Self-Monitoring Blood Glucose Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Self-Monitoring Blood Glucose Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

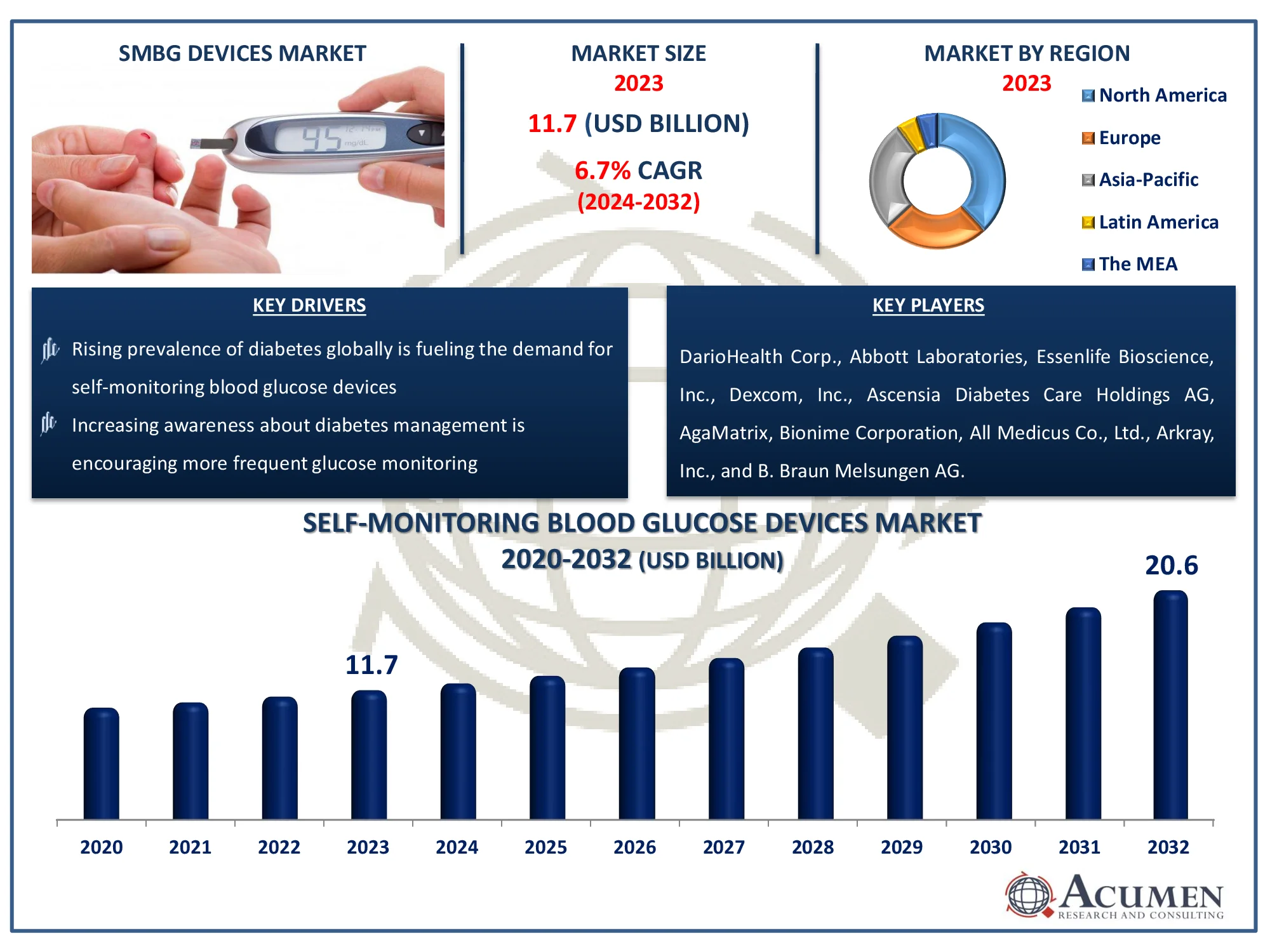

The Global Self-Monitoring Blood Glucose Devices Market Size accounted for USD 11.7 Billion in 2023 and is estimated to achieve a market size of USD 20.6 Billion by 2032 growing at a CAGR of 6.7% from 2024 to 2032.

Self-Monitoring Blood Glucose Devices Market Highlights

- Global self-monitoring blood glucose devices market revenue is poised to garner USD 20.6 billion by 2032 with a CAGR of 6.7% from 2024 to 2032

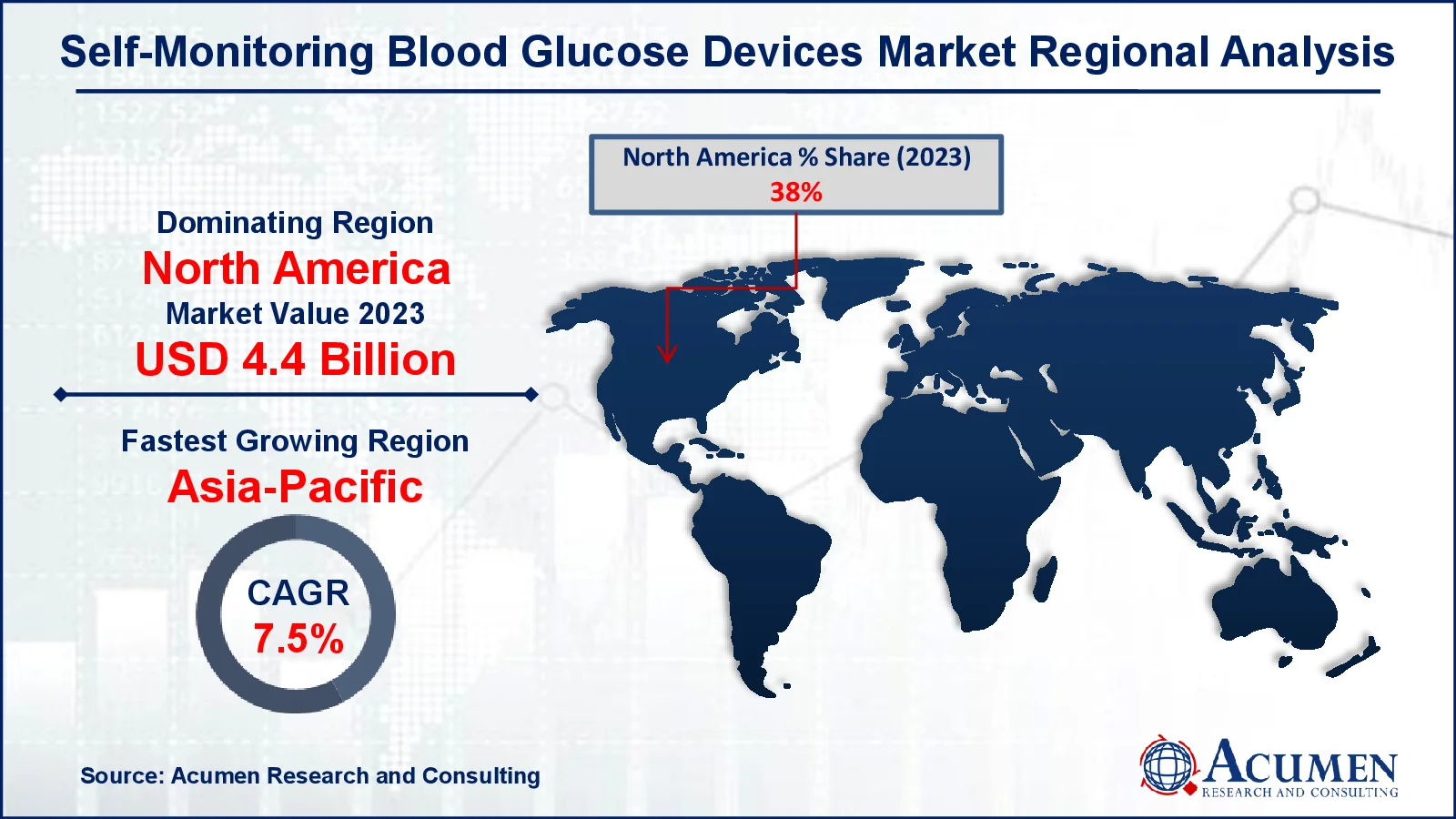

- North America self-monitoring blood glucose devices market value occupied around USD 4.4 billion in 2023

- Asia-Pacific self-monitoring blood glucose devices market growth will record a CAGR of more than 7.5% from 2024 to 2032

- Among application, the type 2 diabetes sub-segment generated more than USD 6.4 billion revenue in 2023

- Based on end use, the hospitals sub-segment generated notable self-monitoring blood glucose devices market share in 2023

- Integration of smartphone connectivity with devices can improve user engagement and data management is a popular self-monitoring blood glucose devices market trend that fuels the industry demand

Diabetes is a clinical disorder in which the blood glucose level rises owing to the pancreas ' incapacity to generate insulin. Monitoring glucose is one of the most important measures in the leadership of diabetes. Blood glucose monitoring enables people to decide the consumption level of meals, insulin dosage and sort of physical exercise needed during the day. Self-monitoring blood glucose (SMBG) includes the use of blood glucose meters to control glucose levels and provide an exact measurement of capillary glucose levels. SMBG technology utilizes blood sugar meters, lancets and sample pads to accomplish more effective long-term glycemic control.

Global Self-Monitoring Blood Glucose Devices Market Dynamics

Market Drivers

- Rising prevalence of diabetes globally is fueling the demand for self-monitoring blood glucose devices

- Increasing awareness about diabetes management is encouraging more frequent glucose monitoring

- Technological advancements, such as continuous glucose monitoring, are enhancing device efficiency

- Growing adoption of wearable and portable devices is making self-monitoring more accessible

Market Restraints

- High cost of advanced blood glucose monitoring devices limits affordability for many users

- Limited reimbursement policies in certain regions constrain market growth

- Invasive nature of some devices leads to discomfort, discouraging regular use among patients

Market Opportunities

- Expanding healthcare infrastructure in emerging economies provides a new market base for manufacturers

- Rising demand for non-invasive glucose monitoring presents scope for innovation and product development

- Government initiatives supporting diabetes awareness and management can drive market penetration

Self-Monitoring Blood Glucose Devices Market Report Coverage

| Market | Self-Monitoring Blood Glucose Devices Market |

| Self-Monitoring Blood Glucose Devices Market Size 2022 |

USD 11.7 Billion |

| Self-Monitoring Blood Glucose Devices Market Forecast 2032 | USD 20.6 Billion |

| Self-Monitoring Blood Glucose Devices Market CAGR During 2023 - 2032 | 6.7% |

| Self-Monitoring Blood Glucose Devices Market Analysis Period | 2020 - 2032 |

| Self-Monitoring Blood Glucose Devices Market Base Year |

2022 |

| Self-Monitoring Blood Glucose Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | DarioHealth Corp., Abbott Laboratories, Essenlife Bioscience, Inc., Dexcom, Inc., Ascensia Diabetes Care Holdings AG, AgaMatrix, Bionime Corporation, All Medicus Co., Ltd., Arkray, Inc., and B. Braun Melsungen AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Self-Monitoring Blood Glucose Devices Market Insights

Increased prevalence of diabetes in both advanced and developing nations will be the main driver during the forecast period of worldwide self-monitoring blood glucose machines (BGBs). Type 2 diabetes is the most common form, followed by Type 1 diabetes and gestational diabetes in around 14% of all pregnancies throughout the USA. In addition, the danger of diabetes rises with era, obesity, carbohydrofood intake and heredity. Thus, the incidence of diabetes will increase rapidly as the frequency of associated risk factors increases, increasing SMBG devices market in the coming years.

Increasing consciousness of diabetes mellitus, its blood sugar leadership and regulate (BGL) in emerging countries will help self-monitoring blood glucose devices market growth over the coming years. It is estimated that the presence of many mobile users in India together with a high population base with diabetes boosts the use of devices to monitor blood glucose levels. Likewise, several government awareness-raising initiatives, R&D investments for innovative technologies and diabetes subsidies will stimulate the implementation of blood glucose meters for the coming years. For example, Australia's National Diabetes Services Scheme offers subsidized blood-glucose test products, including strips, insulin pumps, needles and syringes, and aims to add more subsidised products to increase product demand.

Strict regulations concerning the development of advanced blood glucose surveillance devices may however limit product approvals and thus hinder growth on the self-monitoring blood glucose devices market. Moreover, the elevated price of glucose monitors and related therapy equipment, which is not affordable for the developing country's inhabitants, can hamper company development over the evaluation era in self-monitoring blood glucose devices market.

Self-Monitoring Blood Glucose Devices Market Segmentation

The worldwide market for self-monitoring blood glucose devices is split based on product, application, end use, and geography.

Self-Monitoring Blood Glucose Devices Market By Product

- Continuous Glucose Monitors

- Lancets

- Self-Monitoring Blood Glucose Meters

- Testing Strips

According to self-monitoring blood glucose devices industry analysis, the test pads industry accounted for the biggest share of income in 2023, with comparable trends expected in the prediction era. Test strips make up an important portion of the glucose meters. High acceptance and spending on diabetes test strips will thus enhance segmental development. For example, around 90% of people with diabetes in the UK use blood sugar meters with straps, with an expected expenditure of approximately 974 USD per year. In addition, advances in test strips like the Solo meter, comprising 4 leads on the test strips, helps to produce fast and precise sample results. This, combined with the availability of test strips at affordable costs, will boost the industry growth of test strips during the self-monitoring blood glucose devices market forecast period.

The industry of continuous glucose sensors (CGM) is estimated at a speed of over 5.5% CAGR over time. CGMs are usually used in patients requiring frequent surveillance of blood glucose. CGM schemes assist for up to 60 minutes forecast potential occurrences of hypoglycaemia or hyperglycaemia and provide clinically appropriate insulin models data. In geriatric or critical care clients, the advantages of ongoing insulin monitoring will stimulate segmental development over the coming years.

Self-Monitoring Blood Glucose Devices Market By Application

- Type 2 Diabetes

- Type 1 Diabetes

- Gestational Diabetes

In 2023, the type 2 diabetes industry accounted for a significant sale of USD 6.4 billion. The rapidly increasing prevalence of type 2 diabetes mellitus (T2DM) due to the increase in the incidence of obesity, unhealthy eating and lifestyles can be ascribed to high segmental proportions. The bulk of complete instances of disease are in the T2D-affected population. Blood glucose self-monitoring is an essential component of the T2D therapy regimen. Therefore, an increasing incidence of obesity in combination with an increasing geriatric population and other threat variables will increase segmental development in self-monitoring blood glucose devices market.

The gestational disease industry is forecast to be 4.6% CAGR in the United States. According to the American Diabetes Association, gestational diabetes incidence in the United States is about 1-14% out of all pregnancies and can contribute to additional problems. Self-monitoring of blood glucose in therapy approaches used during pregnancy is therefore regarded a superior strategy. As the frequency of birth increases, the demand for blood glucose self-monitoring in early testing and blood glucose control will increase during pregnancy over the estimate era.

Self-Monitoring Blood Glucose Devices Market By End Use

- Home Usage

- Hospitals

- Diagnostic Clinics & Centers

In 2023, the hospitals sector retained the world's biggest business volume in the self-monitoring blood glucose devices market. Extending the necessity to monitor the danger of hypoglyceremia or hyperglycemia in patients for effective, accurate and on-going BGL surveillance in ICUs will increase demand for advancement of the glucose surveillance system in clinics. High levels of glucose may result in comorbidities and complications in critical care patients; continuous blood glucose monitoring is therefore needed in hospitalized patients. In addition, development in the segment will be stimulated by an extension of the healthcare environment across emerging nations, the increased amount of hospitalizations and the implementation of sophisticated disease monitoring and control systems.

During the self-monitoring blood glucose devices market forecast period, household environments are projected to be notable CAGR owing to a increasing diabetic patient population. Advancing the provision of mobile, effective and easy-to-use tools for diabetes care goods in the future will boost segment development. The increase in people's choice for mobile and high-end technological products will increase SMBG devices ' acceptance in the home environment. In addition, blood sugar self surveillance at home enables decision-makers and analyzes the efficacy of the present leadership of diabetes. These variables will increase segmental development during the era of assessment.

Self-Monitoring Blood Glucose Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Self-Monitoring Blood Glucose Devices Market Regional Analysis

In 2023, the North America industry in self-monitoring blood glucose machines represented over 38% of the worldwide industry. The region’s growing incidence of obesity will be the main driver in the coming years to stimulate general business development. In the diabetic population base the incidence of obesity caused by physical inactivity, unhealthy food consumption and other environmental variables increases further. In addition, increased preference for CGMs, increased knowledge of diabetes management among individuals and a stronger demand for sophisticated diabetes care goods will favorably affect the development of the US blood glucose self-monitoring sector in the foreseeable future.

The APAC self-monitoring blood glucose devices market is expected to grow significantly throughout the evaluation period. Increased diabetes incidence, paired with a growing geriatric population that is predisposed to chronic diseases, will have a significant impact on sector growth. Furthermore, the growing use of homecare systems for self-management and control of low-cost illnesses would force APAC to keep a close eye on the development of its blood glucose machine firm in the self-monitoring blood glucose devices market.

Self-Monitoring Blood Glucose Devices Market Players

Some of the top self-monitoring blood glucose devices market companies offered in our report includes DarioHealth Corp., Abbott Laboratories, Essenlife Bioscience, Inc., Dexcom, Inc., Ascensia Diabetes Care Holdings AG, AgaMatrix, Bionime Corporation, All Medicus Co., Ltd., Arkray, Inc., and B. Braun Melsungen AG.

Frequently Asked Questions

How big is the self-monitoring blood glucose devices market?

The self-monitoring blood glucose devices market size was valued at USD 11.7 billion in 2023.

What is the CAGR of the global self-monitoring blood glucose devices market from 2024 to 2032?

The CAGR of self-monitoring blood glucose devices is 6.7% during the analysis period of 2024 to 2032.

Which are the key players in the self-monitoring blood glucose devices market?

The key players operating in the global market are including DarioHealth Corp., Abbott Laboratories, Essenlife Bioscience, Inc., Dexcom, Inc., Ascensia Diabetes Care Holdings AG, AgaMatrix, Bionime Corporation, All Medicus Co., Ltd., Arkray, Inc., and B. Braun Melsungen AG.

Which region dominated the global self-monitoring blood glucose devices market share?

North America held the dominating position in self-monitoring blood glucose devices industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of self-monitoring blood glucose devices during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global self-monitoring blood glucose devices industry?

The current trends and dynamics in the self-monitoring blood glucose devices industry include rising prevalence of diabetes globally is fueling the demand for self-monitoring blood glucose devices, increasing awareness about diabetes management is encouraging more frequent glucose monitoring, and growing adoption of wearable and portable devices is making self-monitoring more accessible.

Which application held the maximum share in 2023?

The type 2 diabetes application held the maximum share of the self-monitoring blood glucose devices industry.?