal-Based Feeds

- Plant-Based Feed

- Wheat-Based Feeds

- Corn-Based Feeds

According to the shrimp feed industry analysis, fish meal-based feeds occupied the market, due to their high protein content and nutritional value, aligning closely with the dietary needs of shrimp. Fish meal provides essential amino acids, vitamins, and minerals crucial for shrimp growth and health. Moreover, its palatability enhances feed consumption, leading to improved growth rates and overall performance in shrimp farming. Despite concerns regarding sustainability and environmental impact associated with fish meal production, its widespread availability and effectiveness continue to make it a primary choice for formulating shrimp feeds globally.

Shrimp Feed based on Additives

- Vitamins and Proteins

- Antioxidants

- Antibiotics

- Fatty Acids

- Feed Enzymes

- Others

According to the shrimp feed market forecast, shrimp feed market is anticipated to witness a notable rise in the demand for vitamins and proteins. This surge is largely attributed to increasing awareness among shrimp farmers regarding the crucial role of these nutrients in enhancing shrimp health, growth, and overall productivity. Vitamins play a vital role in supporting various physiological functions and immune responses in shrimp, while proteins are essential for muscle development and overall growth. As shrimp farming continues to expand globally, particularly in regions like Asia-Pacific and Latin America, where there is a rising demand for seafood, the need for high-quality feed containing optimal levels of vitamins and proteins is expected to drive market growth significantly.

Shrimp Feed based on Shrimp Species

- Pacific White Leg Shrimp

- Black Tiger Shrimp

- Others

According to the shrimp feed market forecast, pacific white leg shrimp is expected to dominate throughout 2023 to 2032, due to several factors. This species is favored for its fast growth rate, adaptability to various farming conditions, and high market demand. Additionally, advancements in feed formulation technology adapted to the specific nutritional requirements of Pacific white leg shrimp have contributed to its prominence. With increasing aquaculture production and expanding consumer preferences for this species, it is projected to maintain its leading position in the shrimp feed market.

Shrimp Feed Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Shrimp Feed Market Regional Analysis

In terms of shrimp feed market analysis, Asia-Pacific dominates the shrimp feed market, driven by several factors. Rapid urbanization, rising disposable incomes, and changing dietary preferences towards protein-rich diets have fueled the demand for shrimp, particularly in countries like China, India, Indonesia, Thailand, and Vietnam. Moreover, technological advancements in aquaculture practices and increasing investments in research and development have led to the development of specialized shrimp feed formulations. For instance, on december 18, 2023, in Tokyo, and Japan, Charoen Pokphand Group Company, Ltd signed a memorandum of understanding (MoU) to achieve net-zero greenhouse gas emissions by 2025 and reduce carbon dioxide emissions. Additionally, government initiatives aimed at boosting aquaculture production and addressing environmental concerns associated with shrimp farming methods have further propelled market expansion in the region. As a result, Asia-Pacific stands out as a leading region in this market.

Additionally, Europe is the fastest growing region in the shrimp feed market, driven by factors such as technological advancements in aquaculture, increasing consumer demand for seafood, and the presence of established aquaculture infrastructure. European shrimp feed market is characterized by a strong emphasis on research and development, aiming to improve feed efficiency, sustainability, and overall shrimp health, thereby maintain its position in the global market.

Additionally, North America is the second largest growing region in the shrimp feed market. The region benefits from significant shrimp farming activities, particularly in countries like the United States, Mexico, and Canada. Moreover, the availability of advanced feed formulations modified to meet the specific nutritional requirements of shrimp species further enhances the market growth.

Shrimp Feed Market Players

Some of the top shrimp feed companies offered in our report include Cargill Incorporated, Guangdong Yuehai Feeds Group Co., Ltd., Charoen Pokphand Group Company, Ltd., Nutreco N.V., BioMar Group A/S, Nutreco N.V., BioMar Group A/S, BernAqua., Avanti, and CP Aquaculture.

Frequently Asked Questions

How big is the shrimp feed market?

The shrimp feed market size was valued at USD 4.4 billion in 2022.

What is the CAGR of the global shrimp feed market from 2024 to 2032?

The CAGR of shrimp feed is 5.4% during the analysis period of 2024 to 2032.

Which are the key players in the shrimp feed market?

The key players operating in the global market are Cargill Incorporated, Guangdong Yuehai Feeds Group Co., Ltd., Charoen Pokphand Group Company, Ltd., Nutreco N.V., BioMar Group A/S, Nutreco N.V., BioMar Group A/S, BernAqua., Avanti, and CP Aquaculture.

Which region dominated the global shrimp feed market share?

Asia-Pacific held the dominating position in shrimp feed industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of shrimp feed during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global shrimp feed industry?

The current trends and dynamics in the shrimp feed market are rising demand for shrimp products, technological advancements in feed formulations, and intensive shrimp farming practices.

Which type held the maximum share in 2022?

Grower feed type held the maximum share of the shrimp feed market.