Sales Force Automation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Sales Force Automation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

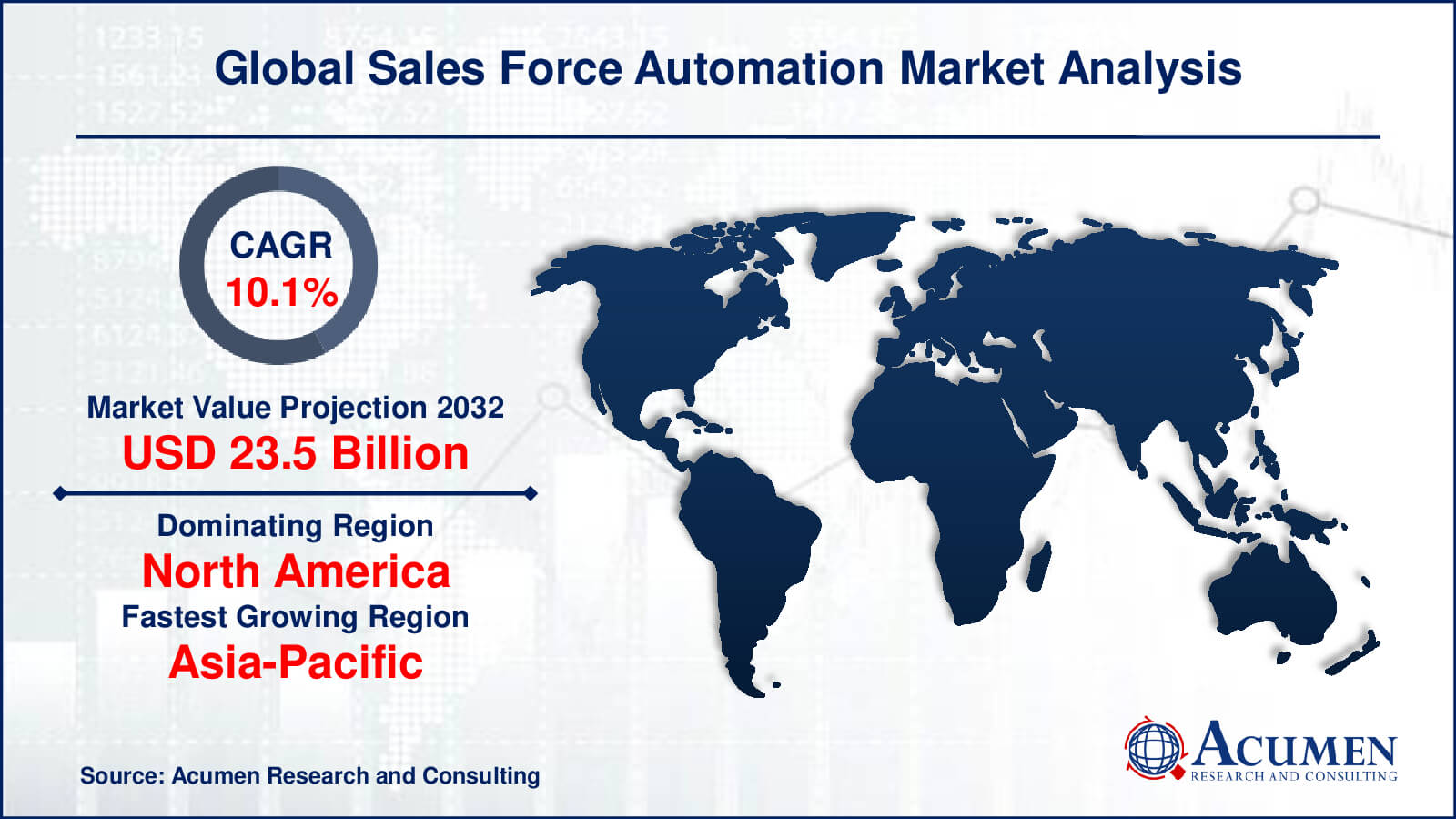

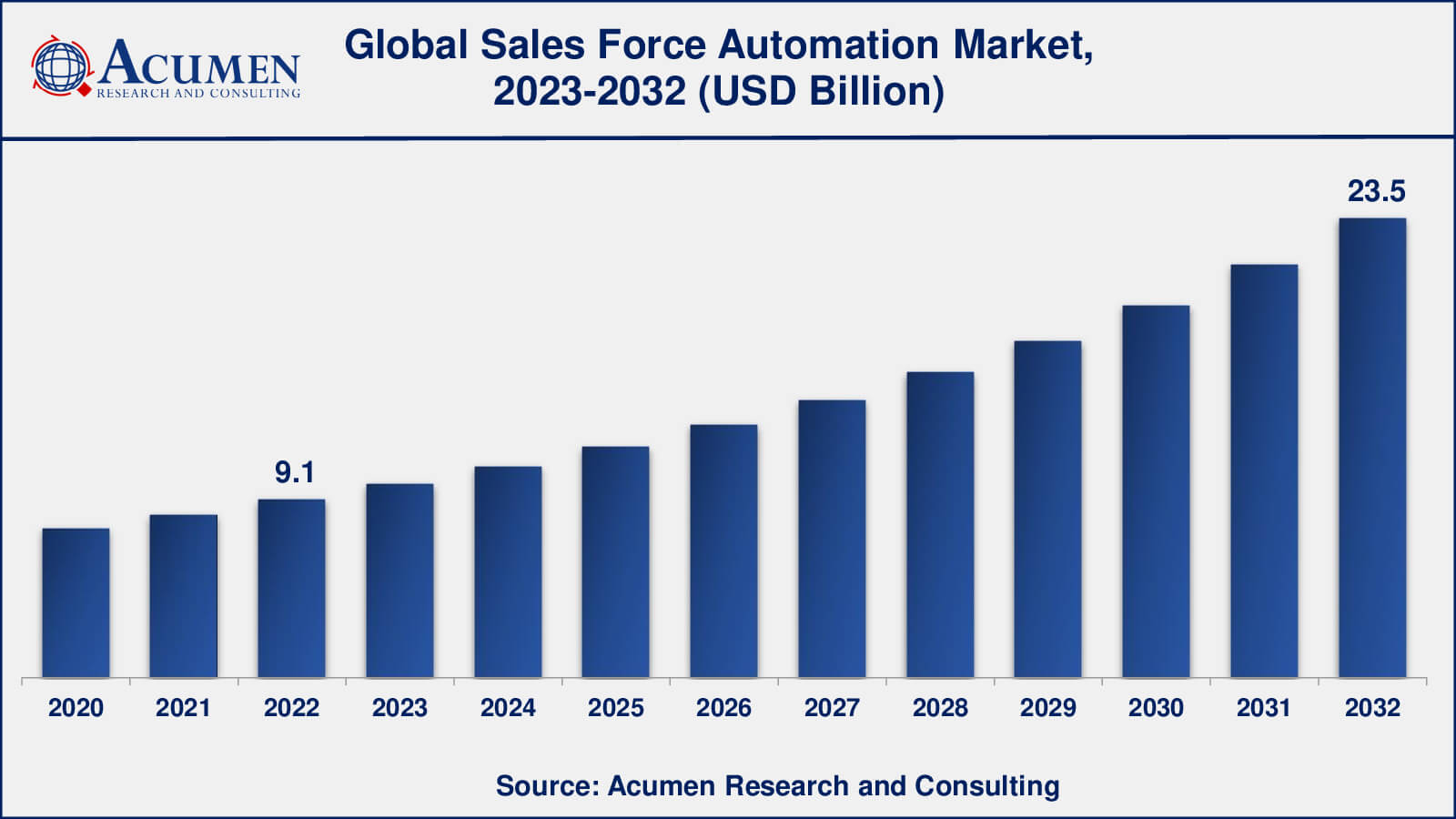

The global Sales Force Automation Market size was valued at USD 9.1 Billion in 2022 and is projected to attain USD 23.5 Billion by 2032 mounting at a CAGR of 10.1% from 2023 to 2032.

Sales Force Automation Market Highlights

- Global sales force automation market revenue is poised to garner USD 23.5 Billion by 2032 with a CAGR of 10.1% from 2023 to 2032

- North America sales force automation market value occupied around USD 4.7 billion in 2022

- Asia-Pacific sales force automation market growth will record a CAGR of more than 11% from 2023 to 2032

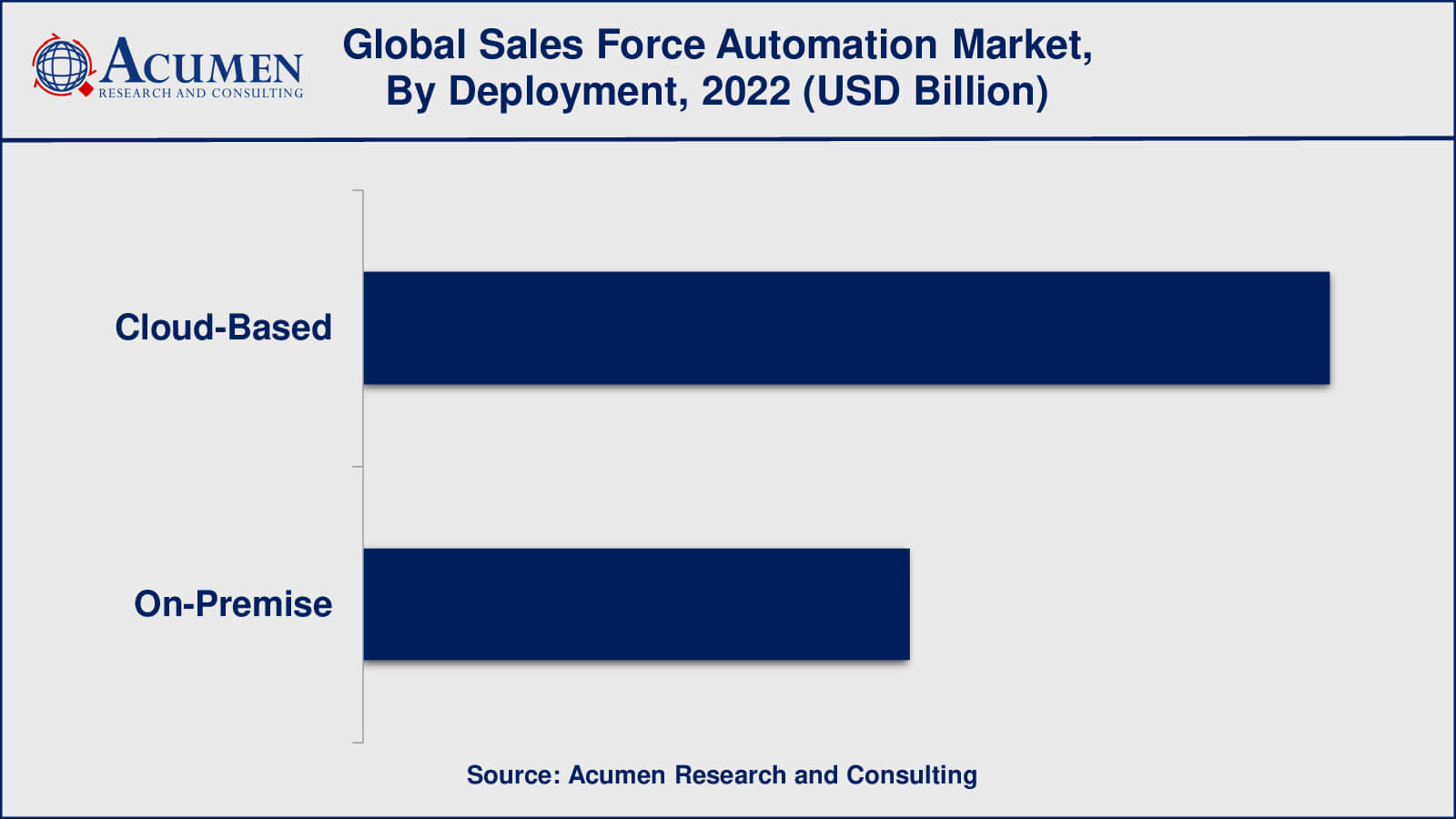

- Among deployment mode, the cloud-based sub-segment occupied over US$ 5.8 billion revenue in 2022

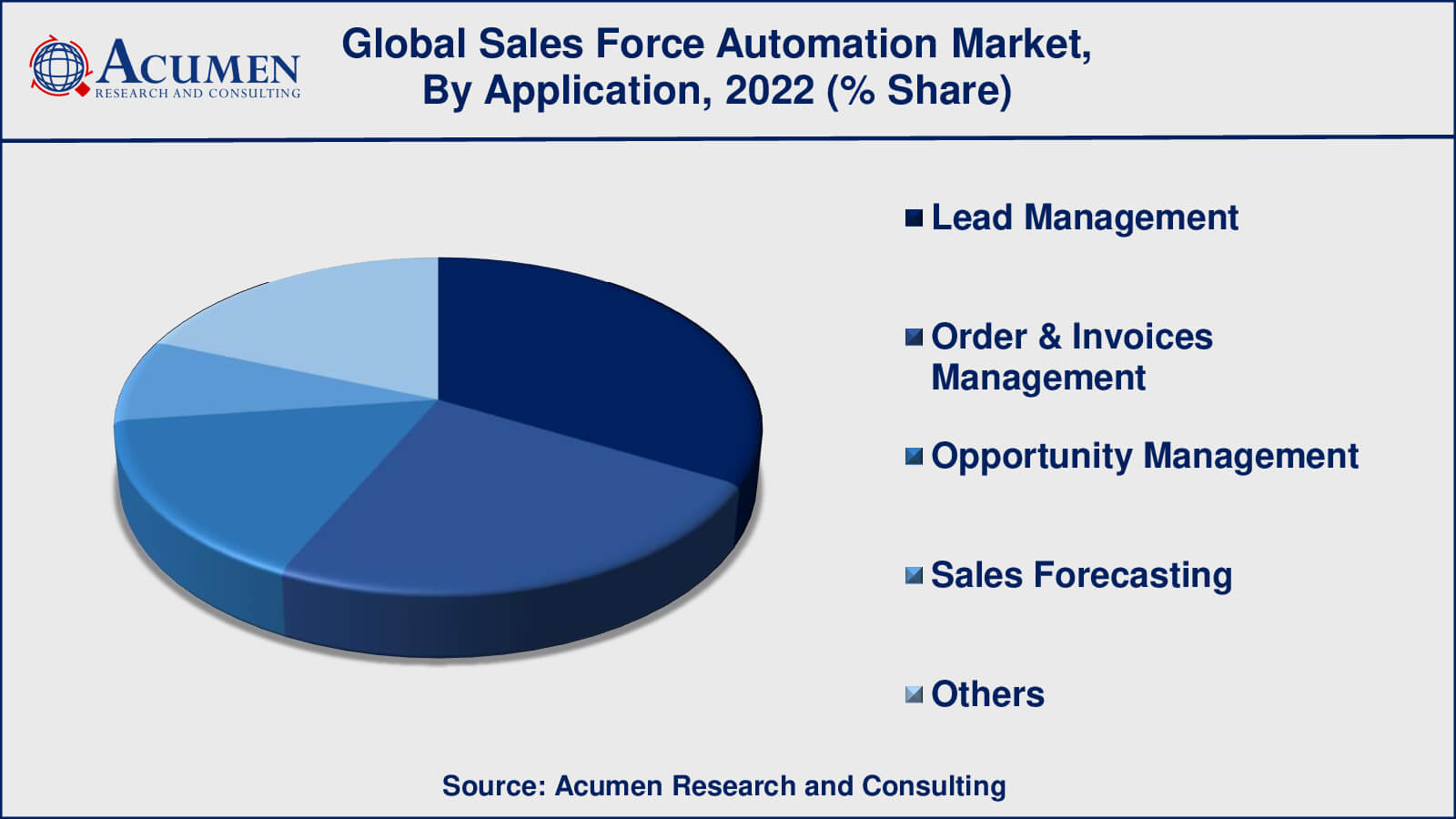

- Based on application, the lead management sub-segment gathered around 33% share in 2022

- Integration of SFA with Internet of Things (IoT) devices for improved sales insights and automation is a popular sales force automation market trend that drives the industry demand

Sales force automation (SFA) is the use of technology and software solutions inside an organization to simplify and automate numerous sales-related duties and procedures. It is intended to improve sales teams' efficiency and productivity by providing them with tools and resources for managing client contacts, tracking leads, monitoring sales activity, and facilitating the full sales cycle.

SFA's fundamental goal is to automate time-consuming and repetitive procedures that sales professionals traditionally undertake manually. Lead management, contact and account management, opportunity monitoring, sales forecasting, order processing, and reporting are examples of these duties. SFA systems allow sales people to focus more on creating connections with clients, completing transactions, and driving revenue growth by automating these processes.

The concentration and organization of customer information is one of the primary advantages of SFA. SFA systems keep and manage a large database of customer information, including contact information, purchase history, preferences, and communication logs. This centralized data provides sales teams with a comprehensive perspective of each consumer, allowing them to adjust their sales approach and create personalized experiences. Furthermore, SFA promotes team cooperation by allowing members to share information, cooperate on agreements, and coordinate activities more efficiently.

Global Sales Force Automation Market Dynamics

Market Drivers

- Increasing demand for streamlined sales processes and improved sales team productivity

- Growing adoption of cloud-based SFA solutions for enhanced accessibility and scalability

- Rising focus on customer relationship management (CRM) and personalized sales experiences

- Advancements in technology, such as artificial intelligence (AI) and machine learning (ML), driving SFA innovation

- Need for accurate sales forecasting and data-driven decision-making

Market Restraints

- Resistance to change and reluctance to adopt new technologies among sales professionals

- Concerns regarding data security and privacy in SFA systems

- Integration challenges with existing legacy systems and infrastructure

- High initial implementation costs and ongoing maintenance expenses

- Potential complexities in customization and configuration of SFA solutions

Market Opportunities

- Emerging markets and industries with untapped potential for SFA adoption

- Integration of SFA with other business systems like marketing automation and customer service

- Expansion of mobile SFA solutions to cater to the growing mobile workforce

- Utilization of SFA data for advanced analytics and predictive modeling

Sales Force Automation Market Report Coverage

| Market | Sales Force Automation Market |

| Sales Force Automation Market Size 2022 | USD 9.1 Billion |

| Sales Force Automation Market Forecast 2032 | USD 23.5 Billion |

| Sales Force Automation Market CAGR During 2023 - 2032 | 10.1% |

| Sales Force Automation Market Analysis Period | 2020 - 2032 |

| Sales Force Automation Market Base Year | 2022 |

| Sales Force Automation Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Deployment, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aptean, Inc., Bpm'online, CRMNEXT, INFOR, INC., Microsoft Corporation, Oracle Corporation, Salesforce.com, Inc., SAP SE, SugarCRM, and Zoho Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Sales Force Automation Market Insights

The sales force automation (SFA) industry is shaped by many main characteristics that affect its growth and development. Firstly, there is a rising desire for increased sales staff efficiency and simplified sales procedures. Businesses in a variety of sectors are seeing the need of automating and optimizing their sales activities in order to improve productivity, decrease manual mistakes, and increase sales effectiveness. SFA systems give sales teams with tools and functions that allow them to handle leads, monitor prospects, and simplify the whole sales cycle, resulting in increased productivity and revenue creation.

Another important factor is the growing use of cloud-based SFA systems. Cloud technology provides advantages like as flexibility, scalability, and accessibility, enabling sales teams to access important sales data and tools from any location at any time. Cloud-based SFA solutions also eliminate the need for on-premises equipment and save IT expenditures, making them appealing to enterprises of all sizes. Cloud-based SFA solutions are very popular due to their simplicity of setup and easy connection with other cloud-based systems.

Furthermore, customer relationship management (CRM) and personalized sales experiences are becoming increasingly important. Businesses understand that excellent customer connections are critical to long-term success. Sales force automation solutions give a centralized database of client information, allowing sales teams to understand customer preferences, track interactions, and modify their sales approach accordingly. Businesses may increase customer happiness and loyalty by providing personalized experiences and matching consumer expectations.

Technological advancements such as artificial intelligence (AI) and machine learning (ML) are also propelling the sales force automation SFA software industry forward. SFA systems are using AI and ML capabilities to automate processes, give predictive insights, and allow intelligent sales suggestions. These tools can analyze massive volumes of data, spot patterns, and help salespeople make data-driven decisions. The rising use of AI and ML in SFA solutions is projected to improve sales efficiency and effectiveness even more.

However, the SFA software market is not without its obstacles and constraints. Sales professionals' resistance to change and unwillingness to accept new technology can stymie the general adoption of SFA solutions. Concerns about data security and privacy are also possible roadblocks, as organizations must guarantee that consumer data is safeguarded within SFA systems. Integration issues with existing legacy systems, as well as high initial implementation costs, might stymie SFA solution adoption.

Sales Force Automation Market Segmentation

The worldwide market for sales force automation is split based on deployment, application, end-use industry, and geography.

Sales Force Automation Deployment Modes

- Cloud-Based

- On-Premise

According to the sales force automation industry analysis, cloud-based deployment mode is currently dominating the SFA industry. Cloud-based SFA solutions have various benefits, including flexibility, scalability, accessibility, and cost-effectiveness. Cloud-based SFA solutions are becoming popular among businesses because they eliminate the need for on-premise equipment, save IT maintenance costs, and provide access to crucial sales data and tools from any location with an internet connection.

While on-premise implementation is still available and favored by particular industries or organizations with unique data security or compliance issues, there has been a considerable trend towards cloud-based SFA solutions. Cloud-based deployment's advantages, including as accessibility, cost savings, flexibility, and integration possibilities, have driven it to supremacy in the sales force automatin software industry.

Sales Force Automation Applications

- Lead Management

- Sales Forecasting

- Order & Invoices Management

- Opportunity Management

- Others

Lead management is an important process in sales force automation (SFA) market that involves acquiring, tracking, and nurturing new customers or leads from initial contact to becoming qualifying sales possibilities. It includes a variety of actions and techniques targeted at properly managing and increasing the value of leads for sales conversion.

Lead generation precedes lead management by attracting potential clients through numerous marketing channels such as commercials, online forms, social media campaigns, and events. Leads are recorded and put into the SFA system, which serves as a centralised database for handling and tracking lead data.

While other applications like as opportunity management, sales forecasting, and order and invoice management are important in sales force automatin SFA software market, opportunity management stands out as a prominent application owing to its direct influence on revenue creation and sales team success.

Sales Force Automation End-Use Industries

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Manufacturing

- Others

According to the sales force automation market forecast, the banking, financial services, and insurance (BFSI) industry is predicted to dominate the industry from 2023 to 2032. To fuel corporate success, the BFSI sector relies largely on sales and customer relationship management. Banks, financial institutions, and insurance firms may use SFA solutions to streamline their sales processes, improve client experiences, and increase sales effectiveness.

The retail industry also plays an important role in the SFA market. SFA systems help retailers manage and track customer interactions, optimize sales regions, track sales performance, and create personalised customer experiences. With the advent of e-commerce and omnichannel retailing, SFA systems are becoming increasingly important for controlling sales across many touchpoints and channels.

While BFSI, retail, healthcare, and IT & telecom are the most significant industries, the saled force automation SFA market also serves a variety of other industries, including manufacturing, where SFA solutions are used to manage sales processes, track client interactions, and optimize sales performance. Other sectors, like automotive, real estate, and professional services, use SFA systems to improve sales processes and client interactions.

Sales Force Automation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Sales Force Automation Market Regional Analysis

North America controls a sizable portion of the SFA market. The region is home to large technological companies as well as a well-developed sales environment. The existence of multiple major organizations, as well as a focus on sales process optimisation, has resulted in a solid market for SFA solutions in the United States in particular. Because of its modern infrastructure, favorable regulatory frameworks, and high rates of technology use, the area is a mature and competitive market for SFA.

Europe is also another important market for SFA. Countries with a substantial presence in areas such as manufacturing, retail, and services include the United Kingdom, Germany, France, and Italy. Customer-centric methods are pushing the use of SFA solutions in European organizations to improve sales performance and create personalized experiences. The area also prioritizes data protection and compliance, which influences the selection of SFA suppliers who adhere to European Union rules.

The Asia-Pacific region offers considerable prospects for growth in the SFA industry. Countries such as China, India, Japan, and South Korea are seeing fast economic expansion, growing middle-class populations, and more digitalization. As organizations aim to improve sales processes, customer engagement, and sales force productivity, these reasons contribute to the growing usage of SFA solutions. Furthermore, the region's mobile-first culture fosters demand for mobile-based SFA solutions that are customized to the demands of remote sales teams.

Sales Force Automation Market Players

Some of the top sales force automation companies offered in our report include Aptean, Inc., Bpm'online, CRMNEXT, INFOR, INC., Microsoft Corporation, Oracle Corporation, Salesforce.com, Inc., SAP SE, SugarCRM, and Zoho Corporation.

Sales Force Automation Industry Recent Developments

- In June 2023, Microsoft has announced the release of Dynamics 365 Intelligent Sales Insights. This AI-powered sales solution uses machine learning to give actionable insights, predictive analytics, and personalized suggestions to sales teams in order to increase sales effectiveness.

- In June 2023, Salesforce launched Salesforce Revenue Cloud. Revenue Cloud is a sales system that integrates CPQ (Configure, Price, Quote) capabilities, billing, and revenue management features. It assists businesses in optimizing their sales processes, accelerating revenue growth, and improving client experiences.

Frequently Asked Questions

What was the size of the global sales force automation market in 2022?

The size of sales force automation market was USD 9.1 billion in 2022.

What is the sales force automation market CAGR from 2023 to 2032?

The sales force automation market CAGR during the analysis period of 2023 to 2032 is 10.1%.

Which are the key players in the sales force automation market?

The key players operating in the global sales force automation market are including Aptean, Inc., Bpm'online, CRMNEXT, INFOR, INC., Microsoft Corporation, Oracle Corporation, Salesforce.com, Inc., SAP SE, SugarCRM, and Zoho Corporation.

Which region dominated the global sales force automation market share?

North America region held the dominating position in sales force automation industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of sales force automation during the analysis period of 2023 to 2032.

What are the current trends in the global sales force automation industry?

The current trends and dynamics in the sales force automation industry include increasing demand for streamlined sales processes and improved sales team productivity, growing adoption of cloud-based SFA solutions for enhanced accessibility and scalability, and rising focus on customer relationship management (CRM) and personalized sales experiences

Which deployment held the maximum share in 2022?

The cloud-based deployment held the maximum share of the sales force automation industry.