Safety Syringes Market | Acumen Research and Consulting

Safety Syringes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

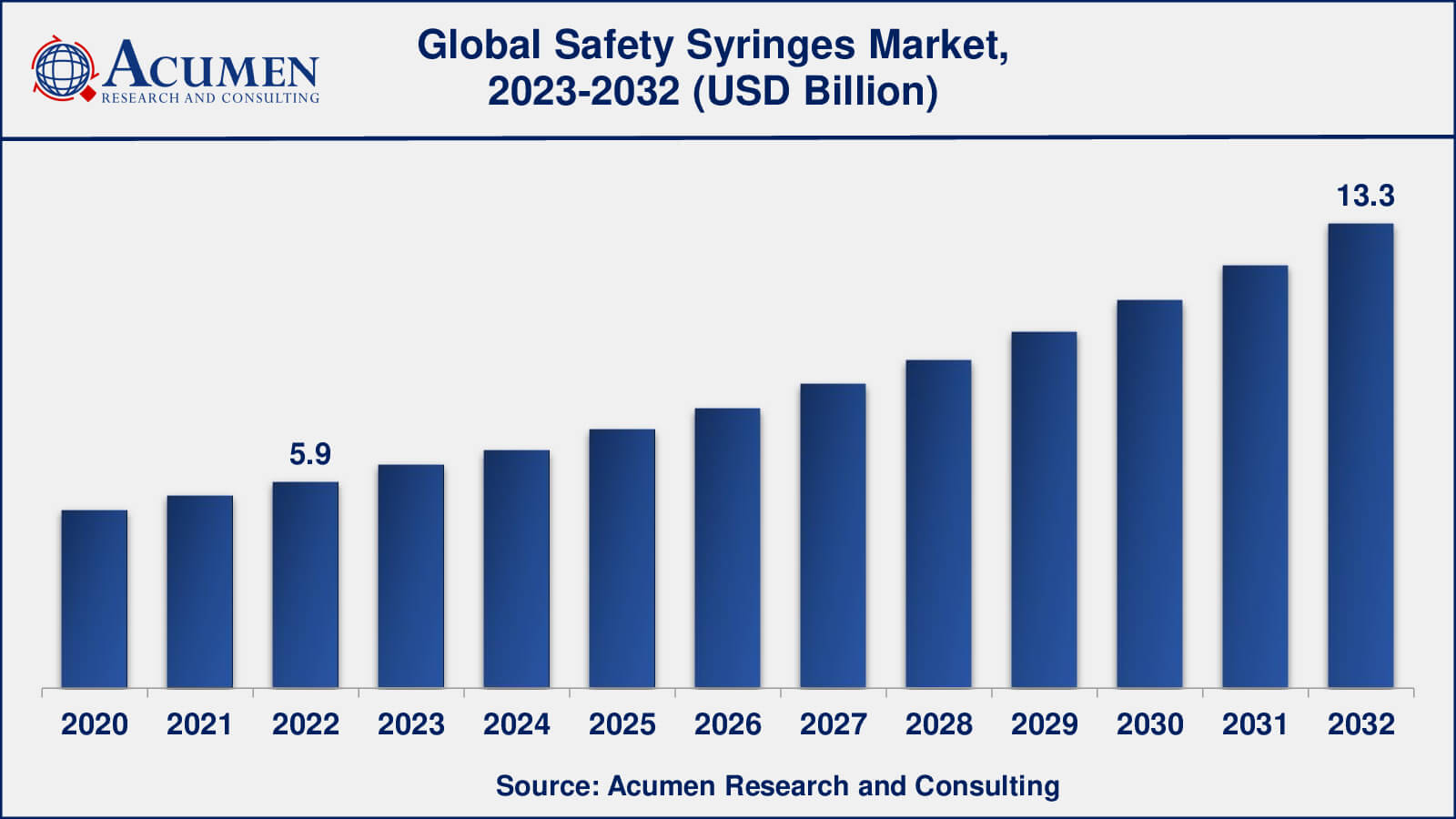

The Global Safety Syringes Market Size accounted for USD 5.9 Billion in 2022 and is estimated to achieve a market size of USD 13.3 Billion by 2032 growing at a CAGR of 8.5% from 2023 to 2032.

Safety Syringes Market Highlights

- Global safety syringes market revenue is poised to garner USD 13.3 billion by 2032 with a CAGR of 8.5% from 2023 to 2032

- North America safety syringes market value occupied more than USD 2 billion in 2022

- Asia-Pacific safety syringes market growth will record a CAGR of around 9% from 2023 to 2032

- Among product type, the skin and hair care oil sub-segment generated around US$ 2.7 billion revenue in 2022

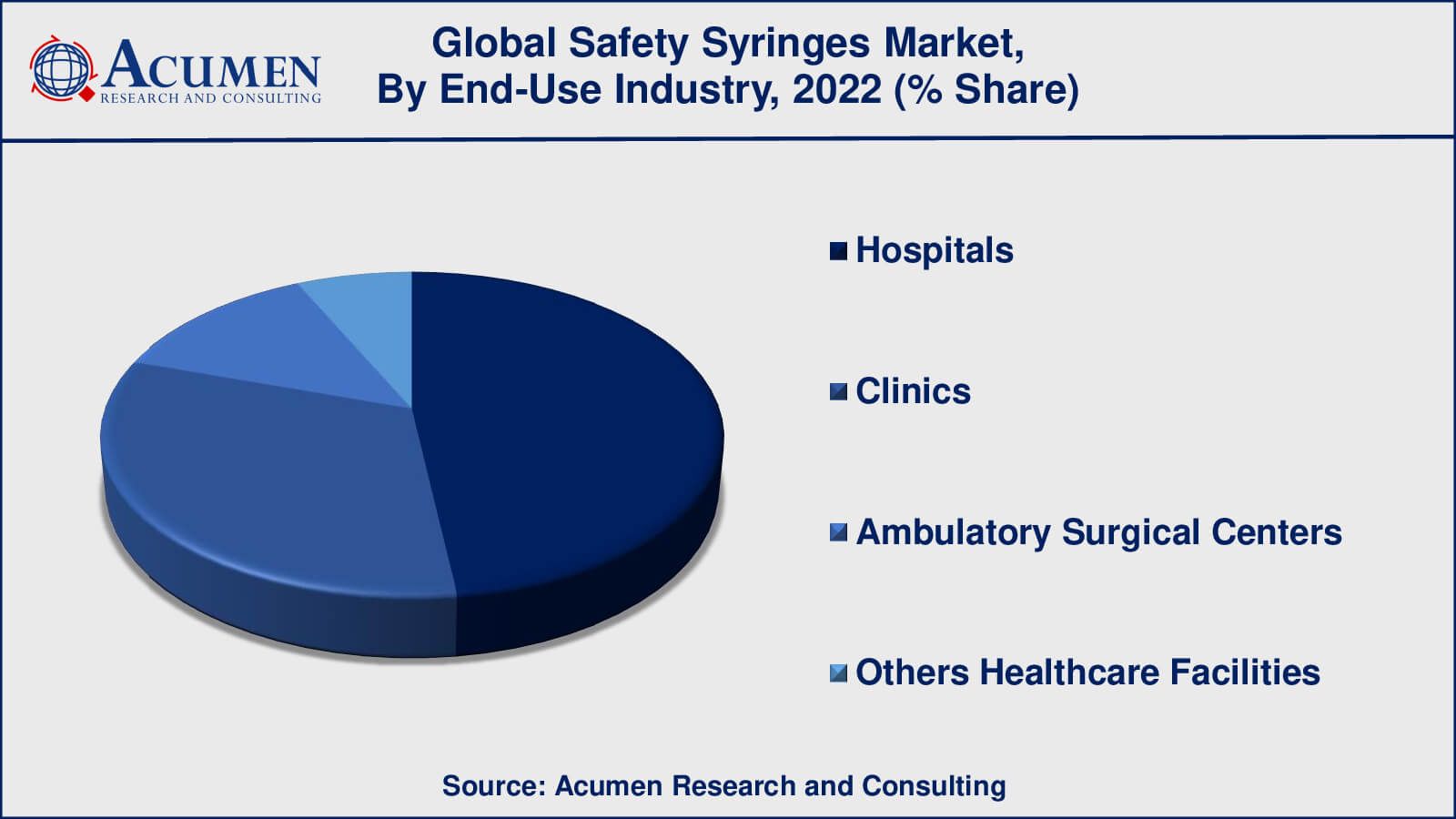

- Based on end-use industry, the hospitals sub-segment generated over 48% share in 2022

- Increasing adoption of self-injection devices is a popular safety syringes market trend that fuels the industry demand

Safety syringes consist of an inherent safety instrument and either a detachable or permanently attached needle and have a close resemblance to conventional syringes in terms of design. They are now commonly used in healthcare to avoid the re-use of needles and needle stick injuries caused usually by conventional syringes. The effective safety syringes with features that can prevent reuse and needle stick are regulated by the government at all healthcare centers. The demand for injectable medications, such as vaccines, insulin, and other drugs, is increasing, driving up the demand for safety syringes. As more medications are administered via injection, there is a greater need for safe and effective delivery systems, such as safety syringes. Infection prevention and control have become critical priorities in healthcare settings, particularly in the aftermath of the COVID-19 pandemic. By reducing the risk of needlestick injuries and subsequent infections among healthcare workers and patients, safety syringes are being recognised as an important tool in preventing the transmission of infections, including bloodborne diseases.

Global Safety Syringes Market Dynamics

Market Drivers

- Increasing emphasis on needlestick injury prevention

- Stringent regulatory guidelines

- Rising prevalence of bloodborne diseases

Market Restraints

- High cost of safety syringes

- Resistance to change

Market Opportunities

- Increasing healthcare spending

- Growing focus on infection control and prevention

- Increasing demand for injectable medications

Safety Syringes Market Report Coverage

| Market | Safety Syringes Market |

| Safety Syringes Market Size 2022 | USD 5.9 Billion |

| Safety Syringes Market Forecast 2032 | USD 13.3 Billion |

| Safety Syringes Market CAGR During 2023 - 2032 | 8.5% |

| Safety Syringes Market Analysis Period | 2020 - 2032 |

| Safety Syringes Market Base Year | 2022 |

| Safety Syringes Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Becton, Dickinson and Company (BD), Medtronic plc, Smiths Medical, Terumo Corporation, Gerresheimer AG, Retractable Technologies, Inc., Cardinal Health, Inc., Baxter International Inc., B. Braun Melsungen AG, Nipro Medical Corporation, Boston Scientific Corporation, UltiMed, Inc., Sol-Millennium Medical Group, Vygon SA, and Axel Bio Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Safety Syringes Market Insights

Safety syringes are commonly used by most healthcare workers globally to avoid accidental needle injuries. Government authorities have introduced regulations in several countries to restrict syringe re-use and needle injuries that compel the use of safety syringes than conventional syringes and are directly driving the growth of the safety syringes market. Lack of awareness towards safety syringes and the high cost of these syringes are primarily slowing down the market growth in emerging economies. In addition, alternative drug delivery techniques are also restraining the market growth. Even though, the growth of the safety syringe market can be attributed to the rising government initiatives towards the use of safety syringes in healthcare and improvisation in safety mechanisms in the injectable market in the upcoming years.

Safety Syringes Market, By Segmentation

The worldwide market for safety syringes is split based on product type, application, end-use industry, and geography.

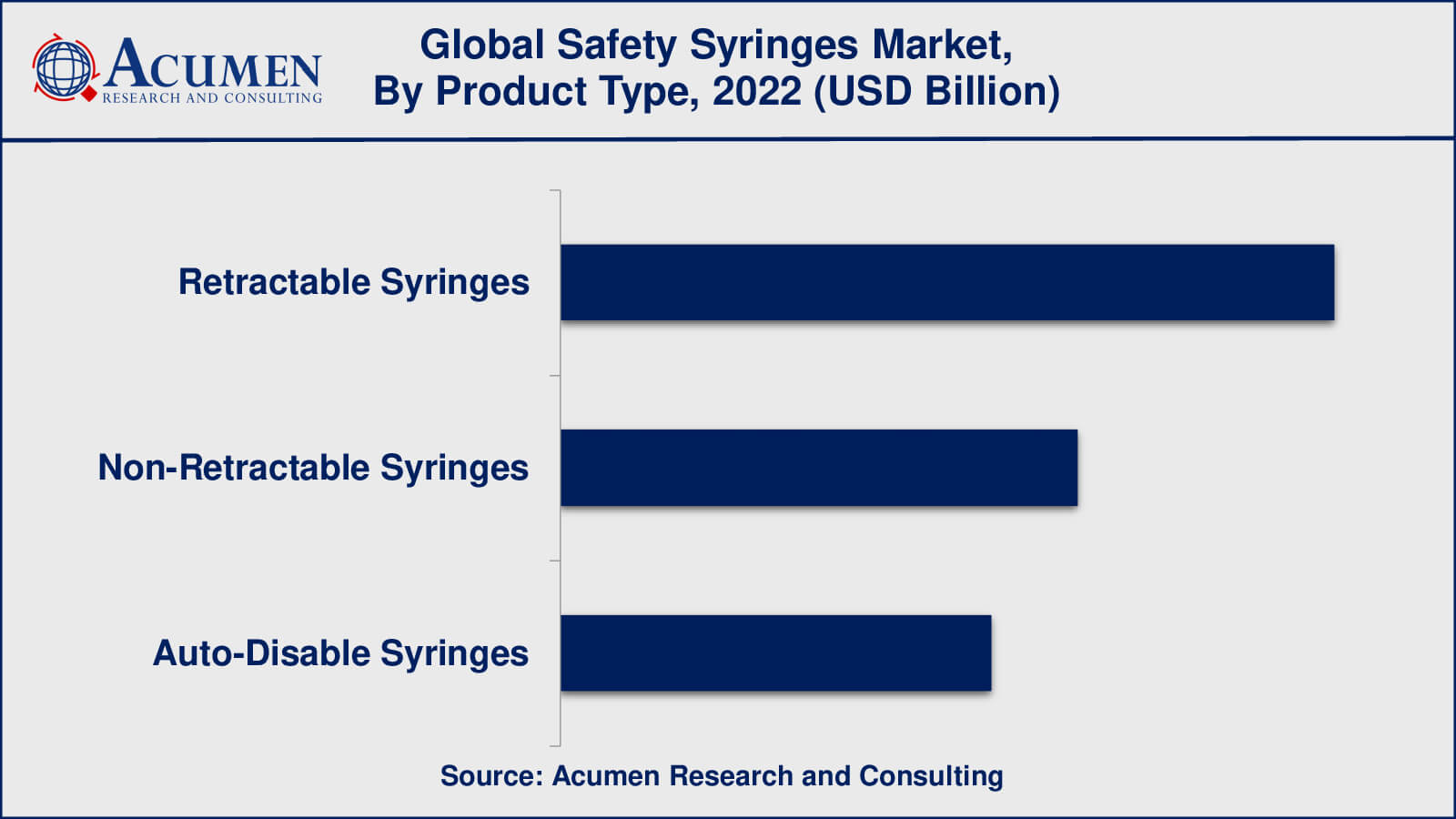

Safety Syringes Product Types

- Retractable Syringes

- Non-Retractable Syringes

- Auto-Disable Syringes

According to safety syringes industry analysis, retractable syringes are considered to be the dominant product type in the safety syringes market. Retractable syringes have a mechanism that allows the needle to retract into the syringe barrel after use, lowering the risk of needlestick injuries. These syringes are commonly used in healthcare settings to prevent needlestick injuries among healthcare workers and are thought to be an effective safety measure.

Non-retractable syringes, on the other hand, lack an in-built needle retraction mechanism, leaving the needle exposed after use. After a single use, auto-disable syringes are designed to automatically disable or render the syringe unusable, preventing reuse and lowering the risk of needlestick injuries and disease transmission. Retractable syringes, on the other hand, have gained wider acceptance due to their ease of use, compatibility with existing healthcare practises, and proven effectiveness in reducing needlestick injuries.

Safety Syringes Applications

- Intramuscular Injections

- Intravenous Injections

- Subcutaneous Injections

- Others

Intramuscular injections are widely regarded as one of the most important applications in the safety syringes market. Intramuscular injections are commonly used to administer vaccines, medications, and other treatments directly into muscle tissue. The use of safety syringes in intramuscular injections reduces the risk of needlestick injuries among healthcare workers while also preventing infection transmission.

Furthermore, intravenous injections, which are given directly into veins, are a significant application area for safety syringes. Intravenous injections are commonly used in hospitals, clinics, and home healthcare settings to administer medications, fluids, and other treatments. Subcutaneous injections, which are given just beneath the skin, are another important application for safety syringes. Vaccines, insulin, and other medications are commonly administered via subcutaneous injection.

Safety Syringes End-Use Industries

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

According to the safety syringes market forecast, hospitals are considered to be the dominant end-use industry in the safety syringes market. Hospitals are primary healthcare facilities where a variety of medical procedures, including injections, are performed on a regular basis. The use of safety syringes in hospitals is critical for preventing needlestick injuries and lowering the risk of infection.

Clinics, including primary care, specialty, and outpatient clinics, are also major users of safety syringes. These healthcare facilities offer a variety of medical services, including injections, and frequently require the use of safety syringes to protect their staff and patients from needlestick injuries and to prevent the spread of infections. Another important end-use industry for safety syringes is ambulatory surgical centres (ASCs), which are outpatient facilities that provide surgical procedures.

Safety Syringes Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Safety Syringes Market Regional Analysis

North America is considered the largest region in the safety syringes market. The United States, in particular, is a major contributor to the market growth in North America, driven by stringent regulatory guidelines and high awareness among healthcare workers about the risks associated with needlestick injuries. North America has well-established healthcare infrastructure and a mature market for safety syringes, with key market players such as Becton, Dickinson and Company (BD), Medtronic plc, and Smiths Medical having a significant presence in the region. However, it's important to note that the market dynamics may have changed since the knowledge cutoff date, and the actual current market size and trends may differ.

Asia-Pacific is a rapidly growing market for safety syringes, with countries such as China, Japan, and India showing significant growth potential. The increasing healthcare expenditure, rising awareness about needlestick injury prevention, and growing adoption of safety practices in healthcare settings are driving the demand for safety syringes in the region. The presence of a large patient population, rising prevalence of bloodborne diseases, and increasing focus on improving healthcare infrastructure and infection control measures are key factors contributing to the market growth in Asia-Pacific. Local and global market players, such as Nipro Medical Corporation, Vygon SA, and Baxter International Inc., are actively operating in the Asia-Pacific market.

Safety Syringes Market Players

Some of the top safety syringes companies offered in the professional report Becton, Dickinson and Company (BD), Medtronic plc, Smiths Medical, Terumo Corporation, Gerresheimer AG, Retractable Technologies, Inc., Cardinal Health, Inc., Baxter International Inc., B. Braun Melsungen AG, Nipro Medical Corporation, Boston Scientific Corporation, UltiMed, Inc., Sol-Millennium Medical Group, Vygon SA, and Axel Bio Corporation.

Frequently Asked Questions

What was the market size of the global safety syringes in 2022?

The market size of safety syringes was USD 5.9 billion in 2022.

What is the CAGR of the global safety syringes from 2023 to 2032?

The CAGR of safety syringes is 8.5% during the analysis period of 2023 to 2032.

Which are the key players in the safety syringes market?

The key players operating in the global safety syringes market is includes Becton, Dickinson and Company (BD), Medtronic plc, Smiths Medical, Terumo Corporation, Gerresheimer AG, Retractable Technologies, Inc., Cardinal Health, Inc., Baxter International Inc., B. Braun Melsungen AG, Nipro Medical Corporation, Boston Scientific Corporation, UltiMed, Inc., Sol-Millennium Medical Group, Vygon SA, and Axel Bio Corporation.

Which region dominated the global safety syringes market share?

North America held the dominating position in safety syringes industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of safety syringes during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global safety syringes industry?

The current trends and dynamics in the safety syringes industry include increasing emphasis on needlestick injury prevention, stringent regulatory guidelines, and rising prevalence of bloodborne diseases.

Which product type held the maximum share in 2022?

The retractable syringes held the maximum share of the safety syringes industry.?