Recycled Plastic and Plastic Waste to Oil Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Recycled Plastic and Plastic Waste to Oil Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

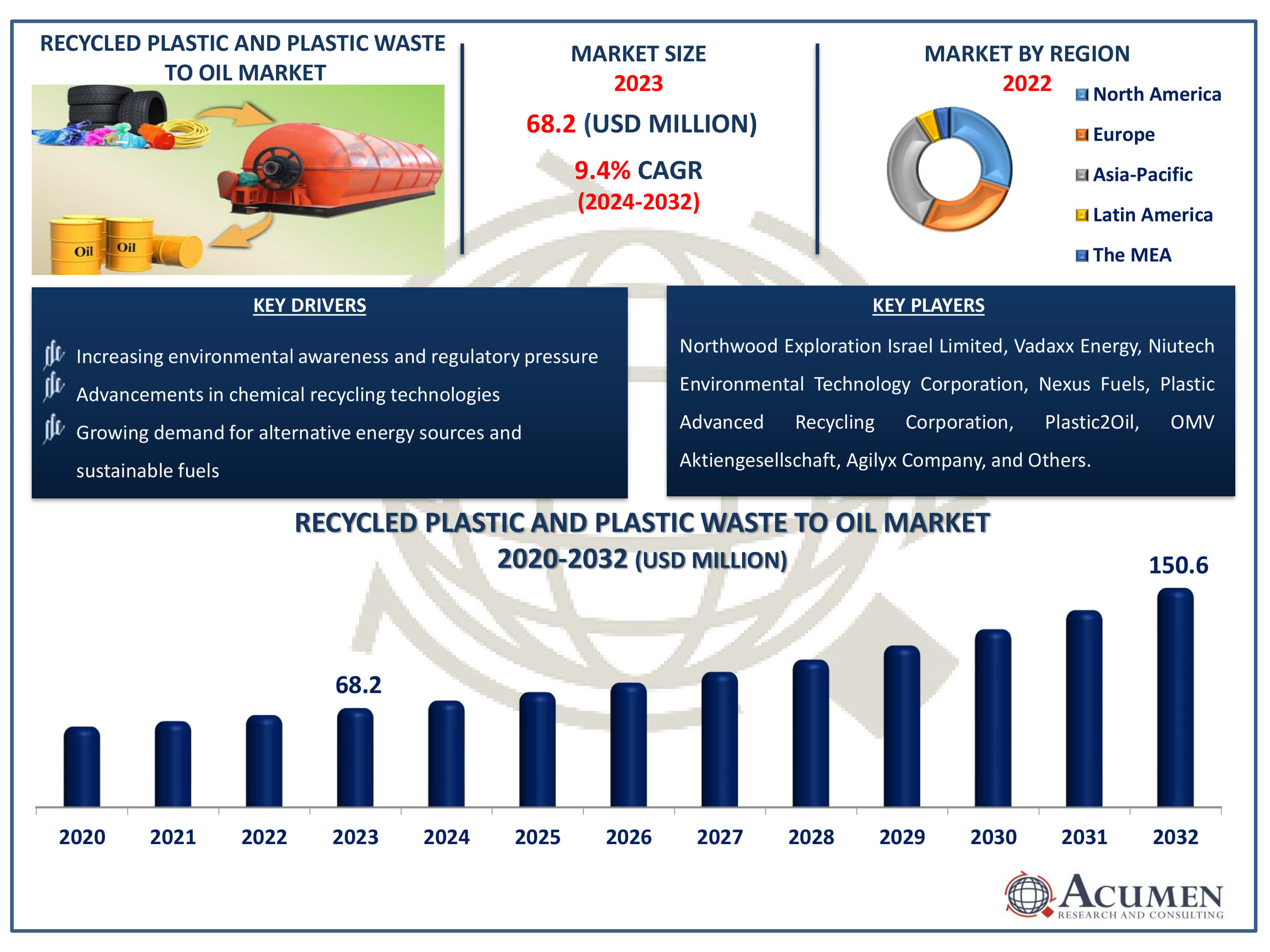

Request Sample Report

The Recycled Plastic and Plastic Waste to Oil Market Size accounted for USD 68.2 Million in 2023 and is estimated to achieve a market size of USD 150.6 Million by 2032 growing at a CAGR of 9.4% from 2024 to 2032.

Recycled Plastic and Plastic Waste to Oil Market Highlights

- Global recycled plastic and plastic waste to oil market revenue is poised to garner USD 150.6 million by 2032 with a CAGR of 9.4% from 2024 to 2032

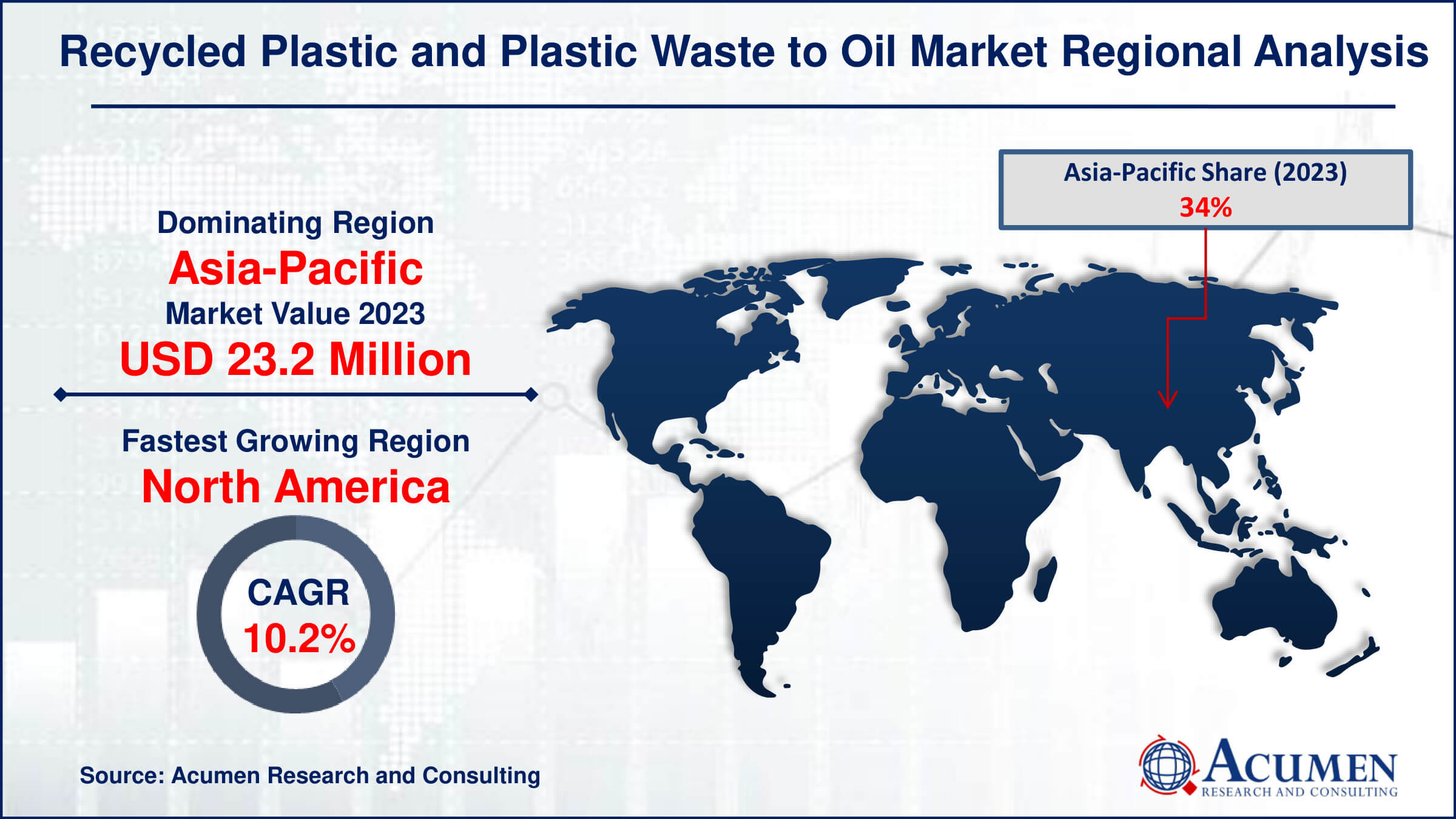

- Asia-Pacific recycled plastic and plastic waste to oil market value occupied around USD 23.2 million in 2023

- North America recycled plastic and plastic waste to oil market growth will record a CAGR of more than 10.2% from 2024 to 2032

- Among by fuels, the diesel sub-segment generated 66% of the market share in 2023

- Based on by type of plastic waste, the LDPE (low-density polyethylene) sub-segment generated 30% market share in 2023

- Increasing adoption of advanced recycling technologies, such as chemical recycling, to improve the quality and usability of recycled plastics is the recycled plastic and plastic waste to oil market trend that by fuels the industry demand

Recycled plastic refers to plastic waste that has been processed and transformed into new plastic products. This process involves collecting, sorting, cleaning, and melting down discarded plastic to create new items, reducing the need for virgin plastic and minimizing environmental impact. Plastic waste to oil, or pyrolysis, converts plastic waste into synthetic oil through thermal decomposition in an oxygen-free environment. Recycling plastic and converting plastic waste into oil are innovative solutions to manage plastic pollution and energy needs. Recycled plastic can be repurposed into new products, reducing the demand for virgin plastic and minimizing environmental impact. Plastic-to-oil technology uses pyrolysis to break down plastics into synthetic crude oil, which can be refined into fuels and other valuable chemicals. This process not only helps in managing plastic waste but also provides an alternative energy source, thus contributing to energy sustainability.

Global Recycled Plastic and Plastic Waste to Oil Market Dynamics

Market Drivers

- Increasing environmental awareness and regulatory pressure to reduce plastic waste

- Advancements in chemical recycling technologies enhancing efficiency

- Growing demand for alternative energy sources and sustainable fuels

Market Restraints

- High initial investment and operational costs for recycling plants

- Technical challenges in processing mixed and contaminated plastic waste

- Competition from traditional plastic disposal methods and fossil fuels

Market Opportunities

- Government incentives and subsidies for sustainable waste management solutions

- Expansion into emerging markets with high plastic waste generation

- Development of partnerships with major corporations aiming for zero-waste goals

Recycled Plastic and Plastic Waste to Oil Market Report Coverage

| Market | Recycled Plastic and Plastic Waste to Oil Market |

| Recycled Plastic and Plastic Waste to Oil Market Size 2022 | USD 68.2 Billion |

| Recycled Plastic and Plastic Waste to Oil Market Forecast 2032 | USD 150.6 Billion |

| Recycled Plastic and Plastic Waste to Oil Market CAGR During 2023 - 2032 | 9.4% |

| Recycled Plastic and Plastic Waste to Oil Market Analysis Period | 2020 - 2032 |

| Recycled Plastic and Plastic Waste to Oil Market Base Year |

2022 |

| Recycled Plastic and Plastic Waste to Oil Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Fuels, By Technology, By Type Of Plastic Waste, By Applications, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Northwood Exploration Israel Limited, Vadaxx Energy, Niutech Environmental Technology Corporation, Nexus Fuels, Plastic Advanced Recycling Corporation, Plastic2Oil, OMV Aktiengesellschaft, Agilyx Company, RES POLYFLOW LLC, and MK Aromatics Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Recycled Plastic and Plastic Waste to Oil Market Insights

The rising environmental awareness and stringent regulations aimed at reducing plastic waste are significantly propelling the growth of the recycled plastic and plastic waste to oil market. For instance, Union Minister for Environment, Forest and Climate Change, Shri Bhupender Yadav, stated 8 December, 2023, that India is dedicated not only to advancing its own sustainable development but also to leading global efforts towards a sustainable future. Speaking at ‘The Green Rising: Powering Youth Action & Solutions for Climate’ event at COP28 in Dubai, UAE, the Minister emphasized that youth play a pivotal role in achieving global sustainability goals. As a result, consumers and industries are increasingly recognizing the unfavorable effects of plastic pollution, thereby boosting demand for sustainable waste management solutions. Innovations in recycling technologies are enhancing the efficiency and viability of converting plastic waste into usable oil, providing an alternative to traditional waste disposal methods. This convergence of environmental consciousness and regulatory imperatives is fostering a robust growth in this industry.

Processing mixed and contaminated plastic waste presents several technical challenges and impedes growth of market. Firstly, different types of plastics often have varying melting points and chemical properties, making them difficult to recycle together effectively. Food residue, labels, and non-plastic objects contaminate the recycling process, necessitating additional cleaning and separation procedures. While advanced sorting technologies continue to improve, they are not always capable of obtaining the required purity substantially hampers market growth.

Government incentives and subsidies for sustainable waste management solutions create an opportunity for market. These financial supports can include tax breaks, grants, and low-interest loans to businesses and municipalities investing in recycling, composting, and waste-to-energy projects. By reducing the financial burden, governments encourage the adoption of innovative waste reduction strategies and infrastructure improvements. For instance, on November 15, 2023, the United States Environmental Protection Agency announced the recipients of the Solid Waste Infrastructure for Recycling Grants for Tribes and Intertribal Consortia. Additionally, such incentives can stimulate economic growth by creating green jobs and supporting the circular economy. Overall, these measures aim to decrease environmental pollution, and foster sustainable development.

Recycled Plastic and Plastic Waste to Oil Market Segmentation

The worldwide market for recycled plastic and plastic waste to oil is split based on fuels, technology, type of plastic waste, applications, and geography.

Recycled Plastic and Plastic Waste to Oil by Fuels

- Gasoline

- Diesel

- Kerosene

- Fuel Oil

- Others

According to the recycled plastic and plastic waste to oil industry analysis, diesel fuel dominates the market due to its strong demand and established infrastructure. The conversion process, known as pyrolysis, efficiently converts numerous plastic kinds into hydrocarbons, with diesel being the primary result. This diesel fuel can be used in current engines and machinery, offering a sustainable alternative to typical fossil fuels. The economic practicality and decreased environmental impact of manufacturing fuel from plastic waste contribute to its domination.

Recycled Plastic and Plastic Waste to Oil by Technology

- Catalytic Depolymerization Process

- Gasification and Synthesis Process

- Pyrolysis Process

According to the recycled plastic and plastic waste to oil industry analysis, pyrolysis process dominates recycled plastic and plastic waste to oil market due to its efficiency in converting diverse plastic types into valuable fuel. This method involves heating plastics in an oxygen-free environment, breaking them down into liquid oil, gas, and char, which can be further refined. The process addresses the growing plastic waste problem and offers an alternative energy source, aligning with sustainability goals. Its scalability and adaptability make it a favorable choice for managing plastic waste globally.

Recycled Plastic and Plastic Waste to Oil by Type of Plastic Waste

- PET (Polyethylene Terephthalate)

- HDPE (High-Density Polyethylene)

- PVC (Polyvinyl Chloride)

- LDPE (Low-Density Polyethylene)

- PP (Polypropylene)

- PS (Polystyrene)

- Others

According to the recycled plastic and plastic waste to oil industry analysis, LDPE (low-density polyethylene) dominates recycled plastic and plastic waste to oil market due to its widespread use and high availability. As a common material in packaging, films, and bags, LDPE constitutes a large portion of plastic waste, making it a key target for recycling initiatives. The physical and chemical properties of LDPE allow it to be effectively converted into oil through pyrolysis, a process that breaks down plastics into hydrocarbons. This conversion process helps mitigate environmental pollution and supports the circular economy by creating valuable products from waste.

Recycled Plastic and Plastic Waste to Oil by Applications

- Waste Treatment Plant

- Chemical Plant

According to the recycled plastic and plastic waste to oil industry forecast, waste treatment plants are crucial for the initial sorting and processing of plastic waste, ensuring that recyclable plastics are effectively separated from non-recyclable materials. These facilities enhance the efficiency of recycling processes and reduce environmental pollution by properly managing and treating plastic waste. Meanwhile, chemical plants play a key role in converting plastic waste into oil through processes like pyrolysis, breaking down plastics into valuable hydrocarbons that can be reused as fuel or raw materials. They enable the creation of high-quality recycled plastic by providing advanced chemical recycling methods, contributing to a circular economy.

Recycled Plastic and Plastic Waste to Oil Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Recycled Plastic and Plastic Waste to Oil Market Regional Analysis

For several reasons, Asia-Pacific dominates recycled plastic and plastic waste to oil market. Plastic waste generation is notably high in the region, especially in China, which supports market players operating in the Asia Pacific. The growing necessity to manage plastic waste, due to its adverse environmental impact, is boosting the regional market value. Furthermore, favorable government initiatives aimed at handling the vast amounts of waste are enhancing the market's regional value. Moreover, presence of robust key players and their innovations and advancements further boost’s market demand in Asian region. For instance, Honeywell, based in Charlotte, North Carolina, has announced a second joint venture to implement its UpCycle Process Technology for chemically recycling end-of-life plastics into polymer feedstock for producing new plastic. The company is partnering with Houston-based Avangard Innovative to construct an advanced recycling plant in Waller, Texas. Additionally, the rising prices and demand for fuel in the region are anticipated to further drive market growth.

North America is experiencing rapid growth in the recycled plastic and plastic waste to oil market, driven by increasing environmental regulations and consumer awareness about sustainability. For instance, the Sustainable Development Goals aim to cut food waste in half by 2030. The U.S. Department of Agriculture, the Environmental Protection Agency, and the Food and Drug Administration are dedicated to achieving this target. The region's technological advancements and significant investments in recycling infrastructure further bolster this expansion. Additionally, major corporations are adopting circular economy practices, enhancing market momentum. This growth underscores North America's pivotal role in global environmental innovation and waste management solutions.

Recycled Plastic and Plastic Waste to Oil Market Players

Some of the top recycled plastic and plastic waste to oil companies offered in our report includes Northwood Exploration Israel Limited, Vadaxx Energy, Niutech Environmental Technology Corporation, Nexus Fuels, Plastic Advanced Recycling Corporation, Plastic2Oil, OMV Aktiengesellschaft, Agilyx Company, RES POLYFLOW LLC, and MK Aromatics Limited.

Frequently Asked Questions

How big is the recycled plastic and plastic waste to oil market?

The recycled plastic and plastic waste to oil market size was valued at USD 68.2Million in 2023.

What is the CAGR of the global recycled plastic and plastic waste to oil market from 2024 to 2032?

The CAGR of recycled plastic and plastic waste to oil is 9.4% during the analysis period of 2024 to 2032.

Which are the key players in the recycled plastic and plastic waste to oil market?

The key players operating in the global market are including Northwood Exploration Israel Limited, Vadaxx Energy, Niutech Environmental Technology Corporation, Nexus Fuels, Plastic Advanced Recycling Corporation, Plastic2Oil, OMV Aktiengesellschaft, Agilyx Company, RES POLYFLOW LLC, and MK Aromatics Limited.

Which region dominated the global recycled plastic and plastic waste to oil market share?

Asia-Pacific held the dominating position in recycled plastic and plastic waste to oil industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of recycled plastic and plastic waste to oil during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global recycled plastic and plastic waste to oil industry?

The current trends and dynamics in the recycled plastic and plastic waste to oil industry include increasing environmental awareness and regulatory pressure to reduce plastic waste, advancements in chemical recycling technologies enhancing efficiency, and growing demand for alternative energy sources and sustainable fuels.

Which by technology held the maximum share in 2023?

The pyrolysis process held the maximum share of the recycled plastic and plastic waste to oil industry.