Robotic Refueling System Market | Acumen Research and Consulting

Robotic Refueling System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format : ![]()

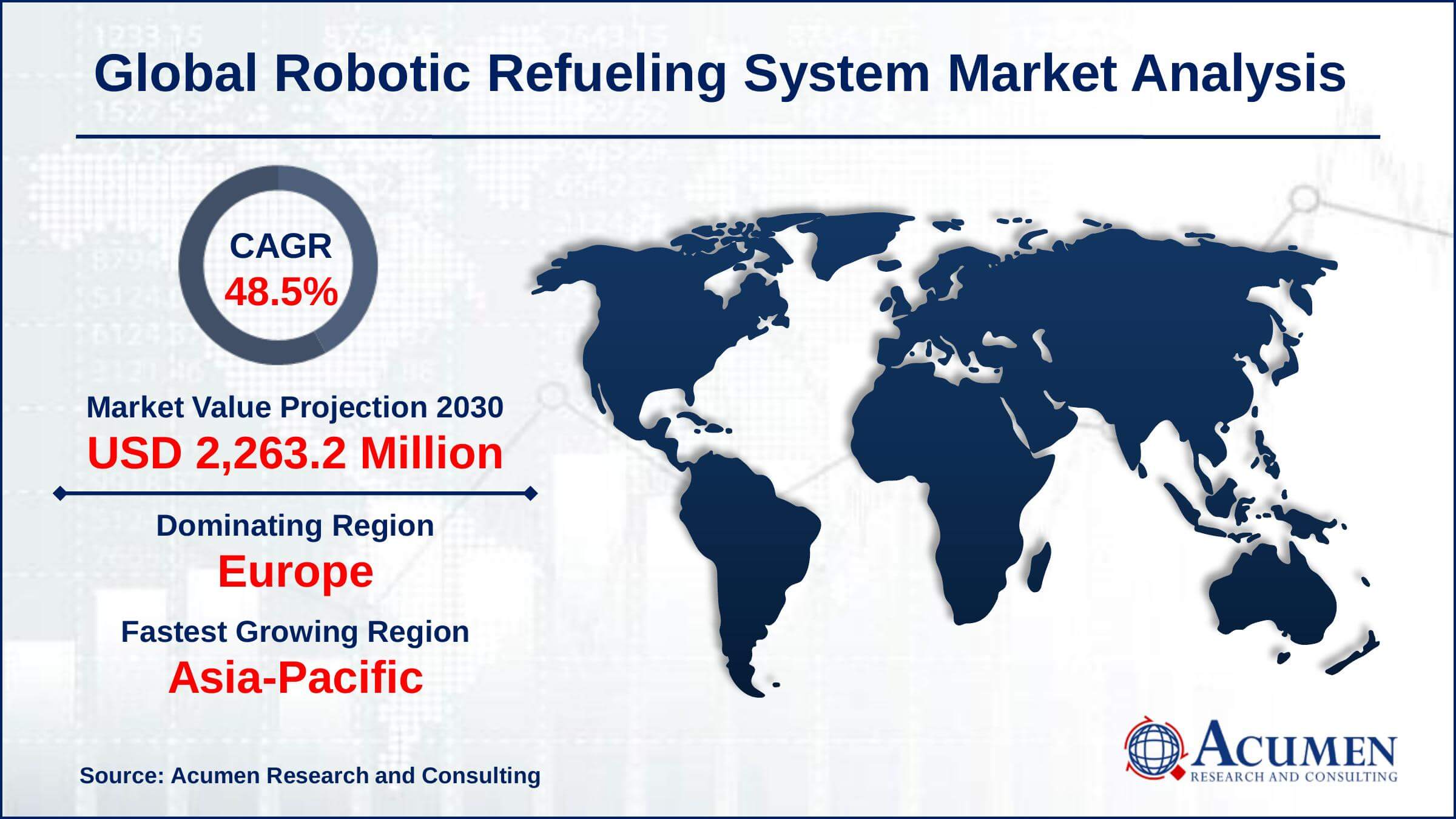

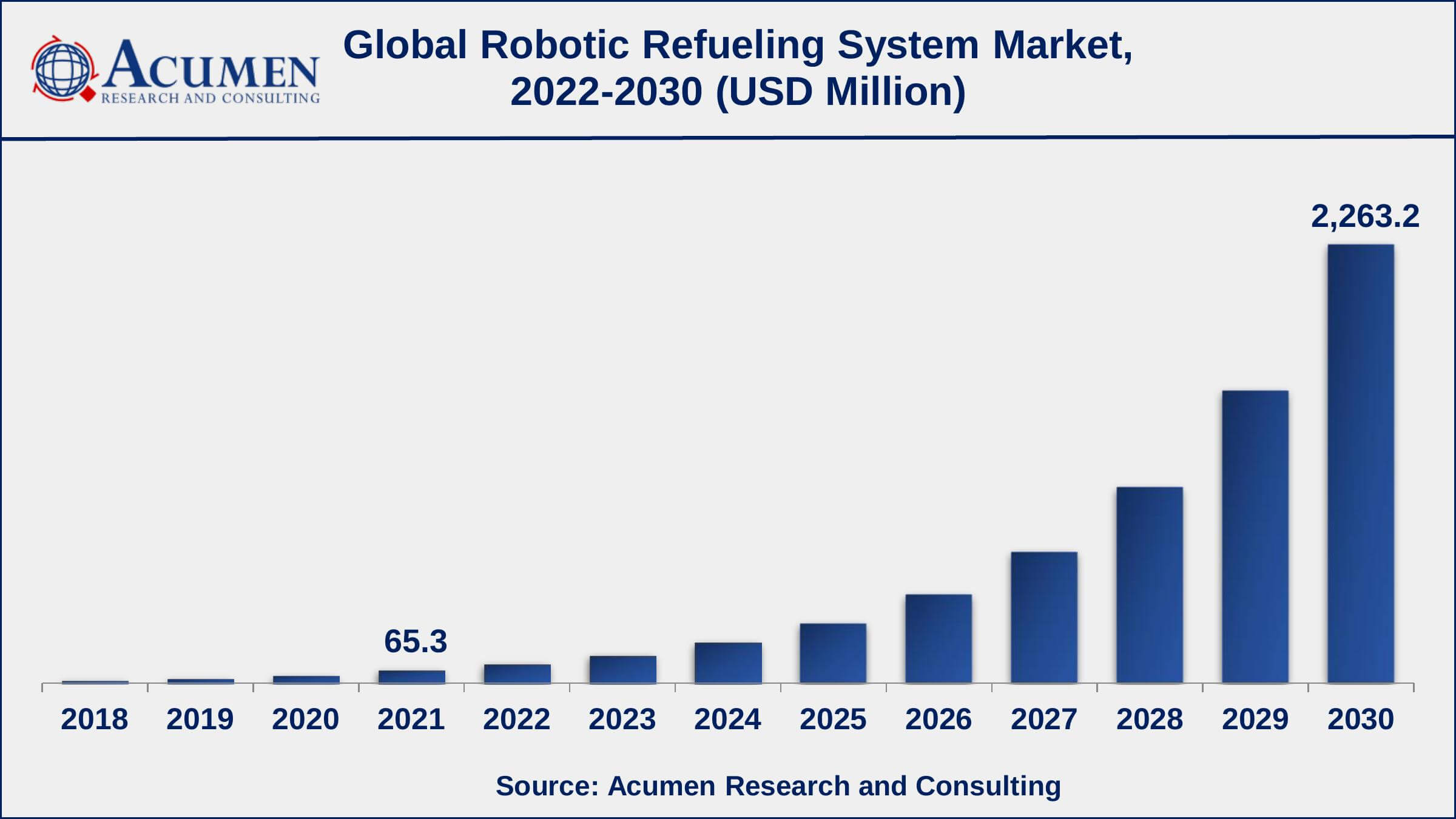

The Global Robotic Refueling System Market Size was valued at USD 65.3 Million in 2021 and is projected to occupy a market size of USD 2,263.2 Million by 2030 growing at a CAGR of 48.5% from 2022 to 2030.

A robotic refueling system is one that employs robots to perform refueling tasks on vehicles or aircraft. Attaching a fuel hose to the vehicle, opening and closing fuel caps, and monitoring the refueling process are examples of such tasks. Robotic refueling systems are intended to increase the efficiency and safety of refueling operations by reducing the need for human workers to carry out these tasks in potentially dangerous environments. They may also be used in situations where human access to the refueling area is difficult or impossible, such as in outer space or at high altitudes.

Robotic Refueling System Market Report Statistics

- Global robotic refueling system market revenue is projected to reach USD 2,263.2 million by 2030 with a CAGR of 48.5% from 2022 to 2030

- Europe robotic refueling system market share gathered more than USD 22.9 million in 2021

- Asia-Pacific robotic refueling system market growth will record a CAGR of more than 49% from 2022 to 2030

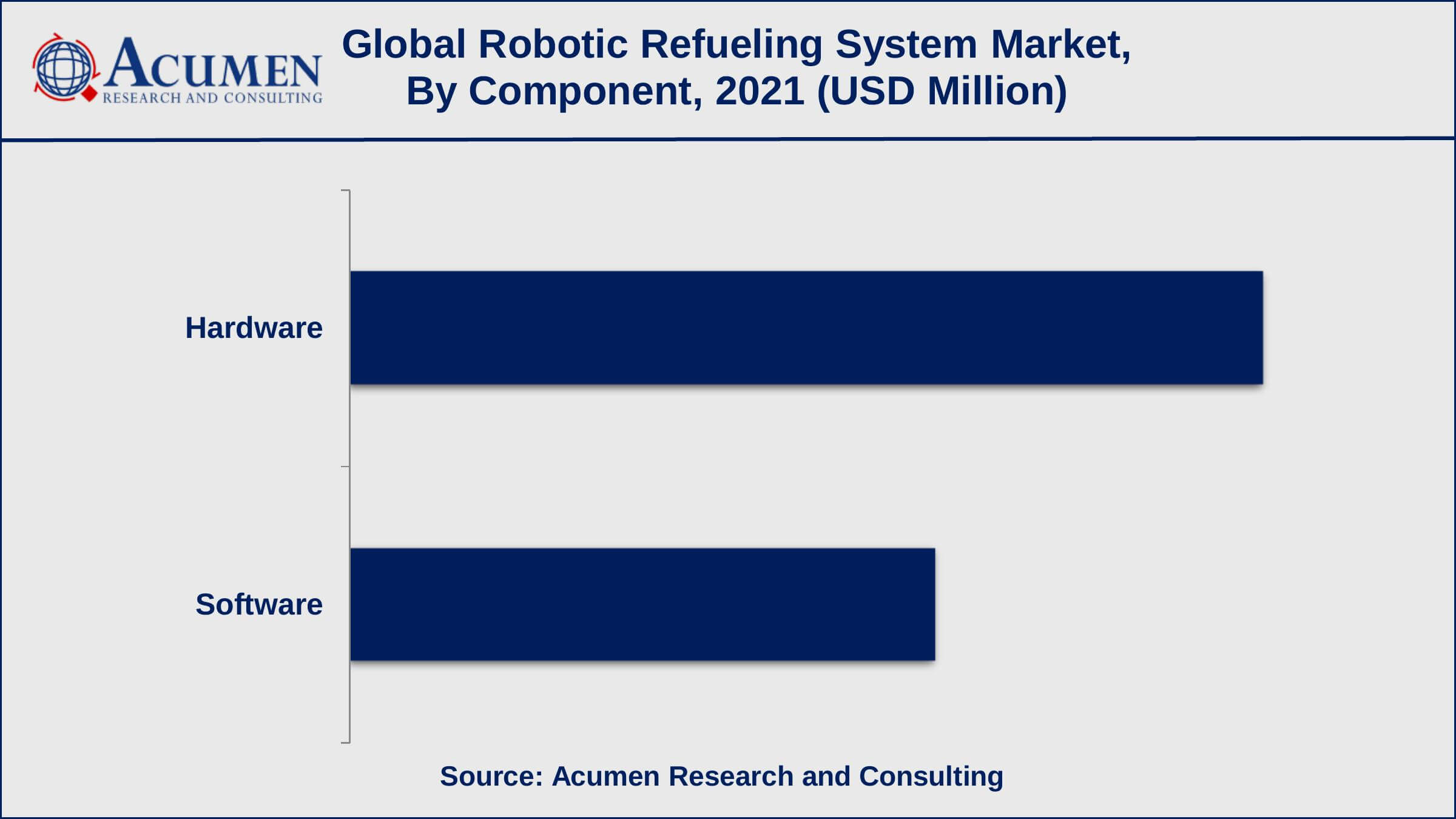

- Based on the component, the hardware sub-segment achieved 61% shares in 2021

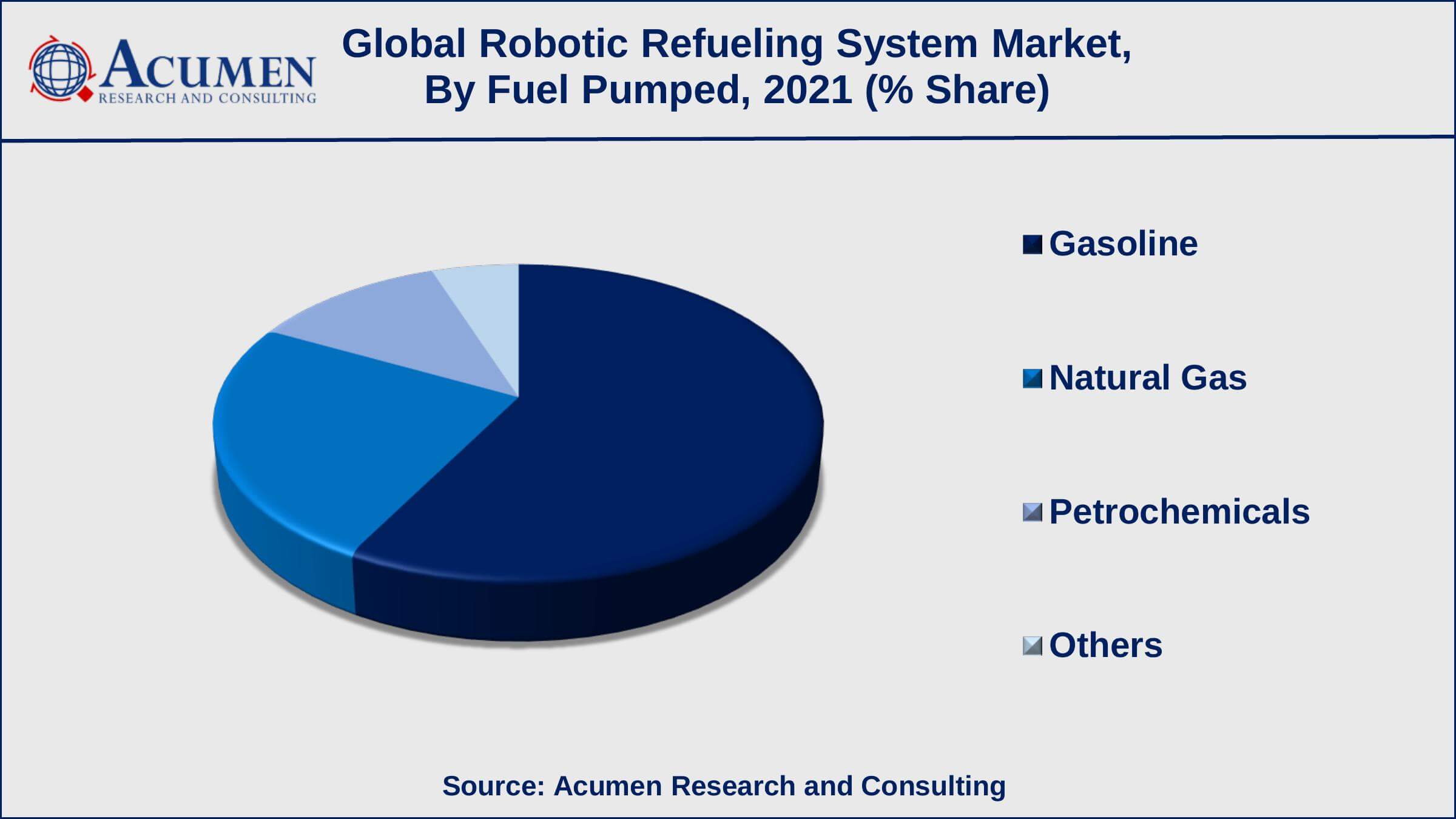

- Among fuel pumped, the gasoline sub-segment occupied USD 37.9 million in revenue in 2021

- The adoption of autonomous haulage trucks is a popular robotic refueling system market trend that drives the industry demand

Global Robotic Refueling System Market Dynamics

Market Drivers

- Growing demand for automation

- Increased safety concerns

- Minimum-cost operations in the mining sector

Market Restraints

- Increased regulatory policies

- High upfront cost and complexity

Market Opportunities

- Rising production of oil & gas

- Growing number of product launches

Robotic Refueling System Market Report Coverage

| Market | Robotic Refueling System Market |

| Robotic Refueling System Market Size 2021 | USD 65.3 Million |

| Robotic Refueling System Market Forecast 2030 | USD 2,263.2 Million |

| Robotic Refueling System Market CAGR During 2022 - 2030 | 48.5% |

| Robotic Refueling System Market Analysis Period | 2018 - 2030 |

| Robotic Refueling System Market Base Year | 2021 |

| Robotic Refueling System Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Component, By Fuel Pumped, By Payload Carrying Capacity, By End-User Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABB Group Ltd., Aerobotix, Boeing, FANUC Corporation, Fuelmatics AB, KUKA AG, Mine Energy Solution (MES), Neste, Rotec Engineering, Scott Technology Ltd, Simon Group Holding, and TATSUNO Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Robotic Refueling System Market Growth Factors

A primary factor driving the global robotic refueling system market is the increasing demand for automation technologies in various industries. Robots can work constantly without breaks and do not require benefits or vacation time, which can help reduce labor costs. Robots performing refueling tasks can improve safety by eliminating the need for human workers to carry out these duties in potentially hazardous surroundings. Robotic refueling systems can operate more quickly and precisely than humans, resulting in increased refueling efficiency. Demand for robotic refueling systems is also being driven by increasingly stringent safety and environmental regulations.

The high upfront costs associated with buying and installing robotic refueling systems are one of the main barriers to their adoption. Some organizations may be put off by the complexity of operating and maintaining robotic refueling systems. The lack of technicians with the essential training to maintain and repair robotic refueling systems can be a barrier to adoption. Robotic refueling systems may be unable to adapt to changes in fuel delivery systems or fuel types, limiting their use.

To improve safety and efficiency in fuel handling operations, the aviation industry is increasingly implementing robotic refueling systems. This factor is expected to generate numerous growth opportunities between the years 2022 and 2030. The development of hybrid robotic refueling systems, which combine the use of robots and human workers to perform tasks, is on the rise.

Robotic Refueling System Market Segmentation

The worldwide robotic refueling system market is categorized based on component, fuel pumped, payload carrying capacity, end-user industry, and geography.

Robotic Refueling System Market By Component

- Software

- Hardware

According to the robotic refueling system industry analysis, the hardware sub-segment achieved a substantial market share in 2021. The growing demand for automation in the fuel handling industry, in addition to the need to improve safety and efficiency in refueling operations, is likely to drive the market for hardware-based robotic refueling systems. The high upfront costs of these systems, as well as the need for specialized technicians to maintain and repair them, may limit their adoption. Trends such as the increasing use of drones for refueling operations and the development of hybrid systems that incorporate the use of robots and human workers are also likely to have an impact on the market.

Robotic Refueling System Market By Fuel Pumped

- Gasoline

- Natural Gas

- Petrochemicals

- Others

Based on the fuel pumped sub-segment, the market gasoline gathered the maximum share in 2021 and is expected to do so in the coming years. Gasoline-based robotic refueling systems are systems that are specifically designed to handle gasoline as a fuel. These systems may be used to refuel gasoline-powered vehicles such as cars, trucks, and buses, as well as small aircraft that use gasoline as fuel. By using robots to perform refueling tasks, gasoline-based robotic refueling systems can reduce the risk of accidents and injuries to human workers.

Robotic Refueling System Market By Payload Carrying Capacity

- Up To 50 Kg

- 50 - 100 Kg

- 100 - 150 Kg

A sizeable portion of the market was driven by demand for payload carrying capacities of 100–150 kg. Depending on the type of fuel pumped and how these systems are used in each location, verticals like automotive and aerospace, military and defense, mining, and warehouse and logistics require robotic refueling systems with a wide range of payload capacities. The main drivers of the 100 to 150 kg payload carrying capacity category are the expanding use of affordable onsite refueling stations for mining haulage trucks globally and the rising desire for automation.

Robotic Refueling System Market By End-User Industry

- Automotive

- Aerospace

- Construction

- Marine and Shipping

- Mining

- Military and Defense

- Oil and Gas

- Warehouse and Logistics

- Others

As per our robotic refueling system market forecast, the aerospace sub-segment will account for the majority of the share from 2022 to 2030. The aerospace and defense sector is a major user of fuel, and the adoption of robotic refueling systems in this sector can help improve the efficiency and safety of fuel handling operations. Robotic refueling systems for the aerospace and defense sector may be designed to withstand harsh environments and be resistant to damage.

Robotic Refueling System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Robotic Refueling System Market Regional Analysis

According to our regional robotic refueling system market analysis, the market for robotic refueling systems in Europe is likely to be supported by the region's increasing demand for automation, as well as the adoption of stringent safety and environmental regulations. The Asia-Pacific market for robotic refueling systems is likely to be driven by rising automation demand in emerging economies such as China and India, as well as the region's need to improve fuel handling infrastructure.

Robotic Refueling System Market Players

Some of the leading robotic refueling system companies include ABB Group Ltd., Aerobotix, Boeing, FANUC Corporation, Fuelmatics AB, KUKA AG, Mine Energy Solution (MES), Neste, Rotec Engineering, Scott Technology Ltd, Simon Group Holding, and TATSUNO Corporation.

Frequently Asked Questions

What was the market size of the global robotic refueling system in 2021?

The market size of robotic refueling system was USD 65.3 Million in 2021.

What is the CAGR of the global robotic refueling system market during forecast period of 2022 to 2030?

The CAGR of robotic refueling system market is 48.5% during the analysis period of 2022 to 2030.

Which are the key players operating in the market?

The key players operating in the global robotic refueling system market are ABB Group Ltd., Aerobotix, Boeing, FANUC Corporation, Fuelmatics AB, KUKA AG, Mine Energy Solution (MES), Neste, Rotec Engineering, Scott Technology Ltd, Simon Group Holding, and TATSUNO Corporation.

Which region held the dominating position in the global robotic refueling system market?

Europe held the dominating position in robotic refueling system market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for robotic refueling system market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global robotic refueling system market?

The current trends and dynamics in the robotic refueling system industry include the growing demand for automation, increased safety concerns, and minimum-cost operations in mining sector.

Which payload carrying capacity held the maximum share in 2021?

The 50 - 100 kg payload carrying capacity held the maximum share of the robotic refueling system market.