Seasonings and Spices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Seasonings and Spices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

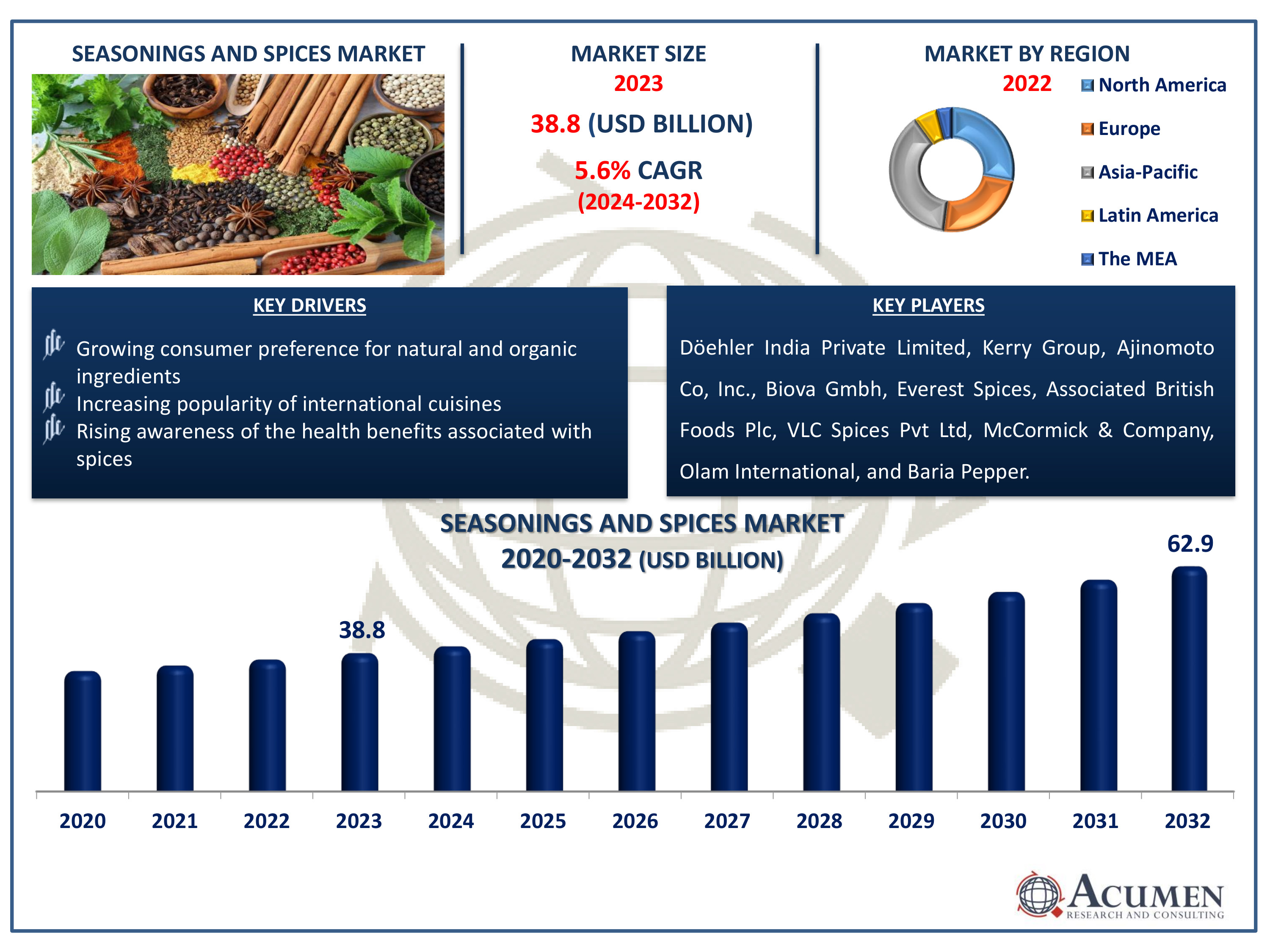

The Global Seasonings and Spices Market Size accounted for USD 38.8 Billion in 2023 and is estimated to achieve a market size of USD 62.9 Billion by 2032 growing at a CAGR of 5.6% from 2024 to 2032.

Seasonings and Spices Market Highlights

- Global seasonings and spices market revenue is poised to garner USD 62.9 billion by 2032 with a CAGR of 5.6% from 2024 to 2032

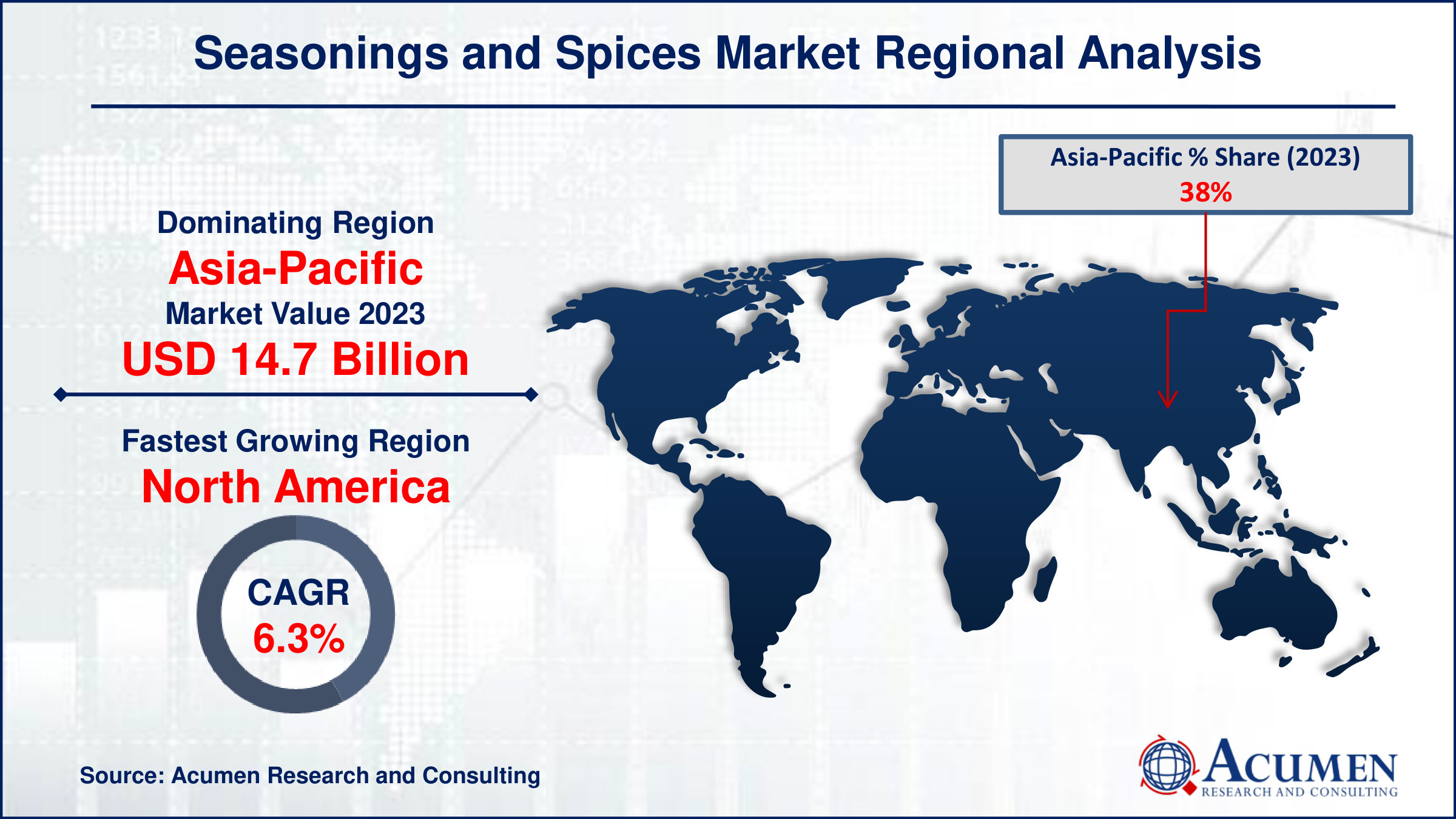

- Asia-Pacific seasonings and spices market value occupied around USD 14.7 billion in 2023

- North America seasonings and spices market growth will record a CAGR of more than 6.3% from 2024 to 2032

- Among product, the spices sub-segment generated 55% of the market share in 2023

- Based on form, the powder sub-segment generated 56% market share in 2023

- Increasing demand for organic and natural seasonings due to health and sustainability concerns is the seasonings and spices market trend that fuels the industry demand

Seasonings and spices are natural substances used to enhance the flavor and aroma of food. They encompass a wide range of plant-derived ingredients such as herbs (like basil, thyme) and spices (like cinnamon, cumin). These ingredients are used in various cuisines globally to impart distinctive tastes, aromas, and even colors to dishes. Beyond flavor enhancement, they often contribute health benefits, such as antioxidant properties or digestive aids. Whether used in marinades, rubs, sauces, or as garnishes, seasonings and spices play a crucial role in culinary traditions worldwide, offering depth and complexity to both simple and elaborate dishes alike. Their versatility extends from savory to sweet preparations, making them essential components in culinary artistry.

Global Seasonings and Spices Market Dynamics

Market Drivers

- Growing consumer preference for natural and organic ingredients

- Increasing popularity of international cuisines

- Rising awareness of the health benefits associated with spices

Market Restraints

- High costs of raw materials

- Stringent regulations and quality standards

- Fluctuations in supply due to climate change and agricultural challenges

Market Opportunities

- Expansion in emerging markets

- Innovation in packaging and product forms for convenience

- Rising demand for premium and exotic spice blends

Seasonings and Spices Market Report Coverage

|

Market |

Seasonings and Spices Market |

|

Seasonings and Spices Market Size 2023 |

USD 38.8 Billion |

|

Seasonings and Spices Market Forecast 2032 |

USD 62.9 Billion |

|

Seasonings and Spices Market CAGR During 2024 - 2032 |

5.6% |

|

Seasonings and Spices Market Analysis Period |

2020 - 2032 |

|

Seasonings and Spices Market Base Year |

2023 |

|

Seasonings and Spices Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Form, By Application, By Distribution Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Döehler India Private Limited, Kerry Group, Ajinomoto Co, Inc., Biova Gmbh, Everest Spices, Associated British Foods Plc, VLC Spices Pvt Ltd, McCormick & Company, Olam International, and Baria Pepper. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Seasonings and Spices Market Insights

The increasing consumer preference for natural and organic ingredients is significantly boosting the demand for seasonings and spices. For instance, according to the Organic Trade Association (OTA), organic food sales in the US surpassed USD 63 billion from 2020 to 2022, surpassing the sales growth of conventional groceries typically found in large hypermarkets and supermarkets. Health-conscious individuals are seeking products free from synthetic additives, prompting manufacturers to offer organic options. This trend aligns with the broader movement towards clean labeling and transparent sourcing. As consumers become more informed about health and wellness, they favor seasonings and spices that enhance flavor while adhering to natural and organic standards. Consequently, the market for these products is expanding, reflecting the shift towards healthier and more sustainable eating habits.

Climate change and agricultural challenges significantly impact the supply of seasonings and spices, causing fluctuations in the market. Extreme weather conditions, such as droughts, floods, and temperature variations, disrupt crop yields and reduce the availability of essential spices. These environmental changes increase production costs and create supply chain uncertainties. Farmers face difficulties in maintaining consistent quality and quantity, leading to price volatility. As a result, the seasonings and spices market encounters restraints in meeting consumer demand consistently.

Innovations in packaging and product forms are transforming the seasonings and spices market by enhancing convenience for consumers. For instance, in March 2023, McCormick introduced a redesigned packaging for its herbs and spices line, featuring bottles made from 50% recycled (PCR) plastic, enhancing the company's commitment to environmentally sustainable production practices. User-friendly packaging such as resealable bags, single-serve packets, and easy-to-use grinders cater to modern lifestyles, making it simpler to incorporate spices into daily cooking. Additionally, innovative product forms like spice blends and pre-measured portions save time and reduce waste. These advancements not only improve the user experience but also broaden the market reach, appealing to a wider audience seeking quick and efficient culinary solutions. Consequently, the seasoning and spices market is poised for significant growth, driven by these consumer-centric innovations.

Seasonings and Spices Market Segmentation

Seasonings and Spices Market Segmentation

The worldwide market for seasonings and spices is split based on product, form, application, distribution channel, and geography.

Seasoning and Spices Market By Product

· Herbs

o Rosemary

o Fennel

o Garlic

o Mint

o Parsley

o Oregano

o Others

· Spices

o Pepper

o Ginger

o Cinnamon

o Cumin

o Turmeric

o Cardamom

o Coriander

o Cloves

o Others

· Salt & Salt substitutes

According to the seasonings and spices industry analysis, spices dominate the market due to their essential role in enhancing the flavor and aroma of dishes across diverse cuisines. Their natural origin and health benefits, such as anti-inflammatory and antioxidant properties, boost consumer demand. The global popularity of ethnic and regional flavors further drives their market dominance. Key player’s further boosts demand due to their advancements in countries. For instance, in April 2023, The Kraft Heinz Company introduced Just Spices to the U.S. market, marking just one year since acquiring a majority stake in the business. Additionally, the versatility of spices in various culinary applications ensures their continued prevalence in both home kitchens and the food industry.

Seasoning and Spices Market By Form

· Whole

· Crushed

· Powder

According to the seasoning and spice market analysis, powder form dominates the seasonings and spices market due to its convenience, longer shelf life, and ease of storage and transportation. Consumers and manufacturers favor powdered spices for their versatility in cooking and ability to blend easily with other ingredients. Additionally, powdered spices retain their flavor and potency over time, making them a preferred choice for both home cooks and the food industry. This dominance is driven by consumer demand for practical and long-lasting seasoning options.

Seasoning and Spices Market By Application

· Bakery & Confectionary Products

· Meat & Poultry Products

· Frozen Food

· Soups, Sauces & Dressings

· Beverages

· Others

According to the seasonings and spices market forecast, the meat & poultry products application shows notable growth in 2023. This is due to the significant global consumption of meat, where seasonings and spices play a crucial role in enhancing flavor, tenderizing, and preserving the meat. Consumers preference for diverse and flavorful meat dishes drives the high demand for spices in this segment. Additionally, the growing popularity of various meat-based cuisines worldwide further boosts this application.

Seasoning and Spices Market By Distribution Channel

· Foodservice

· Retail

According to the seasonings and spices industry forecast, the foodservice channel dominates due to its ability to provide bulk quantities at competitive prices, catering to high-volume demands typical in commercial kitchens. Foodservice distributors offer a wide range of seasonings and spices, ensuring availability of both popular and niche products tailored to culinary preferences. Their efficient logistics and supply chain management support timely delivery, crucial for maintaining kitchen operations. Additionally, they often provide customized blends and packaging options, enhancing convenience and meeting specific culinary requirements of foodservice establishments.

Seasonings and Spices Market Regional Outlook

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Asia-Pacific

· India

· Japan

· China

· Australia

· South Korea

· Rest of Asia-Pacific

Latin America

· Brazil

· Mexico

· Rest of LATAM

The Middle East & Africa

· South Africa

· GCC Countries

· Rest of the Middle East & Africa (ME&A)

Seasonings and Spices Market Regional Analysis

For several reasons, Asia-Pacific dominates seasonings and spices market. This is largely due to the rich diversity of culinary traditions across countries like India, China, Thailand, and others, which have contributed to a wide variety of spices and seasonings being produced and consumed in this region. Additionally, manufacturers focusing on spice blend production which further contributes to market growth in Asian region. For instance, in September 2021, Rumi Spice introduced three new spice blends available on Whole Foods Market shelves, featuring products like 'Rumi Spice Saffron', 'Wild Black Cumin (Ground)', 'Afghan Curry Braise', 'Southwest Chili', and 'Kabul Piquant Chicken'. Moreover, the growing popularity of Asian cuisines worldwide has also boosted the demand for these products globally.

North America has emerged as the fastest-growing region due to increasing consumer demand for diverse and authentic flavors in food. Factors such as presence of robust manufacturers, changing dietary preferences towards healthier options, and growing awareness of international cuisines contribute to this growth. For instance, in April 2023, McCormick announced an expanded partnership with Tabitha Brown, unveiling five new salt-free, vegan seasoning products for U.S. grocery stores. These products, co-created with Tabitha Brown, include: McCormick like Sweet like Smoky All Purpose Seasoning, McCormick Burger Bliss Seasoning Mix, McCormick Very Good Garlic All Purpose Seasoning, McCormick Sauté Sensation Seasoning Mix, and McCormick Taco Tantalizer Seasoning Mix. Moreover, innovations in product formulations and packaging tailored to consumer convenience further drive market expansion in North America.

Seasonings and Spices Market Players

Some of the top seasonings and spices companies offered in our report include Döehler India Private Limited, Kerry Group, Ajinomoto Co, Inc., Biova Gmbh, Everest Spices, Associated British Foods Plc, VLC Spices Pvt Ltd, McCormick & Company, Olam International, and Baria Pepper.

Frequently Asked Questions

How big is the seasonings and spices market?

The seasonings and spices market size was valued at USD 38.8 billion in 2023.

What is the CAGR of the global seasonings and spices market from 2024 to 2032?

The CAGR of seasonings and spices is 5.6% during the analysis period of 2024 to 2032.

Which are the key players in the seasonings and spices market?

The key players operating in the global market are including Döehler India Private Limited, Kerry Group, Ajinomoto Co, Inc., Biova Gmbh, Everest Spices, Associated British Foods Plc, VLC Spices Pvt Ltd, McCormick & Company, Olam International, and Baria Pepper

Which region dominated the global seasonings and spices market share?

Asia-Pacific held the dominating position in seasonings and spices industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of seasonings and spices during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global seasonings and spices industry?

The current trends and dynamics in the seasonings and spices industry include growing consumer preference for natural and organic ingredients, increasing popularity of international cuisines, and rising awareness of the health benefits associated with spices.

Which product held the maximum share in 2023?

The spices product held the maximum share of the seasonings and spices industry.