Satellite-as-a-Service Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Satellite-as-a-Service Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

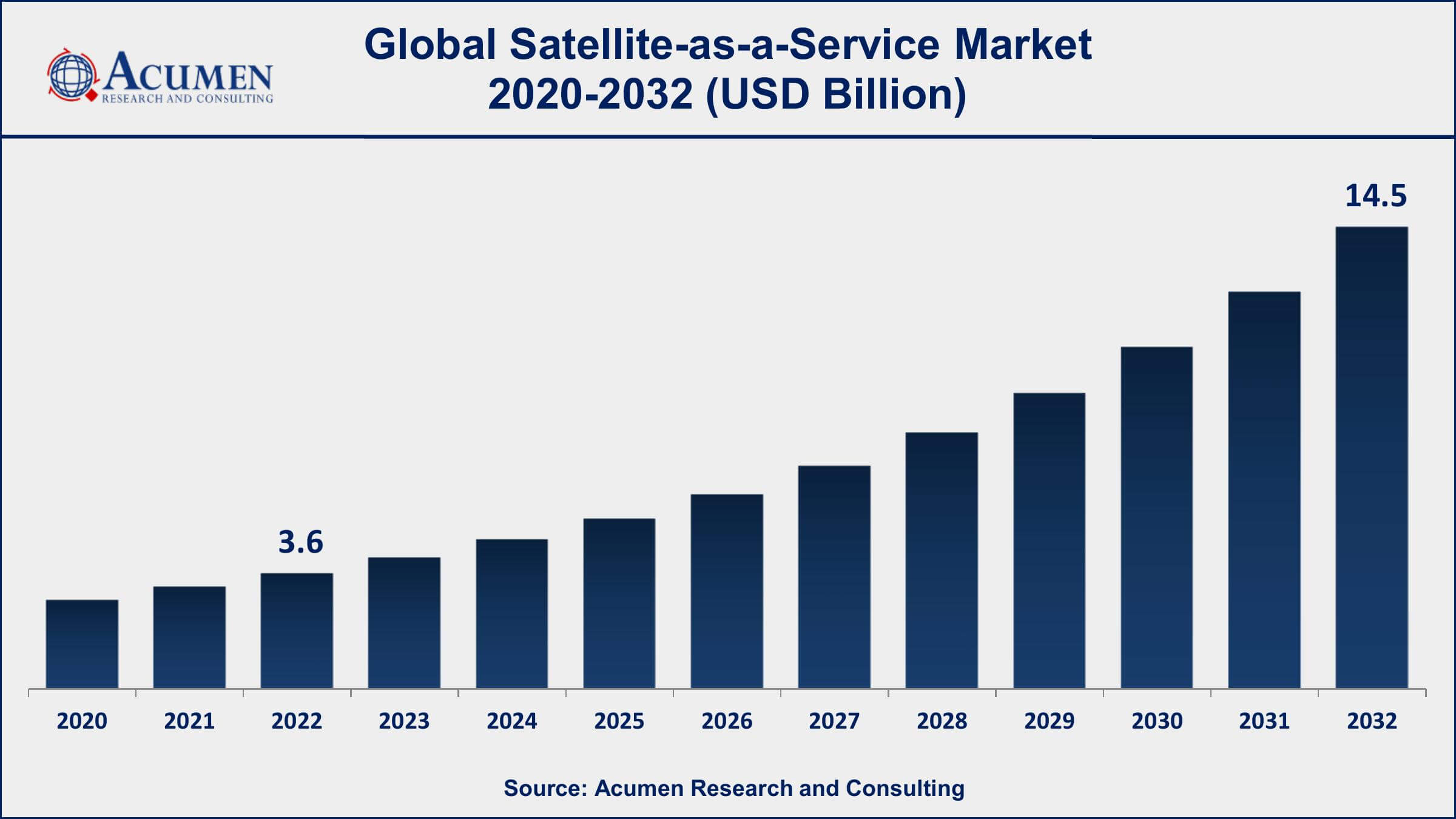

The Global Satellite-as-a-Service (SataaS) Market Size accounted for USD 3.6 Billion in 2022 and is projected to achieve a market size of USD 14.5 Billion by 2032 growing at a CAGR of 15.1% from 2023 to 2032.

Satellite-as-a-Service Market Highlights

- Global satellite-as-a-service market revenue is expected to increase by USD 14.5 Billion by 2032, with a 15.1% CAGR from 2023 to 2032

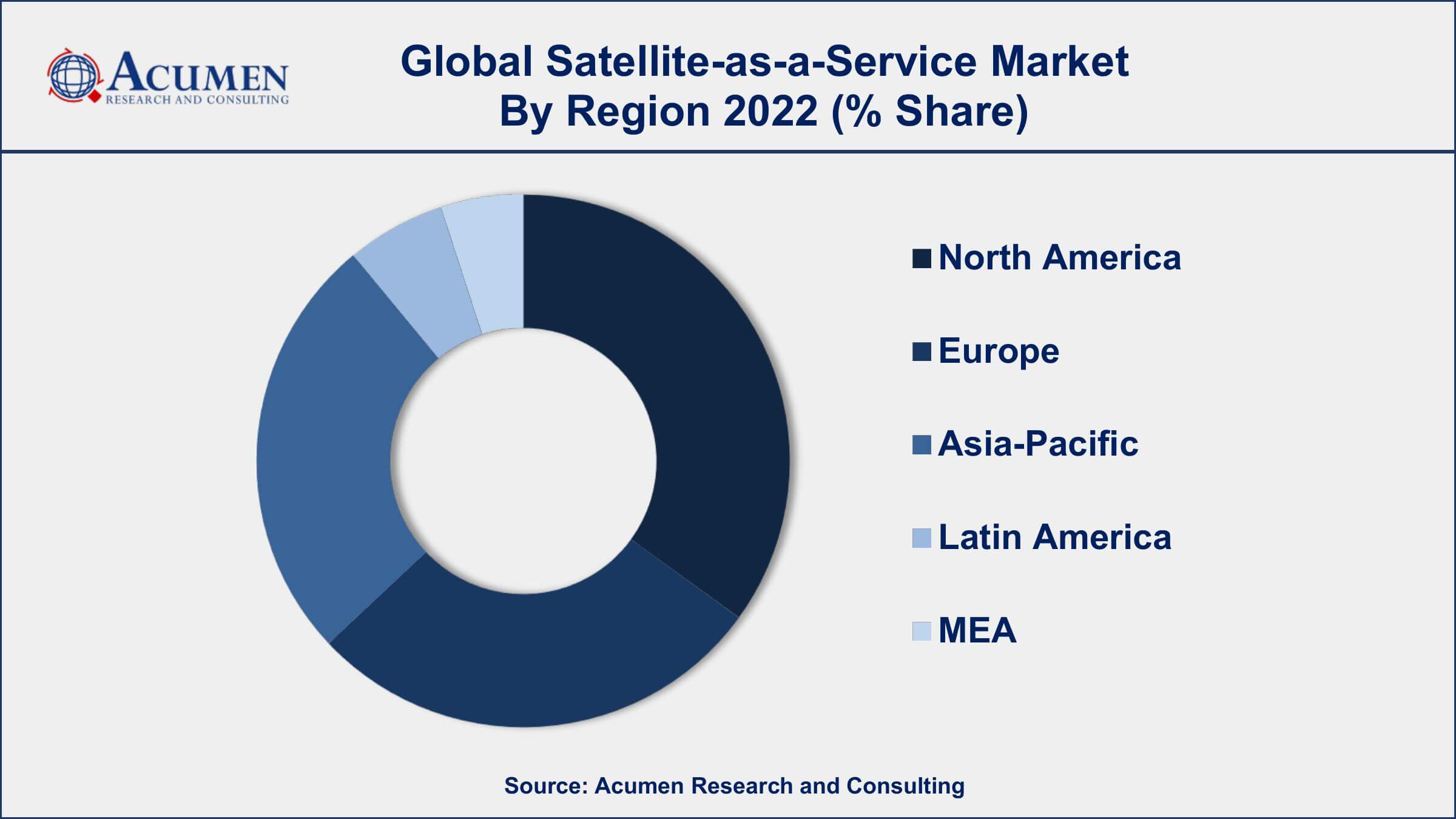

- North America region led with more than 36% of satellite-as-a-service market share in 2022

- Asia-Pacific satellite-as-a-service market growth will record a CAGR of around 16.7% from 2023 to 2032

- By services, the ground station management segment has recorded more than 33% of the revenue share in 2022

- By end-user, the government & defense segment has accounted more than 48% of the revenue share in 2022

- The growing need for efficient satellite data management and distribution, drives the satellite-as-a-service market value

Satellite-as-a-Service (SataaS) refers to a business model where companies offer access to satellite-based services and data to customers on a subscription or pay-per-use basis, similar to the "as-a-Service" model prevalent in cloud computing. Instead of owning and operating their satellites, customers can leverage the capabilities of these SataaS providers to access satellite data, imagery, communication, or other services for various applications, such as Earth observation, remote sensing, Internet of Things (IoT) connectivity, and more.

The SataaS market has witnessed significant growth in recent years due to several factors. Technological advancements have led to the miniaturization of satellite components, resulting in smaller and more cost-effective satellites, commonly referred to as CubeSats or smallsats. These advancements have lowered the barrier to entry for new players, encouraging startups and tech companies to enter the space industry with innovative satellite-based services. Additionally, the increasing demand for real-time and high-resolution data for various applications, including agriculture, urban planning, disaster monitoring, and climate research, has fueled the adoption of SataaS solutions.

Global Satellite-as-a-Service Market Trends

Market Drivers

- Technological advancements and miniaturization of satellite components

- Increasing demand for real-time and high-resolution satellite data for various applications

- Lowering the barrier to entry for new players and startups in the space industry

- Rise of mega-constellations and satellite internet initiatives

- Growing need for efficient satellite data management and distribution

Market Restraints

- Regulatory challenges and spectrum management issues

- High initial investment and operational costs for satellite deployment

Market Opportunities

- Integration of satellite data with emerging technologies like AI, IoT, and blockchain

- Expansion of SataaS applications into new industries, such as transportation and logistics

Satellite-as-a-Service Market Report Coverage

| Market | Satellite-as-a-Service Market |

| Satellite-as-a-Service Market Size 2022 | USD 3.6 Billion |

| Satellite-as-a-Service Market Forecast 2032 | USD 14.5 Billion |

| Satellite-as-a-Service Market CAGR During 2023 - 2032 | 15.1% |

| Satellite-as-a-Service Market Analysis Period | 2020 - 2032 |

| Satellite-as-a-Service Market Base Year | 2022 |

| Satellite-as-a-Service Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Services, By Application, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | SpaceX, Planet Labs Inc., OneWeb, Spire Global Inc., BlackSky, Capella Space, ICEYE, HawkEye 360, Astro Digital Inc., Loft Orbital, Orbital Insight, and Satellogic |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Satellite-as-a-Service (SataaS) is a business model that offers access to satellite-based services and data on a subscription or pay-per-use basis, similar to the "as-a-Service" model seen in cloud computing. Rather than owning and operating their satellites, customers can utilize the capabilities of SataaS providers to access a wide range of satellite data and services. These services may include Earth observation data, satellite imagery, communication services, tracking, and remote sensing. SataaS providers typically maintain and operate a constellation of satellites that customers can access through user-friendly interfaces or APIs, enabling them to gather valuable insights and information from space without the complexities and costs associated with launching and managing their satellites.

The applications of Satellite-as-a-Service are vast and diverse. One primary application is Earth observation, where satellites capture imagery and data of our planet's surface and atmosphere. This data is invaluable for environmental monitoring, agriculture, urban planning, disaster management, and climate research. SataaS can also play a crucial role in IoT (Internet of Things) connectivity, providing a global network for connected devices and sensors. For example, remote and rural areas can benefit from SataaS-enabled IoT to monitor and manage resources, enhance communication, and improve overall efficiency.

The Satellite-as-a-Service (SataaS) market had been experiencing rapid growth and transformation, driven by several key factors. Technological advancements in the space industry, particularly the miniaturization of satellite components and the development of smallsats or CubeSats, have revolutionized the way satellites are deployed and operated. These advancements have significantly reduced the cost of launching and maintaining satellites, making it more accessible for new players and startups to enter the market with innovative SataaS offerings. As a result, the market has seen a surge in companies providing satellite-based services for various applications, ranging from Earth observation and remote sensing to communication and Internet of Things (IoT) connectivity.

Satellite-as-a-Service Market Segmentation

The global satellite-as-a-service (SataaS) market segmentation is based on services, application, end-user, and geography.

Satellite-as-a-Service Market By Services

- Satellite Launch

- Data Processing & Management

- Payload Design & Integration

- Satellite Operations Management

- Ground Station Management

According to the satellite-as-a-service industry analysis, the ground station management segment accounted for the largest market share in 2022. Ground stations play a crucial role in communicating with satellites, receiving data, and controlling their operations. With the rise of mega-constellations and the deployment of numerous smallsats, there has been a growing demand for ground station services to manage and coordinate communication with these satellites effectively. Ground station management services have become a vital component of the SataaS ecosystem, enabling seamless data transmission and reception from satellites in low Earth orbit (LEO) and beyond. As satellite missions become more diverse and frequent, SataaS providers and satellite operators require reliable ground station networks to support their operations. Moreover, advancements in ground station technologies, such as software-defined radio (SDR) and automated control systems, have improved the efficiency and scalability of these services, further fueling the growth of the ground station management segment in the SataaS market.

Satellite-as-a-Service Market By Application

- Satellite IoT

- Air Traffic Monitoring

- Earth Observation

- Ship Tracking

- Weather Forecasting

- Others

In terms of applications, the satellite IoT segment is expected to witness significant growth in the coming years. Traditional terrestrial networks often face limitations in remote and rural areas, as well as in maritime and aviation environments. Satellite IoT fills this gap by providing global coverage and reliable connectivity, making it ideal for applications that require connectivity in remote and challenging terrains. Industries such as agriculture, transportation, energy, environmental monitoring, and asset tracking have shown increasing interest in satellite IoT solutions to enhance their operations and gain valuable insights from their distributed devices and sensors. Satellite IoT's growth has been further propelled by advancements in satellite technology, including the deployment of low Earth orbit (LEO) satellite constellations specifically designed for IoT applications.

Satellite-as-a-Service Market By End-user

- Government & Defense

- Academics

- Commercial

According to the satellite-as-a-service market forecast, the government & defense segment is expected to witness significant growth in the coming years. This growth is driven by the increasing demand for satellite-based services by various government agencies and defense organizations. Governments around the world are recognizing the strategic importance of space assets for national security, surveillance, and intelligence gathering. Instead of investing in building and operating their satellite fleets, many government and defense entities are turning to SataaS providers to access satellite data, communication, and Earth observation services. SataaS offers cost-effective and flexible solutions, allowing government agencies to scale their satellite capabilities based on specific mission requirements without the burden of maintaining and managing a satellite constellation. Satellite-as-a-Service providers are offering tailored solutions to meet the unique needs of the government and defense sector.

Satellite-as-a-Service Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Satellite-as-a-Service Market Regional Analysis

North America dominates the Satellite-as-a-Service (SataaS) market in 2022. North America is home to some of the most prominent and innovative space and technology companies that have heavily invested in satellite technology and infrastructure. Companies like SpaceX, Planet Labs, and OneWeb, among others, have launched and continue to expand their satellite constellations, offering a wide range of satellite-based services to various industries worldwide. The region's advanced technological capabilities and expertise have given North American SataaS providers a competitive edge in the global market. Moreover, North America boasts a robust and mature market for satellite services, driven by a high demand for satellite data and communication across multiple sectors. The continent's vast geographical expanse, remote regions, and challenging terrains often necessitate satellite-based solutions for applications such as agriculture, environmental monitoring, disaster management, and defense operations. Additionally, the region's developed economies, coupled with government support for space initiatives, create a favorable environment for SataaS companies to thrive and expand their offerings.

Satellite-as-a-Service Market Player

Some of the top satellite-as-a-service market companies offered in the professional report include SpaceX, Planet Labs Inc., OneWeb, Spire Global Inc., BlackSky, Capella Space, ICEYE, HawkEye 360, Astro Digital Inc., Loft Orbital, Orbital Insight, and Satellogic.

Frequently Asked Questions

What was the market size of the global satellite-as-a-service in 2022?

The market size of satellite-as-a-service was USD 3.6 Billion in 2022.

What is the CAGR of the global satellite-as-a-service market from 2023 to 2032?

The CAGR of satellite-as-a-service is 15.1% during the analysis period of 2023 to 2032.

Which are the key players in the satellite-as-a-service market?

The key players operating in the global market are including SpaceX, Planet Labs Inc., OneWeb, Spire Global Inc., BlackSky, Capella Space, ICEYE, HawkEye 360, Astro Digital Inc., Loft Orbital, Orbital Insight, and Satellogic.

Which region dominated the global satellite-as-a-service (SataaS) market share?

North America held the dominating position in satellite-as-a-service industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of satellite-as-a-service during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global SataaS industry?

The current trends and dynamics in the satellite-as-a-service industry include technological advancements and miniaturization of satellite components, increasing demand for real-time and high-resolution satellite data for various applications, and lowering the barrier to entry for new players and startups in the space industry.

Which services held the maximum share in 2022?

The ground station management services held the maximum share of the satellite-as-a-service (SataaS) industry.