Rubber Tired Gantry Crane Market | Acumen Research and Consulting

Rubber Tired Gantry Crane Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

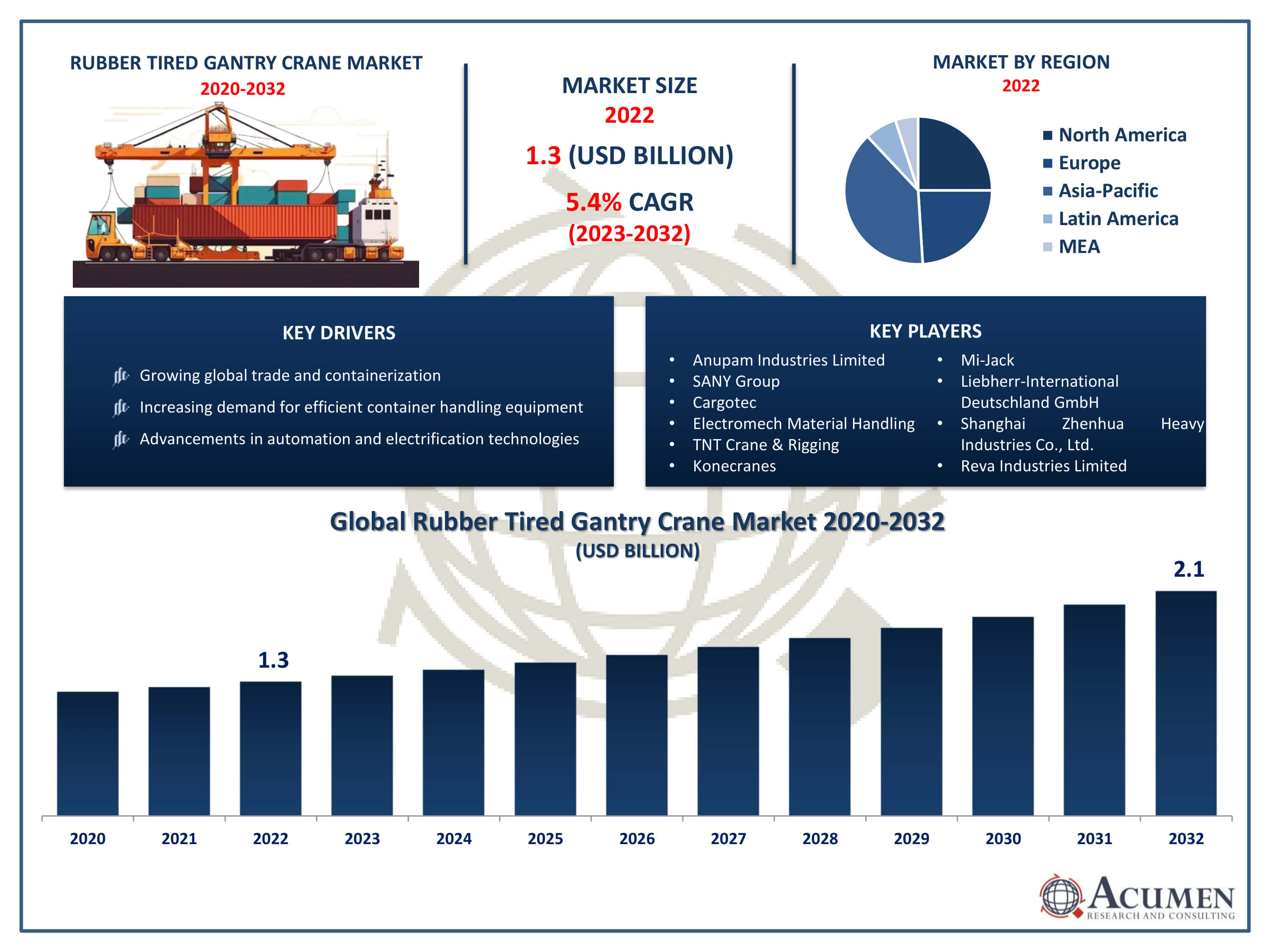

The Rubber Tired Gantry Crane Market Size accounted for USD 1.3 Billion in 2022 and is projected to achieve a market size of USD 2.1 Billion by 2032 growing at a CAGR of 5.4% from 2023 to 2032.

Rubber Tired Gantry Crane Market Highlights

- Global Rubber Tired Gantry Crane Market revenue is expected to increase by USD 2.1 Billion by 2032, with a 5.4% CAGR from 2023 to 2032

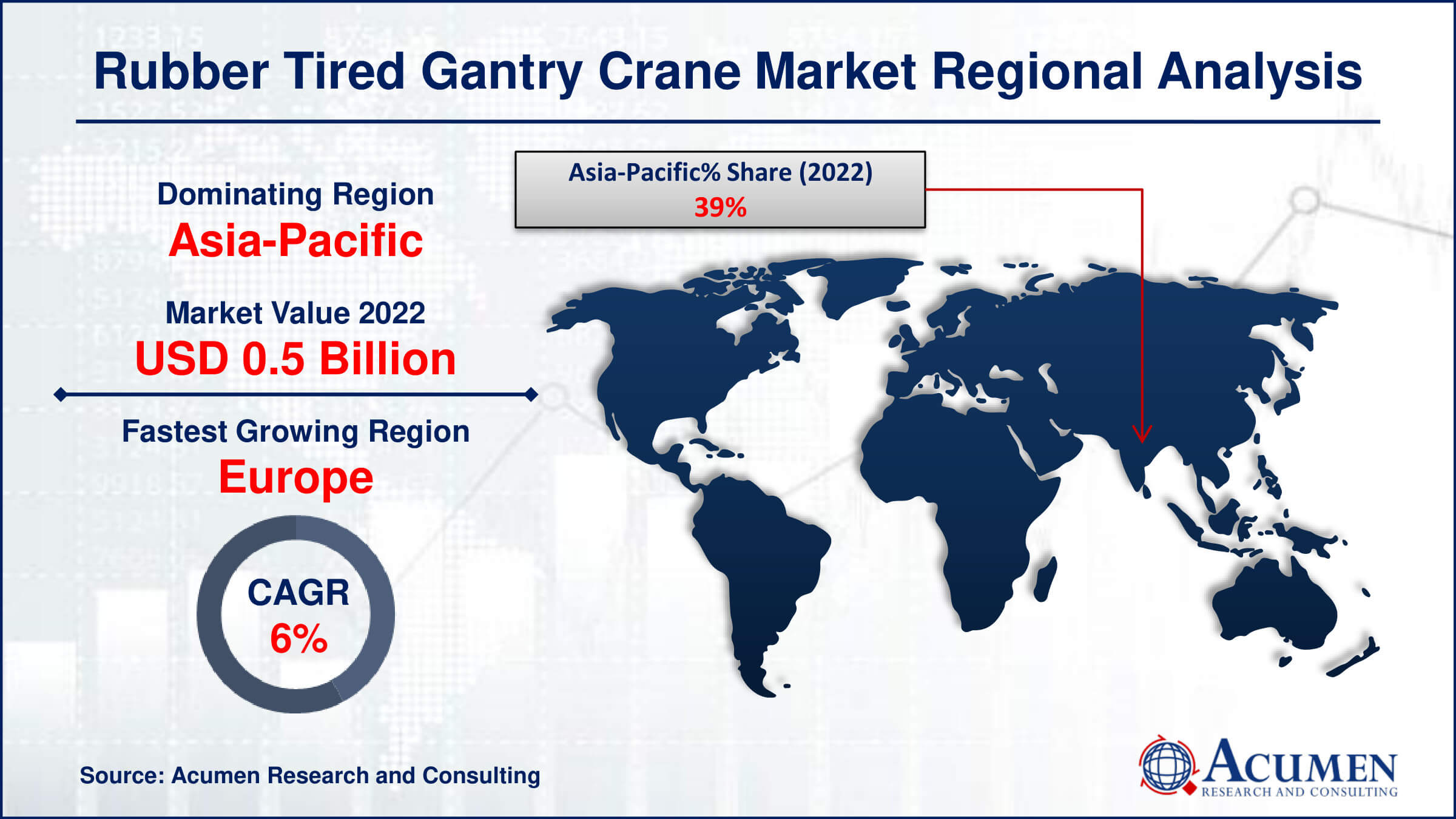

- Asia-Pacific region led with more than 39% of Rubber Tired Gantry Crane Market share in 2022

- Europe Rubber Tired Gantry Crane Market growth will record a CAGR of more than 6.1% from 2023 to 2032

- By type, the 16 Wheel are the largest segment of the market, accounting for over 62% of the global market share

- By power supply, the electric segment is anticipated to grow at a remarkable CAGR of 5.9% between 2023 and 2032

- Growing global trade and containerization, drives the Rubber Tired Gantry Crane Market value

A rubber tired gantry (RTG) crane is a type of mobile crane commonly used in container terminals and intermodal yards to handle containers. Unlike traditional gantry cranes that are fixed to rails, RTGs are mounted on wheels and can move around the terminal with ease. These cranes typically have rubber tires, allowing for increased flexibility and efficiency in container handling operations. RTGs are known for their ability to stack containers in rows and lift them with precision, contributing to the smooth and organized flow of cargo in busy port environments.

The market for rubber tired gantry cranes has experienced significant growth in recent years, driven by the expansion of global trade and the need for more efficient container handling solutions. The increasing size of container ships has led to a higher demand for advanced and flexible container handling equipment, and RTGs have proven to be a valuable solution in meeting these requirements. Additionally, advancements in technology, such as automation and electrification, have further enhanced the appeal of RTGs in the market. As ports and terminals continue to upgrade and modernize their facilities to accommodate larger vessels and improve operational efficiency, the demand for rubber tired gantry cranes is expected to continue growing, making it a key player in the maritime industry's equipment landscape.

Global Rubber Tired Gantry Crane Market Trends

Market Drivers

- Growing global trade and containerization

- Increasing demand for efficient container handling equipment

- Advancements in automation and electrification technologies

- Port and terminal modernization initiatives

- Flexibility and Mobility Advantages of Rubber Tired Gantry Cranes

Market Restraints

- High initial investment costs

- Environmental concerns related to diesel-powered RTGs

Market Opportunities

- Modernization and expansion of port facilities

- Integration of smart technologies for enhanced operations

Rubber Tired Gantry Crane Market Report Coverage

| Market | Rubber Tired Gantry Crane Market |

| Rubber Tired Gantry Crane Market Size 2022 | USD 1.3 Billion |

| Rubber Tired Gantry Crane Market Forecast 2032 | USD 2.1 Billion |

| Rubber Tired Gantry Crane Market CAGR During 2023 - 2032 | 5.4% |

| Rubber Tired Gantry Crane Market Analysis Period | 2020 - 2032 |

| Rubber Tired Gantry Crane Market Base Year |

2022 |

| Rubber Tired Gantry Crane Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Power Supply, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Anupam Industries Limited, SANY Group, Cargotec, ELECTROMECH MATERIAL HANDLING SYSTEMS (INDIA) PVT. LTD., TNT Crane & Rigging, Konecranes, Mi-Jack, Liebherr-International Deutschland GmbH, Shanghai Zhenhua Heavy Industries Co., Ltd., and Reva Industries Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A Rubber Tired Gantry (RTG) crane is a mobile gantry crane commonly used in container handling operations at ports and intermodal terminals. Unlike traditional gantry cranes that are fixed to a specific location on rails, RTGs are equipped with wheels and can move independently throughout the terminal. The rubber tires allow for greater flexibility, enabling the crane to efficiently navigate container stacks, load and unload cargo from ships, and transport containers within the terminal. RTGs are known for their versatility, making them a vital component in the logistics chain of maritime trade. The applications of Rubber Tired Gantry Cranes are diverse and play a crucial role in optimizing container handling processes. RTGs are primarily utilized for stacking and moving containers in storage yards, facilitating the organized storage and retrieval of cargo. They are also involved in the loading and unloading of containers onto and from container ships, ensuring a smooth and efficient flow of goods in and out of ports.

The global increase in trade activities and the expansion of containerized shipping has been a primary growth driver for the RTG crane market. Ports and terminals worldwide have been investing in upgrading their infrastructure to handle larger container vessels, and RTGs have proven to be crucial in efficiently managing the increased cargo volumes. Furthermore, technological advancements, including automation and electrification, have been contributing to the growth of this market by enhancing the operational efficiency and reducing the environmental impact of RTGs. The market's trajectory is also influenced by factors such as the adoption of green technologies and the ongoing modernization efforts in the maritime industry. The demand for more sustainable and environmentally friendly solutions in the material handling equipment sector is expected to drive innovation and create new growth opportunities for RTG manufacturers.

Rubber Tired Gantry Crane Market Segmentation

The global Rubber Tired Gantry Crane Market segmentation is based on type, power supply, and geography.

Rubber Tired Gantry Crane Market By Type

- 8 Wheel

- 16 Wheel

In terms of types, the 16 Wheel segment accounted for the largest market share in 2022. The 16-wheel configuration in RTGs is typically associated with larger and heavier lifting capacities, making them well-suited for handling ultra-large container vessels and the evolving needs of modern container terminals. The demand for higher efficiency and productivity in port operations has been a significant driver for the adoption of RTGs with larger wheel configurations. These cranes are capable of navigating heavy loads with greater stability, contributing to enhanced operational performance in busy container terminals. The growth of the 16-wheel segment is likely influenced by the increasing size of container ships and the need for handling heavier cargo loads. Additionally, as ports continue to invest in infrastructure upgrades to accommodate larger vessels, the demand for RTGs with advanced configurations, such as 16 wheels, is expected to rise.

Rubber Tired Gantry Crane Market By Power Supply

- Diesel

- Hybrid

- Electric

According to the rubber tired gantry crane market forecast, the electric segment is expected to witness significant growth in the coming years. As concerns over carbon emissions and environmental impact have escalated, the demand for electric-powered RTGs has surged. These cranes typically use electricity as a cleaner alternative to diesel fuel, contributing to reduced emissions and aligning with the increasing emphasis on green technologies in port operations. The growth of the electric segment can be attributed to the broader trend of electrification in the maritime sector, supported by advancements in battery technology and the availability of more efficient electric powertrains. Electric RTGs offer benefits such as lower operating costs, reduced air and noise pollution, and compliance with stringent environmental regulations. As ports and terminals prioritize sustainability goals, the electric segment in the RTG market is expected to continue its upward trajectory. Furthermore, governments and industry stakeholders are increasingly incentivizing the adoption of electric and hybrid technologies, further propelling the growth of the electric segment in the RTG crane market.

Rubber Tired Gantry Crane Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Rubber Tired Gantry Crane Market Regional Analysis

The Asia-Pacific region has emerged as the dominant force in the rubber tired gantry (RTG) crane market, driven by the dynamic growth of international trade and the strategic importance of the region in global logistics and supply chains. As a manufacturing and export powerhouse, countries such as China, Japan, and South Korea have witnessed substantial investments in port infrastructure and container handling equipment. The continuous expansion of major container terminals across these nations, coupled with the rise in containerized shipping, has fueled the demand for RTGs to efficiently manage the increasing cargo volumes. Moreover, the sheer scale of economic development and urbanization in the Asia-Pacific region has led to a surge in demand for consumer goods, driving the need for expanded and more sophisticated port facilities. The efficiency and flexibility offered by RTGs in handling containers make them a preferred choice for port operators seeking to optimize operations. The region's dominance in the RTG market is also bolstered by technological advancements, with an increasing focus on automation and electrification to enhance the productivity and sustainability of container handling operations.

Rubber Tired Gantry Crane Market Player

Some of the top rubber tired gantry crane market companies offered in the professional report include Anupam Industries Limited, SANY Group, Cargotec, ELECTROMECH MATERIAL HANDLING SYSTEMS (INDIA) PVT. LTD., TNT Crane & Rigging, Konecranes, Mi-Jack, Liebherr-International Deutschland GmbH, Shanghai Zhenhua Heavy Industries Co., Ltd., and Reva Industries Limited.

Frequently Asked Questions

How big is the rubber tired gantry crane market?

The rubber tired gantry crane market size was USD 1.3 Billion in 2022.

What is the CAGR of the global rubber tired gantry crane market from 2023 to 2032?

The CAGR of rubber tired gantry crane is 5.4% during the analysis period of 2023 to 2032.

Which are the key players in the rubber tired gantry crane market?

The key players operating in the global market are including Anupam Industries Limited, SANY Group, Cargotec, ELECTROMECH MATERIAL HANDLING SYSTEMS (INDIA) PVT. LTD., TNT Crane & Rigging, Konecranes, Mi-Jack, Liebherr-International Deutschland GmbH, Shanghai Zhenhua Heavy Industries Co., Ltd., and Reva Industries Limited.

Which region dominated the global rubber tired gantry crane market share?

Asia-Pacific held the dominating position in rubber tired gantry crane industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of rubber tired gantry crane during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global rubber tired gantry crane industry?

The current trends and dynamics in the rubber tired gantry crane market growth include growing global trade and containerization, increasing demand for efficient container handling equipment, and advancements in automation and electrification technologies.

Which type held the maximum share in 2022?

The 16 wheel type held the maximum share of the rubber tired gantry crane industry.