Saturating Kraft Paper Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Saturating Kraft Paper Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

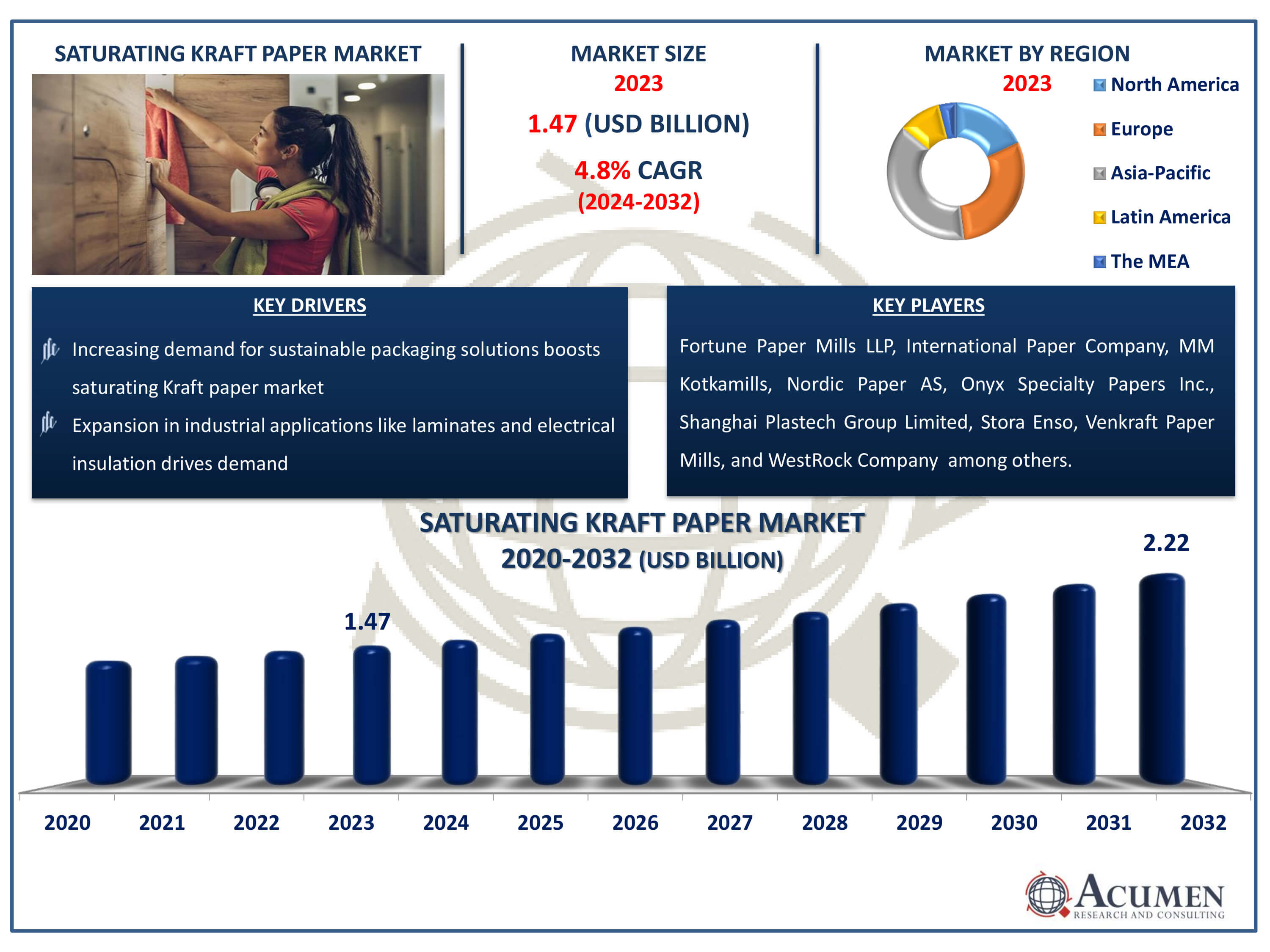

The Saturating Kraft Paper Market Size accounted for USD 1.47 Billion in 2023 and is estimated to achieve a market size of USD 2.22 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

Saturating Kraft Paper Market Highlights

- Global saturating Kraft paper market revenue is poised to garner USD 2.22 billion by 2032 with a CAGR of 4.8% from 2024 to 2032

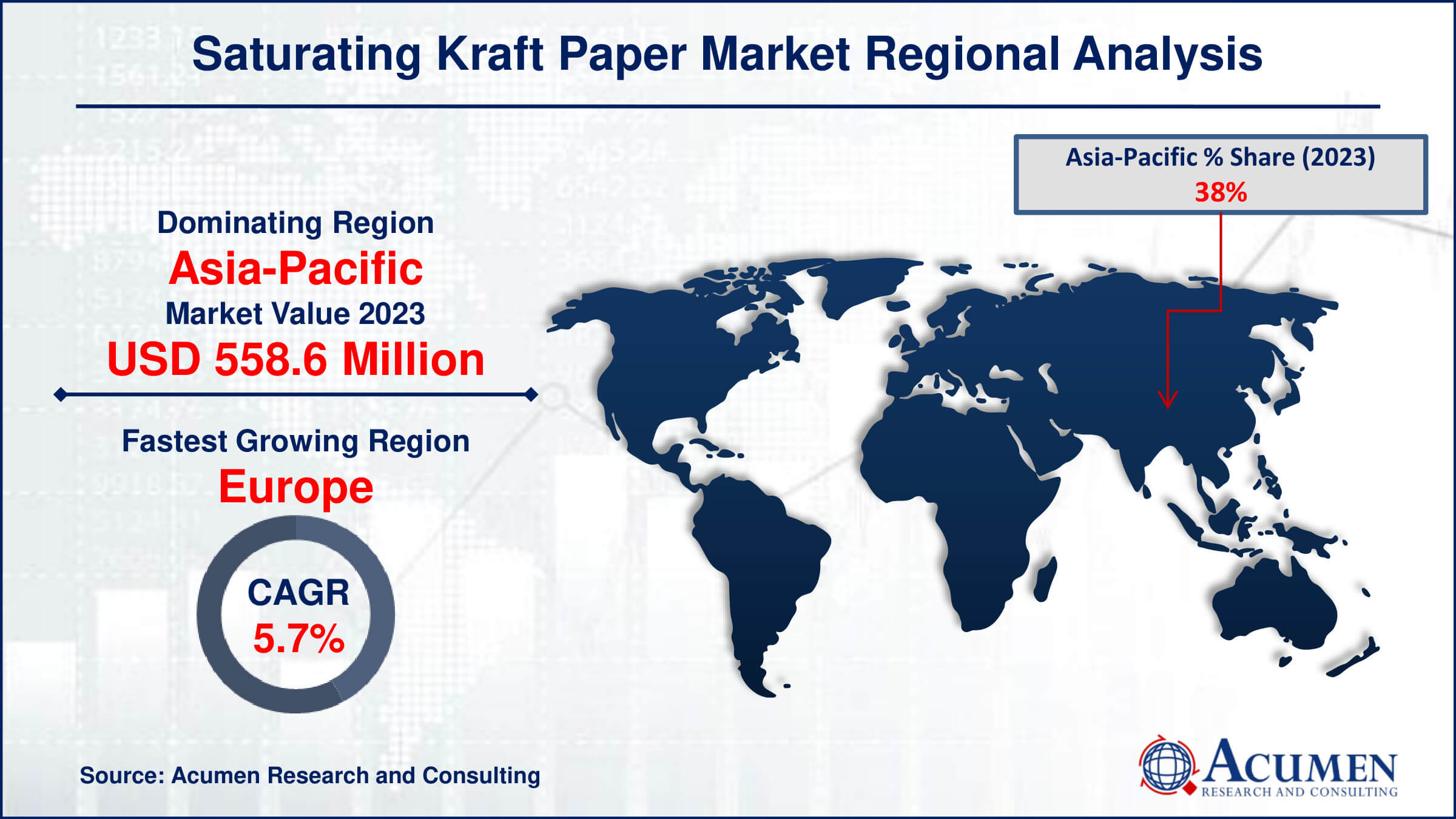

- Asia-Pacific saturating Kraft paper market value occupied around USD 558.6 million in 2023

- Europe saturating Kraft paper market growth will record a CAGR of 5.2% from 2024 to 2032

- Among type, the unbleached Kraft paper sub-segment gathered USD 882 million in revenue in 2023

- Based on weight, the 101 to 200 GSM sub-segment occupied 43% market share in 2023

- Rising environmental consciousness and regulatory pressures is a popular saturating Kraft paper market trend that fuels the industry demand

Saturating Kraft paper is a type of specialty paper made by fully impregnating (or saturated) the paper fibers with a resinous ingredient, such as phenolic or melamine resin. This impregnation technique increases the paper's strength, durability, and moisture resistance, making it appropriate for a wide range of industrial uses. Saturating Kraft paper is well-known for its durability and versatility; it is frequently used in industries that require high-performance materials such as laminates, electrical insulation, abrasives, and industrial packaging.

In laminates, saturating Kraft paper serves as the core material, ensuring structural integrity and dimensional stability. It is also used for electrical insulation because of its high dielectric characteristics and resilience to heat and chemicals. Furthermore, in the field of industrial packaging, saturating Kraft paper is recognized for its capacity to endure heavy loads and hard handling, thereby protecting goods during storage and transit. Its expanding popularity is driven by the need for dependable, environmentally friendly packaging solutions that meet strict industry performance and sustainability standards.

Global Saturating Kraft Paper Market Dynamics

Market Drivers

- Increasing demand for sustainable packaging solutions boosts saturating Kraft paper market

- Expansion in industrial applications like laminates and electrical insulation drives demand

- Technological advancements in resin impregnation enhance paper performance and applications

- Stringent environmental regulations promote adoption of eco-friendly saturating Kraft paper

Market Restraints

- High production costs hinder widespread adoption of saturating Kraft paper

- Competition from plastics and synthetic papers challenges market penetration

- Logistics challenges due to weight and bulkiness affect supply chain efficiency

Market Opportunities

- Emerging economies offer growth opportunities in construction and automotive sectors

- Saturating Kraft paper's use in renewable energy applications like electrical insulation

- Innovation in product customization enhances competitiveness and market share

Saturating Kraft Paper Market Report Coverage

| Market | Saturating Kraft Paper Market |

| Saturating Kraft Paper Market Size 2022 | USD 1.47 Billion |

| Saturating Kraft Paper Market Forecast 2032 | USD 2.22 Billion |

| Saturating Kraft Paper Market CAGR During 2023 - 2032 | 4.8% |

| Saturating Kraft Paper Market Analysis Period | 2020 - 2032 |

| Saturating Kraft Paper Market Base Year |

2022 |

| Saturating Kraft Paper Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Weight, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Fortune Paper Mills LLP, International Paper Company, MM Kotkamills, Nordic Paper AS, Onyx Specialty Papers Inc., Potsdam Specialty Paper Inc., Shanghai Plastech Group Limited, Stora Enso, Venkraft Paper Mills Pvt. Ltd., and WestRock Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Saturating Kraft Paper Market Insights

The saturating Kraft paper market is driven by several key factors that shape its growth trajectory. The increasing demand for sustainable packaging solutions worldwide has led to a surge in popularity for biodegradable and recyclable materials like saturating Kraft paper. This eco-friendly material has gained favor among environmentally conscious consumers and businesses alike due to its robustness and moisture resistance, making it suitable for various applications.

The industrial applications of saturating Kraft paper are also expanding rapidly. It is a critical component in laminates used in furniture, flooring, and construction industries where its strength and dimensional stability are essential. Additionally, its insulation properties make it a valuable material in the electrical sector for transformer insulation.

However, the market faces some challenges. High production costs associated with resin impregnation can limit widespread adoption in price-sensitive markets. The material also competes with alternative materials like plastics and synthetic papers that may offer lower costs or specific performance advantages in certain applications. Logistics and supply chain issues also pose barriers to efficient distribution and accessibility.

Despite these challenges, the saturating Kraft paper market presents opportunities for growth in emerging economies where industrialization is driving demand for durable and sustainable materials. Innovations in product customization and new applications like renewable energy insulation can expand market potential. Ongoing efforts to develop products that meet specific industry requirements and regulatory standards will further enhance market growth prospects.

Saturating Kraft Paper Market Segmentation

The worldwide market for saturating Kraft paper is split based on type, weight, application, end-use, and geography.

Saturated Kraft Paper Market By Type

- Bleached Kraft Paper

- Unbleached Kraft Paper

According to the saturating Kraft paper industry analysis, unbleached Kraft paper has historically led the saturating Kraft paper market. This type of Kraft paper preserves its original brown color since it is not subjected to bleaching methods that utilize chemicals to whiten the fibers. Unbleached Kraft paper is recognized for its eco-friendliness, as it requires less processing while maintaining greater strength and durability than bleached kinds. Unbleached Kraft paper is commonly used in industries such as packaging, particularly for items that require a natural appearance or better strength. However, market preferences can differ depending on unique application requirements and regional market dynamics.

Saturated Kraft Paper Market By Weight

- Less Than 50 GSM

- 50 to 100 GSM

- 101 to 200 GSM

- More Than 200 GSM

The 101 to 200 GSM weight category is one of the most popular in the crowded Kraft paper market due to its remarkable strength and durability, which are critical for demanding industrial applications. This weight range is ideal for high-pressure laminates used in countertops, flooring panels, and other structural components that require long-lasting performance under stress. Furthermore, the thicker paper in this category is well impregnated with resins, increasing moisture resistance and durability. Its adaptability makes it an excellent choice for businesses looking for durable materials that can resist hard use while maintaining high quality standards, contributing to its market domination.

Saturated Kraft Paper Market By Application

- Countertop

- Partition

- Shelving

- Flooring Panels

- Others

Countertops have traditionally been the primary application driving the demand for saturating Kraft paper. This is due to the material's widespread use in high-pressure laminate (HPL) production, which offers durability, moisture resistance, and aesthetic versatility. The enhanced properties of saturating Kraft paper, achieved through resin impregnation, make it an ideal choice for crafting strong and resilient surfaces, solidifying its position as the leading application in this market.

Saturated Kraft Paper Market By End-Use

- Industrial

- Residential

According to the saturating Kraft paper market forecast, the industrial end-use category has traditionally dominated the saturating Kraft paper industry. This dominance stems from the widespread usage of saturating Kraft paper in a variety of industrial applications, including laminates for counters, dividers, shelving, and flooring panels, as well as its use in electrical insulation and packaging. The industrial sector's need for long-lasting, high-performance materials drives the majority of the market for saturating Kraft paper.

Saturating Kraft Paper Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Saturating Kraft Paper Market Regional Analysis

Regional disparities are evident in the saturating Kraft paper market, with North America taking the lead due to its established industrial infrastructure and advanced manufacturing capabilities. The region's construction, furniture, and packaging industries drive demand for saturating Kraft paper, which is used extensively for laminates, countertops, and durable goods. The presence of major players and ongoing R&D investments support market growth in North America. Additionally, the region's focus on sustainable materials aligns with saturating Kraft paper's inherent properties, boosting adoption.

In contrast, the Asia-Pacific region is rapidly emerging as a significant market for saturating Kraft paper. The region's economic growth, industrial expansion, and urbanization have created a surge in demand for high-quality laminates and durable materials. Countries like China and India are seeing increased construction activities and infrastructure development, driving demand for saturating Kraft paper in various applications, including packaging and electrical insulation. Government initiatives promoting sustainable materials and growing awareness of eco-friendly practices among businesses are also contributing to market growth in the Asia-Pacific region.

Saturating Kraft Paper Market Players

Some of the top saturating Kraft paper companies offered in our report includes Fortune Paper Mills LLP, International Paper Company, MM Kotkamills, Nordic Paper AS, Onyx Specialty Papers Inc., Potsdam Specialty Paper Inc., Shanghai Plastech Group Limited, Stora Enso, Venkraft Paper Mills Pvt. Ltd., and WestRock Company.

Frequently Asked Questions

How big is the saturating Kraft paper market?

The saturating Kraft paper market size was valued at USD 1.47 billion in 2023.

What is the CAGR of the global saturating Kraft paper market from 2024 to 2032?

The CAGR of saturating Kraft paper industry is 4.8% during the analysis period of 2024 to 2032.

Which are the key players in the saturating Kraft paper market?

The key players operating in the global market are including Fortune Paper Mills LLP, International Paper Company, MM Kotkamills, Nordic Paper AS, Onyx Specialty Papers Inc., Potsdam Specialty Paper Inc., Shanghai Plastech Group Limited, Stora Enso, Venkraft Paper Mills Pvt. Ltd., and WestRock Company.

Which region dominated the global saturating Kraft paper market share?

Asia-Pacific held the dominating position in saturating Kraft paper industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of saturating Kraft paper during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global saturating Kraft paper industry?

The current trends and dynamics in the saturating Kraft paper industries include increasing demand for sustainable packaging solutions boosts saturating Kraft paper market, expansion in industrial applications like laminates and electrical insulation drives demand, and technological advancements in resin impregnation enhance paper performance and applications.

Which type held the maximum share in 2023?

The unbleached Kraft paper held the maximum share of the saturating Kraft paper industry.