Roofing Chemicals Market | Acumen Research and Consulting

Roofing Chemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

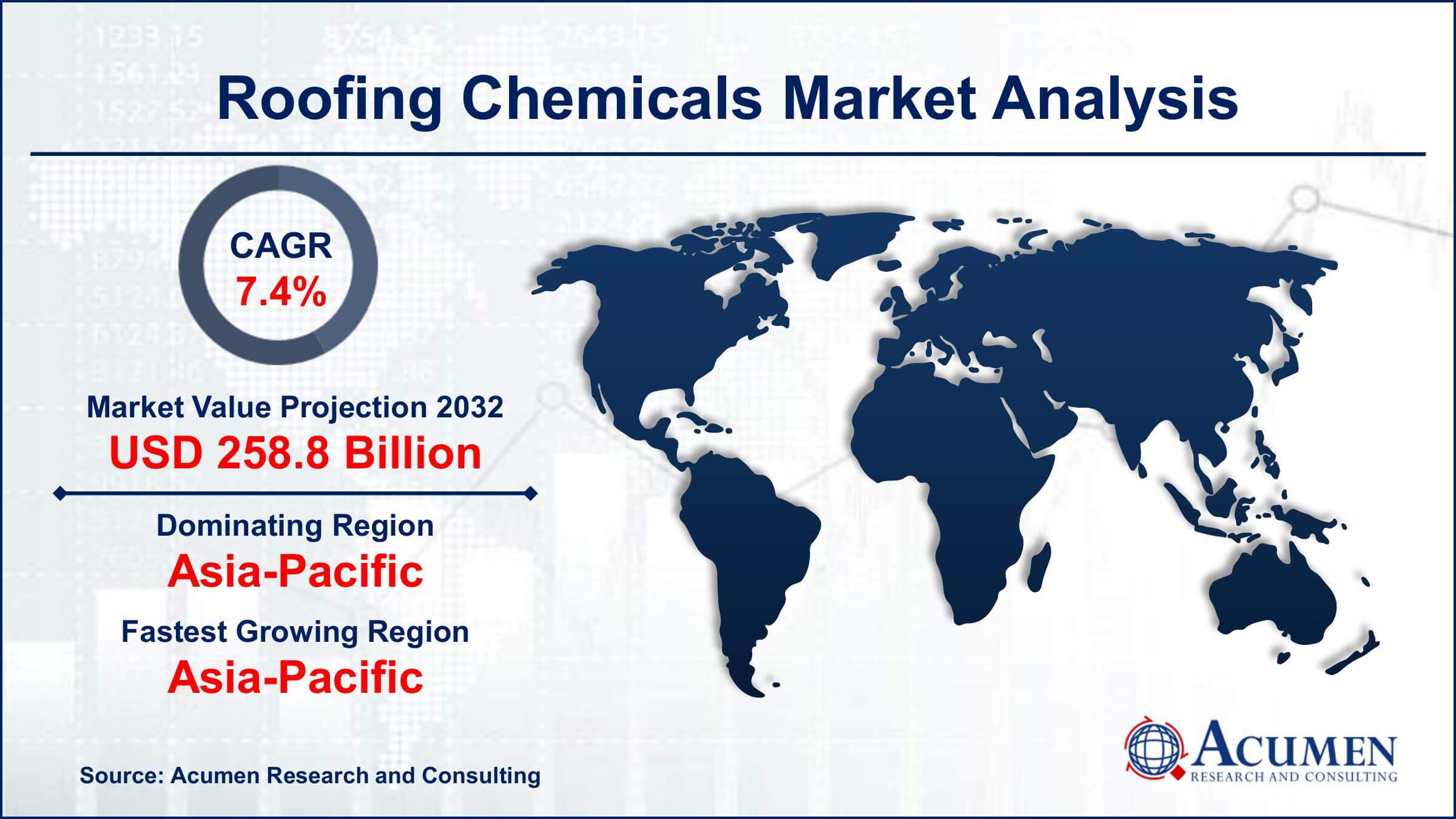

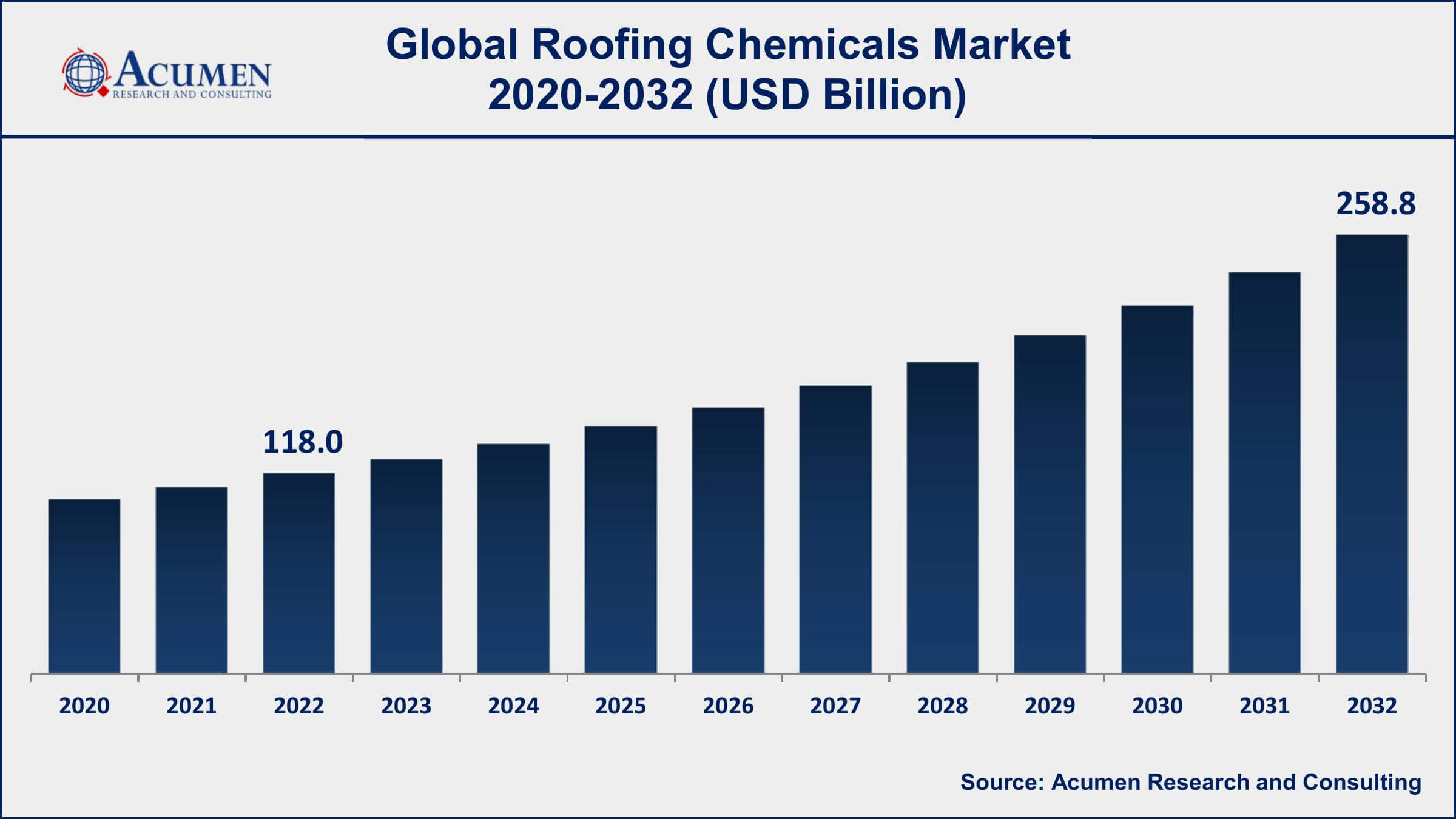

The Global Roofing Chemicals Market Size accounted for USD 118.0 Billion in 2022 and is projected to achieve a market size of USD 258.8 Billion by 2032 growing at a CAGR of 7.4% from 2023 to 2032.

Roofing Chemicals Market Key Highlights

- Global roofing chemicals market revenue is expected to increase by USD 258.8 Billion by 2032, with a 7.4% CAGR from 2023 to 2032

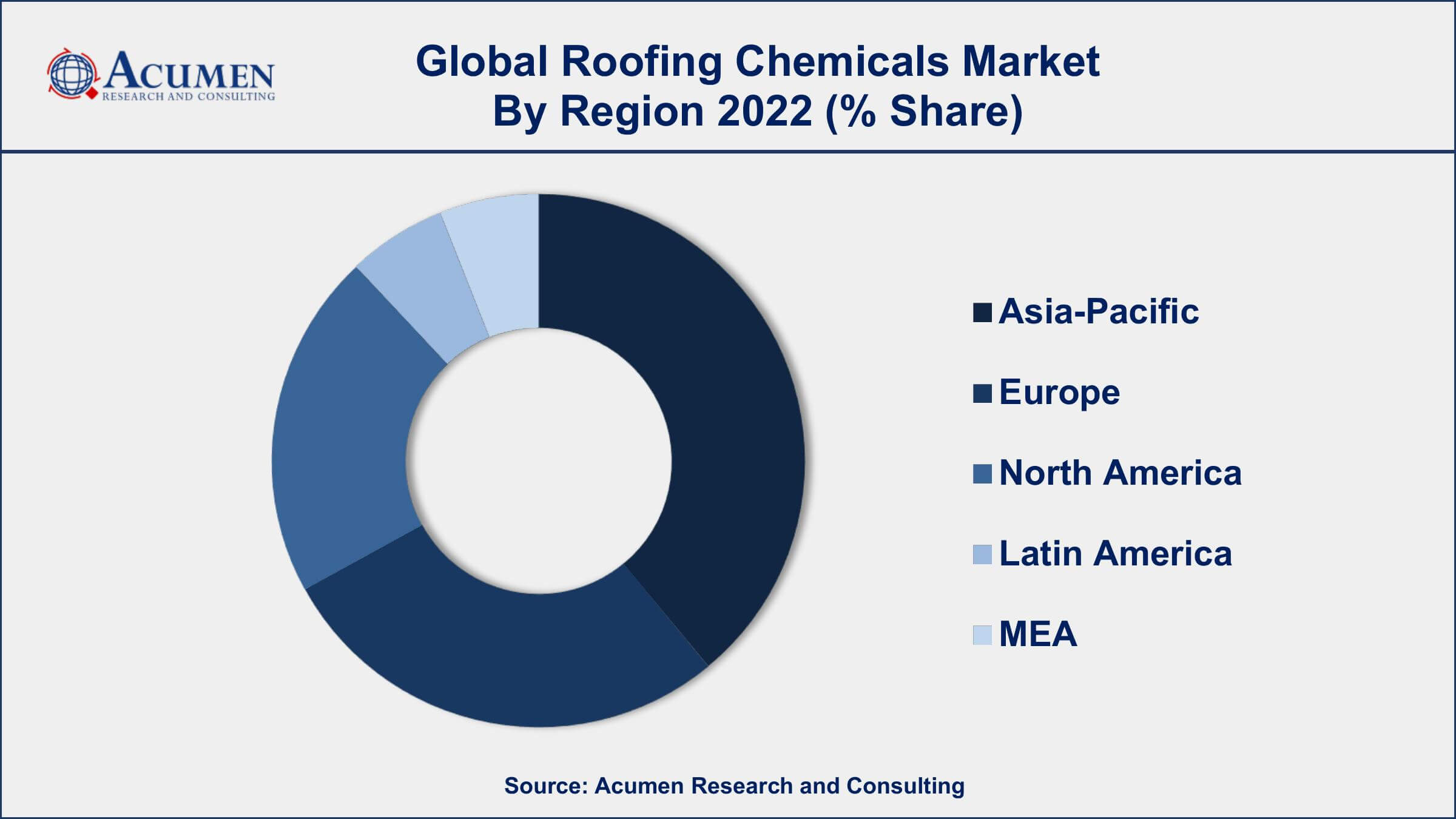

- Asia-Pacific region led with more than 41% of roofing chemicals market share in 2022

- Asphalt is the most commonly used roofing material in the United States, and it is used in approximately 80% of all roofing applications

- By application, the membrane roofing segment is the fastest-growing segment of the market, with a CAGR of over 5% during the forecast period

- The residential construction sector is the largest end-user of roofing chemicals, accounting for over 50% of the market share

- Increasing adoption of renewable energy sources, drives the roofing chemicals market value

Roofing chemicals are chemical substances that are used in the manufacturing and installation of roofing systems. These chemicals include materials such as adhesives, sealants, coatings, and waterproofing agents. They play a critical role in protecting roofing materials from harsh weather conditions and enhancing the durability and lifespan of roofing systems. The global roofing chemicals market growth is driven by factors such as the expansion of the construction industry, increasing demand for energy-efficient roofing systems, and rising adoption of sustainable roofing solutions. The market is highly competitive, with a wide range of companies offering various types of roofing chemicals for different applications.

The growing construction industry, coupled with rising awareness about the benefits of green roofing, is also driving the market growth. The increasing use of roofing chemicals for repairing and maintaining existing roofs is expected to drive market growth during this period. Moreover, the growing demand for high-performance roofing materials that can withstand extreme weather conditions is also expected to contribute to market growth. Overall, the roofing chemicals industry is expected to continue its expansion, driven by the increasing demand for durable and sustainable roofing solutions.

Global Roofing Chemicals Market Trends

Market Drivers

- Growth of the construction industry

- Increasing demand for energy-efficient roofing systems

- Rising adoption of sustainable roofing solutions

- Increasing awareness about the benefits of using roofing chemicals

- Government initiatives to promote sustainable construction practices

Market Restraints

- Fluctuations in raw material prices

- Stringent environmental regulations

- Availability of alternative roofing solutions

Market Opportunities

- Increasing use of green roofs in urban areas

- Rising adoption of cool roofs to reduce energy consumption

- Growing demand for single-ply roofing membranes in commercial buildings

Roofing Chemicals Market Report Coverage

| Market | Roofing Chemicals Market |

| Roofing Chemicals Market Size 2022 | USD 118.0 Billion |

| Roofing Chemicals Market Forecast 2032 | USD 258.8 Billion |

| Roofing Chemicals Market CAGR During 2023 - 2032 | 7.4% |

| Roofing Chemicals Market Analysis Period | 2020 - 2032 |

| Roofing Chemicals Market Base Year | 2022 |

| Roofing Chemicals Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Sika AG, Saint-Gobain S.A., Akzo Nobel N.V., RPM International Inc., GAF Materials Corporation, The Dow Chemical Company, Huntsman Corporation, Owens Corning, Carlisle Companies Incorporated, Firestone Building Products Company, LLC, and Johns Manville. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The process of waterproofing roof surfaces involves protecting them from adverse climatic conditions. The chemicals used for waterproofing the roof surface of any building structure such as decks, basements, or roof surfaces are known as roofing chemicals. Roofing chemicals play an important role in enabling the roof surfaces to diminish the absorption of warmness and retain coolness inside the building. This process of keeping the roof surfaces cool helps in the reduction of power consumption, thereby minimizing the operation cost for industries.

Growth in the construction industry is the major factor in the increase in demand for roofing chemicals. Moreover, the increased requirement for thermal management in buildings drives the market for roofing chemicals. Also, the strict government regulations regarding energy preservation lead to the increased demand for roofing chemicals. The re-roofing activities taking place in emerging economies such as the US, UK, Germany, France, and Russia also drive the market for roofing chemicals. However, the huge investments required for manufacturing roofing chemicals and the increased cost of installation restraints the market for roofing chemicals. Moreover, fluctuating crude oil prices are hampering the production of roofing chemicals and in turn adversely affecting the demand. The manufacturers of roofing chemicals have enormous growth opportunities owing to the increase in the construction sector in emerging economies such as India, Brazil, China, UAE, Saudi Arabia, Argentina, and parts of Africa.

Roofing Chemicals Market Segmentation

The global roofing chemicals market segmentation is based on type, application, and geography.

Roofing Chemicals Market By Type

- Asphalt/bituminous

- Acrylic resin

- Epoxy resin

- Styrene

- Elastomers

In terms of types, the asphalt/bituminous segment has seen significant growth in the roofing chemicals market in recent years. Asphalt or bitumen is a widely used material in the roofing industry due to its excellent waterproofing properties, durability, and resistance to harsh weather conditions. The asphalt/bituminous segment includes a wide range of products such as asphalt shingles, roofing felt, and roofing coatings that are used in both residential and commercial roofing applications. The growth of the asphalt/bituminous segment is driven by several factors. One of the key factors is the increasing demand for asphalt roofing shingles, especially in the residential roofing market. Asphalt shingles are the most popular roofing material in the United States, accounting for over 80% of the residential roofing market. The growing demand for energy-efficient roofing solutions is also driving the demand for asphalt roofing coatings, which are used to reflect sunlight and reduce energy consumption. Another factor driving the growth of the asphalt/bituminous segment is the increasing adoption of sustainable roofing solutions.

Roofing Chemicals Market By Application

- Membrane roofing

- Elastomeric roofing

- Bituminous roofing

- Metal roofing

- Plastic (PVC) roofing

According to the roofing chemicals market forecast, the membrane roofing segment is expected to witness significant growth in the coming years. These roofing membranes offer several advantages over traditional roofing materials, including excellent waterproofing properties, high durability, and resistance to harsh weather conditions. The growth of the membrane roofing segment is driven by several factors. One of the key factors is the increasing demand for energy-efficient roofing solutions, which has led to the growing adoption of cool roofs and green roofs in commercial and industrial buildings. Membrane roofing systems are ideal for these applications due to their reflective and insulating properties, which can help reduce energy consumption and lower cooling costs. Another factor driving the growth of the membrane roofing segment is the increasing focus on sustainability in the construction industry.

Roofing Chemicals Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Roofing Chemicals Market Regional Analysis

The Asia-Pacific region is currently dominating the roofing chemicals market, accounting for a significant share of the global market. This dominance can be attributed to several factors. One of the key factors is the rapid growth of the construction industry in the region, particularly in countries such as China, India, and Southeast Asian nations. The increasing investments in infrastructure development projects, such as airports, highways, and commercial buildings, have led to a surge in demand for roofing chemicals in the region. Another factor driving the growth of the Asia-Pacific market is the increasing adoption of energy-efficient and sustainable roofing solutions. The region has been experiencing rapid urbanization and industrialization, leading to a growing need for environmentally friendly roofing solutions that can help reduce energy consumption and lower carbon emissions. The rising awareness about the benefits of using roofing chemicals and the government initiatives to promote sustainable construction practices are also expected to drive the demand for roofing chemicals in the region.

Roofing Chemicals Market Player

Some of the top roofing chemicals market companies offered in the professional report include BASF SE, Sika AG, Saint-Gobain S.A., Akzo Nobel N.V., RPM International Inc., GAF Materials Corporation, The Dow Chemical Company, Huntsman Corporation, Owens Corning, Carlisle Companies Incorporated, Firestone Building Products Company, LLC, and Johns Manville.

Frequently Asked Questions

How big is the roofing chemicals market?

The roofing chemicals market size was USD 118.0 Billion in 2022.

What is the CAGR of the global roofing chemicals market from 2023 to 2032?

The CAGR of roofing chemicals is 7.4% during the analysis period of 2023 to 2032.

Which are the key players in the roofing chemicals market?

The key players operating in the global market are including BASF SE, Sika AG, Saint-Gobain S.A., Akzo Nobel N.V., RPM International Inc., GAF Materials Corporation, The Dow Chemical Company, Huntsman Corporation, Owens Corning, Carlisle Companies Incorporated, Firestone Building Products Company, LLC, and Johns Manville.

Which region dominated the global roofing chemicals market share?

Asia-Pacific held the dominating position in roofing chemicals industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of roofing chemicals during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global roofing chemicals industry?

The current trends and dynamics in the roofing chemicals market growth include growth of the construction industry, increasing demand for energy-efficient roofing systems, and rising adoption of sustainable roofing solutions.

Which type held the maximum share in 2022?

The bituminous type held the maximum share of the roofing chemicals industry.