Security Analytics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Security Analytics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

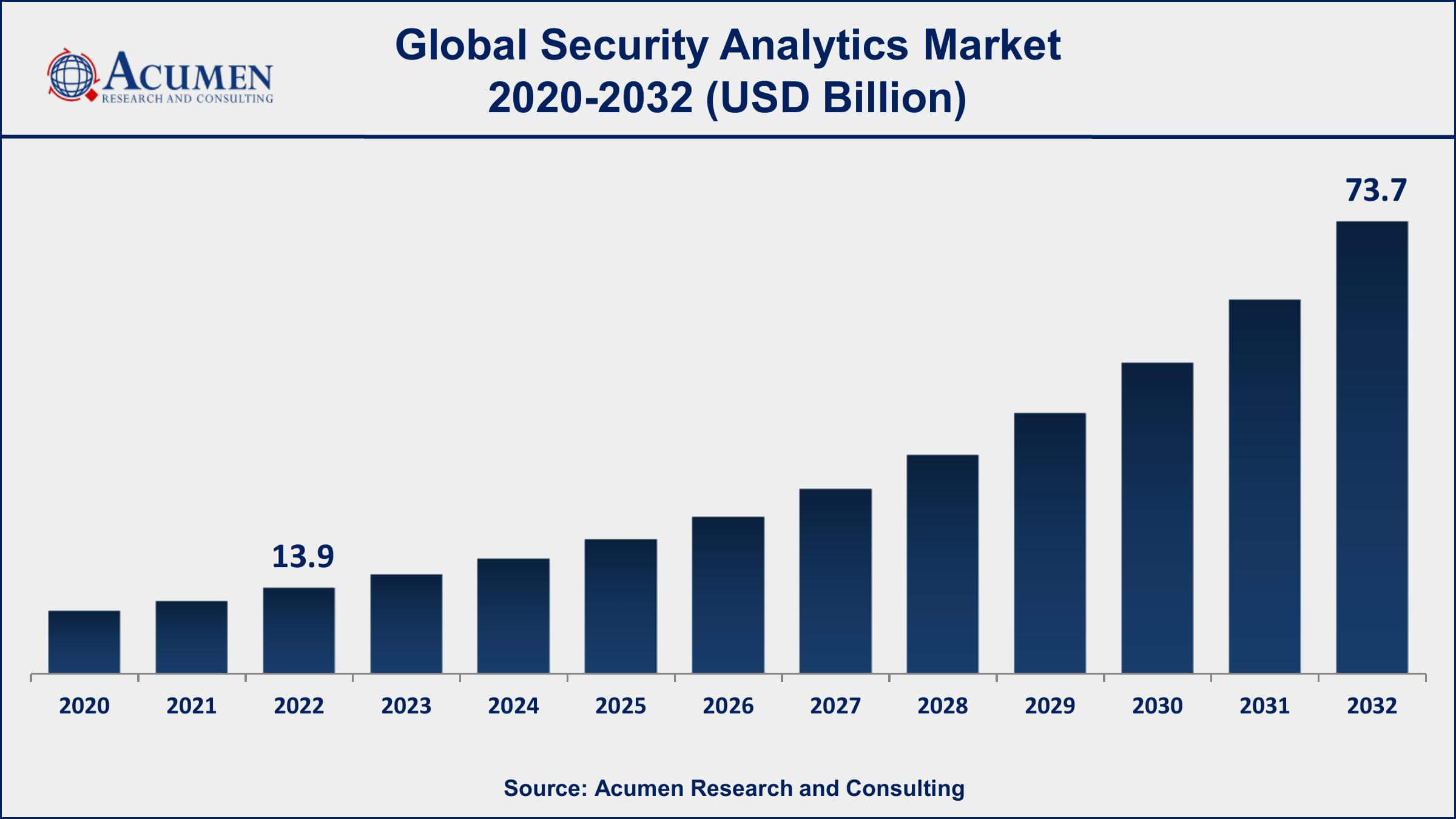

The Security Analytics Market Size accounted for USD 13.9 Billion in 2022 and is projected to achieve a market size of USD 73.7 Billion by 2032 growing at a CAGR of 16.4% from 2023 to 2032.

Security Analytics Market Key Highlights

- Global security analytics market revenue is expected to increase by USD 73.7 Billion by 2032, with a 16.4% CAGR from 2023 to 2032

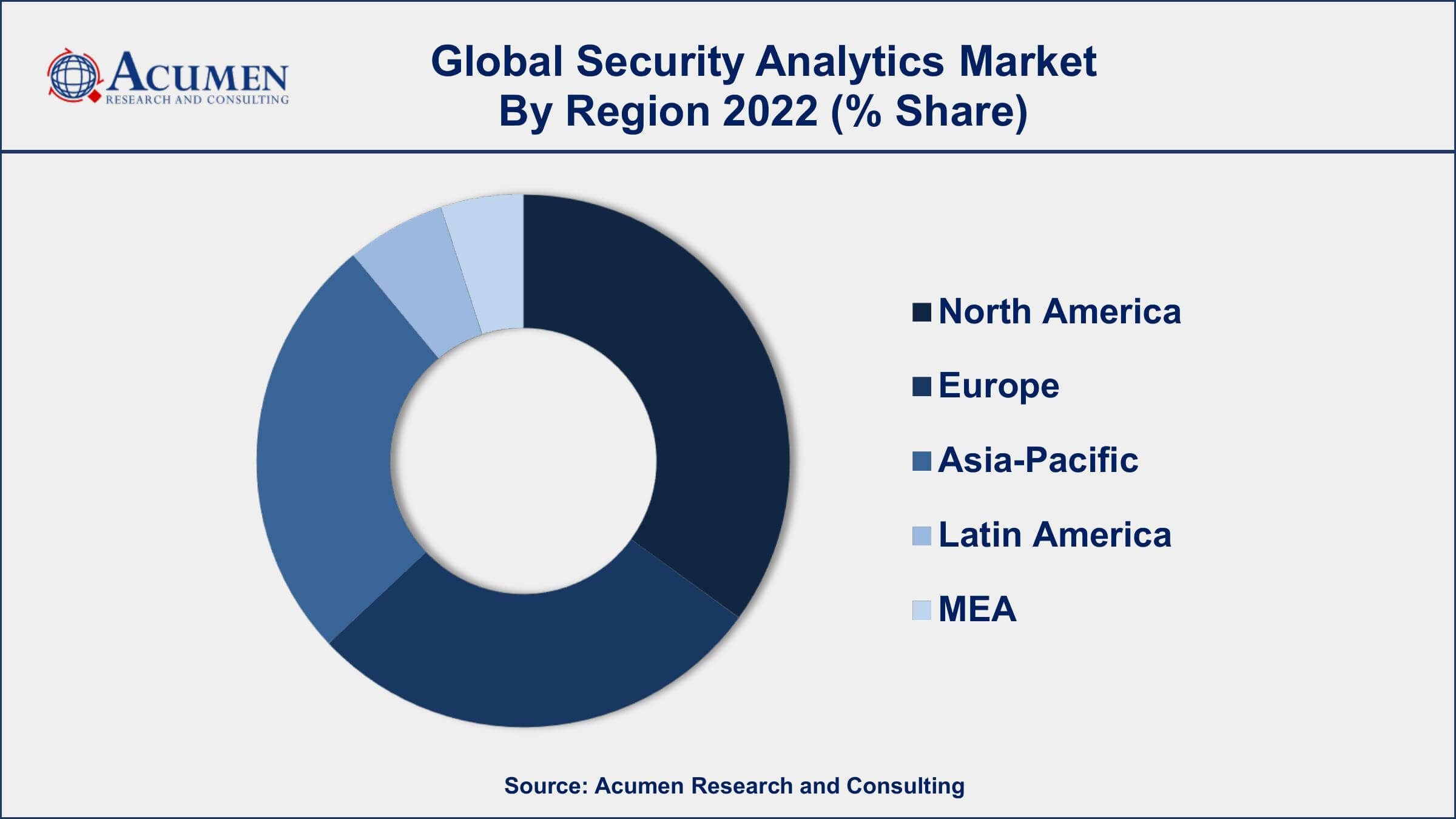

- North America region led with more than 40% of security analytics market share in 2022

- According to a Ponemon Institute survey, 79% of organizations are unable to detect and respond to threats without advanced security analytics tools

- According to a Dark Reading survey, 41% of organizations use security analytics to detect and respond to attacks, and 52% intend to increase their investment in security analytics in the coming year

- According to ISACA, the most common security threats in 2020 were phishing attacks (65%), ransomware (46%), and malware (45%)

- Increasing frequency and sophistication of cyber attacks, drives the security analytics market value

Security analytics is the process of using data analytics tools and techniques to identify security threats and vulnerabilities within an organization's network, systems, and applications. It involves analyzing large amounts of data from multiple sources, such as log files, network traffic, and user behavior, to detect abnormal patterns or behavior that may indicate a security threat. Security analytics helps organizations to proactively identify potential security risks, respond quickly to security incidents, and improve their overall security posture.

The market for security analytics is growing rapidly, driven by the increasing frequency and complexity of cyber attacks, as well as the growing adoption of cloud computing and mobile devices. Moreover, the market growth is driven by factors such as the increasing adoption of cloud-based security analytics solutions, the growing need for threat intelligence and risk management, and the increasing demand for advanced security analytics solutions in various industry verticals, such as healthcare, BFSI, and government.

Global Security Analytics Market Trends

Market Drivers

- Increasing frequency and sophistication of cyber attacks

- Growing adoption of cloud computing and mobile devices

- Need for proactive security measures and quick incident response

- Advancements in machine learning and AI technologies

- Growing awareness about the importance of cybersecurity

Market Restraints

- High cost of security analytics solutions

- Lack of skilled cybersecurity professionals

Market Opportunities

- Growing demand for real-time threat intelligence and incident response

- Adoption of security analytics by small and medium-sized enterprises

Security Analytics Market Report Coverage

| Market | Security Analytics Market |

| Security Analytics Market Size 2022 | USD 13.9 Billion |

| Security Analytics Market Forecast 2032 | USD 73.7 Billion |

| Security Analytics Market CAGR During 2023 - 2032 | 16.4% |

| Security Analytics Market Analysis Period | 2020 - 2032 |

| Security Analytics Market Base Year | 2022 |

| Security Analytics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Deployment Mode, By Organization Size, By Application, By Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | IBM Corporation, Splunk Inc., Cisco Systems Inc., FireEye Inc., McAfee LLC, Rapid7 Inc., RSA Security LLC, Securonix Inc., Symantec Corporation, Trustwave Holdings Inc., Varonis Systems Inc., and LogRhythm Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Factors promoting the security analytics market growth include an increase in the level of sophistication of security breaches and threats, various compliance requirements, and strict regulations. The challenges faced by the global security analytics industry include the limitation of end-user knowledge about threats. Other factors such as budget constraints and the high cost of innovation reduce the market growth. The global security analytics market is categorized on the basis of deployment mode, applications, services, industry vertical, and region. Based on services, the managed services segment is estimated to grow at a robust pace in the future years. Also, this segment is expected to garner huge demand owing to the rising need for organizations to adhere to various regulatory compliances across the world. Various applications for which security analytics solutions are used include network security analytics, web security analytics, application security analytics, end-point security analytics, and others. Among the various segments, end-point security analytics is estimated to grow at a robust pace during the future years owing to the rising trends of BYOD, IoT, and connected devices.

Network security analytics commands the largest share of the global security analytics market currently. The growth is boosted by rising attacks on the significant network infrastructures of organizations. The banking, financial services, and insurance (BFSI) vertical is estimated to grow at a robust pace during the future years owing to the rising adoption of web and mobile-based business applications, which are vulnerable to advanced cyber threats. Various organizations are actively employing security analytics solutions either on-cloud or on-premises. There is an increasing demand for cloud-based security analytics owing to the time-efficient and cost-effective features of the cloud; and its growth is especially high in enterprises, where there is a requirement for cheap cost solutions.

Security Analytics Market Segmentation

The global security analytics market segmentation is based on component, deployment mode, organization size, application, vertical, and geography.

Security Analytics Market By Component

- Services

- Platform

According to security analytics industry analysis, the platform segment held the largest market share in 2022. Platforms offer a range of security analytics tools and capabilities, including data collection, data processing, threat detection, and incident response. They provide a centralized platform for security analysts to monitor and manage security events across the organization, helping to identify potential threats and vulnerabilities before they can cause damage. The growing adoption of cloud-based platforms is also driving the growth of this segment. Cloud-based platforms offer greater scalability and flexibility, enabling organizations to quickly adapt to changing security threats and scale their security infrastructure as needed.

Security Analytics Market By Deployment Mode

- On-premises

- Cloud

In terms of deployment mode, the cloud segment is dominating the market in 2022. Cloud-based security analytics solutions offer several benefits such as scalability, cost-effectiveness, and flexibility. These solutions can be easily scaled up or down as per the organization's requirement, helping them to save costs. Cloud-based security analytics solutions are also easy to implement and maintain, allowing organizations to focus on their core business activities. The increasing need for real-time monitoring and quick response to security incidents is driving the cloud segment growth. Cloud-based solutions provide real-time visibility into security events and alerts, enabling security analysts to quickly respond to security incidents.

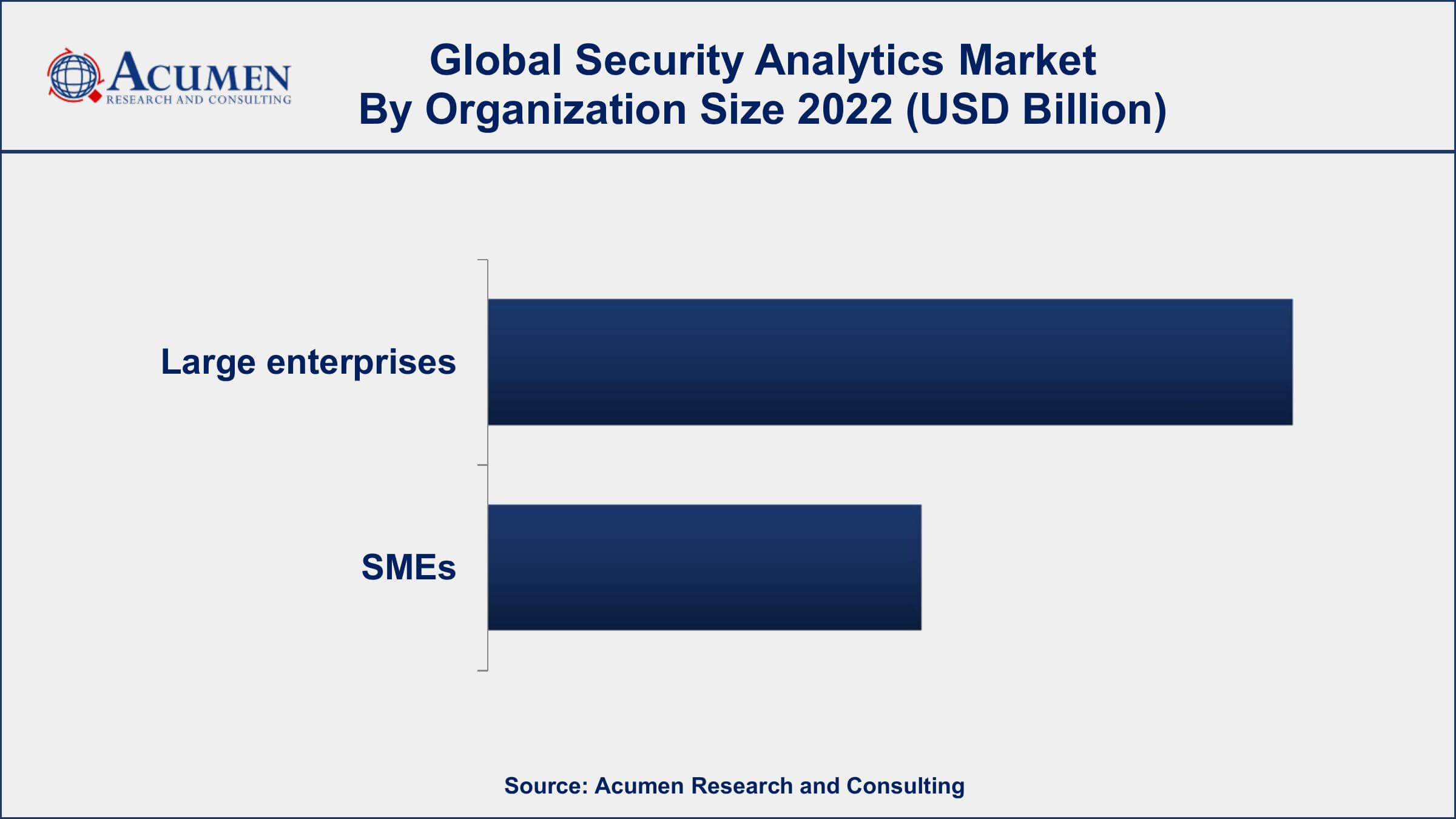

Security Analytics Market By Organization Size

- Large Enterprises

- SMEs

According to the security analytics market forecast, the SMEs (Small and Medium-sized Enterprises) segment is expected to witness significant growth in the coming years. In recent years, SMEs face the same security challenges as larger organizations but have limited resources to invest in expensive security solutions. As a result, SMEs are turning towards security analytics solutions that are cost-effective, easy to implement, and require minimal maintenance. The growing adoption of cloud-based security analytics solutions is driving the growth of the SMEs segment. Cloud-based solutions offer several benefits to SMEs such as cost savings, scalability, and flexibility. SMEs can take advantage of cloud-based security analytics solutions to monitor their networks, detect potential threats, and respond quickly to security incidents without having to invest in expensive hardware and software.

Security Analytics Market By Application

- Endpoint Security Analytics

- Web Security Analytics

- Application Security Analytics

- Network Security Analytics

- Others

Based on the application, the network security analytics segment is expected to witness significant growth in the coming years. This can be attributed to the increasing number of cyber attacks targeting networks and the need for organizations to monitor and secure their network traffic. Network security analytics solutions use machine learning, artificial intelligence, and other advanced analytics techniques to detect and respond to security threats in real-time. They analyze network traffic to identify patterns, anomalies, and other indicators of potential threats, enabling security teams to take immediate action to mitigate risks. The growing adoption of cloud computing, big data analytics, and the Internet of Things (IoT) is also fueling the demand for network security analytics solutions.

Security Analytics Market By Vertical

- BFSI

- Media and Entertainment

- Retail and eCommerce

- Telecom and IT

- Travel and Hospitality

- Healthcare

- Others

In terms of verticals, the BFSI sector has been experiencing significant growth in recent years. This is because the BFSI sector is particularly vulnerable to cyber attacks, and a security breach can have serious consequences such as financial loss, reputation damage, and loss of customer trust. Security analytics solutions enable BFSI organizations to detect and respond to security threats in real-time, and also help them comply with regulatory requirements related to data security and privacy. These solutions analyze large volumes of data from various sources, including transaction data, log data, and customer behavior data, to identify potential threats and anomalies. The increasing adoption of digital banking and mobile payment systems is also driving the demand for security analytics solutions in the BFSI sector.

Security Analytics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Security Analytics Market Regional Analysis

North America is dominating the security analytics market due to several factors, including the presence of a large number of cybersecurity solution providers, high adoption of advanced technologies, and increasing incidents of cyber attacks. The region is home to some of the world's largest technology companies, such as IBM, Microsoft, and Cisco, who are investing heavily in developing security analytics solutions. These companies are leveraging advanced technologies like artificial intelligence and machine learning to develop sophisticated security analytics solutions that can detect and respond to security threats in real-time. Another factor contributing to North America's dominance in the security analytics market is the high adoption of cloud computing and big data analytics. Furthermore, the region has a well-established regulatory framework for data protection and privacy, which is driving the adoption of security analytics solutions among organizations that need to comply with these regulations.

Security Analytics Market Player

Some of the top security analytics market companies offered in the professional report include IBM Corporation, Splunk Inc., Cisco Systems Inc., FireEye Inc., McAfee LLC, Rapid7 Inc., RSA Security LLC, Securonix Inc., Symantec Corporation, Trustwave Holdings Inc., Varonis Systems Inc., and LogRhythm Inc.

Frequently Asked Questions

What was the market size of the global security analytics in 2022?

The market size of security analytics was USD 13.9 Billion in 2022.

What is the CAGR of the global security analytics market from 2023 to 2032?

The CAGR of security analytics is 16.4% during the analysis period of 2023 to 2032.

Which are the key players in the security analytics market?

The key players operating in the global market are including IBM Corporation, Splunk Inc., Cisco Systems Inc., FireEye Inc., McAfee LLC, Rapid7 Inc., RSA Security LLC, Securonix Inc., Symantec Corporation, Trustwave Holdings Inc., Varonis Systems Inc., and LogRhythm Inc.

Which region dominated the global security analytics market share?

North America held the dominating position in security analytics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of security analytics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global security analytics industry?

The current trends and dynamics in the security analytics industry include increasing frequency and sophistication of cyber attacks, and rowing adoption of cloud computing and mobile devices.

Which component held the maximum share in 2022?

The platform component held the maximum share of the security analytics industry.