Rubber Additives Market | Acumen Research and Consulting

Rubber Additives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

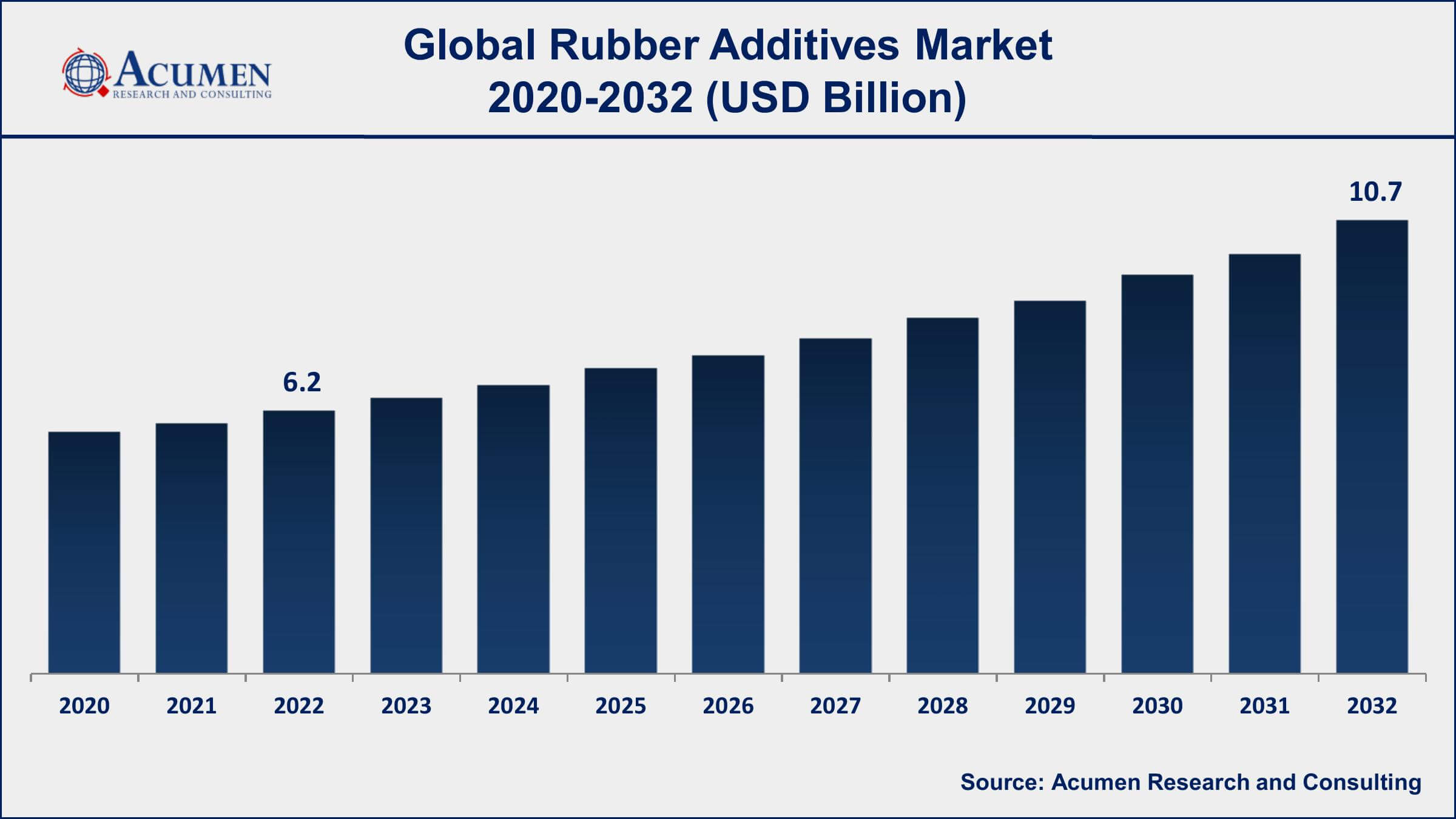

The Rubber Additives Market Size accounted for USD 6.2 Billion in 2022 and is projected to achieve a market size of USD 10.7 Billion by 2032 growing at a CAGR of 5.1% from 2023 to 2032.

Rubber Additives Market Highlights

- Global rubber additives market revenue is expected to increase by USD 10.7 Billion by 2032, with a 5.1% CAGR from 2023 to 2032

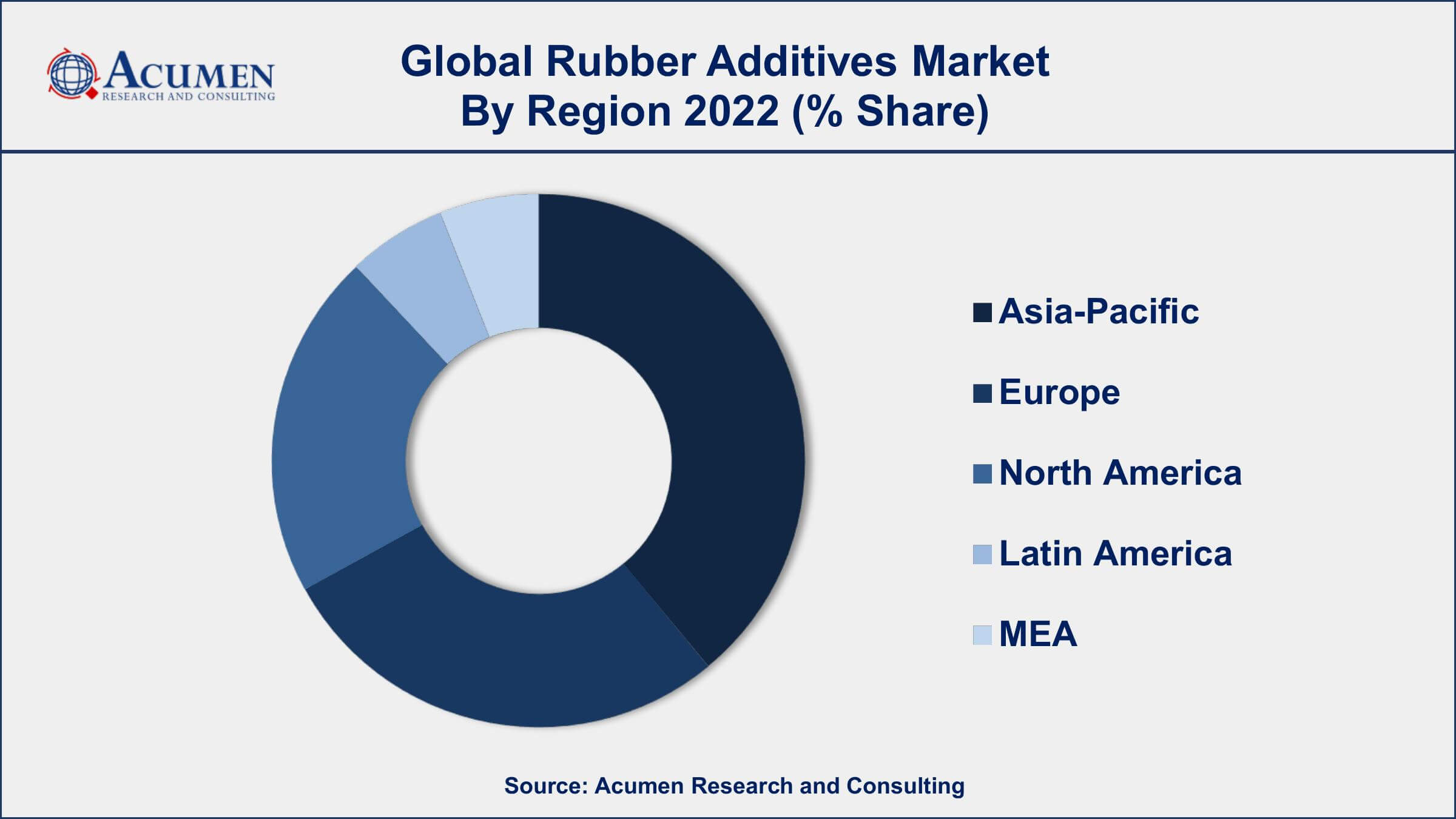

- Asia-Pacific region led with more than 42% of rubber additives market share in 2022

- North America rubber additives market growth will record a CAGR of around 6% from 2023 to 2032

- The global rubber market size was valued at USD 42 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5% from 2023 to 2030

- The tire segment is the largest application segment of the market, accounting for more than 47% of the market share

- Increasing demand from the automotive industry for high-performance tires, drives the rubber additives market value

Rubber additives are substances added to rubber in order to improve its physical and chemical properties, such as durability, elasticity, resistance to heat, and resistance to aging. Rubber additives can be divided into several categories, including vulcanizing agents, accelerators, antioxidants, and antiozonants. These additives are used in the production of a wide range of rubber products, including tires, hoses, belts, seals, and gaskets.

The market for rubber additives is expected to experience strong growth over the next few years, driven by increasing demand from the automotive and construction industries. The rising demand for high-performance tires that offer improved fuel efficiency and safety features is expected to be a key driver of growth in the market. In addition, the growing use of rubber in construction materials, such as roofing materials and waterproofing membranes, is also expected to drive demand for rubber additives. Emerging economies, particularly in Asia-Pacific, are expected to be the key growth markets for rubber additives, driven by increasing industrialization, urbanization, and infrastructure development.

Global Rubber Additives Market Trends

Market Drivers

- Increasing demand from the automotive industry for high-performance tires

- Growing use of rubber in construction materials, such as roofing and waterproofing membranes

- Growing demand for rubber from the medical industry for medical devices and equipment

- Technological advancements in rubber additives leading to new product development

Market Restraints

- Fluctuating raw material prices affect the profitability of manufacturers

- Environmental regulations and sustainability concerns restricting the use of certain rubber additives

Market Opportunities

- Increasing demand for eco-friendly rubber additives to meet sustainability goals

- Growing demand for rubber additives in the Asia-Pacific region due to the rapid industrialization and urbanization

Rubber Additives Market Report Coverage

| Market | Rubber Additives Market |

| Rubber Additives Market Size 2022 | USD 6.2 Billion |

| Rubber Additives Market Forecast 2032 | USD 10.7 Billion |

| Rubber Additives Market CAGR During 2023 - 2032 | 5.1% |

| Rubber Additives Market Analysis Period | 2020 - 2032 |

| Rubber Additives Market Base Year | 2022 |

| Rubber Additives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Lanxess AG, ExxonMobil Chemical, BASF SE, Arkema S.A., Eastman Chemical Company, Kumho Petrochemical Co., Ltd., Solvay SA, Akzo Nobel N.V., Sumitomo Chemical Co., Ltd., Sabic, Evonik Industries AG, and Wacker Chemie AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Rubber additives refer to those agents or chemicals which are added during the synthesis and processing of rubber polymers. Rubber additives are added with raw rubber polymers to improve and enhance overall mechanical and structural properties as well as improve the overall quality and performance of rubber. Several types of rubber additives include vulcanization inhibitors & accelerators, adhesion promoters, processing aids, antiozonants, fillers, and chemical blowing agents. Vulcanization accelerators enhance the cross-linking efficiency whereas the inhibitors slow down the process of vulcanization. Processing aids are employed to reduce the total viscosity of rubber. This in turn helps in fabricating the rubber with other such components and thus helps in the reduction of overall energy required during the time of fabrication. Moreover, adhesion promoters are widely used to enhance the rubber-to-metal adhesion bond during the time of manufacturing of tires. Other rubber additives such as fillers are basically deployed to increase the total stiffness of unvulcanized rubber. Tubing & tire, construction, consumer goods, and electrical insulation industries are some of the key end-users of rubber additives. The tire & tubing industry accounted for the highest market share in the global rubber additives market in 2014 and is anticipated to maintain its dominance over the forecast period. Rubber is a polymer that is categorized as synthetic and natural rubber.

Increasing demand for rubber additives across the globe is significantly fueled by the growing consumption of rubber polymers especially in the manufacturing of tires and electrical insulation industries. The tire manufacturing industry is expected to be the largest consumer of rubber throughout the forecast period. Process aids, vulcanization accelerators, and oil extenders are some of the major rubber additives employed in the manufacturing of tires. Accelerators that are commonly used to increase the cross-linking efficiency over the time of vulcanization include thiazole, guanidine, sulfur, and thiuram among others. In addition, processing aids including some plasticizers and chemical peptizes aid in reducing the overall viscosity for easy stabilization and fabrication. Extenders used during the designing of tire treads include calcium carbonate and clay. Electrical insulation especially in industrial and household constructions is another key factor anticipated to drive the global demand for rubber additives thus driving the global rubber additives market. Since rubber is considered a bad conductor of electricity, it is also considered one of the most favored insulation materials in the construction industry. Oil extenders are widely used rubber additives that help in reducing the overall cost of insulation. Various stabilizers such as esters made up of fatty acids are also added to rubber in order to improve the voltage and heat resistance of rubber. However, several environmental concerns along with stringent governmental regulations are some key factors anticipated to hamper the growth of the global rubber additives market.

Rubber Additives Market Segmentation

The global rubber additives market segmentation is based on type, application, and geography.

Rubber Additives Market By Type

- Accelerators

- Activators

- Plasticizers

- Vulcanization Inhibitors

- Others

In terms of types, the activators segment has seen significant growth in the rubber additives market in recent years. Activators are typically used in combination with vulcanizing agents and accelerators to optimize the vulcanization process and achieve desired physical and chemical properties in rubber products. The activators segment is expected to experience strong growth over the next few years, driven by increasing demand from the automotive and construction industries. The growing demand for high-performance tires that offer improved fuel efficiency and safety features is expected to be a key driver of growth in the activators segment. In addition, the growing use of rubber in construction materials, such as roofing materials and waterproofing membranes, is also expected to drive demand for activators. Furthermore, there has been a growing trend towards the development of eco-friendly activators that are free from harmful substances, such as heavy metals and other toxic chemicals.

Rubber Additives Market By Application

- Tires

- Electric Cables

- Conveyor Belts

- Others

According to the rubber additives market forecast, the tire segment is expected to witness significant growth in the coming years. Rubber additives play a crucial role in the production of tires, improving their physical and chemical properties and ensuring high quality and durability. The tire segment is expected to experience strong growth over the next few years, driven by increasing demand from the automotive industry. The growing demand for electric and hybrid vehicles, which require tires with lower rolling resistance and improved fuel efficiency, is expected to be a key driver of growth in the tire segment. In addition, the increasing focus on safety and sustainability is expected to drive demand for high-performance tires with improved wet grip and reduced environmental impact.

Rubber Additives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Rubber Additives Market Regional Analysis

Asia-Pacific is the largest and fastest-growing market for rubber additives, accounting for a significant share of the global market. The region's dominance in the rubber additives market can be attributed to several factors, including the rapidly growing automotive and construction industries, increasing industrialization and urbanization, and the availability of raw materials and labor at a lower cost. The automotive industry is one of the key end-use industries for rubber additives, and the Asia-Pacific region is home to some of the world's largest automotive markets, including China, Japan, India, and South Korea. The growing demand for high-performance tires and the increasing production of electric and hybrid vehicles in the region are driving the demand for rubber additives. In addition, the construction industry in the Asia-Pacific region is also witnessing rapid growth, driven by the increasing urbanization and infrastructure development in countries such as China, India, and Indonesia. The growing demand for rubber-based construction materials, such as roofing materials and waterproofing membranes, is also driving the demand for rubber additives.

Rubber Additives Market Player

Some of the top rubber additives market companies offered in the professional report include Lanxess AG, ExxonMobil Chemical, BASF SE, Arkema S.A., Eastman Chemical Company, Kumho Petrochemical Co., Ltd., Solvay SA, Akzo Nobel N.V., Sumitomo Chemical Co., Ltd., Sabic, Evonik Industries AG, and Wacker Chemie AG.

Frequently Asked Questions

What was the market size of the global rubber additives in 2022?

The market size of rubber additives was USD 6.2 Billion in 2022.

What is the CAGR of the global rubber additives market from 2023 to 2032?

The CAGR of rubber additives is 5.1% during the analysis period of 2023 to 2032.

Which are the key players in the rubber additives market?

The key players operating in the global market are including Lanxess AG, ExxonMobil Chemical, BASF SE, Arkema S.A., Eastman Chemical Company, Kumho Petrochemical Co., Ltd., Solvay SA, Akzo Nobel N.V., Sumitomo Chemical Co., Ltd., Sabic, Evonik Industries AG, and Wacker Chemie AG.

Which region dominated the global rubber additives market share?

Asia-Pacific held the dominating position in rubber additives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of rubber additives during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global rubber additives industry?

The current trends and dynamics in the rubber additives industry include increasing demand from the automotive industry for high-performance tires, and growing use of rubber in construction materials, such as roofing and waterproofing membranes.

Which type held the maximum share in 2022?

The activators type held the maximum share of the rubber additives industry.