Rice Syrup Market | Acumen Research and Consulting

Rice Syrup Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

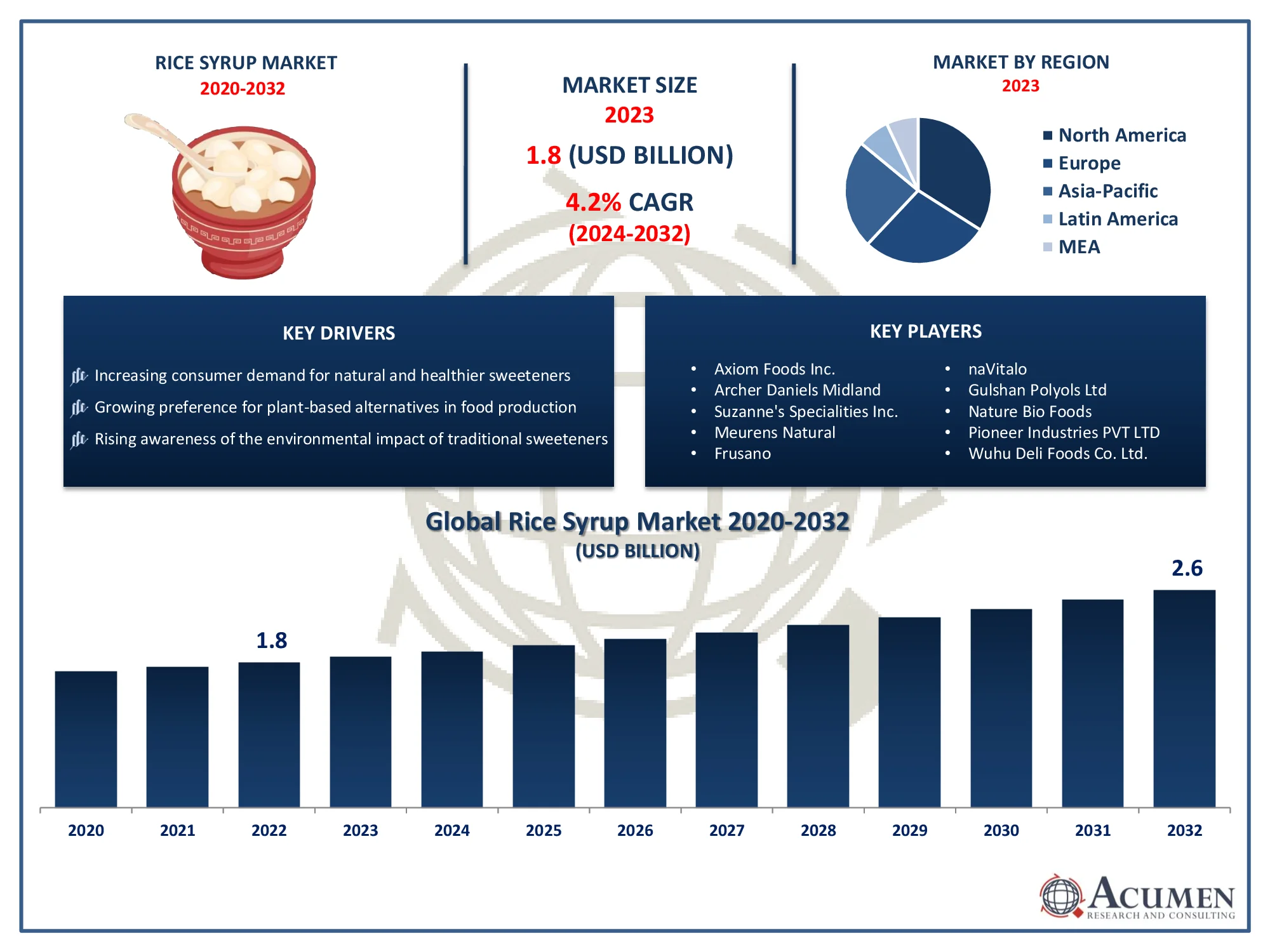

The Rice Syrup Market Size accounted for USD 1.8 Billion in 2023 and is projected to achieve a market size of USD 2.6 Billion by 2032 growing at a CAGR of 4.2% from 2024 to 2032.

Rice Syrup Market Highlights

- Global rice syrup market revenue is expected to increase by USD 2.6 Billion by 2032, with a 4.2% CAGR from 2024 to 2032

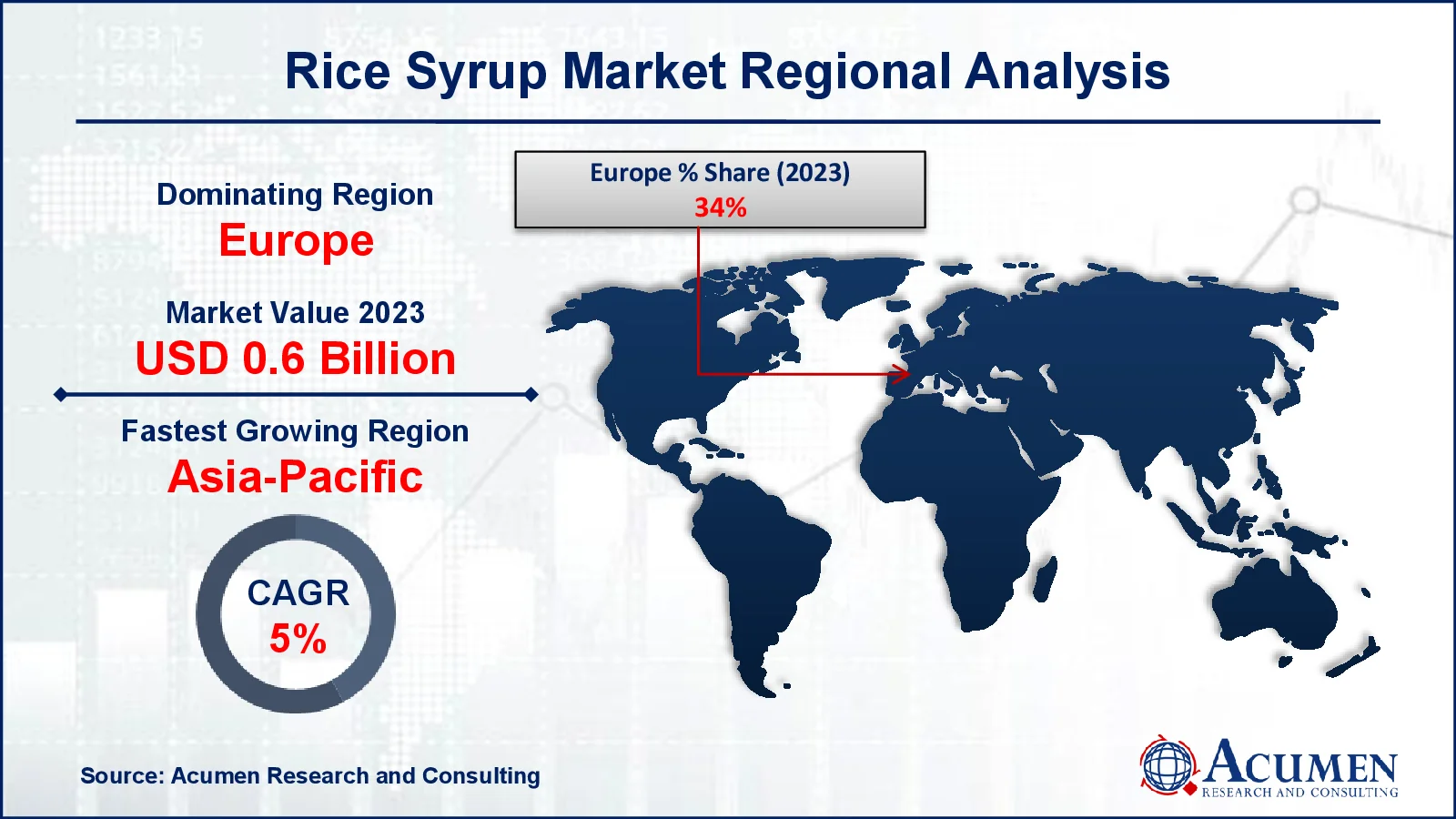

- Europe region led with more than 34% of rice syrup market share in 2023

- North America rice syrup market growth will record a CAGR of more than 4.7% from 2024 to 2032

- By rice type, the white rice segment captured more than 70% of revenue share in 2023

- By application, the bakery & confectionery segment is projected to expand at the fastest CAGR over the projected period

- Increasing consumer demand for natural and healthier sweeteners, drives the rice syrup market value

Rice syrup is a natural sweetener derived from rice starch through a fermentation process. It's commonly used as an alternative to traditional sweeteners like sugar or corn syrup due to its perceived health benefits and lower glycemic index. As the demand for healthier food options rises, rice syrup has gained popularity among consumers looking to reduce their sugar intake while still satisfying their sweet tooth.

In recent years, the market for rice syrup has experienced steady growth, driven by several factors. Health-conscious consumers are increasingly seeking out products with clean labels and natural ingredients, leading to a surge in demand for natural sweeteners like rice syrup. Additionally, as awareness of the environmental impact of food production grows, consumers are turning to plant-based alternatives, further fueling the demand for rice syrup. Moreover, the versatility of rice syrup has contributed to its market expansion. It is not only used as a sweetener in food and beverages but also finds applications in industries such as cosmetics and pharmaceuticals. As manufacturers continue to innovate and develop new products featuring rice syrup, the market is expected to witness sustained growth in the coming years.

Global Rice Syrup Market Trends

Market Drivers

- Increasing consumer demand for natural and healthier sweeteners

- Growing preference for plant-based alternatives in food production

- Rising awareness of the environmental impact of traditional sweeteners

- Versatility of rice syrup across various industries beyond food and beverages

Market Restraints

- Limited availability of rice syrup compared to other sweeteners

- Price fluctuations due to factors affecting rice production

Market Opportunities

- Development of new product formulations

- Increasing adoption of rice syrup in cosmetic and pharmaceutical industries

Rice Syrup Market Report Coverage

| Market | Rice Syrup Market |

| Rice Syrup Market Size 2022 |

USD 1.8 Billion |

| Rice Syrup Market Forecast 2032 | USD 2.6 Billion |

| Rice Syrup Market CAGR During 2023 - 2032 | 4.2% |

| Rice Syrup Market Analysis Period | 2020 - 2032 |

| Rice Syrup Market Base Year |

2022 |

| Rice Syrup Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Rice Type, By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Axiom Foods Inc., Archer Daniels Midland, Suzanne's Specialities Inc., CALIFORNIA NATURAL PRODUCTS, Meurens Natural, Frusano, naVitalo, Gulshan Polyols Ltd, Nature Bio Foods, Pioneer Industries Private Limited, and Wuhu Deli Foods Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Rice Syrup Market Dynamics

Rice syrup, also known as rice malt syrup, is a sweetener derived from the starch of rice grains. It's produced through a process of cooking rice starch with enzymes, breaking down the complex carbohydrates into simpler sugars. This results in a thick, syrupy liquid with a mild sweetness and a subtle flavor reminiscent of rice. Rice syrup is often used as a healthier alternative to refined sugars and artificial sweeteners due to its lower glycemic index and natural composition. The applications of rice syrup are diverse, spanning across various industries. In the food and beverage sector, it serves as a sweetening agent in products such as cereals, granola bars, baked goods, and beverages like teas and fruit juices. Its mild flavor makes it particularly suitable for recipes where a subtle sweetness is desired without overpowering other flavors. Moreover, rice syrup's sticky consistency also makes it a popular ingredient in confectionery items like candies and chewy snacks.

The rice syrup market has been experiencing significant growth in recent years, driven by several key factors. One of the primary drivers is the increasing consumer demand for natural and healthier alternatives to traditional sweeteners like sugar and corn syrup. Rice syrup fits well into this trend as it is perceived as a cleaner, more natural option with a lower glycemic index, making it attractive to health-conscious consumers. This growing awareness of the health benefits associated with rice syrup has led to its widespread adoption in various food and beverage products, fueling market growth. Furthermore, the rising preference for plant-based ingredients has contributed to the expansion of the rice syrup market. As consumers become more environmentally conscious and seek out sustainable food options, the demand for plant-derived sweeteners like rice syrup has surged.

Rice Syrup Market Segmentation

The global rice syrup market segmentation is based on rice type, source, application, and geography.

Rice Syrup Market By Rice Type

- White Rice

- Brown Rice

According to the rice syrup industry analysis, the white rice segment accounted for the largest market share in 2023. White rice, being a primary source for rice syrup production, has seen increased demand due to its versatility and widespread availability. As consumers seek cleaner label products and healthier alternatives to traditional sweeteners, white rice syrup presents itself as a viable option, driving its market growth. Moreover, advancements in processing technologies have enabled manufacturers to extract syrup from white rice more efficiently, leading to increased production capacities and lower production costs. This has made white rice syrup more accessible to food and beverage manufacturers, further fueling its market growth. Additionally, the neutral flavor profile of white rice syrup makes it a versatile ingredient suitable for a wide range of applications, including baked goods, beverages, confectionery, and savory products, contributing to its rising popularity among manufacturers.

Rice Syrup Market By Source

- Conventional

- Organic

In terms of sources, the organic segment is expected to witness significant growth in the coming years. As awareness of the health and environmental benefits of organic products continues to rise, consumers are actively seeking out organic alternatives across various food categories, including sweeteners. Organic rice syrup, derived from organically grown rice without the use of synthetic pesticides or fertilizers, aligns with these consumer preferences for clean label and eco-friendly products. Furthermore, stringent organic certification standards and regulations ensure the integrity and authenticity of organic rice syrup, providing consumers with confidence in its quality and purity. This transparency in labeling and production practices has bolstered consumer trust and contributed to the increasing demand for organic rice syrup in both developed and emerging markets.

Rice Syrup Market By Application

- Bakery & Confectionery

- Meat

- Dairy Products

- Poultry

- Infant Formulas

- Seafood

- Others

According to the rice syrup market forecast, the bakery & confectionery segment is expected to witness significant growth in the coming years. Rice syrup offers numerous advantages for manufacturers in this segment, including its natural sweetness, clean flavor profile, and ability to improve texture and moisture retention in baked goods and confectionery products. As consumer demand for healthier and cleaner label ingredients rises, rice syrup has emerged as a preferred alternative to traditional sweeteners like sugar and corn syrup in bakery and confectionery formulations. Moreover, the versatility of rice syrup makes it suitable for a wide range of applications in the bakery and confectionery industry. It can be used as a primary sweetener in products such as cookies, cakes, and granola bars, as well as in fillings, coatings, and toppings for confectionery items like chocolates and candies. This flexibility in usage allows manufacturers to innovate and create products that meet evolving consumer preferences for indulgent yet health-conscious treats, driving the growth of the bakery and confectionery segment within the rice syrup market.

Rice Syrup Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Rice Syrup Market Regional Analysis

Europe has emerged as a dominating region in the rice syrup market due to several key factors. One significant driver of Europe's dominance is the region's strong focus on health and wellness, leading to a growing demand for natural and healthier sweeteners. Rice syrup, with its clean label and lower glycemic index compared to traditional sweeteners, aligns well with European consumers' preferences for wholesome and sustainable food options. This increased consumer awareness and demand for healthier alternatives have propelled the adoption of rice syrup across various food and beverage categories in the region. Moreover, Europe's stringent regulatory environment regarding food safety and labeling standards has further contributed to the dominance of the region in the rice syrup market. The European Union (EU) has established strict regulations governing the use of sweeteners in food products, including maximum limits for certain types of sweeteners and labeling requirements for ingredients. Rice syrup, being a natural sweetener with no artificial additives, meets the criteria set forth by these regulations, making it an attractive option for food manufacturers seeking to comply with EU standards while meeting consumer demand for clean label products.

Rice Syrup Market Player

Some of the top rice syrup market companies offered in the professional report include Axiom Foods Inc., Archer Daniels Midland, Suzanne's Specialities Inc., CALIFORNIA NATURAL PRODUCTS, Meurens Natural, Frusano, naVitalo, Gulshan Polyols Ltd, Nature Bio Foods, Pioneer Industries Private Limited, and Wuhu Deli Foods Co. Ltd.

Frequently Asked Questions

What was the market size of the global rice syrup in 2023?

The market size of rice syrup was USD 1.8 Billion in 2023.

What is the CAGR of the global rice syrup market from 2024 to 2032?

The CAGR of rice syrup is 4.2% during the analysis period of 2024 to 2032.

Which are the key players in the rice syrup market?

The key players operating in the global market are including Axiom Foods Inc., Archer Daniels Midland, Suzanne's Specialities Inc., CALIFORNIA NATURAL PRODUCTS, Meurens Natural, Frusano, naVitalo, Gulshan Polyols Ltd, Nature Bio Foods, Pioneer Industries Private Limited, and Wuhu Deli Foods Co. Ltd.

Which region dominated the global rice syrup market share?

Europe held the dominating position in rice syrup industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of rice syrup during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global rice syrup industry?

The current trends and dynamics in the rice syrup industry include increasing consumer demand for natural and healthier sweeteners, and growing preference for plant-based alternatives in food production.

Which source held the maximum share in 2023?

The organic source held the maximum share of the rice syrup industry.