Respiratory Assist Device Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Respiratory Assist Device Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

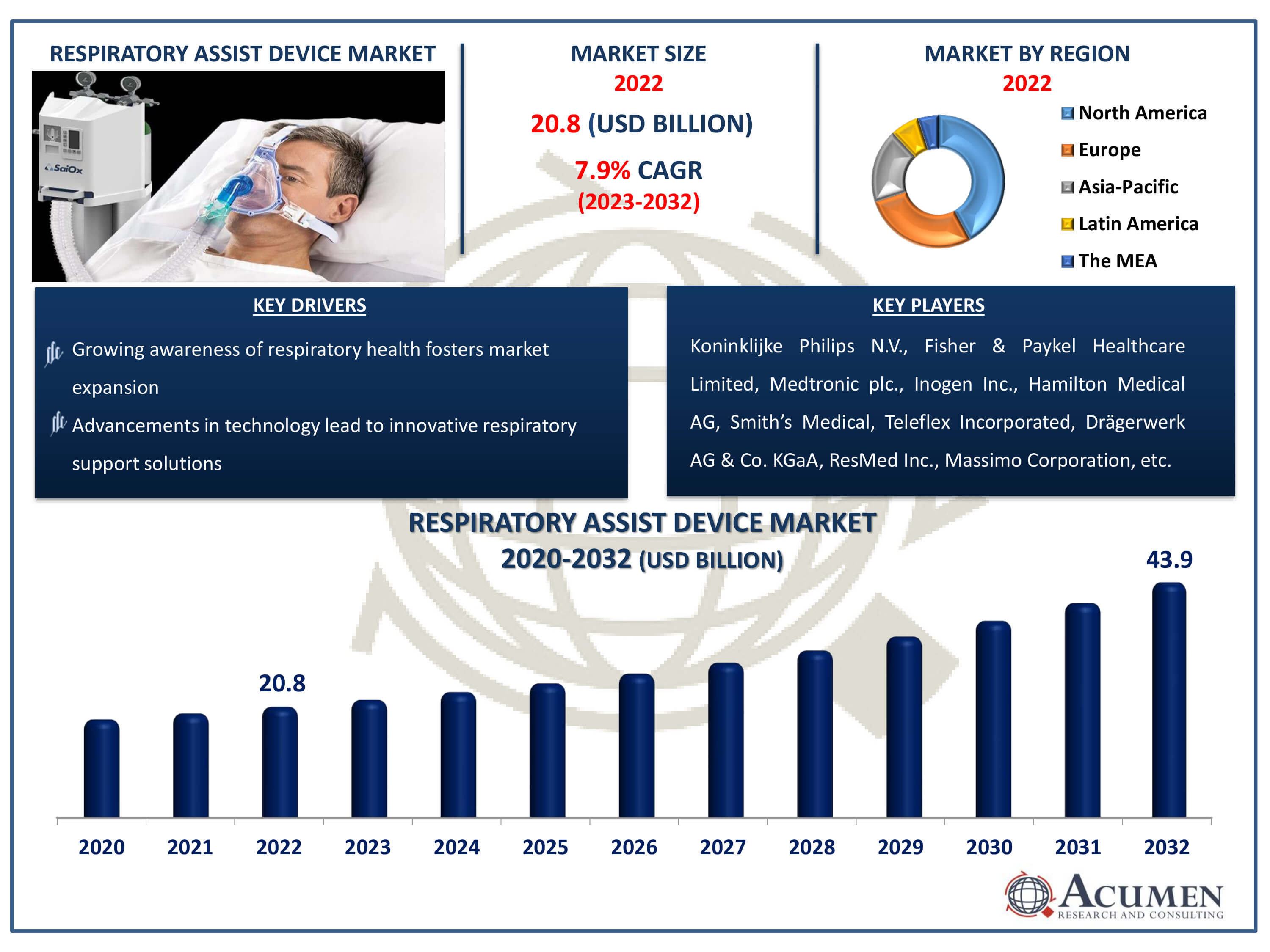

The Respiratory Assist Device Market Size accounted for USD 20.8 Billion in 2022 and is estimated to achieve a market size of USD 43.9 Billion by 2032 growing at a CAGR of 7.9% from 2023 to 2032.

Respiratory Assist Device Market Highlights

- Global respiratory assist device market revenue is poised to garner USD 43.9 billion by 2032 with a CAGR of 7.9% from 2023 to 2032

- North America respiratory assist device market value occupied around USD 8.7 billion in 2022

- Asia-Pacific respiratory assist device market growth will record a CAGR of more than 9% from 2023 to 2032

- Among product type, the inhalers sub-segment generated noteworthy revenue in 2022

- Based on end-user, the hospitals sub-segment generated around 78% share in 2022

- The creation of affordable, portable respiratory assistance equipment responds to a wider range of consumer demands is a popular respiratory assist device market trend that fuels the industry demand

Respiratory assist devices are designed to aid patients in need of breathing support, carbon dioxide removal, and therapeutic measures to alleviate the atrophy of abdominal wall muscles. The global growth of respiratory assist devices is attributed to several factors, including the high prevalence of respiratory diseases among the patient population, the continual rise in the geriatric demographic, increasing pollution levels in urban areas, and various other factors. The demand for these devices has surged due to the critical role they play in addressing respiratory conditions, particularly with the escalating challenges posed by respiratory illnesses, aging populations, and environmental factors such as urban pollution.

Global Respiratory Assist Device Market Dynamics

Market Drivers

- Increasing incidence of respiratory diseases

- Aging population contributes to the rise in respiratory assist device adoption

- Advancements in technology lead to innovative respiratory support solutions

- Growing awareness of respiratory health fosters market expansion

Market Restraints

- Stringent regulatory requirements pose barriers for market entry

- Limited reimbursement coverage restricts widespread adoption of assist devices

- High costs associated with advanced respiratory support technologies

Market Opportunities

- Rising emphasis on respiratory health

- Expansion into untapped markets offers growth prospects for device manufacturers

- Collaborations with healthcare providers enhance product accessibility and market presence

Respiratory Assist Device Market Report Coverage

| Market | Respiratory Assist Device Market |

| Respiratory Assist Device Market Size 2022 | USD 20.8 Billion |

| Respiratory Assist Device Market Forecast 2032 | USD 43.9 Billion |

| Respiratory Assist Device Market CAGR During 2023 - 2032 | 7.9% |

| Respiratory Assist Device Market Analysis Period | 2020 - 2032 |

| Respiratory Assist Device Market Base Year |

2022 |

| Respiratory Assist Device Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Koninklijke Philips N.V., Fisher & Paykel Healthcare Limited, Medtronic plc., Inogen Inc., Hamilton Medical AG, Smith’s Medical, Teleflex Incorporated, Drägerwerk AG & Co. KGaA, ResMed Inc., Massimo Corporation, and General Electric Healthcare Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Respiratory Assist Device Market Insights

COVID-19 Impact on Respiratory Assist Devices Market

The novel corona virus has affected more than a quarter of a million people worldwide, leading to continuous spread and causing pneumonia and difficulty in breathing, resulting in a rising demand for respiratory assist devices. Moreover, conditions like chronic obstructive pulmonary disorder (COPD) and asthma contribute to the global demand for respiratory assist devices. Governments worldwide are increasingly involved in addressing the COVID-19 situation, ensuring a proper supply of respiratory assist devices. These factors significantly accelerate the growth of the global respiratory assist devices market. Government collaboration with prominent manufacturers in handling threats like COVID-19 enhances the market's potential for full-scale growth. International regulatory agencies are expediting the approval process for respiratory assist devices to meet global demand.

In March 2020, Prisma Health announced the emergency use authorization approval by the USFDA for its new product 'VESper.' This specialized product expands the company's range, allowing a single ventilator to support up to four patients during acute equipment shortages in the COVID-19 pandemic. Additionally, in the United Kingdom (UK), the government urged automobile manufacturers such as Ford, Honda, and Rolls-Royce to shift their focus temporarily from car assembly to developing respiratory equipment. This strategy, in favor of the UK government, helped match the demand and supply for respiratory assist devices. Furthermore, the simplification of the registration process for essential goods by regulatory bodies has eased import restrictions, facilitating the supply of respiratory devices without obstacles to ultimately save lives.

The FDA is encouraging foreign and domestic manufacturers of respiratory assist devices to pursue emergency use authorization (EUA) for distributing equipment freely in the states. The FDA is personally reaching out to manufacturers to engage in medical device manufacturing for faster approvals and the sale of devices in the global market, ensuring a proper match between demand and supply. Such factors have significantly bolstered the demand for the global respiratory assist devices market.

Technological Advancements Will Assist Respiratory Assist Devices Market to Grow Tremendously In the Coming Years

The growth of the global respiratory assist device market is supported by new products facilitated by technological advancements. According to EurekAlert, researchers at Monash University have developed groundbreaking non-invasive X-ray technology for the diagnosis, treatment, and management of respiratory lung diseases. For the first time, researchers have utilized this technology in common laboratory settings with the support of confined high-tech synchrotron facilities. The application of four-dimensional X-ray velocity (XV technology) imaging provides high-definition and sensitive real-time images of airflow through the lungs in live organisms. The technology has been commercialized by the Australian-based med-tech company 4Dx Limited and has undergone successful Phase 1 human clinical trials in the US.

Respiratory Assist Device Market Segmentation

The worldwide market for respiratory assist device is split based on product type, end-user, and geography.

Respiratory Assist Devices Market By Product Types

- Respiratory Consumables

- Nebulizers

- Inhalers

- Oxygen Concentrators

- Positive Airway Pressure Devices

- Polysomnography Devices

- Pulse Oximeters

- Mechanical Ventilators

- Spirometers

The high prevalence of respiratory diseases, such as asthma and chronic obstructive disorders, globally fuels the growth of the inhaler segment. According to the World Health Organization (WHO), it was estimated that more than 339 million people suffered from asthma globally in past year. Moreover, released estimates highlight that 417,918 deaths worldwide were reported due to asthma, with 24.8 million disability-adjusted life years (DALYs) attributed to asthma. These figures underscore the increasing cases of asthma, prompting manufacturers of respiratory inhaler devices to ramp up production capacity to meet the rising demand. Additionally, the surge in air pollution levels in urban areas, attributed to increased vehicle sales and the growing number of factories, foretells a fully growing demand for respiratory inhalers. Fast product approvals for respiratory inhalers are expected to flourish, driving market growth during the respiratory assist device industry forecast period.

Respiratory Assist Devices Market By End-Users

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Long Term Care Centers

- Others

According to respiratory assist device industry analysis, hospitals will account for a significant market share, with rising public-private partnerships aimed at improving access to healthcare services, spurring segmental growth. Additionally, rapid developments in healthcare infrastructure and efforts to enhance access to healthcare services are considered prominent factors driving the growth of respiratory assist devices for hospitals in developing economies during the respiratory assist device market forecast period.

Respiratory Assist Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

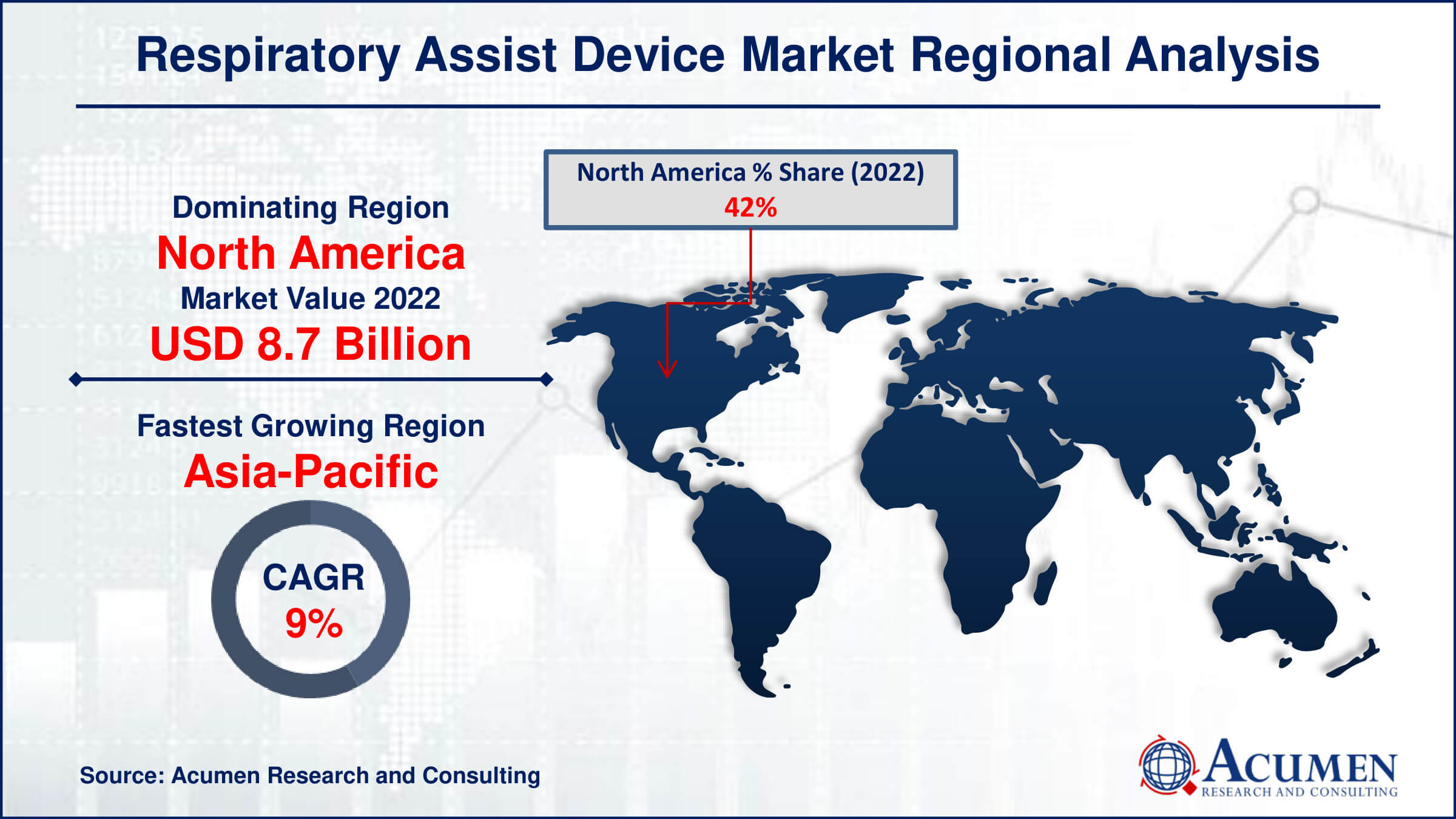

Respiratory Assist Device Market Regional Analysis

North America is projected to hold a dominant position in the global market for respiratory assist devices. On the other hand, Asia-Pacific is expected to be the fastest-growing region for respiratory assist devices in the global market. The growth of the respiratory assist devices market in North America is attributed to enhanced diagnostic technology and favorable reimbursement policies in this region. Additionally, the high prevalence of cases related to respiratory disorders and chronic obstructive pulmonary disorder (COPD) stimulates regional growth. Moreover, the impact of COVID-19 on the North American region has led to tremendous growth in the respiratory assist devices market. The presence of prominent players in this region further enhances the North American respiratory assist devices market.

In terms of respiratory assist devices market analysis, the Asia-Pacific market is expected to record the highest compound annual growth rate (CAGR) in the forecast period. The rapidly developing healthcare infrastructure, a surge in per capita income, and a large patient pool suffering from respiratory-related disorders contribute to the growing demand for the respiratory assist devices market. Moreover, the low infrastructure and treatment costs, along with the availability of highly educated physicians, have garnered strong attention towards medical tourism in Asia Pacific countries, specifically India and China.

Respiratory Assist Device Market Players

Some of the top respiratory assist device companies offered in our report includes Koninklijke Philips N.V., Fisher & Paykel Healthcare Limited, Medtronic plc., Inogen Inc., Hamilton Medical AG, Smith’s Medical, Teleflex Incorporated, Drägerwerk AG & Co. KGaA, ResMed Inc., Massimo Corporation, and General Electric Healthcare Limited.

Frequently Asked Questions

How big is the respiratory assist device market?

The respiratory assist device market size was valued at USD 20.8 billion in 2022.

What is the CAGR of the global respiratory assist device market from 2023 to 2032?

The CAGR of respiratory assist device is 7.9% during the analysis period of 2023 to 2032.

Which are the key players in the respiratory assist device market?

The key players operating in the global market are including Koninklijke Philips N.V., Fisher & Paykel Healthcare Limited, Medtronic plc., Inogen Inc., Hamilton Medical AG, Smith�s Medical, Teleflex Incorporated, Dr�gerwerk AG & Co. KGaA, ResMed Inc., Massimo Corporation, and General Electric Healthcare Limited.

Which region dominated the global respiratory assist device market share?

North America held the dominating position in respiratory assist device industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of respiratory assist device during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global respiratory assist device industry?

The current trends and dynamics in the respiratory assist device industry include increasing incidence of respiratory diseases, aging population contributes to the rise in respiratory assist device adoption, advancements in technology lead to innovative respiratory support solutions, and growing awareness of respiratory health fosters market expansion

Which product type held the maximum share in 2022?

The inhalers product type held the maximum share of the respiratory assist device industry.