Satellite Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

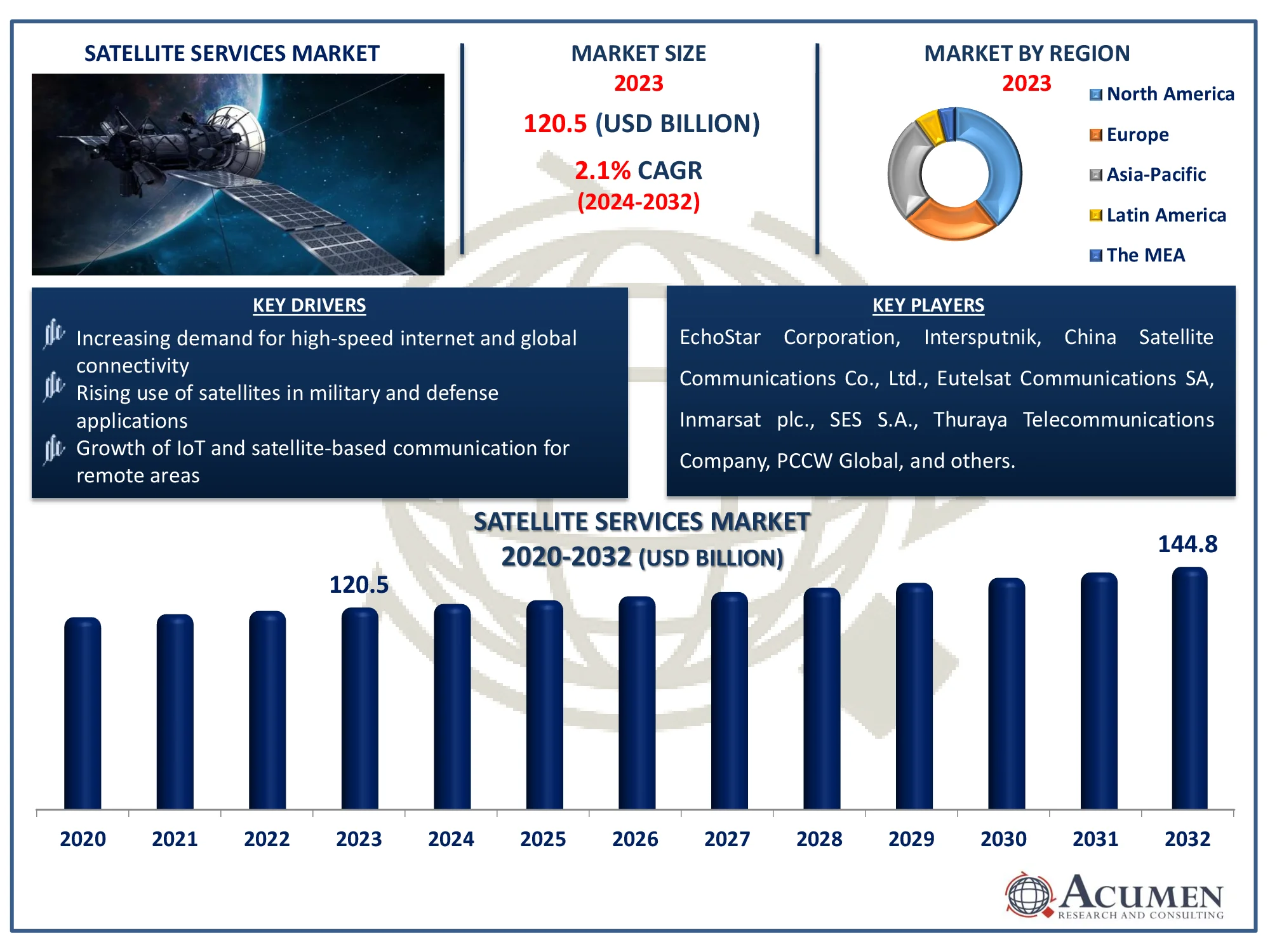

The Global Satellite Services Market Size accounted for USD 120.5 Billion in 2023 and is estimated to achieve a market size of USD 144.8 Billion by 2032 growing at a CAGR of 2.1% from 2024 to 2032.

Satellite Services Market Highlights

- Global satellite services market revenue is poised to garner USD 144.8 billion by 2032 with a CAGR of 2.1% from 2024 to 2032

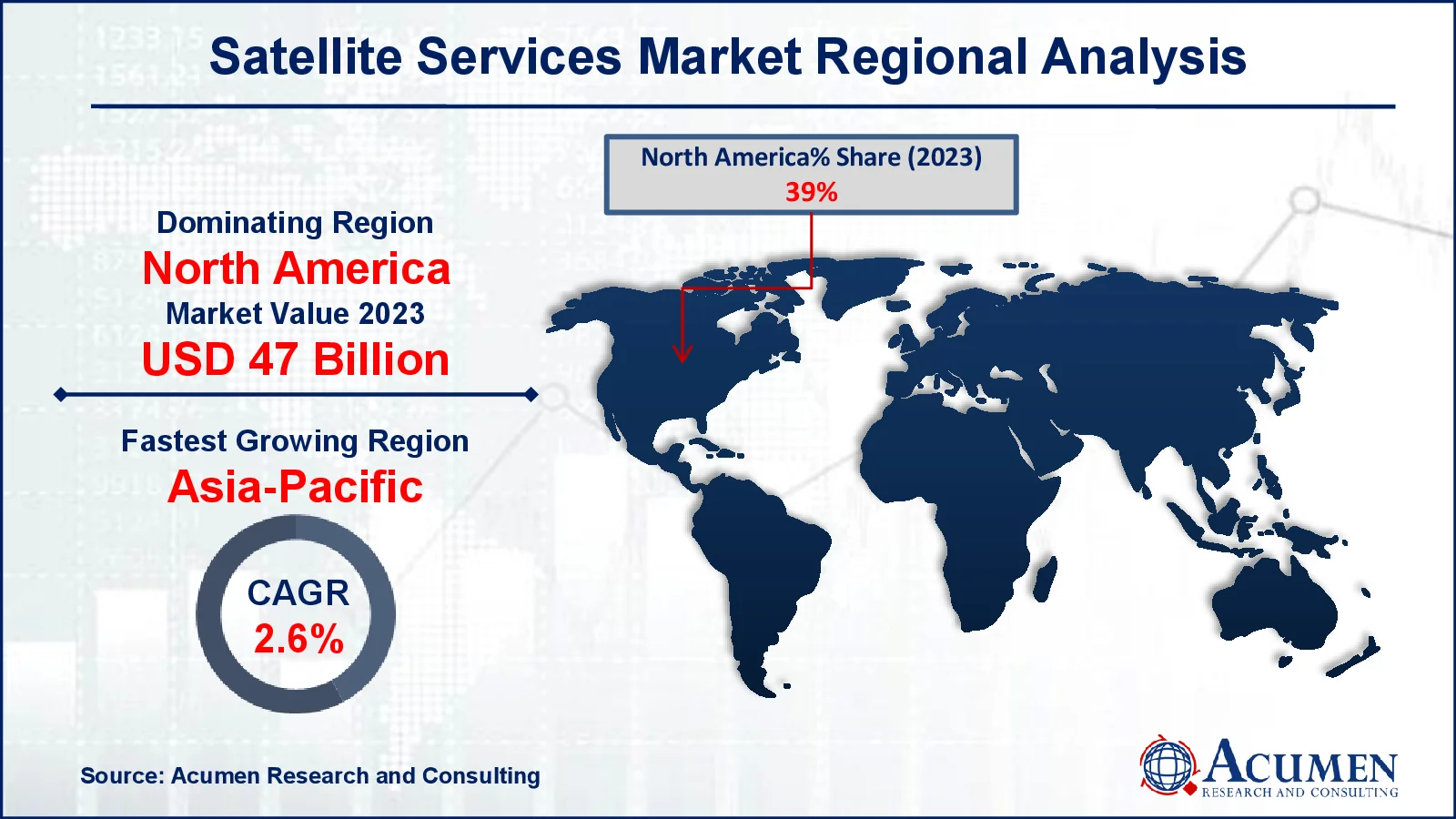

- North America satellite services market value occupied around USD 47 billion in 2023

- Asia-Pacific satellite services market growth will record a CAGR of more than 2.6% from 2024 to 2032

- Based on types, the consumer services sub-segment expected to generated 42% market share in 2023

- Growth in satellite-based 5G network infrastructure for enhanced connectivity is the satellite services market trend that fuels the industry demand

Satellite services are communication, navigation, broadcasting, and data transmission solutions offered by Earth-orbiting satellites. These services offer global connectivity by breaking down geographical barriers, making them indispensable in remote and underserved locations. Key applications include broadband internet access, television transmission, and mobile communication. Satellite services are also essential for Earth observation, including climate monitoring, disaster management, and agricultural planning. They are used in defense and aerospace for secure communication, surveillance, and navigation. Advances in satellite technology, such as low Earth orbit (LEO) constellations, are expanding the scope and efficiency of satellite services across industries. Additionally, significant increase in the number of satellites sent into Earth’s orbit. Between 2016 and 2020, an average of 585 satellites was launched each year. In 2023, the number rose to 2,800 satellites in a single year, marking a 380% increase over the previous average as per data provided by Satellite Industry Association (SIA).

Global Satellite Services Market Dynamics

Market Drivers

- Increasing demand for high-speed internet and global connectivity

- Rising use of satellites in military and defense applications

- Growth of IoT and satellite-based communication for remote areas

Market Restraints

- High costs associated with satellite manufacturing and launch

- Regulatory challenges and spectrum allocation issues

- Competition from terrestrial communication technologies like fiber optics

Market Opportunities

- Expansion of satellite services in emerging markets

- Advancements in small satellite technology and cost-effective launches

- Growing need for Earth observation and remote sensing for climate monitoring

Satellite Services Market Report Coverage

| Market | Satellite Services Market |

| Satellite Services Market Size 2022 |

USD 120.5 Billion |

| Satellite Services Market Forecast 2032 | USD 144.8 Billion |

| Satellite Services Market CAGR During 2023 - 2032 | 2.1% |

| Satellite Services Market Analysis Period | 2020 - 2032 |

| Satellite Services Market Base Year |

2022 |

| Satellite Services Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | EchoStar Corporation, Intersputnik, China Satellite Communications Co., Ltd., Eutelsat Communications SA, Inmarsat plc., SES S.A., Thuraya Telecommunications Company, PCCW Global, Intelsat S.A., Viasat, Inc., Asia Satellite Telecommunications Co. Ltd., and MEASAT Satellite Systems |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Satellite Services Market Insights

Flourishing media and entertainment industries around the world, rising demand for satellite television from emerging nations, and an emphasis on smooth data transfer to end-user locations are all likely to drive worldwide market expansion. For instance, according to Invest India, India spends 78% of its time using mobile phone apps for media and entertainment. The Indian M&E business blasted through to an 8.1% rise to reach INR 2.3 trillion in 2023.

Furthermore, leading companies' focus on business expansion through smart mergers and acquisitions in order to boost client base and improve commercial presence is likely to support target market growth even further. For instance, Cobham Satcom, a business of the Cobham Mission Systems, a global satellite solutions provider for the maritime and land markets, and Viasat Inc. in November 2022 entered into a strategic partnership to design more sophisticated satellite connectivity solutions for the maritime and energy markets, before the launch of the company’s third generation constellation, ViaSat-3.

The high costs of satellite manufacturing and launch are a significant barrier to the satellite services sector, limiting access for smaller businesses and emerging economies. However, growing need for Earth observation and remote sensing for climate monitoring becomes opportunity for satellite services market. For instance, Geospatial Intelligence Solutions for Sustainability Action emphasizes the importance of remote sensing in climate change research by presenting diverse scientific findings. Moving forward, the efficiency and effectiveness of remote sensing will be critical in balancing natural resource use and environmental sustainability.

Overall, as global efforts to combat climate change accelerate, satellites provide important data for monitoring environmental changes, managing resources, and planning for sustainable development, increasing demand for improved satellite solutions.

However, issues such as programmatic and scientific risks inherent in the manufacture of small satellites, as well as design constraints linked to the design and development of small satellites, are likely to stifle worldwide market growth.

Rising demand for high data rate communication and geo-based services is likely to open up new opportunities for participants in the satellite servces market throughout the forecast period. For instance, as per 5G Americas, by the end of 2023, North America had 197 million 5G connections. Latin America also saw significant improvement in both 4G LTE and 5G connectivity, with LTE connections reaching 582 million by the end of 2023, adding 40 million new connections year after year. Furthermore, business expansion through partnerships and agreements is projected to boost revenue traction in the satellite service industry.

Satellite services are likely to expand quicker in the near future due to increased customer demand for high-performance satellite television and broadband services. For instance, in April 2022, SES published the results of its annual satellite monitor market analysis, stressing its leadership in satellite TV content delivery. SES now delivers around 8,400 TV channels, including 3,130 in HD or UHD, to 366 million TV homes worldwide, a five-million increase from the previous year. SES continues to outperform the industry, reaching the most TV homes and offering an unprecedented number of channels.

Satellite Services Market Segmentation

The worldwide market for satellite services is split based on type, end-user, and geography.

Satellite Service Market By Type

- Consumer Services

- Satellite Television

- Satellite Radio

- Satellite Broadband

- Fixed Satellite Services

- Transponder Agreements

- Managed Network Services

- Mobile Satellite Services

- Remote Sensing

- Space Flight Management Services

According to the satellite services industry analysis, the consumer services component of the satellite services market is predicted to expand rapidly due to increased demand for dependable and high-speed internet, particularly in distant or underserved locations. For instance, as of March 2024, 398.35 million rural internet subscribers were among India's 954.40 million total internet subscribers. Furthermore, as of April 2024, 6,12,952 villages in the country (statistics from the Registrar General of India) has 3G/4G mobile coverage. Thus, 95.15% of communities have access to the internet. The growing usage of satellite-based broadband solutions, fueled by efforts like as low Earth orbit (LEO) constellations, will increase connection for consumers and companies. Furthermore, rising demand for satellite television, gaming, and streaming services will also drive this expansion.

Satellite Service Market By End-User

- Media & Entertainment

- Government

- Aviation

- Defense

- Aerospace

- Retail & Enterprise

- Others

According to the satellite services market forecast, the media and entertainment sector is a significant end user in market, driven by rising demand for broadcast services such as television and radio. According to International Trade Administration, the U.S. Media and Entertainment (M&E) industry is the largest in the world at $649 billion (of the $2.8 trillion global market) and is projected to grow to $808 billion by 2028 at an average yearly rate of 4.3%. Satellite technology ensures that content is delivered reliably and in excellent quality across huge geographical areas, including distant locales. The increased demand for global dissemination of media material, particularly live events and streaming services, drives satellite services in the sector.

Satellite Services Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Satellite Services Market Regional Analysis

For several reasons, the market in North America is likely to account for a large revenue share due to the availability of modern infrastructure and increased demand for earth observation services from various end-use industries. For instance, in October 2023, the National Aeronautics and Space Administration (NASA) expanded its Commercial Smallsat Data Acquisition Program by granting contracts to seven companies to provide earth observation data and services. The contracts have a maximum value of $476 million over five years, with an option to extend services for another six months. Furthermore, the presence of large players operating in the country, as well as strong investment in offering innovative solutions, are projected to help the target market in this region grow even more rapidly.

Asia-Pacific is likely to expand quicker in the near future due to increased customer demand for high-performance satellite television and broadband services. Additionally, in March 2023, the Indian Army stated that it would have its top-end communication satellite with the defense ministry after the ministry signed an INR 3,000 crore (about. USD 363.87 million) agreement with NewSpace India Limited for an advanced five-ton class communication satellite for the land forces. A contract with NewSpace India Limited has been struck to acquire a sophisticated communication satellite, GSAT-7B. The project costs INR 2,963 crore (about USD 359.39 million). Furthermore, this increase suggests a greater demand for more robust, high-performance satellite services, both for defense and civilian purposes, such as dependable broadband and television services, which necessitate complex satellite systems for effective coverage.

Satellite Services Market Players

Some of the top satellite services companies offered in our report include EchoStar Corporation, Intersputnik, China Satellite Communications Co., Ltd., Eutelsat Communications SA, Inmarsat plc., SES S.A., Thuraya Telecommunications Company, PCCW Global, Intelsat S.A., Viasat, Inc., Asia Satellite Telecommunications Co. Ltd., and MEASAT Satellite Systems.

Frequently Asked Questions

How big is the satellite services market?

The satellite services market size was valued at USD 120.5 billion in 2023.

What is the CAGR of the global satellite services market from 2024 to 2032?

The CAGR of satellite services is 2.1% during the analysis period of 2024 to 2032.

Which are the key players in the satellite services market?

The key players operating in the global market are including EchoStar Corporation, Intersputnik, China Satellite Communications Co., Ltd., Eutelsat Communications SA, Inmarsat plc., SES S.A., Thuraya Telecommunications Company, PCCW Global, Intelsat S.A., Viasat, Inc., Asia Satellite Telecommunications Co. Ltd., and MEASAT Satellite Systems.

Which region dominated the global satellite services market share?

North America held the dominating position in satellite services industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of satellite services during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global satellite services industry?

The current trends and dynamics in the satellite services industry include increasing demand for high-speed internet and global connectivity, rising use of satellites in military and defense applications, and growth of IoT and satellite-based communication for remote areas

Which type held the maximum share in 2023?

The consumer services expected to hold the maximum share of the satellite services industry.