Rigid Foam Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Rigid Foam Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

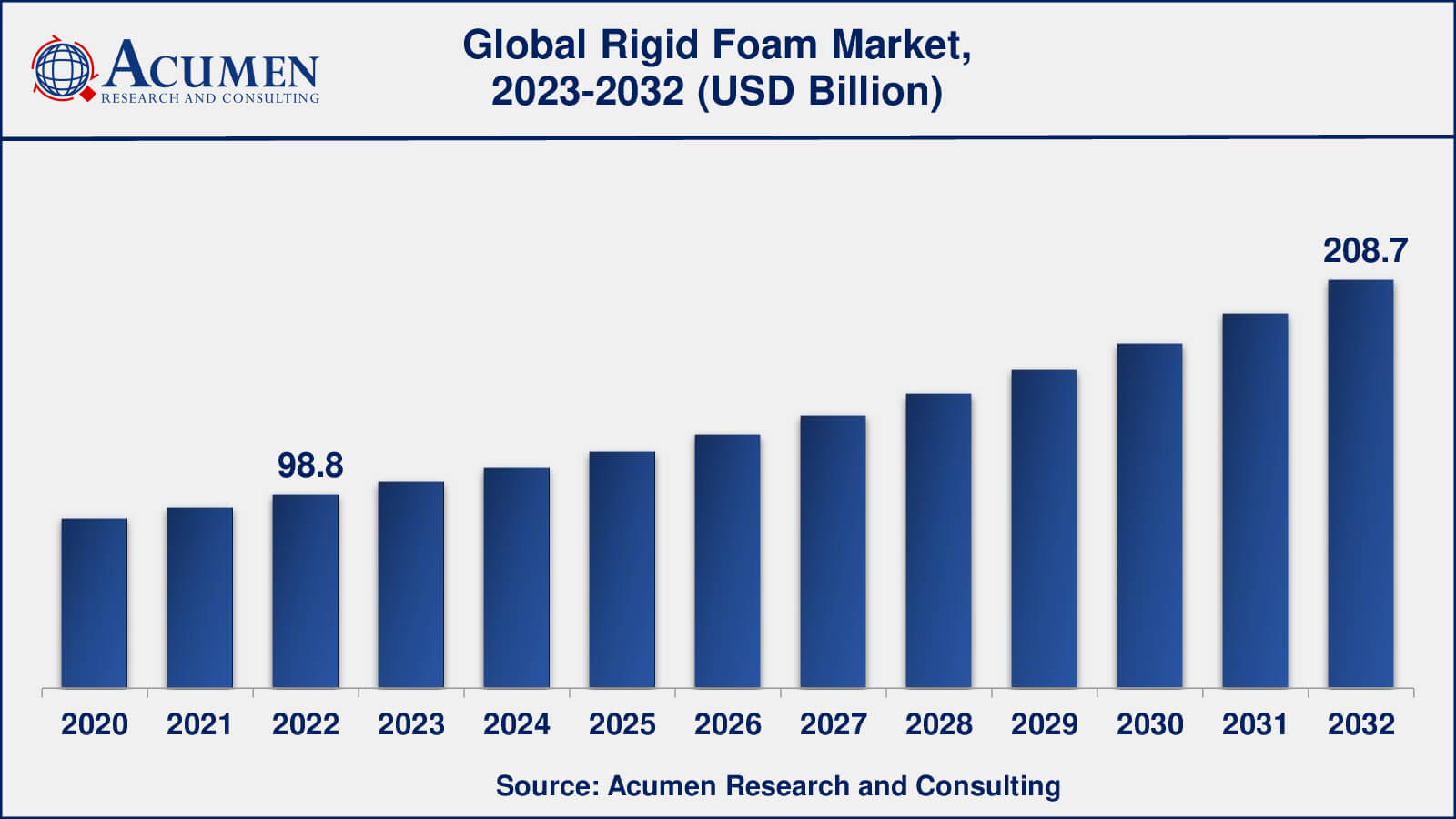

The Global Rigid Foam Market Size accounted for USD 98.8 Billion in 2022 and is estimated to achieve a market size of USD 208.7 Billion by 2032 growing at a CAGR of 7.9% from 2023 to 2032.

Rigid Foam Market Highlights

- Global rigid foam market revenue is poised to garner USD 208.7 billion by 2032 with a CAGR of 7.9% from 2023 to 2032

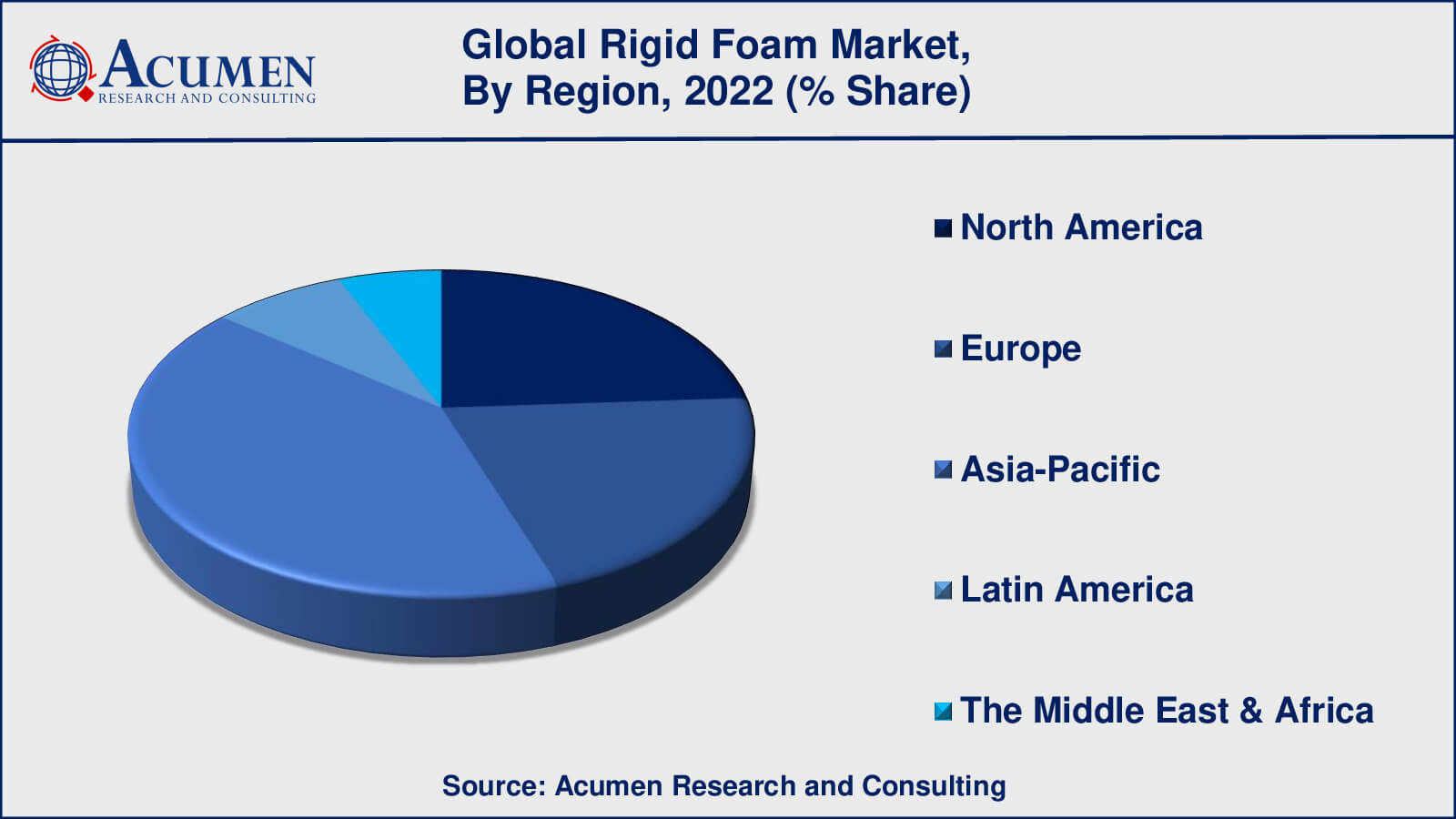

- Asia-Pacific rigid foam market value occupied almost USD 40 billion in 2022

- Asia-Pacific rigid foam market growth will record a CAGR of over 8% from 2023 to 2032

- Among foam type, the polyurethane foam sub-segment generated over US$ 30 billion revenue in 2022

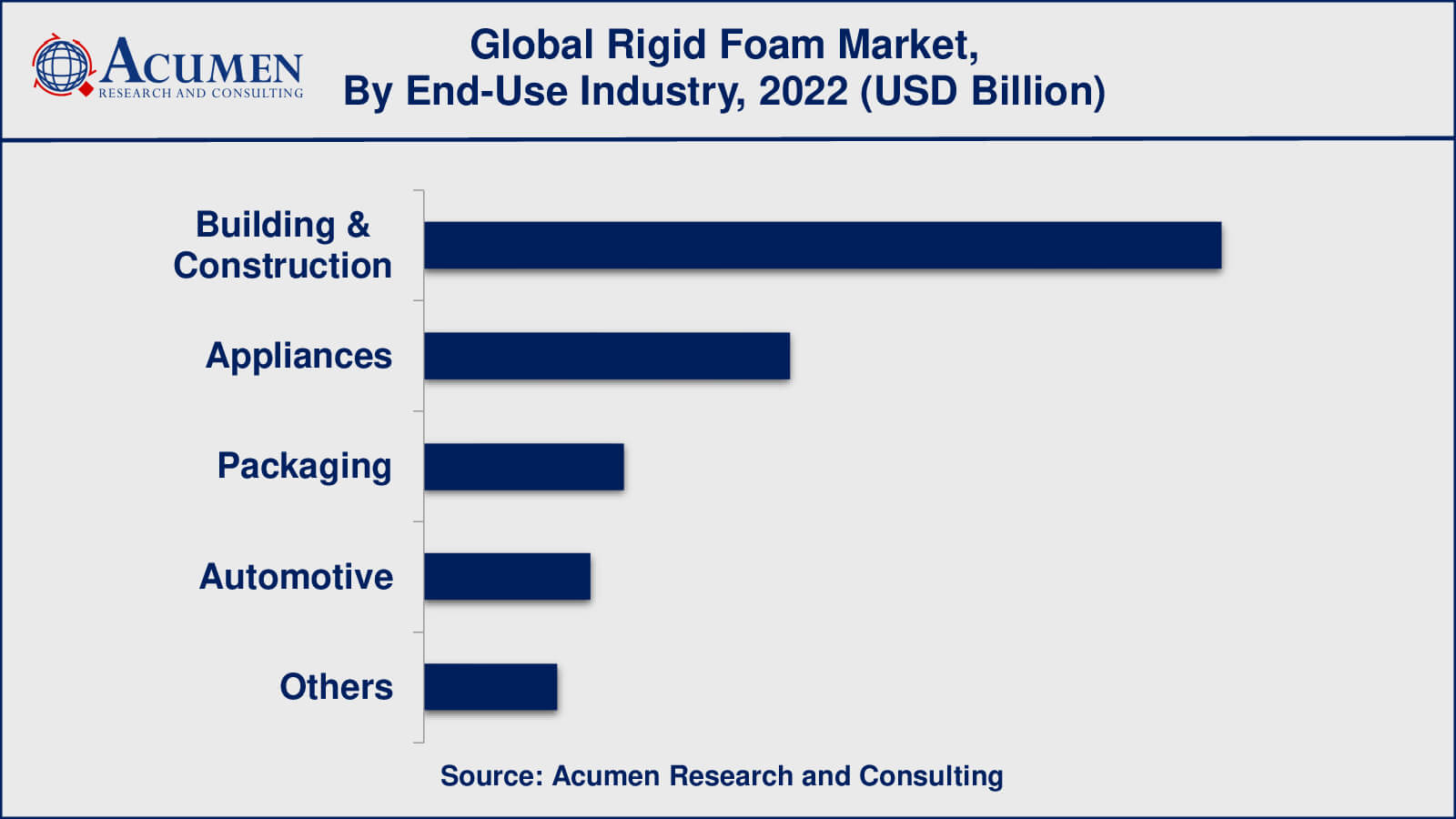

- Based on end-use industry, the building & construction sub-segment generated around 48% share in 2022

- Increasing investments in research and development to improve the performance and sustainability is a popular rigid foam market trend that fuels the industry demand

Rigid foams are crosslinked structures and are majorly used for reducing the transfer of heat. Consequently, the major application of rigid foam includes low and high-temperature insulation. Foams possess excellent insulating properties primarily due to the lower heat resistance of the blowing agent present among the cells. During foam Foam Typeion, the reaction mix arrives at a tacky phase ahead of curing which eases it to form a strong and permanent bond with any facings. Rigid foam is considered a high-performance material for insulating panels and construction.

Global Rigid Foam Market Dynamics

Market Drivers

- Increasing demand for insulation materials in the construction industry

- Growing awareness about energy efficiency and the need for sustainable building practices

- Rising demand for lightweight materials in the automotive and aerospace industries

- Expansion of production capacities by key players in the market

Market Restraints

- Volatility in raw material prices, particularly for polyurethane foam

- Availability of substitutes such as fiberglass and cellulose insulation

- Regulatory constraints on the use of certain types of foam in some regions

Market Opportunities

- Growing demand for rigid foam in emerging economies such as China and India

- Increasing adoption of bio-based and recycled foam materials

- Rising demand for insulation materials in the growing construction industry

Rigid Foam Market Report Coverage

| Market | Rigid Foam Market |

| Rigid Foam Market Size 2022 | USD 98.8 Billion |

| Rigid Foam Market Forecast 2032 | USD 208.7 Billion |

| Rigid Foam Market CAGR During 2023 - 2032 | 7.9% |

| Rigid Foam Market Analysis Period | 2020 - 2032 |

| Rigid Foam Market Base Year | 2022 |

| Rigid Foam Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Foam Type, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Huntsman Corporation, BASF SE, Covestro AG, Sealed Air Corporation, JSP Corporation, Woodbridge Foam Corporation, The Dow Building & Construction Company, Borealis AG, Armacell International S.A, and Zotefoams Plc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Rigid Foam Market Insights

The market is witnessing growth significantly owing to the rapid utilization of rigid foam in the building and construction sector as it lowers the structural weight and provides a cost benefit to the overall construction. Apart from this, saving energy is the prime factor in today’s world as most of the energy is lost through walls, windows, and roofs. Growing demand for rigid foam from multiple end-use industries such as construction, automotive, and packaging is expected to be a key factor driving the market growth. Also, outstanding properties obtained by rigid foam such as higher chemical resistance, lightweight, light-density structure, and high insulation value have increased the use of rigid foam in different applications. The reuse of rigid foam by recyclability is further expected to lead to market growth over the forecast years.

Rigid Foam Market, By Segmentation

The worldwide market for rigid foam is split based on foam type, end-use industry, and geography.

Rigid Foam Types

- Polyurethane Foam

- Polystyrene Foam

- Polypropylene Foam

- Polyethylene Foam

- Polyvinyl Chloride Foam

- Others

According to our rigid foam industry analysis, polyurethane foam is the most commonly used type of rigid foam, accounting for the largest market share. Its superior insulation properties, high strength-to-weight ratio, and ease of installation make it preferred over other types of rigid foam. Polystyrene foam is the most commonly used rigid foam, followed by polyethylene foam and phenolic foam. Other rigid foams with a smaller market share include polyisocyanurate foam, polypropylene foam, and PVC foam.

Rigid Foam End-Use Industries

- Building & Construction

- Appliances

- Packaging

- Automotive

- Others

As per the rigid foam market forecast, the building and construction industry dominates the rigid foam market due to the high demand for insulation materials in residential, commercial, and industrial buildings. Rigid foam is widely used in construction and building applications to provide thermal insulation, soundproofing, and structural support. The growing awareness of energy efficiency and sustainable building practises is also driving the construction industry's demand for rigid foam.

The automotive industry is rigid foam's second-largest end-use industry, where it is used for lightweighting, soundproofing, and vibration damping. Because of its excellent cushioning and protective properties, rigid foam is also widely used in the packaging industry. In the rigid foam market, the appliances industry and other end-use industries, such as marine and HVAC, have a smaller market share.

Rigid Foam Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Rigid Foam Market Regional Analysis

The Asia-Pacific region is the largest market for rigid foam, due to the rapidly growing construction and automotive industries in countries like China and India. The region's market is also being driven by rising awareness of energy efficiency and sustainable building practices. Japan, South Korea, and Australia are also important rigid foam markets in the region.

North America is a significant rigid foam market, owing to the high demand for insulation materials in the construction, automotive, and packaging industries. The growing awareness of energy efficiency and the need for sustainable building practices is also driving the market in North America. The region's major markets are the United States and Canada.

Europe is another important market for rigid foam, owing to the high demand for insulation materials in the construction, automotive, and packaging industries. The European market is also influenced by stringent regulations governing energy efficiency and sustainable building practices. The region's major markets are Germany, France, and the United Kingdom.

Rigid Foam Market Players

Some of the top rigid foam companies offered in the professional report include Huntsman Corporation, BASF SE, Covestro AG, Sealed Air Corporation, JSP Corporation, Woodbridge Foam Corporation, The Dow Chemical Company, Borealis AG, Armacell International S.A, and Zotefoams Plc.

Frequently Asked Questions

What was the market size of the global rigid foam in 2022?

The market size of rigid foam was USD 98.8 Billion in 2022.

What is the CAGR of the global rigid foam market from 2023 to 2032?

The CAGR of rigid foam is 7.9% during the analysis period of 2023 to 2032.

Which are the key players in the rigid foam market?

The key players operating in the global rigid foam market is includes Huntsman Corporation, BASF SE, Covestro AG, Sealed Air Corporation, JSP Corporation, Woodbridge Foam Corporation, The Dow Chemical Company, Borealis AG, Armacell International S.A, and Zotefoams Plc.

Which region dominated the global rigid foam market share?

Asia-Pacific held the dominating position in rigid foam industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of rigid foam during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global rigid foam industry?

The current trends and dynamics in the rigid foam industry include increasing demand for insulation materials in the construction industry, growing awareness about energy efficiency and the need for sustainable building practices, and rising demand for lightweight materials in the automotive and aerospace industries.

Which foam type held the maximum share in 2022?

The polyurethane foam Foam Type held the maximum share of the rigid foam industry.?