Rehabilitation Robots Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Rehabilitation Robots Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

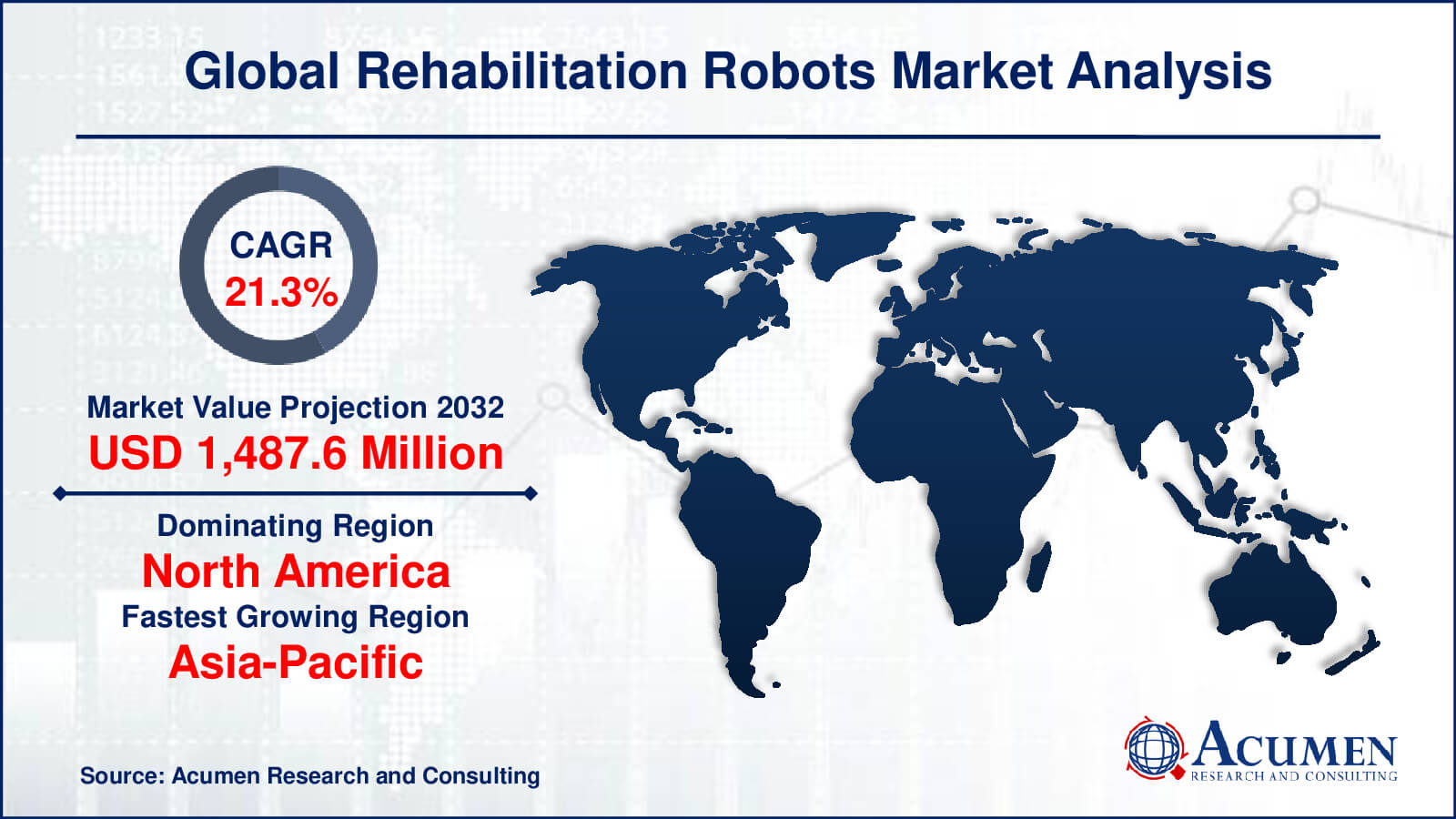

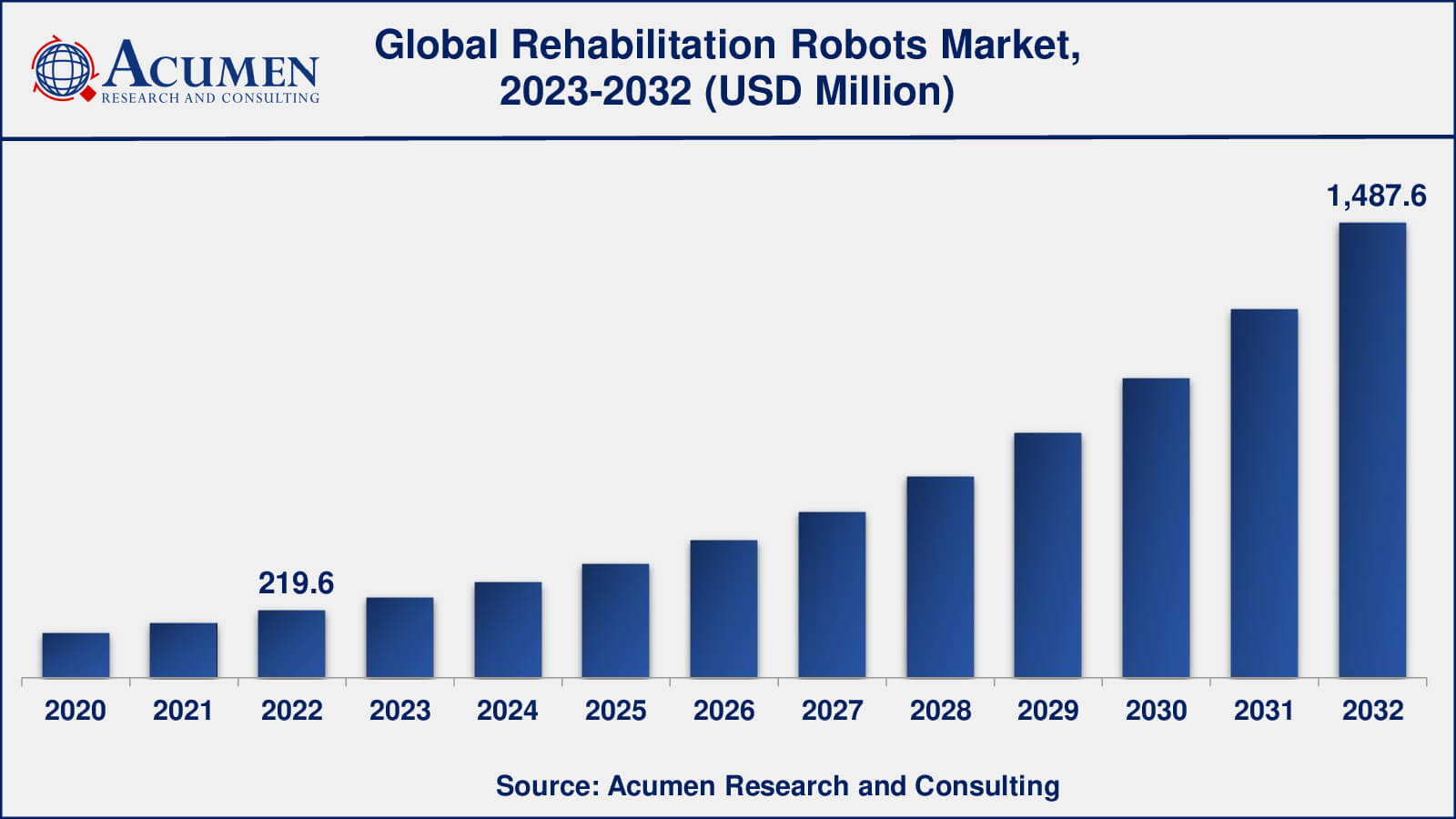

The global Rehabilitation Robots Market size was valued at USD 219.6 Million in 2022 and is projected to reach USD 1,487.6 Million by 2032 mounting at a CAGR of 21.3% from 2023 to 2032.

Rehabilitation Robots Market Highlights

- Global rehabilitation robots market revenue is poised to garner USD 1,487.6 Million by 2032 with a CAGR of 21.3% from 2023 to 2032

- North America rehabilitation robots market value occupied around USD 103.2 million in 2022

- Asia-Pacific rehabilitation robots market growth will record a CAGR of more than 22% from 2023 to 2032

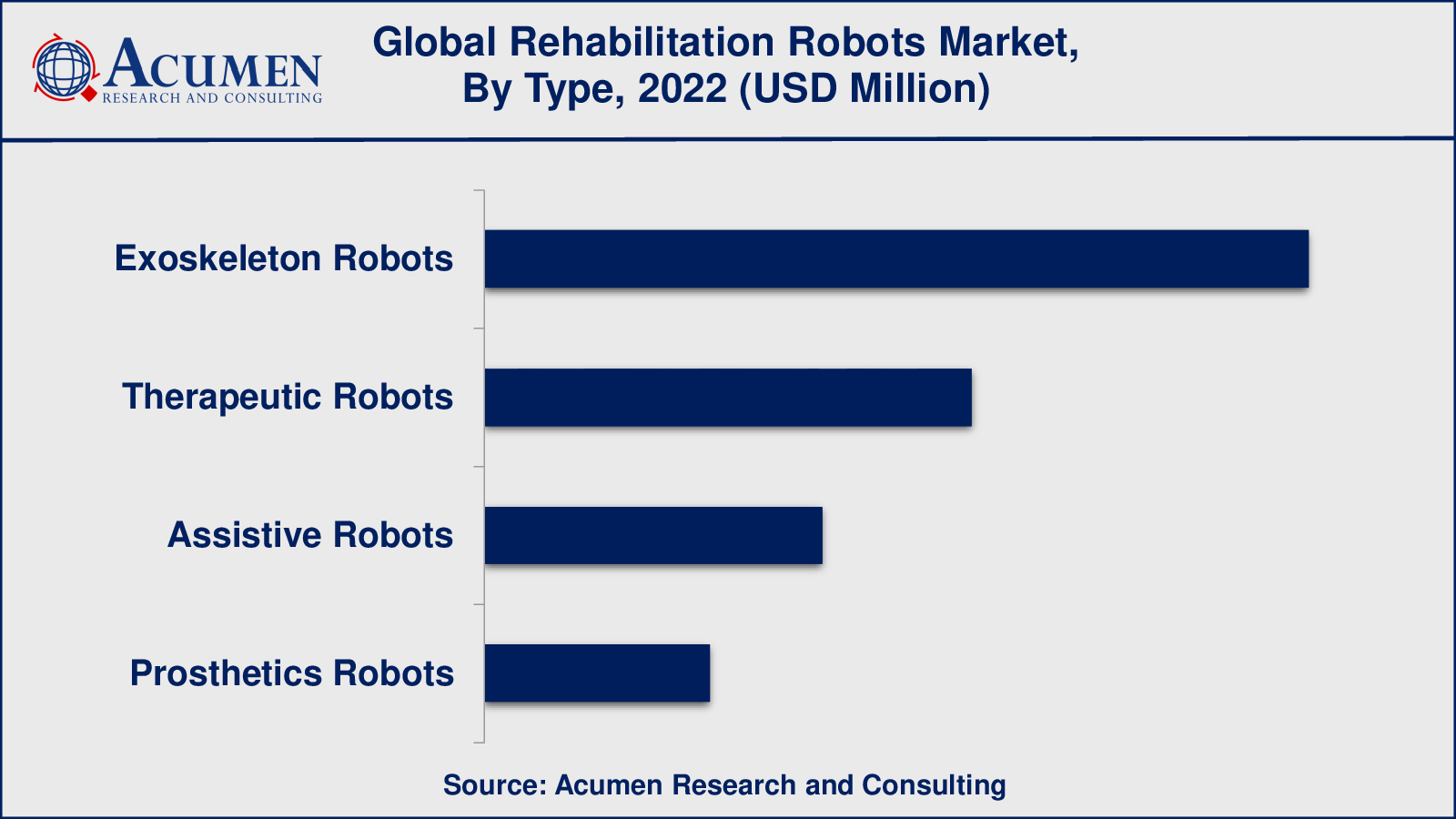

- Among types, the exoskeleton robots sub-segment generated over US$ 96.6 million revenue in 2022

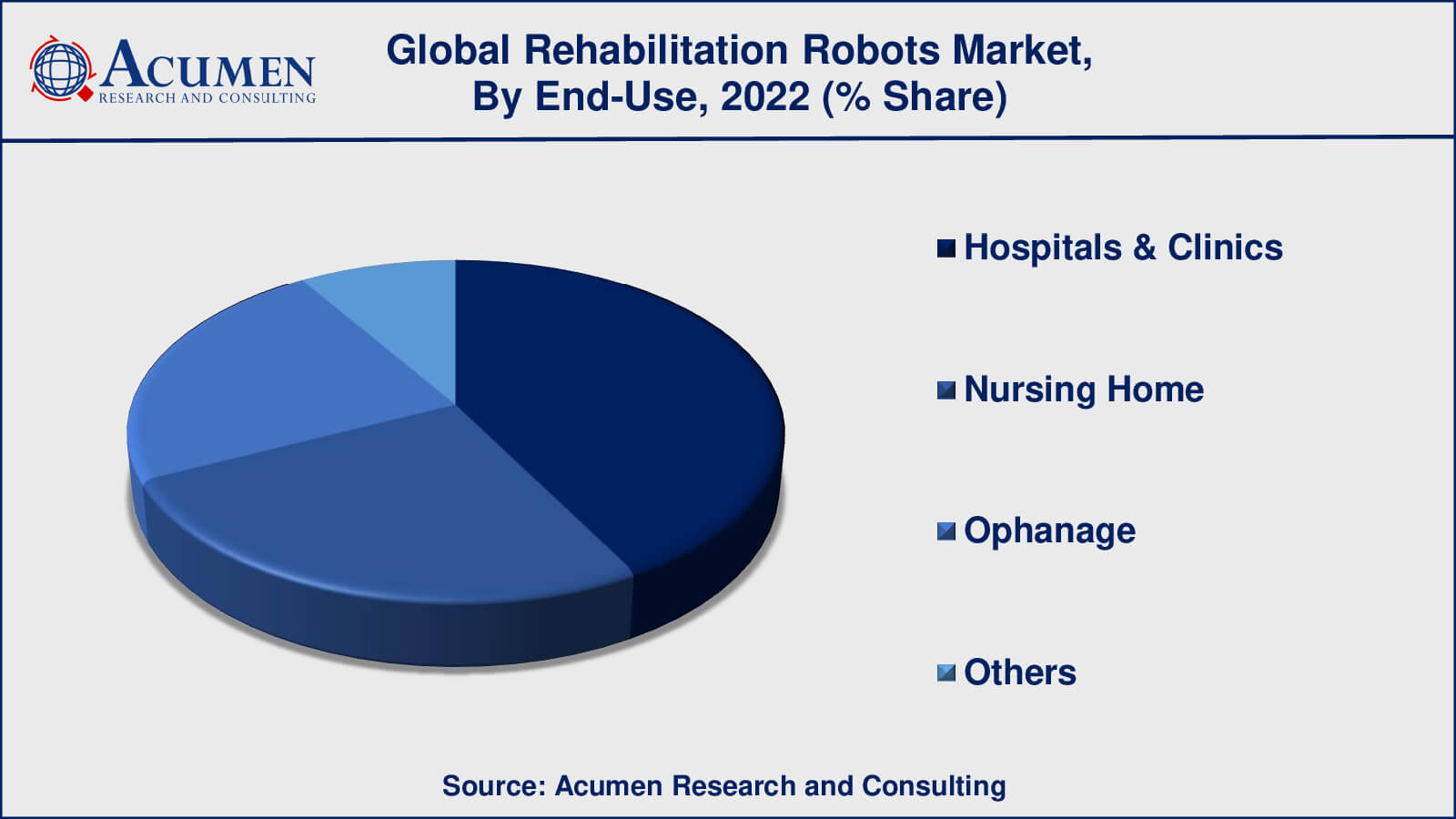

- Based on end-use, the hospitals & clinics sub-segment generated around 42% share in 2022

- Rising demand from virtual reality (VR) and gamification is a popular rehabilitation robots market trend that fuels the industry demand

Rehabilitation robots are specialized equipment meant to help people with physical limitations or injuries heal and rehabilitate. These robots are often utilized in medical environments such as Hospitals & Clinics or rehabilitation centers, where they provide a variety of support and assistance to patients undergoing therapy.

These robots may be designed to assist patients in regaining mobility, developing muscular strength, improving motor control, and encouraging functional independence. They are outfitted with sensors, actuators, and complex software algorithms that allow them to interact with patients and deliver personalized help depending on their individual requirements. Rehabilitation robots can be employed in a variety of settings, including upper and lower limb rehabilitation, gait training, and balance training.

Global Rehabilitation Robots Market Dynamics

Market Drivers

- Increasing prevalence of chronic conditions and disabilities

- Technological advancements and innovation in sensors, actuators, and software algorithms

- Demand for cost-effective and efficient healthcare solutions

- Availability of reimbursement policies and supportive government initiatives

Market Restraints

- High costs associated with advanced rehabilitation robots

- Technical complexities and the need for skilled personnel to operate them

- Safety concerns and the need for regulatory frameworks

Market Opportunities

- Integration of artificial intelligence and machine learning algorithms

- Collaborations between robotics manufacturers and healthcare institutions

- Expansion of home-based rehabilitation and tele-rehabilitation

Rehabilitation Robots Market Report Coverage

| Market | Rehabilitation Robots Market |

| Rehabilitation Robots Market Size 2022 | USD 219.6 Million |

| Rehabilitation Robots Market Forecast 2032 | USD 1,487.6 Million |

| Rehabilitation Robots Market CAGR During 2023 - 2032 | 21.3% |

| Rehabilitation Robots Market Analysis Period | 2020 - 2032 |

| Rehabilitation Robots Market Base Year | 2022 |

| Rehabilitation Robots Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Extremity, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Bionik Laboratories Corporation, Cyberdyne Inc., Ekso Bionics Holdings Inc., Hocoma AG (DIH International Ltd.), Kinova Inc., Life Science Robotics ApS, ReWalk Robotics Ltd, Rehab-Robotics Company Limited, Rex Bionics Ltd, and Tyromotion GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Rehabilitation Robots Market Insights

The increased frequency of chronic illnesses and disabilities is a major driver of the rehabilitation robots industry. The world population is ageing, which increases the chance of physical impairments and illnesses including stroke, spinal cord injuries, and musculoskeletal problems. Rehabilitation robots provide a viable answer for people looking for effective rehabilitation to restore mobility and independence.

One of the most important benefits of rehabilitation robots is their capacity to offer repeated and regulated motions, which is essential for effective therapy. These devices are capable of producing constant and accurate motions that would be impossible to execute manually. Furthermore, rehabilitation robots may provide variable amounts of help, allowing therapists to tailor the intensity of therapy to the patient's development and skills.

The capacity of rehabilitation robots to gather and analyze data during therapy sessions is another key advantage. These robots give significant input to both patients and therapists by monitoring and recording numerous characteristics such as range of motion, muscle activity, and performance metrics. This data-driven method enables doctors to assess progress, make educated treatment plan decisions, and alter therapy regimens as needed.

Rehabilitation robots also solve the issue of human therapists' limited availability and expensive expenses. With an ageing population and a growing number of individuals in need of rehabilitation, there is a growing need for effective and accessible therapeutic choices. Human therapists can be supplemented by robots by providing constant care and expanding treatment hours, thereby reaching more patients in need.

However, there are still problems such as high prices, technological complexity, and the necessity for qualified humans to operate these robots. Furthermore, legislative frameworks and safety issues must be addressed to guarantee that rehabilitation robots are widely used and accepted.

Technological improvements and innovation have also had a significant impact on market dynamics. The advancement of sophisticated sensors, actuators, and software algorithms has resulted in the development of increasingly complex and intelligent rehabilitation robots. These robots are capable of providing personalized therapy, adapting to individual needs, and providing real-time feedback and monitoring. As a consequence, healthcare practitioners and patients are becoming more aware of the potential benefits of these technologies, which are propelling market expansion.

Rehabilitation Robots Market Segmentation

The worldwide market for rehabilitation robots is split based on type, extremity, end-use, and geography.

Rehabilitation Robots Types

- Exoskeleton Robots

- Therapeutic Robots

- Assistive Robots

- Prosthetics Robots

According to rehabilitation industry analysis, exoskeleton robots were thought to have the biggest market share in the rehabilitation robotics industry. Exoskeleton robots are wearable devices that give external support and aid to people who have mobility problems, allowing them to do daily tasks and participate in rehabilitative exercises. These robots provide advantages such as improved mobility, muscular strength, and gait training assistance. Exoskeleton robots have gained substantial traction and were projected to dominate the industry at the time due to their adaptability and wide variety of applications.

Rehabilitation Robots Extremities

- Upper Body

- Lower Body

The rehabilitation robots market was dominated by lower body extremities. Lower body rehabilitation robots are intended to help people with lower limb disabilities or injuries regain mobility and improve their walking patterns. These robots assist and guide people with walking, balance training, and lower limb treatment. They are especially effective for those who have had a stroke, spinal cord injury, or lower limb amputation. Because of its usefulness in restoring lower limb functions and improving patient outcomes, lower body rehabilitation robots have experienced tremendous improvements and adoption.

Rehabilitation Robots End-Uses

- Hospitals & Clinics

- Nursing Home

- Orphanage

- Others

According to the rehabilitation robots market forecast, the hospitals and clinics sub-segment will account for a considerable proportion from 2023 to 2032. Rehabilitation robots are commonly employed in medical settings such as hospitals and clinics to provide specialised care and therapy to patients. These facilities have the infrastructure, resources, and experience to successfully integrate rehabilitation robot systems. Rehabilitation robots are used in hospitals and clinics for a variety of functions such as upper and lower limb rehabilitation, gait training, balance training, and muscle strengthening.

While hospitals and clinics are the most common end-users of rehabilitation robots, their uptake and utilisation can expand to other contexts as well. Nursing facilities, which provide long-term care for people with chronic illnesses or disabilities, may also deploy rehabilitation robots to help their residents with their rehabilitation needs. Rehabilitation robots may also be used in orphanages or care homes for disabled children to assist with physical therapy and motor skill development.

The category "Others" includes a diverse variety of possible end-users, such as research organisations, specialised rehabilitation centres, and private rehabilitation practises. These organisations, while having a lesser market share than hospitals and clinics, nonetheless contribute to the total adoption of rehabilitation robots.

Rehabilitation Robots Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Rehabilitation Robots Market Regional Analysis

North America has a sizable market share in the rehabilitation robots industry. Rehabilitation robots were used as a result of the region's well-established healthcare infrastructure, technical breakthroughs, and high healthcare spending. The United States, in particular, was a significant driver of market growth, with multiple manufacturers and research institutes focusing on creating revolutionary rehabilitation robot solutions.

Europe was another significant market for rehabilitation robots. Countries such as Germany, the United Kingdom, and France shown significant growth and acceptance of these technologies. The region's strong concentration on R&D, supporting government efforts, and an ageing population all contributed to market expansion. Furthermore, Europe has a strong presence of leading market firms producing rehabilitation robots.

In the rehabilitation robots industry, the Asia-Pacific region showed tremendous development potential. Japan, China, and South Korea were among the first to embrace and develop advanced rehabilitation robot systems. These countries have sizable populations, a high prevalence of chronic illnesses, and a growing demand for rehabilitation services. Furthermore, expenditures in research & development, technical developments, and favorable government initiatives all contributed to regional market expansion.

Rehabilitation Robots Market Players

Some of the top rehabilitation robots companies offered in our report include Bionik Laboratories Corporation, Cyberdyne Inc., Ekso Bionics Holdings Inc., Hocoma AG (DIH International Ltd.), Kinova Inc., Life Science Robotics ApS, ReWalk Robotics Ltd, Rehab-Robotics Company Limited, Rex Bionics Ltd, and Tyromotion GmbH.

Rehabilitation Robots Industry Recent Developments

- In September 2021, Kinova has announced the release of the Gen3 robotic system, their next-generation robotic system. This collaborative robot platform is intended to help people with upper limb limitations conduct a variety of jobs and activities. The improved capabilities of the Gen3 include increased dexterity, accuracy, and flexibility.

- In February 2021, ReWalk Robotics has announced the European commercial launch of their ReStore soft exo-suit technology. The ReStore system is intended to help those who have difficulty walking due to a stroke or other lower-limb disability. The European introduction made this unique exo-suit technology more accessible to a larger patient group.

Frequently Asked Questions

What was the market size of the global rehabilitation robots in 2022?

The market size of rehabilitation robots was USD 219.6 Million in 2022.

What is the CAGR of the global rehabilitation robots market from 2023 to 2032?

The CAGR of rehabilitation robots is 21.3% during the analysis period of 2023 to 2032.

Which are the key players in the rehabilitation robots market?

The key players operating in the global market are including Global Laser Ltd, Honeywell International Inc., Kentek Corporation, Laser Safety Industries, NoIR Laser Company LLC, Phillips Safety Types, Inc., Thorlabs, Inc., Univet Optical Technologies, and VS Eyewear.

Which region dominated the global rehabilitation robots market share?

North America held the dominating position in rehabilitation robots industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of rehabilitation robots during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global rehabilitation robots industry?

The current trends and dynamics in the rehabilitation robots industry include increasing prevalence of chronic conditions and disabilities, technological advancements and innovation in sensors, actuators, and software algorithms, demand for cost-effective and efficient healthcare solutions, and availability of reimbursement policies and supportive government initiatives

Which type held the maximum share in 2022?

The exoskeleton robots held the maximum share of the rehabilitation robots industry.