Shipbuilding Market | Acumen Research and Consulting

Shipbuilding Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

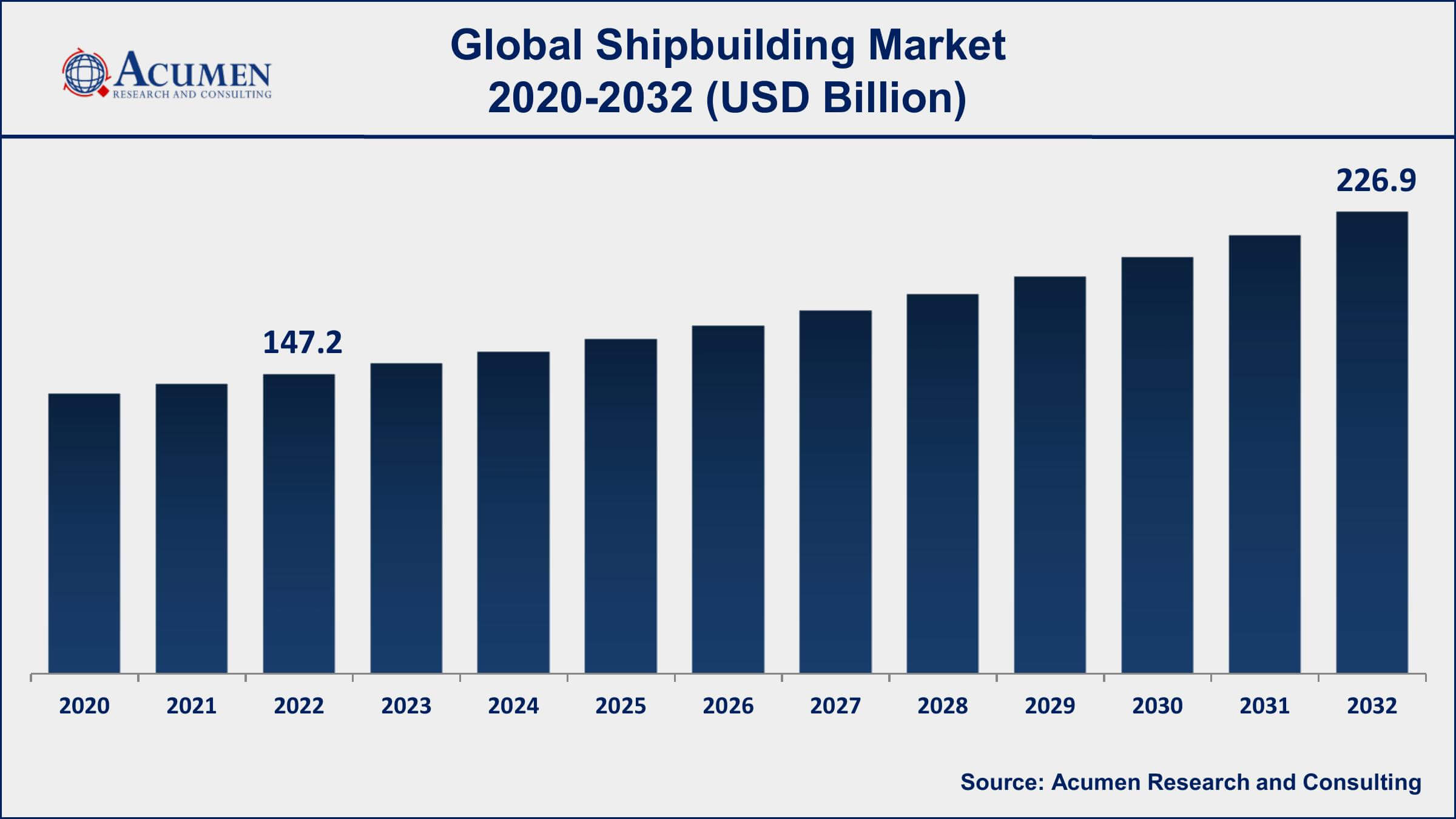

The Shipbuilding Market Size accounted for USD 147.2 Billion in 2022 and is projected to achieve a market size of USD 226.9 Billion by 2032 growing at a CAGR of 4.1% from 2023 to 2032.

Shipbuilding Market Key Highlights

- Global shipbuilding market revenue is expected to increase by USD 226.9 Billion by 2032, with a 4.1% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 75% of shipbuilding market share in 2022

- The China Association of the National Shipbuilding Industry reports that in 2020, China launched 1,116 ships with a total tonnage of 46.67 million, making it the world's second-largest shipbuilding nation after South Korea

- The most commonly built ships are bulk carriers, which account for approximately 40% of all new ships built.

- The largest container ship ever built is the HMM Algeciras, which has a capacity of 24,000 TEU (twenty-foot equivalent unit)

- Increasing international seaborne trade, drives the shipbuilding market value

Shipbuilding refers to the process of designing and constructing ships, boats, and other seafaring vessels. This includes all stages of the process, from the initial design and engineering to the final construction and outfitting of the ship. The shipbuilding industry plays a crucial role in global trade and transportation, as ships are the primary means of transporting goods and people across oceans and waterways. Additionally, the industry encompasses a range of sub-sectors, including ship repair, maintenance, and retrofitting.

In recent years, the shipbuilding industry has experienced significant growth, driven by factors such as increasing demand for shipping and rising global trade. The growth of the industry is also being fueled by the development of new technologies, such as autonomous ships and eco-friendly vessels, which are more efficient and sustainable than traditional ships. However, the industry faces challenges such as overcapacity, competition from low-cost shipbuilders, and changing regulations related to emissions and environmental impact.

Global Shipbuilding Market Trends

Market Drivers

- Growing demand for commercial vessels and offshore support vessels

- Increasing international seaborne trade

- Technological advancements and innovations in shipbuilding

- Rising demand for eco-friendly and energy-efficient ships

- Government initiatives and subsidies to support shipbuilding industry

Market Restraints

- High capital investment requirements

- Intense competition from low-cost shipbuilders in emerging economies

Market Opportunities

- Development of specialized vessels such as liquefied natural gas (LNG) carriers and cruise ships

- Adoption of digitalization and automation technologies in shipbuilding processes

Shipbuilding Market Report Coverage

| Market | Shipbuilding Market |

| Shipbuilding Market Size 2022 | USD 147.2 Billion |

| Shipbuilding Market Forecast 2032 | USD 226.9 Billion |

| Shipbuilding Market CAGR During 2023 - 2032 | 4.1% |

| Shipbuilding Market Analysis Period | 2020 - 2032 |

| Shipbuilding Market Base Year | 2022 |

| Shipbuilding Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering, China Shipbuilding Industry Corporation, Mitsubishi Heavy Industries, Samsung Heavy Industries, China State Shipbuilding Corporation, Sumitomo Heavy Industries, General Dynamics NASSCO, Fincantieri S.p.A., Tsuneishi Shipbuilding Co., Ltd., Imabari Shipbuilding Co., Ltd., and Kawasaki Heavy Industries. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The shipbuilding industry is crucially responsible for the construction and designing of ocean-going vessels across the globe. The global shipbuilding industry is currently involved in the modification and construction of ships. These construction and modification operations are carried out in shipyards with specialized facilities. The shipbuilding industry involves building ships to be used for military as well as commercial purposes across the globe. Most of the ship production in the world is witnessed in developing Asian countries such as Japan, China, South Korea, and India but large shipyards are also present in various other countries. The shipbuilding market is considered one of the most open, highly competitive, and oldest markets in the world. Also, the market has wide experience in surviving slumps and peaks in the economy. Government support and strong political stability are of crucial importance for the shipbuilding industry since the market is highly capital-intensive. Some of the traditional shipbuilding companies in China, Korea, and Japan are focusing on enhancing their capabilities to provide a one-stop marine solution for both off-shore and shipbuilding. During the years of the industry boom, there were huge new vessel orders across the globe. The shipbuilding companies repair and build cargo ships, barges, passenger ships, platforms, and naval vessels which are used for gas and oil production and drilling.

Some of the key factors driving the global shipbuilding market growth include improved economic growth, global seaborne trade, an increase in steel production across the globe, and rising urbanization. Some of the noteworthy developments and trends in the global shipbuilding marketplace include advanced outfitting, green shipbuilding technology, LNG-fueled engines, wind and solar-powered ships, and ship-launching airbag. However, the rapid expansion of the global market can be influenced by environmental regulations, increased competition, and financial and political instability. The weaker demand for shipbuilding was the result of the rapid increase in the cost of shipbuilding, and the decline in the bulk carrier and containership which contributed to the decline in demand. Some of the factors such as growth in shipping confidence level, seaborne trade, and a rapid upsurge in the overall demand for eco-friendly ships are expected to support the growth of this industry. Apart from the fact that the global market is driven by various factors, there are several restraints such as ups and downs on the existing backlogs, volatile oil prices, delays in financial decisions, and increasing competition among shipbuilders in the commercial segment, financial and political instability, stringent environmental regulations and financial crisis.

Shipbuilding Market Segmentation

The global shipbuilding market segmentation is based on type, end-user, and geography.

Shipbuilding Market By Type

- Vessel

- Passenger

- Container

- Others

In terms of types, the container segment has seen significant growth in the shipbuilding market in recent years. Container ships are specialized vessels designed for the transportation of cargo in standardized containers, providing a cost-effective and efficient means of transporting goods across the world's oceans. The container segment has experienced significant growth in recent years, driven by the increase in international trade and the globalization of supply chains. The growth in the container segment has led to the development of larger and more efficient container ships, such as the Triple E class vessels that can carry up to 18,000 twenty-foot equivalent units (TEUs). These larger vessels are more fuel-efficient, reducing operating costs and environmental impact. In addition, there has been an increase in demand for eco-friendly container ships that use alternative fuels and energy sources, such as liquefied natural gas (LNG) or hybrid electric propulsion systems.

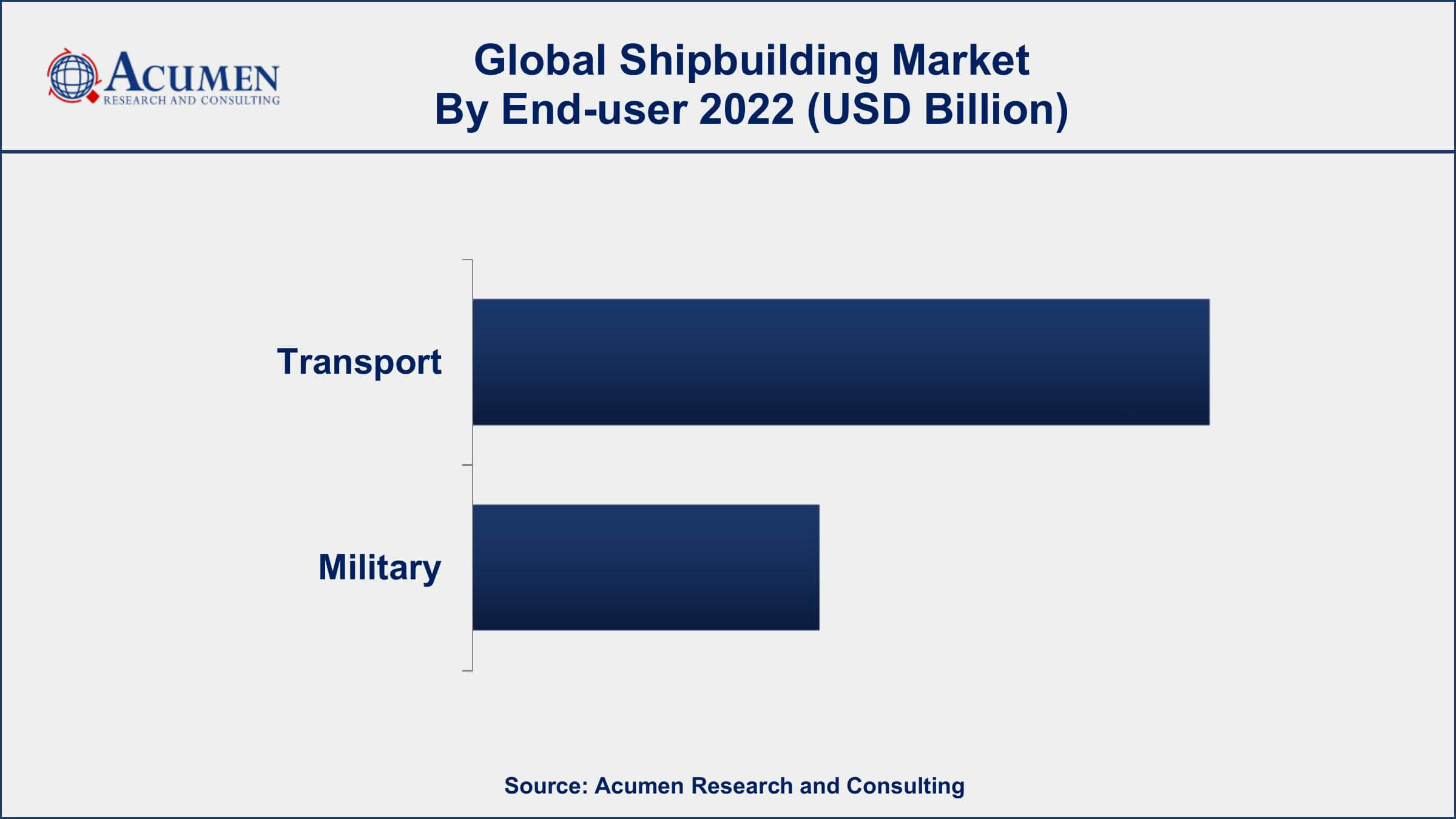

Shipbuilding Market By End-user

- Transport

- Military

According to the shipbuilding market forecast, the transport segment is expected to witness significant growth in the coming years. This includes cargo ships, tankers, passenger ferries, and other specialized vessels used in the transportation industry. The transport segment has experienced significant growth in recent years, driven by increasing global trade and the need for more efficient and sustainable transport solutions. One of the key trends in the transport segment is the development of eco-friendly and energy-efficient vessels. This includes the use of alternative fuels such as liquefied natural gas (LNG) and the adoption of hybrid or electric propulsion systems. Additionally, there has been a focus on the development of larger and more efficient vessels, such as Ultra Large Container Ships (ULCS), which can carry more cargo and reduce transportation costs. The transport segment is expected to continue to grow in the coming years, driven by the increasing demand for transportation services and the need for more efficient and sustainable vessels.

Shipbuilding Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Shipbuilding Market Regional Analysis

Asia-Pacific has emerged as the dominant region in the shipbuilding market, accounting for a significant share of global shipbuilding activities. This dominance is due to several factors, including the region's low labor costs, extensive supply chain networks, and access to advanced technologies. In addition, the region's strategic location and proximity to major shipping routes have made it an attractive location for shipbuilding activities. China, South Korea, and Japan are the leading countries in the Asia-Pacific region in terms of shipbuilding activities. These countries have established themselves as global leaders in shipbuilding, with advanced technological capabilities, high-quality standards, and a skilled workforce. The presence of major shipbuilding companies and industry clusters in these countries has also facilitated the growth of the shipbuilding industry in the region.

Shipbuilding Market Player

Some of the top shipbuilding market companies offered in the professional report include Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering, China Shipbuilding Industry Corporation, Mitsubishi Heavy Industries, Samsung Heavy Industries, China State Shipbuilding Corporation, Sumitomo Heavy Industries, General Dynamics NASSCO, Fincantieri S.p.A., Tsuneishi Shipbuilding Co., Ltd., Imabari Shipbuilding Co., Ltd., and Kawasaki Heavy Industries.

Frequently Asked Questions

How big is the shipbuilding market?

The shipbuilding market size was USD 147.2 Billion in 2022.

What is the CAGR of the global shipbuilding market from 2023 to 2032?

The CAGR of shipbuilding is 4.1% during the analysis period of 2023 to 2032.

Which are the key players in the shipbuilding market?

The key players operating in the global market are including Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering, China Shipbuilding Industry Corporation, Mitsubishi Heavy Industries, Samsung Heavy Industries, China State Shipbuilding Corporation, Sumitomo Heavy Industries, General Dynamics NASSCO, Fincantieri S.p.A., Tsuneishi Shipbuilding Co., Ltd., Imabari Shipbuilding Co., Ltd., and Kawasaki Heavy Industries.

Which region dominated the global shipbuilding market share?

Asia-Pacific held the dominating position in shipbuilding industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of shipbuilding during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global shipbuilding industry?

The current trends and dynamics in the shipbuilding industry include growing demand for commercial vessels and offshore support vessels, and increasing international seaborne trade.

Which end-user held the maximum share in 2022?

The transport end-user held the maximum share of the shipbuilding industry.