Scissor Lift Market

Published :

Report ID:

Pages :

Format :

Scissor Lift Market

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

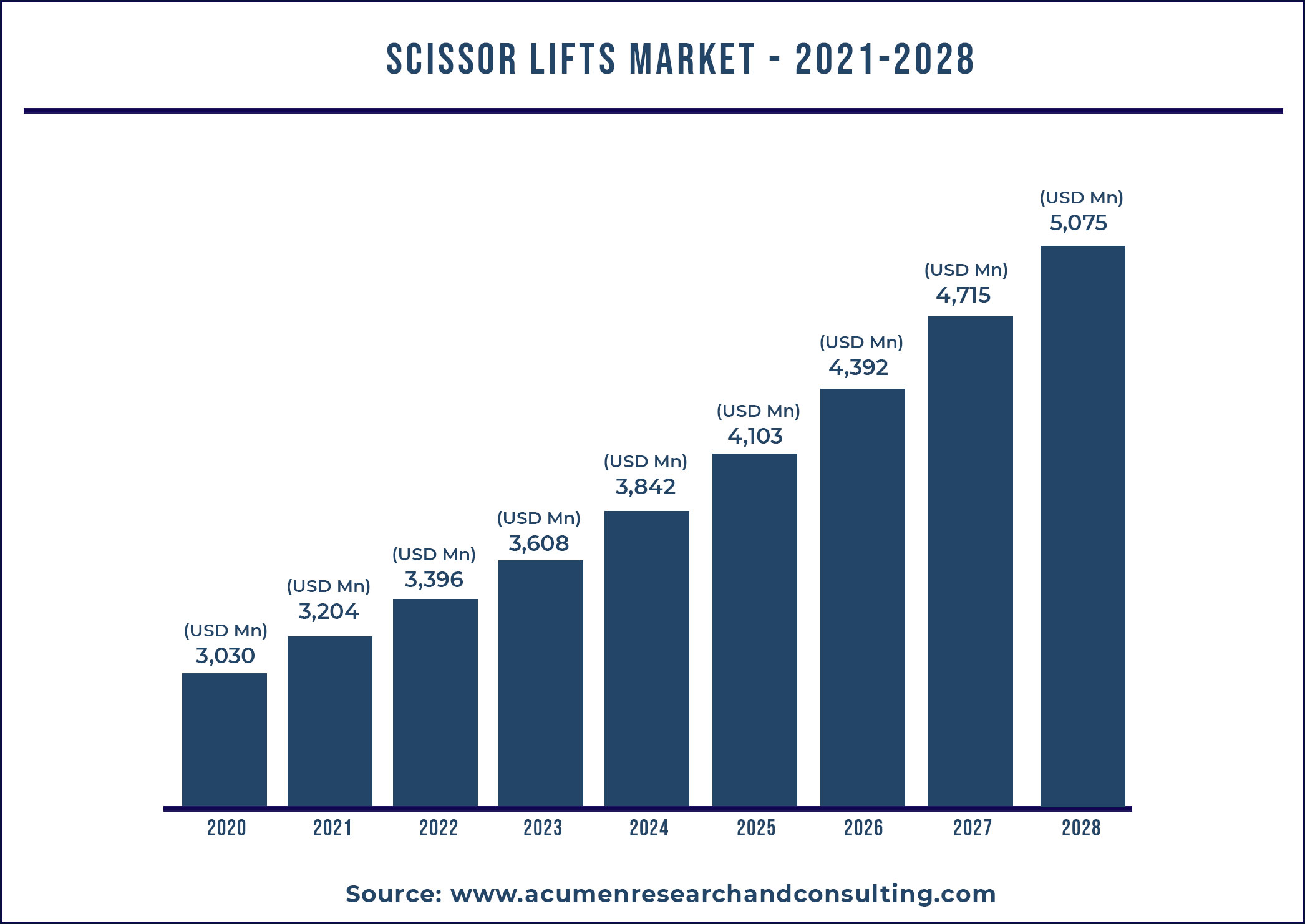

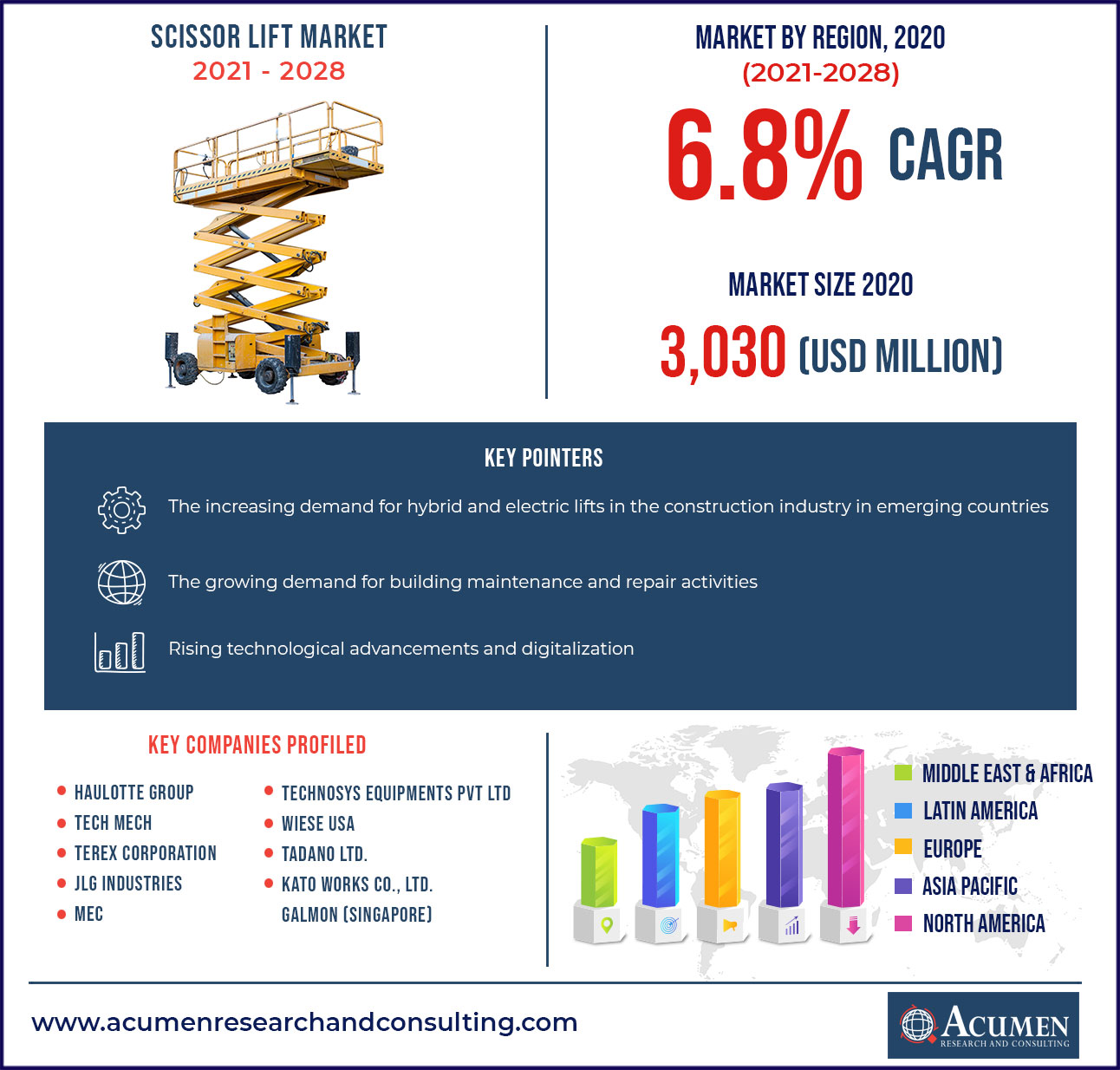

The scissor lift market accounted for US $3,030 Million in 2020 with a considerable CAGR of 6.8% throughout the forecast period from 2021 to 2028.

A scissor lift, also known as amobile elevated work platform (MEWP) or aerial work platform (AWP),is a motorized vehicle utilized for moving personnel and equipment to inaccessible areas, often at a height. These lifts are trendy model of aerial platform lift which is used for interior work such as hanging signs, ceiling construction and maintenance projects among others. Scissor lifts often only reach as high as 20 – 50 feet and have a lower platform height than a boom lift.In addition, it offers a safe and reliable environment for workers to complete their projects. However,these lifts are mostly used in construction, irrigation, urban infrastructures, mining operations, airports, railways, and ports construction. Furthermore, increasing the adoption of scissor lifts due to safety concerns will drive the market of scissor lifts and is expected to reach value of US$5,075 million in 2028.

Market Drivers:

- Increasing demand for hybrid and electric lifts in the construction industry

- Rising concerns regarding workplace safety

- Ease of operation and flexibility

Market Restraints:

- High maintenance cost

Market Opportunities:

- Rising technological advancements and digitalization

- Growing demand for building maintenance and repair activities

Ease of operation and flexibility provide by scissor lifts is boosting scissor lift market.

One of the key advantages scissor lifts providesis ease of operation and compact storage. Scissor lifts are veryeasy to handle and can be easily moved from one place to another, as compared to mobile scaffoldings and ladders.Additionally, scissor lifts can be operated without need of training for the workers, which makes them more productive. Also, these lifts require very few spaces for storage due to their compact size. Increasing adoption of scissor lifts inconstruction industries iscontributing to the growth of the scissor lifts market. The worldwide scissor lift players are gaining remarkable sales opportunities in the recent years asthere is remarkable growth in construction activities due to the growing urban populationacross the globe and rising focus on the infrastructural development by the government.

Rising technological advancements and digitalization driving the growth of the scissor lift market in forthcoming years

Rising technological advancements and digitalization will boost the growth of the scissor lift market in forthcoming years. In recent years, the rental areas or industry has accelerated due to surge in adoption of new technologies. For instance, the recent technologyis telematics systems, which is designed to enhance the efficiency of machine operation. Since 2015,Terex Corporation are putting telematics equipment on their products tosave customers money in the form of less service callsand to give them more rental time on the machine. Moreover, in 2019, Terex Corporation also launched the Genie lift connect telematics solution which provide information data about battery life, fault codes and fuel levels.Furthermore, technological advancement to increase productivity and safety are expected drive the scissor lifts industry further.

Report Coverage:

| Market | Scissor Lift Market |

| Market Size 2020 | US $3,030 Mn |

| Market Forecast 2028 | US $5,075 Mn |

| CAGR | 6.8 % During 2021 - 2028 |

| Analysis Period | 2017 - 2028 |

| Base Year | 2020 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Engine Type, By Lift Height, By End-User and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | HAULOTTE GROUP, Tech Mech, Terex Corporation, JLG Industries, MEC, TechnosysEquipments Private Limited, WIESE USA, Tadano Ltd., KATO WORKS CO., LTD., Galmon (Singapore) and among others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Market Segmentation

Thescissor liftmarket is segmented based on, engine type, lift height, end-user and region.

Market by Engine Type

- Electric Scissor Lift

- Engine Powered Lift

By the engine type segment, the electric scissor lift segment leads the market share in 2020 is expected to exhibit lucrative growth of the market asthese lifts areoften used as an indoor aerial work platform like accessing a high storage rack, working in a loading beam, replacing a light bulb etc. In addition, most electric scissor lifts have a narrow platform that allows workers to secure space in retail stores and warehouses. Also, this is less expensive as compared others lift such as gas-powered lifts. Furthermore, the flexibility and usability make electric lifts an ideal replacement for traditional ladders in various workplaces.

Market Lift Height

- Less than 10 Meters

- 10 Meters to 20 Meters

- More than 20 Meters

Based on lift height segment, less than 10 meters dominates the market share and expected to grow over the forecast period, owing tosize compatibility, low cost as compared to otherslift sizes. In addition, less than 10 meters lift size are usually ideal for usage in cramped and tight spaces. Also, these sizes are usually used for indoor constructions such as access the ductwork of buildings, interior roofs, window repairing or washing and other maintenance works. Furthermore, small size scissor lift i.e less than 10 meters are used for small indoor job sites and generally runs on electricity.

Market by End-User

- Construction Industry

- Retail Storage & Warehouse

- Transportation

- Logistics

Based on end-user segment,the construction industryhas advanced rate of scissor lift usageand projected to expand over the forthcoming years, owing tothe adoption of advanced technologies in construction industry in North America and Asia Pacific.

Regional Overview

North America region contributed for the largest global Scissor Lift market share in 2020

Of all the regions, North America has the largest market share in 2020, with increasing investment in infrastructure development expected to be a key factor for region's growing market over the forecast period. In addition, the future implementation of American National Standards Institute(ANSI) standardsfor construction products and safety is the major reason for supporting the potential growth of the region. Also, surge in number ofcommercial and residential constructions is creating demand for scissor lifts.Moreover, technological advancement in the region will further develop the entire North American scissor lifts market during the forthcoming years.

Moreover, Asia Pacific is anticipated to grow at a substantial CAGR of scissor lift market during forthcoming years from 2021 to 2028, due toincreasing disposable income, rising population and consequent pressure on carrier infrastructure in the telecommunications industry in Southeast Asian countries.

Competitive Landscape

This section of the report identifies various key players of the market. Some of the key players profiled in the report include HAULOTTE GROUP, Tech Mech, Terex Corporation, JLG Industries, MEC, TechnosysEquipments Private Limited, WIESE USA, Tadano Ltd., KATO WORKS CO., LTD., Galmon (Singapore) and among others.

Market By Geography

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions

How much was the estimated value of the global Scissor Lift market in 2020

The estimated value of global Scissor Lift market in 2020 was accounted to be US$3,030 Mn.

What will be the projected CAGR for global Scissor Lift market during forecast period of 2021 to 2028?

The projected CAGR of Scissor Lift during the analysis period of 2021 to 2028 is 6.8%.

Which are the prominent competitors operating in the market?

This section of the report identifies various key manufacturers of the market. Some of the key players profiled in the report include HAULOTTE GROUP, Tech Mech, Terex Corporation, JLG Industries, MEC, Technosys Equipments Private Limited, WIESE USA, Tadano Ltd., KATO WORKS CO., LTD., Galmon (Singapore) and among others.

Which region held the dominating position in the global Scissor Lift market?

North America held the dominating share for Scissor Lift during the analysis period of 2021 to 2028

Which region exhibited the fastest growing CAGR for the forecast period of 2021 to 2028?

Asia Pacific region exhibited fastest growing CAGR for Scissor Lift during the analysis period of 2021 to 2028

What are the current trends and dynamics in the global Scissor Lift market?

The increasing demand for hybrid and electric lifts in the construction industry in emerging countries, the growing demand for building maintenance and repair activities, ease of operation and flexibility offered by scissor lifts and rising technological advancements and digitalization driving the growth of the scissor lift market.

By segment Lift Height, which sub-segment held the maximum share?

Based on engine type, electric scissor lift segment accounted the significant share in 2020.