Red Biotechnology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Red Biotechnology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

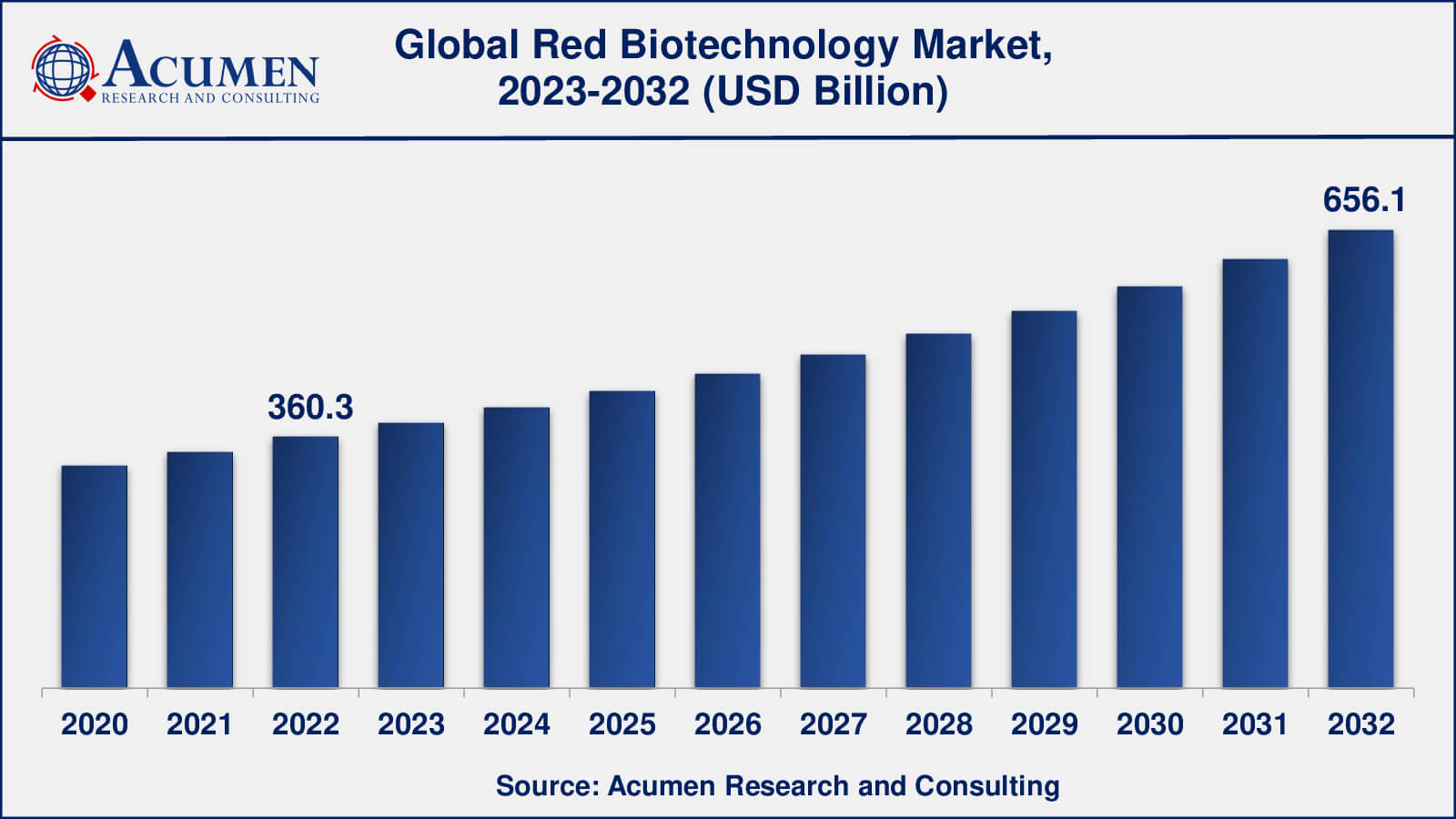

The Global Red Biotechnology Market Size accounted for USD 360.3 Billion in 2022 and is estimated to achieve a market size of USD 656.1 Billion by 2032 growing at a CAGR of 6.3% from 2023 to 2032.

Red Biotechnology Market Highlights

- Global red biotechnology market revenue is poised to garner USD 656.1 billion by 2032 with a CAGR of 6.3% from 2023 to 2032

- North America red biotechnology market value occupied more than USD 137 billion in 2022

- Asia-Pacific red biotechnology market growth will record a CAGR of around 7% from 2023 to 2032

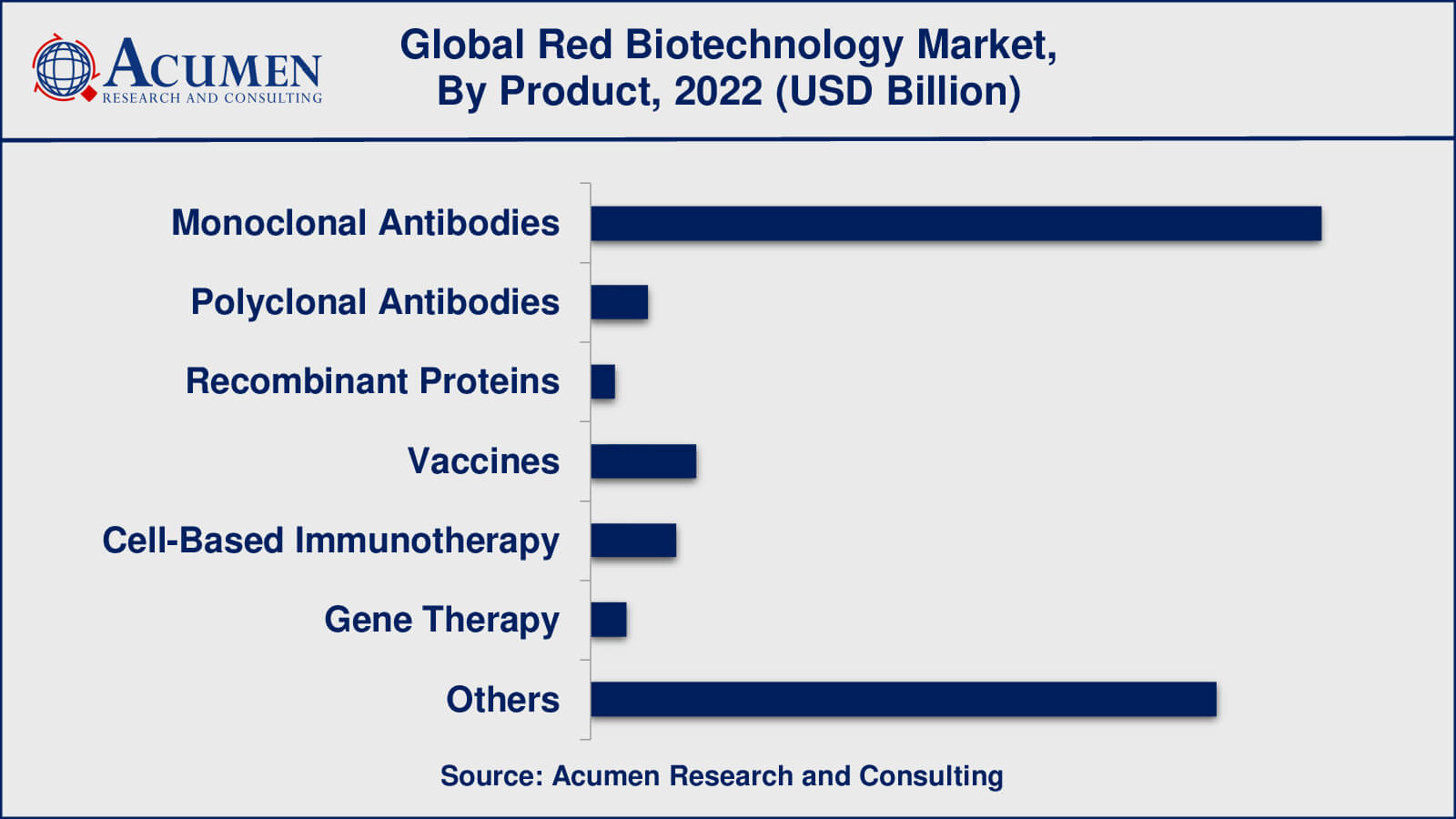

- Among products, the monoclonal antibodies sub-segment generated around US$ 158 billion revenue in 2022

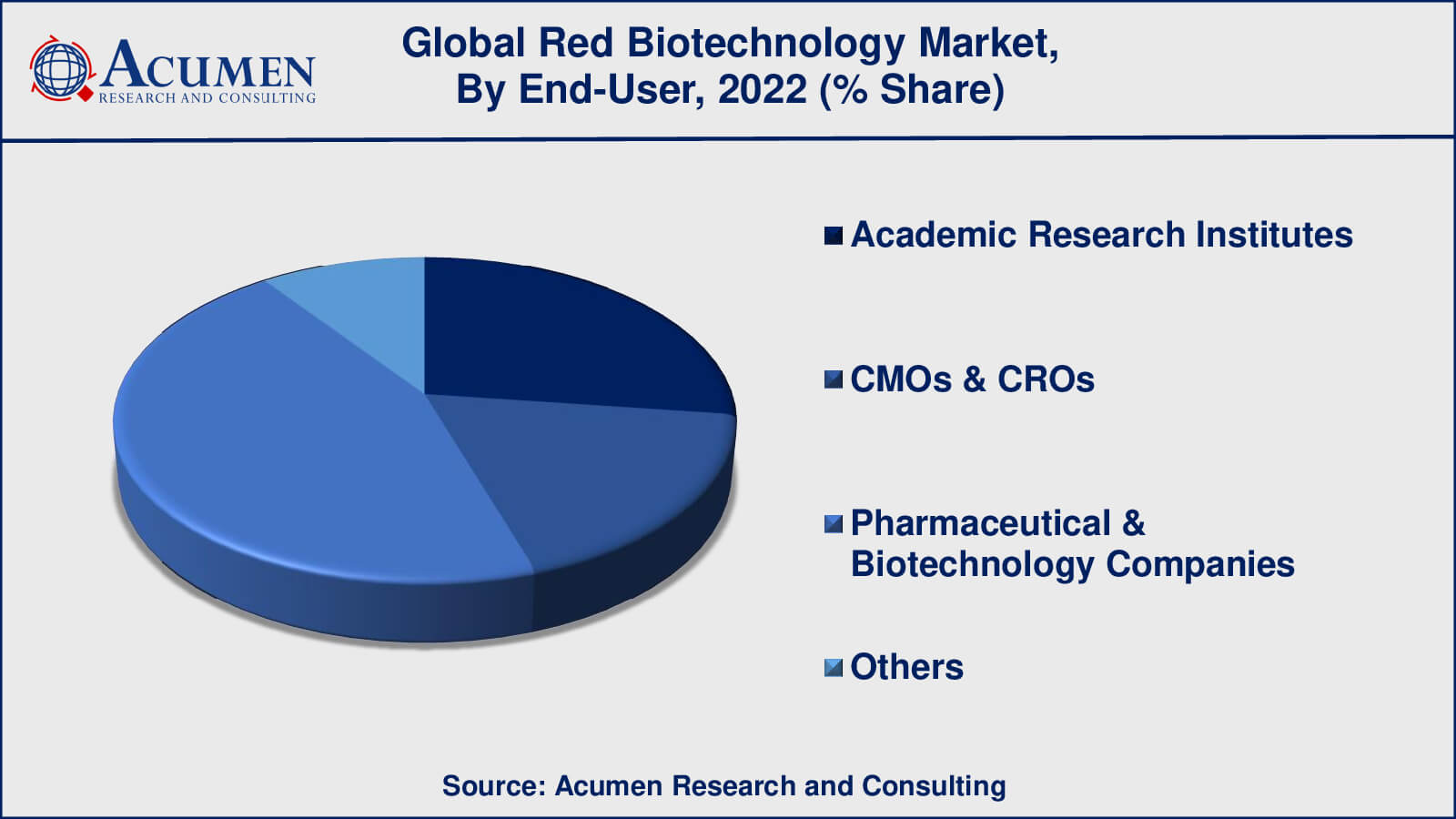

- Based on end-user, the pharmaceutical & biotechnology companies sub-segment generated around 45% share in 2022

- Growing demand for personalized medicine is a popular red biotechnology market trend that fuels the industry demand

Since the age of biotechnology, numerous tests and research into the implications of biotechnology to increase health have been carried out with the growth of recombinant DNA (rDNA) technologies. New doors to the design of new therapeutic drugs to sophisticate disease control have been opened by the progress made in biotechnology.

As biotechnology expands further, the future of the red biotechnology industry will be determined through increased investment by worldwide producers. Keeping the regulation of biotechnology and pharmaceutical companies compliant with standardized legislation is quoted as a crucial milestone for business development. Although the growing incidence of cancer offers a broader range of red biotechnology actors, costly cancer therapy equipment and technology can probably burden patients financially, in turn preventing a growing red biotechnology market

Global Red Biotechnology Market Dynamics

Market Drivers

- Rising prevalence of chronic and infectious diseases

- Increasing investments in R&D

- Development of advanced technologies such as gene editing

- Growing geriatric population

Market Restraints

- High cost of biotechnology products

- Regulatory hurdles

- Ethical concerns

Market Opportunities

- Development of personalized medicine

- Collaboration and partnerships between biotechnology companies and pharmaceutical companies

- Emerging markets such as India, China, and Brazil

Red Biotechnology Market Report Coverage

| Market | Red Biotechnology Market |

| Red Biotechnology Market Size 2022 | USD 360.3 Billion |

| Red Biotechnology Market Forecast 2032 | USD 656.1 Billion |

| Red Biotechnology Market CAGR During 2023 - 2032 | 6.3% |

| Red Biotechnology Market Analysis Period | 2020 - 2032 |

| Red Biotechnology Market Base Year | 2022 |

| Red Biotechnology Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amgen Inc., F. Hoffmann-La Roche AG, Novartis AG, Pfizer Inc., Sanofi S.A., Gilead Sciences Inc., Biogen Inc., Regeneron Pharmaceuticals Inc., AbbVie Inc., and Bristol Myers Squibb Co. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Red Biotechnology Market Insights

Rapid progress in stem cell studies stresses the need to develop personalized therapeutic options by using one patient's own cells. Genetic engineering technology likewise includes the modification of patients ' genetic structure in order to find particular points of interest. Several actions to investigate and include biotechnology in the establishment of personalized medical care are being taken. The use of biotechnology for personalized medical treatments will probably open up a range of possibilities for the competing red biotechnology industry. Although, as a result of its consistent contribution to improving health care, red biotechnology is continuing to grow upwards, its potential reversal is not rejected. It remains in danger. Regional governance has an impact on medicines pricing as it is necessary to remunerate increasing innovation.

The increase in chronic disease incidence, the fast growth of the biological sector, and enhanced worldwide healthcare expenditure will probably sustain the development of the market in red biotechnology. In addition, the worldwide red biotechnology market is anticipated to be driven by increasing knowledge of chronic illness therapy and solid pipelines for new therapeutic molecules.

Red Biotechnology Market Segmentation

The worldwide market for Red Biotechnology is split based on product, end-user, and geography.

Red Biotechnology Products

- Monoclonal Antibodies

- Polyclonal Antibodies

- Recombinant Proteins

- Vaccines

- Cell-Based Immunotherapy Products

- Gene Therapy Products

- Others

According to a red biotechnology industry analysis, monoclonal antibodies are the leading product segment and are expected to lead in the years 2023-2032. Monoclonal antibodies are laboratory-created molecules that mimic the immune system's ability to combat pathogens such as cancer cells. They have a wide range of therapeutic applications, including cancer treatment, autoimmune disease treatment, and infectious disease treatment. The rising prevalence of chronic diseases, rising investments in research and development, and the development of advanced biomanufacturing technologies are all driving the growth of the monoclonal antibody market.

Red Biotechnology End-Users

- Academic Research Institutes

- CMOs & CROs

- Pharmaceutical & Biotechnology Companies

- Others

According to the red biotechnology market forecast, pharmaceutical and biotechnology companies held the largest market share in the red biotechnology market. These firms work on the development, manufacture, and commercialization of biotechnology products such as monoclonal antibodies, recombinant proteins, vaccines, and gene therapy products.

The growing demand for innovative and effective biotechnology products, as well as the increased emphasis on R&D activities, are driving the growth of this segment. Academic research institutes, as well as CMOs and CROs (Contract Manufacturing and Research Organizations), are significant end users in the red biotechnology market. Academic research institutes conduct basic research that aids in the development of new biotechnology products and technologies.

Red Biotechnology Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Red Biotechnology Market Regional Analysis

In 2022, North America dominated the red biotechnology Market, accounting for the largest market share. Some of the factors driving the growth of the Red Biotechnology Market in this region include the presence of a well-established healthcare infrastructure, increasing investments in research and development activities, and the increasing prevalence of chronic diseases. In U.S. biotechnology firms, a biotechnology cluster centered in the nation, entrepreneurship, and research are concentrated. In combination with huge product launches in North America, a higher acceptance rate of fresh biotechnology drugs is the dominance of the region, where the US is likely to flourish as a leader in the biotechnology field. In an effort to expand its presence in the nation, a big amount of mature biotech firms and pharmaceutical firms based in the US attract red biotechnology market contributors. But growing demand for high-quality and economical drugs throughout Asia has attracted the attention of the competition in the red biotechnology market. In advanced nations, biopharmaceutical sector behemoths aim to establish research facilities for their manufacturing capacities in new regions, such as the Asian nations of India and South Korea. These scenarios illustrate the region's growth potential. When planning their future investments, new entrants should consider Asia Pacific nations.

The Asia-Pacific region is expected to experience significant growth in the red biotechnology Market as a result of factors such as rising healthcare expenditures and increased investments in research and development. Countries such as China, India, and Japan are expected to drive this region's market growth.

Red Biotechnology Market Competitors Stance

Global actors in the global biotechnology market, especially in Asia-Pacific, are focusing on developing nations. Building on the increasing demand for drugs and biologics and the increasing number of patients in this region, worldwide market players are focusing on enhancing distribution and partnership contracts in developing countries to boost the high demand for bio-drugs and bio-parallels.

The growing cancer impact worldwide has led to significant cancer therapy advances, which have led to increased investments in cancer research and drug development. The significance of cancer therapy has been acknowledged by red biotechnology rivals, with an emphasis on the growth of the oncology portfolio.

Due to the rapid growth of demand for these disease-targeted medicines and their higher efficiency and safety, the manufacturing of biopharmaceuticals remains the most sought-after application for red biotechnology. Biological products have become commonly recognized by end-users, and their capacity to treat earlier untreatable illnesses has driven demand for strong investment in biopharmaceutical research and development.

Red Biotechnology Market Players

Some of the top red biotechnology companies offered in the professional report include Amgen Inc., F. Hoffmann-La Roche AG, Novartis AG, Pfizer Inc., Sanofi S.A., Gilead Sciences Inc., Biogen Inc., Regeneron Pharmaceuticals Inc., AbbVie Inc., and Bristol Myers Squibb Co.

Red biotechnology companies continue to develop innovative goods and invest in related clinical studies to obtain regulatory support. As research and development initiatives continue to thrive for the production of sophisticated illness therapeutics, red biotechnology innovations stay an essential strategy that will generate profit for rivals.

The key players operating in the market are Amgen Inc., F. Hoffmann-La Roche, Gilead Sciences Inc., CSL, and Pfizer Inc. In 2022, almost half the market share was accounted for. Expansion policies such as purchases stay essential in the Red Biotechnology industry for the rivals. Companies engage in strategic partnerships with other biotechnology companies situated in profitable areas in an effort to increase their customer base. In addition, innovative product launches enable market players in red biotechnology to reinforce their place on the market, with a focus on more R&D.

Red Biotechnology Market Developments

Approval of KANJINTI and Herptin for the treatment of HER2-over-expressing metastatic gastric or gastroesophageal junction adenocarcinoma and HER2-overexpressing adjuvant and metastatic breast cancer was announced by Amgen and Allergan plc in June 2019 to the US FDA.

Biosimilar anti-TNF information, which covers BENEPALI, FLIXABI, and IMRALDE, has lately been announced by Biogen Inc. The firm estimated that the use of its biosimilars in Europe saved almost 2 billion euros in healthcare costs in 2019. In the first place, it received 145.000 biogenic treatments in Europe.

In a recent Australian Research and Development briefing CSL Limited highlighted advances in cell-based vaccine technology. Actual information and emerging evidence suggest that compared to the conventional egg-based vaccine, cell-based influenza vaccines can provide better influenza-related results.

Frequently Asked Questions

What was the market size of the global red biotechnology in 2022?

The market size of red biotechnology was USD 360.3 billion in 2022.

What is the CAGR of the global red biotechnology from 2023 to 2032?

The CAGR of red biotechnology is 6.3% during the analysis period of 2023 to 2032.

Which are the key players in the red biotechnology market?

The key players operating in the global red biotechnology market is includes Amgen Inc., F. Hoffmann-La Roche AG, Novartis AG, Pfizer Inc., Sanofi S.A., Gilead Sciences Inc., Biogen Inc., Regeneron Pharmaceuticals Inc., AbbVie Inc., and Bristol Myers Squibb Co.

Which region dominated the global red biotechnology market share?

North America held the dominating position in red biotechnology industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of red biotechnology during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global red biotechnology industry?

The current trends and dynamics in the red biotechnology industry include rising prevalence of chronic and infectious diseases, increasing investments in R&D, development of advanced technologies such as gene editing, and growing geriatric population.

Which product held the maximum share in 2022?

The monoclonal antibodies product held the maximum share of the red biotechnology industry.