Self-Compacting Concrete Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Self-Compacting Concrete Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Self-Compacting Concrete Market Size accounted for USD 13.2 Billion in 2022 and is estimated to achieve a market size of USD 25.9 Billion by 2032 growing at a CAGR of 7.1% from 2023 to 2032.

Self-Compacting Concrete Market Highlights

- Global self-compacting concrete market revenue is poised to garner USD 25.9 billion by 2032 with a CAGR of 7.1% from 2023 to 2032

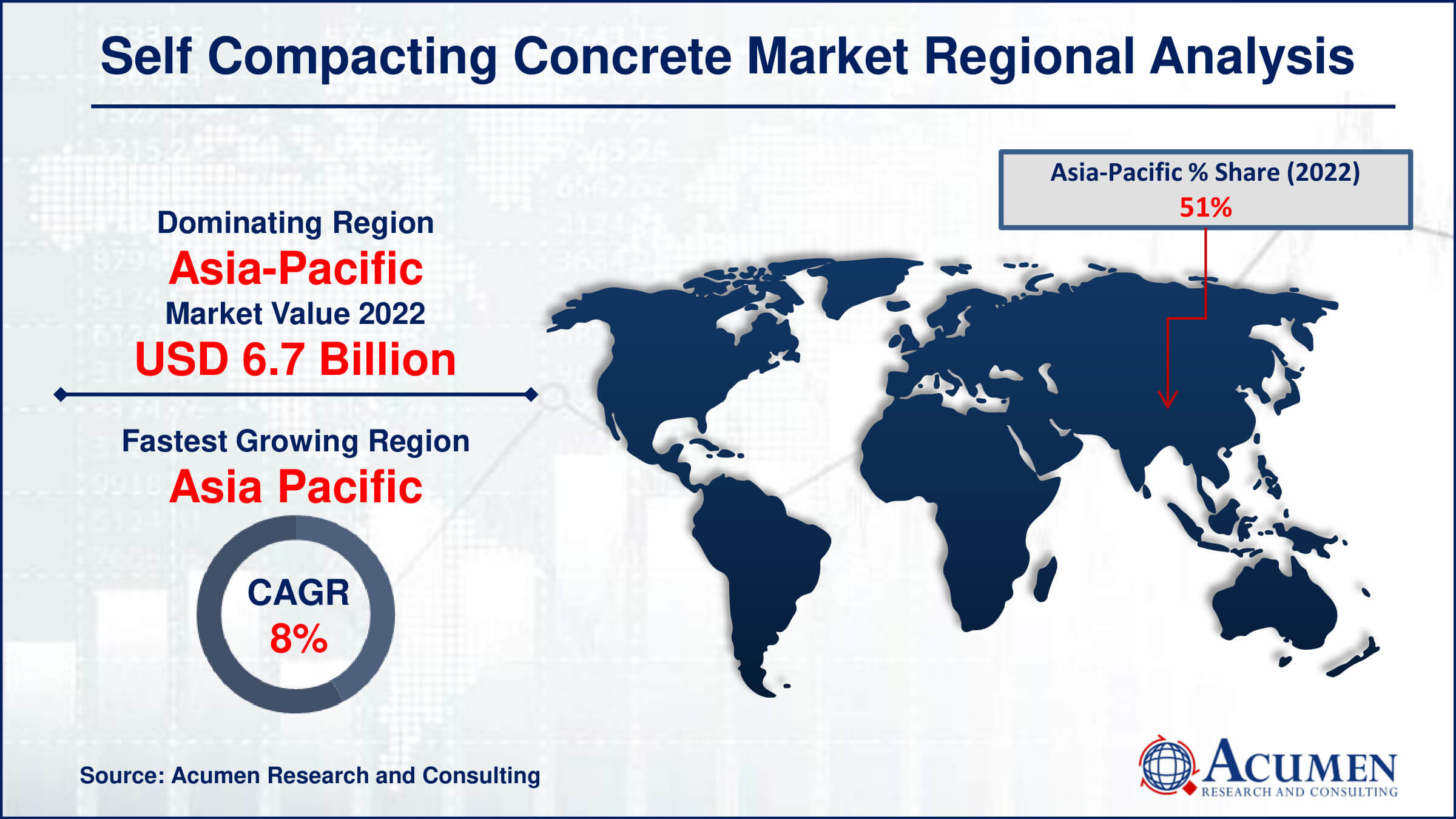

- Asia-Pacific self-compacting concrete market value occupied around USD 6.7 billion in 2022

- Asia-Pacific self-compacting concrete market growth will record a CAGR of more than 8% from 2023 to 2032

- Among type, the viscosity sub-segment generated USD 7.9 billion revenue in 2022

- Based on application, the metal decking sub-segment generated around notable market share in 2022

- Based on end-user, the building & construction sub-segment generated around 45% market share in 2022

- Increasing demand for sustainable construction practices is a popular self-compacting concrete market trend

concrete, was developed by the University of Tokyo in the 1980s. This innovative type of concrete eliminates the need for external vibration during the pouring process. Instead, it relies on its inherent high fluidity, allowing it to flow and fill the formwork under its own weight. Additionally, self-compacting concrete (SCC) outperforms regular concrete in several ways. Firstly, there's no need for shaking during production, making it more efficient. It also works, flows, and pumps better, streamlining the entire process. Additionally, SCC forms stronger bonds with closely packed reinforcement. In essence, SCC simplifies production, improves handling, and enhances the connections within the structure.

Global Self-Compacting Concrete Market Dynamics

Market Drivers

- Minimal noise is generated during construction with self-compacting concrete

- Self-compacting concrete substantially reduces maintenance, repair, and overhaul costs

- No vibration procedures are needed when placing self-compacting concrete

Market Restraints

- Expensive raw materials are a constraint

- Limited adoption in developing economies restricts widespread use

- ECO-SSC serves as a substitute for self-compacting concrete, posing a restraint

Market Opportunities

- Low-fines self-compacting concrete is gaining popularity

- The construction sector is rebounding and recovering

- Ongoing research and development in concrete technology presents opportunities

Self-Compacting Concrete Market Report Coverage

| Market | Self-Compacting Concrete Market |

| Self-Compacting Concrete Market Size 2022 | USD 13.2 Billion |

| Self-Compacting Concrete Market Forecast 2032 |

USD 25.9 Billion |

| Self-Compacting Concrete Market CAGR During 2023 - 2032 | 7.1% |

| Self-Compacting Concrete Market Analysis Period | 2020 - 2032 |

| Self-Compacting Concrete Market Base Year |

2022 |

| Self-Compacting Concrete Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ACC Limited, Sika AG, BASF, Tarmac, Kilsaran, Breedon Group, Lafargeholcim Ltd., Unibeton Ready Mix, Ultratech Cement Limited, and Cemex. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Self-Compacting Concrete Market Insights

In recent years, self-compacting concrete has become an important invention in the building sector. The removal of vibration operations during the laying of self-compacting concrete is the key driver of the global self-compacting concrete market. During the casting process, self-compacting concrete easily fills the areas between reinforcements and mold corners without the need for vibration or compaction. However, because self-compacting concrete does not vibrate, its implantation requires human intervention. The absence of vibration methods has resulted in a significant reduction in energy consumption during the self-compacting concrete process. Formwork is no longer required in typical vibration operations, which saves money on maintenance. Furthermore, self-compacting concrete decreases repair and maintenance costs, minimizes noise, saves labor, tackles environmental problems, and speeds up project schedules. It may be installed in any location without the need for vibration and has a level surface finish.

However, low acceptance in emerging nations limits the usage of self-compacting concrete. Disruptive technologies and technology developments present new firms with both difficulties and opportunity. Competition and regulatory conditions can impede startup success. Furthermore, high raw material costs impede market expansion. Coal is significantly used as a raw ingredient in aggregates, cement, additives, plasticizers, and admixtures. Furthermore, the costs of raw materials like as clay, fly ash, limestone, and shale are expected to rise. Shipping concrete and increasing labor costs further constrain the market.

On the other side, developments in self-compacting concrete processes will create possibilities in the coming years. For example, Ouchi and Okamura have made advances in self-compacting concrete. Furthermore, the rebounding and recovering building sector, as well as the expanding use of low-fines self-compacting concrete, create potential. Low-fines self-compacting concrete may save 100 kg/m3 of cementitious material while also reducing fines by 350-550 kg/m3. These assets strengthen LF-SCC's portfolio, creating prospects in the next years."

Self-Compacting Concrete Market Segmentation

The worldwide market for self-compacting concrete is split based on type, application, end-user and geography.

Self Compacting Concrete Market By Type

- Combination

- Powder

- Viscosity

According to the self-compacting concrete industry analysis, the market is segmented based on types into combination, powder, and viscosity. The powder segment is predicted to be one of the prominent types throughout the forecast year. This segment is considered the most reasonable compared to others. Furthermore, it enhances the thickness and potency of the material, and it also supports a higher degree of reduction. Due to these features, demand for powder is increasing in the SCC market.

Self Compacting Concrete Market By Application

- Metal Decking

- Concrete Frames

- Drilled Shafts

- Columns

According to self-compacting concrete industry data, the market is split By Application: metal decking, concrete frames, drilled shafts, and columns. Metal decking dominates the SCC market. Metal decking is utilized to construct the intricate metal floor deck as well as to keep the roof's insulating membrane intact. Additionally, it has a good strength-to-weight ratio, is simple to install, and is inexpensive. Furthermore, this contains two primary types of metal roof decking: B deck and N deck, which both support built-up roof systems. As a result of these numerous applications, metal decking currently dominates the industry.

Self-Compacting Concrete Market By End-User

- Building and Construction

- Oil and Gas Construction

- Infrastructure

According to self-compacting concrete industry analysis, based on the end-users, the market is segmented into building and construction, oil and gas construction, and infrastructure segment. The infrastructure area is one of the most rapidly increasing in the SCC industry. The developing global infrastructure will raise demand for this sector. For example, in November 2021, Congress authorized an unprecedented investment in US infrastructure totaling hundreds of billions of dollars in additional spending. Furthermore, the drop in the cost of starting a business influences China's infrastructure. For instance, infrastructure invetment in the China is become high at GDP that is 6.7%.As a result, this increasing infrastructure will undoubtedly dominate the market as an end user.

Self-Compacting Concrete Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Self-Compacting Concrete Market Regional Analysis

In terms of self-compacting concrete market analysis, based on regional analysis, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East and Africa. Asia Pacific region dominate the market in the forecast year. Countries like China, Japan, Malaysia, Indonesia contain the presence of robust number of key players. For instance, Infrastructure sector in 2019-20, 63 billion USD is to be paid by the Indian government and 1.4 trillion USD is scheduling to expend in further years. Moreover, for the period of October 2019, Indian construction industry increased by the investment of USD 1.4 billion throughout venture capital investments and private equity. Furthermore, China also remains at the forefront in the growing infrastructure. For example, the National Development and Reform Commission of China said that in 2019, the Chinese government approved 26 infrastructure projects worth USD 142 billion.

Self-Compacting Concrete Market Players

Some of the top self-compacting concrete companies offered in our report include ACC Limited, Sika AG, BASF, Tarmac, Kilsaran, Breedon Group, Lafargeholcim Ltd., Unibeton Ready Mix, Ultratech Cement Limited, and Cemex.

Frequently Asked Questions

How big is the self-compacting concrete market?

The self-compacting concrete market size was valued at USD 13.2 Billion in 2022.

What is the CAGR of the global self-compacting concrete market from 2023 to 2032?

The CAGR of self-compacting concrete is 7.1% during the analysis period of 2023 to 2032.

Which are the key players in the self-compacting concrete market?

The key players operating in the global market are including ACC Limited, Sika AG, BASF, Tarmac, Kilsaran, Breedon Group, Lafargeholcim Ltd., Unibeton Ready Mix, Ultratech Cement Limited, and Cemex.

Which region dominated the global self-compacting concrete market share?

Asia Pacific held the dominating position in self-compacting concrete industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of self-compacting concrete during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global self-compacting concrete industry?

The current trends and dynamics in the self-compacting concrete industry are advancement in the technique and the growing popularity of low-fines self-compacting concrete, and minimal noise is generated during construction,

Which application held the maximum share in 2022?

The building & construction application held the maximum share of the self-compacting concrete industry.