Seeds Market | Acumen Research and Consulting

Seeds Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

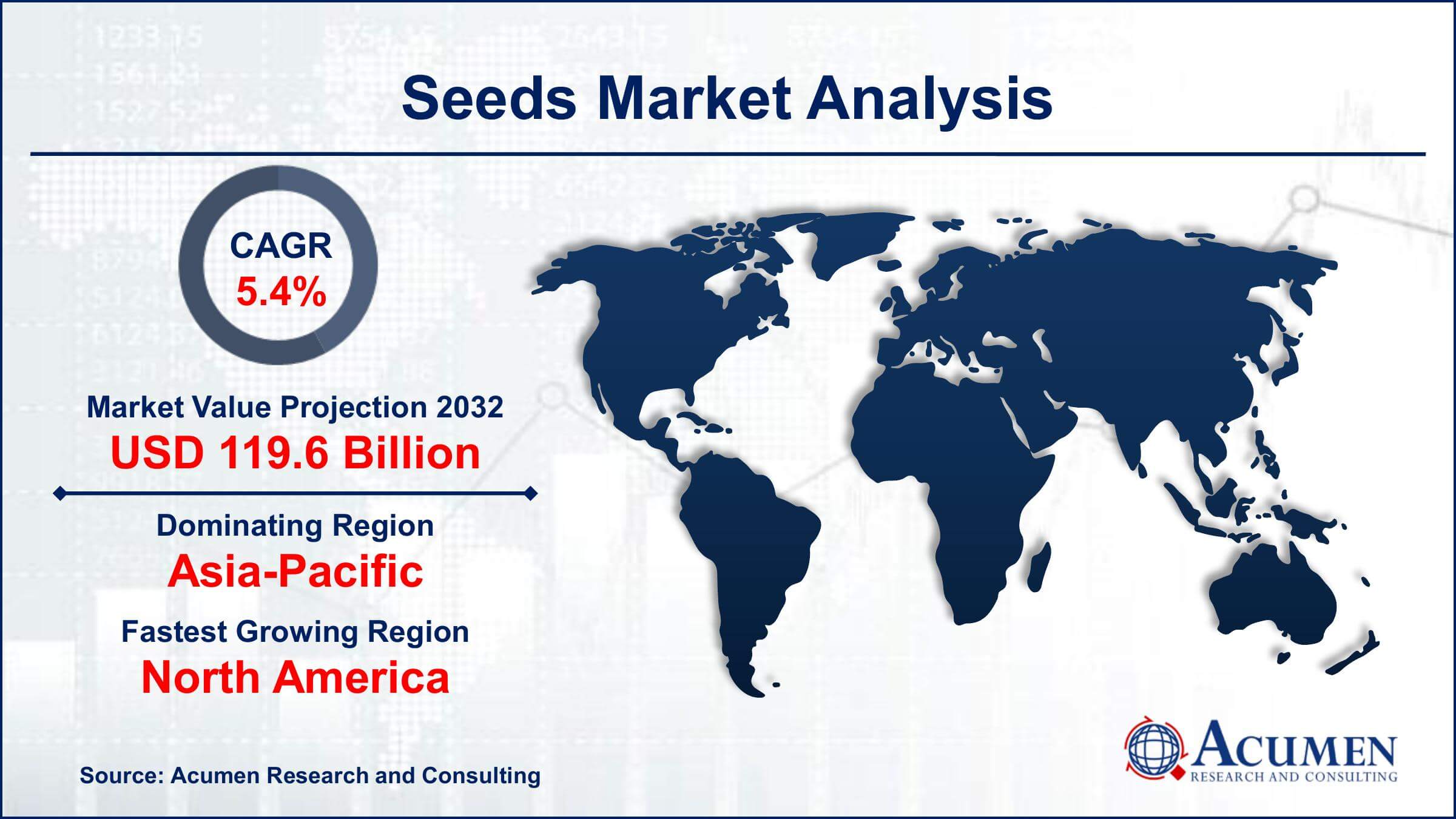

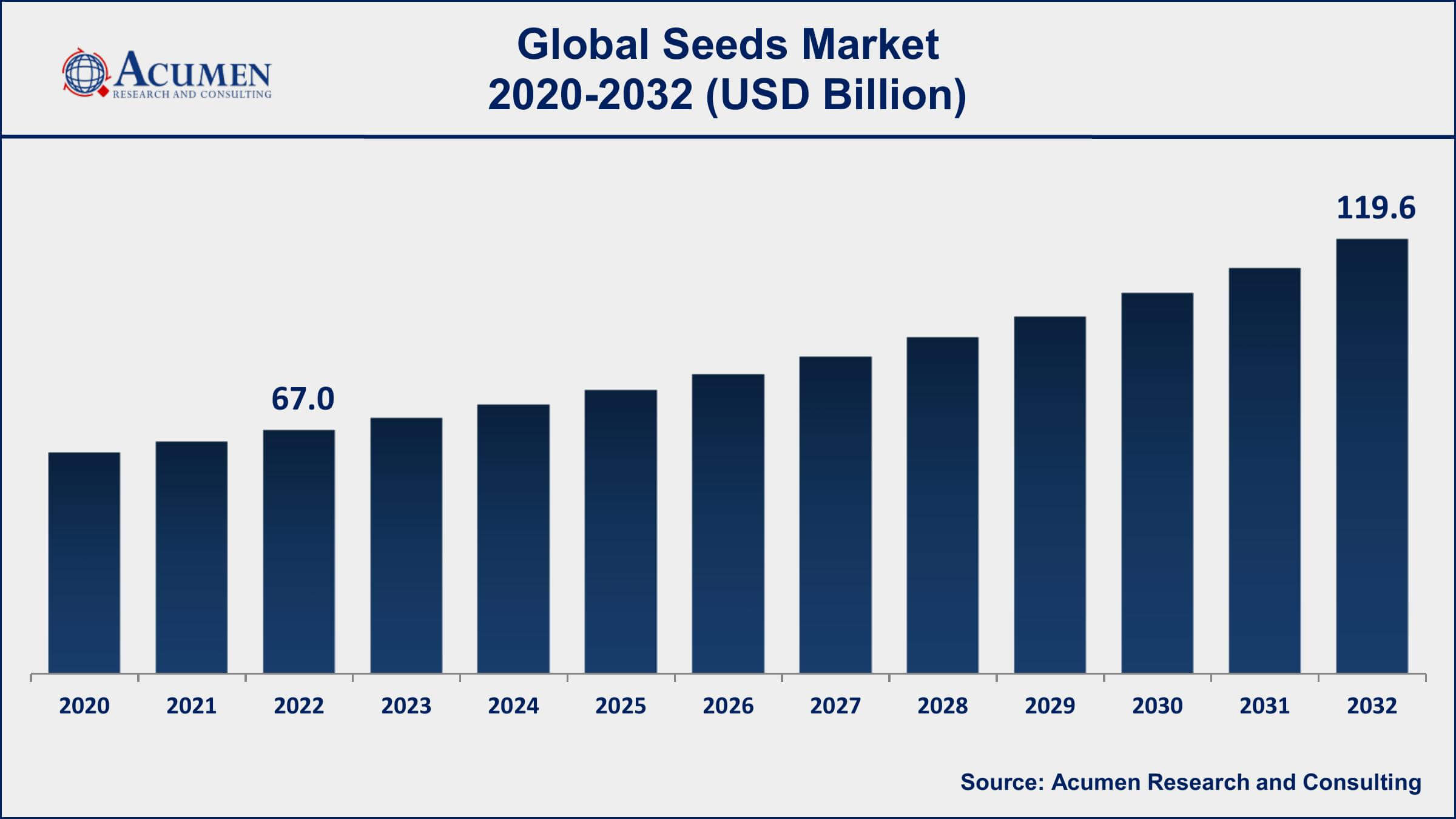

The Global Seeds Market Size accounted for USD 67.0 Billion in 2022 and is projected to achieve a market size of USD 119.6 Billion by 2032 growing at a CAGR of 5.4% from 2023 to 2032.

Seeds Market Key Highlights

- Global seeds market revenue is expected to increase by USD 119.6 Billion by 2032, with a 5.4% CAGR from 2023 to 2032

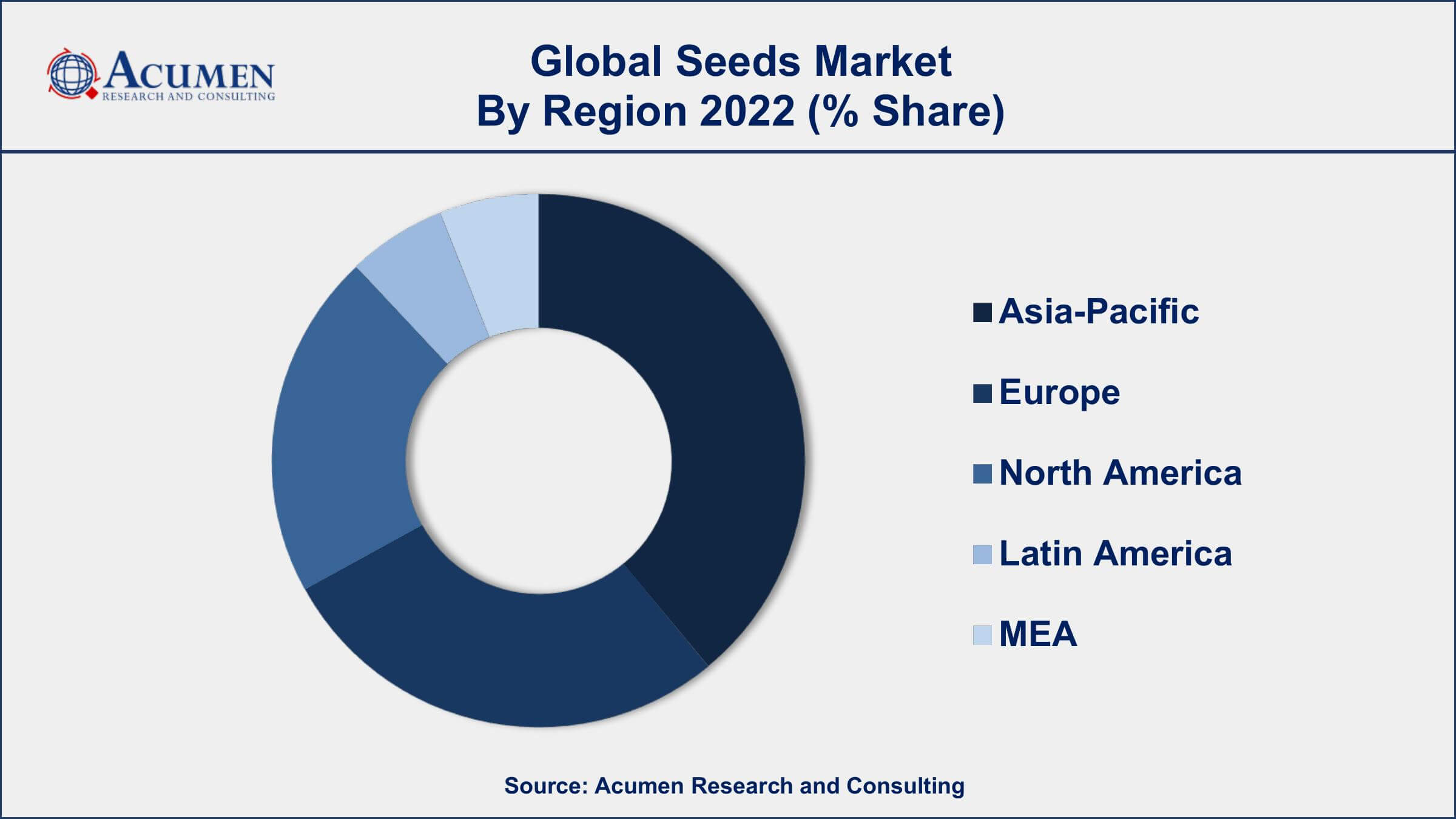

- Asia-Pacific region led with more than 38% of seeds market share in 2022

- The Food and Agriculture Organization of the United Nations (FAO) reports that the global production of major crops like wheat, maize, and rice has increased by 300% since 1960

- According to the Joint Research Centre of the European Commission, the EU produced around 230,000 tonnes of vegetable seeds in 2019, with the Netherlands being the leading producer

- As per the study, genetically modified crops accounted for 94% of U.S. soybean acreage, 93% of U.S. cotton acreage, and 92% of U.S. corn acreage in 2021

- Growing demand for food due to increasing population and changing dietary patterns, drives the seeds market size

Seeds are the fundamental units of agriculture that play a critical role in ensuring global food security. A seed is essentially an embryonic plant enclosed in a protective outer covering. They contain all the genetic material necessary for plant growth, development, and reproduction. Seeds are available in a vast range of varieties and are used for growing crops, fruits, and vegetables. The global seed industry is expanding rapidly, and the market for seeds is expected to continue to grow in the coming years.

The global seed market growth is being driven by several factors, including the increasing demand for food, population growth, and urbanization. As the global population continues to grow, the demand for food is also increasing, leading to the need for more efficient agricultural practices. Additionally, the growing trend of healthy eating habits and the increased awareness of the importance of a balanced diet are also driving the growth of the seed market. The use of genetically modified (GM) seeds is also becoming more popular due to their ability to enhance crop productivity and improve resistance to pests and diseases.

Global Seeds Market Trends

Market Drivers

- Growing demand for food due to increasing population and changing dietary patterns

- Rising adoption of genetically modified (GM) seeds to enhance crop productivity and improve resistance to pests and diseases

- Advancements in seed technologies, such as gene editing and synthetic biology

- Favorable government policies and initiatives to promote sustainable agriculture practices and increase crop yields

- Growing awareness about the benefits of using high-quality seeds for agriculture

Market Restraints

- Stringent regulations and laws related to the use of GM seeds in certain regions

- Lack of awareness and knowledge about the benefits of using high-quality seeds among farmers

Market Opportunities

- Increasing demand for organic and non-GMO seeds, driven by the rising consumer preference for natural and healthy foods

- Advancements in seed breeding technologies, such as precision breeding and genomic selection

Seeds Market Report Coverage

| Market | Seeds Market |

| Seeds Market Size 2022 | USD 67.0 Billion |

| Seeds Market Forecast 2032 | USD 119.6 Billion |

| Seeds Market CAGR During 2023 - 2032 | 5.4% |

| Seeds Market Analysis Period | 2020 - 2032 |

| Seeds Market Base Year | 2022 |

| Seeds Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Seed Trait, By Crop Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Monsanto Company, Syngenta AG, Limagrain, Dow AgroSciences LLC, KWS SAAT SE, Sakata Seed Corporation, Groupe Limagrain Holding SA, Land O'Lakes, Inc., Takii & Co., Ltd., Rallis India Limited, and The Scotts Miracle-Gro Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Seed refers to an embryonic plant generally enclosed in a protective covering or the outer sheath. Seed formation is the process of reproduction of seeds in plants. This happens with the spermatophytes, angiosperm, and gymnosperm plants. Seeds are the evolution of ripened ovule wherein the pollens after fertilization grows in the mother plant. The embryo of the seed is developed using the seed coat and zygote from the characteristic parts of the ovule. Seeds act as an important part in the development of the reproduction process as well as the success of angiosperms and gymnosperms plants and are relative to other primitive plants including mosses, ferns, and liverworts that don’t possess seeds and thus use other means of propagation by themselves. Seeded plants dominate biological species ranging from forests to grasslands and reproduce in both cold and hot climates. Seeds are generally produced in various related clusters of plants and the way their reproduction is distinguished from the angiosperms which are enclosed seeds from gymnosperms, also known as naked seeds. Angiosperm seeds are usually produced in a fleshy or hard structure, also known as a fruit that encloses the seed within itself and thus its name. Some fruits possess different layers of fleshy and hard material in themselves. Whereas gymnosperms have no distinct structure developed in order to enclose seeds and, thus this makes their development naked on the ends of the cones. The production of seeds in the populations of natural plants varies distinctly from place to place with respect to variable weather conditions, internal cycles within the plants, and insects and diseases.

Over the past few years, farmers are increasingly inclined towards biological seed treatment methods due to the rising environmental impact as well as hazards associated with health such as chemical agents. Biological agents are extremely researched and are being developed in order to enable sustainable agriculture and organic farming. Biologically treated seeds are relatively cost-effective and offer benefits related to the environment which makes them preferable as compared to other chemical agents. Biological agents, generally, are either used in combination or in isolation with other chemicals to enhance and improve their overall efficiency to make their yield potential more efficient. Various seed companies in the global seeds market are focusing on investing in research and development to produce target-specific seeds. Such developments in seed treatment technologies are expected to propel the overall global seeds market growth over the forecast period.

Seeds Market Segmentation

The global seeds market segmentation is based on type, seed trait, crop type, and geography.

Seeds Market By Type

- Genetically Modified (GM) Seed

- Conventional Seed

According to the seeds industry analysis, the genetically modified (GM) seed segment accounted for the largest market share in 2022. GM seeds are seeds that have been genetically altered through biotechnology to enhance their desirable traits, such as higher yields, resistance to pests and diseases, and tolerance to environmental stresses. The growth of the GM seed segment is driven by several factors, including the increasing global population, rising demand for food, and the need for more sustainable and efficient agricultural practices. GM seeds offer several benefits over traditional seeds, such as reduced use of pesticides and herbicides, increased crop productivity, and improved food quality.

Seeds Market By Seed Trait

- Herbicide Tolerant

- Insecticide Resistant

- Others

In terms of seed traits, the herbicide tolerant segment is expected to witness significant growth in the coming years. Herbicide-tolerant seeds are genetically modified to resist the effects of certain herbicides, allowing farmers to use these herbicides to control weeds without harming their crops. The growth of the herbicide-tolerant segment in the seed market is driven by several factors, including the increasing demand for high-yielding crops, the need for sustainable and efficient farming practices, and the cost-saving benefits of herbicide-tolerant crops. Herbicide-tolerant seeds allow farmers to use herbicides more efficiently, reducing the need for manual weeding and improving crop yields. Moreover, the increasing adoption of herbicide-tolerant crops in developing countries, such as Brazil and Argentina, and the growing demand for biofuels and animal feed are some of the key factors driving the growth of this segment.

Seeds Market By Crop Type

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Others

According to the seeds market forecast, the cereals and grains segment is expected to witness significant growth in the coming years. Cereals and grains are staple crops that are widely used for food, animal feed, and industrial purposes. The growth of the cereals and grains segment in the seed market is driven by several factors, including the increasing global population, rising demand for food, and the need for sustainable and efficient agricultural practices. The cereals and grains segment includes several crops, including corn, wheat, rice, barley, sorghum, and oats. Among these crops, corn, and wheat are the largest markets for seeds. The adoption of genetically modified seeds has been particularly significant in the corn market, where herbicide-tolerant and insect-resistant varieties are widely used.

Seeds Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Seeds Market Regional Analysis

The Asia-Pacific region is currently dominating the global seed market and is expected to continue to grow in the coming years. The region is home to some of the world's largest agricultural economies, including China and India, and has a rapidly growing population that is driving demand for food and agricultural products. Additionally, the region has favorable climatic conditions for agriculture and is experiencing significant growth in its agricultural sector. One of the key drivers of the seed market in the Asia-Pacific region is the increasing adoption of genetically modified (GM) seeds. The region has seen significant growth in the adoption of GM seeds, particularly in China and India, where herbicide-tolerant and insect-resistant seeds are widely used. The adoption of GM seeds has helped farmers to increase crop yields and reduce their reliance on pesticides and herbicides, leading to significant cost savings.

Seeds Market Player

Some of the top seeds market companies offered in the professional report includes Monsanto Company, Syngenta AG, Limagrain, Dow AgroSciences LLC, KWS SAAT SE, Sakata Seed Corporation, Groupe Limagrain Holding SA, Land O'Lakes, Inc., Takii & Co., Ltd., Rallis India Limited, and The Scotts Miracle-Gro Company.

Frequently Asked Questions

What was the market size of the global seeds in 2022?

The market size of seeds was USD 67.0 Billion in 2022.

What is the CAGR of the global seeds market from 2023 to 2032?

The CAGR of seeds is 5.4% during the analysis period of 2023 to 2032.

Which are the key players in the seeds market?

The key players operating in the global market are including Monsanto Company, Syngenta AG, Limagrain, Dow AgroSciences LLC, KWS SAAT SE, Sakata Seed Corporation, Groupe Limagrain Holding SA, Land O'Lakes, Inc., Takii & Co., Ltd., Rallis India Limited, and The Scotts Miracle-Gro Company.

Which region dominated the global seeds market share?

Asia-Pacific held the dominating position in seeds industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of seeds during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global seeds industry?

The current trends and dynamics in the seeds industry include favorable government policies and initiatives to promote sustainable agriculture practices and increase crop yields.

Which type held the maximum share in 2022?

The genetically modified (GM) seed type held the maximum share of the seeds industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date