Risk Analytics Market Size (By Risk Type, By Deployment, By Component, By End-User Vertical, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Risk Analytics Market Size (By Risk Type, By Deployment, By Component, By End-User Vertical, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

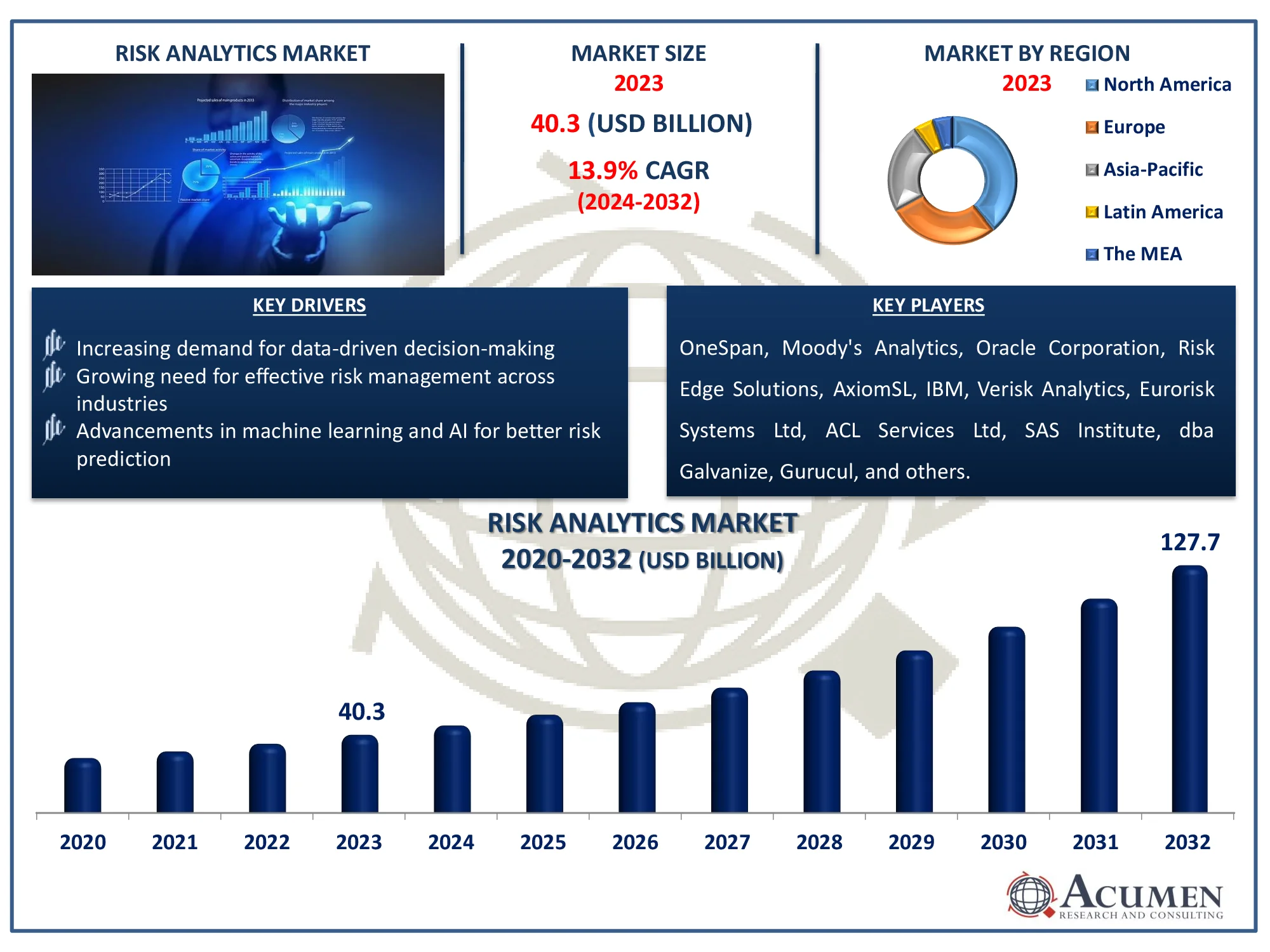

Request Sample Report

The Global Risk Analytics Market Size accounted for USD 40.3 Billion in 2023 and is estimated to achieve a market size of USD 127.7 Billion by 2032 growing at a CAGR of 13.9% from 2024 to 2032.

Risk Analytics Market Highlights

- The global risk analytics market is expected to reach USD 127.7 billion by 2032, growing at a CAGR of 13.9% from 2024 to 2032

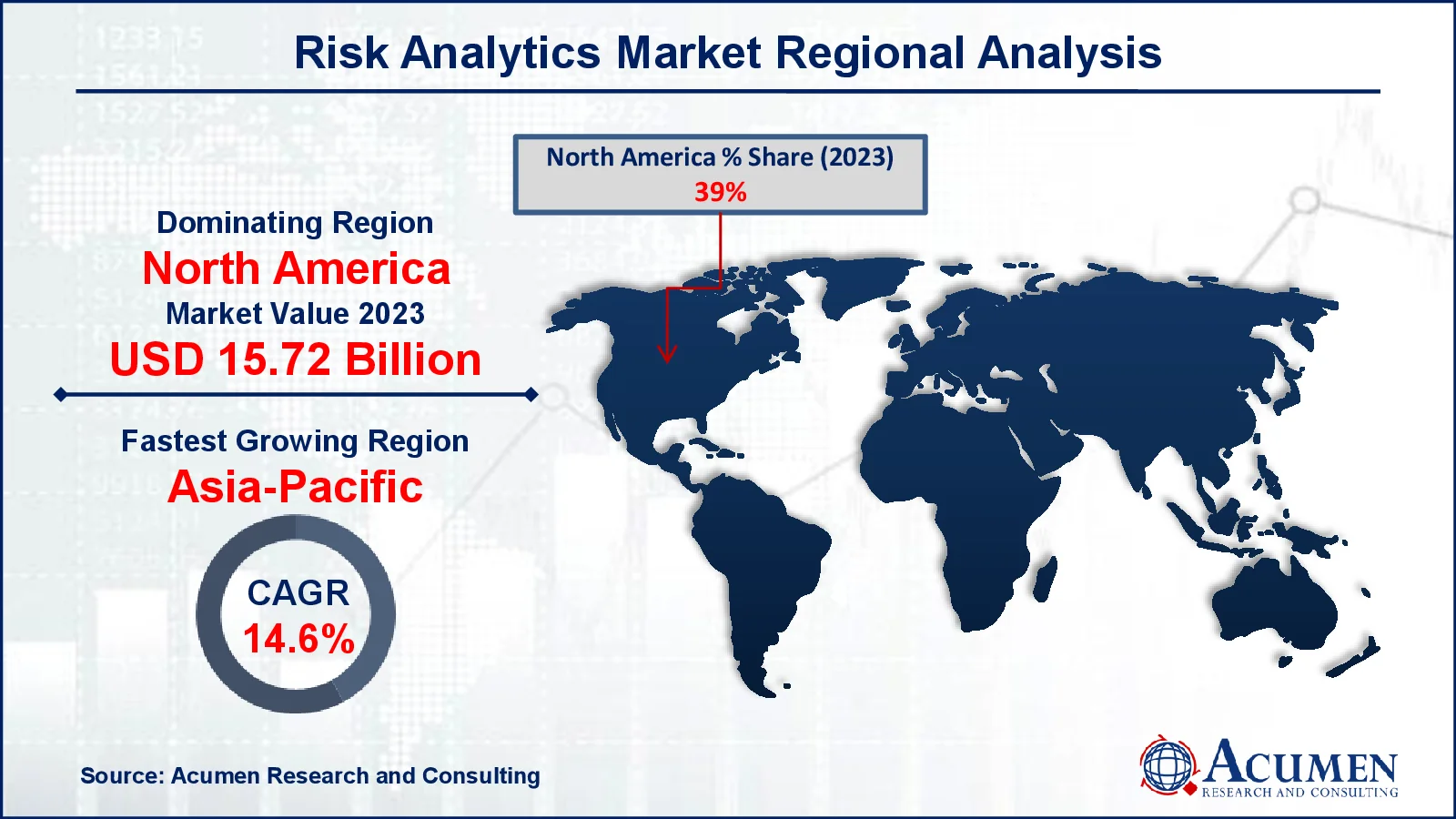

- The North America risk analytics market was valued at approximately USD 15.72 billion in 2023

- The Asia-Pacific risk analytics market is projected to grow at a CAGR of over 14.6% from 2024 to 2032

- The software sub-segment accounted for 66% of the market share in 2023

- The BFSI sub-segment generated 23% of the market share based on the end-user vertical in 2023

- Enhanced focus on cybersecurity and data privacy in response to increasing cyber threats is the risk analytics market trend that fuels the industry demand

Risk analytics is a technique that helps organizations understands the risks associated with their operations. It involves a set of tools that assist businesses in identifying, assessing, and making informed decisions regarding risks, ultimately improving their overall performance. Additionally, these tools contribute to enhancing the return on invested capital and reducing regulatory compliance costs. As businesses strive to minimize catastrophic losses, there has been a growing trend of adopting risk analytics tools worldwide. Furthermore, risk analytics tools facilitate the central clearing of over-the-counter derivatives. These tools help organizations identify risks within their business processes, enabling them to recognize, define, and manage risks accurately.

Global Risk Analytics Market Dynamics

Market Drivers

- Increasing demand for data-driven decision-making

- Growing need for effective risk management across industries

- Advancements in machine learning and AI for better risk prediction

Market Restraints

- High implementation and maintenance costs

- Lack of skilled professionals in risk analytics

- Data privacy and security concerns

Market Opportunities

- Rising adoption of cloud-based risk analytics solutions

- Expansion of risk analytics in emerging markets

- Integration of risk analytics with real-time data sources

Risk Analytics Market Report Coverage

|

Market |

Risk Analytics Market |

|

Risk Analytics Market Size 2023 |

USD 40.3 Billion |

|

Risk Analytics Market Forecast 2032 |

USD 127.7 Billion |

|

Risk Analytics Market CAGR During 2024 - 2032 |

13.9% |

|

Risk Analytics Market Analysis Period |

2020 - 2032 |

|

Risk Analytics Market Base Year |

2023 |

|

Risk Analytics Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Risk Type, By Deployment, By Component, By End-User Vertical, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

OneSpan, Moody's Analytics, Oracle Corporation, Risk Edge Solutions, AxiomSL, IBM, Verisk Analytics, Eurorisk Systems Ltd, ACL Services Ltd, SAS Institute, dba Galvanize, Gurucul, Fidelity National Information Services, and Accenture. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Risk Analytics Market Insights

The growing need for effective risk management and identification is expected to drive up demand for risk analytics across a variety of industries. For instance, the World Economic Forum reports that, as we approach 2024, the results of the Forum's Global Risks Perception Survey 2023-2024 (GRPS) show a predominantly negative outlook for the world in the short term, which is expected to worsen in the long term. According to a September 2023 survey, the majority of respondents (54%) foresee some instability and a modest chance of worldwide catastrophes, while another 27% expect increasing turbulence and 3% expect global catastrophic risks to materialize in the near future. Only 16% predict a stable or quiet picture over the next two years.

Advances in risk analytics approaches are also helping to transform and enhance the worldwide market's capabilities. For example, in May 2023, Gurucul launched its Security Analytics and Operations platform on Snowflake Data Cloud, which includes Next-Gen SIEM, Open XDR, UEBA, and Identity Analytics solutions. The platform centralizes company and security data, allowing for real-time threat detection and automatic reaction to data breaches. Gurucul also offers extensive technology connections with key companies to give comprehensive security solutions. Real-time risk analytics solutions, which can evaluate, process, and calculate data quickly, are becoming increasingly popular. Financial organizations, in particular, are increasingly using risk analytics to efficiently manage and reduce risks.

The growing demand to solve unique difficulties within company sectors, as well as the increased emphasis on competitive intelligence and market trends, are important growth factors for the worldwide risk analytics market. Risk analytics is becoming increasingly popular in the corporate and financial services sectors. For example, PWC claims that risk analytics enables organizations to foresee possible threats and weaknesses before they arise. Businesses can use risk analytics to proactively identify hazards, develop plans to reduce or manage those risks, and implement control measures to mitigate their impact. This improves the organization's ability to prevent or decrease disruptions, resulting in smoother operations and overall performance.

Many financial institutions are expected to adopt risk analytics solutions in response to rising regulatory requirements around the world. Furthermore, the rapid development of on-demand and real-time risk analytics solutions is driving up global demand. Technological improvements are also playing an important role in supplying firms with efficient trading data and real-time market insights, allowing them to give on-demand risk analytics services.

Risk Analytics Market Segmentation

The worldwide market for risk analytics is split based on risk type, deployment, component, end-user vertical, and geography.

Risk Analytics Market By Risk Type

- Compliance Risk

- Operational Risk

- Strategic Risk

- Financial Risk

- Others

According to the risk analytics industry analysis, operational risk is a big concern since it involves the possibility of losses caused by ineffective internal processes, systems, people, or external events. Organizations are increasingly relying on risk analytics to identify, assess, and manage these risks, which have the potential to interrupt normal operations. With the rise of digital transformation and complex company environments, the potential of operational disruptions has increased, making risk analytics critical to avoiding substantial losses. Businesses can use these technologies to strengthen their resilience and ensure smoother, more efficient operations.

Risk Analytics Market By Deployment

- On-Premises

- Cloud-Based

According to the risk analytics industry analysis, on-premises category is likely to develop significantly as enterprises seek to keep control over sensitive data and meet compliance standards. With growing worries about data security and privacy, businesses are turning to on-premises solutions to provide better protection and flexibility. These technologies enable businesses to manage and assess risks while adhering to stringent internal policies and industry requirements.

Risk Analytics Market By Component

- Software

- Extract, Transform and Load Tools

- Risk Calculation Engines

- Scorecard and Visualization Tools

- Dashboard Analytics and Risk Reporting Tools

- GRC Software

- Others

- Services

- System Integration Service

- Support and Maintenance Service

- Risk Assessment and Analysis Service

According to the risk analytics market forecast, software market will lead in the next years due to its capacity to provide specialized tools for discovering, assessing, and reducing risks. Software solutions offer real-time data, predictive modeling, and customized capabilities to assist enterprises in effectively managing a variety of risks. As more firms adopt data-driven decision-making, the demand for advanced risk analytics software will continue to climb. Furthermore, software solutions' scalability and adaptability make them appropriate for a wide range of industries, adding to their dominance.

Risk Analytics End-User Vertical

- BFSI

- Retail

- Healthcare

- Manufacturing

- IT and Telecom

- Government and Defense

- Energy and Utilities

- Others

According to the risk analytics market forecast, banking, financial services, and insurance (BFSI) sector is notable for its substantial dependence on data-driven decision-making to mitigate financial risks. Regulatory compliance, fraud detection, and investment risk management are significant concerns in this industry, which drives the use of risk analytics solutions. BFSI firms can use risk analytics to identify possible hazards, minimize risks, and improve their financial performance. The rising complexity of financial goods, combined with market volatility, underscores the importance of improved risk management techniques in this area.

Risk Analytics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Risk Analytics Market Regional Analysis

For several reasons, North America dominates the risk analytics industry due to its superior technology infrastructure, widespread use of data analytics, and the presence of significant financial institutions. For example, in March 2024, Accenture (NYSE: CAN) successfully completed its acquisition of GemSeek, a well-known provider of customer experience analytics. GemSeek focuses on assisting multinational corporations in developing a thorough understanding of their customers through the use of inMoody's analytics and AI-driven prediction models. The purchase demonstrates Accenture Song's ongoing commitment in data and AI capabilities to help clients grow their businesses and stay relevant to their customers. The region's robust regulatory environment and increasing demand for cybersecurity solutions add to its market leadership.

Asia-Pacific, on the other hand, is experiencing significant growth, owing to rapid digital transformation, a growing emphasis on risk management, and the rise of emerging market industries such as banking, finance, and insurance. According to the India Brand Equity Foundation (IBEF), India benefits from a high level of cross-channel utilization to broaden the reach of financial services.

In the Union Budget 2022-23, India unveiled plans for a Central Bank Digital Currency (CBDC), known as the Digital Rupee.

Risk Analytics Market Players

Some of the top risk analytics companies offered in our report include OneSpan, Moody's Analytics, Oracle Corporation, Risk Edge Solutions, AxiomSL, IBM, Verisk Analytics, Eurorisk Systems Ltd, ACL Services Ltd, SAS Institute, dba Galvanize, Gurucul, Fidelity National Information Services, and Accenture.

Frequently Asked Questions

How big is the Risk Analytics market?

The risk analytics market size was valued at USD 40.3 Billion in 2023.

What is the CAGR of the global Risk Analytics market from 2024 to 2032?

The CAGR of risk analytics is 13.9% during the analysis period of 2024 to 2032.

Which are the key players in the Risk Analytics market?

The key players operating in the global market are including OneSpan, Moody's Analytics, Oracle Corporation, Risk Edge Solutions, AxiomSL, IBM, Verisk Analytics, Eurorisk Systems Ltd, ACL Services Ltd, SAS Institute, dba Galvanize, Gurucul, Fidelity National Information Services, and Accenture.

Which region dominated the global Risk Analytics market share?

North America held the dominating position in risk analytics industry during the analysis period of 2024 to 2032.

Which region registered fastest growing CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of risk analytics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Risk Analytics industry?

The current trends and dynamics in the risk analytics industry include increasing demand for data-driven decision-making, growing need for effective risk management across industries, and advancements in machine learning and AI for better risk prediction.

Which component held the maximum share in 2023?

The software held the maximum share of the risk analytics industry.