Ride Hailing Services Market | Acumen Research and Consulting

Ride Hailing Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 – 2030

Published :

Report ID:

Pages :

Format :

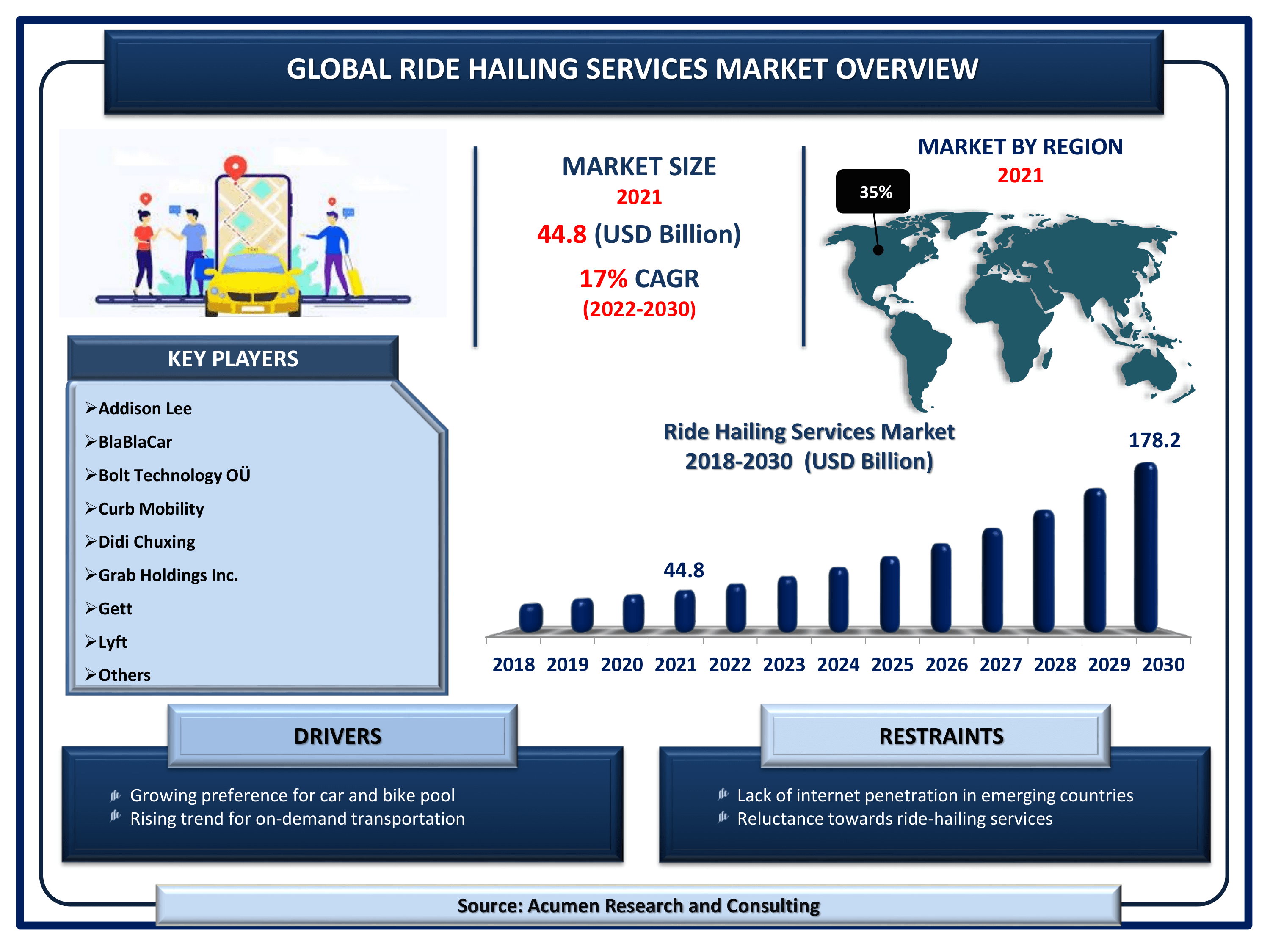

The Global Ride Hailing Services Market Size accounted for USD 44.8 Billion in 2021 and is estimated to garner a market size of USD 178.2 Billion by 2030 rising at a CAGR of 17% from 2022 to 2030. Increasing preference for car and bike pool services is a ride hailing services market trend that is fueling the industry growth. In addition, growing trend of on-demand transportation services is another factor that is boosting the global ride hailing services market growth.

Ride Hailing Services Market Report Key Highlights

- Global ride hailing services market revenue is estimated to reach USD 178.2 Billion by 2030 with a CAGR of 17% from 2022 to 2030

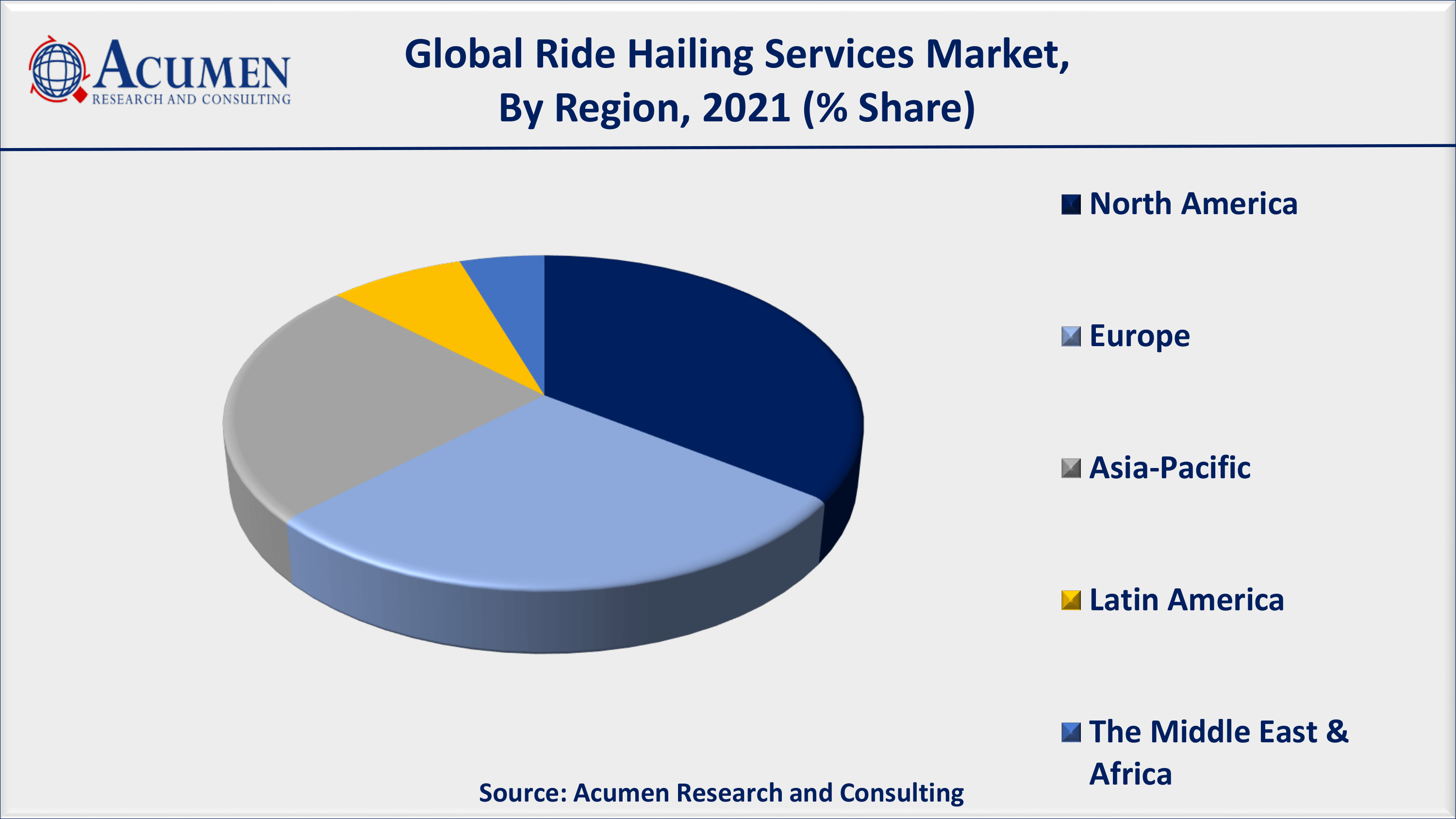

- North America ride hailing services market accounted for over 35% regional shares in 2021

- Asia-Pacific ride hailing services market will register fastest CAGR from 2022 to 2030

- According to recent statistics, Uber drivers completed 6.3 billion trips globally in 2021

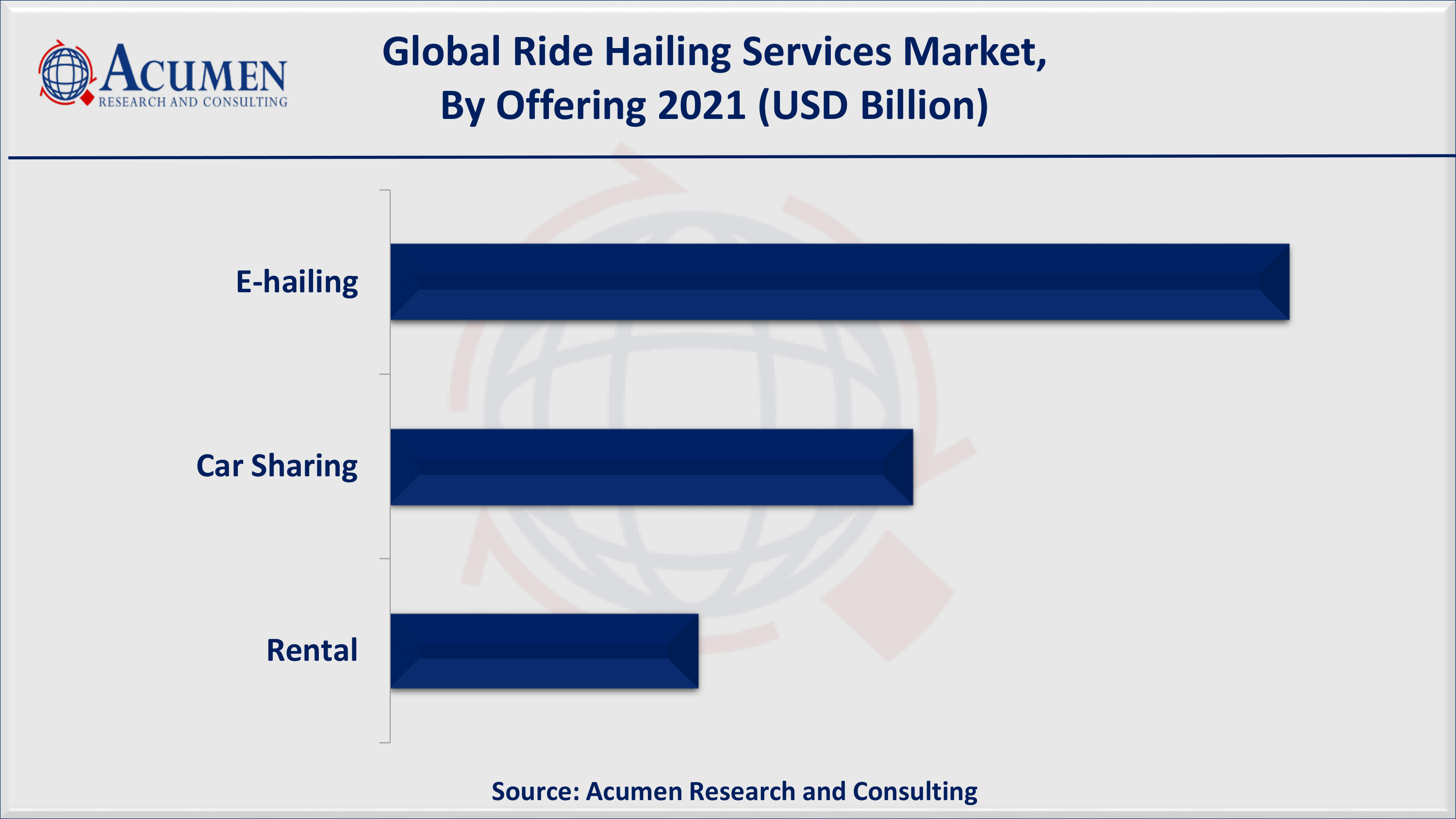

- Based on offering segment, e-hailing accounted 50% of the overall market share in 2021

- Growing preference of car pool services propels the ride hailing services market growth in coming years

Ride hailing is the process by which a person uses an app to hail or request a local driver to pick them up and take them directly to a specific location. These trips can be scheduled on-demand or in advance, and passengers can ride alone or in a group with other passengers. The primary distinction between ride hailing and taxi services is that ride hailing deals with experiencing services through an app and offers pooling options, whereas taxi services offer private transportation and are typically not pooled.

Global Ride Hailing Services Market Dynamics

Market Drivers

- Growing preference for car and bike pool

- Rising trend for on-demand transportation

- Increasing traffic congestion

- Lower rate of car ownership among millennials

Market Restraints

- Lack of internet penetration in emerging countries

- Reluctance towards ride-hailing services

Market Opportunities

- Growing need for safe journey

- Increased government initiatives in digitalization

Ride Hailing Services Market Report Coverage

| Market | Ride Hailing Services Market |

| Ride Hailing Services Market Size 2021 | USD 44.8 Billion |

| Ride Hailing Services Market Forecast 2030 | USD 178.2 Billion |

| Ride Hailing Services Market CAGR During 2022 - 2030 | 17% |

| Ride Hailing Services Market Analysis Period | 2018 - 2030 |

| Ride Hailing Services Market Base Year | 2021 |

| Ride Hailing Services Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Offering, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Addison Lee, BlaBlaCar, Didi Chuxing, Grab, Gett, Lyft, My Taxi, Ola, Uber, ViaVan, Zoox, and Yandex.taxi. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Ride-Hailing Services Market Insights

Ride Hailing Services Is Highly Concentrated Among Urban Residents Coupled With Demographics Groups Using Ride Hailing At Maximum Rates

According to a Pew Research Center report, ride hailing apps primarily offer their services in and around urban areas because demand for these services is low among rural residents. For example, one in every five urban Americans (21%) has used ride-hailing services, with 15% living in suburbs. In comparison, only 3% of rural residents have used these services, and more than half (54%) have never heard of ride-hailing apps. Such factors have a positive impact on the global ride-hailing services market growth.

Ride Hailing Services Is More Popular Among Young Generation Making It Popular Ultimately Fuelling the Overall Market Growth Globally

Ride hailing utility varies significantly with age due to the strong influx of technology in ride hailing services. Approximately one-quarter of 18-29-year-olds (28%) and one in every five 30-49-year-olds (19%) have used ride hailing services. This demonstrates that ride-hailing services are more popular among the young population, who use them frequently. Furthermore, ride hailing services are very popular among college graduates and the relatively affluent. According to estimates, 29% of college graduates have used ride-hailing services, while only 13% are unfamiliar with them. Aside from that, there is no discernible difference in ride hailing usage across gender or race. Whites, Blacks, and Hispanics are more likely to use these services than men and women.

As Per Ride Hailing Services Market Forecast Technological Advancements Will Fuel the Industry Growth

Technological advancements and commitments from ride hailing operators and the government indicate that ride hailing fleets are on the verge of transitioning to electric vehicles (EVs). Because of the high number of kilometers driven by these vehicles, this ultimately results in providing climate and public health benefits. The influx of electrifying ride-hailing fleets also hastens the broader transition to electric vehicles by raising public awareness of EVs and spurring the deployment of an efficient charging network. One of the key factors resulting in the overall growth of the global ride hailing services market is the acceleration of ride hailing fleets, which reduces environmental impacts.

Ride Hailing Services Market Segmentation

The worldwide ride hailing services market is split based on offering, and geography.

Ride Hailing Services Market By Offering

- E-hailing

- Car Sharing

- Rental

In terms of offering segment, the e-hailing segment accounted for a sizable share in 2020 and is expected to maintain this trend throughout the forecast period. According to UCSUSA statistics, e-hailing services can reduce emissions by nearly 68% when compared to a private vehicle trip in an average car, or by nearly 79% when compared to a non-pooled ride hailing trip. This is one of the key factors influencing segmental growth, which in turn contributes to overall ride-hailing market value.

Ride Hailing Services Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America records dominating share; Asia Pacific to register fastest growing CAGR for the ride hailing services market

15% of Americans have experienced using ride hailing services resulting in recording reasonable share for the market

According to a Pew Research Center report, despite technological advancements, only 15% of American adults have ever used a ride-hailing service such as Uber or Lyft. Half of all Americans (51%) are aware of these services but have not used them, while one-third (33%) have never heard of them. Furthermore, 6% of Americans use rides hailing services on a regular (daily or weekly) basis, indicating that these services are not available in their area.

Asia Pacific to register all time high CAGR for ride hailing services market

Asia Pacific will experience a high CAGR in the coming years as ride hailing electrification progresses. According to the ICCT report, China is aiming for ride hailing fleets to be 100% electric by the end of 2020. China will also allow electric vehicles to be newly registered on ride-hailing platforms beginning in 2021, with a total conversion to electric vehicles by 2028. Such factors have a positive impact on regional growth, which in turn contributes to the overall market growth for ride hailing services.

Ride Hailing Services Market Players

The global ride hailing services companies profiled in the report include Addison Lee, BlaBlaCar, Bolt Technology OÜ, Curb Mobility, Didi Chuxing, Grab Holdings Inc., Gett, Lyft, My Taxi, Ola, Uber, ViaVan, Yandex.taxi, and Zoox.

Frequently Asked Questions

What is the size of global ride hailing services market in 2021?

The market size of ride hailing services market in 2021 was accounted to be USD 44.8 Billion.

What is the CAGR of global ride hailing services market during forecast period of 2022 to 2030?

The projected CAGR of ride hailing services market during the analysis period of 2022 to 2030 is 17%.

Which are the key players operating in the market?

The prominent players of the global ride hailing services market Addison Lee, BlaBlaCar, Bolt Technology OÜ, Curb Mobility, Didi Chuxing, Grab Holdings Inc., Gett, Lyft, My Taxi, Ola, Uber, ViaVan, Yandex.taxi, and Zoox.

Which region held the dominating position in the global ride hailing services market?

North America held the dominating ride hailing services during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for ride hailing services during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global ride hailing services market?

Growing preference for car and bike pool, rising trend for on-demand transportation, and increasing traffic congestion drives the growth of global ride hailing services market.

Which offering held the maximum share in 2021?

Based on offering, ride hailing segment is expected to hold the maximum share ride hailing services market.