Retail Digital Transformation Market Size (By Product, By Mode Of Access, By Technology, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Retail Digital Transformation Market Size (By Product, By Mode Of Access, By Technology, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

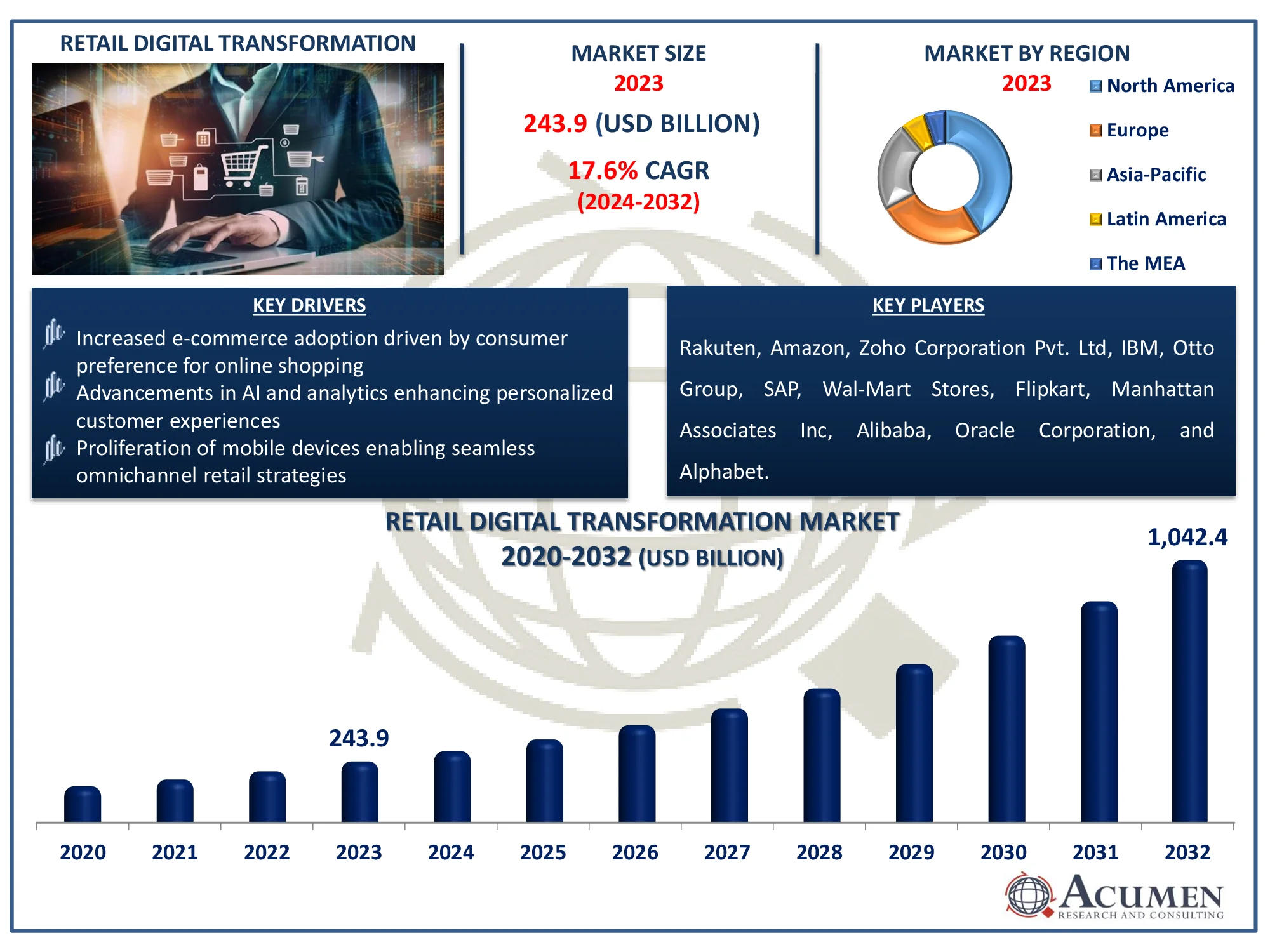

Request Sample Report

The Global Retail Digital Transformation Market Size accounted for USD 243.9 Billion in 2023 and is estimated to achieve a market size of USD 1,042.4 Billion by 2032 growing at a CAGR of 17.6% from 2024 to 2032.

Retail Digital Transformation Market Highlights

- The global retail digital transformation market is projected to reach USD 1,042.4 billion by 2032, growing at a CAGR of 17.6% from 2024 to 2032

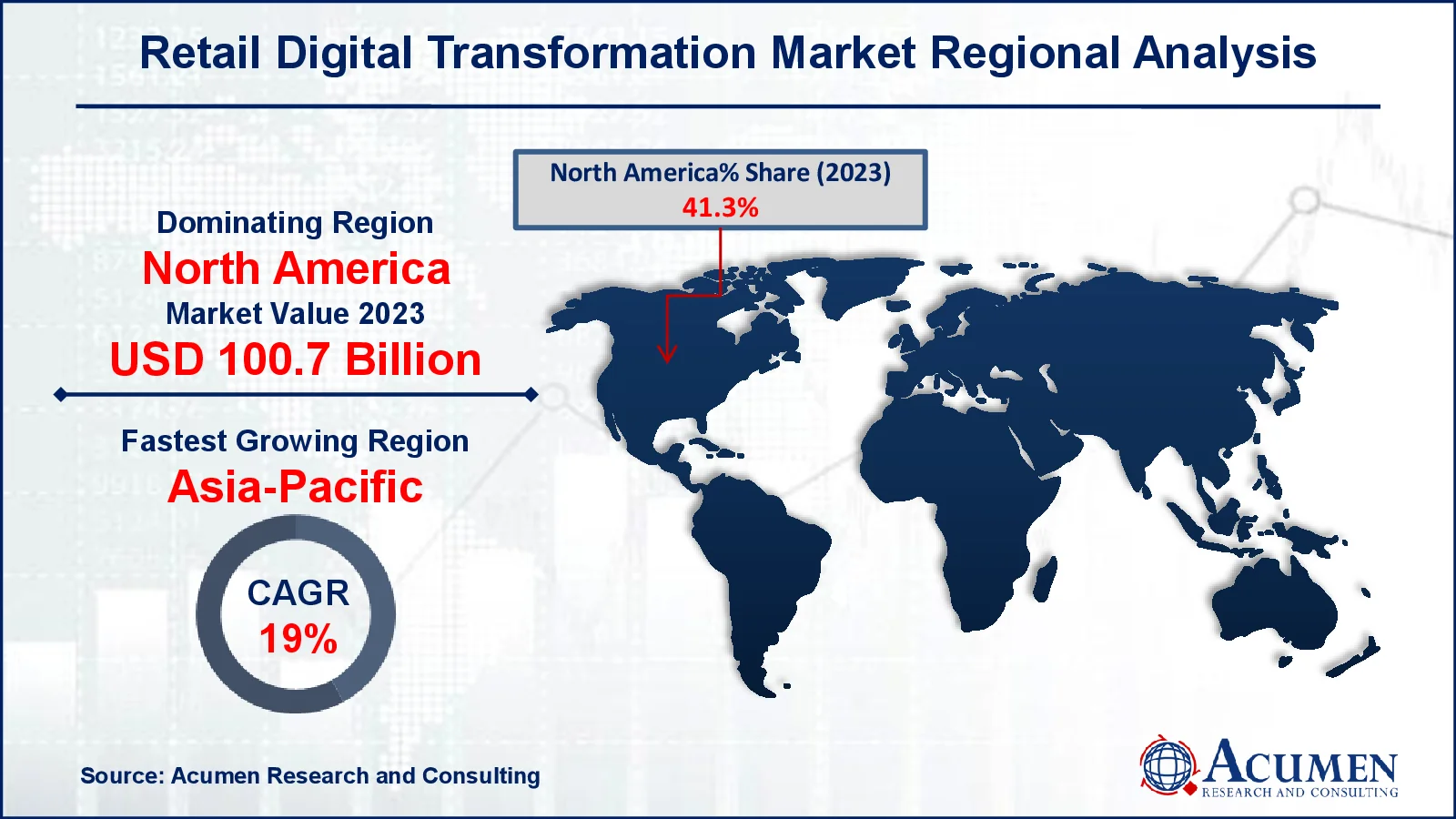

- In 2023, the North American retail digital transformation market was valued at approximately USD 100.7 billion

- The Asia-Pacific region is anticipated to grow at a CAGR exceeding 19% from 2024 to 2032

- Integration of IoT for improved inventory management and customer interactions is the retail digital transformation market trend that fuels the industry demand

The growing trend toward digital transformation has had a tremendous impact on the retail sector. The use of tablets, social media, cellphones, and image processing techniques has enhanced contact and productivity across the retail industry's value chain, from supplier to customer. Business-to-business transactions have increased exponentially as a result of these technologies. Other modern technology will allow major retailers to increase their presence through multichannel commerce, while business analytics will significantly improve their decision-making process.

Global Retail Digital Transformation Market Dynamics

Market Drivers

- Increased e-commerce adoption driven by consumer preference for online shopping

- Advancements in AI and analytics enhancing personalized customer experiences

- Proliferation of mobile devices enabling seamless omnichannel retail strategies

Market Restraints

- High implementation costs for advanced digital transformation solutions

- Data privacy concerns and regulatory compliance challenges

- Resistance to change among traditional retailers and workforce

Market Opportunities

- Integration of emerging technologies like AR/VR for immersive shopping experiences

- Growth in untapped markets with rising internet penetration

- Expansion of subscription-based models leveraging digital platforms for recurring revenue

Retail Digital Transformation Market Report Coverage

|

Market |

Retail Digital Transformation Market |

|

Retail Digital Transformation Market Size 2023 |

USD 243.9 Billion |

|

Retail Digital Transformation Market Forecast 2032 |

USD 1,042.4 Billion |

|

Retail Digital Transformation Market CAGR During 2024 - 2032 |

17.6% |

|

Retail Digital Transformation Market Analysis Period |

2020 - 2032 |

|

Retail Digital Transformation Market Base Year |

2023 |

|

Retail Digital Transformation Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Mode Of Access, By Technology, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Rakuten, Amazon, Zoho Corporation Pvt. Ltd, IBM, Otto Group, SAP, Wal-Mart Stores, Flipkart, Manhattan Associates Inc, Alibaba, Oracle Corporation, and Alphabet. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Retail Digital Transformation Market Insights

The increasing use of e-commerce in a variety of domains drives the retail digital transformation company. According to the India Brand Equity Foundation (IBEF), India's e-commerce sector earned over $14 billion in Gross Merchandise Value (GMV) during the 2024 Christmas season, a 12% increase over the prior year. Furthermore, as per the IBEF, the Indian e-commerce market is projected to grow from US$ 123 billion in 2024 to US$ 292.3 billion in 2028. The expansion of online shopping platforms has prompted merchants to embrace digital initiatives in order to remain competitive, and this is also becoming a crucial growth driver.

Proliferation of mobile devices enabling seamless omnichannel retail strategies boosts retail digital transformation market growth in the forecast year. According to the International Telecommunication Union (ITU), there were more than 8.58 billion mobile subscriptions in use worldwide in 2022, compared to a global population of 7.95 billion halfway through the year. Furthermore, the World Economic Forum states that mobile phones are ubiquitous, with over 5.4 billion people worldwide having at least one mobile subscription. Contactless payment options are further simplifying transactions, increasing customer engagement.

Data privacy concerns and regulatory compliance challenges impede the growth of the retail digital transformation industry. To meet these issues, retailers are investing in sophisticated data encryption and compliance management solutions.

The integration of emerging technologies such as AR/VR for immersive shopping experiences opens up new opportunities in the retail digital transformation sector. According to the India Brand Equity Foundation, AR/VR technology is widely used in retail, education, gaming, and healthcare. AR/VR is the future of retail since it enhances customer experiences. In recent years, over 260 AR/VR startups have operated in India. This change is leading the way in a new era of experiential retail, with higher consumer satisfaction and conversion rates.

Retail Digital Transformation Market Segmentation

The worldwide market for retail digital transformation is split based on product, mode of access, application, and geography.

Retail Digital Transformation Market By Product

- Apparel and Footwear

- Consumer Electronics And Appliances

- Food, Toys and Games

- Media, Beauty and Personal Care

- Grocery and Beverages

- Others

According to the retail digital transformation industry analysis, the apparel and footwear market has a significant demand for online shopping platforms, personalized recommendations, and virtual try-on technologies. The use of AR/VR and omnichannel tactics has improved customer experiences in this area, which is projected to continue to drive its large market share. Consumer gadgets and appliances are rapidly expanding, due to the incorporation of AI-powered shopping assistants. Food, toys, and games all benefit from higher e-commerce penetration. Media, beauty, and personal care use influencer marketing and personalization capabilities to reach a larger audience, while food and beverages continue to gain traction through quick delivery services and online shopping platforms.

Retail Digital Transformation Market By Mode of Access

- Websites

- Mobile Apps

In the retail digital transformation market, mobile apps are expected to witness tremendous growth since they provide seamless, personalized, and user-friendly experiences. Apps help retailers to provide greater customer involvement. Furthermore, the proliferation of mobile payment systems and their interaction with social media has increased their attractiveness. Websites are still important for merchants because they provide complete product catalogs, detailed information, and a platform for cross-device buying experiences.

Retail Digital Transformation Market By Technology

- Cloud Computing

- Internet of Things

- Artificial Intelligence

- Big Data & Analytics

- Others

According to the retail digital transformation market forecast, artificial intelligence is primarily responsible for driving tailored experiences, increasing client engagement, and improving operational efficiency. AI allows merchants to examine enormous datasets in real time, delivering insights for making data-driven decisions. Cloud computing enables merchants to manage massive amounts of data and apps. The internet of things (IoT) improves client interactions by connecting gadgets and allowing for real-time data sharing. Big data & analytics enables data-driven insights, which improve targeting and consumer experiences.

Retail Digital Transformation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Retail Digital Transformation Market Regional Analysis

For several reasons, North America has the highest share of the global retail digital transformation market due to the presence of significant corporations and increased internet availability in the region. For example, new data from the National Telecommunications and Information Administration (NTIA) show that there will be 13 million more internet users in the United States in 2023 than in 2021. The results of the latest NTIA Internet Use Survey suggest to substantial progress toward achieving Internet for All, as 13 million more people utilized the internet in the United States in 2023 than just two years earlier.

However, Asia-Pacific is likely to experience substantial growth in the coming years. According to the Press Information Bureau (PIB), the total number of internet users climbed from 88.1 crore at the end of March 2023 to 95.4 crore at the end of March 2024, with an annual growth rate of 8.3%, resulting in the addition of 7.3 crore internet subscribers over the last year. Growing internet penetration leads to significant industry growth.

Retail Digital Transformation Market Players

Some of the top retail digital transformation companies offered in our report includes Rakuten, Amazon, Zoho Corporation Pvt. Ltd, IBM, Otto Group, SAP, Wal-Mart Stores, Flipkart, Manhattan Associates Inc, Alibaba, Oracle Corporation, and Alphabet.

Frequently Asked Questions

How big is the Retail Digital Transformation market?

The retail digital transformation market size was valued at USD 243.9 Billion in 2023.

What is the CAGR of the global Retail Digital Transformation market from 2024 to 2032?

The CAGR of retail digital transformation is 17.6% during the analysis period of 2024 to 2032.

Which are the key players in the Retail Digital Transformation market?

The key players operating in the global market are including Rakuten, Amazon, Zoho Corporation Pvt. Ltd, IBM, Otto Group, SAP, Wal-Mart Stores, Flipkart, Manhattan Associates Inc, Alibaba, Oracle Corporation, and Alphabet.

Which region dominated the global Retail Digital Transformation market share?

North America held the dominating position in retail digital transformation industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of retail digital transformation during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Retail Digital Transformation industry?

The current trends and dynamics in the retail digital transformation industry include increased e-commerce adoption driven by consumer preference for online shopping, advancements in AI and analytics enhancing personalized customer experiences, and proliferation of mobile devices enabling seamless omnichannel retail strategies.

Which product held the maximum share in 2023?

The apparel and footwear product held the maximum share of the retail digital transformation industry.