Security Robots Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Security Robots Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

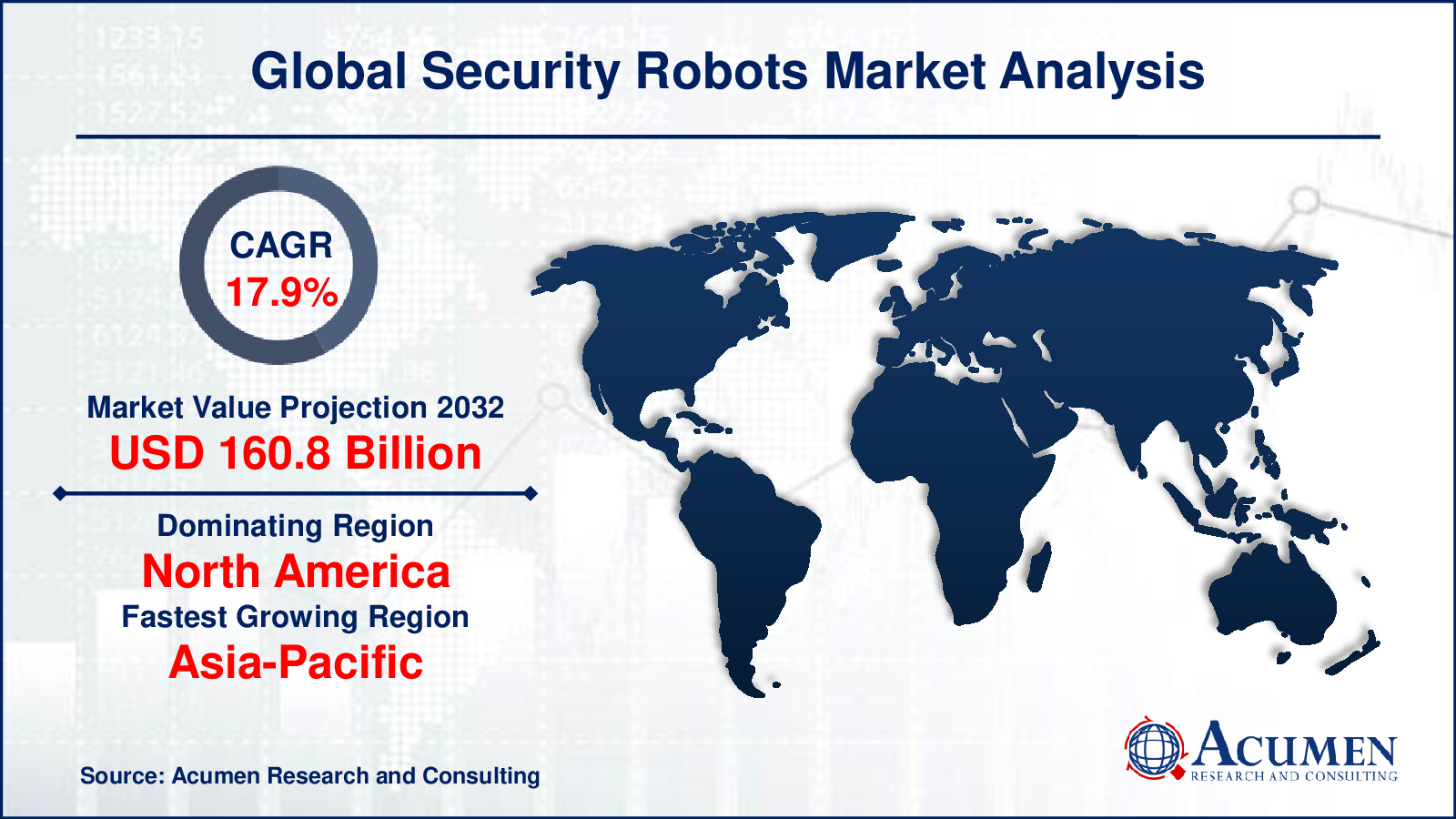

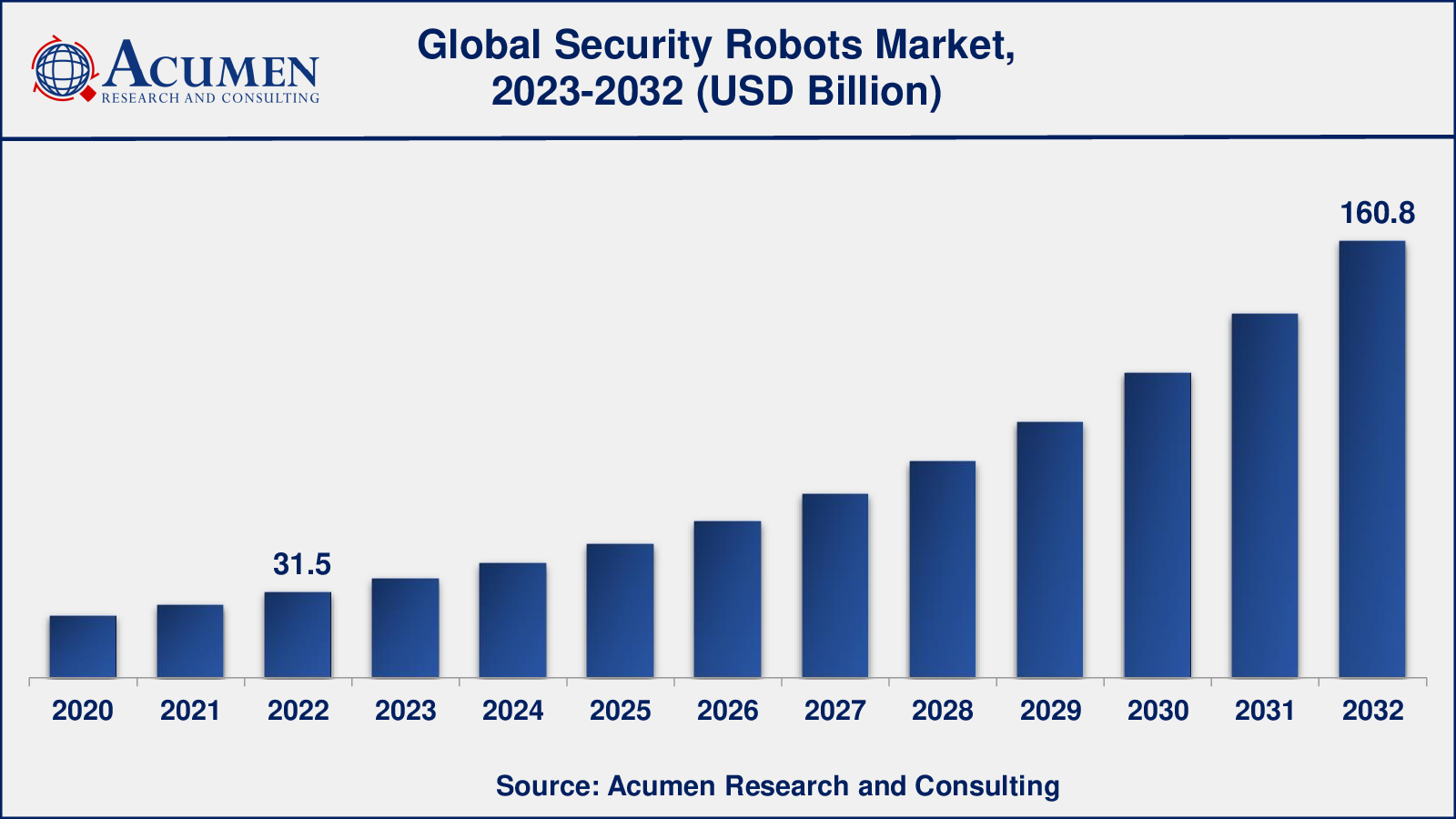

The Global Security Robots Market Size accounted for USD 31.5 Billion in 2022 and is estimated to achieve a market size of USD 160.8 Billion by 2032 growing at a CAGR of 17.9% from 2023 to 2032.

Security Robots Market Highlights

- Global security robots market revenue is poised to garner USD 160.8 billion by 2032 with a CAGR of 17.9% from 2023 to 2032

- North America security robots market value occupied around USD 16.1 billion in 2022

- Asia-Pacific security robots market growth will record a CAGR of more than 18% from 2023 to 2032

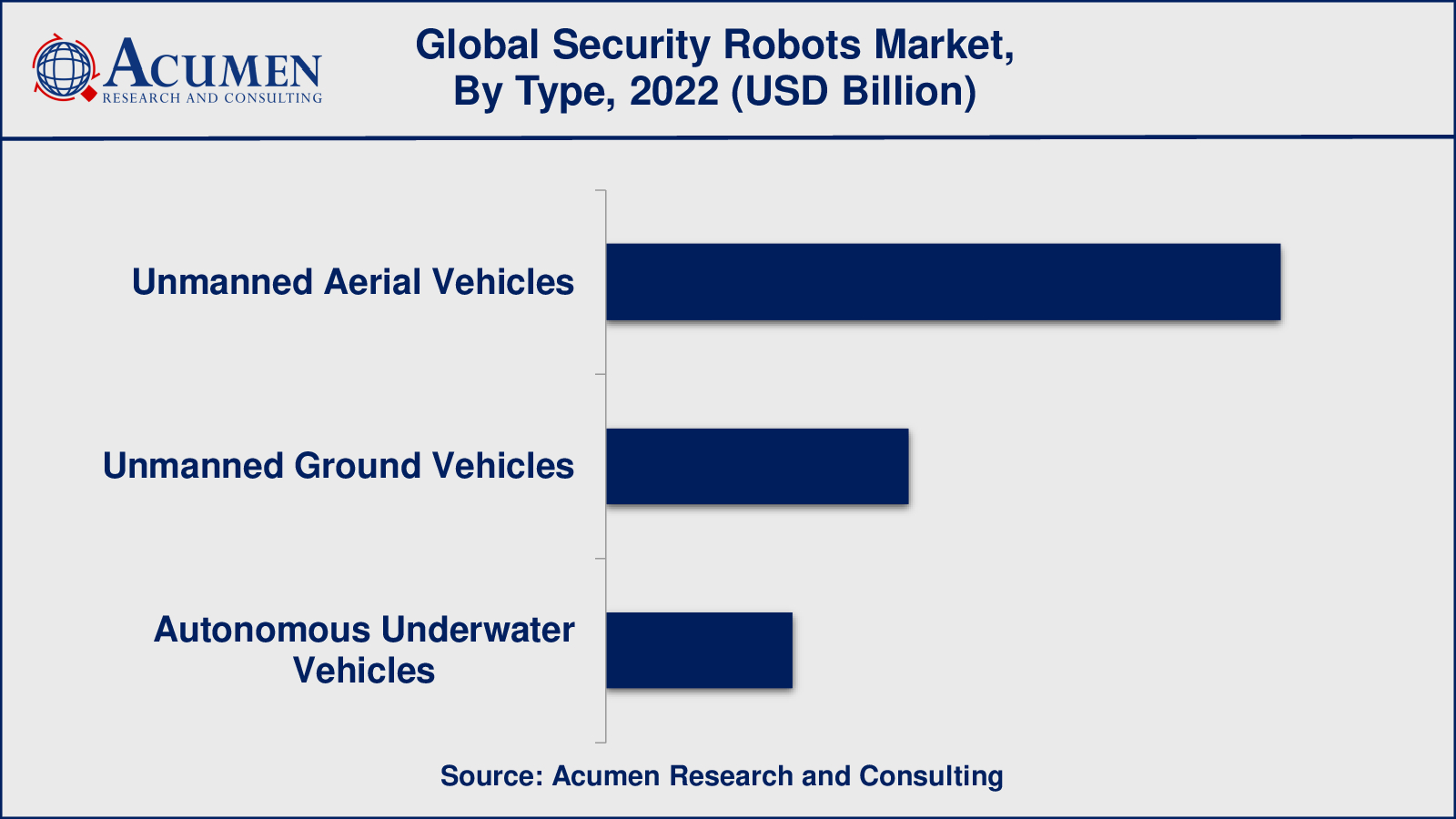

- Among type, the unmanned aerial vehicles sub-segment generated over US$ 18.3 billion revenue in 2022

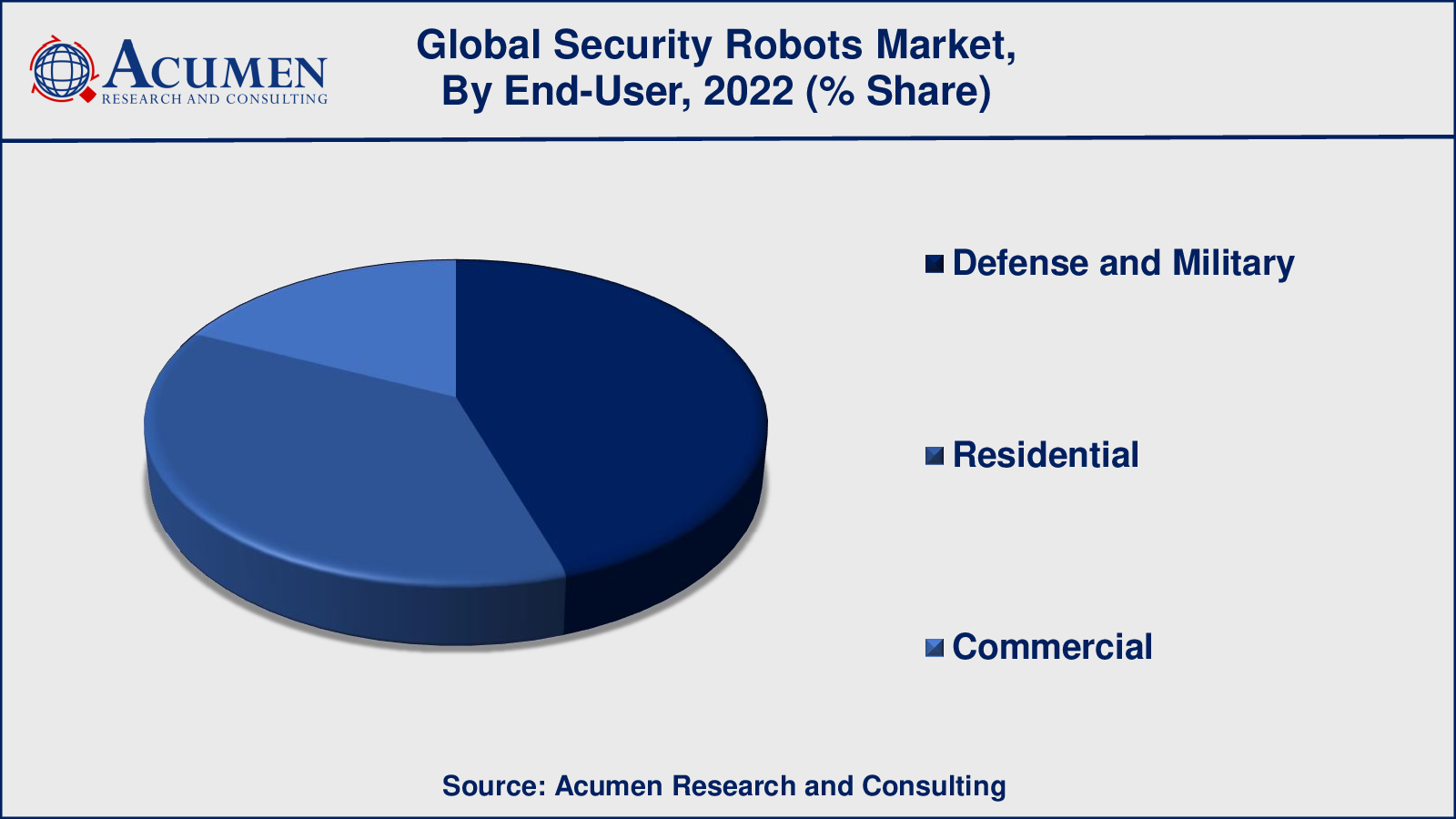

- Based on end-user, the defense and military sub-segment generated around 45% share in 2022

- Increasing integration of IoT and connectivity is a popular market trend that fuels the industry demand

A security robot is a versatile system designed to aid in various security tasks, spanning military applications, defense operations, and more. These robots are available in both hardware and software formats, including mobile applications with features like mapping and navigation. They find applications in both commercial and residential sectors, serving the purpose of enhancing safety and security. Security robots prove particularly valuable in defense systems, such as border security and surveillance, enabling governments to employ them for efficient patrolling and monitoring of border areas. Such advancements are expected to fuel market growth in this field.

Global Security Robots Market Dynamics

Market Drivers

- Increasing security concerns

- Rising use of robots for observation and security

- Growing criminal rate and territorial conflict

Market Restraints

- High installation cost of security robots

- Safety and security issue of robots

Market Opportunities

- Rising investment by government

- Adoption of cloud technologies and IoT

Security Robots Market Report Coverage

| Market | Security Robot Market |

| Security Robot Market Size 2022 | USD 31.5 Billion |

| Security Robot Market Forecast 2032 | USD 160.8 Billion |

| Security Robot Market CAGR During 2023 - 2032 | 17.9% |

| Security Robot Market Analysis Period | 2020 - 2032 |

| Security Robot Market Base Year | 2022 |

| Security Robot Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Component, By Application, By End-User, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AeroVironment Inc., BAE Systems Plc, Cobham Limited, DJI, Elbit Systems, Endeavor Robotics, Hyundai Motor Company, Knightscope Inc., Kongsberg Maritime, Leonardo SPA, L3 Harris Technologies Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, QinetiQ Group Plc., Recon Robotics, and Thales Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Security Robots Market Insights

The global increase in crime rates has led to a growing demand for security and safety measures. In this regard, security robots, including drones, play a vital role in surveillance applications and maintaining security. Drones, with their compact size and easy operability through remote devices, offer valuable assistance in security operations. The market for security robots is primarily driven by the escalating security concerns worldwide, with defense and military applications serving as significant factors for market growth. The demand for security robots is particularly on the rise in areas like surveillance and border security.

However, the installation and operational costs associated with security robots can be relatively high. The cost depends on the specific benefits and applications of the robots, typically ranging from $50,000 to $100,000. This factor can pose a challenge to the market's expansion.

On the positive side, the increasing popularity of security robots stems from their numerous advantages. These systems can effectively track assets and individuals while recording crucial data. Moreover, their ability to operate continuously without interruptions further enhances their appeal. The realization of these benefits is expected to create multiple opportunities in the security robot market in the coming years.

Security Robots Market Segmentation

The worldwide market for security robots is split based on type, component, application, end-user, and geography.

Security Robots Types

- Unmanned Aerial Vehicles

- Unmanned Ground Vehicles

- Autonomous Underwater Vehicles

According to security robots industry analysis, unmanned aerial vehicles (UAVs) have held the largest portion in the past years within the type segment. UAVs find significant utilization in both residential and commercial sectors due to their superior surveillance capabilities, making them an ideal choice for enhancing security and protecting border areas. Aerial robots employed for activities such as bomb detection, surveillance, mapping, and flight dynamics will be key drivers for the market's growth. On the other hand, unmanned ground vehicles (UGVs) are predominantly used in military applications. While UAVs hold the largest market revenue share, UGVs follow closely behind in the rankings.

Security Robots Components

- Hardware

- Software

- Services

Within the component segment, the hardware category emerged as the leader in terms of revenue share in previous years. Some of the primary hardware used in security robots include cameras, sensors, processing units, communication systems, and power systems among others. Looking ahead, the software segment is projected to exhibit the highest revenue growth rate over the forecast period, indicating promising prospects in the market. One commonly used robotic system in this domain is the Internet of Robotic Things (IoRT). IoRT is widely employed in smartphones for functions like navigation, surveillance, and integration with sensors.

Security Robots Applications

- Spying

- Explosive Detection

- Patrolling

- Rescue Operations

- Others

In recent years, the patrolling segment has emerged as the dominant application segment in the security robot market. The increasing demand for enhanced security measures in various sectors, including commercial areas, residential neighborhoods, and other monitored spaces, has necessitated the use of patrolling robots. This significant demand for patrolling robots is a key driver for the market's growth. Two noteworthy applications of mobile robots include patrolling and gas leak detection systems.

Another prominent application segment is spying, which holds the second-largest market share after patrolling. The spying segment is expected to exhibit the highest compound annual growth rate (CAGR) during the forecast period. As there is a growing emphasis on safety and heightened security at national borders, there is often a shortage of manpower for effective security monitoring. This creates a need for patrolling robots, and this segment is anticipated to significantly contribute to the market's growth in the coming years.

Security Robots End-Users

- Defense and Military

- Residential

- Commercial

According to the security robots market forecast, the defense and military segments have dominated the market share and are likely to continue its dominance throughout the forecasted timeframe from 2023 to 2032. The defense sector, particularly at border areas, has a crucial requirement for security robots to enhance line control, observation, and overall security. This demand from the defense and military sector has been a major driving force for the growth of the security robot market.

In terms of growth rate, the commercial segment is experiencing the fastest revenue growth with a high compound annual growth rate (CAGR) during the forecast period. The utilization of robots in commercial sectors, including public malls and parks, is on the rise. The integration of robots in these settings offers numerous benefits, such as obtaining high-quality data and improving worker safety. These factors contribute to the expanding adoption of security robots in the commercial segment, consequently driving market growth.

Security Robots Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Security Robots Market Regional Analysis

In terms of regional segments, North America has consistently held the largest revenue share in the security robots market in recent years. This growth can be attributed to increased government investments in the military, defense, and security sectors. In the United States, the demand for security robots has risen due to concerns regarding terrorist operations, further bolstering market growth in the region.

Europe follows closely behind with the second-largest revenue share in the security robot market. Germany, in particular, has shown a significant focus on advancing defense technologies, leading to an increase in the adoption of security robot systems. The rising demand for defense technology in Europe is expected to drive further growth in the market in the coming years.

The Asia-Pacific region, on the other hand, is experiencing the fastest growth in the security robot market. China, in particular, is witnessing a surge in the adoption of robotic systems, coupled with increasing emphasis on artificial intelligence (AI) applications, especially in the security and defense sectors. The government's focus on developing defense security robotic systems is anticipated to be a key driver for market growth in the Asia-Pacific region.

Security Robots Market Players

Some of the top security robots companies offered in our report includes AeroVironment Inc., BAE Systems Plc, Cobham Limited, DJI, Elbit Systems, Endeavor Robotics, Hyundai Motor Company, Knightscope Inc., Kongsberg Maritime, Leonardo SPA, L3 Harris Technologies Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, QinetiQ Group Plc., Recon Robotics, and Thales Group.

- AeroVironment has worked with Draganfly to create the QuantixTM Recon, a fully integrated drone-based system for aerial surveillance and reconnaissance. AeroVironment's drone expertise is combined with Draganfly's AI-powered imagery and analytics capabilities in this solution.

- BAE Systems has introduced the Manta, a new unmanned underwater vehicle (UUV). The Manta UUV is intended for a variety of missions, including mine detection, anti-submarine warfare, and information collection. It employs modern technology to improve autonomy and operating flexibility

Frequently Asked Questions

What was the market size of the global security robots in 2022?

The market size of security robots was USD 31.5 billion in 2022.

What is the CAGR of the global security robots market from 2023 to 2032?

The CAGR of security robots is 17.9% during the analysis period of 2023 to 2032.

Which are the key players in the security robots market?

The key players operating in the global market are including AeroVironment Inc., BAE Systems Plc, Cobham Limited, DJI, Elbit Systems, Endeavor Robotics, Hyundai Motor Company, Knightscope Inc., Kongsberg Maritime, Leonardo SPA, L3 Harris Technologies Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, QinetiQ Group Plc., Recon Robotics, and Thales Group.

Which region dominated the global security robots market share?

North America held the dominating position in security robots industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of security robots during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global security robots industry?

The current trends and dynamics in the security robots industry include increasing security concerns, raising use of robots for observation and security, and growing criminal rate and territorial conflict.

Which type held the maximum share in 2022?

The UAVs type held the maximum share of the security robots industry.