Sensors Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Sensors Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

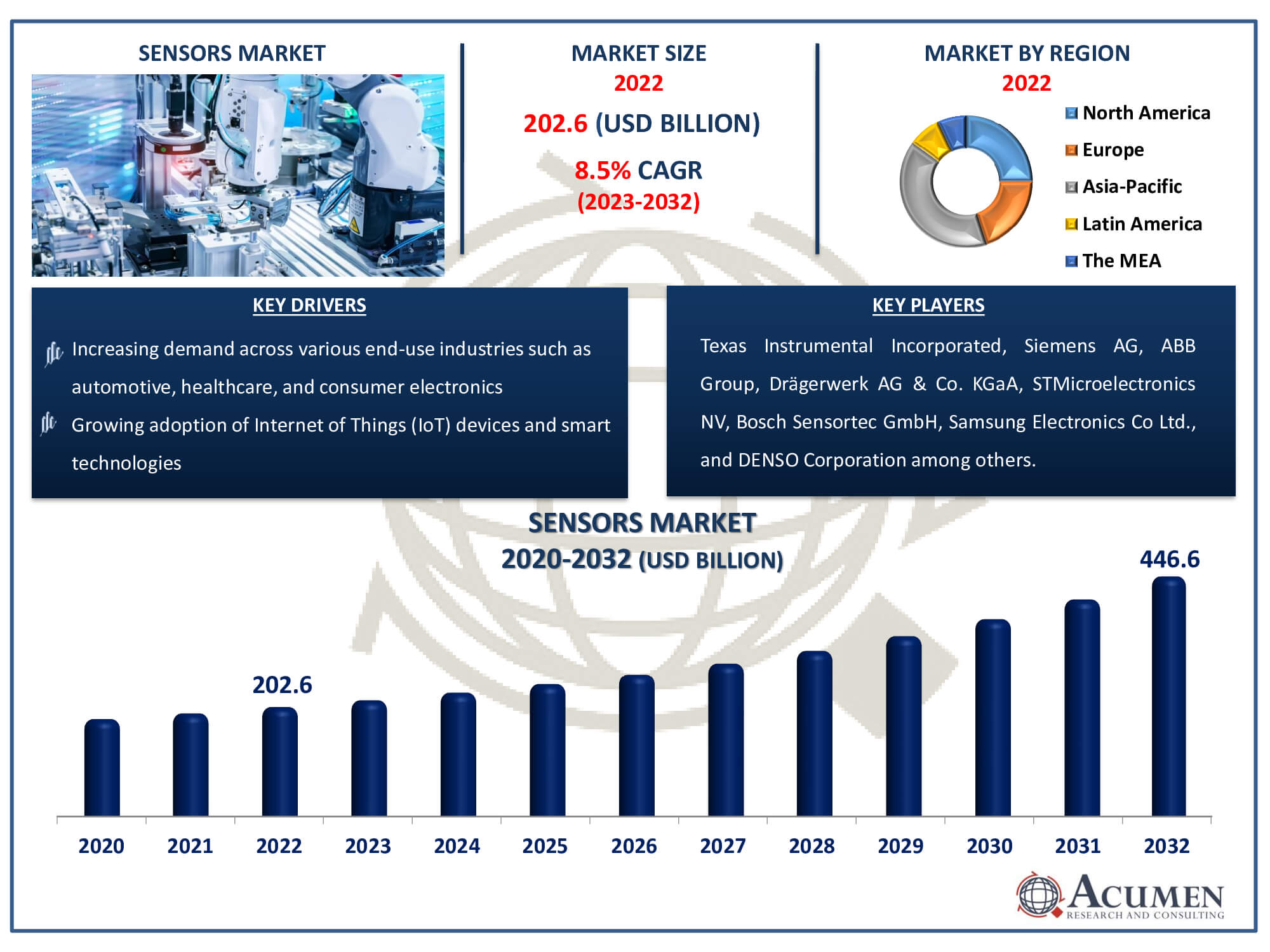

The Sensors Market Size accounted for USD 202.6 Billion in 2022 and is estimated to achieve a market size of USD 446.6 Billion by 2032 growing at a CAGR of 8.5% from 2023 to 2032.

Sensors Market Highlights

- Global sensors market revenue is poised to garner USD 446.6 billion by 2032 with a CAGR of 8.5% from 2023 to 2032

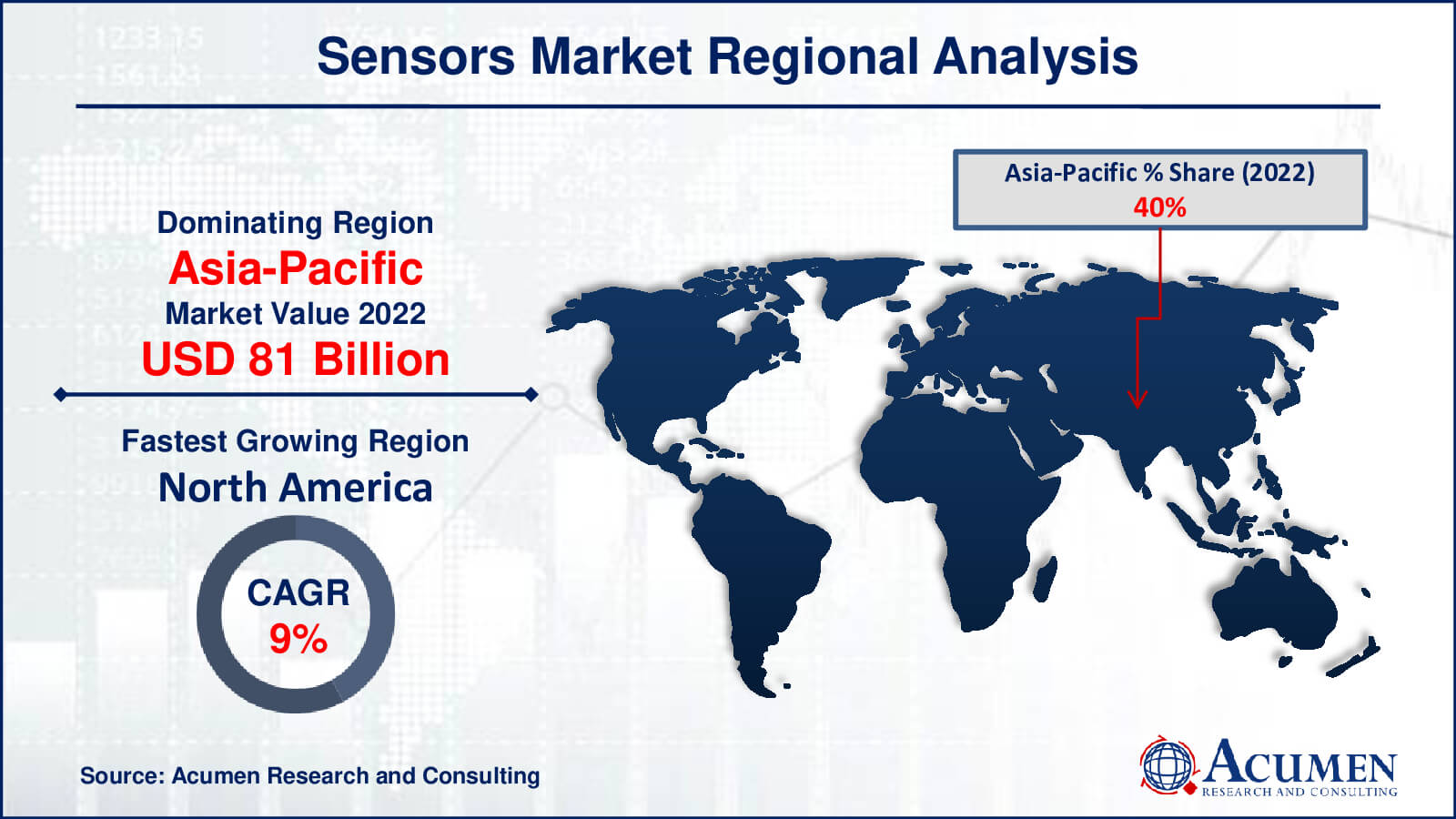

- Asia-Pacific sensors market value occupied around USD 81 billion in 2022

- North America sensors market growth will record a CAGR of more than 9% from 2023 to 2032

- Among technology, the MEMS sub-segment generated over US$ 64.8 billion revenue in 2022

- Based on end use, the electronics sub-segment generated around 50% share in 2022

- Increasing focus on environmental monitoring and sustainability initiatives is a popular sensors market trend that fuels the industry demand

At the forefront of technological innovation, the sensors market is a quickly changing sector. In a wide range of applications, such as automotive, consumer electronics, healthcare, industrial automation, and more, sensors are essential for gathering and transferring data. By detecting changes in their surroundings and translating them into quantifiable signals, these gadgets allow for real-time control, monitoring, and decision-making. Sensor technology advancements including miniaturization, more sensitivity, and better communication have made systems smarter and more effective. The market is growing due to the development of Internet of Things (IoT) devices and the incorporation of sensors into common things. In the upcoming years, the sensors market is expected to grow significantly due to the growing applications in various sectors and the ongoing improvements in technology.

Global Sensors Market Dynamics

Market Drivers

- Rapid technological advancements in sensor technology

- Increasing demand across various end-use industries such as automotive, healthcare, and consumer electronics

- Growing adoption of internet of things (IoT) devices and smart technologies

- Rising emphasis on industrial automation and process optimization

Market Restraints

- Security and privacy concerns related to data collected by sensors

- High initial costs associated with sensor implementation and integration

- Compatibility issues between different sensor types and systems

Market Opportunities

- Expansion of sensor applications in emerging sectors like smart agriculture and smart cities

- Development of sensors with enhanced accuracy, sensitivity, and reliability

- Integration of artificial intelligence and machine learning algorithms for advanced data analytics

Sensors Market Report Coverage

| Market | Sensors Market |

| Sensors Market Size 2022 | USD 202.6 Billion |

| Sensors Market Forecast 2032 | USD 446.6 Billion |

| Sensors Market CAGR During 2023 - 2032 | 8.5% |

| Sensors Market Analysis Period | 2020 - 2032 |

| Sensors Market Base Year |

2022 |

| Sensors Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Technology, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Texas Instrumental Incorporated, Siemens AG, ABB Group, Drägerwerk AG & Co. KGaA, STMicroelectronics NV, Bosch Sensortec GmbH, Samsung Electronics Co Ltd., DENSO Corporation, OMRON Corporation, International Sensor Technology, Honeywell International Inc., and NXF Semiconductors. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Sensors Market Insights

Rapid technological advancements in the electronics sector and the wide applicability of sensor technology across various end-use verticals such as medical, automotive, and consumer electronics are major factors expected to drive the growth of the global market. The automotive sector, in particular, is witnessing rapid technological advancements worldwide. Manufacturers are increasingly adopting sensors for tasks ranging from surface scanning to measuring part positions, utilizing various types such as mass airflow sensors, engine speed sensors, and oxygen sensors. Major players are focusing on introducing innovative products to attract new customers, which is expected to further augment market growth. For instance, in 2020, Honeywell launched a new, high-performance, value-priced line of Media Isolated stainless steel pressure sensors (MIP) for the industrial and HVAC market, expanding its product portfolio and customer base. Similarly, in 2019, Honeywell introduced the Industrial Internet of Things (IIoT)-enabled Experion® MX Q6088 Compact Scanner, specifically designed for paper producers, flat sheet manufacturers, and OEM machine vendors.

Furthermore, strategic merger and acquisition activities by major players to increase revenue share are expected to support market growth. In 2019, Honeywell acquired Rebellion Photonics, a leader in intelligent, automated, visual gas monitoring solutions, which is anticipated to expand the company's customer base and profits.

However, factors such as the additional costs associated with incorporating sensors and the high expenses related to the installation and maintenance of smart sensors are expected to hamper market growth. Additionally, the high complexity in manufacturing poses another challenge to market growth. Nevertheless, high investments by major players in R&D activities and product innovation are expected to create new opportunities for market players over the sensors industry forecast period. Moreover, the inclination of players towards emerging economies to tap into untapped markets is anticipated to further support market growth.

Sensors Market Segmentation

The worldwide market for sensors is split based on type, technology, end use, and geography.

Sensor Types

- Radar Sensor

- Optical Sensor

- Biosensor

- Touch Sensor

- Image Sensor

- Pressure Sensor

- Temperature Sensor

- Proximity & Displacement Sensor

- Level Sensor

- Motion & Position Sensor

- Humidity Sensor

- Accelerometer & Speed Sensor

- Others

According to sensors industry analysis, the most popular category of all the sensors available on the market is pressure sensor. Pressure sensors are widely employed in a wide range of industries, including consumer electronics, healthcare, automotive, and industrial applications. They are essential for monitoring and measuring pressure levels in a variety of situations and systems. Applications for pressure sensors include medical equipment, industrial process control, HVAC systems, and tyre pressure monitoring systems. The market for pressure sensors is expanding significantly due to the rising need for smart technologies and automation. Furthermore, developments in pressure sensor technology, such the creation of MEMS-based sensors, are accelerating their uptake and bolstering the pressure sensor market's supremacy.

Sensor Technologies

- CMOS

- MEMS

- NEMS

- Others

The MEMS (micro-electro-mechanical systems) segment is the largest technological category in the sensors market. MEMS technology combines electronics, sensors, actuators, and mechanical components into a single silicon chip. The resulting integration makes it possible to produce extremely small, powerful, and affordable sensor devices. Numerous industries, including automotive, consumer electronics, healthcare, and industrial automation, use MEMS sensors extensively. They are used in a variety of systems and devices that measure and detect physical factors as motion, temperature, pressure, acceleration, and so on. MEMS sensors are perfect for use in portable devices and Internet of Things applications because of its low power consumption, great sensitivity, and miniaturisation. Furthermore, continuous improvements in MEMS materials and production techniques spur innovation and further establish the MEMS segment as the industry leader in sensors technology.

Sensors End Use

- Electronics

- IT & Telecom

- Industrial

- Automotive

- Aerospace & Defense

- Healthcare

- Others

In terms of sensors market analysis, the electronics sector stands out as the largest end-use category. Sensors are widely used in the electronics industry for a variety of purposes and products, from wearables and smartphones to smart home appliances and consumer electronics. In electronic devices, sensors are essential for providing a range of functions like touch sensitivity, motion detection, environmental monitoring, and biometric authentication. Furthermore, as IoT (Internet of Things) technologies proliferate, there is a growing need for sensors in networked electronic systems for automation, data collecting, and analysis. Additionally, the development of increasingly compact, effective, and advanced electronic devices has been made possible by developments in sensor technology, such as the fusion of CMOS and MEMS sensors. The demand for sensors is anticipated to stay strong due to the electronics industry's ongoing innovation and evolution, maintaining the electronics segment's position as the largest end-use category in the sensors market.

Sensors Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Sensors Market Regional Analysis

Asia-Pacific stands out as the largest region in the sensors market owing to its rapidly expanding economies, fast industrialization, and sizable consumer electronics market. Large investments in the automotive, consumer electronics and manufacturing industries are occurring in countries like China, Japan, South Korea, and India, which is increasing demand for sensors. Asia-Pacific's market dominance is further cemented by the region's widespread acceptance of IoT technologies and smart infrastructure efforts, which accelerate the deployment of sensors across a wide range of industries.

However, thanks to technological improvements, notably in the automotive, aerospace, and healthcare industries, North America is emerging as the region with the fastest-growing sensors market. The area is home to a thriving ecosystem of technological businesses, academic institutions, and sensor manufacturers that propels innovation and market expansion. North America is positioned for rapid expansion in the sensors market forecast period due to the accelerated deployment of sensors and growing investments in autonomous vehicles, IoT, and smart city initiatives.

Sensors Market Players

Some of the top sensors companies offered in our report includes Texas Instrumental Incorporated, Siemens AG, ABB Group, Drägerwerk AG & Co. KGaA, STMicroelectronics NV, Bosch Sensortec GmbH, Samsung Electronics Co Ltd., DENSO Corporation, OMRON Corporation, International Sensor Technology, Honeywell International Inc., and NXF Semiconductors.

Frequently Asked Questions

How big is the sensors market?

The Sensors market size was valued at USD 202.6 billion in 2022.

What is the CAGR of the global sensors market from 2023 to 2032?

The CAGR of Sensors is 8.5% during the analysis period of 2023 to 2032.

Which are the key players in the sensors market?

The key players operating in the global market are including Texas Instrumental Incorporated, Siemens AG, ABB Group, Dr�gerwerk AG & Co. KGaA, STMicroelectronics NV, Bosch Sensortec GmbH, Samsung Electronics Co Ltd., DENSO Corporation, OMRON Corporation, International Sensor Technology, Honeywell International Inc., and NXF Semiconductors.

Which region dominated the global sensors market share?

Asia-Pacific held the dominating position in sensors industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of sensors during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global sensors industry?

The current trends and dynamics in the Sensors industry include rapid technological advancements in sensor technology, increasing demand across various end-use industries such as automotive, healthcare, and consumer electronics, growing adoption of internet of things (iot) devices and smart technologies, and rising emphasis on industrial automation and process optimization.

Which end use held the maximum share in 2022?

The electronics end use held the maximum share of the sensors industry.